India Wires And Cables Market (2025-2031) | Industry, Outlook, Size, Share, Forecast, Value, Growth, Revenue, Trends, Analysis & Companies

Market Report By Voltages (Low Voltage, Medium Voltage, High Voltage, Extra High Voltage), By Installation (Overhead, Underground), By Products (Fiber Optic Cable, Co-axial Cable And Other Cables), By Material (Copper, Aluminium, Glass), By End Users (Aerospace & Defense, Building & Construction, Oil & Gas, Energy & Power, IT & Telecommunication And Others) And Competitive Landscape

| Product Code: ETC131486 | Publication Date: Dec 2023 | Updated Date: Oct 2025 | Product Type: Report | |

| Publisher: 6Wresearch | Author: Ravi Bhandari | No. of Pages: 70 | No. of Figures: 35 | No. of Tables: 5 |

India Wires and Cables Market Growth Rate

According to 6Wresearch internal database and industry insights, the India Wires and Cables Market is projected to reach at a compound annual growth rate (CAGR) of 10.8% during the forecast period (2025–2031).

India Wires and Cables Market Highlights

| Report Name | Europe Aluminum Extrusion Market |

| Forecast period | 2025–2031 |

| CAGR | 10.8% |

| Growing Sector | Energy & Power |

Topics Covered in the India Wires and Cables Market Report

The India Wires and Cables Market report thoroughly covers the market By Voltages, By Installation, By Products, By Material, and By End Users. The report provides an unbiased and detailed analysis of ongoing market trends, opportunities/high growth areas, and market drivers, which would help stakeholders devise and align their market strategies according to the current and future market dynamics.

India Wires and Cables Market Synopsis

The India Wires and Cables Market has been experiencing a massive growth over the years, driven by various factors such as the rising expansion of the power sector, growing construction activities and a rise in the adoption of smart grid technologies. Additionally, the demand for wires and cables in India is estimated to increase due to the growing urban population and electrification of rural areas. Other major growth drivers proliferating the growth of the market are digital connectivity projects and the rapid development of industrial corridors.

Evaluation of Growth Drivers in the India Wires and Cables Market

Below are some prominent drivers and their influence on market dynamics:

| Driver | Primary Segments Affected | Why it matters (evidence) |

| Infrastructure Modernization | Low & Medium Voltage; Overhead | Massive infrastructure development under programs drives demand for transmission and distribution cables. |

| Rising Power Demand | High & Extra High Voltage; Energy & Power | India’s growing energy demand is increasing the use of high-voltage and extra-high-voltage cables. |

| Rapid Urbanization & Housing Development | Low Voltage; Building & Construction | Government housing schemes like “Pradhan Mantri Awas Yojana (PMAY)” boost the demand for wires and cables. |

| Renewable Energy Integration | Medium & High Voltage; Energy & Power | Renewable energy expansion in solar and wind sectors demands specialized power cables for transmission. |

| Telecom & Data Connectivity | Fiber Optic Cable; IT & Telecommunication | Government’s “Digital India” initiative and rollout of 5G networks significantly increase the use of fiber optic cables. |

The India Wires and Cables Market is projected to grow at a CAGR of 10.8% during the forecast period (2025–2031). Several growth drivers are proliferating the growth of the market, including continuous development of power infrastructure and the rising expansion of manufacturing industries. In addition to this, a continuous focus on renewable energy and smart grids is estimated to be a major growth driver. Moreover, the requirement for efficient transmission and distribution networks is estimated to increase due to the rising demand for electricity, driven by expanding manufacturing sectors and a growing urban population in the country. Additionally, the growing adoption of renewable energy sources like solar and wind and the expansion of 5G connectivity are likely to increase revenue potential.

Evaluation of Restraints in the India Wires and Cables Market

Below are some major restraints and their influence on market dynamics:

| Restraint | Primary Segments Affected | What this means (evidence) |

| Volatility in Raw Material Prices | Copper & Aluminium | Variations in copper and aluminum prices affect production costs, which affect the profit margins. |

| Counterfeit Product Penetration | Low Voltage, Residential | Availability of inferior wires in the unorganized sector affects brand reliability. |

| High Initial Cost for Underground Installations | Underground Cables; Public Infrastructure | Underground cable systems involve high capital investment and complex installation processes. |

| Environmental Regulations | Manufacturing; All Voltage Levels | Strict safety regulations increase compliance costs for cable manufacturers. |

| Supply Chain Disruptions | Industrial & Construction | Reliance on imported raw materials and global logistics fluctuations impact timely project execution. |

India Wires and Cables Market Challenges

On the other hand, the market consists of several challenges that need to be addressed. Such as intense competition from unorganized players and rising commodity prices. The market growth is hampered by the high installation cost of underground cabling. In addition to this, lengthy regulatory approvals for large infrastructure projects further act as a barrier to increasing the market revenue.

India Wires and Cables Market Trends

There are several notable trends which are currently shaping the market dynamics:

- Smart Grid Expansion – Integration of smart grid systems enhances the demand for intelligent power cables and monitoring systems.

- Rising Adoption of Fiber Optics – Increasing use of fiber optic cables for 5G, broadband, and IoT infrastructure.

- Sustainable Manufacturing Practices – Manufacturers are adopting eco-friendly insulation materials and recyclable conductors.

- Export Growth – Indian manufacturers are expanding globally with rising exports to Southeast Asia and the Middle East.

Investment Opportunities in the India Wires and Cables Industry

Potential investment opportunities in the India Wires and Cables Industry include:

- High-Voltage Power Transmission Projects – Investment opportunities in HV and EHV cable manufacturing for national grid projects.

- Smart Infrastructure and Urban Electrification – Expanding opportunities in cable installations for smart cities and metro projects.

- Renewable Integration Cables – The rising demand for solar and wind-compatible cabling solutions offering high efficiency and heat resistance.

- Fiber Optic Network Expansion – Investments in high-speed communication networks and data centers.

Top 5 Leading Players in the India Wires and Cables Market

Some leading players dominating the India Wires and Cables Market Share include:

1. Polycab India Limited

| Company Name | Polycab India Limited |

| Establishment Year | 1968 |

| Headquarter | Mumbai, India |

| Official Website | Click here |

Polycab is one of India’s leading wire and cable manufacturers, offering extensive products for power, communication, and industrial applications.

2. Havells India Limited

| Company Name | Havells India Limited |

| Establishment Year | 1958 |

| Headquarter | Noida, India |

| Official Website | Click here |

Havells is a major player providing a comprehensive range of electrical cables used across residential, commercial, and industrial sectors.

3. KEI Industries Limited

| Company Name | KEI Industries Limited |

| Establishment Year | 1968 |

| Headquarter | New Delhi, India |

| Official Website | Click here |

KEI specializes in power cables, EHV cables, and control cables catering to utilities, renewable, and infrastructure segments.

4. RR Kabel Limited

| Company Name | RR Kabel Limited |

| Establishment Year | 1995 |

| Headquarter | Mumbai, India |

| Official Website | Click here |

RR Kabel offers advanced low-voltage and industrial cables with a focus on safety, innovation, and sustainability.

5. Finolex Cables Limited

| Company Name | Finolex Cables Limited |

| Establishment Year | 1958 |

| Headquarter | Pune, India |

| Official Website | Click here |

Finolex is a leading manufacturer known for high-quality electrical and communication cables, widely used in energy, building, and telecom sectors.

Government Regulations Introduced in the India Wires and Cables Market

According to Indian government data, numerous initiatives have been implemented to boost the wires and cables industry growth. The demand for wires and cables is increasing with a surge in the power distribution and broadband connectivity under various programs, such as “Power for All”, “Saubhagya Scheme,” and “Digital India.” Additionally, the deployment of advanced and eco-friendly cables across India has been increasing under the National Smart Grid Mission (NSGM) and Green Energy Corridor Projects.

Future Insights of the India Wires and Cables Market

The India Wires and Cables Market future seems positive, underpinned by heavy investments in infrastructure and rising renewable energy. Industrial expansion across the nation will leave a positive impact on the market growth in the coming years. The market revenue is likely to increase due to increasing electrification in rural areas, coupled with the rising adoption of smart grids and energy-efficient technologies. The shift towards underground cabling and the integration of fiber optic networks will be major growth catalysts in the coming years.

Market Segmentation Analysis

The report offers a comprehensive study of the following market segments and their leading categories:

High Voltage to Dominate the Market – By Voltages

According to Mansi Singh, Senior Research Analyst, 6Wresearch, the High Voltage segment holds the largest market share in India’s Wires and Cables Market. The demand is driven by expanding power transmission and distribution networks, along with ongoing renewable energy projects requiring high-voltage power transfer capabilities.

Underground Installation to Dominate the Market – By Installation

The Underground Installation segment is dominating the market due to rapid urban development and safety concerns in metropolitan cities. Government initiatives to replace overhead lines with underground systems for improved aesthetics and reduced outages are propelling this segment’s growth.

Fiber Optic Cable to Dominate the Market – By Products

Among products, Fiber Optic Cables dominate due to the increasing need for high-speed communication, internet penetration, and 5G deployment under the “Digital India” initiative.

Copper to Dominate the Market – By Material

The Copper segment holds the dominant share due to its superior conductivity, flexibility, and corrosion resistance. It remains the preferred material for most residential and industrial applications in India.

Energy & Power to Dominate the Market – By End Users

The Energy & Power segment dominates the market as India continues to invest heavily in power generation and distribution projects. Expansion of transmission networks, smart grids, and renewable energy systems contributes significantly to the segment’s leadership.

Key Attractiveness of the Report

- 10 Years of Market Numbers

- Historical Data Starting from 2021 to 2024

- Base Year: 2024

- Forecast Data until 2031

- Key Performance Indicators Impacting the Market

- Major Upcoming Developments and Projects

- Market Size and Segmentation by End Users and Regions

Key Highlights of the Report:

- Historical data of India wires and cables market revenues for the period 2021-2031

- India wires and cables market size and market forecast of revenues, until 2031F

- Historical data of India wires and cables market revenues, by voltages, for the period 2021-2031

- India wires and cables market size and market forecast of revenues, by voltages, until 2031F

- Historical data of India wires and cables market revenues, by installation, for the period 2021-2031

- India wires and cables market size and market forecast of revenues, by installation, until 2031F

- Historical data of India wires and cables market revenues, by products, for the period 2021-2031

- India wires and cables market size and market forecast of revenues, by products, until 2031F

- Historical data of India wires and cables market revenues, by material, for the period 2021-2031

- India wires and cables market size and market forecast of revenues, by material, until 2031F

- Historical data of India wires and cables market revenues, by end user, for the period 2021-2031

- India wires and cables market size and market forecast of revenues, by end user, until 2031F

- Historical data of India wires and cables market revenues, by region, for the period 2021-2031

- India wires and cables market size and market forecast of revenues, by region, until 2031F

- Market Drivers and Restraints.

- Market Trends and Developments.

- Player Market Share and Competitive Landscape.

- Company Profiles.

- Strategic Recommendations.

Market Scope and Segmentation

The report provides a detailed analysis of the following market segments:

By Voltage

- Low Voltage (Up to 1,000 V)

- Medium Voltage (1,000.1 V - 35 kV)

- High Voltage (35.1 kV - 240 kV)

- Extra High Voltage (Above 240 kV)

By Installation

- Overhead

- Underground

- By Products

- Fiber Optic Cable

- Co-Axial Cable

- Other Cables (Twisted Pair Cable, Non-Metallic and Metallic Sheathed Cable)

By Material

- Copper

- Aluminium

- Glass

By End Users

- Aerospace & Defence

- Building & Construction

- Oil & Gas

- Energy & Power

- IT & Telecommunication

- Others (Manufacturing, Consumer Electronics and Automotive)

India Wires And Cables Market (2025-2031): FAQ

| 1. Executive Summary |

| 2. Introduction |

| 2.1. Report Description |

| 2.2. Key Highlights |

| 2.2. Market Scope & Segmentation |

| 2.3. Research Methodology |

| 2.4. Assumptions |

| 3. India Wires and Cables Market Overview |

| 3.1. India Wires and Cables Market Revenues |

| 3.2. India Wires and Cables Market - Industry Life Cycle, 2024 |

| 3.3. India Wires and Cables Market - Porter’s Five Forces, 2024 |

| 3.4. India Wires and Cables Market Revenue Share, By Voltage |

| 3.5. India Wires and Cables Market Revenue Share, By Installation |

| 3.6. India Wires and Cables Market Revenue Share, By-Products |

| 3.7. India Wires and Cables Market Revenue Share, By Materials |

| 3.8. India Wires and Cables Market Revenue Share, By End Users |

| 4. India Wires and Cables Market Dynamics |

| 4.1. Impact Analysis |

| 4.2. Market Drivers |

| 4.2.1 Increasing urbanization and industrialization in India leading to higher demand for wires and cables |

| 4.2.2 Government initiatives to boost infrastructure development and power sector in the country |

| 4.2.3 Growing adoption of renewable energy sources driving the demand for specialized wires and cables |

| 4.3. Market Restraints |

| 4.3.1 Fluctuating prices of raw materials impacting the cost of production for wires and cables manufacturers |

| 4.3.2 Intense market competition leading to price wars and margin pressures |

| 4.3.3 Technological advancements leading to the development of wireless technologies as potential substitutes |

| 5. India Wires and Cables Market Trend |

| 6. India Wires and Cables Market Overview, By Voltages |

| 6.1. India Wires and Cables Market Revenues, By Voltages |

| 6.1.1. India Low Voltage Wires and Cables Market Revenues, 2021 - 2031F |

| 6.1.2. India Medium Voltage Wires and Cables Market Revenues, 2021 - 2031F |

| 6.1.3. India High Voltage Wires and Cables Market Revenues, 2021 - 2031F |

| 6.1.4. India Extra High Voltage Wires and Cables Market Revenues, 2021 - 2031F |

| 7. India Wires and Cables Market Overview, By Installation |

| 7.1. India Wires and Cables Market Revenues, By Installation |

| 7.1.1. India Over Head Wires and Cables Market Revenues, 2021 - 2031F |

| 7.1.2. India Underground Wires and Cables Market Revenues, 2021 - 2031F |

| 8. India Wires and Cables Market Overview, By-Products |

| 8.1. India Wires and Cables Market Revenues, By-Products |

| 8.1.1. India Fiber Optic Wires and Cables Market Revenues, 2021 - 2031F |

| 8.1.2. India Co-Axial Wires and Cables Market Revenues, 2021 - 2031F |

| 8.1.3. India Other Wires and Cables Market Revenues, 2021 - 2031F |

| 9. India Wires and Cables Market Overview, By Material |

| 9.1. India Wires and Cables Market Revenues, By Material |

| 9.1.1. India Copper Wires and Cables Market Revenues, 2021 - 2031F |

| 9.1.2. India Aluminum Wires and Cables Market Revenues, 2021 - 2031F |

| 9.1.3. India Glass Wires and Cables Market Revenues, 2021 - 2031F |

| 10. India Wires and Cables Market Overview, By End Users |

| 10.1. India Wires and Cables Market Revenues, By End Users |

| 10.1.1. India Aerospace & Defense Wires and Cables Market Revenues, 2021 - 2031F |

| 10.1.2. India Building & Construction Wires and Cables Market Revenues, 2021 - 2031F |

| 10.1.3. India Oil & Gas Wires and Cables Market Revenues, 2021 - 2031F |

| 10.1.4. India Energy & Power Wires and Cables Market Revenues, 2021 - 2031F |

| 10.1.5. India IT & Telecommunication Wires and Cables Market Revenues, 2021 - 2031F |

| 10.1.6. India Other Wires and Cables Market Revenues, 2021 - 2031F |

| 11. India Wires and Cables Key Performance Indicators |

| 11.1 Length of new transmission lines and distribution networks installed |

| 11.2 Number of new renewable energy projects initiated in India |

| 11.3 Investment in RD for developing innovative and efficient wires and cables |

| 11.4 Number of government tenders awarded for infrastructure development projects |

| 11.5 Percentage of manufacturing capacity utilization in the wires and cables industry |

| 12. India Electrical Equipment and Components Market Opportunity Assessment |

| 12.1. India Wires and Cables Market Opportunity Assessment, By Voltages, 2031F |

| 12.2. India Wires and Cables Market Opportunity Assessment, By Installation, 2031F |

| 12.3. India Wires and Cables Market Opportunity Assessment, By-Products, 2031F |

| 12.4. India Wires and Cables Market Opportunity Assessment, By Materials, 2031F |

| 12.5. India Wires and Cables Market Opportunity Assessment, By End Users, 2031F |

| 13. Competitive Landscape |

| 13.1. India Wires and Cables Market Revenue Share Ranking, By Company, 2024 |

| 14. Company Profiles |

| 15. Key Strategic Recommendations |

| 16. Disclaimer |

Market Report By Voltages (Low Voltage, Medium Voltage, High Voltage, Extra High Voltage), By Installation (Overhead, Underground), By Products (Fiber Optic Cable, Co-axial Cable And Other Cables), By Material (Copper, Aluminium, Glass), By End Users (Aerospace & Defense, Building & Construction, Oil & Gas, Energy & Power, IT & Telecommunication And Others) And Competitive Landscape

| Product Code: ETC131486 | Publication Date: Aug 2023 | Product Type: Report | |

| Publisher: 6Wresearch | No. of Pages: 70 | No. of Figures: 35 | No. of Tables: 5 |

India Wires And Cables Market report thoroughly covers the market by voltage, installation, product, material, end-users, and regions including central, western, southern, and eastern regions. The India wires and cables market outlook report provides an unbiased and detailed analysis of the on-going India wires and cables market trends, opportunities/high growth areas and market drivers which would help the stakeholders to devise and align their market strategies according to the current and future market dynamics.

India Wires and Cables Market Synopsis

India Wires and Cables Market would grow on the back of rapidly growing investment by the government towards the development of infrastructural projects. The development of smart cities in the country along with the increase in electronic devices in the household would increase the demand for wires and cables in the Indian market. The development of manufacturing industries as a part of the Make in India initiative would result in the growth of the wires and cables market during the forecast period. The market has seen a halt owing to the massive outbreak of COVID-19 which resulted in nationwide lockdowns to combat the spread of the virus and has led to a decline in the overall market growth.

India wires and cables market is expected to witness progressive growth in the upcoming six years backed by the growing telecommunication sector in the country. The increased number of internet subscribers due to rising internet penetration rapidly from past years is an active contributor to the India wires and cables market growth. On the other side, telecom operators are spending in bulk on the integration of telecom towers in rural areas and all this can be possible with the needful resources for the same and as a result, the use of wires and cables is rising in the telecom sector which tends to ensure better signals through consistent power supply as a result is estimated to strengthen India wires and cables market growth in the forthcoming years. Moreover, the COVID-19 outbreak has stimulated the entire population to work online which has led to a rising need for better connectivity and signals to work efficiently which is expected to instigate the significant demand for better connectivity and for proper integration of the data channels, wires, and cables are in high demand and would benefit the India wires and cables market positively in the coming years.

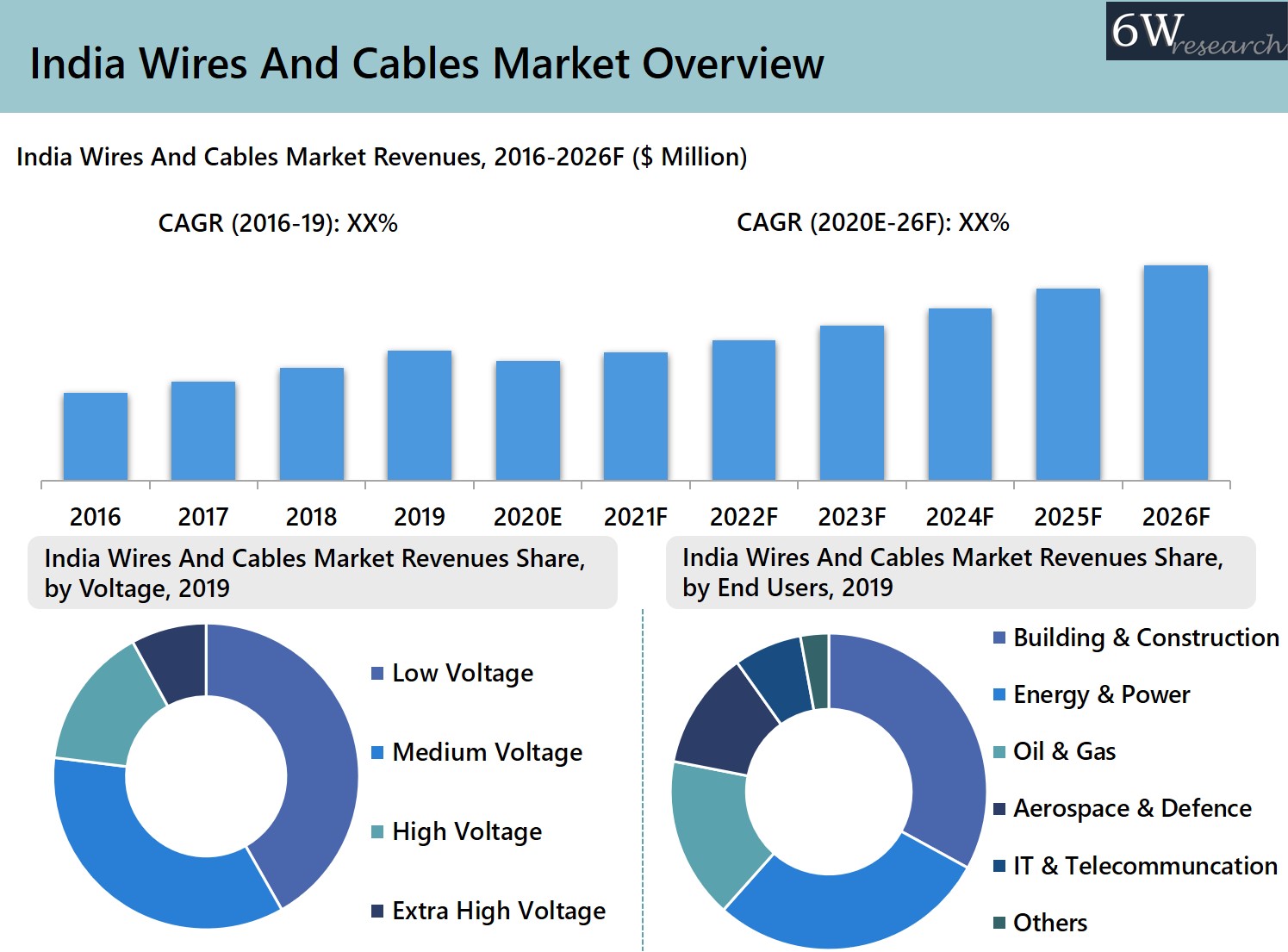

According to 6Wresearch, India Wires and Cables Market size is projected to grow at CAGR of 6.1% during 2020-2026. The market would witness a decline in 2020 on account of the economic slowdown caused due to COVID-19, however, the market would recover post-2020. The low voltage market portrays dominance in India cable market owing to rapid urbanization synergized by increasing demand for reliable power supply which will encourage product growth in the aforementioned segment. The medium voltage segment is anticipated to grow significantly in terms of revenue share due to its application in the oil and gas industry.

Market Analysis by Voltage

On the basis of voltage, high-voltage cables and wires have gained majority of the dominance in the overall market revenues in 2019. High demand for high voltage cables from end-users such as telecom, power distribution, oil & gas, and aerospace & Defense is expected to be the major factor responsible for the growth of wires and cables over the forecast period. Furthermore, trends in the market such as polymer optic fiber products being widely used in the automotive, aircraft manufacturing, electronics, and other industries apart from the telecommunications industry are also bound to increase the wires and cables market of India during the forecast period.

India wires & cables market is anticipated to gain momentum during the forecast period 2020-26F backed by the rising growth of the industrial landscape in the country. Further, new government policy, the introduction of a new GST regime under which GST on the electric vehicle has been reduced to 12 to 5% which has led to an upsurge in the electric vehicle adoption coupled with two and three-wheelers is also estimated to secure high electrification rate in the upcoming years and is estimated to evolve the general cable and battery cable deployment to ensure continue transmitting of signals with context to driving, therefore, is expected to bolster the continuous growth of wires and cables market in the coming timeframe.

Key Attractiveness of the Report

- COVID-19 Impact on the Market.

- 10 Years Market Numbers.

- Historical Data Starting from 2016 to 2020.

- Base Year: 2019

- Forecast Data until 2026.

- Key Performance Indicators Impacting the Market.

- Major Upcoming Developments and Projects.

Key Highlights of the Report

- Historical data of India wires and cables market revenues for the period 2016-2019

- India wires and cables market size and market forecast of revenues, until 2026F

- Historical data of India wires and cables market revenues, by voltages, for the period 2016-2019

- India wires and cables market size and market forecast of revenues, by voltages, until 2026F

- Historical data of India wires and cables market revenues, by installation, for the period 2016-2019

- India wires and cables market size and market forecast of revenues, by installation, until 2026F

- Historical data of India wires and cables market revenues, by products, for the period 2016-2019

- India wires and cables market size and market forecast of revenues, by products, until 2026F

- Historical data of India wires and cables market revenues, by material, for the period 2016-2019

- India wires and cables market size and market forecast of revenues, by material, until 2026F

- Historical data of India wires and cables market revenues, by end user, for the period 2016-2019

- India wires and cables market size and market forecast of revenues, by end user, until 2026F

- Historical data of India wires and cables market revenues, by region, for the period 2016-2019

- India wires and cables market size and market forecast of revenues, by region, until 2026F

- Market Drivers and Restraints.

- Market Trends and Developments.

- Player Market Share and Competitive Landscape.

- Company Profiles.

- Strategic Recommendations.

Market Scope and Segmentation

The report provides a detailed analysis of the following market segments:

- By Voltages

- Low Voltage

- Medium Voltage

- High Voltage

- Extra-High Voltage

- By Installation

- Overhead

- Underground

- By Products

- Fiber Optic Cable

- Co-Axial Cable

- Other Cables

- By Material

- Copper

- Aluminum

- Glass

- By End Users

- Aerospace & Defense

- Building & Construction

- Oil & Gas

- Energy & Power

- IT & Telecommunication

- Others

- By Region

- Central

- Western

- Eastern

- Southern

Other Key Reports Available:

- Indonesia Wires and Cables Market (2020-2026F)

- Singapore Wires and Cables Market (2020-2026F)

- Single User License$ 1,995

- Department License$ 2,400

- Site License$ 3,120

- Global License$ 3,795

Search

Thought Leadership and Analyst Meet

Our Clients

Related Reports

- Afghanistan Apparel Market (2026-2032) | Growth, Outlook, Industry, Segmentation, Forecast, Size, Companies, Trends, Value, Share, Analysis & Revenue

- Canada Oil and Gas Market (2026-2032) | Share, Segmentation, Value, Industry, Trends, Forecast, Analysis, Size & Revenue, Growth, Competitive Landscape, Outlook, Companies

- Germany Breakfast Food Market (2026-2032) | Industry, Share, Growth, Size, Companies, Value, Analysis, Revenue, Trends, Forecast & Outlook

- Australia Briquette Market (2025-2031) | Growth, Size, Revenue, Forecast, Analysis, Trends, Value, Share, Industry & Companies

- Vietnam System Integrator Market (2025-2031) | Size, Companies, Analysis, Industry, Value, Forecast, Growth, Trends, Revenue & Share

- ASEAN and Thailand Brain Health Supplements Market (2025-2031) | Strategy, Consumer Insights, Analysis, Investment Trends, Opportunities, Growth, Size, Share, Industry, Revenue, Segments, Value, Segmentation, Supply, Forecast, Restraints, Outlook, Competition, Drivers, Trends, Demand, Pricing Analysis, Competitive, Strategic Insights, Companies, Challenges

- ASEAN Bearings Market (2025-2031) | Strategy, Consumer Insights, Analysis, Investment Trends, Opportunities, Growth, Size, Share, Industry, Revenue, Segments, Value, Segmentation, Supply, Forecast, Restraints, Outlook, Competition, Drivers, Trends, Demand, Pricing Analysis, Competitive, Strategic Insights, Companies, Challenges

- Europe Flooring Market (2025-2031) | Outlook, Share, Industry, Trends, Forecast, Companies, Revenue, Size, Analysis, Growth & Value

- Saudi Arabia Manlift Market (2025-2031) | Outlook, Size, Growth, Trends, Companies, Industry, Revenue, Value, Share, Forecast & Analysis

- Uganda Excavator, Crane, and Wheel Loaders Market (2025-2031) | Strategy, Consumer Insights, Analysis, Investment Trends, Opportunities, Growth, Size, Share, Industry, Revenue, Segments, Value, Segmentation, Supply, Forecast, Restraints, Outlook, Competition, Drivers, Trends, Demand, Pricing Analysis, Competitive, Strategic Insights, Companies, Challenges

Industry Events and Analyst Meet

Whitepaper

- Middle East & Africa Commercial Security Market Click here to view more.

- Middle East & Africa Fire Safety Systems & Equipment Market Click here to view more.

- GCC Drone Market Click here to view more.

- Middle East Lighting Fixture Market Click here to view more.

- GCC Physical & Perimeter Security Market Click here to view more.

6WResearch In News

- Doha a strategic location for EV manufacturing hub: IPA Qatar

- Demand for luxury TVs surging in the GCC, says Samsung

- Empowering Growth: The Thriving Journey of Bangladesh’s Cable Industry

- Demand for luxury TVs surging in the GCC, says Samsung

- Video call with a traditional healer? Once unthinkable, it’s now common in South Africa

- Intelligent Buildings To Smooth GCC’s Path To Net Zero