India Air Filteration Market (2023-2029) | Share, Revenue, Value, Forecast, Growth, Industry, Trends, Analysis, Companies & Size

Market Forecast By Types (HEPA Filters, Compact Filters, Baghouse Filters, Gas Phase Filters, Activated Carbon Filters, Dust Collectors, AHU Filters, Others), By Application (Industrial, Commercial), By Distribution Channel (Online, Offline), By Region (Northern, Western, Southern, Eastern) and Competitive Landscape.

| Product Code: ETC4624270 | Publication Date: Sep 2023 | Updated Date: Aug 2025 | Product Type: Report | |

| Publisher: 6Wresearch | Author: Ravi Bhandari | No. of Pages: 112 | No. of Figures: 41 | No. of Tables: 18 |

India Air Filtration Market Size & Growth Rate

The India Air Filtration Market is projected to grow at a CAGR of 7.6% from 2023 to 2029. Growth is driven by rising awareness of indoor air quality’s impact on health and productivity, along with increasing industrialization and infrastructure development across the country.

India Air Filteration Market Synopsis

India air filteration market has witnessed robust revenue growth in the industrial and commercial segments. This upward trend can be attributed to the increasing awareness among businesses about the significant impact of indoor air quality on employee well-being and productivity. Additionally, rapid industrialization and commercial development have led to higher levels of air pollution, prompting organizations to invest in advanced air filteration solutions to maintain clean and healthy indoor environments. Furthermore, the growing emphasis on environmental sustainability has driven businesses to adopt air filteration systems as part of their commitment to reducing their carbon footprint and complying with environmental regulations. As businesses prioritize employee health and environmental responsibility, the demand for air filteration systems is projected to continue rising, fostering further market expansion in the industrial and commercial sectors.

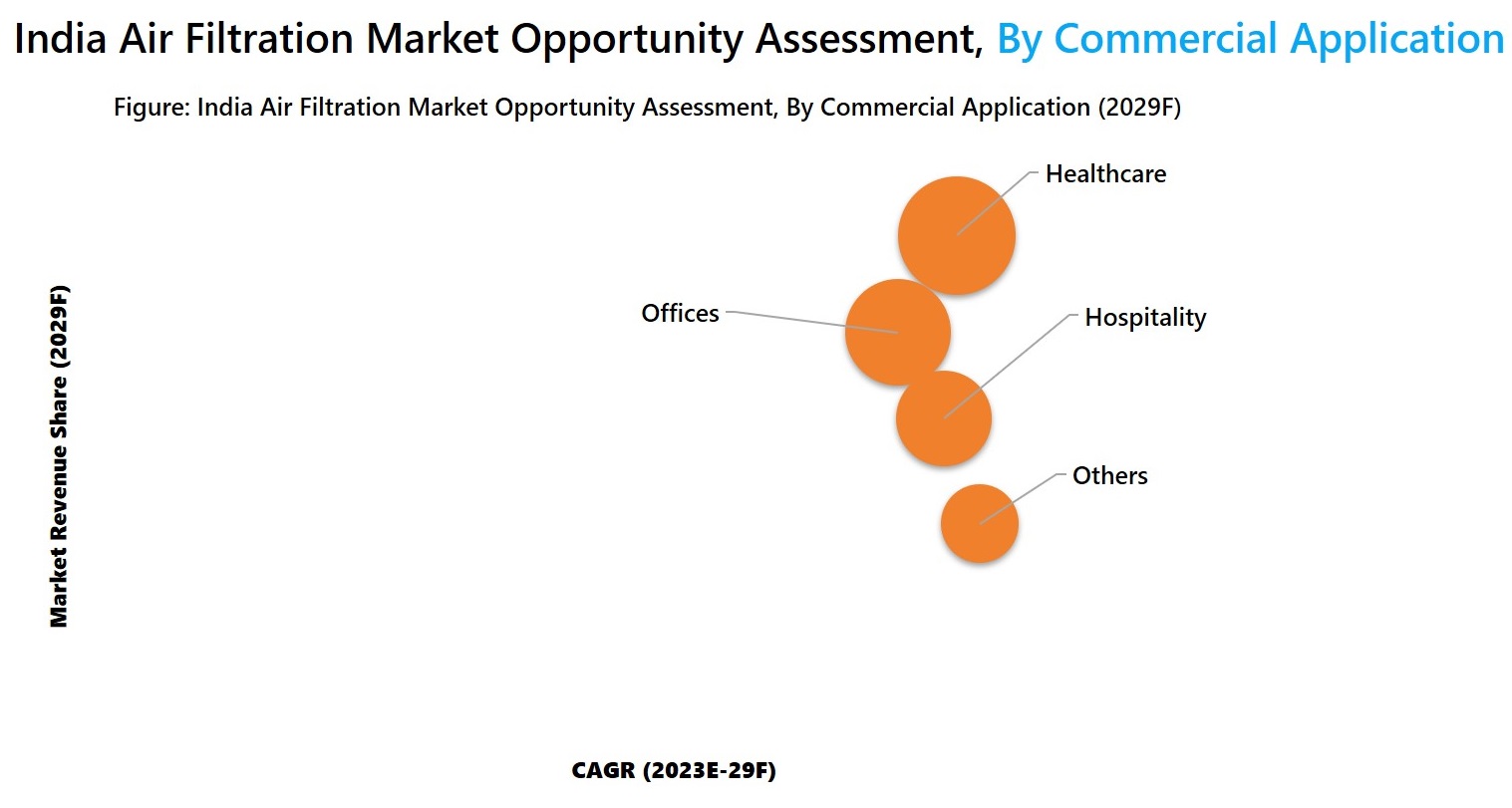

According to 6Wresearch, India Air Filteration Market revenue is projected to grow at a CAGR of 7.6% during 2023-2029. India air filteration market is driven by increased air pollution levels as India became the world's eighth most polluted country, with an annual average PM2.5 concentration of 53.3 micrograms per cubic meter, more than 10 times the WHO's recommended levels. Additionally, India plans to infuse $1.4 trillion on infrastructure between 2019 to 2023 which would drive the demand for advanced filteration systems to ensure clean indoor environments across various sectors. Hospitals play a crucial role in India's healthcare sector, accounting for approximately 80% of the market. They serve as a significant revenue generator due to their wide consumer base, making them a key component of Indian healthcare industry. The hospital industry in India is witnessing significant growth, primarily fueled by a rise in the number of hospitals, projected to reach 81,000 by 2025 from 69,000 in 2019. Advancements in technology and the increasing prevalence of chronic diseases across the nation also contribute to this growth. Furthermore, the hospital market is experiencing substantial demand from both global and domestic investors, further propelling its expansion in the country.

Market by Types

HEPA filter accounted for the highest revenue share in India Air Filteration market in 2022 owing to the proven efficiency in capturing microscopic particles, allergens, and pollutants, making them highly sought after for various applications, including healthcare, and industrial settings. As the awareness of indoor air pollution grows, the demand for reliable and effective air purification solutions like HEPA filters is expected to remain robust, reinforcing their prominent position in the market.

Market by Application

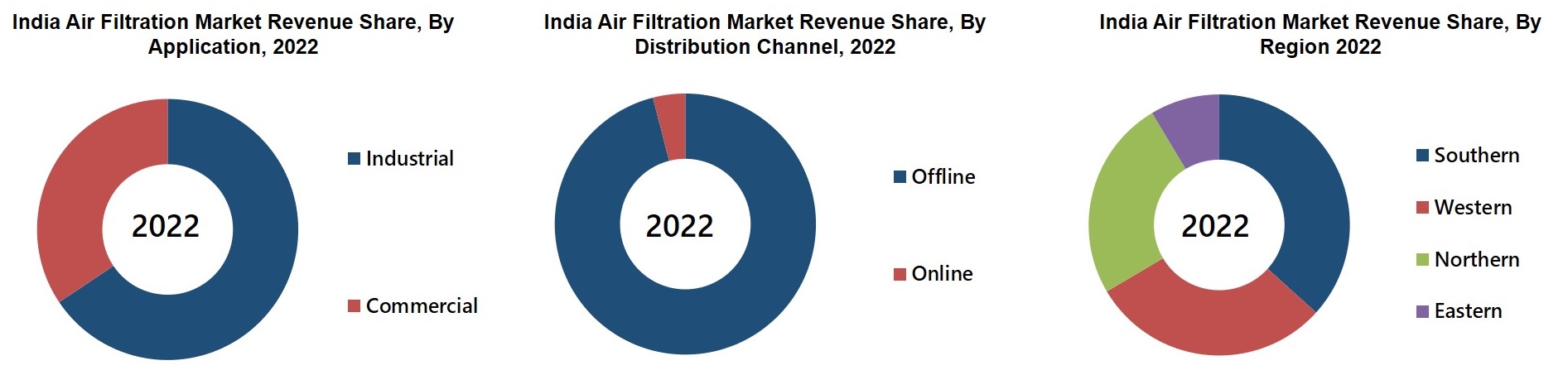

In 2022, Industrial segment acquired the highest market revenue share in India Air Filteration Industry due to various factors, including elevated air contaminant levels in industrial settings, strict air quality regulations, the need for extensive filteration in larger-scale industrial operations, critical protection of sensitive processes and products, growing emphasis on workplace health and safety, and continuous production demands, which all necessitate durable and efficient air filteration systems.

Market by Distribution Channel

In 2022, offline sales accounted for the highest share in India Air Filteration market. This can be attributed to several factors, including the specialized nature of air filteration products, the need for personalized service and technical expertise during the purchasing process, and the well-established distribution networks of offline retail channels.

Market by Region

In 2022, the Southern region emerged as the leader in India Air Filteration market. This commanding position can be attributed to the region's robust industrial and commercial development. With a significant concentration of manufacturing facilities, healthcare institutions, and hospitality establishments, the demand for effective air filteration solutions surged in the Southern region, reinforcing its prominence in the market.

Key Attractiveness of the Report

- COVID-19 Impact on the Market.

- 11 Years Market Numbers.

- Historical Data Starting from 2019 to 2022.

- Base Year: 2022

- Forecast Data until 2029.

- Key Performance Indicators Impacting the Market.

- Major Upcoming Developments and Projects.

Key Highlights of the Report:

- India Air Filteration Market Overview

- India Air Filteration Market Outlook

- India Air Filteration Market Forecast

- Historical Data and Forecast of India Air Filteration Market Revenues, for the Period 2019-2029F

- Historical Data and Forecast of India Air Filteration Market Revenues, By Types, for the Period 2019-2029F

- Historical Data and Forecast of India Air Filteration Market Revenues, By Applications, for the Period 2019-2029F

- Historical Data and Forecast of India Air Filteration Market Revenues, By Industrial Application, for the Period 2019-2029F

- Historical Data and Forecast of India Air Filteration Market Revenues, By Commercial Application, for the Period 2019-2029F

- Historical Data and Forecast of India Air Filteration Market Revenues, By Distribution Channel, for the Period 2019-2029F

- Historical Data and Forecast of India Air Filteration Market Revenues, By Offline Distribution Channel, for the Period 2019-2029F

- India Air Filteration Market Revenue Share, By Companies

- India Air Filteration Market Drivers and Restraints

- India Air Filteration Market Trends

- India Air Filteration Market Porters Five Forces

- India Air Filteration Market Opportunity Assessment

- Competitive Benchmarking

- Company Profiles

- Key Strategic Recommendations

Market Scope and Segmentation

Thereportprovides a detailed analysis of the following market segments:

By Types

- HEPA Filters

- Compact Filters

- Baghouse Filters

- Gas Phase Filters

- Activated Carbon Filters

- Dust Collectors

- AHU Filters

- Others

By Application

- Industrial

- Commercial

By Distribution Channel

- Online

- Offline

By Region

- Northern

- Western

- Southern

- Eastern

Frequently Asked Questions About the Market Study (FAQs):

| 1. Executive Summary |

| 2. Introduction |

| 2.1 Report Description |

| 2.2 Key Highlights of the Report |

| 2.3 Market Scope and Segmentation |

| 2.4 Research Methodology |

| 2.5 Assumptions |

| 3. India Air Filtration Market Overview |

| 3.1 India Air Filtration Market Revenues (2019-2029F) |

| 3.2 India Air Filtration Market Industry Life Cycle |

| 3.3 India Air Filtration Market Porter’s Five Forces Model |

| 4. India Air Filtration Market Dynamics |

| 4.1 Impact Analysis |

| 4.2 Market Drivers |

| 4.2.1 Increasing industrialization and urbanization leading to higher air pollution levels in India |

| 4.2.2 Growing awareness about air quality and health concerns among individuals and organizations |

| 4.2.3 Stringent government regulations and initiatives promoting air filtration technologies |

| 4.3 Market Restraints |

| 4.3.1 High initial investment and maintenance costs associated with air filtration systems |

| 4.3.2 Lack of awareness and education about the benefits of air filtration systems among certain consumer segments |

| 4.3.3 Availability of alternative solutions or technologies for air quality improvement |

| 5. India Air Filtration Market Trends and Evolution |

| 6. India Air Filtration Market Overview, By Type |

| 6.1 India Air Filtration Market Revenue Share and Revenues, By Type, 2019-2029F |

| 6.1.1 India Air Filtration Market Revenue Share and Revenues, By HEPA, 2019-2029F |

| 6.1.2 India Air Filtration Market Revenue Share and Revenues, By Dust Collectors, 2019-2029F |

| 6.1.3 India Air Filtration Market Revenue Share and Revenues, By AHU Filters, 2019-2029F |

| 6.1.4 India Air Filtration Market Revenue Share and Revenues, By Baghouse Filters, 2019-2029F |

| 6.1.5 India Air Filtration Market Revenue Share and Revenues, By Compact Filters, 2019-2029F |

| 6.1.6 India Air Filtration Market Revenue Share and Revenues, By Gas Phase Filters, 2019-2029F |

| 6.1.7 India Air Filtration Market Revenue Share and Revenues, By Activated Carbon Filters, 2019-2029F |

| 6.1.8 India Air Filtration Market Revenue Share and Revenues, By Others, 2019-2029F |

| 7. India Air Filtration Market Overview, By Application |

| 7.1 India Air Filtration Market Revenue Share and Revenues, By Application, 2019-2029F |

| 7.1.1 India Air Filtration Market Revenue Share and Revenues, By Industrial Application, 2019-2029F |

| 7.1.2 India Air Filtration Market Revenue Share and Revenues, By Commercial Application, 2019-2029F |

| 8. India Air Filtration Market Overview, By Industrial Application |

| 8.1 India Air Filtration Market Revenue Share and Revenues, By Industrial Application, 2019-2029F |

| 8.1.1 India Air Filtration Market Revenue Share and Revenues, By Pharmaceutical, 2019-2029F |

| 8.1.2 India Air Filtration Market Revenue Share and Revenues, By Food and Beverage, 2019-2029F |

| 8.1.3 India Air Filtration Market Revenue Share and Revenues, By Semiconductor and Electronics, 2019-2029F |

| 8.1.4 India Air Filtration Market Revenue Share and Revenues, By Microelectronics, 2019-2029F |

| 8.1.5 India Air Filtration Market Revenue Share and Revenues, By Automotive, 2019-2029F |

| 8.1.6 India Air Filtration Market Revenue Share and Revenues, By Oil and Gas, 2019-2029F |

| 8.1.7 India Air Filtration Market Revenue Share and Revenues, By Datacenters, 2019-2029F |

| 8.1.8 India Air Filtration Market Revenue Share and Revenues, By Energy and Power, 2019-2029F |

| 8.1.9 India Air Filtration Market Revenue Share and Revenues, By Cement, 2019-2029F |

| 8.1.10 India Air Filtration Market Revenue Share and Revenues, By Others, 2019-2029F |

| 9. India Air Filtration Market Overview, By Commercial Application |

| 9.1 India Air Filtration Market Revenue Share and Revenues, By Commercial Application, 2019-2029F |

| 9.1.1 India Air Filtration Market Revenue Share and Revenues, By Healthcare, 2019-2029F |

| 9.1.2 India Air Filtration Market Revenue Share and Revenues, By Offices, 2019-2029F |

| 9.1.3 India Air Filtration Market Revenue Share and Revenues, By Hospitality, 2019-2029F |

| 9.1.4 India Air Filtration Market Revenue Share and Revenues, By Others, 2019-2029F |

| 10. India Air Filtration Market Overview, By Distribution Channel |

| 10.1 India Air Filtration Market Revenue Share and Revenues, By Distribution Channel, 2019-2029F |

| 10.1.1 India Air Filtration Market Revenue Share and Revenues, By Offline, 2019-2029F |

| 10.1.2 India Air Filtration Market Revenue Share and Revenues, By Online, 2019-2029F |

| 11. India Air Filtration Market Overview, By Offline Distribution Channel |

| 11.1 India Air Filtration Market Revenue Share and Revenues, By offline Distribution Channel, 2019-2029F |

| 11.1.1 India Air Filtration Market Revenue Share and Revenues, By Distributors and Retailers, 2019-2029F |

| 11.1.2 India Air Filtration Market Revenue Share and Revenues, By Direct Sales, 2019-2029F |

| 12. India Air Filtration Market Overview, By Region |

| 12.1 India Air Filtration Market Revenue Share and Revenues, By Region, 2019-2029F |

| 12.1.1 India Air Filtration Market Revenue Share and Revenues, By Northern, 2019-2029F |

| 12.1.2 India Air Filtration Market Revenue Share and Revenues, By Western, 2019-2029F |

| 12.1.3 India Air Filtration Market Revenue Share and Revenues, By Southern, 2019-2029F |

| 12.1.4 India Air Filtration Market Revenue Share and Revenues, By Eastern, 2019-2029F |

| 13. India Air Filtration Market Revenues, Government Regulations |

| 13.1 BIS Standards for Air Filters |

| 13.2 NCAP for Air Filters |

| 13.3 NAMP for Air Filters |

| 14. Top Brands Analysis |

| 15. India Air Filtration Market, Price Trend Analysis |

| 16. India Air Filtration Market, Key Performance Indicators |

| 17. India Air Filtration Market Opportunity Assessment |

| 17.1 India Air Filtration Market Opportunity Assessment, By Products, 2029F |

| 17.2 India Air Filtration Market Opportunity Assessment, By Application, 2029F |

| 17.3 India Air Filtration Market Opportunity Assessment, By Industrial Application, 2029F |

| 17.4 India Air Filtration Market Opportunity Assessment, By Commercial Application, 2029F |

| 17.5 India Air Filtration Market Opportunity Assessment, By Distribution Channel, 2029F |

| 17.6 India Air Filtration Market Opportunity Assessment, By Offline Distribution Channel, 2029F |

| 17.7 India Air Filtration Market Opportunity Assessment, By Region, 2029F |

| 18. India Air Filtration Market - Competitive Landscape |

| 18.1 India Air Filtration Market Share, By Companies |

| 18.2 India Air Filtration Market Competitive Benchmarking, By Technical Parameters |

| 18.3 India Air Filtration Market Competitive Benchmarking, By Operating Parameters |

| 19. Company Profiles |

| 19.1 Thermadyne Private Limited |

| 19.2 Dyna Filters Private Limited |

| 19.3 Spectrum Filtration Private Limited |

| 19.4 American Air Filter Company, Inc. |

| 19.5 Mann And Hummel Filter Private Limited |

| 19.6 Camfil |

| 19.7 Rieco Industries Ltd |

| 19.8 Freudenberg Filtration Technologies India Private Limited |

| 19.9 3M India |

| 19.10 Donaldson Company, Inc. |

| 20. Key Potential Clients |

| 20.1 Chemical and Pharmaceutical Sector |

| 20.2 Oil and Gas Sector |

| 20.3 Steel Sector |

| 21. Key Strategic Recommendations |

| 22. Disclaimer |

| List of Figures |

| 1. India Air Filtration Market Revenues, 2019-2029F (USD Million) |

| 2. India Air Filtration Product Types Market Revenues, 2019-2029F (USD Million) |

| 3. India Air Filtration I&C Systems Market Revenues, 2019-2029F (USD Million) |

| 4. India Air Pollution emission based on annual average PM2 |

| 5. Hospital Industry Growth Trend (US$ Billion), 2017 and 2024F |

| 6. Growth in Number of Doctors, 2019-2021 |

| 7. Growth in Number of Medical Colleges, 2019-2022 |

| 8. Nation Infrastructure Pipeline projected sector-wise investment allocation during, (2020-2025) in INR Lakh Crore |

| 9. Investment Under PLI Scheme by Sub-Manufacturing Sector ($ Billion) |

| 10. India Manufacturing Output, 2017-2021 ($ Billion) |

| 11. Share of States in Mineral Production, (FY22) |

| 12. Mineral Production in India, 2017-2022, (in US$ Billion) |

| 13. India Banking Sector Bad Loans, (2015-2020) in INR Thousand Crore |

| 14. India Air Filtration Market Revenue Share, By Types, 2022 & 2029F |

| 15. India Air Filtration Market Revenue Share, By Applications, 2022 & 2029F |

| 16. India Air Filtration Market Revenue Share, By Industrial Application, 2022 & 2029F |

| 17. India Air Filtration Market Revenue Share, By Commercial Application, 2022 & 2029F |

| 18. India Air Filtration Market Revenue Share, By Distribution Channel, 2022 & 2029F |

| 19. India Air Filtration Market Revenue Share, By Offline Distribution Channel, 2022 & 2029F |

| 20. India Air Filtration Market Revenue Share, By Region, 2022 & 2029F |

| 21. India Air Filter Price Trend, by Product Types, 2019-2029F |

| 22. Medical Devices Market Growth Trend (US$ Billion), 2021 and 2025F |

| 23. Healthcare Sector Growth Trend (US$ Billion), 2017- 2024F |

| 24. Capital Expenditure in Energy Sector (In Billion USD) |

| 25. Total Power Generation in India (In Billion Unit) |

| 26. India Steel production capacity (MT) |

| 27. Import and Domestic Oil Production in India, 2017-2022, (Million Barrel Per Day) |

| 28. Import and Domestic Gas Production in India, 2017-2022, (Billion Cubic Meter) |

| 29. Chemical Industry Market size, (US$ Billion), 2019-2025F |

| 30. Import and Exports of Chemicals (US$ Million) – FY22 |

| 31. India Air Filtration Market Opportunity Assessment, By Types (2029F) |

| 32. India Air Filtration Market Opportunity Assessment, By Application (2029F) |

| 33. India Air Filtration Market Opportunity Assessment, By Industrial Application (2029F) |

| 34. India Air Filtration Market Opportunity Assessment, By Commercial Application (2029F) |

| 35. India Air Filtration Market Opportunity Assessment, By Distribution Channel (2029F) |

| 36. India Air Filtration Market Opportunity Assessment, By Offline Distribution Channel (2029F) |

| 37. India Air Filtration Market Opportunity Assessment, By Region (2029F) |

| 38. India Air Filtration Market Share, By Companies, 2022 |

| 39. States with the Highest Oil & Gas-Producing Capacity in India |

| 40. States with the Highest Chemical and Petrochemical Producing Capacity in India |

| 41. States with the Highest Steel-Producing Capacity in India |

| List of Tables |

| 1. India most polluted city ranking based on annual average PM2.5 concentration (μg/m ), 2022 |

| 2. India Air Filtration Market Revenues, By Types, 2019-2029F (USD Million) |

| 3. India Air Filtration Market Revenues, By Applications, 2019-2029F (USD Million) |

| 4. India Air Filtration Market Revenues, By Industrial Application, 2019-2029F (USD Million) |

| 5. India Air Filtration Market Revenues, By Commercial Application, 2019-2029F (USD Million) |

| 6. India Air Filtration Market Revenues, By Distribution Channel, 2019-2029F (USD Million) |

| 7. India Air Filtration Market Revenues, By Offline Distribution Channel, 2019-2029F (USD Million) |

| 8. India Air Filtration Market Revenues, By Region, 2019-2029F (USD Million) |

| 9. Key BIS standards related to air filters |

| 10. National Ambient Air Quality Standards (NAAQS) |

| 11. Air Filter Products Price Trend, 2019-2029 |

| 12. Top Steel producer company and Capacity in India (In Mn TPA) |

| 13. Leading Chemical and Pharmaceuticals Companies in India |

| 14. Leading Pharma Companies in India |

| 15. Leading Oil and Gas Companies in India |

| 16. Leading Steel Sector Companies in India |

| 17. Upcoming Major Oil & Gas Projects and their Estimated Cost (USD Million) |

| 18. Upcoming Major Pharmaceutical Projects and their Estimated Cost (USD Million) |

Export potential assessment - trade Analytics for 2030

Export potential enables firms to identify high-growth global markets with greater confidence by combining advanced trade intelligence with a structured quantitative methodology. The framework analyzes emerging demand trends and country-level import patterns while integrating macroeconomic and trade datasets such as GDP and population forecasts, bilateral import–export flows, tariff structures, elasticity differentials between developed and developing economies, geographic distance, and import demand projections. Using weighted trade values from 2020–2024 as the base period to project country-to-country export potential for 2030, these inputs are operationalized through calculated drivers such as gravity model parameters, tariff impact factors, and projected GDP per-capita growth. Through an analysis of hidden potentials, demand hotspots, and market conditions that are most favorable to success, this method enables firms to focus on target countries, maximize returns, and global expansion with data, backed by accuracy.

By factoring in the projected importer demand gap that is currently unmet and could be potential opportunity, it identifies the potential for the Exporter (Country) among 190 countries, against the general trade analysis, which identifies the biggest importer or exporter.

To discover high-growth global markets and optimize your business strategy:

Click Here- Single User License$ 1,995

- Department License$ 2,400

- Site License$ 3,120

- Global License$ 3,795

Search

Thought Leadership and Analyst Meet

Our Clients

Related Reports

- India Switchgear Market Outlook (2026 - 2032) | Size, Share, Trends, Growth, Revenue, Forecast, Analysis, Value, Outlook

- Pakistan Contraceptive Implants Market (2025-2031) | Demand, Growth, Size, Share, Industry, Pricing Analysis, Competitive, Strategic Insights, Strategy, Consumer Insights, Analysis, Investment Trends, Opportunities, Revenue, Segments, Value, Segmentation, Supply, Forecast, Restraints, Outlook, Competition, Drivers, Trends, Companies, Challenges

- Sri Lanka Packaging Market (2026-2032) | Outlook, Competition, Drivers, Trends, Demand, Pricing Analysis, Competitive, Strategic Insights, Companies, Challenges, Strategy, Consumer Insights, Analysis, Investment Trends, Opportunities, Growth, Size, Share, Industry, Revenue, Segments, Value, Segmentation, Supply, Forecast, Restraints

- India Kids Watches Market (2026-2032) | Strategy, Consumer Insights, Analysis, Investment Trends, Opportunities, Growth, Size, Share, Industry, Revenue, Segments, Value, Segmentation, Supply, Forecast, Restraints, Outlook, Competition, Drivers, Trends, Demand, Pricing Analysis, Competitive, Strategic Insights, Companies, Challenges

- Saudi Arabia Core Assurance Service Market (2025-2031) | Strategy, Consumer Insights, Analysis, Investment Trends, Opportunities, Growth, Size, Share, Industry, Revenue, Segments, Value, Segmentation, Supply, Forecast, Restraints, Outlook, Competition, Drivers, Trends, Demand, Pricing Analysis, Competitive, Strategic Insights, Companies, Challenges

- Romania Uninterruptible Power Supply (UPS) Market (2026-2032) | Industry, Analysis, Revenue, Size, Forecast, Outlook, Value, Trends, Share, Growth & Companies

- Saudi Arabia Car Window Tinting Film, Paint Protection Film (PPF), and Ceramic Coating Market (2025-2031) | Strategy, Consumer Insights, Analysis, Investment Trends, Opportunities, Growth, Size, Share, Industry, Revenue, Segments, Value, Segmentation, Supply, Forecast, Restraints, Outlook, Competition, Drivers, Trends, Demand, Pricing Analysis, Competitive, Strategic Insights, Companies, Challenges

- South Africa Stationery Market (2025-2031) | Share, Size, Industry, Value, Growth, Revenue, Analysis, Trends, Segmentation & Outlook

- Afghanistan Rocking Chairs And Adirondack Chairs Market (2026-2032) | Size & Revenue, Competitive Landscape, Share, Segmentation, Industry, Value, Outlook, Analysis, Trends, Growth, Forecast, Companies

- Afghanistan Apparel Market (2026-2032) | Growth, Outlook, Industry, Segmentation, Forecast, Size, Companies, Trends, Value, Share, Analysis & Revenue

Industry Events and Analyst Meet

Whitepaper

- Middle East & Africa Commercial Security Market Click here to view more.

- Middle East & Africa Fire Safety Systems & Equipment Market Click here to view more.

- GCC Drone Market Click here to view more.

- Middle East Lighting Fixture Market Click here to view more.

- GCC Physical & Perimeter Security Market Click here to view more.

6WResearch In News

- Doha a strategic location for EV manufacturing hub: IPA Qatar

- Demand for luxury TVs surging in the GCC, says Samsung

- Empowering Growth: The Thriving Journey of Bangladesh’s Cable Industry

- Demand for luxury TVs surging in the GCC, says Samsung

- Video call with a traditional healer? Once unthinkable, it’s now common in South Africa

- Intelligent Buildings To Smooth GCC’s Path To Net Zero