Brazil Ferro-alloys Market (2025-2031) | Analysis, Forecast, Growth, Outlook, Revenue, Trends, Share, Size, Industry, Value & Companies

Market Forecast By Product Type (Ferrochrome, Ferromanganese, Ferro Silicomanganese, Ferrosilicon), By Application (Carbon & Low Alloy Steel, Stainless Steel, Alloy Steel, Cast Iron, Others) And Competitive Landscape

| Product Code: ETC031102 | Publication Date: Oct 2020 | Updated Date: Oct 2025 | Product Type: Report | |

| Publisher: 6Wresearch | Author: Ravi Bhandari | No. of Pages: 70 | No. of Figures: 35 | No. of Tables: 5 |

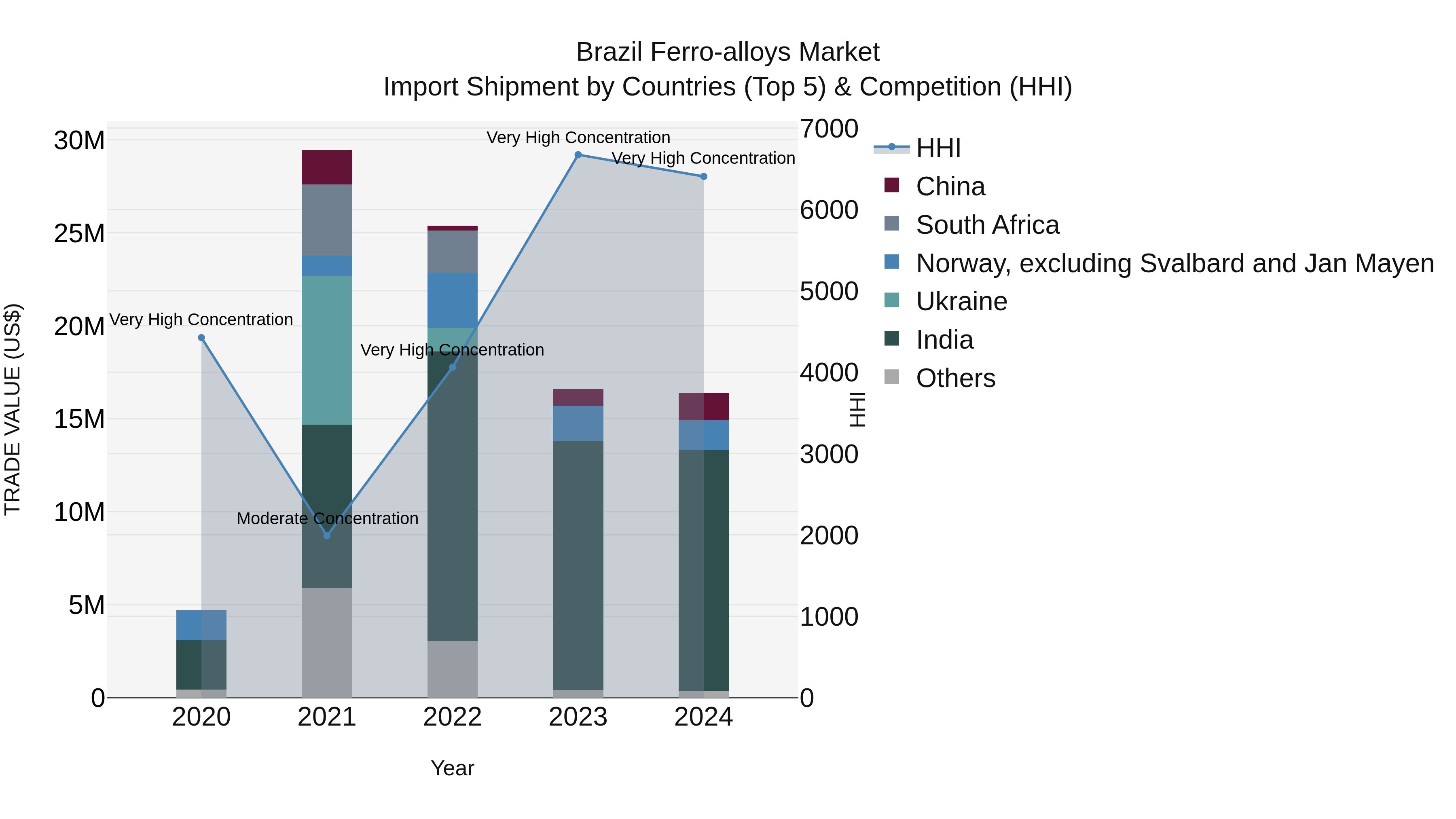

Brazil Ferro-alloys Market Top 5 Importing Countries and Market Competition (HHI) Analysis

Brazil`s ferro-alloys import market in 2024 continued to be dominated by top exporting countries such as India, Norway, China, Metropolitan France, and Canada. The Herfindahl-Hirschman Index (HHI) indicated a high concentration within the market. Despite a strong compound annual growth rate (CAGR) of 36.65% from 2020 to 2024, there was a slight decline in the growth rate from 2023 to 2024, showing a decrease of -1.15%. This data suggests a dynamic and competitive landscape in the Brazilian ferro-alloys import sector, with potential shifts in trade patterns and market dynamics.

Topics Covered in the Brazil Ferro-alloys Market Report

Brazil Ferro-alloys Market report thoroughly covers the by product type, and by application. The market report provides an unbiased and detailed analysis of the ongoing market trends, opportunities/high growth areas, and market drivers which would help the stakeholders to devise and align their market strategies according to the current and future market dynamics.

Brazil Ferro-alloys Market Synopsis

The Brazil ferro-alloys market stands as a significant pillar of the nation's industrial landscape, testament to its robust mining capabilities and diversified production economy. As a major player on the global stage, Brazil's strategic geographic location, coupled with its extensive natural resources, provides a competitive edge in ferro-alloys production. The market is well-poised to capitalize on growing domestic and international demand, positioning itself as an integral component of the global supply chain.

According to 6Wresearch, Brazil Ferro-alloys Marketrevenue is expected to reach at a significant CAGR of 5.6% during the forecast period 2024-2030. Several key drivers fuel the expansion of Brazil's ferro-alloys market. Chief among these is the burgeoning infrastructure development across Latin America, which demands high volumes of steel and its alloys. Brazil's automotive sector is thriving, requiring consistent supplies of durable materials such as ferro-alloys to sustain its growth. This combined with a steady rise in construction activities, both domestically and overseas, complements the upward trajectory of market demand. Technological advancements further enhance production efficiencies, enabling Brazil to produce high-quality ferro-alloys at competitive prices, maintaining its global competitiveness in the Brazil Ferro-alloys Market growth.

Despite the positive outlook, the Brazil ferro-alloys market faces a set of challenges that could impede growth. Key among these is the reliance on global economic conditions, which dictate demand variability and pricing fluctuations in the steel and alloy sectors. Environmental concerns and regulatory compliance pose significant hurdles, as there is an increasing need to balance economic growth with sustainable practices. The industry also grapples with infrastructural bottlenecks and logistical inefficiencies, which can disrupt supply chains and increase operational costs.

Brazil Ferro-alloys Market Trends

The Brazil ferro-alloys market is currently experiencing transformative trends driven by both global and local influences. One major trend is the shift towards green technologies and sustainable practices. As environmental concerns continue to rise, industry players are being pushed to adopt eco-friendly mining and production processes, with an emphasis on reducing carbon emissions and minimizing waste. Technological advancements in metallurgy promise to refine production methods and improve the quality of ferro-alloys, catering to evolving demands for high-performance materials across industries.

Investment Opportunities in the Brazil Ferro-alloys Market

Investment opportunities in the Brazil ferro-alloys market are abundant, primarily due to the country's rich mineral resources and strategic geographical location. Investors can capitalize on emerging renewable energy projects that require substantial ferro-alloys for infrastructure development. The burgeoning construction and automotive industries also present high potential avenues for investment. Fostering partnerships with local enterprises can provide valuable insights and facilitate smoother market entry, making joint ventures particularly attractive to foreign investors. With government incentives favoring infrastructural developments, there is ample scope for investment in enhancing production facilities and logistics to meet rising market demand.

Leading Players of the Brazil Ferro-alloys Market

The market is dominated by several key players who have established a significant presence due to their extensive production capabilities and strategic initiatives. Companies such as Vale S.A. and BHP Group are among the frontrunners, leveraging robust supply chains and a strong international foothold to deliver high-quality ferro-alloys. These industry leaders have capitalized on technological advancements and strategic acquisitions to enhance their market positions, setting benchmarks for efficiency and sustainability.

Government Regulations Introduced in the Brazil Ferro-alloys Market

The Brazilian government has introduced a series of regulations aimed at ensuring sustainable development within the ferro-alloys sector. These policies emphasize environmental protection, mandating stringent standards for emissions and waste management to mitigate ecological impact. Tax incentives and subsidies are offered to companies implementing green technologies and adhering to sustainable mining practices. Policy frameworks are in place to encourage foreign investment, streamlining bureaucratic processes and facilitating easy market access. The government's focus on infrastructure improvement also includes regulations focused on enhancing transportation networks, crucial for efficient logistics and supply chain management in this heavy industry.

Future Insights of theBrazil Ferro-alloys Market

Looking forward, the Brazil ferro-alloys market is poised for significant growth and transformation. As global demand for sustainable and resilient materials increases, Brazil's market will likely expand to meet these needs, propelled by advancements in manufacturing processes and eco-friendly innovations. Future prospects include increased automation and digitization in production, leading to higher efficiency and reduced production costs. The evolution of smart technologies in mining and processing will become increasingly integral, aligning with global trends toward Industry 4.0 practices.

Market Segmentation Analysis

The report offers a comprehensive study of the subsequent market segments and their leading categories.

Ferrosiliconto Dominate the Market - By Product type

According to Ravi Bhandari, Research Head, 6wresearch, Ferrosilicon stands out as the leading product type, attributed to its essential role in deoxidizing steel and enhancing strength and magnetic properties in steel production. Its widespread application across multiple sectors substantiates its significance in the market.

Stainless Steelto dominate the market - By Application

Stainless Steel manufacturing emerges as the leading sector using these ferroalloys. The ongoing demand for corrosion-resistant and aesthetic metals within this segment drives substantial consumption of ferrochrome and ferromanganese.

Key Attractiveness of the Report

- 10 Years of Market Numbers.

- Historical Data Starting from 2020 to 2023.

- Base Year 2023

- Forecast Data until 2030.

- Key Performance Indicators Impacting the Market.

- Major Upcoming Developments and Projects.

Key Highlights of the Report:

- Brazil Ferro-alloys Market Outlook

- Market Size of Brazil Ferro-alloys Market, 2024

- Forecast of Brazil Ferro-alloys Market, 2031

- Historical Data and Forecast of Brazil Ferro-alloys Revenues & Volume for the Period 2021-2031

- Brazil Ferro-alloys Market Trend Evolution

- Brazil Ferro-alloys Market Drivers and Challenges

- Brazil Ferro-alloys Price Trends

- Brazil Ferro-alloys Porter's Five Forces

- Brazil Ferro-alloys Industry Life Cycle

- Historical Data and Forecast of Brazil Ferro-alloys Market Revenues & Volume By Product Type for the Period 2021-2031

- Historical Data and Forecast of Brazil Ferro-alloys Market Revenues & Volume By Ferrochrome for the Period 2021-2031

- Historical Data and Forecast of Brazil Ferro-alloys Market Revenues & Volume By Ferromanganese for the Period 2021-2031

- Historical Data and Forecast of Brazil Ferro-alloys Market Revenues & Volume By Ferro Silicomanganese for the Period 2021-2031

- Historical Data and Forecast of Brazil Ferro-alloys Market Revenues & Volume By Ferrosilicon for the Period 2021-2031

- Historical Data and Forecast of Brazil Ferro-alloys Market Revenues & Volume By Application for the Period 2021-2031

- Historical Data and Forecast of Brazil Ferro-alloys Market Revenues & Volume By Carbon & Low Alloy Steel for the Period 2021-2031

- Historical Data and Forecast of Brazil Ferro-alloys Market Revenues & Volume By Stainless Steel for the Period 2021-2031

- Historical Data and Forecast of Brazil Ferro-alloys Market Revenues & Volume By Alloy Steel for the Period 2021-2031

- Historical Data and Forecast of Brazil Ferro-alloys Market Revenues & Volume By Cast Iron for the Period 2021-2031

- Historical Data and Forecast of Brazil Ferro-alloys Market Revenues & Volume By Others for the Period 2021-2031

- Brazil Ferro-alloys Import Export Trade Statistics

- Market Opportunity Assessment By Product Type

- Market Opportunity Assessment By Application

- Brazil Ferro-alloys Top Companies Market Share

- Brazil Ferro-alloys Competitive Benchmarking By Technical and Operational Parameters

- Brazil Ferro-alloys Company Profiles

- Brazil Ferro-alloys Key Strategic Recommendations

Market Covered

The market report has been segmented and sub segmented into the following categories:

By Product Type

- Ferrochrome

- Ferromanganese

- Ferro Silicomanganese

- Ferrosilicon

By Application

- Carbon & Low Alloy Steel

- Stainless Steel

- Alloy Steel

- Cast Iron

- Others

Brazil Ferro-alloys Market (2024-2030): FAQs

| 1 Executive Summary |

| 2 Introduction |

| 2.1 Key Highlights of the Report |

| 2.2 Report Description |

| 2.3 Market Scope & Segmentation |

| 2.4 Research Methodology |

| 2.5 Assumptions |

| 3 Brazil Ferro-alloys Market Overview |

| 3.1 Brazil Country Macro Economic Indicators |

| 3.2 Brazil Ferro-alloys Market Revenues & Volume, 2021 & 2031F |

| 3.3 Brazil Ferro-alloys Market - Industry Life Cycle |

| 3.4 Brazil Ferro-alloys Market - Porter's Five Forces |

| 3.5 Brazil Ferro-alloys Market Revenues & Volume Share, By Product Type, 2021 & 2031F |

| 3.6 Brazil Ferro-alloys Market Revenues & Volume Share, By Application, 2021 & 2031F |

| 4 Brazil Ferro-alloys Market Dynamics |

| 4.1 Impact Analysis |

| 4.2 Market Drivers |

| 4.2.1 Increasing demand for steel in various industries, driving the need for ferro-alloys. |

| 4.2.2 Growth in the automotive and construction sectors in Brazil, leading to higher consumption of ferro-alloys. |

| 4.2.3 Government initiatives and investments in infrastructure projects boosting the demand for ferro-alloys. |

| 4.3 Market Restraints |

| 4.3.1 Fluctuating prices of raw materials impacting the production costs of ferro-alloys. |

| 4.3.2 Environmental regulations and sustainability concerns affecting the production processes of ferro-alloys. |

| 4.3.3 Competition from alternative materials or substitutes in the market challenging the growth of ferro-alloys. |

| 5 Brazil Ferro-alloys Market Trends |

| 6 Brazil Ferro-alloys Market, By Types |

| 6.1 Brazil Ferro-alloys Market, By Product Type |

| 6.1.1 Overview and Analysis |

| 6.1.2 Brazil Ferro-alloys Market Revenues & Volume, By Product Type, 2021-2031F |

| 6.1.3 Brazil Ferro-alloys Market Revenues & Volume, By Ferrochrome, 2021-2031F |

| 6.1.4 Brazil Ferro-alloys Market Revenues & Volume, By Ferromanganese, 2021-2031F |

| 6.1.5 Brazil Ferro-alloys Market Revenues & Volume, By Ferro Silicomanganese, 2021-2031F |

| 6.1.6 Brazil Ferro-alloys Market Revenues & Volume, By Ferrosilicon, 2021-2031F |

| 6.2 Brazil Ferro-alloys Market, By Application |

| 6.2.1 Overview and Analysis |

| 6.2.2 Brazil Ferro-alloys Market Revenues & Volume, By Carbon & Low Alloy Steel, 2021-2031F |

| 6.2.3 Brazil Ferro-alloys Market Revenues & Volume, By Stainless Steel, 2021-2031F |

| 6.2.4 Brazil Ferro-alloys Market Revenues & Volume, By Alloy Steel, 2021-2031F |

| 6.2.5 Brazil Ferro-alloys Market Revenues & Volume, By Cast Iron, 2021-2031F |

| 6.2.6 Brazil Ferro-alloys Market Revenues & Volume, By Others, 2021-2031F |

| 7 Brazil Ferro-alloys Market Import-Export Trade Statistics |

| 7.1 Brazil Ferro-alloys Market Export to Major Countries |

| 7.2 Brazil Ferro-alloys Market Imports from Major Countries |

| 8 Brazil Ferro-alloys Market Key Performance Indicators |

| 8.1 Energy efficiency improvements in ferro-alloy production processes. |

| 8.2 Adoption of advanced technology and automation in manufacturing facilities. |

| 8.3 Percentage increase in research and development investments for product innovation. |

| 8.4 Reduction in carbon footprint and emissions during ferro-alloy production. |

| 8.5 Improvement in supply chain efficiency and logistics management. |

| 9 Brazil Ferro-alloys Market - Opportunity Assessment |

| 9.1 Brazil Ferro-alloys Market Opportunity Assessment, By Product Type, 2021 & 2031F |

| 9.2 Brazil Ferro-alloys Market Opportunity Assessment, By Application, 2021 & 2031F |

| 10 Brazil Ferro-alloys Market - Competitive Landscape |

| 10.1 Brazil Ferro-alloys Market Revenue Share, By Companies, 2024 |

| 10.2 Brazil Ferro-alloys Market Competitive Benchmarking, By Operating and Technical Parameters |

| 11 Company Profiles |

| 12 Recommendations |

| 13 Disclaimer |

- Single User License$ 1,995

- Department License$ 2,400

- Site License$ 3,120

- Global License$ 3,795

Search

Thought Leadership and Analyst Meet

Our Clients

Related Reports

- Germany Breakfast Food Market (2026-2032) | Industry, Share, Growth, Size, Companies, Value, Analysis, Revenue, Trends, Forecast & Outlook

- Australia Briquette Market (2025-2031) | Growth, Size, Revenue, Forecast, Analysis, Trends, Value, Share, Industry & Companies

- Vietnam System Integrator Market (2025-2031) | Size, Companies, Analysis, Industry, Value, Forecast, Growth, Trends, Revenue & Share

- ASEAN and Thailand Brain Health Supplements Market (2025-2031) | Strategy, Consumer Insights, Analysis, Investment Trends, Opportunities, Growth, Size, Share, Industry, Revenue, Segments, Value, Segmentation, Supply, Forecast, Restraints, Outlook, Competition, Drivers, Trends, Demand, Pricing Analysis, Competitive, Strategic Insights, Companies, Challenges

- ASEAN Bearings Market (2025-2031) | Strategy, Consumer Insights, Analysis, Investment Trends, Opportunities, Growth, Size, Share, Industry, Revenue, Segments, Value, Segmentation, Supply, Forecast, Restraints, Outlook, Competition, Drivers, Trends, Demand, Pricing Analysis, Competitive, Strategic Insights, Companies, Challenges

- Europe Flooring Market (2025-2031) | Outlook, Share, Industry, Trends, Forecast, Companies, Revenue, Size, Analysis, Growth & Value

- Saudi Arabia Manlift Market (2025-2031) | Outlook, Size, Growth, Trends, Companies, Industry, Revenue, Value, Share, Forecast & Analysis

- Uganda Excavator, Crane, and Wheel Loaders Market (2025-2031) | Strategy, Consumer Insights, Analysis, Investment Trends, Opportunities, Growth, Size, Share, Industry, Revenue, Segments, Value, Segmentation, Supply, Forecast, Restraints, Outlook, Competition, Drivers, Trends, Demand, Pricing Analysis, Competitive, Strategic Insights, Companies, Challenges

- Rwanda Excavator, Crane, and Wheel Loaders Market (2025-2031) | Strategy, Consumer Insights, Analysis, Investment Trends, Opportunities, Growth, Size, Share, Industry, Revenue, Segments, Value, Segmentation, Supply, Forecast, Restraints, Outlook, Competition, Drivers, Trends, Demand, Pricing Analysis, Competitive, Strategic Insights, Companies, Challenges

- Kenya Excavator, Crane, and Wheel Loaders Market (2025-2031) | Strategy, Consumer Insights, Analysis, Investment Trends, Opportunities, Growth, Size, Share, Industry, Revenue, Segments, Value, Segmentation, Supply, Forecast, Restraints, Outlook, Competition, Drivers, Trends, Demand, Pricing Analysis, Competitive, Strategic Insights, Companies, Challenges

Industry Events and Analyst Meet

Whitepaper

- Middle East & Africa Commercial Security Market Click here to view more.

- Middle East & Africa Fire Safety Systems & Equipment Market Click here to view more.

- GCC Drone Market Click here to view more.

- Middle East Lighting Fixture Market Click here to view more.

- GCC Physical & Perimeter Security Market Click here to view more.

6WResearch In News

- Doha a strategic location for EV manufacturing hub: IPA Qatar

- Demand for luxury TVs surging in the GCC, says Samsung

- Empowering Growth: The Thriving Journey of Bangladesh’s Cable Industry

- Demand for luxury TVs surging in the GCC, says Samsung

- Video call with a traditional healer? Once unthinkable, it’s now common in South Africa

- Intelligent Buildings To Smooth GCC’s Path To Net Zero