South Africa Video Surveillance Market (2016-2022) | Share, Companies, Size, Revenue, Outlook, Growth, Industry, Trends, Value, Analysis & Forecast

Market Forecast By Surveillance Type (Analog & IP Surveillance), Software (Video Management Software, Video Analytics and Others), By Components (Cameras (Analog and IP)), DVR/NVR, Encoders/Decoders, By Verticals (Government & Transportation, Banking & Financial, Retail & Logistics, Industrial & Manufacturing, Commercial Offices, Residential, Hospitality & Healthcare, and Educational Institutions) and Regions (Northern Cape, Eastern Cape, Western Cape, North West Province, LimPOPO Province, MPU Malanga, Free State, Kwazulu Natal, and Gauteng)

| Product Code: ETC000303 | Publication Date: Apr 2016 | Product Type: Report | |

| Publisher: 6Wresearch | No. of Pages: 132 | No. of Figures: 90 | No. of Tables: 18 |

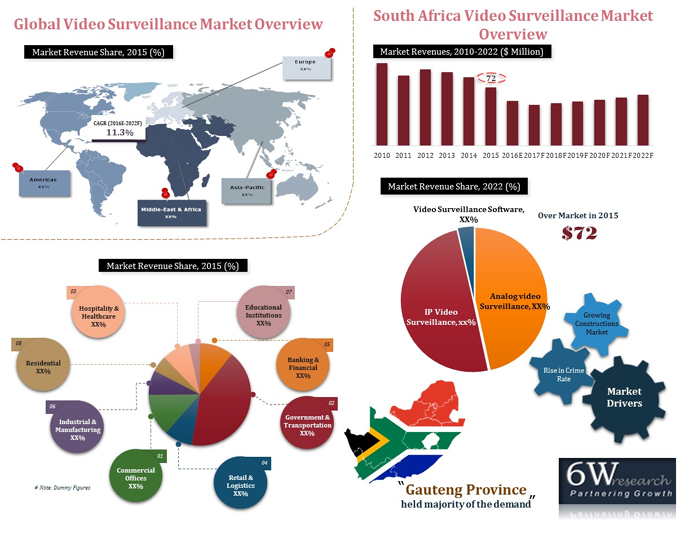

Expected growth in construction market, rising crime rate, upcoming new hotels & shopping malls, coupled with increasing urbanization rate are some of the few factors that have resulted in the overall growth of video surveillance market in South Africa. In South Africa's video surveillance market, IP video surveillance segment accounted for majority of the market revenue owing to major deployments in government & transportation vertical. However, in terms of volume, analog video surveillance systems accounted for majority of the volume share owing to low pricing and accessibility.

According to 6Wresearch, South Africa video surveillance market generated $72.3 million in 2015. Weak economic conditions and currency depreciation have resulted in rise in ASP of video surveillance systems during 2010-15. Amongst all the verticals, government & transportation acquired largest revenue share of the market pie in the country. Over the next six years, commercial offices and healthcare & hospitality verticals are forecast to grow at relatively higher CAGR from 2016 to 2022.

Gauteng Province has accounted for the largest share in the market revenue due to growing construction activities in commercial and retail verticals. During the forecast period, Mpumalanga province region is forecast to grow at relatively higher CAGR from 2016 to 2022.

The report thoroughly covers the market by video surveillance types, by verticals, and by regions. The report provides unbiased and detailed analysis of the on-going trends, opportunities/ high growth areas, market drivers, which would help stakeholders to device and align market strategies according to the current and future market dynamics.

Key Highlights of the Report

• Historical data of Global Video Surveillance Market for the Period 2010-2015

• Market Size & Forecast of Global Video Surveillance Market until 2022

• Historical data of South Africa Video Surveillance Market Revenue & Volume for the Period 2010-2015

• Market Size & Forecast of South Africa Video Surveillance Revenue & Volume Market until 2022

• Historical data of South Africa Analog Video Surveillance Market Revenue & Volume for the Period 2010-2015

• Market Size & Forecast of South Africa Analog Video Surveillance Market Revenue & Volume until 2022

• Historical data of South Africa IP Video Surveillance Market Revenue & Volume for the Period 2010-2015

• Market Size & Forecast of South Africa IP Video Surveillance Market Revenue & Volume until 2022

• Historical data of South Africa Video Surveillance Software Market Revenue for the Period 2010-2015

• Market Size & Forecast of South Africa Video Surveillance Software Market Revenue until 2022

• Historical data of South Africa Video Surveillance Vertical Market Revenue for the Period 2010-2015

• Market Size & Forecast of South Africa Video Surveillance Vertical Market Revenue until 2022

• Historical & Forecast data of South Africa Video Surveillance Regional Market Revenue for the Period 2010-2015

• Market Drivers and Restraints

• Players Market Share and Competitive Landscape

Markets Covered

The report provides the detailed analysis of the following market segments:

• Segments

o Analog Based Surveillance System

• Analog Cameras

• DVR

• Software

o IP Based Surveillance System

• IP Camera

• NVR

• Encoders/ Decoders

o Surveillance System Software

• Video Analytics software

• Video Management Software

• Other Video Surveillance Software

• Verticals

o Banking & Financial

o Government & Transportation

o Retail & Logistics

o Commercial Offices

o Industrial & Manufacturing

o Residential

o Hospitality & Healthcare

o Educational Institutions

• Regions

o Northern Cape

o Eastern Cape

o Western Cape

o North West Province

o LimPOPO Province

o MPU Malanga

o Free State

o Kwazulu Natal

o Gauteng

Frequently Asked Questions About the Market Study (FAQs):

1 Executive Summary

2 Introduction

2.1 Key Highlights of the Report

2.2 Report Description

2.3 Market Scope & Segmentation

2.4 Assumptions & Methodology

3 Global Video Surveillance Market Overview

3.1 Global Video Surveillance Market Revenues (2010-2022F)

3.2 Global Video Surveillance Market Volume (2010-2022F)

3.3 Global Video Surveillance Market Revenue Share, By Region (2015 & 2022F)

4 South Africa Video Surveillance Market Overview

4.1 South Africa Video Surveillance Market Revenues (2010-2022F)

4.2 South Africa Video Surveillance Market Volume (2010-2022F)

4.3 South Africa Video Surveillance Industry Life Cycle

4.4 South Africa Video Surveillance Market Value Chain Analysis

4.5 South Africa Video Surveillance Market Porter's Five Forces Analysis

4.6 South Africa Video Surveillance Market Revenue Share, By Type (2015 & 2022F)

4.7 South Africa Video Surveillance Market Revenue Share, By Vertical (2015 & 2022F)

4.8 South Africa Video Surveillance Market Revenue Share, By Region (2015 & 2022F)

5 South Africa Video Surveillance Market Dynamics

5.1 Impact Analysis

5.2 Market Drivers

5.2.1 Burgeoning Construction Industry

5.2.2 Rise in Crime Rate

5.3 Market Restraints

5.3.1 Surging Prices

6 South Africa Video Surveillance Market Trends

6.1 High Definition Cameras to Propel Video Surveillance

6.2 Increasing Penetration of Chinese Brands

7 South Africa Analog Video Surveillance Market Overview

7.1 South Africa Analog Video Surveillance Market Revenues (2010-2022F)

7.2 South Africa Analog Video Surveillance Market Volume (2010-2022F)

7.3 South Africa Analog Video Surveillance Market , By Types

7.3.1 South Africa Analog Video Surveillance Market Revenue, By Types

7.3.2 South Africa Analog Video Surveillance Market Volume, By Types

7.4 South Africa Analog Video Surveillance Market Revenue, By Verticals

7.5 South Africa Analog Video Surveillance Market Price Trend

8 South Africa IP Video Surveillance Market Overview

8.1 South Africa IP Video Surveillance Market Revenues (2010-2022F)

8.2 South Africa IP Video Surveillance Market Volume (2010-2022F)

8.3 South Africa IP Video Surveillance Market , By Types

8.3.1 South Africa IP Video Surveillance Market Revenue, By Types

8.3.2 South Africa IP Video Surveillance Market Volume, By Types

8.4 South Africa IP Video Surveillance Market Revenue, By Verticals

8.5 South Africa IP Video Surveillance Market Price Trend

9 South Africa Video Surveillance Software Market Overview

9.1 South Africa Video Surveillance Software Market Revenues (2010-2022F)

9.2 South Africa Video Surveillance Software Market Revenue , By Types

9.2.1 South Africa Video Management Software Market Revenues (2010-2022F)

9.2.2 South Africa Video Analytics Software Market Revenues (2010-2022F)

9.2.3 South Africa Video Other Software Market Revenues (2010-2022F)

9.3 South Africa Analog Video Surveillance Market Revenue, By Verticals

10 South Africa Video Surveillance Market Overview, By Verticals

10.1 South Africa Video Surveillance Market, By Verticals

10.2 South Africa Banking & Financial Video Surveillance Market Revenues (2010-2022F)

10.3 South Africa Government & Transportation Video Surveillance Market Revenues (2010-2022F)

10.4 South Africa Retail & Logistics Video Surveillance Market Revenues (2010-2022F)

10.5 South Africa Commercial Offices Video Surveillance Market Revenues (2010-2022F)

10.6 South Africa Industrial & Manufacturing Video Surveillance Market Revenues (2010-2022F)

10.7 South Africa Residential Video Surveillance Market Revenues (2010-2022F)

10.8 South Africa Hospitality & Healthcare Video Surveillance Market Revenues (2010-2022F)

10.9 South Africa Educational Institute Video Surveillance Market Revenues (2010-2022F)

11 South Africa Video Surveillance Market Overview, By Regions

11.1 Northern Cape and Eastern Cape Video Surveillance Market Revenues (2010-2022F)

11.2 Western Cape and North West Province Video Surveillance Market Revenues (2010-2022F)

11.3 LimPOPO Province and Mpumalanga Province Video Surveillance Market Revenues (2010-2022F)

11.4 Free State Province and Kwazulu Natal Province Video Surveillance Market Revenues (2010-2022F)

11.5 Gauteng Province Video Surveillance Market Revenues (2010-2022F)

12 Competitive Landscape

12.1 South Africa Video Surveillance Market Revenue, By Company

12.2 Competitive Benchmarking, By Technology

13 Company Profile

13.1 Avigilon Corporation

13.2 Axis Communications

13.3 Bosch Security Systems, Inc.

13.4 Hangzhou Hik-Vision Digital Technology Co. Ltd. (Hikvision)

13.5 Hanwha Techwin Co. Ltd

13.6 Honeywell International Inc.

13.7 Panasonic Corporation

13.8 Pelco, Inc.

13.9 Vivotek Inc.

13.10 Zhejiang Dahua Technology Co. Ltd

14 Key Strategic Pointers

15 Disclaimer

List of Figures

Figure 1 Evolution of Video Surveillance System

Figure 2 Global Video Surveillance Market Revenues, 2010-2015 ($ Billion)

Figure 3 Global Video Surveillance Market Revenues, 2016E-2022F ($ Billion)

Figure 4 Global Video Surveillance Market Volume, 2010-2022 (Million Units)

Figure 5 Global Video Surveillance Market Revenue Share, By Region (2015)

Figure 6 South Africa Video Surveillance Market Revenues, 2010-2015 ($ Million)

Figure 7 South Africa Video Surveillance Market Revenues, 2016E-2022F ($ Million)

Figure 8 South Africa Annual GDP Growth (%), 2008-2017

Figure 9 South Africa Video Surveillance Market Revenues, 2010-2015 (Million Units)

Figure 10 South Africa Video Surveillance Market Revenues, 2016E-2022F (Million Units)

Figure 11 South Africa Video Surveillance Market Industry Life Cycle (2015)

Figure 12 South Africa Video Surveillance Market Opportunistic Matrix (2015)

Figure 13 South Africa Video Surveillance Market Porters Five Forces

Figure 14 South Africa Video Surveillance Market Revenue Share, By Types (2015)

Figure 15 South Africa Video Surveillance Market Revenue Share, By Types (2022)

Figure 16 South Africa Video Surveillance Market Revenue Share, By Verticals (2015)

Figure 17 South Africa Video Surveillance Market Revenue Share, By Verticals (2022)

Figure 18 South Africa Video Surveillance Market Revenue Share, By Region (2015 & 2022)

Figure 19 South Africa Construction Industry, 2010-2017F ($ Billion)

Figure 20 South Africa Video Surveillance System Market Price Trend, 2010-2022F ($ Per Unit)

Figure 21 South Africa IP surveillance market as a percentage of Video Surveillance Market (2010-2022)

Figure 22 South Africa Analog Video Surveillance Market Revenues, 2010-2015 ($ Million)

Figure 23 South Africa Analog Video Surveillance Market Revenues, 2016E-2022F ($ Million)

Figure 24 South Africa Analog Video Surveillance Market Volume, 2010-2015 (Million Units)

Figure 25 South Africa Analog Video Surveillance Market Volume, 2016E-2022F (Million Units)

Figure 26 South Africa Analog Video Surveillance Verticals Market Revenue Share, (2015)

Figure 27 South Africa Analog Video Surveillance Verticals Market Revenue Share, (2022)

Figure 28 South Africa Analog Camera Market Price Trend, 2010-2022F ($ Per Unit)

Figure 29 South Africa DVR Market Price Trend, 2010-2022F ($ Per Unit)

Figure 30 South Africa IP Video Surveillance Market Revenues, 2010-2015 ($ Million)

Figure 31 South Africa IP Video Surveillance Market Revenues, 2016E-2022F ($ Million)

Figure 32 South Africa IP Video Surveillance Market Volume, 2010-2015 (Million Units)

Figure 33 South Africa IP Video Surveillance Market Volume, 2016E-2022F ($ Million)

Figure 34 South Africa IP Video Surveillance Verticals Market Revenue Share, (2015)

Figure 35 South Africa IP Video Surveillance Verticals Market Revenue Share, (2022)

Figure 36 South Africa IP Camera Market Price Trend, 2010-2022F ($ Per Unit)

Figure 37 South Africa NVR Market Price Trend, 2010-2022F ($ Per Unit)

Figure 38 South Africa Encoder/ Decoder Market Price Trend, 2010-2022F ($ Per Unit)

Figure 39 South Africa Video Surveillance Software Market Revenues, 2010-2015 ($ Million)

Figure 40 South Africa Video Surveillance Software Market Revenues, 2016E-2022F ($ Million)

Figure 41 South Africa Video Management Software Market Revenue, 2010-2022F ($ Million)

Figure 42 South Africa Video Analytics Software Market Revenue, 2010-2022F ($ Million)

Figure 43 South Africa Other Video Surveillance Software Market Revenue, 2010-2022F ($ Thousand)

Figure 44 South Africa Video Surveillance Software Verticals Market Revenue Share (2015)

Figure 45 South Africa Video Surveillance Software Verticals Market Revenue Share (2022)

Figure 46 South Africa Video Surveillance Market CAGR, By Verticals (2022)

Figure 47 Banking & Financial Video Surveillance Market Revenues, 2010-2015 ($ Million)

Figure 48 Banking & Financial Video Surveillance Market Revenues, 2016-2022 ($ Million)

Figure 49 Africa Commercial Bank Branches Per 100 Thousand People (2014)

Figure 50 Government & Transportation Video Surveillance Market Revenues, 2010-2015 ($ Million)

Figure 51 Government & Transportation Video Surveillance Market Revenues, 2016-2022 ($ Million)

Figure 52 Retail & Logistics Video Surveillance Market Revenues, 2010-2015 ($ Million)

Figure 53 Retail & Logistics Video Surveillance Market Revenues, 2016-2022 ($ Million)

Figure 54 South Africa Real Annual Retail Sales Growth (2009-2014)

Figure 55 South Real Monthly Retail Trade Sales, 2009-2014 (Rand Billion)

Figure 56 Commercial Offices Video Surveillance Market Revenues, 2010-2015 ($ Million)

Figure 57 Commercial Offices Video Surveillance Market Revenues, 2016-2022 ($ Million)

Figure 58 Industrial & Manufacturing Video Surveillance Market Revenues, 2010-2015 ($ Million)

Figure 59 Industrial & Manufacturing Video Surveillance Market Revenues, 2016-2022 ($ Million)

Figure 60 South Africa Mining Revenue, 2005-2014 ($ Billion)

Figure 61 South Africa Mining Revenue Per Commodity, 2012-2014 ($ Billion)

Figure 62 Residential Video Surveillance Market Revenues, 2010-2015 ($ Million)

Figure 63 Residential Video Surveillance Market Revenues, 2016-2022 ($ Million)

Figure 64 Hospitality & Healthcare Video Surveillance Market Revenues, 2010-2015 ($ Million)

Figure 65 Hospitality & Healthcare Video Surveillance Market Revenues, 2016-2022 ($ Million)

Figure 66 Educational Institute Video Surveillance Market Revenues, 2010-2015 ($ Million)

Figure 67 Educational Institute Video Surveillance Market Revenues, 2016-2022 ($ Million)

Figure 68 South Africa Video Surveillance Northern Cape Region Market Revenue, 2010-2015 ($ Million)

Figure 69 South Africa Video Surveillance Northern Cape Region Market Revenue, 2016E-2022F ($ Million)

Figure 70 South Africa Video Surveillance Eastern Cape Region Market Revenue, 2010-2015 ($ Million)

Figure 71 South Africa Video Surveillance Eastern Cape Region Market Revenue, 2016E-2022F ($ Million)

Figure 72 South Africa Video Surveillance Western Cape Region Market Revenue, 2010-2015 ($ Million)

Figure 73 South Africa Video Surveillance Western Cape Region Market Revenue, 2016E-2022F ($ Million)

Figure 74 South Africa Video Surveillance North West Province Region Market Revenue, 2010-2015 ($ Million)

Figure 75 South Africa Video Surveillance North West Province Region Market Revenue, 2016-2022F ($ Million)

Figure 76 South Africa Video Surveillance LimPOPO Province Market Revenue, 2010-2015 ($ Million)

Figure 77 South Africa Video Surveillance LimPOPO Province Market Revenue, 2016E-2022F ($ Million)

Figure 78 South Africa Video Surveillance Mpumalanga Province Region Market Revenue, 2010-2015 ($ Million)

Figure 79 South Africa Video Surveillance Mpumalanga Province Region Market Revenue, 2016-2022F ($ Million)

Figure 80 South Africa Video Surveillance Free State Province Market Revenue, 2010-2015 ($ Million)

Figure 81 South Africa Video Surveillance Free State Province Market Revenue, 2016E-2022F ($ Million)

Figure 82 South Africa Video Surveillance Kwazulu Natal Province Region Market Revenue, 2010-2015 ($ Million)

Figure 83 South Africa Video Surveillance Kwazulu Natal Province Region Market Revenue, 2016-2022F ($ Million)

Figure 84 South Africa Video Surveillance Gauteng Province Market Revenue, 2010-2015 ($ Million)

Figure 85 South Africa Video Surveillance Gauteng Province Market Revenue, 2016E-2022F ($ Million)

Figure 86 South Africa Video Surveillance Market Revenues Share, By Companies (2015)

Figure 87 Avigilon Corporation Market, Revenues and Net Income Quarter Wise for 2015 ($ Million)

Figure 88 Axis Communications Market Revenue Share by Segment (2013 & 2012)

Figure 89 Robert Bosch GmbH., Revenue Share by Segment (2014)

Figure 90 Panasonic Corporation, Revenue Share by Segment (2014)

List of Tables

Table 1 South Africa Crime Index (2014-2015)

Table 2 South Africa Analog Video Surveillance Market Revenue Share, By Types, 2010-2015 ($ Million)

Table 3 South Africa Analog Video Surveillance Market Revenue Share, By Types, 2016E-2022F ($ Million)

Table 4 South Africa Analog Video Surveillance Market Volume Share, By Types, 2010-2015 (Million Units)

Table 5 South Africa Analog Video Surveillance Market Volume Share, By Types, 2016E-2022F (Million Units)

Table 6 South Africa Analog Video Surveillance Market Revenue Share, By Verticals, 2010-2015 ($ Million)

Table 7 South Africa Analog Video Surveillance Market Revenue Share, By Verticals, 2016E-2022F ($ Million)

Table 8 South Africa IP Video Surveillance Market Revenue Share, By Types, 2010-2015 ($ Million)

Table 9 South Africa IP Video Surveillance Market Revenue Share, By Types, 2016E-2022F ($ Million)

Table 10 South Africa IP Video Surveillance Market Volume Share, By Types, 2010-2015 (Thousand Units)

Table 11 South Africa IP Video Surveillance Market Volume Share, By Types, 2016E-2022F (Thousand Units)

Table 12 South Africa IP Video Surveillance Market Revenue Share, By Verticals, 2010-2015 ($ Million)

Table 13 South Africa IP Video Surveillance Market Revenue Share, By Verticals, 2016E-2022F ($ Million)

Table 14 South Africa Video Surveillance Software Market Revenue Share, By Verticals, 2010-2015 ($ Million)

Table 15 South Africa Video Surveillance Software Market Revenue Share, By Verticals, 2016-2022F ($ Million)

Table 16 South Africa Leading Commercial Bank Number of Branches and ATMs (2015)

Table 17 South Africa Infrastructural Projects with Project Value, 2015

Table 18 Johannesburg Region Industrial & Retail Construction Projects (2015)

Growing construction market along with increasing crime rate in the country has resulted in the growth in market for Video Surveillance in South Africa. Further, growing government spending towards the public safety and security are the few factors that are spurring the market for video surveillance in South Africa.

In South Africa, video surveillance market is primarily driven by government & transportation vertical followed by commercial office and banking & financial institution verticals. However, hospitality vertical market is expected to experience a major growth in the forecast period attributed to growing tourism industry and rising security concerns in South Africa.

Amongst all the regions, Gauteng province has generated largest revenue share of the market pie in the country and would maintain its market leadership through the forecast period as well.

“South Africa Video Surveillance Market (2016-2022)” report estimates and forecast overall South Africa Video Surveillance market by revenue, by volume, by types, by verticals such as banking & financial, government & transportation, retail & logistics, commercial offices, industrial & manufacturing, residential, hospitality & healthcare and educational institutions and by region such as Northern Cape, Eastern Cape, Western Cape, North West Province, LimPOPO Province, MPU Malanga Province, Free State Province, Kwazulu Natal Province and Gauteng province. The report also gives the insights on market trends, company profiles, market drivers and restraints.

- Single User License$ 1,995

- Department License$ 2,400

- Site License$ 3,120

- Global License$ 3,795

Search

Related Reports

- India LV Switchgear Market (2024-2030) | Share, Trends, Value, Analysis, Outlook, Forecast, Growth, Industry, Companies, Size & Revenue

- Hungary Air Conditioner Market (2024-2030) | Size, Trends, Industry, Forecast, Share, Growth, Value, Revenue, Analysis, Outlook & COVID-19 IMPACT

- Australia Cyber Security Market (2024-2030) | Companies, industry, Size, Revenue, Forecast, Trends, Growth, Analysis, Outlook

- Australia Endpoint Detection and Response Market (2024-2030) | Outlook, Analysis, Size, Value, Industry, Forecast, Revenue, Companies, Growth, Share & Trends

- Egypt Commercial Stainless Steel Refrigerator Market (2024-2030) | Share, Trends, Value, Analysis, Outlook, Forecast, Growth, Industry, Companies, Size & Revenue

- India Mixer Grinder Market (2023-2029) | Segmentation, Growth, Companies, Revenue, Trends, Share, Outlook, Forecast, Industry, Analysis, Value & Size

- GCC PVC Additives Market (2024-2030) | Share, Trends, Value, Analysis, Outlook, Forecast, Growth, Industry, Companies, Size & Revenue

- Iraq ICE & Electric Passenger Vehicle Market (2024-2030) | Share, Trends, Value, Analysis, Outlook, Forecast, Growth, Industry, Companies, Size & Revenue

- UAE Corrugated Board Packaging Market (2024-2030) | Size, Trends, Segmentation, Revenue, Outlook, Companies, Share, Growth, Analysis, Value, Industry & Forecast

- India Biopolymer Market (2024-2030) | Segmentation, Growth, Companies, Revenue, Trends, Share, Outlook, Forecast, Industry, Analysis, Value & Size

Industry Events and Analyst Meet

Our Clients

Whitepaper

- Middle East & Africa Commercial Security Market Click here to view more.

- Middle East & Africa Fire Safety Systems & Equipment Market Click here to view more.

- GCC Drone Market Click here to view more.

- Middle East Lighting Fixture Market Click here to view more.

- GCC Physical & Perimeter Security Market Click here to view more.

6WResearch In News

- India's Printer Market Faces 20.7% Decline in Q4 2023: Epson and HP Lead Amidst Downturn

- India's Camera Market Sees 8.9% Decline in Q4 2023; Canon Leads with 38.4% Share

- Doha a strategic location for EV manufacturing hub: IPA Qatar

- Demand for luxury TVs surging in the GCC, says Samsung

- Empowering Growth: The Thriving Journey of Bangladesh’s Cable Industry

- The future of gaming industry in the Philippines