Burkina Faso Digital Banking Platforms Market (2025-2031) | Trends, Value, Industry, Size, Outlook, Companies, Growth, Revenue, Analysis, Share, Segmentation & Forecast

| Product Code: ETC5531064 | Publication Date: Nov 2023 | Updated Date: Oct 2025 | Product Type: Market Research Report | |

| Publisher: 6Wresearch | Author: Vasudha | No. of Pages: 60 | No. of Figures: 30 | No. of Tables: 5 |

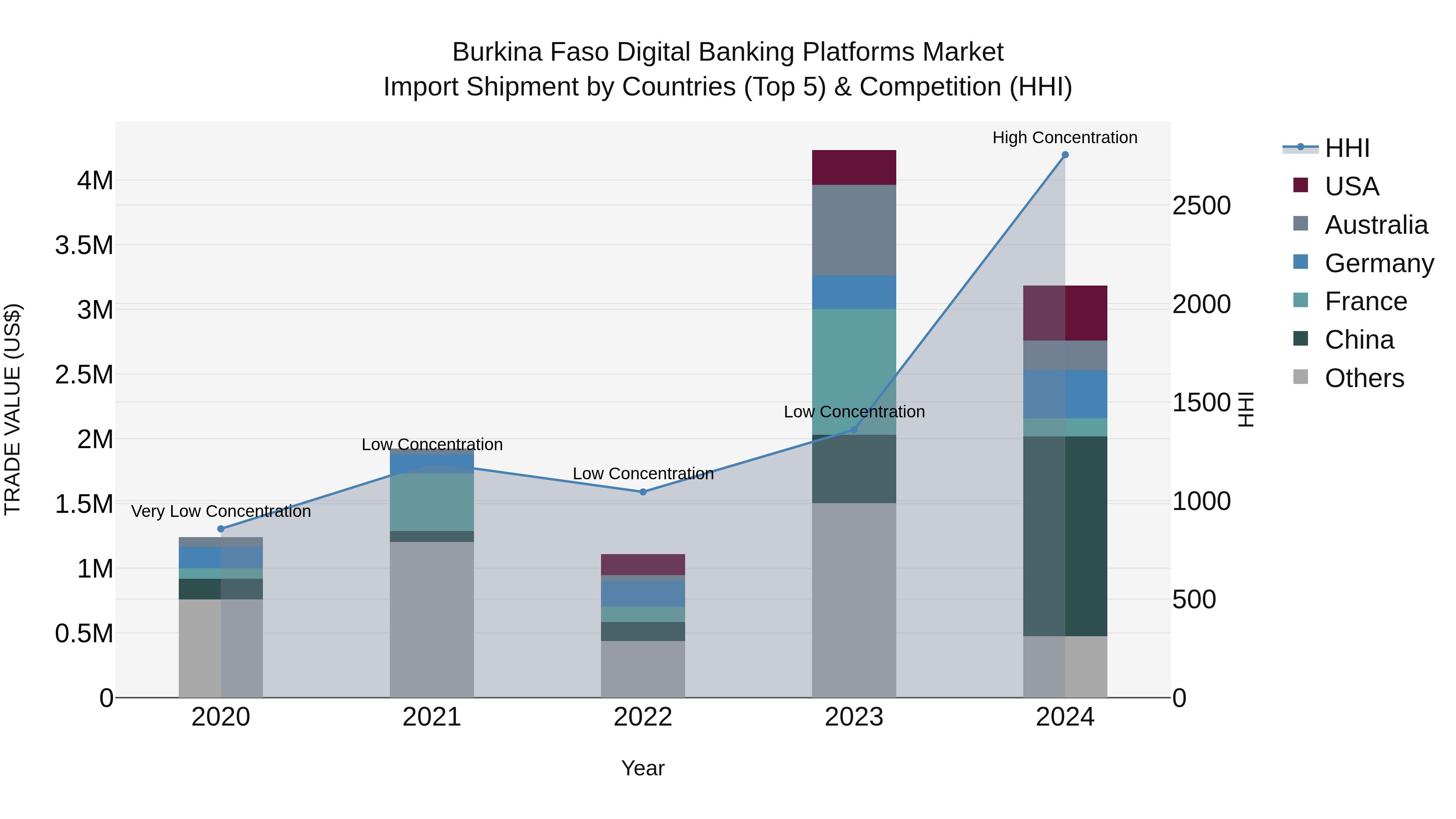

Burkina Faso Digital Banking Platforms Market Top 5 Importing Countries and Market Competition (HHI) Analysis

In 2024, Burkina Faso saw a significant shift in the digital banking platforms import landscape with top exporters being China, USA, Germany, Australia, and France. The market experienced a notable increase in concentration levels from 2023 to 2024, indicating a more focused supplier base. Despite a growth rate decline in 2024 compared to the previous year, the compound annual growth rate (CAGR) for 2020-2024 remained strong at 26.56%. This suggests a thriving market for digital banking platforms in Burkina Faso, with key players from diverse countries contributing to its growth.

Burkina Faso Digital Banking Platforms Market Overview

The Digital Banking Platforms Market in Burkina Faso is rapidly evolving as financial institutions seek to offer more convenient and accessible banking services. Digital banking platforms allow customers to conduct transactions, access accounts, and manage finances online. As mobile and internet penetration increase, the market for digital banking platforms is expected to grow.

Drivers of the market

The digital banking platforms market in Burkina Faso is driven by the growing demand for convenient and accessible financial services. With the rise of mobile and internet penetration, more people are turning to digital banking solutions for their financial needs. These platforms offer a range of services, from payments and transfers to account management, making banking more efficient and user-friendly. The push for financial inclusion, supported by government initiatives and the expansion of mobile money services, is also contributing to the growth of the digital banking platforms market in Burkina Faso.

Challenges of the market

The digital banking platforms market in Burkina Faso is confronted by several significant challenges, including the limited penetration of digital banking infrastructure in rural and remote areas. This lack of infrastructure makes it difficult for digital banking platforms to reach a broader audience. Additionally, there is a general lack of trust in digital banking services among the population, which can be attributed to concerns over security and privacy. The high cost of implementing and maintaining digital banking platforms also poses a barrier to entry, particularly for smaller financial institutions.

Government Policy of the market

To improve financial services accessibility, the government supports the development and adoption of digital banking platforms. Policies focus on encouraging the use of digital banking technologies to enhance financial inclusion and efficiency. The government provides regulatory support and incentives for innovation in digital banking services.

Key Highlights of the Report:

- Burkina Faso Digital Banking Platforms Market Outlook

- Market Size of Burkina Faso Digital Banking Platforms Market, 2024

- Forecast of Burkina Faso Digital Banking Platforms Market, 2031

- Historical Data and Forecast of Burkina Faso Digital Banking Platforms Revenues & Volume for the Period 2021-2031

- Burkina Faso Digital Banking Platforms Market Trend Evolution

- Burkina Faso Digital Banking Platforms Market Drivers and Challenges

- Burkina Faso Digital Banking Platforms Price Trends

- Burkina Faso Digital Banking Platforms Porter`s Five Forces

- Burkina Faso Digital Banking Platforms Industry Life Cycle

- Historical Data and Forecast of Burkina Faso Digital Banking Platforms Market Revenues & Volume By Component for the Period 2021-2031

- Historical Data and Forecast of Burkina Faso Digital Banking Platforms Market Revenues & Volume By Platforms for the Period 2021-2031

- Historical Data and Forecast of Burkina Faso Digital Banking Platforms Market Revenues & Volume By Services for the Period 2021-2031

- Historical Data and Forecast of Burkina Faso Digital Banking Platforms Market Revenues & Volume By Banking Mode for the Period 2021-2031

- Historical Data and Forecast of Burkina Faso Digital Banking Platforms Market Revenues & Volume By Online Banking for the Period 2021-2031

- Historical Data and Forecast of Burkina Faso Digital Banking Platforms Market Revenues & Volume By Mobile Banking for the Period 2021-2031

- Historical Data and Forecast of Burkina Faso Digital Banking Platforms Market Revenues & Volume By Banking Type for the Period 2021-2031

- Historical Data and Forecast of Burkina Faso Digital Banking Platforms Market Revenues & Volume By Retail Banking for the Period 2021-2031

- Historical Data and Forecast of Burkina Faso Digital Banking Platforms Market Revenues & Volume By Corporate Banking for the Period 2021-2031

- Historical Data and Forecast of Burkina Faso Digital Banking Platforms Market Revenues & Volume By Investment Banking for the Period 2021-2031

- Historical Data and Forecast of Burkina Faso Digital Banking Platforms Market Revenues & Volume By Deployment Mode for the Period 2021-2031

- Historical Data and Forecast of Burkina Faso Digital Banking Platforms Market Revenues & Volume By Cloud for the Period 2021-2031

- Historical Data and Forecast of Burkina Faso Digital Banking Platforms Market Revenues & Volume By On-premises for the Period 2021-2031

- Burkina Faso Digital Banking Platforms Import Export Trade Statistics

- Market Opportunity Assessment By Component

- Market Opportunity Assessment By Banking Mode

- Market Opportunity Assessment By Banking Type

- Market Opportunity Assessment By Deployment Mode

- Burkina Faso Digital Banking Platforms Top Companies Market Share

- Burkina Faso Digital Banking Platforms Competitive Benchmarking By Technical and Operational Parameters

- Burkina Faso Digital Banking Platforms Company Profiles

- Burkina Faso Digital Banking Platforms Key Strategic Recommendations

Frequently Asked Questions About the Market Study (FAQs):

1 Executive Summary |

2 Introduction |

2.1 Key Highlights of the Report |

2.2 Report Description |

2.3 Market Scope & Segmentation |

2.4 Research Methodology |

2.5 Assumptions |

3 Burkina Faso Digital Banking Platforms Market Overview |

3.1 Burkina Faso Country Macro Economic Indicators |

3.2 Burkina Faso Digital Banking Platforms Market Revenues & Volume, 2021 & 2031F |

3.3 Burkina Faso Digital Banking Platforms Market - Industry Life Cycle |

3.4 Burkina Faso Digital Banking Platforms Market - Porter's Five Forces |

3.5 Burkina Faso Digital Banking Platforms Market Revenues & Volume Share, By Component , 2021 & 2031F |

3.6 Burkina Faso Digital Banking Platforms Market Revenues & Volume Share, By Banking Mode , 2021 & 2031F |

3.7 Burkina Faso Digital Banking Platforms Market Revenues & Volume Share, By Banking Type , 2021 & 2031F |

3.8 Burkina Faso Digital Banking Platforms Market Revenues & Volume Share, By Deployment Mode, 2021 & 2031F |

4 Burkina Faso Digital Banking Platforms Market Dynamics |

4.1 Impact Analysis |

4.2 Market Drivers |

4.2.1 Increasing smartphone penetration in Burkina Faso |

4.2.2 Rising demand for convenient and secure banking services |

4.2.3 Government initiatives to promote digital financial inclusion |

4.3 Market Restraints |

4.3.1 Limited internet infrastructure and connectivity challenges |

4.3.2 Low levels of financial literacy and awareness about digital banking |

4.3.3 Security concerns and lack of trust in digital platforms |

5 Burkina Faso Digital Banking Platforms Market Trends |

6 Burkina Faso Digital Banking Platforms Market Segmentations |

6.1 Burkina Faso Digital Banking Platforms Market, By Component |

6.1.1 Overview and Analysis |

6.1.2 Burkina Faso Digital Banking Platforms Market Revenues & Volume, By Platforms , 2021-2031F |

6.1.3 Burkina Faso Digital Banking Platforms Market Revenues & Volume, By Services, 2021-2031F |

6.2 Burkina Faso Digital Banking Platforms Market, By Banking Mode |

6.2.1 Overview and Analysis |

6.2.2 Burkina Faso Digital Banking Platforms Market Revenues & Volume, By Online Banking, 2021-2031F |

6.2.3 Burkina Faso Digital Banking Platforms Market Revenues & Volume, By Mobile Banking, 2021-2031F |

6.3 Burkina Faso Digital Banking Platforms Market, By Banking Type |

6.3.1 Overview and Analysis |

6.3.2 Burkina Faso Digital Banking Platforms Market Revenues & Volume, By Retail Banking, 2021-2031F |

6.3.3 Burkina Faso Digital Banking Platforms Market Revenues & Volume, By Corporate Banking, 2021-2031F |

6.3.4 Burkina Faso Digital Banking Platforms Market Revenues & Volume, By Investment Banking, 2021-2031F |

6.4 Burkina Faso Digital Banking Platforms Market, By Deployment Mode |

6.4.1 Overview and Analysis |

6.4.2 Burkina Faso Digital Banking Platforms Market Revenues & Volume, By Cloud, 2021-2031F |

6.4.3 Burkina Faso Digital Banking Platforms Market Revenues & Volume, By On-premises, 2021-2031F |

7 Burkina Faso Digital Banking Platforms Market Import-Export Trade Statistics |

7.1 Burkina Faso Digital Banking Platforms Market Export to Major Countries |

7.2 Burkina Faso Digital Banking Platforms Market Imports from Major Countries |

8 Burkina Faso Digital Banking Platforms Market Key Performance Indicators |

8.1 Average number of new users onboarded monthly |

8.2 Percentage increase in mobile transactions |

8.3 Customer satisfaction score with digital banking services |

8.4 Number of active users utilizing multiple digital banking features |

8.5 Growth in the number of partnerships with local businesses for digital payments |

9 Burkina Faso Digital Banking Platforms Market - Opportunity Assessment |

9.1 Burkina Faso Digital Banking Platforms Market Opportunity Assessment, By Component , 2021 & 2031F |

9.2 Burkina Faso Digital Banking Platforms Market Opportunity Assessment, By Banking Mode , 2021 & 2031F |

9.3 Burkina Faso Digital Banking Platforms Market Opportunity Assessment, By Banking Type , 2021 & 2031F |

9.4 Burkina Faso Digital Banking Platforms Market Opportunity Assessment, By Deployment Mode, 2021 & 2031F |

10 Burkina Faso Digital Banking Platforms Market - Competitive Landscape |

10.1 Burkina Faso Digital Banking Platforms Market Revenue Share, By Companies, 2024 |

10.2 Burkina Faso Digital Banking Platforms Market Competitive Benchmarking, By Operating and Technical Parameters |

11 Company Profiles |

12 Recommendations | 13 Disclaimer |

- Single User License$ 1,995

- Department License$ 2,400

- Site License$ 3,120

- Global License$ 3,795

Search

Thought Leadership and Analyst Meet

Our Clients

Related Reports

- Afghanistan Apparel Market (2026-2032) | Growth, Outlook, Industry, Segmentation, Forecast, Size, Companies, Trends, Value, Share, Analysis & Revenue

- Canada Oil and Gas Market (2026-2032) | Share, Segmentation, Value, Industry, Trends, Forecast, Analysis, Size & Revenue, Growth, Competitive Landscape, Outlook, Companies

- Germany Breakfast Food Market (2026-2032) | Industry, Share, Growth, Size, Companies, Value, Analysis, Revenue, Trends, Forecast & Outlook

- Australia Briquette Market (2025-2031) | Growth, Size, Revenue, Forecast, Analysis, Trends, Value, Share, Industry & Companies

- Vietnam System Integrator Market (2025-2031) | Size, Companies, Analysis, Industry, Value, Forecast, Growth, Trends, Revenue & Share

- ASEAN and Thailand Brain Health Supplements Market (2025-2031) | Strategy, Consumer Insights, Analysis, Investment Trends, Opportunities, Growth, Size, Share, Industry, Revenue, Segments, Value, Segmentation, Supply, Forecast, Restraints, Outlook, Competition, Drivers, Trends, Demand, Pricing Analysis, Competitive, Strategic Insights, Companies, Challenges

- ASEAN Bearings Market (2025-2031) | Strategy, Consumer Insights, Analysis, Investment Trends, Opportunities, Growth, Size, Share, Industry, Revenue, Segments, Value, Segmentation, Supply, Forecast, Restraints, Outlook, Competition, Drivers, Trends, Demand, Pricing Analysis, Competitive, Strategic Insights, Companies, Challenges

- Europe Flooring Market (2025-2031) | Outlook, Share, Industry, Trends, Forecast, Companies, Revenue, Size, Analysis, Growth & Value

- Saudi Arabia Manlift Market (2025-2031) | Outlook, Size, Growth, Trends, Companies, Industry, Revenue, Value, Share, Forecast & Analysis

- Uganda Excavator, Crane, and Wheel Loaders Market (2025-2031) | Strategy, Consumer Insights, Analysis, Investment Trends, Opportunities, Growth, Size, Share, Industry, Revenue, Segments, Value, Segmentation, Supply, Forecast, Restraints, Outlook, Competition, Drivers, Trends, Demand, Pricing Analysis, Competitive, Strategic Insights, Companies, Challenges

Industry Events and Analyst Meet

Whitepaper

- Middle East & Africa Commercial Security Market Click here to view more.

- Middle East & Africa Fire Safety Systems & Equipment Market Click here to view more.

- GCC Drone Market Click here to view more.

- Middle East Lighting Fixture Market Click here to view more.

- GCC Physical & Perimeter Security Market Click here to view more.

6WResearch In News

- Doha a strategic location for EV manufacturing hub: IPA Qatar

- Demand for luxury TVs surging in the GCC, says Samsung

- Empowering Growth: The Thriving Journey of Bangladesh’s Cable Industry

- Demand for luxury TVs surging in the GCC, says Samsung

- Video call with a traditional healer? Once unthinkable, it’s now common in South Africa

- Intelligent Buildings To Smooth GCC’s Path To Net Zero