India Paper Market (2026-2032) | Growth, Analysis, Share, Size & Revenue, Industry, Value, Companies, Segmentation, Forecast, Outlook, Competitive Landscape, Trends

Market Forecast By Type (Graphic Papers, Case Materials, Sanitary and Household, Wrappings, Carton Board, Other Types) And Competitive Landscape

| Product Code: ETC7550266 | Publication Date: Sep 2024 | Updated Date: Jan 2026 | Product Type: Market Research Report | |

| Publisher: 6Wresearch | Author: Shubham Deep | No. of Pages: 75 | No. of Figures: 35 | No. of Tables: 20 |

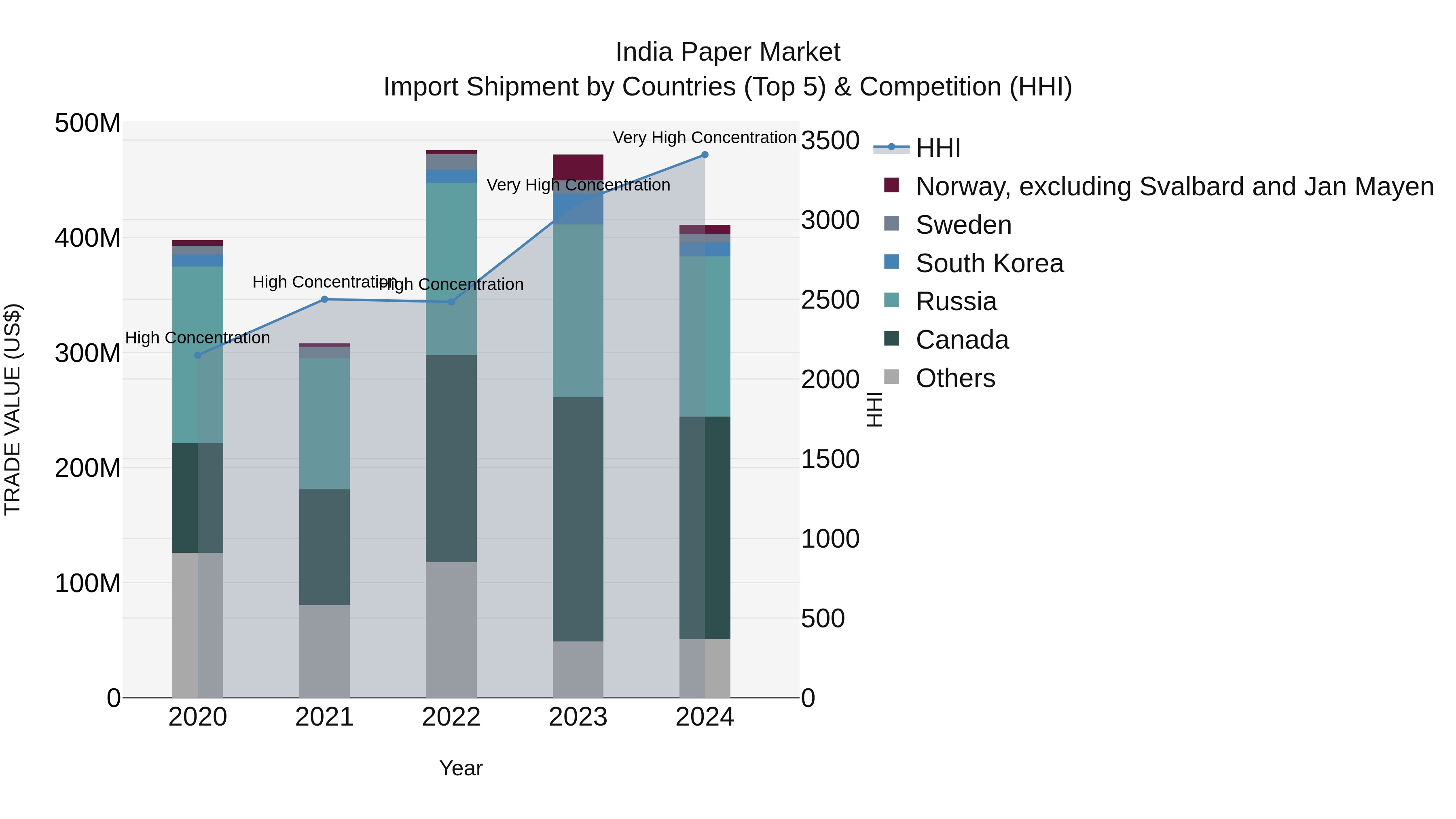

India Paper Market Top 5 Importing Countries and Market Competition (HHI) Analysis

India`s paper import market in 2024 continued to be dominated by top exporting countries such as Canada, Russia, Australia, South Korea, and Malaysia. Despite the high concentration with a high Herfindahl-Hirschman Index (HHI), the market saw a modest compound annual growth rate (CAGR) of 0.84% from 2020 to 2024. However, there was a notable decline in growth rate from 2023 to 2024, with a decrease of -12.94%. This indicates a challenging year for paper import shipments into India, possibly influenced by various market dynamics and external factors.

India Paper Market Growth Rate

According to 6Wresearch internal database and industry insights, the India Paper Market is projected to grow at a compound annual growth rate (CAGR) of 6.3% during the forecast period (2026-2032).

Five-Year Growth Trajectory of the India Paper Market with Core Drivers

Below mentioned are the evaluation of years-wise growth rate along with key growth drivers:

|

Year |

Est. Annual Growth (%) |

Growth Drivers |

|

2021 |

3.4 |

The stable demand from education, publishing, and packaging sectors |

|

2022 |

4.1 |

More consumption of tissue and hygiene paper products |

|

2023 |

4.9 |

Expansion of e-commerce and corrugated packaging demand |

|

2024 |

5.6 |

Government push for paper-based packaging alternatives |

|

2025 |

6 |

The growth in food delivery, FMCG, and organized retail |

Topics Covered in the India Paper Market Report

The India Paper Market report thoroughly covers the market by type. The market report provides an unbiased and detailed analysis of ongoing market trends, opportunities/high growth areas, and market drivers, which help stakeholders devise and align their market strategies according to the current and future market dynamics.

India Paper Market Highlights

| Report Name | India Paper Market |

| Forecast Period | 2026–2032 |

| CAGR | 6.3% |

| Growing Sector | Packaging and Sanitary Paper |

India Paper Market Synopsis

India Paper Market is anticipated to record strong growth driven by escalating packaging demand, enhanced sanitation awareness, and the expansion of educational and publishing initiatives. Expansion in the e-commerce, food delivery, and FMCG sectors is substantially increasing the demand for carton board and packaging papers. Furthermore, government initiatives encouraging paper-based substitutes for plastic, expanding recycling capacity, and modernizing paper mills are supporting domestic production and ensuring long-term market sustainability.

Evaluation of Growth Drivers in the India Paper Market

Below mentioned are some prominent drivers and their influence to the market dynamics:

| Drivers | Primary Segments Affected | Why it Matters (Evidence) |

| Growth of Packaging Industry | Carton Board; Wrappings | E-commerce and retail require durable and reliable packaging materials. |

| Rising Hygiene Awareness | Sanitary and Household | Increased use of tissue and hygiene paper products across households. |

| Education and Publishing Demand | Graphic Papers | Growth in literacy and academic publishing sustains paper consumption. |

| Government Plastic Reduction Policies | All Types | Encourages a shift toward eco-friendly paper-based packaging solutions. |

| FMCG and Food Processing Growth | Case Materials; Carton Board | High-volume packaging needs significantly boost paper consumption. |

India Paper Market is expected to grow at the CAGR of 6.3% during the forecast period of 2026-2032. The industry is growing due to packaging is being used more and more, there is a growing demand for sanitary paper, and the government is encouraging the use of materials that are better for the environment. The quick growth of e-commerce, organized retail, and food services always leads to more demand. Also, domestic paper producers are increasing their capacity, and improvements to recycling infrastructure will help the market grow in the long term.

Evaluation of Restraints in the India Paper Market

Below mentioned are some major restraints and their influence to the market dynamics:

| Restraints | Primary Segments Affected | What This Means (Evidence) |

| High Raw Material Costs | Graphic Papers; Case Materials | Wood pulp price volatility negatively impacts profit margins. |

| Environmental Compliance Costs | All Types | Compliance with regulations increases overall operational expenses. |

| Water and Energy Intensive Process | Sanitary and Household | High consumption of resources raises production costs. |

| Competition from Digital Media | Graphic Papers | Digital alternatives reduce demand for printing and writing paper. |

| Unorganized Market Presence | Other Types | Quality variability hampers standardization across the value chain. |

India Paper Industry Challenges

Despite steady growth, the India Paper Industry faces challenges including increasing costs of raw materials, environmental compliance liabilities, and high consumption of water and energy. Digitization has also led to a decline in demand for traditional printing materials in certain segments. Besides, the fragmented industry structure, low recycling levels in rural areas, and competition from alternative packaging materials are important bottlenecks to regular growth and profitability.

India Paper Market Trends

Key trends evaluating the landscape of the India Paper Market are:

- Change Toward Sustainable Packaging: Businesses are moving away from plastic packaging and toward paper that can be recycled and broken down.

- Demand for E-commerce Packaging: With the surge in online shopping, companies require more corrugated boxes and paper-based protective packaging.

- Agro-Residue Raw Material Utilization: The packaging industry is adopting bagasse and wheat straw increasingly as raw material as a means of reducing dependence on wood pulp.

Investment Opportunities in the India Paper Market

Some best investment prospects within the India Paper Market include:

- Recycling of Paper Materials: Scaling up facilities dedicated to processing waste paper to improve recovery rates and support circular economy objectives.

- Energy-Efficient Mills: Adoption of mills that consume less water and energy while emitting lower levels of pollution during paper production.

- Paper Factories Using Agro-Residues: Increasing use of agro-residues such as bagasse and straw as alternatives to wood pulp, reducing dependence on forest-based raw materials.

Top 5 Leading Players in the India Paper Market

Some leading players operating in the India Paper Market include:

1. ITC Limited

| Company Name | ITC Limited |

| Established Year | 1910 |

| Headquarters | Kolkata, India |

| Official Website | Click Here |

ITC manufactures paperboards, packaging, and specialty papers, supporting FMCG, food packaging, and export-oriented industries with sustainable forestry-backed operations.

2. JK Paper Limited

| Company Name | JK Paper Limited |

| Established Year | 1962 |

| Headquarters | New Delhi, India |

| Official Website | Click Here |

JK Paper produces writing, printing, and packaging paper, serving education, publishing, and industrial sectors.

3. West Coast Paper Mills Ltd.

| Company Name | West Coast Paper Mills Ltd. |

| Established Year | 1955 |

| Headquarters | Karnataka, India |

| Official Website | Click Here |

West Coast Paper specializes in graphic and specialty papers. It primarily supplies publishing houses and commercial printing companies.

4. Tamil Nadu Newsprint and Papers Limited (TNPL)

| Company Name | Tamil Nadu Newsprint and Papers Limited (TNPL) |

| Established Year | 1979 |

| Headquarters | Chennai, India |

| Official Website | Click Here |

TNPL is known for eco-friendly paper manufacturing using bagasse-based pulp. The company focuses on sustainable paper for printing and packaging needs.

5. Ballarpur Industries Limited

| Company Name | Ballarpur Industries Limited |

| Established Year | 1945 |

| Headquarters | Gurugram, India |

| Official Website | Click Here |

Ballarpur Industries manufactures writing, printing, and packaging papers. It mainly serves the domestic market with a wide portfolio of paper products.

Government Regulations Introduced in the India Paper Market

According to India’s government data, initiatives such as the Swachh Bharat Mission, plastic waste management rules, and the promotion of paper-based alternatives are positively impacting paper demand. Increased focus on waste paper recycling, afforestation, and support for eco-friendly manufacturing practices is aiding industry development. Furthermore, advancements in recycling technologies, adoption of energy-efficient production processes, and innovation in advanced packaging solutions are expected to create new growth avenues for the paper industry in the coming years.

Future Insights of the India Paper Market

The outlook for the India Paper Market is positive driven by growing packaging requirements, increased awareness of hygiene, and ongoing government backing for sustainable materials. The growth of organized retail, food delivery, and e-commerce will keep driving up the need for carton board and packaging paper. Strong, recyclable, and compatible with automated packaging lines, it has the properties required in high-volume logistics and consumer product packages to maintain a leading position in the market

Market Segmentation Analysis

The report offers a comprehensive study of the subsequent market segments and their leading categories.

Carton Board to Dominate the Market – By Type

According to Mohit, Senior Research Analyst, 6Wresearch, carton board dominates the India Paper Market share due to strong demand from packaging, e-commerce, and FMCG sectors. Its high strength, recyclability, and compatibility with automated packaging systems make it ideal for high-volume logistics and consumer goods applications, enabling it to maintain a leading position in the market.

Key Attractiveness of the Report

- 10 Years of Market Numbers.

- Historical Data Starting from 2022 to 2025.

- Base Year: 2025.

- Forecast Data until 2032.

- Key Performance Indicators Impacting the Market.

- Major Upcoming Developments and Projects.

Key Highlights of the Report:

- India Paper Market Outlook

- Market Size of India Paper Market, 2025

- Forecast of India Paper Market, 2032

- Historical Data and Forecast of India Paper Revenues & Volume for the Period 2022- 2032

- India Paper Market Trend Evolution

- India Paper Market Drivers and Challenges

- India Paper Price Trends

- India Paper Porter's Five Forces

- India Paper Industry Life Cycle

- Historical Data and Forecast of India Paper Market Revenues & Volume By Type for the Period 2022- 2032

- Historical Data and Forecast of India Paper Market Revenues & Volume By Graphic Papers for the Period 2022- 2032

- Historical Data and Forecast of India Paper Market Revenues & Volume By Case Materials for the Period 2022- 2032

- Historical Data and Forecast of India Paper Market Revenues & Volume By Sanitary and Household for the Period 2022- 2032

- Historical Data and Forecast of India Paper Market Revenues & Volume By Wrappings for the Period 2022- 2032

- Historical Data and Forecast of India Paper Market Revenues & Volume By Carton Board for the Period 2022- 2032

- Historical Data and Forecast of India Paper Market Revenues & Volume By Other Types for the Period 2022- 2032

- India Paper Import Export Trade Statistics

- Market Opportunity Assessment By Type

- India Paper Top Companies Market Share

- India Paper Competitive Benchmarking By Technical and Operational Parameters

- India Paper Company Profiles

- India Paper Key Strategic Recommendations

Market Covered

The report offers a comprehensive study of the subsequent market segments:

By Type

- Graphic Papers

- Case Materials

- Sanitary and Household

- Wrappings

- Carton Board

- Other Types

India Paper Market (2026-2032) : FAQs

| 1 Executive Summary |

| 2 Introduction |

| 2.1 Key Highlights of the Report |

| 2.2 Report Description |

| 2.3 Market Scope & Segmentation |

| 2.4 Research Methodology |

| 2.5 Assumptions |

| 3 India Paper Market Overview |

| 3.1 India Country Macro Economic Indicators |

| 3.2 India Paper Market Revenues & Volume, 2022 & 2032F |

| 3.3 India Paper Market - Industry Life Cycle |

| 3.4 India Paper Market - Porter's Five Forces |

| 3.5 India Paper Market Revenues & Volume Share, By Paper Type, 2022 & 2032F |

| 3.6 India Paper Market Revenues & Volume Share, By End-Use, 2022 & 2032F |

| 3.7 India Paper Market Revenues & Volume Share, By Distribution Channel, 2022 & 2032F |

| 4 India Paper Market Dynamics |

| 4.1 Impact Analysis |

| 4.2 Market Drivers |

| 4.2.1 Increasing demand for eco-friendly packaging solutions |

| 4.2.2 Growth in e-commerce industry leading to higher demand for paper packaging |

| 4.2.3 Government initiatives promoting the use of recycled paper products |

| 4.3 Market Restraints |

| 4.3.1 Fluctuating prices of raw materials like pulp and chemicals |

| 4.3.2 Competition from alternative packaging materials like plastics |

| 4.3.3 Rising concerns about deforestation and environmental impact of paper production |

| 5 India Paper Market Trends |

| 6 India Paper Market, By Types |

| 6.1 India Paper Market, By Paper Type |

| 6.1.1 Overview and Analysis |

| 6.1.2 India Paper Market Revenues & Volume, By Paper Type, 2022- 2032F |

| 6.1.3 India Paper Market Revenues & Volume, By Printing Paper, 2022- 2032F |

| 6.1.4 India Paper Market Revenues & Volume, By Copier Paper, 2022- 2032F |

| 6.1.5 India Paper Market Revenues & Volume, By Waxed Paper, 2022- 2032F |

| 6.1.6 India Paper Market Revenues & Volume, By Greeting Card Paper, 2022- 2032F |

| 6.1.7 India Paper Market Revenues & Volume, By Bond Paper, 2022- 2032F |

| 6.1.8 India Paper Market Revenues & Volume, By Tracing Paper, 2022- 2032F |

| 6.1.9 India Paper Market Revenues & Volume, By Inkjet Paper, 2022- 2032F |

| 6.1.10 India Paper Market Revenues & Volume, By Inkjet Paper, 2022- 2032F |

| 6.2 India Paper Market, By End-Use |

| 6.2.1 Overview and Analysis |

| 6.2.2 India Paper Market Revenues & Volume, By Packaging, 2022- 2032F |

| 6.2.3 India Paper Market Revenues & Volume, By Stationery, 2022- 2032F |

| 6.2.4 India Paper Market Revenues & Volume, By Home Care and Personal Care, 2022- 2032F |

| 6.2.5 India Paper Market Revenues & Volume, By Building and Construction, 2022- 2032F |

| 6.3 India Paper Market, By Distribution Channel |

| 6.3.1 Overview and Analysis |

| 6.3.2 India Paper Market Revenues & Volume, By Direct Sale/B2B, 2022- 2032F |

| 6.3.3 India Paper Market Revenues & Volume, By Specialty Stores, 2022- 2032F |

| 6.3.4 India Paper Market Revenues & Volume, By E-Commerce, 2022- 2032F |

| 7 India Paper Market Import-Export Trade Statistics |

| 7.1 India Paper Market Export to Major Countries |

| 7.2 India Paper Market Imports from Major Countries |

| 8 India Paper Market Key Performance Indicators |

| 8.1 Percentage of recycled content in paper products |

| 8.2 Adoption rate of sustainable paper packaging solutions |

| 8.3 Investment in research and development for paper recycling technologies |

| 9 India Paper Market - Opportunity Assessment |

| 9.1 India Paper Market Opportunity Assessment, By Paper Type, 2022 & 2032F |

| 9.2 India Paper Market Opportunity Assessment, By End-Use, 2022 & 2032F |

| 9.3 India Paper Market Opportunity Assessment, By Distribution Channel, 2022 & 2032F |

| 10 India Paper Market - Competitive Landscape |

| 10.1 India Paper Market Revenue Share, By Companies, 2025 |

| 10.2 India Paper Market Competitive Benchmarking, By Operating and Technical Parameters |

| 11 Company Profiles |

| 12 Recommendations |

| 13 Disclaimer |

Export potential assessment - trade Analytics for 2030

Export potential enables firms to identify high-growth global markets with greater confidence by combining advanced trade intelligence with a structured quantitative methodology. The framework analyzes emerging demand trends and country-level import patterns while integrating macroeconomic and trade datasets such as GDP and population forecasts, bilateral import–export flows, tariff structures, elasticity differentials between developed and developing economies, geographic distance, and import demand projections. Using weighted trade values from 2020–2024 as the base period to project country-to-country export potential for 2030, these inputs are operationalized through calculated drivers such as gravity model parameters, tariff impact factors, and projected GDP per-capita growth. Through an analysis of hidden potentials, demand hotspots, and market conditions that are most favorable to success, this method enables firms to focus on target countries, maximize returns, and global expansion with data, backed by accuracy.

By factoring in the projected importer demand gap that is currently unmet and could be potential opportunity, it identifies the potential for the Exporter (Country) among 190 countries, against the general trade analysis, which identifies the biggest importer or exporter.

To discover high-growth global markets and optimize your business strategy:

Click Here- Single User License$ 1,995

- Department License$ 2,400

- Site License$ 3,120

- Global License$ 3,795

Search

Thought Leadership and Analyst Meet

Our Clients

Related Reports

- Pakistan Contraceptive Implants Market (2025-2031) | Demand, Growth, Size, Share, Industry, Pricing Analysis, Competitive, Strategic Insights, Strategy, Consumer Insights, Analysis, Investment Trends, Opportunities, Revenue, Segments, Value, Segmentation, Supply, Forecast, Restraints, Outlook, Competition, Drivers, Trends, Companies, Challenges

- Sri Lanka Packaging Market (2026-2032) | Outlook, Competition, Drivers, Trends, Demand, Pricing Analysis, Competitive, Strategic Insights, Companies, Challenges, Strategy, Consumer Insights, Analysis, Investment Trends, Opportunities, Growth, Size, Share, Industry, Revenue, Segments, Value, Segmentation, Supply, Forecast, Restraints

- India Kids Watches Market (2026-2032) | Strategy, Consumer Insights, Analysis, Investment Trends, Opportunities, Growth, Size, Share, Industry, Revenue, Segments, Value, Segmentation, Supply, Forecast, Restraints, Outlook, Competition, Drivers, Trends, Demand, Pricing Analysis, Competitive, Strategic Insights, Companies, Challenges

- Saudi Arabia Core Assurance Service Market (2025-2031) | Strategy, Consumer Insights, Analysis, Investment Trends, Opportunities, Growth, Size, Share, Industry, Revenue, Segments, Value, Segmentation, Supply, Forecast, Restraints, Outlook, Competition, Drivers, Trends, Demand, Pricing Analysis, Competitive, Strategic Insights, Companies, Challenges

- Romania Uninterruptible Power Supply (UPS) Market (2026-2032) | Industry, Analysis, Revenue, Size, Forecast, Outlook, Value, Trends, Share, Growth & Companies

- Saudi Arabia Car Window Tinting Film, Paint Protection Film (PPF), and Ceramic Coating Market (2025-2031) | Strategy, Consumer Insights, Analysis, Investment Trends, Opportunities, Growth, Size, Share, Industry, Revenue, Segments, Value, Segmentation, Supply, Forecast, Restraints, Outlook, Competition, Drivers, Trends, Demand, Pricing Analysis, Competitive, Strategic Insights, Companies, Challenges

- South Africa Stationery Market (2025-2031) | Share, Size, Industry, Value, Growth, Revenue, Analysis, Trends, Segmentation & Outlook

- Afghanistan Rocking Chairs And Adirondack Chairs Market (2026-2032) | Size & Revenue, Competitive Landscape, Share, Segmentation, Industry, Value, Outlook, Analysis, Trends, Growth, Forecast, Companies

- Afghanistan Apparel Market (2026-2032) | Growth, Outlook, Industry, Segmentation, Forecast, Size, Companies, Trends, Value, Share, Analysis & Revenue

- Canada Oil and Gas Market (2026-2032) | Share, Segmentation, Value, Industry, Trends, Forecast, Analysis, Size & Revenue, Growth, Competitive Landscape, Outlook, Companies

Industry Events and Analyst Meet

Whitepaper

- Middle East & Africa Commercial Security Market Click here to view more.

- Middle East & Africa Fire Safety Systems & Equipment Market Click here to view more.

- GCC Drone Market Click here to view more.

- Middle East Lighting Fixture Market Click here to view more.

- GCC Physical & Perimeter Security Market Click here to view more.

6WResearch In News

- Doha a strategic location for EV manufacturing hub: IPA Qatar

- Demand for luxury TVs surging in the GCC, says Samsung

- Empowering Growth: The Thriving Journey of Bangladesh’s Cable Industry

- Demand for luxury TVs surging in the GCC, says Samsung

- Video call with a traditional healer? Once unthinkable, it’s now common in South Africa

- Intelligent Buildings To Smooth GCC’s Path To Net Zero