Austria Polysulfone Market (2025-2031) | Revenue, Share, Outlook, Growth, Forecast, Trends, Value, Industry, Segmentation, Analysis, Companies & Size

| Product Code: ETC5308960 | Publication Date: Nov 2023 | Updated Date: Sep 2025 | Product Type: Market Research Report | |

| Publisher: 6Wresearch | Author: Ravi Bhandari | No. of Pages: 60 | No. of Figures: 30 | No. of Tables: 5 |

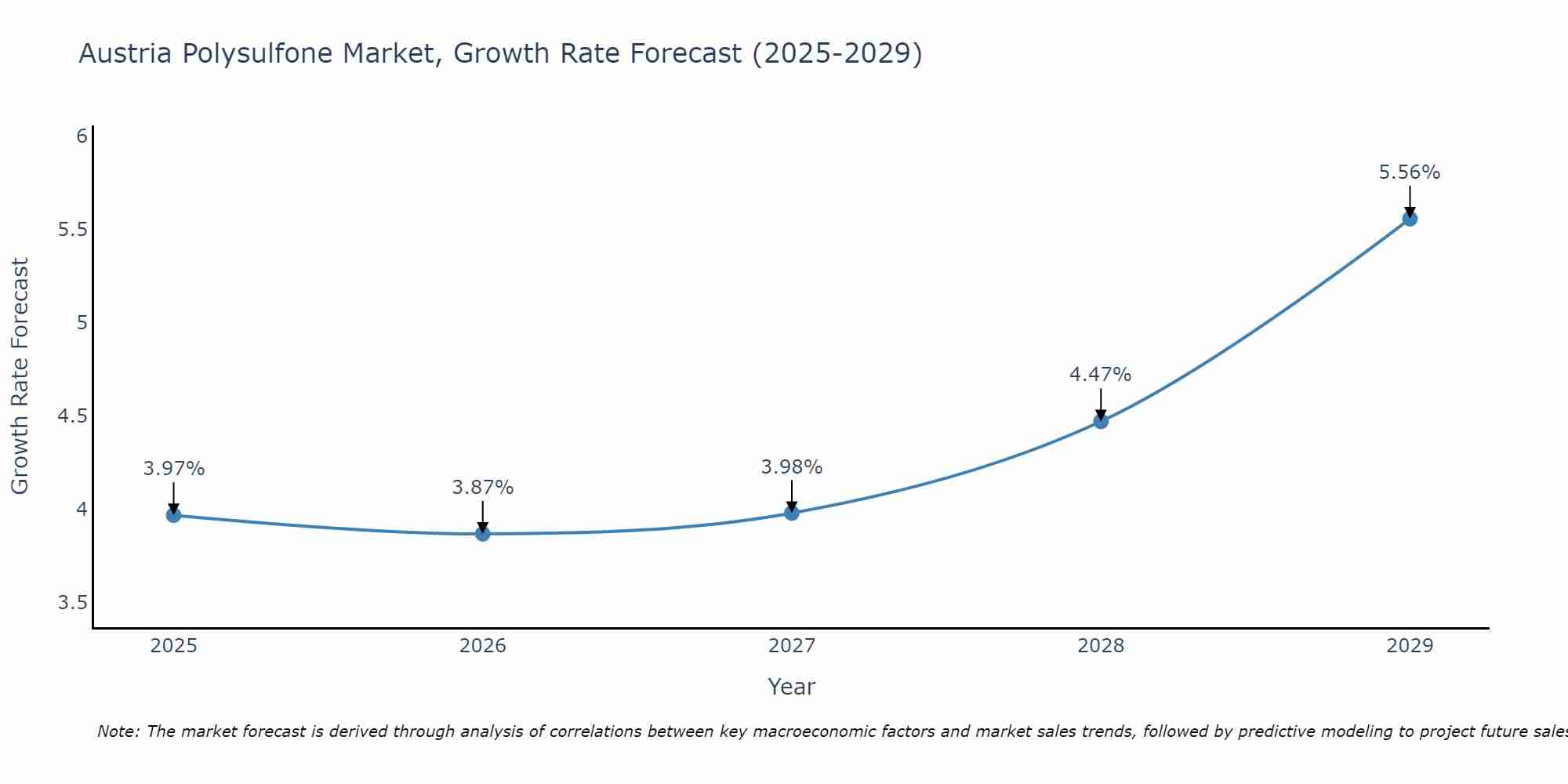

Austria Polysulfone Market Size Growth Rate

The Austria Polysulfone Market is projected to witness mixed growth rate patterns during 2025 to 2029. From 3.97% in 2025, the growth rate steadily ascends to 5.56% in 2029.

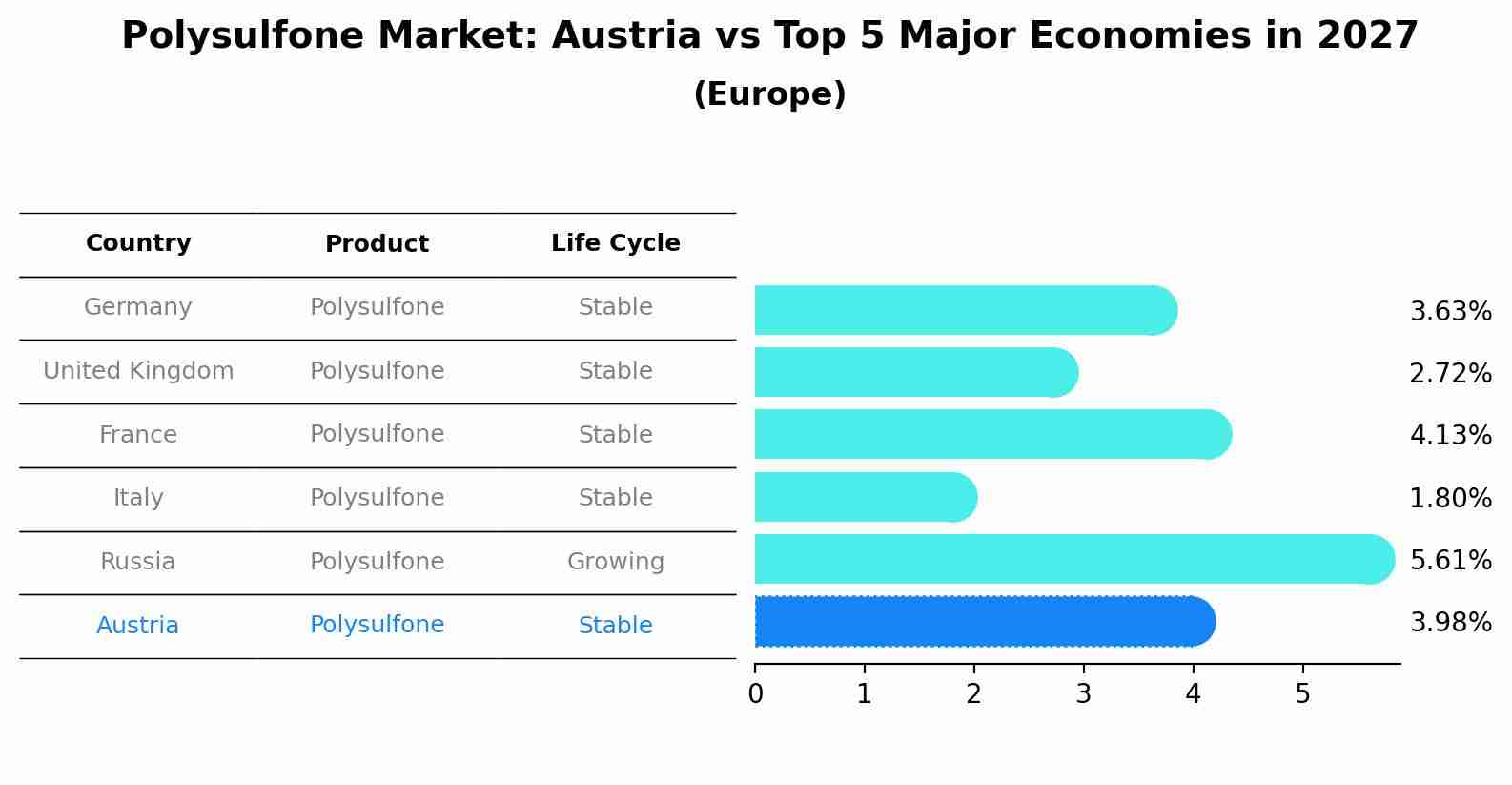

Polysulfone Market: Austria vs Top 5 Major Economies in 2027 (Europe)

The Polysulfone market in Austria is projected to grow at a stable growth rate of 3.98% by 2027, highlighting the country's increasing focus on advanced technologies within the Europe region, where Germany holds the dominant position, followed closely by United Kingdom, France, Italy and Russia, shaping overall regional demand.

Key Highlights of the Report:

- Austria Polysulfone Market Outlook

- Market Size of Austria Polysulfone Market, 2024

- Forecast of Austria Polysulfone Market, 2031

- Historical Data and Forecast of Austria Polysulfone Revenues & Volume for the Period 2021-2031

- Austria Polysulfone Market Trend Evolution

- Austria Polysulfone Market Drivers and Challenges

- Austria Polysulfone Price Trends

- Austria Polysulfone Porter`s Five Forces

- Austria Polysulfone Industry Life Cycle

- Historical Data and Forecast of Austria Polysulfone Market Revenues & Volume By Type for the Period 2021-2031

- Historical Data and Forecast of Austria Polysulfone Market Revenues & Volume By Poly-ether-sulfone for the Period 2021-2031

- Historical Data and Forecast of Austria Polysulfone Market Revenues & Volume By Poly-phenyl-sulfone for the Period 2021-2031

- Historical Data and Forecast of Austria Polysulfone Market Revenues & Volume By Poly-phenyl-sulfone for the Period 2021-2031

- Historical Data and Forecast of Austria Polysulfone Market Revenues & Volume By Polyethersulfone (PESU) for the Period 2021-2031

- Historical Data and Forecast of Austria Polysulfone Market Revenues & Volume By Polysulfone (PSU) for the Period 2021-2031

- Historical Data and Forecast of Austria Polysulfone Market Revenues & Volume By Polyphenylsulfone (PPSU) for the Period 2021-2031

- Historical Data and Forecast of Austria Polysulfone Market Revenues & Volume By Others (PEI, polyetherimide) for the Period 2021-2031

- Historical Data and Forecast of Austria Polysulfone Market Revenues & Volume By End User Industry for the Period 2021-2031

- Historical Data and Forecast of Austria Polysulfone Market Revenues & Volume By Electrical and electronics for the Period 2021-2031

- Historical Data and Forecast of Austria Polysulfone Market Revenues & Volume By Aerospace for the Period 2021-2031

- Historical Data and Forecast of Austria Polysulfone Market Revenues & Volume By Automotive for the Period 2021-2031

- Historical Data and Forecast of Austria Polysulfone Market Revenues & Volume By Medical &Healthcare for the Period 2021-2031

- Historical Data and Forecast of Austria Polysulfone Market Revenues & Volume By Food &Beverage for the Period 2021-2031

- Historical Data and Forecast of Austria Polysulfone Market Revenues & Volume By Others for the Period 2021-2031

- Austria Polysulfone Import Export Trade Statistics

- Market Opportunity Assessment By Type

- Market Opportunity Assessment By Poly-phenyl-sulfone

- Market Opportunity Assessment By End User Industry

- Austria Polysulfone Top Companies Market Share

- Austria Polysulfone Competitive Benchmarking By Technical and Operational Parameters

- Austria Polysulfone Company Profiles

- Austria Polysulfone Key Strategic Recommendations

Frequently Asked Questions About the Market Study (FAQs):

1 Executive Summary |

2 Introduction |

2.1 Key Highlights of the Report |

2.2 Report Description |

2.3 Market Scope & Segmentation |

2.4 Research Methodology |

2.5 Assumptions |

3 Austria Polysulfone Market Overview |

3.1 Austria Country Macro Economic Indicators |

3.2 Austria Polysulfone Market Revenues & Volume, 2021 & 2031F |

3.3 Austria Polysulfone Market - Industry Life Cycle |

3.4 Austria Polysulfone Market - Porter's Five Forces |

3.5 Austria Polysulfone Market Revenues & Volume Share, By Type, 2021 & 2031F |

3.6 Austria Polysulfone Market Revenues & Volume Share, By Poly-phenyl-sulfone, 2021 & 2031F |

3.7 Austria Polysulfone Market Revenues & Volume Share, By End User Industry, 2021 & 2031F |

4 Austria Polysulfone Market Dynamics |

4.1 Impact Analysis |

4.2 Market Drivers |

4.2.1 Increasing demand for lightweight and high-performance materials in industries such as automotive, aerospace, and healthcare. |

4.2.2 Growing focus on sustainability and environmentally-friendly materials, as polysulfone is recyclable and has a low carbon footprint. |

4.2.3 Technological advancements leading to the development of innovative polysulfone products with enhanced properties. |

4.3 Market Restraints |

4.3.1 Fluctuations in raw material prices, particularly affecting the production cost of polysulfone. |

4.3.2 Intense competition from alternative materials such as polyetheretherketone (PEEK) or polyphenylene sulfide (PPS) in high-performance applications. |

4.3.3 Regulatory challenges related to environmental policies and chemical regulations impacting the production and usage of polysulfone. |

5 Austria Polysulfone Market Trends |

6 Austria Polysulfone Market Segmentations |

6.1 Austria Polysulfone Market, By Type |

6.1.1 Overview and Analysis |

6.1.2 Austria Polysulfone Market Revenues & Volume, By Poly-ether-sulfone, 2021-2031F |

6.1.3 Austria Polysulfone Market Revenues & Volume, By Poly-phenyl-sulfone, 2021-2031F |

6.2 Austria Polysulfone Market, By Poly-phenyl-sulfone |

6.2.1 Overview and Analysis |

6.2.2 Austria Polysulfone Market Revenues & Volume, By Polyethersulfone (PESU), 2021-2031F |

6.2.3 Austria Polysulfone Market Revenues & Volume, By Polysulfone (PSU), 2021-2031F |

6.2.4 Austria Polysulfone Market Revenues & Volume, By Polyphenylsulfone (PPSU), 2021-2031F |

6.2.5 Austria Polysulfone Market Revenues & Volume, By Others (PEI, polyetherimide), 2021-2031F |

6.3 Austria Polysulfone Market, By End User Industry |

6.3.1 Overview and Analysis |

6.3.2 Austria Polysulfone Market Revenues & Volume, By Electrical and electronics, 2021-2031F |

6.3.3 Austria Polysulfone Market Revenues & Volume, By Aerospace, 2021-2031F |

6.3.4 Austria Polysulfone Market Revenues & Volume, By Automotive, 2021-2031F |

6.3.5 Austria Polysulfone Market Revenues & Volume, By Medical &Healthcare, 2021-2031F |

6.3.6 Austria Polysulfone Market Revenues & Volume, By Food &Beverage, 2021-2031F |

6.3.7 Austria Polysulfone Market Revenues & Volume, By Others, 2021-2031F |

7 Austria Polysulfone Market Import-Export Trade Statistics |

7.1 Austria Polysulfone Market Export to Major Countries |

7.2 Austria Polysulfone Market Imports from Major Countries |

8 Austria Polysulfone Market Key Performance Indicators |

8.1 Research and development investment in polysulfone-based technologies and applications. |

8.2 Number of patents filed for new polysulfone formulations or manufacturing processes. |

8.3 Adoption rate of polysulfone in key end-user industries such as automotive, healthcare, and electronics. |

9 Austria Polysulfone Market - Opportunity Assessment |

9.1 Austria Polysulfone Market Opportunity Assessment, By Type, 2021 & 2031F |

9.2 Austria Polysulfone Market Opportunity Assessment, By Poly-phenyl-sulfone, 2021 & 2031F |

9.3 Austria Polysulfone Market Opportunity Assessment, By End User Industry, 2021 & 2031F |

10 Austria Polysulfone Market - Competitive Landscape |

10.1 Austria Polysulfone Market Revenue Share, By Companies, 2024 |

10.2 Austria Polysulfone Market Competitive Benchmarking, By Operating and Technical Parameters |

11 Company Profiles |

12 Recommendations | 13 Disclaimer |

- Single User License$ 1,995

- Department License$ 2,400

- Site License$ 3,120

- Global License$ 3,795

Search

Thought Leadership and Analyst Meet

Our Clients

Related Reports

- Germany Breakfast Food Market (2026-2032) | Industry, Share, Growth, Size, Companies, Value, Analysis, Revenue, Trends, Forecast & Outlook

- Australia Briquette Market (2025-2031) | Growth, Size, Revenue, Forecast, Analysis, Trends, Value, Share, Industry & Companies

- Vietnam System Integrator Market (2025-2031) | Size, Companies, Analysis, Industry, Value, Forecast, Growth, Trends, Revenue & Share

- ASEAN and Thailand Brain Health Supplements Market (2025-2031) | Strategy, Consumer Insights, Analysis, Investment Trends, Opportunities, Growth, Size, Share, Industry, Revenue, Segments, Value, Segmentation, Supply, Forecast, Restraints, Outlook, Competition, Drivers, Trends, Demand, Pricing Analysis, Competitive, Strategic Insights, Companies, Challenges

- ASEAN Bearings Market (2025-2031) | Strategy, Consumer Insights, Analysis, Investment Trends, Opportunities, Growth, Size, Share, Industry, Revenue, Segments, Value, Segmentation, Supply, Forecast, Restraints, Outlook, Competition, Drivers, Trends, Demand, Pricing Analysis, Competitive, Strategic Insights, Companies, Challenges

- Europe Flooring Market (2025-2031) | Outlook, Share, Industry, Trends, Forecast, Companies, Revenue, Size, Analysis, Growth & Value

- Saudi Arabia Manlift Market (2025-2031) | Outlook, Size, Growth, Trends, Companies, Industry, Revenue, Value, Share, Forecast & Analysis

- Uganda Excavator, Crane, and Wheel Loaders Market (2025-2031) | Strategy, Consumer Insights, Analysis, Investment Trends, Opportunities, Growth, Size, Share, Industry, Revenue, Segments, Value, Segmentation, Supply, Forecast, Restraints, Outlook, Competition, Drivers, Trends, Demand, Pricing Analysis, Competitive, Strategic Insights, Companies, Challenges

- Rwanda Excavator, Crane, and Wheel Loaders Market (2025-2031) | Strategy, Consumer Insights, Analysis, Investment Trends, Opportunities, Growth, Size, Share, Industry, Revenue, Segments, Value, Segmentation, Supply, Forecast, Restraints, Outlook, Competition, Drivers, Trends, Demand, Pricing Analysis, Competitive, Strategic Insights, Companies, Challenges

- Kenya Excavator, Crane, and Wheel Loaders Market (2025-2031) | Strategy, Consumer Insights, Analysis, Investment Trends, Opportunities, Growth, Size, Share, Industry, Revenue, Segments, Value, Segmentation, Supply, Forecast, Restraints, Outlook, Competition, Drivers, Trends, Demand, Pricing Analysis, Competitive, Strategic Insights, Companies, Challenges

Industry Events and Analyst Meet

Whitepaper

- Middle East & Africa Commercial Security Market Click here to view more.

- Middle East & Africa Fire Safety Systems & Equipment Market Click here to view more.

- GCC Drone Market Click here to view more.

- Middle East Lighting Fixture Market Click here to view more.

- GCC Physical & Perimeter Security Market Click here to view more.

6WResearch In News

- Doha a strategic location for EV manufacturing hub: IPA Qatar

- Demand for luxury TVs surging in the GCC, says Samsung

- Empowering Growth: The Thriving Journey of Bangladesh’s Cable Industry

- Demand for luxury TVs surging in the GCC, says Samsung

- Video call with a traditional healer? Once unthinkable, it’s now common in South Africa

- Intelligent Buildings To Smooth GCC’s Path To Net Zero