Saudi Arabia Core Assurance Service Market (2025-2031) | Strategy, Consumer Insights, Analysis, Investment Trends, Opportunities, Growth, Size, Share, Industry, Revenue, Segments, Value, Segmentation, Supply, Forecast, Restraints, Outlook, Competition, Drivers, Trends, Demand, Pricing Analysis, Competitive, Strategic Insights, Companies, Challenges

Market Forecast By Organization Type (Public, Private), By End User (Energy & Utilities (Public, Private), Construction & Infrastructure (Public, Private), Oil & Gas / Petrochemicals (Public, Private), BFSI (Banking, Financial Services & Insurance) (Public, Private), Telecom & IT (Public, Private), Healthcare (Public, Private), Retail (Public, Private), Tourism and Hospitality (Public, Private)) And Competitve Landscape

| Product Code: ETC13413776 | Publication Date: Feb 2026 | Updated Date: Feb 2026 | Product Type: Report | |

| Publisher: 6Wresearch | No. of Pages: 70 | No. of Figures: 35 | No. of Tables: 5 | |

Topics Covered in Saudi Arabia Core Assurance Service Market Report

Saudi Arabia Core Assurance Service Market Report thoroughly covers the market by Organization Type and by End user. Saudi Arabia Core Assurance Service Market Outlook report provides an unbiased and detailed analysis of the ongoing Saudi Arabia Core Assurance Service Market trends, opportunities/high growth areas, and market drivers. This would help stakeholders devise and align their market strategies according to the current and future market dynamics.

Saudi Arabia Core Assurance Service Market Synopsis

The Saudi Arabia Core Assurance Services Market is witnessing sustained expansion, underpinned by Vision 2030–driven public spending, regulatory tightening, and a sharp rise in the number of regulated operating entities across priority sectors. Saudi Arabia’s annual government budget increased, reflecting continued fiscal commitment to infrastructure, transportation, energy, and industrial development. These investments are directly translating into the formation of new operating companies, SPVs, and government-linked enterprises, all of which are subject to mandatory statutory audits, audited financial statements, and IFRS-aligned reporting. Vision 2030 focus sectors including construction, transportation, healthcare, and renewables are projected to collectively increase in the coming years, structurally expanding the addressable market for core financial and statutory assurance services.

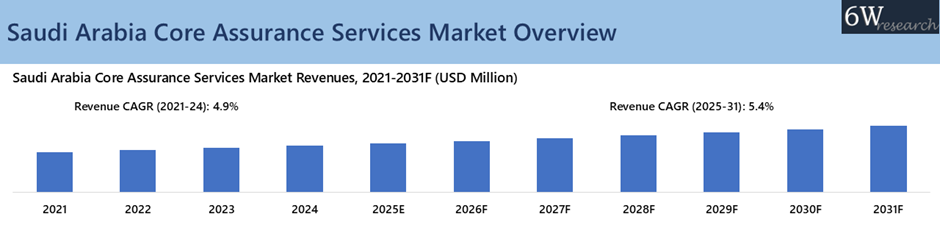

According to 6Wresearch, Saudi Arabia Core Assurance Services Market revenue size is projected to grow at a CAGR of 5.4% during 2025-2031. Supported by tourism expansion which is emerging as a major incremental demand driver for assurance services. In 2024, Saudi Arabia issued hospitality licenses, while accommodation room licenses and travel and tourism service licenses rate increased tremendously, materially expanding the base of regulated hospitality operators requiring audited financial statements. International arrivals are projected to rise in the coming years, reinforced by global events such as the 2026 Spanish Super Cup and the 2034 FIFA World Cup, sustaining long-term statutory audit demand across hotels, entertainment, and supporting infrastructure. Manufacturing expansion is further reinforcing market growth, with the sector’s GDP contribution increasing and industrial establishments rising massively. Saudi Arabia aims to triple industrial production by 2030, supported by billions in planned manufacturing investments across electronics, automotive, steel, food & beverages, and renewable components, increasing statutory audit complexity linked to capital intensity, inventory valuation, and consolidation requirements.

Market Segmentation By Organization Type

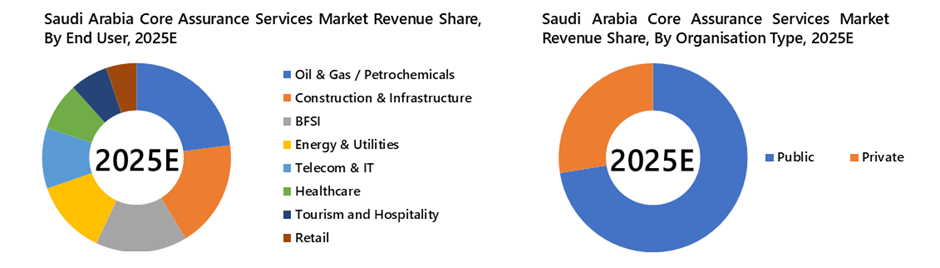

The private sector in Saudi Arabia’s Core Assurance Services Market is expected to record the fastest growth from 2025 to 2031, supported by the expanding base of privately owned companies, increased capital market participation, and steady growth in debt-funded expansion and M&A activity. Rising enforcement of financial reporting standards, cross-border investments, and private sector participation in Vision 2030 projects are driving sustained demand for recurring statutory and financial assurance services, accelerating growth ahead of the public sector.”

Market Segmentation By End user

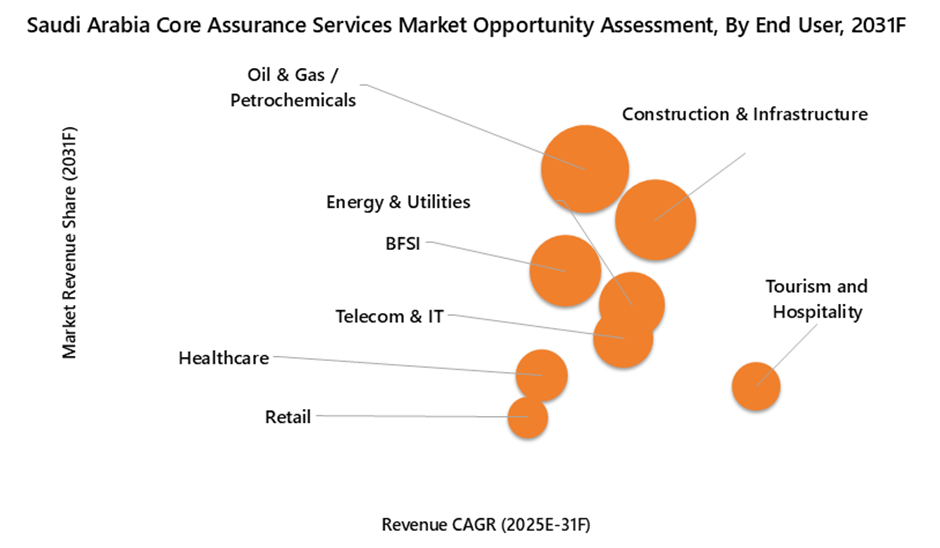

The tourism and hospitality sector in Saudi Arabia’s Core Assurance Services Market is expected to record the fastest growth from 2025 to 2031, supported by rapid capacity additions across hotels, resorts, entertainment destinations, and travel services, alongside accelerating private investment. Increasing capital market participation, asset-heavy expansion, and a steady pipeline of debt-funded development and M&A across operators and developers are intensifying the need for robust financial assurance. Rising enforcement of financial reporting standards, higher volumes of cross-border partnerships and investments, and the sector’s central role in Vision 2030 giga-projects are driving sustained demand for recurring statutory audits, revenue and receivables assurance, internal controls reviews, and compliance assurance, accelerating growth ahead of more mature segments.

Key Attractiveness of the Report

- 10 Years Market Numbers.

- Historical Data Starting from 2021 to 2024

- Base Year: 2024

- Forecast Data until 2031

- Key Performance Indicators Impacting the Market.

- Major Upcoming Developments and Projects.

Key Highlights of the Report:

- Global Core Assurance Services Market Overview

- Saudi Arabia Core Assurance Services Market Overview

- Saudi Arabia Core Assurance Services Market Outlook

- Saudi Arabia Core Assurance Services Market Forecast

- Historical Data and Forecast of Saudi Arabia Core Assurance Services Market Revenues for the Period 2021-2031F

- Historical Data and Forecast of Saudi Arabia Core Assurance Services Market Revenues, By Organization Type, for the Period 2021-2031F

- Historical Data and Forecast of Saudi Arabia Core Assurance Services Market Revenues, By End User, for the Period 2021-2031F

- Industry Life Cycle

- Porter’s Five Force Analysis

- Saudi Arabia Core Assurance Services Market Drivers and Restraints

- Market Trends & Evolution

- Market Opportunity Assessment

- Saudi Arabia Core Assurance Services Market Revenues, By Top 4 Companies

- Competitive Benchmarking

- Company Profiles

- Key Strategic Recommendations

Market Scope and Segmentation

The report provides a detailed analysis of the following market segments:

By Organization Type

- Public

- Private

By End User

- Energy & Utilities

- Public

- Private

- Construction & Infrastructure

- Public

- Private

- Oil & Gas / Petrochemicals

- Public

- Private

- BFSI (Banking, Financial Services & Insurance)

- Public

- Private

- Telecom & IT

- Public

- Private

- Healthcare

- Public

- Private

- Retail

- Public

- Private

- Tourism and Hospitality

- Public

- Private

Saudi Arabia Core Assurance Service Market (2025-2031): FAQs

| 1. Executive Summary |

| 2. Introduction |

| 2.1 Report Description |

| 2.2 Key Highlights of the Report |

| 2.3 Market Scope & Segmentation |

| 2.4 Research Methodology |

| 2.5 Assumptions |

| 3. Saudi Arabia Core Assurance Service Market Overview |

| 3.1 Saudi Arabia Core Assurance Service Market Macroeconomic Indicator |

| 3.2 Saudi Arabia Core Assurance Service Market Revenues, (2021-2031F) |

| 3.3 Saudi Arabia Core Assurance Service Market Industry Life Cycle |

| 3.4 Saudi Arabia Core Assurance Service Market Porter's Five Forces |

| 4. Saudi Arabia Core Assurance Service Market Dynamics |

| 4.1 Impact Analysis |

| 4.2 Market Drivers |

| 4.3 Market Restraints |

| 5. Saudi Arabia Core Assurance Service Market Trends |

| 6. Saudi Arabia Core Assurance Service Market Overview, By Public Vs Private |

| 6.1. Saudi Arabia Core Assurance Service Market Revenues and Revenue Share, By Public Vs Private, (2025E & 2031F) |

| 6.1.1 Saudi Arabia Core Assurance Service Market Revenues, By Public, (2021-2031F) |

| 6.1.2 Saudi Arabia Core Assurance Service Market Revenues, By Private, (2021-2031F) |

| 7. Saudi Arabia Core Assurance Service Market Overview, By End User |

| 7.1. Saudi Arabia Core Assurance Service Market Revenues and Revenue Share, By End User, (2025E & 2031F) |

| 7.1.1 Saudi Arabia Core Assurance Service Market Revenues, By Energy & Utilities, (2021-2031F) |

| 7.1.1.1 Energy & Utilities Market Revenues, By Public Companies, (2021-2031F) |

| 7.1.1.2 Energy & Utilities Market Revenues, By Private Companies, (2021-2031F) |

| 7.1.2 Saudi Arabia Core Assurance Service Market Revenues, By Construction & Infrastructure, (2021-2031F) |

| 7.1.2.1 Construction & Infrastructure Market Revenues, By Public Companies, (2021-2031F) |

| 7.1.2.2 Construction & Infrastructure Market Revenues, By Private Companies, (2021-2031F) |

| 7.1.3 Saudi Arabia Core Assurance Service Market Revenues, By Oil & Gas / Petrochemicals, (2021-2031F) |

| 7.1.3.1 Oil & Gas / Petrochemicals Market Revenues, By Public Companies, (2021-2031F) |

| 7.1.3.2 Oil & Gas / Petrochemicals Market Revenues, By Private Companies, (2021-2031F) |

| 7.1.4 Saudi Arabia Core Assurance Service Market Revenues, By BFSI, (2021-2031F) |

| 7.1.4.1 BFSI Market Revenues, By Public Companies, (2021-2031F) |

| 7.1.4.2 BFSI Market Revenues, By Private Companies, (2021-2031F) |

| 7.1.5 Saudi Arabia Core Assurance Service Market Revenues, By Telecom & IT, (2021-2031F) |

| 7.1.5.1 Telecom & IT Market Revenues, By Public Companies, (2021-2031F) |

| 7.1.5.2 Telecom & IT Market Revenues, By Private Companies, (2021-2031F) |

| 7.1.6 Saudi Arabia Core Assurance Service Market Revenues, By Healthcare, (2021-2031F) |

| 7.1.6.1 Others Market Revenues, By Public Companies, (2021-2031F) |

| 7.1.6.2 Others Market Revenues, By Private Companies, (2021-2031F) |

| 7.1.7 Saudi Arabia Core Assurance Service Market Revenues, By Retail, (2021-2031F) |

| 7.1.7.1 Others Market Revenues, By Public Companies, (2021-2031F) |

| 7.1.7.2 Others Market Revenues, By Private Companies, (2021-2031F) |

| 7.1.8 Saudi Arabia Core Assurance Service Market Revenues, By Tourism and Healthcare, (2021-2031F) |

| 7.1.8.1 Others Market Revenues, By Public Companies, (2021-2031F) |

| 7.1.8.2 Others Market Revenues, By Private Companies, (2021-2031F) |

| 8. Saudi Arabia Core Assurance Service Market – Key Performance Indicator |

| 9. Saudi Arabia Core Assurance Service Market Opportunity Assessment |

| 9.1 Saudi Arabia Core Assurance Service Market Opportunity Assessment, By Public Vs. Private (2031F) |

| 9.2 Saudi Arabia Core Assurance Service Market Opportunity Assessment, By End User (2031F) |

| 10. Saudi Arabia Core Assurance Service Market Competitive Landscape |

| 10.1 Saudi Arabia Core Assurance Service Market Revenues, By Big 4 Companies, 2025 |

| 10.1 Riyadh Core Assurance Service Market Revenues, By Big 4 Companies, 2025 |

| 10.2 Saudi Arabia Core Assurance Service Market Competitive Benchmarking, By Technical & Operating Parameters |

| 11. Company Profiles |

| 11.1 Ernst & Young |

| 11.2 PricewaterhouseCoopers International Limited |

| 11.3 Deloitte Touche Tohmatsu Limited |

| 11.4 Klynveld Peat Marwick Goerdeler (KPMG) |

| 11.5 RSM International Ltd |

| 11.6 Forvis Mazars |

| 11.7 Grant Thornton |

| 11.8 BDO Global |

| 11.9 Sidra Salman & Co. |

| 11.10 Baker Tilly International |

| 12. Key Strategic Recommendations |

| 13. Disclaimer |

| List of Figures |

| 1. Saudi Arabia GDP, 2021-2024, (In $ Billion)) |

| 2. Saudi Arabia GDP per Capita, 2021-2024, (In $) |

| 3. Saudi Arabia Total Population, 2020-2040F, (In Million) |

| 4. Saudi Arabia Core Assurance Services Market Revenues, 2021-2031F (USD Million) |

| 5. Saudi Arabia Annual Budget Revenue, 2022-25, (In $ Billion) |

| 6. Saudi Arabia Number of International Arrivals, 2023-2030F (Million) |

| 7. Saudi Arabia Private Tourism Room Accommodation, 2023-2024 (units) |

| 8. Saudi Arabia Tourism Sector Investment, 2023-2030F ($ Billion) |

| 9. Saudi Arabia ICT Market Size, 2025-34F, (In $ Billion) |

| 10. Saudi Arabia IT & Software Market Size, 2025-34F, (In $ Billion) |

| 11. Saudi Arabia Core Assurance Services Market Revenue Share, By Organization Type, 2025E & 2031F |

| 12. Saudi Arabia Core Assurance Services Market Revenue Share, By End User, 2025E & 2031F |

| 13. Saudi Arabia Core Assurance Services Market Revenue Share, By Energy & Utilities, 2025E & 2031F |

| 14. Saudi Arabia Core Assurance Services Market Revenue Share, By Construction & Infrastructure, 2025E & 2031F |

| 15. Saudi Arabia Core Assurance Services Market Revenue Share, By Oil & Gas / Petrochemicals, 2025E & 2031F |

| 16. Saudi Arabia Core Assurance Services Market Revenue Share, By BFSI, 2025E & 2031F |

| 17. Saudi Arabia Core Assurance Services Market Revenue Share, By Telecom & IT, 2025E & 2031F |

| 18. Saudi Arabia Core Assurance Services Market Revenue Share, By Healthcare, 2025E & 2031F |

| 19. Saudi Arabia Core Assurance Services Market Revenue Share, By Retail, 2025E & 2031F |

| 20. Saudi Arabia Core Assurance Services Market Revenue Share, By Tourism and Hospitality, 2025E & 2031F |

| 21. Saudi Arabia Installed Power Capacity, 2020-2030F (GW) |

| 22. Saudi Arabia Renewable Energy Market 2022-2028F (US$ Million) |

| 23. National Industrial Strategy Growth Targets To Boost Manufacturing |

| 24. Saudi Arabia. Manufacturing Sector’s GDP Contribution 2020-2023 (%) |

| 25. Saudi Arabia Manufacturing Indicators as of 2023 |

| 26. Saudi Arabia Core Assurance Services Market Opportunity Assessment, By Organization Type, 2031F |

| 27. Saudi Arabia Core Assurance Services Market Opportunity Assessment, By End User, 2031F |

| 28. Saudi Arabia Top 4 Core Assurance Services Market Share & Revenues, By Companies, CY2024, (In USD Million) |

| 29. Riyadh Top 4 Core Assurance Services Market Share & Revenues, By Companies, CY2024, (In USD Million) |

| List of tables |

| 1. Saudi Arabia Core Assurance Services Market Revenues, By Organization Type, 2021-2031F (USD Million) |

| 2. Saudi Arabia Core Assurance Services Market Revenues, By End User, 2021-2031F (USD Million) |

| 3. Saudi Arabia Core Assurance Services Market Revenues, By Energy & Utilities, 2021-2031F (USD Million) |

| 4. Saudi Arabia Core Assurance Services Market Revenues, By Construction & Infrastructure, 2021-2031F (USD Million) |

| 5. Saudi Arabia Core Assurance Services Market Revenues, By Oil & Gas / Petrochemicals, 2021-2031F (USD Million) |

| 6. Saudi Arabia Core Assurance Services Market Revenues, By BFSI, 2021-2031F (USD Million) |

| 7. Saudi Arabia Core Assurance Services Market Revenues, By Telecom & IT, 2021-2031F (USD Million) |

| 8. Saudi Arabia Core Assurance Services Market Revenues, By Healthcare, 2021-2031F (USD Million) |

| 9. Saudi Arabia Core Assurance Services Market Revenues, By Retail, 2021-2031F (USD Million) |

| 10. Saudi Arabia Core Assurance Services Market Revenues, By Tourism and Hospitality, 2021-2031F (USD Million) |

| 11. Saudi Arabia Thermal Power Plant, 2024 |

| 12. Saudi Arabia Upcoming Manufacturing Plant 2024 |

Export potential assessment - trade Analytics for 2030

Export potential enables firms to identify high-growth global markets with greater confidence by combining advanced trade intelligence with a structured quantitative methodology. The framework analyzes emerging demand trends and country-level import patterns while integrating macroeconomic and trade datasets such as GDP and population forecasts, bilateral import–export flows, tariff structures, elasticity differentials between developed and developing economies, geographic distance, and import demand projections. Using weighted trade values from 2020–2024 as the base period to project country-to-country export potential for 2030, these inputs are operationalized through calculated drivers such as gravity model parameters, tariff impact factors, and projected GDP per-capita growth. Through an analysis of hidden potentials, demand hotspots, and market conditions that are most favorable to success, this method enables firms to focus on target countries, maximize returns, and global expansion with data, backed by accuracy.

By factoring in the projected importer demand gap that is currently unmet and could be potential opportunity, it identifies the potential for the Exporter (Country) among 190 countries, against the general trade analysis, which identifies the biggest importer or exporter.

To discover high-growth global markets and optimize your business strategy:

Click Here- Single User License$ 1,995

- Department License$ 2,400

- Site License$ 3,120

- Global License$ 3,795

Search

Thought Leadership and Analyst Meet

Our Clients

Related Reports

- Saudi Arabia Core Assurance Service Market (2025-2031) | Strategy, Consumer Insights, Analysis, Investment Trends, Opportunities, Growth, Size, Share, Industry, Revenue, Segments, Value, Segmentation, Supply, Forecast, Restraints, Outlook, Competition, Drivers, Trends, Demand, Pricing Analysis, Competitive, Strategic Insights, Companies, Challenges

- Romania Uninterruptible Power Supply (UPS) Market (2026-2032) | Industry, Analysis, Revenue, Size, Forecast, Outlook, Value, Trends, Share, Growth & Companies

- Saudi Arabia Car Window Tinting Film, Paint Protection Film (PPF), and Ceramic Coating Market (2025-2031) | Strategy, Consumer Insights, Analysis, Investment Trends, Opportunities, Growth, Size, Share, Industry, Revenue, Segments, Value, Segmentation, Supply, Forecast, Restraints, Outlook, Competition, Drivers, Trends, Demand, Pricing Analysis, Competitive, Strategic Insights, Companies, Challenges

- South Africa Stationery Market (2025-2031) | Share, Size, Industry, Value, Growth, Revenue, Analysis, Trends, Segmentation & Outlook

- Afghanistan Rocking Chairs And Adirondack Chairs Market (2026-2032) | Size & Revenue, Competitive Landscape, Share, Segmentation, Industry, Value, Outlook, Analysis, Trends, Growth, Forecast, Companies

- Afghanistan Apparel Market (2026-2032) | Growth, Outlook, Industry, Segmentation, Forecast, Size, Companies, Trends, Value, Share, Analysis & Revenue

- Canada Oil and Gas Market (2026-2032) | Share, Segmentation, Value, Industry, Trends, Forecast, Analysis, Size & Revenue, Growth, Competitive Landscape, Outlook, Companies

- Germany Breakfast Food Market (2026-2032) | Industry, Share, Growth, Size, Companies, Value, Analysis, Revenue, Trends, Forecast & Outlook

- Australia Briquette Market (2025-2031) | Growth, Size, Revenue, Forecast, Analysis, Trends, Value, Share, Industry & Companies

- Vietnam System Integrator Market (2026-2032) | Size, Companies, Analysis, Industry, Value, Forecast, Growth, Trends, Revenue & Share

Industry Events and Analyst Meet

Whitepaper

- Middle East & Africa Commercial Security Market Click here to view more.

- Middle East & Africa Fire Safety Systems & Equipment Market Click here to view more.

- GCC Drone Market Click here to view more.

- Middle East Lighting Fixture Market Click here to view more.

- GCC Physical & Perimeter Security Market Click here to view more.

6WResearch In News

- Doha a strategic location for EV manufacturing hub: IPA Qatar

- Demand for luxury TVs surging in the GCC, says Samsung

- Empowering Growth: The Thriving Journey of Bangladesh’s Cable Industry

- Demand for luxury TVs surging in the GCC, says Samsung

- Video call with a traditional healer? Once unthinkable, it’s now common in South Africa

- Intelligent Buildings To Smooth GCC’s Path To Net Zero