Singapore Polytetrafluoroethylene (PTFE) Market (2025-2031) Outlook | Share, Industry, Revenue, Analysis, Trends, Forecast, Growth, Value, Size & Companies

| Product Code: ETC082906 | Publication Date: Jun 2021 | Updated Date: Feb 2026 | Product Type: Report | |

| Publisher: 6Wresearch | Author: Ravi Bhandari | No. of Pages: 70 | No. of Figures: 35 | No. of Tables: 5 |

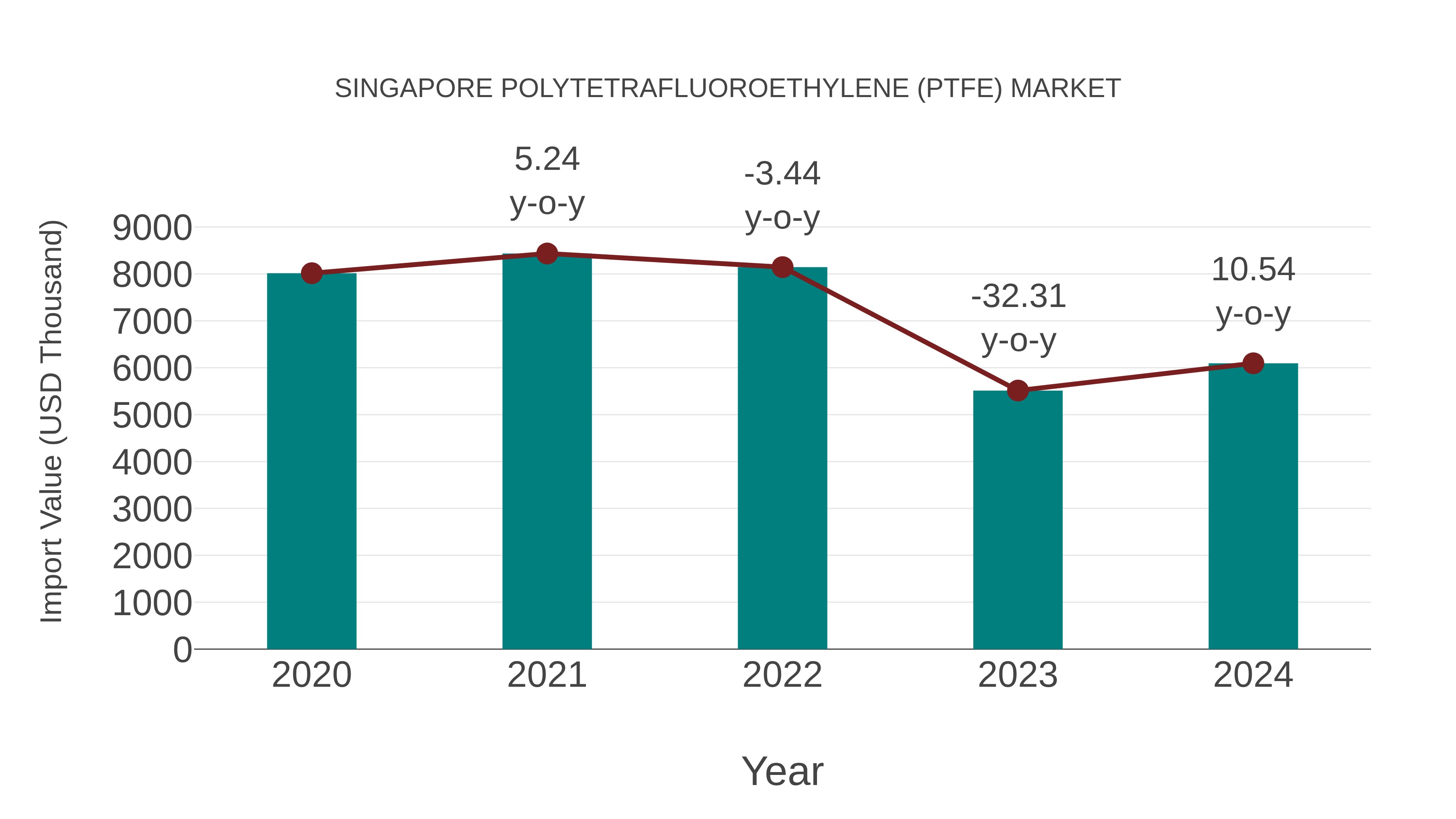

Singapore Polytetrafluoroethylene (Ptfe) Market: Import Trend Analysis

In 2024, Singapore`s import of polytetrafluoroethylene (PTFE) for the Singapore market showed a steady increase, driven by demand from various industries such as electronics, automotive, and chemical processing. This trend reflected the country`s reliance on imported PTFE for manufacturing processes.

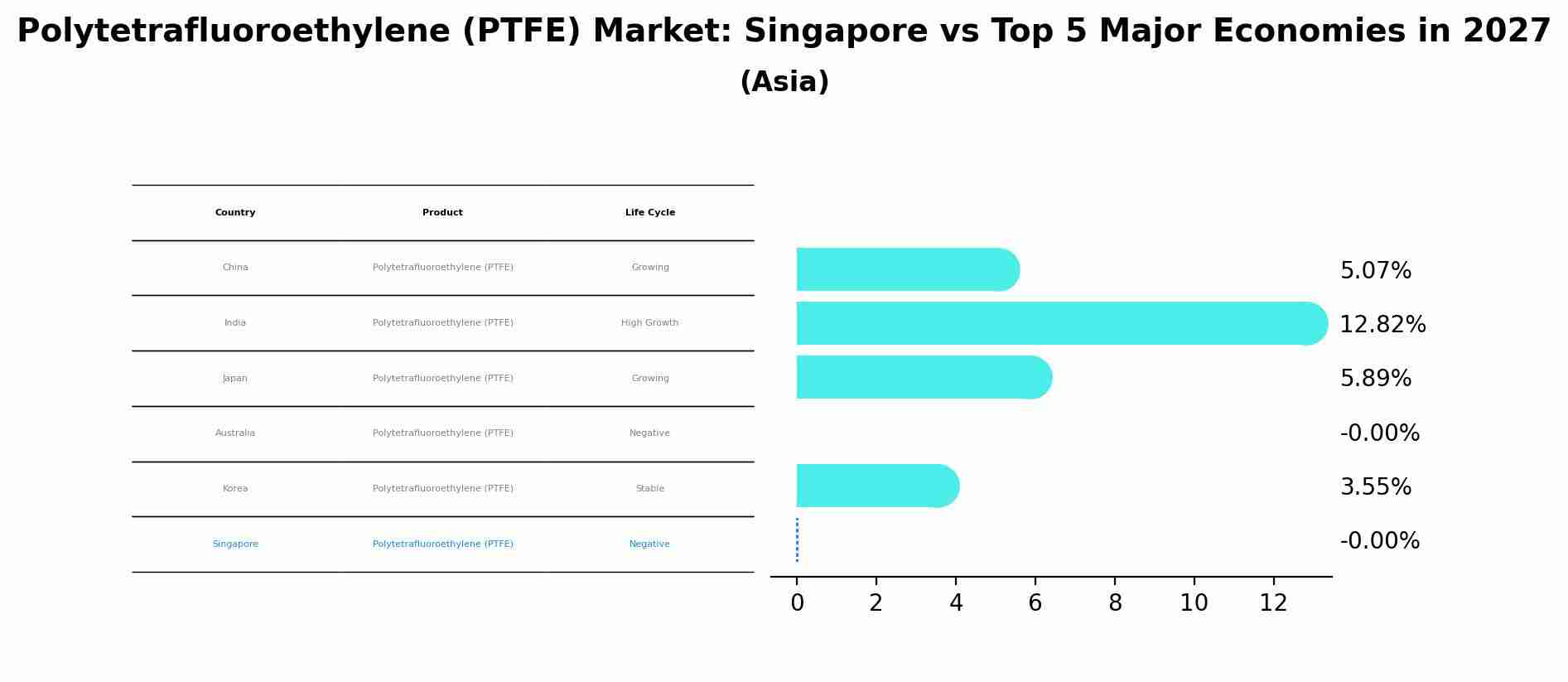

Polytetrafluoroethylene (PTFE) Market: Singapore vs Top 5 Major Economies in 2027 (Asia)

The Polytetrafluoroethylene (PTFE) market in Singapore is projected to grow at a negative growth rate of -0.00% by 2027, within the Asia region led by China, along with other countries like India, Japan, Australia and South Korea, collectively shaping a dynamic and evolving market environment driven by innovation and increasing adoption of emerging technologies.

Singapore Polytetrafluoroethylene Ptfe Market Synopsis

Polytetrafluoroethylene (PTFE) is a versatile material known for its non-stick properties and resistance to chemicals and high temperatures. The Singapore PTFE market is poised for growth, driven by its applications in industries such as electronics, pharmaceuticals, and food processing. PTFE`s use as a coating for cookware and in the manufacturing of gaskets and seals also contributes to its demand. In addition to traditional applications, emerging industries like 3D printing and semiconductor manufacturing are likely to create new opportunities for PTFE. The market`s future success will depend on innovation and product development to meet evolving industry needs.

Drivers of the Market

The Singapore PTFE market is expected to witness steady growth in the coming years. One of the primary drivers for this growth is the increasing demand for PTFE in various industrial applications. PTFE is known for its excellent chemical resistance and non-stick properties, making it a preferred material in industries such as electronics, chemicals, and manufacturing. Additionally, the expanding electronics and semiconductor manufacturing sector in Singapore is likely to drive the demand for PTFE as it is used in the production of components like wires, cables, and insulators. The emphasis on sustainability and environmental regulations may also push manufacturers to opt for PTFE due to its durability and long-lasting nature.

Challenges of the Market

The Singapore PTFE market is expected to witness growth due to its widespread use in industries such as chemicals, electronics, and automotive. PTFE is known for its non-stick and high-temperature resistance properties. However, a challenge in this market is the competition from substitute materials and the need for continuous research to enhance the properties of PTFE. Manufacturers must invest in innovation to maintain their market share and meet the evolving demands of various industries.

COVID-19 Impact on the Market

The Singapore PTFE market, which caters to industries such as electronics, chemicals, and manufacturing, underwent significant changes during the COVID-19 pandemic. As global manufacturing activities slowed down due to lockdowns and disruptions in supply chains, demand for PTFE products also saw a decline. Industries dependent on PTFE, such as the electronics sector for insulating materials, faced challenges in maintaining production levels. However, the healthcare sector saw an increased demand for PTFE products in the manufacturing of medical devices, including PPE and ventilator components. Post-pandemic, the Singapore PTFE market is expected to stabilize as manufacturing resumes, but continued vigilance regarding global supply chain resilience remains crucial.

Key Players in the Market

The Singapore PTFE market is expected to witness steady growth due to its widespread use in various industries like electronics, automotive, and chemical processing. Key players in the Singapore PTFE market include Chemours, 3M, and Daikin.

Key Highlights of the Report:

- Singapore Polytetrafluoroethylene (PTFE) Market Outlook

- Market Size of Singapore Polytetrafluoroethylene (PTFE) Market, 2024

- Forecast of Singapore Polytetrafluoroethylene (PTFE) Market, 2031

- Historical Data and Forecast of Singapore Polytetrafluoroethylene (PTFE) Revenues & Volume for the Period 2021-2031

- Singapore Polytetrafluoroethylene (PTFE) Market Trend Evolution

- Singapore Polytetrafluoroethylene (PTFE) Market Drivers and Challenges

- Singapore Polytetrafluoroethylene (PTFE) Price Trends

- Singapore Polytetrafluoroethylene (PTFE) Porter's Five Forces

- Singapore Polytetrafluoroethylene (PTFE) Industry Life Cycle

- Historical Data and Forecast of Singapore Polytetrafluoroethylene (PTFE) Market Revenues & Volume By Form for the Period 2021-2031

- Historical Data and Forecast of Singapore Polytetrafluoroethylene (PTFE) Market Revenues & Volume By Micronized Powder for the Period 2021-2031

- Historical Data and Forecast of Singapore Polytetrafluoroethylene (PTFE) Market Revenues & Volume By Granular for the Period 2021-2031

- Historical Data and Forecast of Singapore Polytetrafluoroethylene (PTFE) Market Revenues & Volume By Fine Powder for the Period 2021-2031

- Historical Data and Forecast of Singapore Polytetrafluoroethylene (PTFE) Market Revenues & Volume By Aqueous Dispersion for the Period 2021-2031

- Historical Data and Forecast of Singapore Polytetrafluoroethylene (PTFE) Market Revenues & Volume By Others for the Period 2021-2031

- Historical Data and Forecast of Singapore Polytetrafluoroethylene (PTFE) Market Revenues & Volume By Type for the Period 2021-2031

- Historical Data and Forecast of Singapore Polytetrafluoroethylene (PTFE) Market Revenues & Volume By Virgin PTFE for the Period 2021-2031

- Historical Data and Forecast of Singapore Polytetrafluoroethylene (PTFE) Market Revenues & Volume By Stainless Steel Filled PTFE for the Period 2021-2031

- Historical Data and Forecast of Singapore Polytetrafluoroethylene (PTFE) Market Revenues & Volume By Carbon Filled PTFE for the Period 2021-2031

- Historical Data and Forecast of Singapore Polytetrafluoroethylene (PTFE) Market Revenues & Volume By Bronze Filled PTFE for the Period 2021-2031

- Historical Data and Forecast of Singapore Polytetrafluoroethylene (PTFE) Market Revenues & Volume By Glass Filled PTFE for the Period 2021-2031

- Historical Data and Forecast of Singapore Polytetrafluoroethylene (PTFE) Market Revenues & Volume By Graphite Filled PTFE for the Period 2021-2031

- Historical Data and Forecast of Singapore Polytetrafluoroethylene (PTFE) Market Revenues & Volume By Application for the Period 2021-2031

- Historical Data and Forecast of Singapore Polytetrafluoroethylene (PTFE) Market Revenues & Volume By Sheet for the Period 2021-2031

- Historical Data and Forecast of Singapore Polytetrafluoroethylene (PTFE) Market Revenues & Volume By Film for the Period 2021-2031

- Historical Data and Forecast of Singapore Polytetrafluoroethylene (PTFE) Market Revenues & Volume By Coatings for the Period 2021-2031

- Historical Data and Forecast of Singapore Polytetrafluoroethylene (PTFE) Market Revenues & Volume By Ink for the Period 2021-2031

- Historical Data and Forecast of Singapore Polytetrafluoroethylene (PTFE) Market Revenues & Volume By Pipes for the Period 2021-2031

- Historical Data and Forecast of Singapore Polytetrafluoroethylene (PTFE) Market Revenues & Volume By Plastics for the Period 2021-2031

- Historical Data and Forecast of Singapore Polytetrafluoroethylene (PTFE) Market Revenues & Volume By Others for the Period 2021-2031

- Historical Data and Forecast of Singapore Polytetrafluoroethylene (PTFE) Market Revenues & Volume By End-use Industry for the Period 2021-2031

- Historical Data and Forecast of Singapore Polytetrafluoroethylene (PTFE) Market Revenues & Volume By Electrical & Electronics for the Period 2021-2031

- Historical Data and Forecast of Singapore Polytetrafluoroethylene (PTFE) Market Revenues & Volume By Automotive for the Period 2021-2031

- Historical Data and Forecast of Singapore Polytetrafluoroethylene (PTFE) Market Revenues & Volume By Medical for the Period 2021-2031

- Historical Data and Forecast of Singapore Polytetrafluoroethylene (PTFE) Market Revenues & Volume By Building & Construction for the Period 2021-2031

- Historical Data and Forecast of Singapore Polytetrafluoroethylene (PTFE) Market Revenues & Volume By Oil & Gas for the Period 2021-2031

- Historical Data and Forecast of Singapore Polytetrafluoroethylene (PTFE) Market Revenues & Volume By Aviation & Aerospace for the Period 2021-2031

- Historical Data and Forecast of Singapore Polytetrafluoroethylene (PTFE) Market Revenues & Volume By Packaging for the Period 2021-2031

- Historical Data and Forecast of Singapore Polytetrafluoroethylene (PTFE) Market Revenues & Volume By Others for the Period 2021-2031

- Singapore Polytetrafluoroethylene (PTFE) Import Export Trade Statistics

- Market Opportunity Assessment By Form

- Market Opportunity Assessment By Type

- Market Opportunity Assessment By Application

- Market Opportunity Assessment By End-use Industry

- Singapore Polytetrafluoroethylene (PTFE) Top Companies Market Share

- Singapore Polytetrafluoroethylene (PTFE) Competitive Benchmarking By Technical and Operational Parameters

- Singapore Polytetrafluoroethylene (PTFE) Company Profiles

- Singapore Polytetrafluoroethylene (PTFE) Key Strategic Recommendations

Frequently Asked Questions About the Market Study (FAQs):

1 Executive Summary |

2 Introduction |

2.1 Key Highlights of the Report |

2.2 Report Description |

2.3 Market Scope & Segmentation |

2.4 Research Methodology |

2.5 Assumptions |

3 Singapore Polytetrafluoroethylene (PTFE) Market Overview |

3.1 Singapore Country Macro Economic Indicators |

3.2 Singapore Polytetrafluoroethylene (PTFE) Market Revenues & Volume, 2021 & 2031F |

3.3 Singapore Polytetrafluoroethylene (PTFE) Market - Industry Life Cycle |

3.4 Singapore Polytetrafluoroethylene (PTFE) Market - Porter's Five Forces |

3.5 Singapore Polytetrafluoroethylene (PTFE) Market Revenues & Volume Share, By Form, 2021 & 2031F |

3.6 Singapore Polytetrafluoroethylene (PTFE) Market Revenues & Volume Share, By Type, 2021 & 2031F |

3.7 Singapore Polytetrafluoroethylene (PTFE) Market Revenues & Volume Share, By Application, 2021 & 2031F |

3.8 Singapore Polytetrafluoroethylene (PTFE) Market Revenues & Volume Share, By End-use Industry, 2021 & 2031F |

4 Singapore Polytetrafluoroethylene (PTFE) Market Dynamics |

4.1 Impact Analysis |

4.2 Market Drivers |

4.2.1 Increase in demand for non-stick coatings in various industries such as food processing, pharmaceuticals, and automotive. |

4.2.2 Growing usage of PTFE in electrical and electronics applications due to its high dielectric strength and chemical resistance. |

4.3 Market Restraints |

4.3.1 Fluctuating raw material prices, particularly for fluoropolymer resins used in PTFE production. |

4.3.2 Stringent regulations regarding the use of PTFE due to environmental concerns. |

5 Singapore Polytetrafluoroethylene (PTFE) Market Trends |

6 Singapore Polytetrafluoroethylene (PTFE) Market, By Types |

6.1 Singapore Polytetrafluoroethylene (PTFE) Market, By Form |

6.1.1 Overview and Analysis |

6.1.2 Singapore Polytetrafluoroethylene (PTFE) Market Revenues & Volume, By Form, 2021-2031F |

6.1.3 Singapore Polytetrafluoroethylene (PTFE) Market Revenues & Volume, By Micronized Powder, 2021-2031F |

6.1.4 Singapore Polytetrafluoroethylene (PTFE) Market Revenues & Volume, By Granular, 2021-2031F |

6.1.5 Singapore Polytetrafluoroethylene (PTFE) Market Revenues & Volume, By Fine Powder, 2021-2031F |

6.1.6 Singapore Polytetrafluoroethylene (PTFE) Market Revenues & Volume, By Aqueous Dispersion, 2021-2031F |

6.1.7 Singapore Polytetrafluoroethylene (PTFE) Market Revenues & Volume, By Others, 2021-2031F |

6.2 Singapore Polytetrafluoroethylene (PTFE) Market, By Type |

6.2.1 Overview and Analysis |

6.2.2 Singapore Polytetrafluoroethylene (PTFE) Market Revenues & Volume, By Virgin PTFE, 2021-2031F |

6.2.3 Singapore Polytetrafluoroethylene (PTFE) Market Revenues & Volume, By Stainless Steel Filled PTFE, 2021-2031F |

6.2.4 Singapore Polytetrafluoroethylene (PTFE) Market Revenues & Volume, By Carbon Filled PTFE, 2021-2031F |

6.2.5 Singapore Polytetrafluoroethylene (PTFE) Market Revenues & Volume, By Bronze Filled PTFE, 2021-2031F |

6.2.6 Singapore Polytetrafluoroethylene (PTFE) Market Revenues & Volume, By Glass Filled PTFE, 2021-2031F |

6.2.7 Singapore Polytetrafluoroethylene (PTFE) Market Revenues & Volume, By Graphite Filled PTFE, 2021-2031F |

6.3 Singapore Polytetrafluoroethylene (PTFE) Market, By Application |

6.3.1 Overview and Analysis |

6.3.2 Singapore Polytetrafluoroethylene (PTFE) Market Revenues & Volume, By Sheet, 2021-2031F |

6.3.3 Singapore Polytetrafluoroethylene (PTFE) Market Revenues & Volume, By Film, 2021-2031F |

6.3.4 Singapore Polytetrafluoroethylene (PTFE) Market Revenues & Volume, By Coatings, 2021-2031F |

6.3.5 Singapore Polytetrafluoroethylene (PTFE) Market Revenues & Volume, By Ink, 2021-2031F |

6.3.6 Singapore Polytetrafluoroethylene (PTFE) Market Revenues & Volume, By Pipes, 2021-2031F |

6.3.7 Singapore Polytetrafluoroethylene (PTFE) Market Revenues & Volume, By Plastics, 2021-2031F |

6.4 Singapore Polytetrafluoroethylene (PTFE) Market, By End-use Industry |

6.4.1 Overview and Analysis |

6.4.2 Singapore Polytetrafluoroethylene (PTFE) Market Revenues & Volume, By Electrical & Electronics, 2021-2031F |

6.4.3 Singapore Polytetrafluoroethylene (PTFE) Market Revenues & Volume, By Automotive, 2021-2031F |

6.4.4 Singapore Polytetrafluoroethylene (PTFE) Market Revenues & Volume, By Medical, 2021-2031F |

6.4.5 Singapore Polytetrafluoroethylene (PTFE) Market Revenues & Volume, By Building & Construction, 2021-2031F |

6.4.6 Singapore Polytetrafluoroethylene (PTFE) Market Revenues & Volume, By Oil & Gas, 2021-2031F |

6.4.7 Singapore Polytetrafluoroethylene (PTFE) Market Revenues & Volume, By Aviation & Aerospace, 2021-2031F |

6.4.8 Singapore Polytetrafluoroethylene (PTFE) Market Revenues & Volume, By Others, 2021-2031F |

6.4.9 Singapore Polytetrafluoroethylene (PTFE) Market Revenues & Volume, By Others, 2021-2031F |

7 Singapore Polytetrafluoroethylene (PTFE) Market Import-Export Trade Statistics |

7.1 Singapore Polytetrafluoroethylene (PTFE) Market Export to Major Countries |

7.2 Singapore Polytetrafluoroethylene (PTFE) Market Imports from Major Countries |

8 Singapore Polytetrafluoroethylene (PTFE) Market Key Performance Indicators |

8.1 Research and development investment in PTFE technology advancements. |

8.2 Number of new product launches or applications utilizing PTFE. |

8.3 Adoption rate of PTFE in emerging industries such as renewable energy or medical devices. |

9 Singapore Polytetrafluoroethylene (PTFE) Market - Opportunity Assessment |

9.1 Singapore Polytetrafluoroethylene (PTFE) Market Opportunity Assessment, By Form, 2021 & 2031F |

9.2 Singapore Polytetrafluoroethylene (PTFE) Market Opportunity Assessment, By Type, 2021 & 2031F |

9.3 Singapore Polytetrafluoroethylene (PTFE) Market Opportunity Assessment, By Application, 2021 & 2031F |

9.4 Singapore Polytetrafluoroethylene (PTFE) Market Opportunity Assessment, By End-use Industry, 2021 & 2031F |

10 Singapore Polytetrafluoroethylene (PTFE) Market - Competitive Landscape |

10.1 Singapore Polytetrafluoroethylene (PTFE) Market Revenue Share, By Companies, 2024 |

10.2 Singapore Polytetrafluoroethylene (PTFE) Market Competitive Benchmarking, By Operating and Technical Parameters |

11 Company Profiles |

12 Recommendations |

13 Disclaimer |

Export potential assessment - trade Analytics for 2030

Export potential enables firms to identify high-growth global markets with greater confidence by combining advanced trade intelligence with a structured quantitative methodology. The framework analyzes emerging demand trends and country-level import patterns while integrating macroeconomic and trade datasets such as GDP and population forecasts, bilateral import–export flows, tariff structures, elasticity differentials between developed and developing economies, geographic distance, and import demand projections. Using weighted trade values from 2020–2024 as the base period to project country-to-country export potential for 2030, these inputs are operationalized through calculated drivers such as gravity model parameters, tariff impact factors, and projected GDP per-capita growth. Through an analysis of hidden potentials, demand hotspots, and market conditions that are most favorable to success, this method enables firms to focus on target countries, maximize returns, and global expansion with data, backed by accuracy.

By factoring in the projected importer demand gap that is currently unmet and could be potential opportunity, it identifies the potential for the Exporter (Country) among 190 countries, against the general trade analysis, which identifies the biggest importer or exporter.

To discover high-growth global markets and optimize your business strategy:

Click Here- Single User License$ 1,995

- Department License$ 2,400

- Site License$ 3,120

- Global License$ 3,795

Search

Thought Leadership and Analyst Meet

Our Clients

Related Reports

- Saudi Arabia Core Assurance Service Market (2025-2031) | Strategy, Consumer Insights, Analysis, Investment Trends, Opportunities, Growth, Size, Share, Industry, Revenue, Segments, Value, Segmentation, Supply, Forecast, Restraints, Outlook, Competition, Drivers, Trends, Demand, Pricing Analysis, Competitive, Strategic Insights, Companies, Challenges

- Romania Uninterruptible Power Supply (UPS) Market (2026-2032) | Industry, Analysis, Revenue, Size, Forecast, Outlook, Value, Trends, Share, Growth & Companies

- Saudi Arabia Car Window Tinting Film, Paint Protection Film (PPF), and Ceramic Coating Market (2025-2031) | Strategy, Consumer Insights, Analysis, Investment Trends, Opportunities, Growth, Size, Share, Industry, Revenue, Segments, Value, Segmentation, Supply, Forecast, Restraints, Outlook, Competition, Drivers, Trends, Demand, Pricing Analysis, Competitive, Strategic Insights, Companies, Challenges

- South Africa Stationery Market (2025-2031) | Share, Size, Industry, Value, Growth, Revenue, Analysis, Trends, Segmentation & Outlook

- Afghanistan Rocking Chairs And Adirondack Chairs Market (2026-2032) | Size & Revenue, Competitive Landscape, Share, Segmentation, Industry, Value, Outlook, Analysis, Trends, Growth, Forecast, Companies

- Afghanistan Apparel Market (2026-2032) | Growth, Outlook, Industry, Segmentation, Forecast, Size, Companies, Trends, Value, Share, Analysis & Revenue

- Canada Oil and Gas Market (2026-2032) | Share, Segmentation, Value, Industry, Trends, Forecast, Analysis, Size & Revenue, Growth, Competitive Landscape, Outlook, Companies

- Germany Breakfast Food Market (2026-2032) | Industry, Share, Growth, Size, Companies, Value, Analysis, Revenue, Trends, Forecast & Outlook

- Australia Briquette Market (2025-2031) | Growth, Size, Revenue, Forecast, Analysis, Trends, Value, Share, Industry & Companies

- Vietnam System Integrator Market (2026-2032) | Size, Companies, Analysis, Industry, Value, Forecast, Growth, Trends, Revenue & Share

Industry Events and Analyst Meet

Whitepaper

- Middle East & Africa Commercial Security Market Click here to view more.

- Middle East & Africa Fire Safety Systems & Equipment Market Click here to view more.

- GCC Drone Market Click here to view more.

- Middle East Lighting Fixture Market Click here to view more.

- GCC Physical & Perimeter Security Market Click here to view more.

6WResearch In News

- Doha a strategic location for EV manufacturing hub: IPA Qatar

- Demand for luxury TVs surging in the GCC, says Samsung

- Empowering Growth: The Thriving Journey of Bangladesh’s Cable Industry

- Demand for luxury TVs surging in the GCC, says Samsung

- Video call with a traditional healer? Once unthinkable, it’s now common in South Africa

- Intelligent Buildings To Smooth GCC’s Path To Net Zero