United States (US) Dentures Market Outlook | Size, Share, Analysis, Revenue, Value, Growth, Trends, Companies, Forecast, COVID-19 IMPACT & Industry

| Product Code: ETC099380 | Publication Date: Jun 2021 | Updated Date: Nov 2025 | Product Type: Report | |

| Publisher: 6Wresearch | Author: Sachin Kumar Rai | No. of Pages: 70 | No. of Figures: 35 | No. of Tables: 5 |

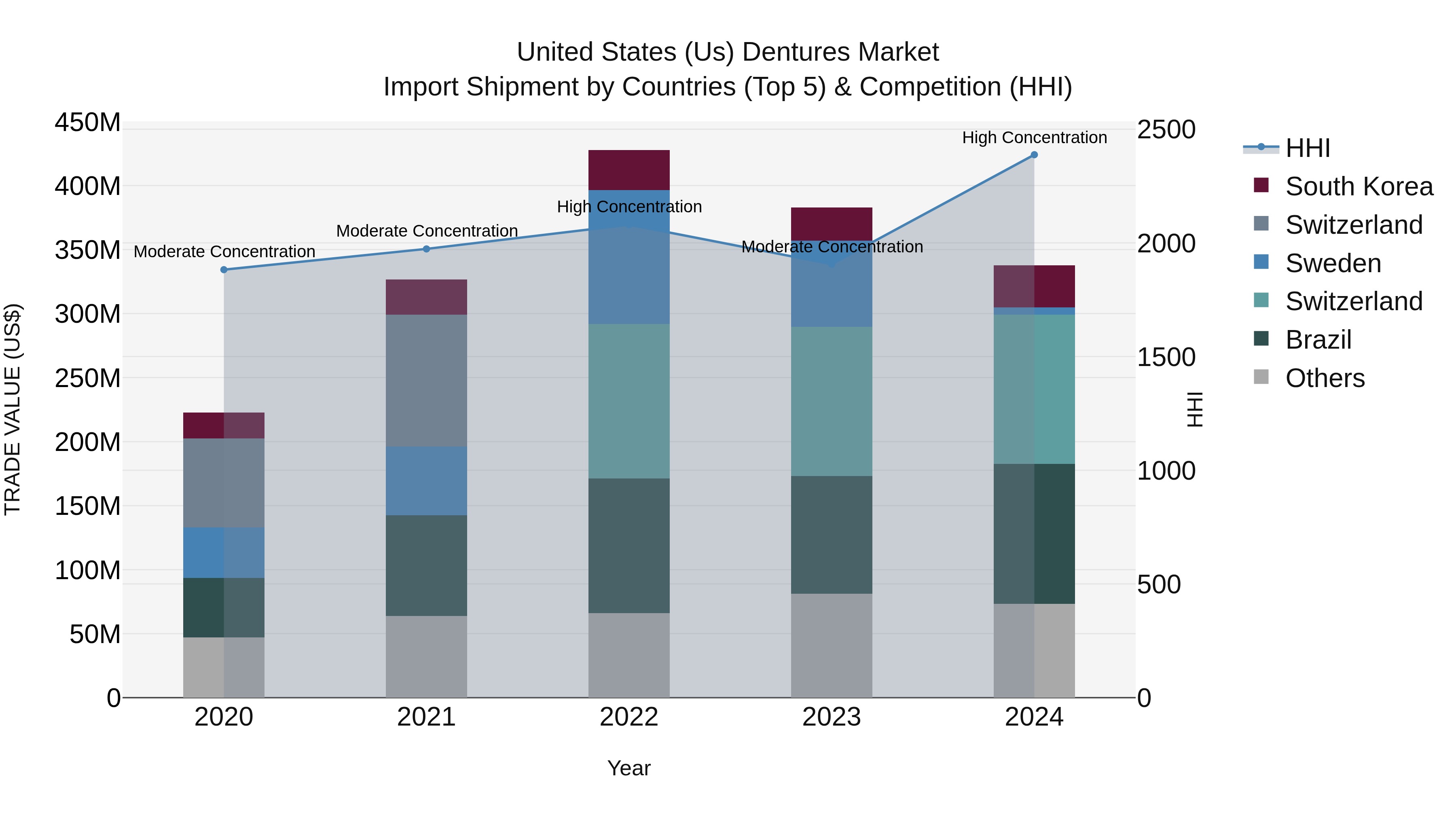

United States (US) Dentures Market Top 5 Importing Countries and Market Competition (HHI) Analysis

The United States saw a significant shift in dentures import patterns in 2024, with Switzerland, Brazil, South Korea, China, and Germany emerging as top exporting countries. The market concentration, as measured by HHI, escalated from moderate to high, indicating a more consolidated market landscape. Despite a slight decline in growth rate from 2023 to 2024, the compound annual growth rate (CAGR) over the period of 2020-2024 remained robust at 10.97%, reflecting sustained demand for dentures in the US market. This evolving import scenario suggests changing dynamics and competitive pressures within the industry.

USA Export Potential Assessment For Dentures Market (Values in USD Thousand)

United States (US) Dentures Market Overview

The United States dentures market is a mature and well-established sector within the dental industry, driven by factors such as the aging population, increasing awareness of dental health, and advancements in denture technology. The market is characterized by a wide range of products including full dentures, partial dentures, and implant-supported dentures, catering to the diverse needs of consumers. Key players in the US dentures market include dental laboratories, dental clinics, and dental product manufacturers. Marketing strategies often focus on promoting the comfort, aesthetics, and durability of dentures to attract customers. With a growing demand for dental prosthetics and an emphasis on oral health, the US dentures market is expected to continue its steady growth trajectory in the coming years.

United States (US) Dentures Market Trends

The United States Dentures Market is experiencing several key trends currently. One major trend is the increasing demand for customized and high-quality dentures as consumers seek more comfortable and natural-looking solutions. Another trend is the rising adoption of digital dentures, which are fabricated using advanced technologies like 3D printing for improved accuracy and efficiency. Additionally, there is a growing focus on eco-friendly and sustainable denture materials to align with consumer preferences for environmentally conscious products. Moreover, the aging population in the US is driving the market growth, as older individuals are more likely to require dentures for tooth replacement. Overall, the US Dentures Market is witnessing a shift towards personalized, technologically advanced, and sustainable solutions to meet the evolving needs of consumers.

United States (US) Dentures Market Challenges

The US dentures market faces several challenges, including increasing competition from alternative dental solutions such as dental implants and bridge work, which offer more natural-looking and long-lasting results. Additionally, the high costs associated with dentures and related procedures pose a barrier for many patients, especially those without adequate insurance coverage. Another challenge is the aging population in the US, leading to a higher demand for dentures but also requiring more specialized and customized solutions to meet the diverse needs of older adults. Moreover, there is a growing trend towards preventive dental care, which may reduce the need for dentures in the long term. Overall, the US dentures market must navigate these challenges by innovating with new materials and technologies, improving affordability, and adapting to changing consumer preferences.

United States (US) Dentures Market Investment Opportunities

The United States dentures market presents several investment opportunities driven by factors such as the growing aging population, increasing awareness about oral health, and advancements in denture materials and technologies. Investors can explore opportunities in manufacturing and selling innovative denture products, investing in dental clinics specializing in denture services, or supporting research and development efforts for more comfortable and natural-looking dentures. Additionally, the rising demand for cosmetic dentistry and the expansion of dental insurance coverage could further boost the market. Collaborating with dental professionals to develop customized solutions or investing in marketing strategies to reach a wider consumer base are also viable options for tapping into the lucrative US dentures market.

United States (US) Dentures Market Government Policy

Government policies related to the US Dentures Market primarily revolve around regulating the safety and quality of dentures to ensure consumer protection. The Food and Drug Administration (FDA) oversees the approval and monitoring of dental products, including dentures, to guarantee they meet established standards for efficacy and safety. Additionally, Medicaid, a government healthcare program, provides coverage for some individuals who require dentures but cannot afford them. Medicare, another government program, generally does not cover routine dental care or dentures, although there may be exceptions for certain circumstances. Overall, government policies in the US Dentures Market aim to uphold quality standards, ensure access to necessary dental care for vulnerable populations, and protect consumers from substandard products.

United States (US) Dentures Market Future Outlook

The United States dentures market is expected to witness steady growth in the coming years, driven by factors such as the aging population, increasing prevalence of dental diseases, and advancements in denture materials and technologies. The rising demand for cosmetic dentistry procedures and the growing awareness about the importance of oral health are also contributing to market expansion. Additionally, the availability of various types of dentures catering to different patient needs and preferences is likely to fuel market growth. However, challenges such as the high cost of dental procedures and limited insurance coverage for dental care could potentially hinder market growth. Overall, the US dentures market is anticipated to remain resilient and show promising growth prospects in the foreseeable future.

Key Highlights of the Report:

- United States (US) Dentures Market Outlook

- Market Size of United States (US) Dentures Market, 2021

- Forecast of United States (US) Dentures Market, 2027

- Historical Data and Forecast of United States (US) Dentures Revenues & Volume for the Period 2018 - 2027

- United States (US) Dentures Market Trend Evolution

- United States (US) Dentures Market Drivers and Challenges

- United States (US) Dentures Price Trends

- United States (US) Dentures Porter's Five Forces

- United States (US) Dentures Industry Life Cycle

- Historical Data and Forecast of United States (US) Dentures Market Revenues & Volume By Type for the Period 2018 - 2027

- Historical Data and Forecast of United States (US) Dentures Market Revenues & Volume By Complete for the Period 2018 - 2027

- Historical Data and Forecast of United States (US) Dentures Market Revenues & Volume By Partial for the Period 2018 - 2027

- Historical Data and Forecast of United States (US) Dentures Market Revenues & Volume By Usage for the Period 2018 - 2027

- Historical Data and Forecast of United States (US) Dentures Market Revenues & Volume By Removable for the Period 2018 - 2027

- Historical Data and Forecast of United States (US) Dentures Market Revenues & Volume By Fixed for the Period 2018 - 2027

- Historical Data and Forecast of United States (US) Dentures Market Revenues & Volume By End-user for the Period 2018 - 2027

- Historical Data and Forecast of United States (US) Dentures Market Revenues & Volume By Dental Hospital & Clinics for the Period 2018 - 2027

- Historical Data and Forecast of United States (US) Dentures Market Revenues & Volume By Dental Laboratories for the Period 2018 - 2027

- Historical Data and Forecast of United States (US) Dentures Market Revenues & Volume By Others for the Period 2018 - 2027

- United States (US) Dentures Import Export Trade Statistics

- Market Opportunity Assessment By Type

- Market Opportunity Assessment By Usage

- Market Opportunity Assessment By End-user

- United States (US) Dentures Top Companies Market Share

- United States (US) Dentures Competitive Benchmarking By Technical and Operational Parameters

- United States (US) Dentures Company Profiles

- United States (US) Dentures Key Strategic Recommendations

Frequently Asked Questions About the Market Study (FAQs):

1 Executive Summary |

2 Introduction |

2.1 Key Highlights of the Report |

2.2 Report Description |

2.3 Market Scope & Segmentation |

2.4 Research Methodology |

2.5 Assumptions |

3 United States (US) Dentures Market Overview |

3.1 United States (US) Country Macro Economic Indicators |

3.2 United States (US) Dentures Market Revenues & Volume, 2021 & 2027F |

3.3 United States (US) Dentures Market - Industry Life Cycle |

3.4 United States (US) Dentures Market - Porter's Five Forces |

3.5 United States (US) Dentures Market Revenues & Volume Share, By Type, 2021 & 2027F |

3.6 United States (US) Dentures Market Revenues & Volume Share, By Usage, 2021 & 2027F |

3.7 United States (US) Dentures Market Revenues & Volume Share, By End-user, 2021 & 2027F |

4 United States (US) Dentures Market Dynamics |

4.1 Impact Analysis |

4.2 Market Drivers |

4.2.1 Increasing geriatric population in the United States leading to higher demand for dental care, including dentures. |

4.2.2 Technological advancements in denture materials and manufacturing processes improving the quality and durability of dentures. |

4.2.3 Growing awareness about oral health and the importance of maintaining dental hygiene driving the demand for dentures. |

4.3 Market Restraints |

4.3.1 High cost associated with dentures and related dental procedures may limit adoption, especially among low-income individuals. |

4.3.2 Limited insurance coverage for dental care, including dentures, leading to out-of-pocket expenses for patients. |

4.3.3 Competition from alternative solutions such as dental implants impacting the demand for traditional dentures. |

5 United States (US) Dentures Market Trends |

6 United States (US) Dentures Market, By Types |

6.1 United States (US) Dentures Market, By Type |

6.1.1 Overview and Analysis |

6.1.2 United States (US) Dentures Market Revenues & Volume, By Type, 2018 - 2027F |

6.1.3 United States (US) Dentures Market Revenues & Volume, By Complete, 2018 - 2027F |

6.1.4 United States (US) Dentures Market Revenues & Volume, By Partial, 2018 - 2027F |

6.2 United States (US) Dentures Market, By Usage |

6.2.1 Overview and Analysis |

6.2.2 United States (US) Dentures Market Revenues & Volume, By Removable, 2018 - 2027F |

6.2.3 United States (US) Dentures Market Revenues & Volume, By Fixed, 2018 - 2027F |

6.3 United States (US) Dentures Market, By End-user |

6.3.1 Overview and Analysis |

6.3.2 United States (US) Dentures Market Revenues & Volume, By Dental Hospital & Clinics, 2018 - 2027F |

6.3.3 United States (US) Dentures Market Revenues & Volume, By Dental Laboratories, 2018 - 2027F |

6.3.4 United States (US) Dentures Market Revenues & Volume, By Others, 2018 - 2027F |

7 United States (US) Dentures Market Import-Export Trade Statistics |

7.1 United States (US) Dentures Market Export to Major Countries |

7.2 United States (US) Dentures Market Imports from Major Countries |

8 United States (US) Dentures Market Key Performance Indicators |

8.1 Average waiting time for denture fittings and adjustments, indicating efficiency in meeting patient needs. |

8.2 Percentage of dentists offering denture services, reflecting market penetration and availability of services. |

8.3 Number of dental clinics offering same-day denture services, showing responsiveness to consumer demand. |

8.4 Patient satisfaction scores related to denture fit, comfort, and aesthetics, indicating quality of services provided. |

9 United States (US) Dentures Market - Opportunity Assessment |

9.1 United States (US) Dentures Market Opportunity Assessment, By Type, 2021 & 2027F |

9.2 United States (US) Dentures Market Opportunity Assessment, By Usage, 2021 & 2027F |

9.3 United States (US) Dentures Market Opportunity Assessment, By End-user, 2021 & 2027F |

10 United States (US) Dentures Market - Competitive Landscape |

10.1 United States (US) Dentures Market Revenue Share, By Companies, 2021 |

10.2 United States (US) Dentures Market Competitive Benchmarking, By Operating and Technical Parameters |

11 Company Profiles |

12 Recommendations |

13 Disclaimer |

- Single User License$ 1,995

- Department License$ 2,400

- Site License$ 3,120

- Global License$ 3,795

Search

Thought Leadership and Analyst Meet

Our Clients

Related Reports

- Germany Breakfast Food Market (2026-2032) | Industry, Share, Growth, Size, Companies, Value, Analysis, Revenue, Trends, Forecast & Outlook

- Australia Briquette Market (2025-2031) | Growth, Size, Revenue, Forecast, Analysis, Trends, Value, Share, Industry & Companies

- Vietnam System Integrator Market (2025-2031) | Size, Companies, Analysis, Industry, Value, Forecast, Growth, Trends, Revenue & Share

- ASEAN and Thailand Brain Health Supplements Market (2025-2031) | Strategy, Consumer Insights, Analysis, Investment Trends, Opportunities, Growth, Size, Share, Industry, Revenue, Segments, Value, Segmentation, Supply, Forecast, Restraints, Outlook, Competition, Drivers, Trends, Demand, Pricing Analysis, Competitive, Strategic Insights, Companies, Challenges

- ASEAN Bearings Market (2025-2031) | Strategy, Consumer Insights, Analysis, Investment Trends, Opportunities, Growth, Size, Share, Industry, Revenue, Segments, Value, Segmentation, Supply, Forecast, Restraints, Outlook, Competition, Drivers, Trends, Demand, Pricing Analysis, Competitive, Strategic Insights, Companies, Challenges

- Europe Flooring Market (2025-2031) | Outlook, Share, Industry, Trends, Forecast, Companies, Revenue, Size, Analysis, Growth & Value

- Saudi Arabia Manlift Market (2025-2031) | Outlook, Size, Growth, Trends, Companies, Industry, Revenue, Value, Share, Forecast & Analysis

- Uganda Excavator, Crane, and Wheel Loaders Market (2025-2031) | Strategy, Consumer Insights, Analysis, Investment Trends, Opportunities, Growth, Size, Share, Industry, Revenue, Segments, Value, Segmentation, Supply, Forecast, Restraints, Outlook, Competition, Drivers, Trends, Demand, Pricing Analysis, Competitive, Strategic Insights, Companies, Challenges

- Rwanda Excavator, Crane, and Wheel Loaders Market (2025-2031) | Strategy, Consumer Insights, Analysis, Investment Trends, Opportunities, Growth, Size, Share, Industry, Revenue, Segments, Value, Segmentation, Supply, Forecast, Restraints, Outlook, Competition, Drivers, Trends, Demand, Pricing Analysis, Competitive, Strategic Insights, Companies, Challenges

- Kenya Excavator, Crane, and Wheel Loaders Market (2025-2031) | Strategy, Consumer Insights, Analysis, Investment Trends, Opportunities, Growth, Size, Share, Industry, Revenue, Segments, Value, Segmentation, Supply, Forecast, Restraints, Outlook, Competition, Drivers, Trends, Demand, Pricing Analysis, Competitive, Strategic Insights, Companies, Challenges

Industry Events and Analyst Meet

Whitepaper

- Middle East & Africa Commercial Security Market Click here to view more.

- Middle East & Africa Fire Safety Systems & Equipment Market Click here to view more.

- GCC Drone Market Click here to view more.

- Middle East Lighting Fixture Market Click here to view more.

- GCC Physical & Perimeter Security Market Click here to view more.

6WResearch In News

- Doha a strategic location for EV manufacturing hub: IPA Qatar

- Demand for luxury TVs surging in the GCC, says Samsung

- Empowering Growth: The Thriving Journey of Bangladesh’s Cable Industry

- Demand for luxury TVs surging in the GCC, says Samsung

- Video call with a traditional healer? Once unthinkable, it’s now common in South Africa

- Intelligent Buildings To Smooth GCC’s Path To Net Zero