India Glyphosate Market (2025-2031) Outlook | Value, Analysis, Trends, Companies, Industry, Revenue, Size, Share, Forecast & Growth

| Product Code: ETC415760 | Publication Date: Aug 2023 | Updated Date: Nov 2025 | Product Type: Market Research Report | |

| Publisher: 6Wresearch | Author: Ravi Bhandari | No. of Pages: 75 | No. of Figures: 35 | No. of Tables: 20 |

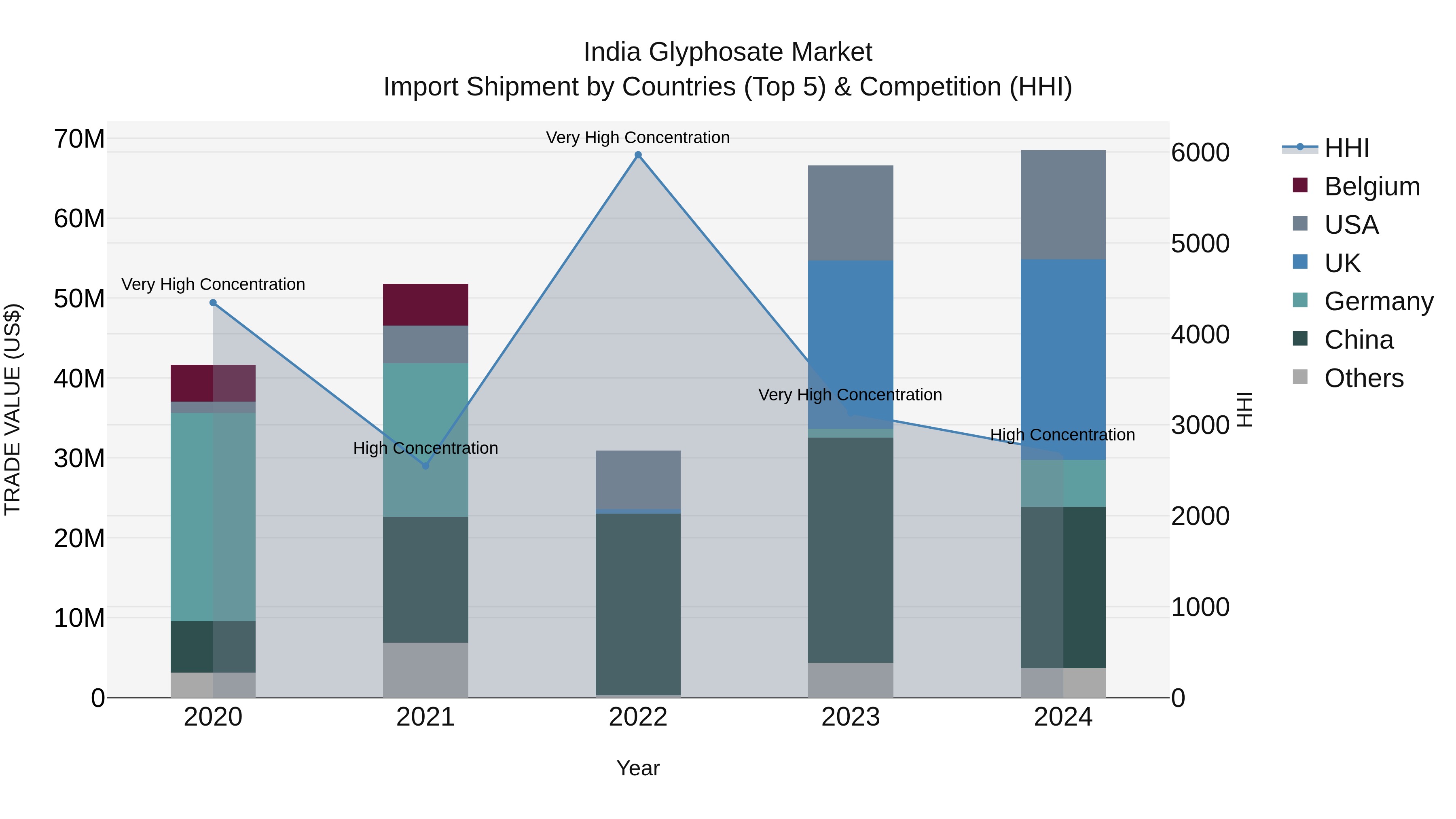

India Glyphosate Market Top 5 Importing Countries and Market Competition (HHI) Analysis

India`s glyphosate import shipments in 2024 saw significant contributions from top exporting countries including the UK, China, USA, Germany, and Switzerland. The Herfindahl-Hirschman Index (HHI) indicated a high concentration level in 2023, which further increased in 2024. With a notable Compound Annual Growth Rate (CAGR) of 13.26% from 2020 to 2024, the sector displayed resilience and potential. Although the growth rate slightly slowed down from 2023 to 2024 at 2.9%, the overall positive trajectory suggests a thriving market for glyphosate imports in India.

India Glyphosate Market Overview

The glyphosate market in India has been facing challenges due to increasing concerns about environmental impact and health risks associated with the use of this herbicide. While glyphosate has been widely used in agriculture to control weeds, the market has witnessed some restrictions and controversies in recent years. As India agriculture evolves towards more sustainable practices, the glyphosate market may see shifts in demand and usage patterns.

Drivers of the Market

The India glyphosate market is primarily driven by its role in agriculture as a broad-spectrum herbicide. Glyphosate is widely used to control weeds and improve crop yields. The market`s growth is influenced by the expansion of agriculture in India, the adoption of genetically modified (GM) crops, and the need for efficient weed control methods. Government regulations, safety concerns, and the development of glyphosate-resistant weed species are factors that shape the market`s trajectory.

Challenges of the Market

The India Glyphosate market faces several challenges, including increasing concerns about its environmental impact and potential health risks. Glyphosate has come under scrutiny due to its association with water pollution and potential harm to non-target crops and wildlife. Regulatory restrictions and bans on glyphosate in some regions pose obstacles to its usage, affecting the market. The emergence of glyphosate-resistant weeds also requires the development of new herbicides and farming practices, adding complexity to the industry.

COVID-19 Impact on the Market

The India glyphosate market faced disruptions during the COVID-19 pandemic. The market experienced supply chain challenges and reduced demand from agriculture, particularly in the early stages of the pandemic. However, as agricultural activities continued and farmers sought cost-effective weed control solutions, the demand for glyphosate rebounded. The market adapted to the changing landscape and showed resilience.

Key Players in the Market

In the India Glyphosate market, key players are essential in the manufacturing and distribution of glyphosate-based herbicides. Leading companies in this segment include UPL Limited, Nufarm Limited, Rallis India Limited, and Adama India Private Limited. These companies play a crucial role in the agricultural sector, providing effective weed control solutions that help India farmers enhance crop yields and agricultural productivity.

Key Highlights of the Report:

- India Glyphosate Market Outlook

- Market Size of India Glyphosate Market, 2024

- Forecast of India Glyphosate Market, 2031

- Historical Data and Forecast of India Glyphosate Revenues & Volume for the Period 2021-2031

- India Glyphosate Market Trend Evolution

- India Glyphosate Market Drivers and Challenges

- India Glyphosate Price Trends

- India Glyphosate Porter's Five Forces

- India Glyphosate Industry Life Cycle

- Historical Data and Forecast of India Glyphosate Market Revenues & Volume By Application for the Period 2021-2031

- Historical Data and Forecast of India Glyphosate Market Revenues & Volume By Genetically Modified (GM) Crops for the Period 2021-2031

- Historical Data and Forecast of India Glyphosate Market Revenues & Volume By Conventional Crops for the Period 2021-2031

- India Glyphosate Import Export Trade Statistics

- Market Opportunity Assessment By Application

- India Glyphosate Top Companies Market Share

- India Glyphosate Competitive Benchmarking By Technical and Operational Parameters

- India Glyphosate Company Profiles

- India Glyphosate Key Strategic Recommendations

Frequently Asked Questions About the Market Study (FAQs):

1 Executive Summary |

2 Introduction |

2.1 Key Highlights of the Report |

2.2 Report Description |

2.3 Market Scope & Segmentation |

2.4 Research Methodology |

2.5 Assumptions |

3 India Glyphosate Market Overview |

3.1 India Country Macro Economic Indicators |

3.2 India Glyphosate Market Revenues & Volume, 2021 & 2031F |

3.3 India Glyphosate Market - Industry Life Cycle |

3.4 India Glyphosate Market - Porter's Five Forces |

3.5 India Glyphosate Market Revenues & Volume Share, By Application, 2021 & 2031F |

4 India Glyphosate Market Dynamics |

4.1 Impact Analysis |

4.2 Market Drivers |

4.2.1 Increasing adoption of no-till farming practices in India |

4.2.2 Growth in the agriculture sector due to government initiatives and investments |

4.2.3 Rising demand for herbicides to improve crop yield |

4.3 Market Restraints |

4.3.1 Stringent regulations and bans on glyphosate usage in certain regions |

4.3.2 Concerns over environmental impact and health hazards associated with glyphosate |

4.3.3 Competition from alternative herbicides and bio-based products |

5 India Glyphosate Market Trends |

6 India Glyphosate Market, By Types |

6.1 India Glyphosate Market, By Application |

6.1.1 Overview and Analysis |

6.1.2 India Glyphosate Market Revenues & Volume, By Application, 2021-2031F |

6.1.3 India Glyphosate Market Revenues & Volume, By Genetically Modified (GM) Crops, 2021-2031F |

6.1.4 India Glyphosate Market Revenues & Volume, By Conventional Crops, 2021-2031F |

7 India Glyphosate Market Import-Export Trade Statistics |

7.1 India Glyphosate Market Export to Major Countries |

7.2 India Glyphosate Market Imports from Major Countries |

8 India Glyphosate Market Key Performance Indicators |

8.1 Average price of glyphosate in the Indian market |

8.2 Adoption rate of glyphosate-resistant crops in India |

8.3 Investment and research funding in developing glyphosate formulations with lower environmental impact |

8.4 Number of new product launches and innovations in the glyphosate market in India |

9 India Glyphosate Market - Opportunity Assessment |

9.1 India Glyphosate Market Opportunity Assessment, By Application, 2021 & 2031F |

10 India Glyphosate Market - Competitive Landscape |

10.1 India Glyphosate Market Revenue Share, By Companies, 2024 |

10.2 India Glyphosate Market Competitive Benchmarking, By Operating and Technical Parameters |

11 Company Profiles |

12 Recommendations |

13 Disclaimer |

- Single User License$ 1,995

- Department License$ 2,400

- Site License$ 3,120

- Global License$ 3,795

Search

Thought Leadership and Analyst Meet

Our Clients

Related Reports

- Canada Oil and Gas Market (2026-2032) | Share, Segmentation, Value, Industry, Trends, Forecast, Analysis, Size & Revenue, Growth, Competitive Landscape, Outlook, Companies

- Germany Breakfast Food Market (2026-2032) | Industry, Share, Growth, Size, Companies, Value, Analysis, Revenue, Trends, Forecast & Outlook

- Australia Briquette Market (2025-2031) | Growth, Size, Revenue, Forecast, Analysis, Trends, Value, Share, Industry & Companies

- Vietnam System Integrator Market (2025-2031) | Size, Companies, Analysis, Industry, Value, Forecast, Growth, Trends, Revenue & Share

- ASEAN and Thailand Brain Health Supplements Market (2025-2031) | Strategy, Consumer Insights, Analysis, Investment Trends, Opportunities, Growth, Size, Share, Industry, Revenue, Segments, Value, Segmentation, Supply, Forecast, Restraints, Outlook, Competition, Drivers, Trends, Demand, Pricing Analysis, Competitive, Strategic Insights, Companies, Challenges

- ASEAN Bearings Market (2025-2031) | Strategy, Consumer Insights, Analysis, Investment Trends, Opportunities, Growth, Size, Share, Industry, Revenue, Segments, Value, Segmentation, Supply, Forecast, Restraints, Outlook, Competition, Drivers, Trends, Demand, Pricing Analysis, Competitive, Strategic Insights, Companies, Challenges

- Europe Flooring Market (2025-2031) | Outlook, Share, Industry, Trends, Forecast, Companies, Revenue, Size, Analysis, Growth & Value

- Saudi Arabia Manlift Market (2025-2031) | Outlook, Size, Growth, Trends, Companies, Industry, Revenue, Value, Share, Forecast & Analysis

- Uganda Excavator, Crane, and Wheel Loaders Market (2025-2031) | Strategy, Consumer Insights, Analysis, Investment Trends, Opportunities, Growth, Size, Share, Industry, Revenue, Segments, Value, Segmentation, Supply, Forecast, Restraints, Outlook, Competition, Drivers, Trends, Demand, Pricing Analysis, Competitive, Strategic Insights, Companies, Challenges

- Rwanda Excavator, Crane, and Wheel Loaders Market (2025-2031) | Strategy, Consumer Insights, Analysis, Investment Trends, Opportunities, Growth, Size, Share, Industry, Revenue, Segments, Value, Segmentation, Supply, Forecast, Restraints, Outlook, Competition, Drivers, Trends, Demand, Pricing Analysis, Competitive, Strategic Insights, Companies, Challenges

Industry Events and Analyst Meet

Whitepaper

- Middle East & Africa Commercial Security Market Click here to view more.

- Middle East & Africa Fire Safety Systems & Equipment Market Click here to view more.

- GCC Drone Market Click here to view more.

- Middle East Lighting Fixture Market Click here to view more.

- GCC Physical & Perimeter Security Market Click here to view more.

6WResearch In News

- Doha a strategic location for EV manufacturing hub: IPA Qatar

- Demand for luxury TVs surging in the GCC, says Samsung

- Empowering Growth: The Thriving Journey of Bangladesh’s Cable Industry

- Demand for luxury TVs surging in the GCC, says Samsung

- Video call with a traditional healer? Once unthinkable, it’s now common in South Africa

- Intelligent Buildings To Smooth GCC’s Path To Net Zero