Indonesia Lithium Hydroxide Market (2025-2031) Outlook | Revenue, Growth, Industry, Trends, Companies, Size, Analysis, Share, Forecast & Value

| Product Code: ETC195280 | Publication Date: Jul 2023 | Updated Date: Apr 2025 | Product Type: Market Research Report | |

| Publisher: 6Wresearch | No. of Pages: 60 | No. of Figures: 40 | No. of Tables: 7 | |

Indonesia Lithium Hydroxide Market Size Growth Rate

The Indonesia Lithium Hydroxide Market is poised for steady growth rate improvements from 2025 to 2029. From 11.20% in 2025, the growth rate steadily ascends to 13.88% in 2029.

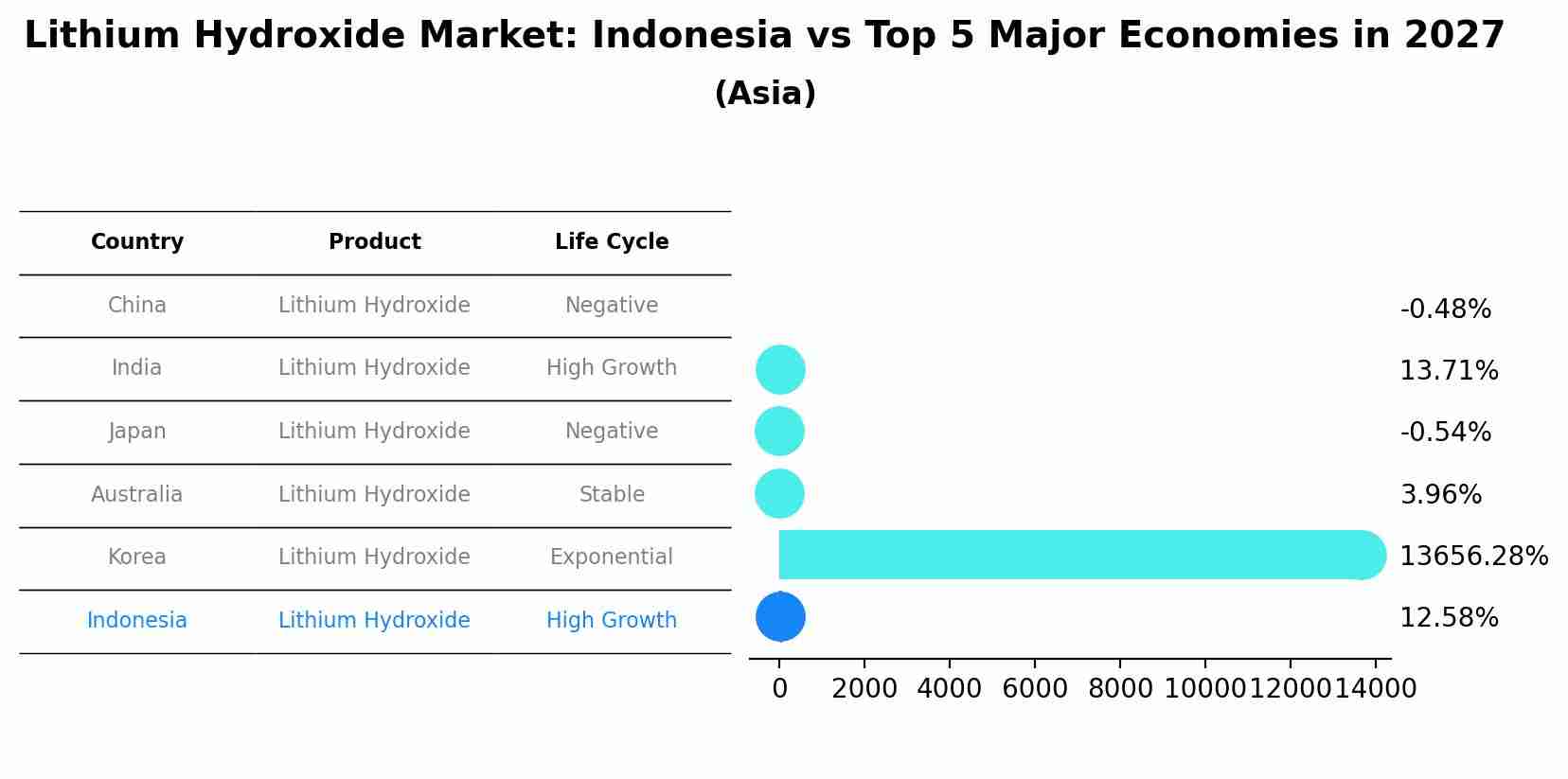

Lithium Hydroxide Market: Indonesia vs Top 5 Major Economies in 2027 (Asia)

The Lithium Hydroxide market in Indonesia is projected to grow at a high growth rate of 12.58% by 2027, highlighting the country's increasing focus on advanced technologies within the Asia region, where China holds the dominant position, followed closely by India, Japan, Australia and South Korea, shaping overall regional demand.

Indonesia Lithium Hydroxide Market Synopsis

Indonesia has recently emerged as one of the major global players in the production and consumption of lithium hydroxide. The country?s abundance of natural resources, strategic location and strong infrastructure have enabled it to become a key supplier for international markets. Indonesia government also recognizes that lithium-ion battery technology is an important area of investment, both from a commercial and environmental perspective. In 2018, the government announced plans to develop an industrial complex dedicated to producing advanced materials for batteries such as lithium hydroxide.

Market Trends

The rising demand for electric vehicles has been driving growth in the Indonesia market for lithium hydroxide over recent years due its use in high performance batteries used in these vehicles. There are several other trends influencing this market including increased private sector investments into research and development (R&D) into more efficient methods of extracting minerals such as spodumene which can be used to produce lithium hydroxide; increasing uptake of renewable energy sources such as wind and solar power; greater levels of collaboration between producers across different countries; as well as growing interest in green technologies among consumers. These developments are expected to drive further growth in Indonesia local market for lithium hydroxide over the coming years.

Market Drivers

The main drivers behind Indonesia rapid expansion within its Lithium Hydroxide Market include increasing demand from electric car manufacturers who require large volumes of high purity material with consistent deliveries at competitive prices; favorable government policies towards foreign investors looking to take advantage of cheap labor costs; technological advancements allowing more efficient extraction processes enabling higher profits margins on sales products than ever before; heavy investment by foreign companies looking to gain footholds into new markets or consolidate their position within existing ones; lower cost raw materials available through plentiful deposits throughout Southeast Asia making up part Indonesia exports make them highly attractive on regional markets; access to untapped regions opening up new opportunities where previously they were unavailable due low supply chains or lack development infrastructure necessary grow business operations efficiently.

COVID-19 Impact on the Market

The impact COVID-19 pandemic had on Lithium Hydroxide industry was profound albeit short lived because most suppliers recovered quickly when conditions normalised again after first wave infection rates subsided late 2025/2025. Government incentives like cash grants provided financial cushion businesses needed during hard times while strict social distancing measures helped keep workforce safe resume operations soon enough maintain steady.

Challenges of the Market

However, high costs associated with raw material extraction and processing operations will remain key challenges for players operating in this market. Additionally, availability may be an issue due to limited reserves present within Indonesia borders.

Industry Key Players

Companies such as PT Cahaya Bintang Selatan (CBS), PT Surya Energi Alam Sejahtera (SEAS) and Sakura Mitsui Mining & Smelting Co., Ltd are some of the main players operating within this space.

Key Highlights of the Report:

- Indonesia Lithium Hydroxide Market Outlook

- Market Size of Indonesia Lithium Hydroxide Market, 2024

- Forecast of Indonesia Lithium Hydroxide Market, 2031

- Historical Data and Forecast of Indonesia Lithium Hydroxide Revenues & Volume for the Period 2021-2031

- Indonesia Lithium Hydroxide Market Trend Evolution

- Indonesia Lithium Hydroxide Market Drivers and Challenges

- Indonesia Lithium Hydroxide Price Trends

- Indonesia Lithium Hydroxide Porter's Five Forces

- Indonesia Lithium Hydroxide Industry Life Cycle

- Historical Data and Forecast of Indonesia Lithium Hydroxide Market Revenues & Volume By By Application for the Period 2021-2031

- Historical Data and Forecast of Indonesia Lithium Hydroxide Market Revenues & Volume By Batteries for the Period 2021-2031

- Historical Data and Forecast of Indonesia Lithium Hydroxide Market Revenues & Volume By Lubricating Greases for the Period 2021-2031

- Historical Data and Forecast of Indonesia Lithium Hydroxide Market Revenues & Volume By Purification for the Period 2021-2031

- Historical Data and Forecast of Indonesia Lithium Hydroxide Market Revenues & Volume By Others for the Period 2021-2031

- Indonesia Lithium Hydroxide Import Export Trade Statistics

- Market Opportunity Assessment By By Application

- Indonesia Lithium Hydroxide Top Companies Market Share

- Indonesia Lithium Hydroxide Competitive Benchmarking By Technical and Operational Parameters

- Indonesia Lithium Hydroxide Company Profiles

- Indonesia Lithium Hydroxide Key Strategic Recommendations

Frequently Asked Questions About the Market Study (FAQs):

1 Executive Summary |

2 Introduction |

2.1 Key Highlights of the Report |

2.2 Report Description |

2.3 Market Scope & Segmentation |

2.4 Research Methodology |

2.5 Assumptions |

3 Indonesia Lithium Hydroxide Market Overview |

3.1 Indonesia Country Macro Economic Indicators |

3.2 Indonesia Lithium Hydroxide Market Revenues & Volume, 2021 & 2031F |

3.3 Indonesia Lithium Hydroxide Market - Industry Life Cycle |

3.4 Indonesia Lithium Hydroxide Market - Porter's Five Forces |

3.5 Indonesia Lithium Hydroxide Market Revenues & Volume Share, By By Application, 2021 & 2031F |

4 Indonesia Lithium Hydroxide Market Dynamics |

4.1 Impact Analysis |

4.2 Market Drivers |

4.3 Market Restraints |

5 Indonesia Lithium Hydroxide Market Trends |

6 Indonesia Lithium Hydroxide Market, By Types |

6.1 Indonesia Lithium Hydroxide Market, By By Application |

6.1.1 Overview and Analysis |

6.1.2 Indonesia Lithium Hydroxide Market Revenues & Volume, By By Application, 2021-2031F |

6.1.3 Indonesia Lithium Hydroxide Market Revenues & Volume, By Batteries, 2021-2031F |

6.1.4 Indonesia Lithium Hydroxide Market Revenues & Volume, By Lubricating Greases, 2021-2031F |

6.1.5 Indonesia Lithium Hydroxide Market Revenues & Volume, By Purification, 2021-2031F |

6.1.6 Indonesia Lithium Hydroxide Market Revenues & Volume, By Others, 2021-2031F |

7 Indonesia Lithium Hydroxide Market Import-Export Trade Statistics |

7.1 Indonesia Lithium Hydroxide Market Export to Major Countries |

7.2 Indonesia Lithium Hydroxide Market Imports from Major Countries |

8 Indonesia Lithium Hydroxide Market Key Performance Indicators |

9 Indonesia Lithium Hydroxide Market - Opportunity Assessment |

9.1 Indonesia Lithium Hydroxide Market Opportunity Assessment, By By Application, 2021 & 2031F |

10 Indonesia Lithium Hydroxide Market - Competitive Landscape |

10.1 Indonesia Lithium Hydroxide Market Revenue Share, By Companies, 2024 |

10.2 Indonesia Lithium Hydroxide Market Competitive Benchmarking, By Operating and Technical Parameters |

11 Company Profiles |

12 Recommendations |

13 Disclaimer |

- Single User License$ 1,995

- Department License$ 2,400

- Site License$ 3,120

- Global License$ 3,795

Search

Related Reports

- Middle East OLED Market (2025-2031) | Outlook, Forecast, Revenue, Growth, Companies, Analysis, Industry, Share, Trends, Value & Size

- Taiwan Electric Truck Market (2025-2031) | Outlook, Industry, Revenue, Size, Forecast, Growth, Analysis, Share, Companies, Value & Trends

- South Korea Electric Bus Market (2025-2031) | Outlook, Industry, Companies, Analysis, Size, Revenue, Value, Forecast, Trends, Growth & Share

- Vietnam Electric Vehicle Charging Infrastructure Market (2025-2031) | Outlook, Analysis, Forecast, Trends, Growth, Share, Industry, Companies, Size, Value & Revenue

- Vietnam Meat Market (2025-2031) | Companies, Industry, Forecast, Value, Trends, Analysis, Share, Growth, Revenue, Size & Outlook

- Vietnam Spices Market (2025-2031) | Companies, Revenue, Share, Value, Growth, Trends, Industry, Forecast, Outlook, Size & Analysis

- Iran Portable Fire Extinguisher Market (2025-2031) | Value, Forecast, Companies, Industry, Analysis, Trends, Growth, Revenue, Size & Share

- Philippines Animal Feed Market (2025-2031) | Companies, industry, Size, Share, Revenue, Analysis, Forecast, Growth, Outlook

- India Lingerie Market (2025-2031) | Companies, Growth, Forecast, Outlook, Size, Value, Revenue, Share, Trends, Analysis & Industry

- India Smoke Detector Market (2025-2031) | Trends, Share, Analysis, Revenue, Companies, Industry, Forecast, Size, Growth & Value

Industry Events and Analyst Meet

Our Clients

Whitepaper

- Middle East & Africa Commercial Security Market Click here to view more.

- Middle East & Africa Fire Safety Systems & Equipment Market Click here to view more.

- GCC Drone Market Click here to view more.

- Middle East Lighting Fixture Market Click here to view more.

- GCC Physical & Perimeter Security Market Click here to view more.

6WResearch In News

- Doha a strategic location for EV manufacturing hub: IPA Qatar

- Demand for luxury TVs surging in the GCC, says Samsung

- Empowering Growth: The Thriving Journey of Bangladesh’s Cable Industry

- Demand for luxury TVs surging in the GCC, says Samsung

- Video call with a traditional healer? Once unthinkable, it’s now common in South Africa

- Intelligent Buildings To Smooth GCC’s Path To Net Zero