ASEAN Low Voltage Switchgear Market (2023-2029) | Trends, Analysis, Forecast, COVID-19 IMPACT, Size, Growth, Share, Industry, Value, Revenue & Companies

Market Forecast By Types (MCB,MCCB,RCD (Residual Current Device),ACB,DB’s (Distribution Board),Contactors and Relays), By Applications (Residential,Commercial,Industrial,Power Utilities, Transportation and Infrastructure), By Countries (Malaysia,Thailand,Indonesia,Singapore,Philippines,Vietnam) and competitive landscape

| Product Code: ETC4624275 | Publication Date: Nov 2023 | Product Type: Market Research Report | ||

| Publisher: 6Wresearch | Author: Ravi Bhandari | No. of Pages: 445 | No. of Figures: 15 | No. of Tables: 45 |

ASEAN Low Voltage Switchgear Market Synopsis

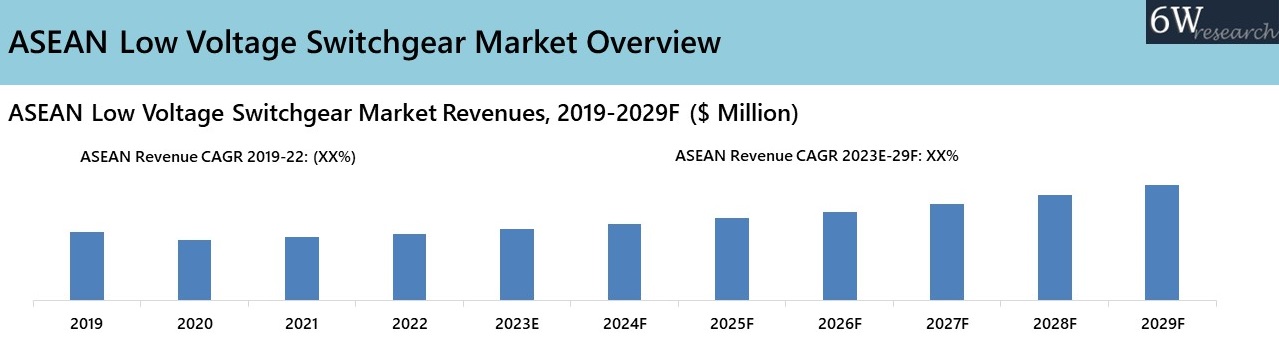

Between 2019 and 2022, the ASEAN Low Voltage Switchgear Market saw robust expansion, primarily attributed to growth in residential, commercial, and other construction projects. Nonetheless, the market encountered setbacks in 2020 due to the COVID-19 pandemic, leading to supply chain disruptions and a temporary construction halt. For instance, Indonesia's construction industry witnessed a contraction of 2.9% in Q1 2020 and -5.39% in Q2 2020. Despite these challenges, the ASEAN region's burgeoning infrastructure development remains a driving force behind the demand for low-voltage switchgear products. Additionally, a noteworthy trend is the focus of ASEAN countries on fostering a green economy and launching renewable energy projects. These initiatives are poised to further fuel the demand for low-voltage switchgear throughout the forecast period.

According to 6Wresearch, the ASEAN Low Voltage Switchgear market size is anticipated to grow at a CAGR of 8.4% respectively during 2023-2029. The impending creation of Indonesia's new capital city, Nusantara, holds the potential for the construction of 184 residential towers in the foreseeable future. Concurrently, there are plans to construct 1,601 housing units, with a target completion date set for Q2 2025 with an investment of approximately $246 million. Furthermore, Vietnam's government is actively working on introducing more than 1 million residences for individuals with lower incomes by the year 2030. Additionally, Singapore's landscape is poised for commercial advancement, anticipating an influx of 4.2 million square feet in office supply within the span from 2023 to 2025. Such large-scale projects are poised to generate demand for switchgear in the coming years.

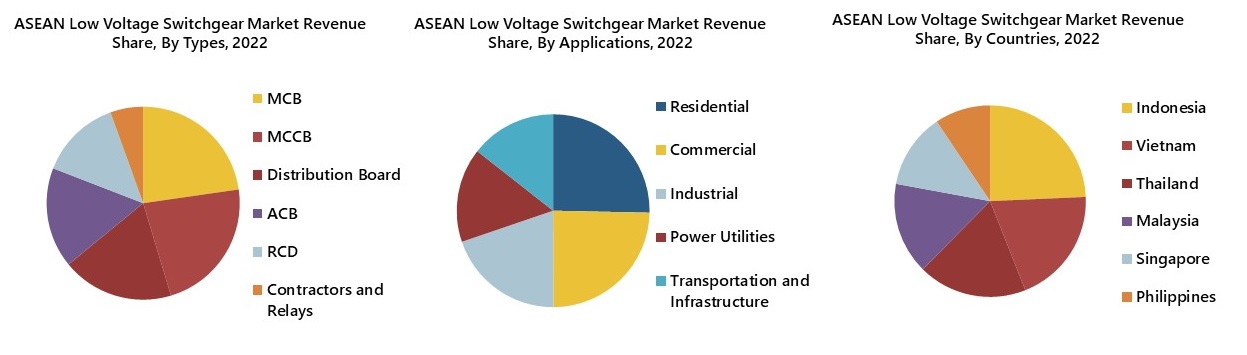

Market by Types

MCB has accounted highest revenue share in ASEAN low voltage switchgear industry owing to its wide usage in residential, commercial and other sectors. Further, growing demand of residential units, establishment of commercial offices, hotels among other infrastructural development would escalate the demand of MCB in low voltage switchgear market.

Market by Applications

Within the ASEAN low voltage switchgear market, the residential sector has emerged as a dominant revenue contributor. This is attributed to the considerable number of flats completed by The Housing and Development Board (HDB) in Singapore in 2022, coupled with the successful completion of high-end condominiums in Malaysia and Indonesia. Additionally, the governments' ambitious initiatives to construct millions of affordable houses in countries like the Philippines and Vietnam are poised to substantially enhance the demand for low voltage switchgear products within the residential sector in the years ahead.

Market by Countries

Indonesia has garnered maximum revenue share in low voltage switchgear market of ASEAN as the country has accounted highest completion of new condominiums units in 2022 which was up by 7.6% annually. Further, development of new capital city and rising tourism would lead to new supply of hotels and thus, would contribute towards the demand of low voltage switchgear products in the country.

Key Attractiveness of the Report

- COVID-19 Impact on the Market.

- 11 Years Market Numbers.

- Historical Data Starting from 2019 to 2022.

- Base Year: 2022

- Forecast Data until 2029.

- Key Performance Indicators Impacting the Market.

- Major Upcoming Developments and Projects.

Key Highlights of the Report:

- ASEAN Low Voltage SwitchgearMarket Overview

- ASEAN Low Voltage SwitchgearMarket Outlook

- ASEAN Low Voltage SwitchgearMarket Forecast

- Historical Data and Forecast ofASEAN Low Voltage SwitchgearMarketRevenues for the Period 2019-2029F

- Historical Data and Forecast ofASEAN Low Voltage SwitchgearMarketRevenues, By Types, for the Period 2019-2029F

- Historical Data and Forecast ofASEAN Low Voltage SwitchgearMarketRevenues, By Applications, for the Period 2019-2029F

- Historical Data and Forecast ofASEAN Low Voltage SwitchgearMarketRevenues, By Countries, for the Period 2019-2029F

- Market Drivers and Restraints

- Industry Life Cycle

- Porter’s Five Force Analysis

- Impact Analysis of Covid-19

- Market Trends

- ASEAN Country-wise Low Voltage SwitchgearMarketRevenue Ranking, By Companies

- Competitive Benchmarking

- Company Profiles

- Key Strategic Recommendations

Market Scope and Segmentation

Thereportprovides a detailed analysis of the following market segments:

By Types

- MCB

- MCCB

- RCD (Residual Current Device)

- ACB

- DB’s (Distribution Board)

- Contactors and Relays

By Applications

- Residential

- Commercial

- Industrial

- Power Utilities

- Transportation and Infrastructure

By Countries

- Malaysia

- Thailand

- Indonesia

- Singapore

- Philippines

- Vietnam

Frequently Asked Questions About the Market Study (FAQs):

| 1. Executive Summary |

| 2. Introduction |

| 2.1 Key Highlights of the Report |

| 2.2 Report Description |

| 2.3 Market Scope & Segmentation |

| 2.4 Research Methodology |

| 2.5 Assumptions |

| 3. ASEAN Low Voltage Switchgear Market Overview |

| 3.1 ASEAN Low Voltage Switchgear Market Revenues, 2019-2029F |

| 3.2 ASEAN Low Voltage Switchgear Market Industry Life Cycle |

| 3.3 ASEAN Low Voltage Switchgear Market Porter’s Five Forces |

| 3.4 ASEAN Low Voltage Switchgear Market Revenue Share, By Types, 2022 & 2029F |

| 3.5 ASEAN Low Voltage Switchgear Market Revenue Share, By Applications, 2022 & 2029F |

| 3.6 ASEAN Low Voltage Switchgear Market Revenue Share, By Countries, 2022 & 2029F |

| 4. Impact Analysis of Covid-19 |

| 5. ASEAN Low Voltage Switchgear Market Dynamics |

| 5.1 Impact Analysis |

| 5.2 Market Drivers |

| 5.3 Market Restraints |

| 6. ASEAN Low Voltage Switchgear Market Trends & Evolution |

| 7. Malaysia Low Voltage Switchgear Market Overview |

| 7.1 Malaysia Low Voltage Switchgear Market Revenues (2019-2029F) |

| 7.2 Malaysia Low Voltage Switchgear Market Revenue Share and Revenues, By Types (2019-2029F) |

| 7.2.1 Malaysia Low Voltage Switchgear Market Revenues, By MCB (2019-2029F) |

| 7.2.2 Malaysia Low Voltage Switchgear Market Revenues, By MCCB (2019-2029F) |

| 7.2.3 Malaysia Low Voltage Switchgear Market Revenues, By RCD (2019-2029F) |

| 7.2.4 Malaysia Low Voltage Switchgear Market Revenues, By ACB (2019-2029F) |

| 7.2.5 Malaysia Low Voltage Switchgear Market Revenues, By Distribution Board (2019-2029F) |

| 7.2.6 Malaysia Low Voltage Switchgear Market Revenues, By Contactors and Relays (2019-2029F) |

| 7.3 Malaysia Low Voltage Switchgear Market Revenue Share and Revenues, By Applications (2019-2029F) |

| 7.3.1 Malaysia Low Voltage Switchgear Market Revenues, By Residential (2019-2029F) |

| 7.3.2 Malaysia Low Voltage Switchgear Market Revenues, By Commercial (2019-2029F) |

| 7.3.3 Malaysia Low Voltage Switchgear Market Revenues, By Industrial (2019-2029F) |

| 7.3.4 Malaysia Low Voltage Switchgear Market Revenues, By Power Utilities (2019-2029F) |

| 7.3.5 Malaysia Low Voltage Switchgear Market Revenues, By Transportation & Infrastructure (2019-2029F) |

| 7.4 Key Performance Indicators |

| 7.5 Malaysia Low Voltage Switchgear Market Opportunity Assessment |

| 7.5.1 Malaysia Low Voltage Switchgear Market Opportunity Assessment, By Types (2029F) |

| 7.5.2 Malaysia Low Voltage Switchgear Market Opportunity Assessment, By Applications (2029F) |

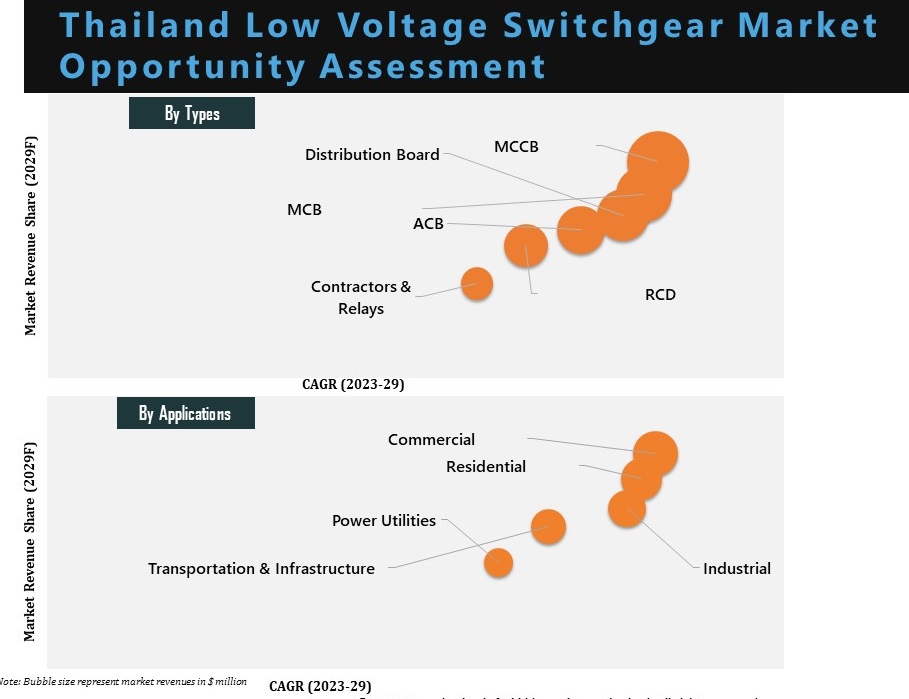

| 8. Thailand Low Voltage Switchgear Market Overview |

| 8.1 Thailand Low Voltage Switchgear Market Revenues (2019-2029F) |

| 8.2 Thailand Low Voltage Switchgear Market Revenue Share and Revenues, By Types (2019-2029F) |

| 8.2.1 Thailand Low Voltage Switchgear Market Revenues, By MCB (2019-2029F) |

| 8.2.2 Thailand Low Voltage Switchgear Market Revenues, By MCCB (2019-2029F) |

| 8.2.3 Thailand Low Voltage Switchgear Market Revenues, By RCD (2019-2029F) |

| 8.2.4 Thailand Low Voltage Switchgear Market Revenues, By ACB (2019-2029F) |

| 8.2.5 Thailand Low Voltage Switchgear Market Revenues, By Distribution Board (2019-2029F) |

| 8.2.6 Thailand Low Voltage Switchgear Market Revenues, By Contactors and Relays (2019-2029F) |

| 8.3 Thailand Low Voltage Switchgear Market Revenue Share and Revenues, By Applications (2019-2029F) |

| 8.3.1 Thailand Low Voltage Switchgear Market Revenues, By Residential (2019-2029F) |

| 8.3.2 Thailand Low Voltage Switchgear Market Revenues, By Commercial (2019-2029F) |

| 8.3.3 Thailand Low Voltage Switchgear Market Revenues, By Industrial (2019-2029F) |

| 8.3.4 Thailand Low Voltage Switchgear Market Revenues, By Power Utilities (2019-2029F) |

| 8.3.5 Thailand Low Voltage Switchgear Market Revenues, By Transportation & Infrastructure (2019-2029F) |

| 8.4 Key Performance Indicators |

| 8.5 Thailand Low Voltage Switchgear Market Opportunity Assessment |

| 8.5.1 Thailand Low Voltage Switchgear Market Opportunity Assessment, By Types (2029F) |

| 8.5.2 Thailand Low Voltage Switchgear Market Opportunity Assessment, By Applications (2029F) |

| 9. Indonesia Low Voltage Switchgear Market Overview |

| 9.1 Indonesia Low Voltage Switchgear Market Revenues (2019-2029F) |

| 9.2 Indonesia Low Voltage Switchgear Market Revenue Share and Revenues, By Types (2019-2029F) |

| 9.2.1 Indonesia Low Voltage Switchgear Market Revenues, By MCB (2019-2029F) |

| 9.2.2 Indonesia Low Voltage Switchgear Market Revenues, By MCCB (2019-2029F) |

| 9.2.3 Indonesia Low Voltage Switchgear Market Revenues, By RCD (2019-2029F) |

| 9.2.4 Indonesia Low Voltage Switchgear Market Revenues, By ACB (2019-2029F) |

| 9.2.5 Indonesia Low Voltage Switchgear Market Revenues, By Distribution Board (2019-2029F) |

| 9.2.6 Indonesia Low Voltage Switchgear Market Revenues, By Contactors and Relays (2019-2029F) |

| 9.3 Indonesia Low Voltage Switchgear Market Revenue Share and Revenues, By Applications (2019-2029F) |

| 9.3.1 Indonesia Low Voltage Switchgear Market Revenues, By Residential (2019-2029F) |

| 9.3.2 Indonesia Low Voltage Switchgear Market Revenues, By Commercial (2019-2029F) |

| 9.3.3 Indonesia Low Voltage Switchgear Market Revenues, By Industrial (2019-2029F) |

| 9.3.4 Indonesia Low Voltage Switchgear Market Revenues, By Power Utilities (2019-2029F) |

| 9.3.5 Indonesia Low Voltage Switchgear Market Revenues, By Transportation & Infrastructure (2019-2029F) |

| 9.4 Key Performance Indicators |

| 9.5 Indonesia Low Voltage Switchgear Market Opportunity Assessment |

| 9.5.1 Indonesia Low Voltage Switchgear Market Opportunity Assessment, By Types (2029F) |

| 9.5.2 Indonesia Low Voltage Switchgear Market Opportunity Assessment, By Applications (2029F) |

| 10. Singapore Low Voltage Switchgear Market Overview |

| 10.1 Singapore Low Voltage Switchgear Market Revenues (2019-2029F) |

| 10.2 Singapore Low Voltage Switchgear Market Revenue Share and Revenues, By Types (2019-2029F) |

| 10.2.1 Singapore Low Voltage Switchgear Market Revenues, By MCB (2019-2029F) |

| 10.2.2 Singapore Low Voltage Switchgear Market Revenues, By MCCB (2019-2029F) |

| 10.2.3 Singapore Low Voltage Switchgear Market Revenues, By RCD (2019-2029F) |

| 10.2.4 Singapore Low Voltage Switchgear Market Revenues, By ACB (2019-2029F) |

| 10.2.5 Singapore Low Voltage Switchgear Market Revenues, By Distribution Board (2019-2029F) |

| 10.2.6 Singapore Low Voltage Switchgear Market Revenues, By Contactors and Relays (2019-2029F) |

| 10.3 Singapore Low Voltage Switchgear Market Revenue Share and Revenues, By Applications (2019-2029F) |

| 10.3.1 Singapore Low Voltage Switchgear Market Revenues, By Residential (2019-2029F) |

| 10.3.2 Singapore Low Voltage Switchgear Market Revenues, By Commercial (2019-2029F) |

| 10.3.3 Singapore Low Voltage Switchgear Market Revenues, By Industrial (2019-2029F) |

| 10.3.4 Singapore Low Voltage Switchgear Market Revenues, By Power Utilities (2019-2029F) |

| 10.3.5 Singapore Low Voltage Switchgear Market Revenues, By Transportation & Infrastructure (2019-2029F) |

| 10.4 Key Performance Indicators |

| 10.5 Singapore Low Voltage Switchgear Market Opportunity Assessment |

| 10.5.1 Singapore Low Voltage Switchgear Market Opportunity Assessment, By Types (2029F) |

| 10.5.2 Singapore Low Voltage Switchgear Market Opportunity Assessment, By Applications (2029F) |

| 11. Philippines Low Voltage Switchgear Market Overview |

| 11.1 Philippines Low Voltage Switchgear Market Revenues (2019-2029F) |

| 11.2 Philippines Low Voltage Switchgear Market Revenue Share and Revenues, By Types (2019-2029F) |

| 11.2.1 Philippines Low Voltage Switchgear Market Revenues, By MCB (2019-2029F) |

| 11.2.2 Philippines Low Voltage Switchgear Market Revenues, By MCCB (2019-2029F) |

| 11.2.3 Philippines Low Voltage Switchgear Market Revenues, By RCD (2019-2029F) |

| 11.2.4 Philippines Low Voltage Switchgear Market Revenues, By ACB (2019-2029F) |

| 11.2.5 Philippines Low Voltage Switchgear Market Revenues, By Distribution Board (2019-2029F) |

| 11.2.6 Philippines Low Voltage Switchgear Market Revenues, By Contactors and Relays (2019-2029F) |

| 11.3 Philippines Low Voltage Switchgear Market Revenue Share and Revenues, By Applications (2019-2029F) |

| 11.3.1 Philippines Low Voltage Switchgear Market Revenues, By Residential (2019-2029F) |

| 11.3.2 Philippines Low Voltage Switchgear Market Revenues, By Commercial (2019-2029F) |

| 11.3.3 Philippines Low Voltage Switchgear Market Revenues, By Industrial (2019-2029F) |

| 11.3.4 Philippines Low Voltage Switchgear Market Revenues, By Power Utilities (2019-2029F) |

| 11.3.5 Philippines Low Voltage Switchgear Market Revenues, By Transportation & Infrastructure (2019-2029F) |

| 11.4 Key Performance Indicators |

| 11.5 Philippines Low Voltage Switchgear Market Opportunity Assessment |

| 11.5.1 Philippines Low Voltage Switchgear Market Opportunity Assessment, By Types (2029F) |

| 11.5.2 Philippines Low Voltage Switchgear Market Opportunity Assessment, By Applications (2029F) |

| 12. Vietnam Low Voltage Switchgear Market Overview |

| 12.1 Vietnam Low Voltage Switchgear Market Revenues (2019-2029F) |

| 12.2 Vietnam Low Voltage Switchgear Market Revenue Share and Revenues, By Types (2019-2029F) |

| 12.2.1 Vietnam Low Voltage Switchgear Market Revenues, By MCB (2019-2029F) |

| 12.2.2 Vietnam Low Voltage Switchgear Market Revenues, By MCCB (2019-2029F) |

| 12.2.3 Vietnam Low Voltage Switchgear Market Revenues, By RCD (2019-2029F) |

| 12.2.4 Vietnam Low Voltage Switchgear Market Revenues, By ACB (2019-2029F) |

| 12.2.5 Vietnam Low Voltage Switchgear Market Revenues, By Distribution Board (2019-2029F) |

| 12.2.6 Vietnam Low Voltage Switchgear Market Revenues, By Contactors and Relays (2019-2029F) |

| 12.3 Vietnam Low Voltage Switchgear Market Revenue Share and Revenues, By Applications (2019-2029F) |

| 12.3.1 Vietnam Low Voltage Switchgear Market Revenues, By Residential (2019-2029F) |

| 12.3.2 Vietnam Low Voltage Switchgear Market Revenues, By Commercial (2019-2029F) |

| 12.3.3 Vietnam Low Voltage Switchgear Market Revenues, By Industrial (2019-2029F) |

| 12.3.4 Vietnam Low Voltage Switchgear Market Revenues, By Power Utilities (2019-2029F) |

| 12.3.5 Vietnam Low Voltage Switchgear Market Revenues, By Transportation & Infrastructure (2019-2029F) |

| 12.4 Key Performance Indicators |

| 12.5 Vietnam Low Voltage Switchgear Market Opportunity Assessment |

| 12.5.1 Vietnam Low Voltage Switchgear Market Opportunity Assessment, By Types (2029F) |

| 12.5.2 Vietnam Low Voltage Switchgear Market Opportunity Assessment, By Applications (2029F) |

| 13. ASEAN Low Voltage Switchgear Market Competitive Landscape |

| 13.1 Malaysia/Thailand/Indonesia Low Voltage Switchgear Market Revenue Share Ranking, By Top 3/5 Companies (2022) |

| 13.1 Singapore/Philippines/Vietnam Low Voltage Switchgear Market Revenue Share Ranking, By Top 3/5 Companies (2022) |

| 13.2 ASEAN Low Voltage Switchgear Market Key Companies Competitive Benchmarking, By Technical & Operating Parameters |

| 14. Company Profiles |

| 14.1 ABB Ltd |

| 14.2 Schneider Electric |

| 14.3 Eaton Corporation |

| 14.4 Fuji SMBE Pte Ltd. |

| 14.5 Siemens AG |

| 14.6 HD Hyundai Electric |

| 14.7 Mitsubishi Electric Corporation |

| 14.8 LS ELECTRIC Co., Ltd. |

| 14.9 Hager Group |

| 14.10 CHINT Group Co., Ltd. |

| 15. Key Strategic Recommendations |

| 16. Disclaimer |

| List of Figures |

| 1. ASEAN Low Voltage Switchgear Market Revenues, 2019-2029F ($ Million) |

| 2. ASEAN Low Voltage Switchgear Market Revenue Share, By Types, 2022 & 2029F |

| 3. ASEAN Low Voltage Switchgear Market Revenue Share, By Applications, 2022 & 2029F |

| 4. ASEAN Low Voltage Switchgear Market Revenue Share, By Countries, 2022 & 2029F |

| 5. Malaysia Low Voltage Switchgear Market Revenues, 2019-2029F ($ Million) |

| 6. Malaysia Low Voltage Switchgear Market Revenue Share, By Types, 2022 & 2029F |

| 7. Malaysia Low Voltage Switchgear Market Revenue Share, By Applications, 2022 & 2029F |

| 8. High-End Condominiums (Units), Kuala Lumpur, 2022 – Post 2023 |

| 9. Thailand Low Voltage Switchgear Market Revenues, 2019-2029F ($ Million) |

| 10. Thailand Low Voltage Switchgear Market Revenue Share, By Types, 2022 & 2029F |

| 11. Thailand Low Voltage Switchgear Market Revenue Share, By Applications, 2022 & 2029F |

| 12. Thailand Upcoming Hotel Projects, 2022-2025F |

| 13. Thailand Upcoming Hotel Room Supply, By 2024F, (Units) |

| 14. Indonesia Low Voltage Switchgear Market Revenues, 2019-2029F ($ Million) |

| 15. Indonesia Low Voltage Switchgear Market Revenue Share, By Types, 2022 & 2029F |

| 16. Indonesia Low Voltage Switchgear Market Revenue Share, By Applications, 2022 & 2029F |

| 17. CBD and Outside CBD Annual Office Supply, 2019-2023E (square meter) |

| 18. Singapore Low Voltage Switchgear Market Revenues, 2019-2029F ($ Million) |

| 19. Singapore Low Voltage Switchgear Market Revenue Share, By Types, 2022 & 2029F |

| 20. Singapore Low Voltage Switchgear Market Revenue Share, By Applications, 2022 & 2029F |

| 21. Number of Flats Completed By The Housing and Development Board (HDB), Singapore, 2019-2022 |

| 22. Philippines Low Voltage Switchgear Market Revenues, 2019-2029F ($ Million) |

| 23. Philippines Low Voltage Switchgear Market Revenue Share, By Types, 2022 & 2029F |

| 24. Philippines Low Voltage Switchgear Market Revenue Share, By Applications, 2022 & 2029F |

| 25. Metro Manila Residential Stock Forecast, end of 2020 & 2023 (Units) |

| 26. Philippines Hotel Projects Pipeline, 2021-2024F |

| 27. Metro Manila Malls Retail Spaces (in sqm), 2020-2023E |

| 28. Philippines Hotel Rooms Openings, 2021-2024F |

| 29. Vietnam Low Voltage Switchgear Market Revenues, 2019-2029F ($ Million) |

| 30. Vietnam Low Voltage Switchgear Market Revenue Share, By Types, 2022 & 2029F |

| 31. Vietnam Low Voltage Switchgear Market Revenue Share, By Applications, 2022 & 2029F |

| 32. Vietnam Newly Registered Manufacturing Investment, By Province, H1/2022 |

| 33. Vietnam Manufacturing Sector Contribution Towards GDP, 2017-2022 |

| 34. Vietnam Number of Airports, 2022 & 2030F |

| 35. Vietnam Investments in Transportation Sector, 2021-2030F ($ Million) |

| 36. Malaysia Low Voltage Switchgear Market Ranking, By Companies, 2022 |

| 37. Thailand Low Voltage Switchgear Market Ranking, By Companies, 2022 |

| 38. Indonesia Low Voltage Switchgear Market Ranking, By Companies, 2022 |

| 39. Singapore Low Voltage Switchgear Market Ranking, By Companies, 2022 |

| 40. Philippines Low Voltage Switchgear Market Ranking, By Companies, 2022 |

| 41. Vietnam Low Voltage Switchgear Market Ranking, By Companies, 2022 |

| 42. Country-wise Percentage of Urban Population, 2015-2025F |

| List of Tables |

| 1. Singapore Upcoming Key Hospitality Projects, 2024-2025 |

| 2. Malaysia Low Voltage Switchgear Market Revenues, By Types, 2019-2029F ($ Million) |

| 3. Malaysia Low Voltage Switchgear Market Revenues, By Applications, 2019-2029F ($ Million) |

| 4. Completions of High-End Condominiums / Residences, Malaysia, 1H2022 |

| 5. Malaysia Upcoming Projects in Power Sector |

| 6. Thailand Low Voltage Switchgear Market Revenues, By Types, 2019-2029F ($ Million) |

| 7. Thailand Low Voltage Switchgear Market Revenues, By Applications, 2019-2029F ($ Million) |

| 8. Thailand Residential Sector Projects, 2020-2026F |

| 9. Indonesia Low Voltage Switchgear Market Revenues, By Types, 2019-2029F ($ Million) |

| 10. Indonesia Low Voltage Switchgear Market Revenues, By Applications, 2019-2029F ($ Million) |

| 11. Indonesia Newly Completed Projects, Q4 2022 |

| 12. Jakarta CBD Under-construction Office Projects In 2023 |

| 13. Singapore Low Voltage Switchgear Market Revenues, By Types, 2019-2029F ($ Million) |

| 14. Singapore Low Voltage Switchgear Market Revenues, By Applications, 2019-2029F ($ Million) |

| 15. Singapore Highly Demanded Residential Projects Launched in 2022 |

| 16. Office Supply Pipeline (2023-2025) (Sq Ft) |

| 17. Philippines Low Voltage Switchgear Market Revenues, By Types, 2019-2029F ($ Million) |

| 18. Philippines Low Voltage Switchgear Market Revenues, By Applications, 2019-2029F ($ Million) |

| 19. Vietnam Low Voltage Switchgear Market Revenues, By Types, 2019-2029F ($ Million) |

| 20. Vietnam Low Voltage Switchgear Market Revenues, By Applications, 2019-2029F ($ Million) |

| 21. Vietnam Upcoming Residential Projects |

Export potential assessment - trade Analytics for 2030

Export potential enables firms to identify high-growth global markets with greater confidence by combining advanced trade intelligence with a structured quantitative methodology. The framework analyzes emerging demand trends and country-level import patterns while integrating macroeconomic and trade datasets such as GDP and population forecasts, bilateral import–export flows, tariff structures, elasticity differentials between developed and developing economies, geographic distance, and import demand projections. Using weighted trade values from 2020–2024 as the base period to project country-to-country export potential for 2030, these inputs are operationalized through calculated drivers such as gravity model parameters, tariff impact factors, and projected GDP per-capita growth. Through an analysis of hidden potentials, demand hotspots, and market conditions that are most favorable to success, this method enables firms to focus on target countries, maximize returns, and global expansion with data, backed by accuracy.

By factoring in the projected importer demand gap that is currently unmet and could be potential opportunity, it identifies the potential for the Exporter (Country) among 190 countries, against the general trade analysis, which identifies the biggest importer or exporter.

To discover high-growth global markets and optimize your business strategy:

Click Here- Single User License$ 4,560

- Department License$ 5,055

- Site License$ 5,595

- Global License$ 6,000

Search

Thought Leadership and Analyst Meet

Our Clients

Related Reports

- India Switchgear Market Outlook (2026 - 2032) | Size, Share, Trends, Growth, Revenue, Forecast, Analysis, Value, Outlook

- Pakistan Contraceptive Implants Market (2025-2031) | Demand, Growth, Size, Share, Industry, Pricing Analysis, Competitive, Strategic Insights, Strategy, Consumer Insights, Analysis, Investment Trends, Opportunities, Revenue, Segments, Value, Segmentation, Supply, Forecast, Restraints, Outlook, Competition, Drivers, Trends, Companies, Challenges

- Sri Lanka Packaging Market (2026-2032) | Outlook, Competition, Drivers, Trends, Demand, Pricing Analysis, Competitive, Strategic Insights, Companies, Challenges, Strategy, Consumer Insights, Analysis, Investment Trends, Opportunities, Growth, Size, Share, Industry, Revenue, Segments, Value, Segmentation, Supply, Forecast, Restraints

- India Kids Watches Market (2026-2032) | Strategy, Consumer Insights, Analysis, Investment Trends, Opportunities, Growth, Size, Share, Industry, Revenue, Segments, Value, Segmentation, Supply, Forecast, Restraints, Outlook, Competition, Drivers, Trends, Demand, Pricing Analysis, Competitive, Strategic Insights, Companies, Challenges

- Saudi Arabia Core Assurance Service Market (2025-2031) | Strategy, Consumer Insights, Analysis, Investment Trends, Opportunities, Growth, Size, Share, Industry, Revenue, Segments, Value, Segmentation, Supply, Forecast, Restraints, Outlook, Competition, Drivers, Trends, Demand, Pricing Analysis, Competitive, Strategic Insights, Companies, Challenges

- Romania Uninterruptible Power Supply (UPS) Market (2026-2032) | Industry, Analysis, Revenue, Size, Forecast, Outlook, Value, Trends, Share, Growth & Companies

- Saudi Arabia Car Window Tinting Film, Paint Protection Film (PPF), and Ceramic Coating Market (2025-2031) | Strategy, Consumer Insights, Analysis, Investment Trends, Opportunities, Growth, Size, Share, Industry, Revenue, Segments, Value, Segmentation, Supply, Forecast, Restraints, Outlook, Competition, Drivers, Trends, Demand, Pricing Analysis, Competitive, Strategic Insights, Companies, Challenges

- South Africa Stationery Market (2025-2031) | Share, Size, Industry, Value, Growth, Revenue, Analysis, Trends, Segmentation & Outlook

- Afghanistan Rocking Chairs And Adirondack Chairs Market (2026-2032) | Size & Revenue, Competitive Landscape, Share, Segmentation, Industry, Value, Outlook, Analysis, Trends, Growth, Forecast, Companies

- Afghanistan Apparel Market (2026-2032) | Growth, Outlook, Industry, Segmentation, Forecast, Size, Companies, Trends, Value, Share, Analysis & Revenue

Industry Events and Analyst Meet

Whitepaper

- Middle East & Africa Commercial Security Market Click here to view more.

- Middle East & Africa Fire Safety Systems & Equipment Market Click here to view more.

- GCC Drone Market Click here to view more.

- Middle East Lighting Fixture Market Click here to view more.

- GCC Physical & Perimeter Security Market Click here to view more.

6WResearch In News

- Doha a strategic location for EV manufacturing hub: IPA Qatar

- Demand for luxury TVs surging in the GCC, says Samsung

- Empowering Growth: The Thriving Journey of Bangladesh’s Cable Industry

- Demand for luxury TVs surging in the GCC, says Samsung

- Video call with a traditional healer? Once unthinkable, it’s now common in South Africa

- Intelligent Buildings To Smooth GCC’s Path To Net Zero