Germany Brake System Market (2025-2031) | Size, Trends, Outlook, Revenue, Share, Analysis, Value, Segmentation, Industry

Market Forecast By Brake Type (Disc, Drum), By Technology (Antilock Braking Systems (ABS), Electronic Stability Control (ESC), Traction Stability Control (TCS), Electronic Brakeforce Distribution (EBD)), By Vehicle Type (Passenger Car, Light-commercial Vehicles (LCV), Truck, Bus), By Actuation (Hydraulic, Pneumatic), By Off-highway Brake Type (Hydraulic Wet Brake, Dynamic Brake, Hydrostatic Brake, Other), By Off-highway Application (Construction Equipment, Mining Equipment, Agricultural Tractors) And Competitive Landscape

| Product Code: ETC172650 | Publication Date: Sep 2022 | Updated Date: Apr 2025 | Product Type: Market Research Report | |

| Publisher: 6Wresearch | No. of Pages: 70 | No. of Figures: 35 | No. of Tables: 5 | |

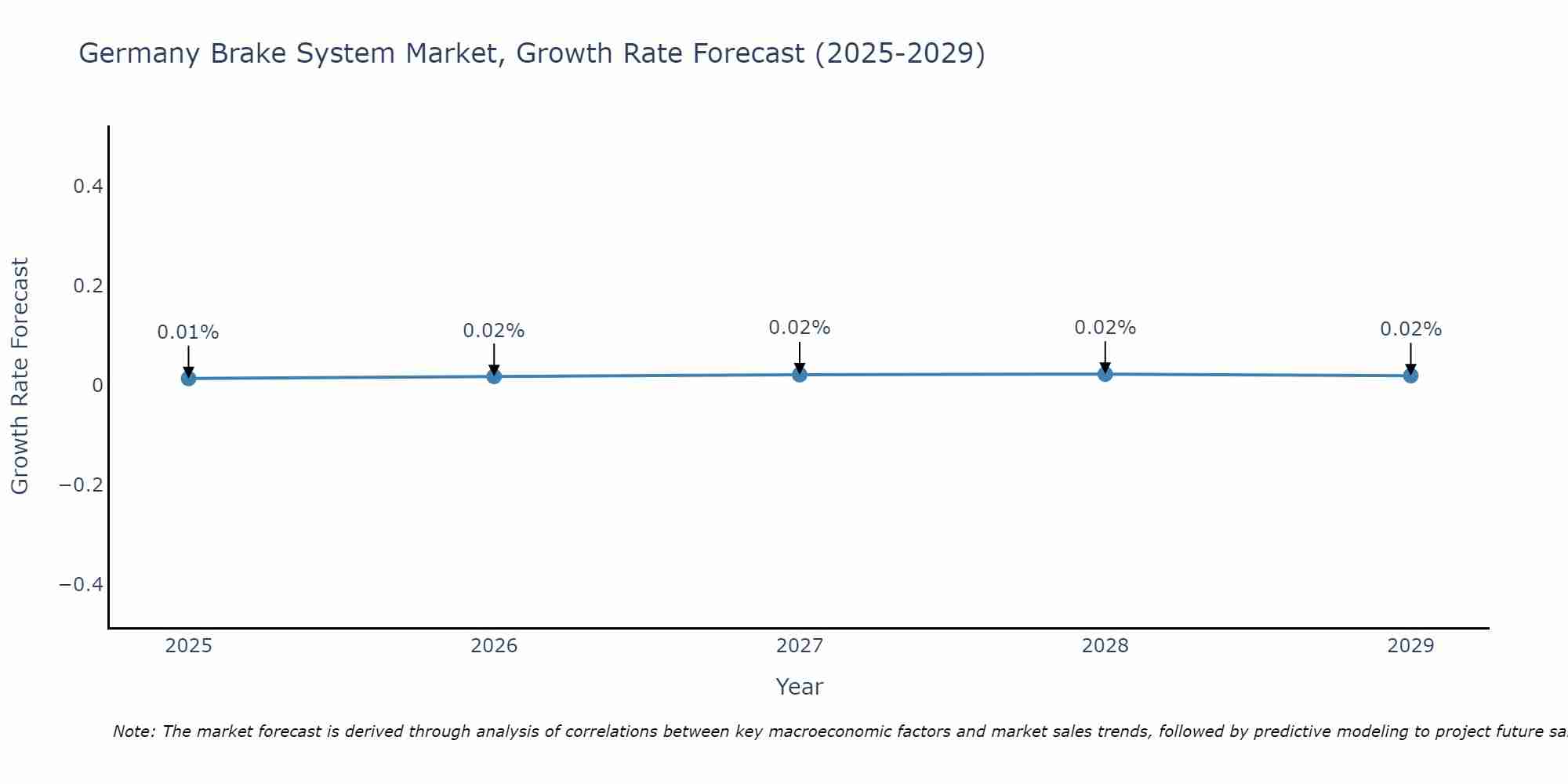

Germany Brake System Market Size Growth Rate

The Germany Brake System Market is projected to witness mixed growth rate patterns during 2025 to 2029. Starting at 0.01% in 2025, the market peaks at 0.02% in 2028, and settles at 0.02% by 2029.

Topics Covered in the Germany Brake System Market Report

Germany Brake System Market report thoroughly covers the market by brake type, technology, vehicle type, actuation, off-highway brake type and off-highway application. The market report provides an unbiased and detailed analysis of the ongoing market trends, opportunities/high growth areas, and market drivers which would help the stakeholders to devise and align their market strategies according to the current and future market dynamics.

Germany Brake System Market Synopsis

The Germany brake system market has grown steadily over the years, owing to advances in automotive technology, increased vehicle manufacturing, and stringent safety requirements. This growing trend is likely to continue as demand for economical, durable, and novel braking solutions grows in both the passenger and commercial vehicle segments.

According to 6Wresearch, Germany Brake System Market size is expected to grow at a significant CAGR of 4.2% during 2025-2031. Rising vehicle demand and technical developments are driving the braking system market's strong expansion in Germany. Vehicle ownership has increased due to changing lifestyle preferences and rising disposable money, which has increased demand for dependable and effective braking systems.

Manufacturers are simultaneously utilizing technology advancements to launch cutting-edge braking solutions, including regenerative braking, electronic stability control, and anti-lock braking systems. These technologies improve efficiency, performance, and safety while meeting legal requirements and customer preferences. The Germany brake system market growth trajectory is being cemented by the adoption of advanced brake systems in both passenger and commercial vehicles, which is being driven by a mix of increasing vehicle demand and ongoing innovation.

The high cost of improved brake systems remains a key obstacle to wider adoption, particularly among price-sensitive buyers. Although many cutting-edge systems provide exceptional safety and performance, their high research and production costs limit their accessibility for consumers on a tight budget. Furthermore, a highly qualified labor is needed for the development and installation of these systems, yet this workforce is frequently scarce in some areas. Manufacturers may find it difficult to expand their operations and satisfy rising demand as a result of this skilled worker scarcity. For the German brake system market to see wider adoption and long-term growth, these issues must be resolved.

Germany Brake System Market Trends

The Germany brake system industry is being pushed by rising demand for electric cars (EVs), as environmental concerns force customers to seek out more sustainable transportation options. It is anticipated that this change will greatly increase demand for electronic braking systems, which are necessary for electric vehicles. Furthermore, real-time monitoring and data analysis are being improved by the incorporation of Internet of Things (IoT) technology into brake systems, which raises system efficiency and safety. Due to their increased performance and control, these technologies are expected to become more widely used as they develop. It is anticipated that these trends will keep propelling the braking system market's expansion and innovation in Germany.

Investment Opportunities in the Germany Brake System Market

The German brake system market offers numerous prospects for collaborations and partnerships, as increased demand for sophisticated braking technology drives manufacturers and suppliers to collaborate to produce innovative products. These collaborations make it possible to pool resources and expertise to develop innovative solutions that satisfy changing market demands. Furthermore, even though Germany's automotive sector is well-established, there are still unexplored regions with significant room for expansion. In these areas, manufacturers might establish new facilities or grow their current operations to reach a wider audience and gain market share. The market for brake systems will continue to rise because to this expansion approach.

Leading Players in the Germany Brake System Market

Leading companies in the brake system market in Germany include Brembo S.p.A., Bosch GmbH, Continental AG, ZF Friedrichshafen AG, and Aisin Seiki Co. Ltd. These companies are spearheading innovation and braking technology breakthroughs, leading the market. They are concentrating on product innovation and creating cutting-edge brake solutions with improved safety, performance, and efficiency in order to keep a competitive edge. Their growth strategies also heavily rely on strategic alliances and partnerships with suppliers, automakers, and tech companies, which help them satisfy the growing need for cutting-edge solutions and maintain an advantage in the dynamic braking system industry.

Government Regulations

The German government has implemented a number of measures and legislation to improve vehicle safety, which have had a direct impact on the brake system industry. Since 2014, all new cars have been required to have electronic stability control (ESC) systems installed. This is one of the main laws. By identifying and minimizing sliding, ESC increases vehicle stability and dramatically raises safety. The government has also enforced stringent car safety regulations and promoted the creation of advanced driver-assistance systems (ADAS), which depend on sophisticated braking systems. In addition to increasing safety, these regulations stimulate demand for cutting-edge braking technologies, opening up new markets for brake systems in Germany.

Future Insights of the Germany Brake System Market

The Germany brake system market is expected to grow significantly, owing to technical advancements and an increased emphasis on vehicle safety. The increasing use of electric vehicles, the incorporation of IoT technologies for improved braking performance, and strategic manufacturer partnerships to provide creative solutions are some of the main drivers of this expansion. However, obstacles like the expensive price of sophisticated braking systems and a personnel scarcity could hinder market growth. Notwithstanding these obstacles, the braking system market in Germany has a bright future ahead of it, with lots of room for technological advancement, innovation, and market growth.

Market Segmentation Analysis

The report offers a comprehensive study of the subsequent market segments and their leading categories.

Disc to dominate the Market - by Brake Type

According to Ravi Bhandari, Research Head, 6Wresearch, the disc brakes segment is currently the dominating section in the German braking system market, owing to their superior performance, efficiency, and longevity. Disc brakes are widely utilized in both passenger and commercial vehicles, providing increased safety and reliability, which contributes to their domination.

Hydraulic to dominate the Market - by Actuation

The hydraulic brakes segment currently dominates the German brake system market due to its superior performance, dependability, and efficiency. Widely employed in numerous vehicle types, hydraulic brake systems offer higher braking force, making them a favorite choice for both passenger and commercial vehicles.

Key Attractiveness of the Report

- 10 Years Market Numbers.

- Historical Data Starting from 2021 to 2024.

- Base Year: 2024

- Forecast Data until 2031.

- Key Performance Indicators Impacting the Market.

- Major Upcoming Developments and Projects.

Key Highlights of the Report:

- Germany Brake System Market Outlook

- Market Size of Germany Brake System Market, 2024

- Forecast of Germany Brake System Market, 2031

- Historical Data and Forecast of Germany Brake System Revenues & Volume for the Period 2021 - 2031

- Germany Brake System Market Trend Evolution

- Germany Brake System Market Drivers and Challenges

- Germany Brake System Price Trends

- Germany Brake System Porter's Five Forces

- Germany Brake System Industry Life Cycle

- Historical Data and Forecast of Germany Brake System Market Revenues & Volume By Brake Type for the Period 2021 - 2031

- Historical Data and Forecast of Germany Brake System Market Revenues & Volume By Disc for the Period 2021 - 2031

- Historical Data and Forecast of Germany Brake System Market Revenues & Volume By Drum for the Period 2021 - 2031

- Historical Data and Forecast of Germany Brake System Market Revenues & Volume By Technology for the Period 2021 - 2031

- Historical Data and Forecast of Germany Brake System Market Revenues & Volume By Antilock Braking Systems (ABS) for the Period 2021 - 2031

- Historical Data and Forecast of Germany Brake System Market Revenues & Volume By Electronic Stability Control (ESC) for the Period 2021 - 2031

- Historical Data and Forecast of Germany Brake System Market Revenues & Volume By Traction Stability Control (TCS) for the Period 2021 - 2031

- Historical Data and Forecast of Germany Brake System Market Revenues & Volume By Electronic Brakeforce Distribution (EBD) for the Period 2021 - 2031

- Historical Data and Forecast of Germany Brake System Market Revenues & Volume By Vehicle Type for the Period 2021 - 2031

- Historical Data and Forecast of Germany Brake System Market Revenues & Volume By Passenger Car for the Period 2021 - 2031

- Historical Data and Forecast of Germany Brake System Market Revenues & Volume By Light-commercial Vehicles (LCV) for the Period 2021 - 2031

- Historical Data and Forecast of Germany Brake System Market Revenues & Volume By Truck for the Period 2021 - 2031

- Historical Data and Forecast of Germany Brake System Market Revenues & Volume By Bus for the Period 2021 - 2031

- Historical Data and Forecast of Germany Brake System Market Revenues & Volume By Actuation for the Period 2021 - 2031

- Historical Data and Forecast of Germany Brake System Market Revenues & Volume By Hydraulic for the Period 2021 - 2031

- Historical Data and Forecast of Germany Brake System Market Revenues & Volume By Pneumatic for the Period 2021 - 2031

- Historical Data and Forecast of Germany Brake System Market Revenues & Volume By Off-highway Brake Type for the Period 2021 - 2031

- Historical Data and Forecast of Germany Brake System Market Revenues & Volume By Hydraulic Wet Brake for the Period 2021 - 2031

- Historical Data and Forecast of Germany Brake System Market Revenues & Volume By Dynamic Brake for the Period 2021 - 2031

- Historical Data and Forecast of Germany Brake System Market Revenues & Volume By Hydrostatic Brake for the Period 2021 - 2031

- Historical Data and Forecast of Germany Brake System Market Revenues & Volume By Other for the Period 2021 - 2031

- Historical Data and Forecast of Germany Brake System Market Revenues & Volume By Off-highway Application for the Period 2021 - 2031

- Historical Data and Forecast of Germany Brake System Market Revenues & Volume By Construction Equipment for the Period 2021 - 2031

- Historical Data and Forecast of Germany Brake System Market Revenues & Volume By Mining Equipment for the Period 2021 - 2031

- Historical Data and Forecast of Germany Brake System Market Revenues & Volume By Agricultural Tractors for the Period 2021 - 2031

- Germany Brake System Import Export Trade Statistics

- Market Opportunity Assessment By Brake Type

- Market Opportunity Assessment By Technology

- Market Opportunity Assessment By Vehicle Type

- Market Opportunity Assessment By Actuation

- Market Opportunity Assessment By Off-highway Brake Type

- Market Opportunity Assessment By Off-highway Application

- Germany Brake System Top Companies Market Share

- Germany Brake System Competitive Benchmarking By Technical and Operational Parameters

- Germany Brake System Company Profiles

- Germany Brake System Key Strategic Recommendations

Markets Covered

The report offers a broad study of the subsequent market segments:

By Brake Type

- Disc

- Drum

By Technology

- Antilock Braking Systems (ABS)

- Electronic Stability Control (ESC)

- Traction Stability Control (TCS)

- Electronic Brakeforce Distribution (EBD))

By Vehicle Type

- Passenger Car

- Light-Commercial Vehicles (LCV)

- Truck

- Bus

By Actuation

- Hydraulic

- Pneumatic

By Off-Highway Brake Type

- Hydraulic Wet Brake

- Dynamic Brake

- Hydrostatic Brake

- Other

By Off-Highway Application

- Construction Equipment

- Mining Equipment

- Agricultural Tractors

Germany Brake System Market (2025 - 2031): FAQs

| 1 Executive Summary |

| 2 Introduction |

| 2.1 Key Highlights of the Report |

| 2.2 Report Description |

| 2.3 Market Scope & Segmentation |

| 2.4 Research Methodology |

| 2.5 Assumptions |

| 3 Germany Brake System Market Overview |

| 3.1 Germany Country Macro Economic Indicators |

| 3.2 Germany Brake System Market Revenues & Volume, 2021 & 2031F |

| 3.3 Germany Brake System Market - Industry Life Cycle |

| 3.4 Germany Brake System Market - Porter's Five Forces |

| 3.5 Germany Brake System Market Revenues & Volume Share, By Brake Type, 2021 & 2031F |

| 3.6 Germany Brake System Market Revenues & Volume Share, By Technology, 2021 & 2031F |

| 3.7 Germany Brake System Market Revenues & Volume Share, By Vehicle Type, 2021 & 2031F |

| 3.8 Germany Brake System Market Revenues & Volume Share, By Actuation, 2021 & 2031F |

| 3.9 Germany Brake System Market Revenues & Volume Share, By Off-highway Brake Type, 2021 & 2031F |

| 3.10 Germany Brake System Market Revenues & Volume Share, By Off-highway Application, 2021 & 2031F |

| 4 Germany Brake System Market Dynamics |

| 4.1 Impact Analysis |

| 4.2 Market Drivers |

| 4.3 Market Restraints |

| 5 Germany Brake System Market Trends |

| 6 Germany Brake System Market, By Types |

| 6.1 Germany Brake System Market, By Brake Type |

| 6.1.1 Overview and Analysis |

| 6.1.2 Germany Brake System Market Revenues & Volume, By Brake Type, 2021 - 2031F |

| 6.1.3 Germany Brake System Market Revenues & Volume, By Disc, 2021 - 2031F |

| 6.1.4 Germany Brake System Market Revenues & Volume, By Drum, 2021 - 2031F |

| 6.2 Germany Brake System Market, By Technology |

| 6.2.1 Overview and Analysis |

| 6.2.2 Germany Brake System Market Revenues & Volume, By Antilock Braking Systems (ABS), 2021 - 2031F |

| 6.2.3 Germany Brake System Market Revenues & Volume, By Electronic Stability Control (ESC), 2021 - 2031F |

| 6.2.4 Germany Brake System Market Revenues & Volume, By Traction Stability Control (TCS), 2021 - 2031F |

| 6.2.5 Germany Brake System Market Revenues & Volume, By Electronic Brakeforce Distribution (EBD), 2021 - 2031F |

| 6.3 Germany Brake System Market, By Vehicle Type |

| 6.3.1 Overview and Analysis |

| 6.3.2 Germany Brake System Market Revenues & Volume, By Passenger Car, 2021 - 2031F |

| 6.3.3 Germany Brake System Market Revenues & Volume, By Light-commercial Vehicles (LCV), 2021 - 2031F |

| 6.3.4 Germany Brake System Market Revenues & Volume, By Truck, 2021 - 2031F |

| 6.3.5 Germany Brake System Market Revenues & Volume, By Bus, 2021 - 2031F |

| 6.4 Germany Brake System Market, By Actuation |

| 6.4.1 Overview and Analysis |

| 6.4.2 Germany Brake System Market Revenues & Volume, By Hydraulic, 2021 - 2031F |

| 6.4.3 Germany Brake System Market Revenues & Volume, By Pneumatic, 2021 - 2031F |

| 6.5 Germany Brake System Market, By Off-highway Brake Type |

| 6.5.1 Overview and Analysis |

| 6.5.2 Germany Brake System Market Revenues & Volume, By Hydraulic Wet Brake, 2021 - 2031F |

| 6.5.3 Germany Brake System Market Revenues & Volume, By Dynamic Brake, 2021 - 2031F |

| 6.5.4 Germany Brake System Market Revenues & Volume, By Hydrostatic Brake, 2021 - 2031F |

| 6.5.5 Germany Brake System Market Revenues & Volume, By Other, 2021 - 2031F |

| 6.6 Germany Brake System Market, By Off-highway Application |

| 6.6.1 Overview and Analysis |

| 6.6.2 Germany Brake System Market Revenues & Volume, By Construction Equipment, 2021 - 2031F |

| 6.6.3 Germany Brake System Market Revenues & Volume, By Mining Equipment, 2021 - 2031F |

| 6.6.4 Germany Brake System Market Revenues & Volume, By Agricultural Tractors, 2021 - 2031F |

| 7 Germany Brake System Market Import-Export Trade Statistics |

| 7.1 Germany Brake System Market Export to Major Countries |

| 7.2 Germany Brake System Market Imports from Major Countries |

| 8 Germany Brake System Market Key Performance Indicators |

| 9 Germany Brake System Market - Opportunity Assessment |

| 9.1 Germany Brake System Market Opportunity Assessment, By Brake Type, 2021 & 2031F |

| 9.2 Germany Brake System Market Opportunity Assessment, By Technology, 2021 & 2031F |

| 9.3 Germany Brake System Market Opportunity Assessment, By Vehicle Type, 2021 & 2031F |

| 9.4 Germany Brake System Market Opportunity Assessment, By Actuation, 2021 & 2031F |

| 9.5 Germany Brake System Market Opportunity Assessment, By Off-highway Brake Type, 2021 & 2031F |

| 9.6 Germany Brake System Market Opportunity Assessment, By Off-highway Application, 2021 & 2031F |

| 10 Germany Brake System Market - Competitive Landscape |

| 10.1 Germany Brake System Market Revenue Share, By Companies, 2024 |

| 10.2 Germany Brake System Market Competitive Benchmarking, By Operating and Technical Parameters |

| 11 Company Profiles |

| 12 Recommendations |

| 13 Disclaimer |

- Single User License$ 1,995

- Department License$ 2,400

- Site License$ 3,120

- Global License$ 3,795

Search

Related Reports

- Middle East OLED Market (2025-2031) | Outlook, Forecast, Revenue, Growth, Companies, Analysis, Industry, Share, Trends, Value & Size

- Taiwan Electric Truck Market (2025-2031) | Outlook, Industry, Revenue, Size, Forecast, Growth, Analysis, Share, Companies, Value & Trends

- South Korea Electric Bus Market (2025-2031) | Outlook, Industry, Companies, Analysis, Size, Revenue, Value, Forecast, Trends, Growth & Share

- Vietnam Electric Vehicle Charging Infrastructure Market (2025-2031) | Outlook, Analysis, Forecast, Trends, Growth, Share, Industry, Companies, Size, Value & Revenue

- Vietnam Meat Market (2025-2031) | Companies, Industry, Forecast, Value, Trends, Analysis, Share, Growth, Revenue, Size & Outlook

- Vietnam Spices Market (2025-2031) | Companies, Revenue, Share, Value, Growth, Trends, Industry, Forecast, Outlook, Size & Analysis

- Iran Portable Fire Extinguisher Market (2025-2031) | Value, Forecast, Companies, Industry, Analysis, Trends, Growth, Revenue, Size & Share

- Philippines Animal Feed Market (2025-2031) | Companies, industry, Size, Share, Revenue, Analysis, Forecast, Growth, Outlook

- India Lingerie Market (2025-2031) | Companies, Growth, Forecast, Outlook, Size, Value, Revenue, Share, Trends, Analysis & Industry

- India Smoke Detector Market (2025-2031) | Trends, Share, Analysis, Revenue, Companies, Industry, Forecast, Size, Growth & Value

Industry Events and Analyst Meet

Our Clients

Whitepaper

- Middle East & Africa Commercial Security Market Click here to view more.

- Middle East & Africa Fire Safety Systems & Equipment Market Click here to view more.

- GCC Drone Market Click here to view more.

- Middle East Lighting Fixture Market Click here to view more.

- GCC Physical & Perimeter Security Market Click here to view more.

6WResearch In News

- Doha a strategic location for EV manufacturing hub: IPA Qatar

- Demand for luxury TVs surging in the GCC, says Samsung

- Empowering Growth: The Thriving Journey of Bangladesh’s Cable Industry

- Demand for luxury TVs surging in the GCC, says Samsung

- Video call with a traditional healer? Once unthinkable, it’s now common in South Africa

- Intelligent Buildings To Smooth GCC’s Path To Net Zero