United States (US) Quaternary Ammonium Compounds Market (2021-2027) | Analysis, Value, Industry, COVID-19 IMPACT, Share, Forecast, Companies, Outlook, Trends, Growth, Size & Revenue

| Product Code: ETC062300 | Publication Date: Aug 2021 | Updated Date: Aug 2025 | Product Type: Report | |

| Publisher: 6Wresearch | Author: Dhaval Chaurasia | No. of Pages: 70 | No. of Figures: 35 | No. of Tables: 5 |

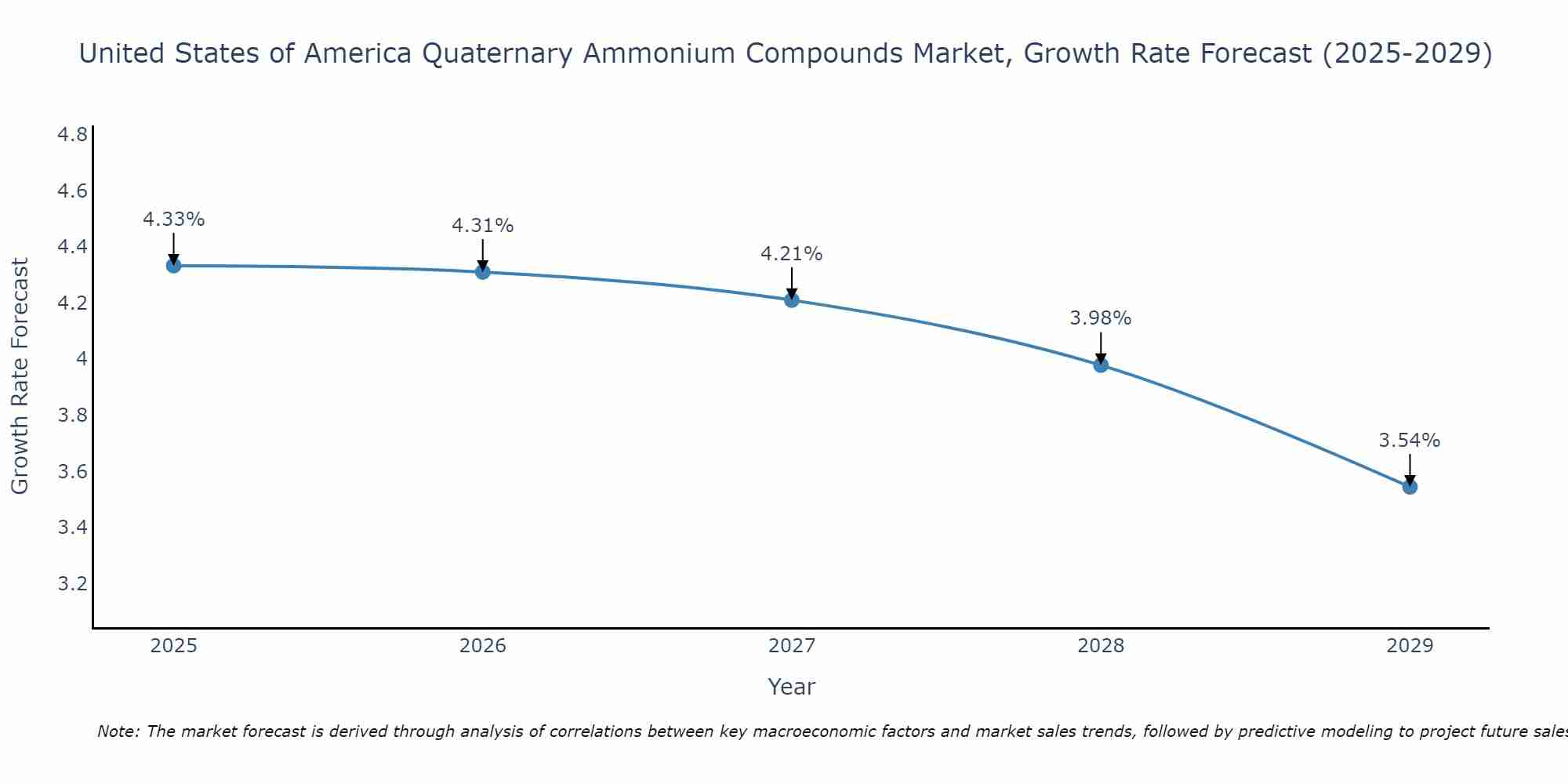

United States of America Quaternary Ammonium Compounds Market Size Growth Rate

The United States of America Quaternary Ammonium Compounds Market may undergo a gradual slowdown in growth rates between 2025 and 2029. Beginning strongly at 4.33% in 2025, growth softens to 3.54% in 2029.

United States (US) Quaternary Ammonium Compounds Market Overview

The United States Quaternary Ammonium Compounds Market is experiencing steady growth driven by increasing demand in various industries such as pharmaceuticals, agriculture, and personal care. Quaternary Ammonium Compounds, also known as quats, are versatile chemicals used as disinfectants, surfactants, and preservatives. The market is witnessing a surge in demand for disinfectant products due to the ongoing COVID-19 pandemic, driving growth in the healthcare and household cleaning sectors. Additionally, the agricultural industry is adopting quats for their biocidal properties to enhance crop protection. Regulatory initiatives promoting hygiene and sanitation further bolster market growth. Key players in the US Quaternary Ammonium Compounds Market include Lonza Group, Stepan Company, and Merck KGaA. Continuous innovation in product development and increasing applications across industries are expected to fuel market expansion in the coming years.

United States (US) Quaternary Ammonium Compounds Market Trends

The US Quaternary Ammonium Compounds market is experiencing steady growth driven by increasing awareness about the benefits of these compounds in disinfection and cleaning applications. With the ongoing emphasis on hygiene and sanitation due to the COVID-19 pandemic, the demand for quaternary ammonium compounds has surged across various industries, including healthcare, food processing, and household cleaning. Manufacturers are focusing on developing innovative formulations with enhanced effectiveness and safety profiles to meet the evolving consumer preferences and regulatory standards. Additionally, the market is witnessing a growing preference for sustainable and eco-friendly quaternary ammonium compounds as environmental concerns gain prominence among consumers and businesses. Overall, the US Quaternary Ammonium Compounds market is expected to continue its growth trajectory in the foreseeable future.

United States (US) Quaternary Ammonium Compounds Market Challenges

In the US Quaternary Ammonium Compounds Market, some of the key challenges include increasing competition from alternative disinfectants and sanitizers, regulatory scrutiny regarding the safety and environmental impact of these compounds, and the need for continuous innovation to meet evolving consumer preferences and regulations. Additionally, the rising costs of raw materials and production processes can pose challenges for manufacturers in maintaining competitive pricing. Market players also need to navigate complex supply chains and distribution networks to ensure efficient delivery of products to end-users. Overall, staying ahead in the US Quaternary Ammonium Compounds Market requires companies to address these challenges effectively through strategic planning, research, and development efforts to sustain growth and remain competitive in the industry.

United States (US) Quaternary Ammonium Compounds Market Investment Opportunities

The United States Quaternary Ammonium Compounds Market presents promising investment opportunities due to several key factors. The market is experiencing steady growth driven by increasing demand for disinfectants and sanitizers across various industries such as healthcare, food processing, and water treatment. With stricter regulations on disinfection and hygiene practices, the use of quaternary ammonium compounds is expected to rise, creating a consistent market demand. Additionally, the versatility of these compounds in terms of applications, including surface disinfection, fabric softeners, and corrosion inhibitors, further enhances their market potential. Investing in this market can be lucrative for companies involved in chemical manufacturing, distribution, and research to capitalize on the growing need for effective and safe disinfection solutions in the US market.

United States (US) Quaternary Ammonium Compounds Market Government Policy

In the United States, the market for Quaternary Ammonium Compounds is subject to regulations and policies set forth by government agencies such as the Environmental Protection Agency (EPA) and the Food and Drug Administration (FDA). The EPA regulates the use of these compounds as disinfectants and sanitizers under the Federal Insecticide, Fungicide, and Rodenticide Act (FIFRA), ensuring their safety and effectiveness for public health and environmental protection. The FDA oversees the use of Quaternary Ammonium Compounds in food contact surfaces and food processing facilities to prevent contamination and ensure food safety. Compliance with these regulations is essential for companies operating in the US Quaternary Ammonium Compounds market to ensure product quality, safety, and legal compliance.

United States (US) Quaternary Ammonium Compounds Market Future Outlook

The United States Quaternary Ammonium Compounds Market is expected to witness steady growth in the coming years due to increasing demand for disinfectants and sanitizers across various industries such as healthcare, food & beverage, and agriculture. The market is anticipated to be driven by the rising awareness about the importance of maintaining hygiene standards to prevent the spread of infectious diseases. Additionally, the stringent regulations pertaining to cleanliness and sanitation in public spaces and healthcare facilities will further boost the demand for quaternary ammonium compounds. Innovations in product formulations and increasing focus on sustainable and eco-friendly solutions are also projected to shape the market landscape, with opportunities for growth in specialty applications such as personal care products and industrial cleaning.

Key Highlights of the Report:

- United States (US) Quaternary Ammonium Compounds Market Outlook

- Market Size of United States (US) Quaternary Ammonium Compounds Market, 2021

- Forecast of United States (US) Quaternary Ammonium Compounds Market, 2027

- Historical Data and Forecast of United States (US) Quaternary Ammonium Compounds Revenues & Volume for the Period 2018 - 2027

- United States (US) Quaternary Ammonium Compounds Market Trend Evolution

- United States (US) Quaternary Ammonium Compounds Market Drivers and Challenges

- United States (US) Quaternary Ammonium Compounds Price Trends

- United States (US) Quaternary Ammonium Compounds Porter's Five Forces

- United States (US) Quaternary Ammonium Compounds Industry Life Cycle

- Historical Data and Forecast of United States (US) Quaternary Ammonium Compounds Market Revenues & Volume By Product for the Period 2018 - 2027

- Historical Data and Forecast of United States (US) Quaternary Ammonium Compounds Market Revenues & Volume By Industrial Grade for the Period 2018 - 2027

- Historical Data and Forecast of United States (US) Quaternary Ammonium Compounds Market Revenues & Volume By Cosmetic Grade for the Period 2018 - 2027

- Historical Data and Forecast of United States (US) Quaternary Ammonium Compounds Market Revenues & Volume By Pharmaceutical Grade for the Period 2018 - 2027

- Historical Data and Forecast of United States (US) Quaternary Ammonium Compounds Market Revenues & Volume By Applications for the Period 2018 - 2027

- Historical Data and Forecast of United States (US) Quaternary Ammonium Compounds Market Revenues & Volume By Disinfectants for the Period 2018 - 2027

- Historical Data and Forecast of United States (US) Quaternary Ammonium Compounds Market Revenues & Volume By Fabric Softeners for the Period 2018 - 2027

- Historical Data and Forecast of United States (US) Quaternary Ammonium Compounds Market Revenues & Volume By Surfactants for the Period 2018 - 2027

- Historical Data and Forecast of United States (US) Quaternary Ammonium Compounds Market Revenues & Volume By Antistatic Agents for the Period 2018 - 2027

- Historical Data and Forecast of United States (US) Quaternary Ammonium Compounds Market Revenues & Volume By Others for the Period 2018 - 2027

- United States (US) Quaternary Ammonium Compounds Import Export Trade Statistics

- Market Opportunity Assessment By Product

- Market Opportunity Assessment By Applications

- United States (US) Quaternary Ammonium Compounds Top Companies Market Share

- United States (US) Quaternary Ammonium Compounds Competitive Benchmarking By Technical and Operational Parameters

- United States (US) Quaternary Ammonium Compounds Company Profiles

- United States (US) Quaternary Ammonium Compounds Key Strategic Recommendations

Frequently Asked Questions About the Market Study (FAQs):

1 Executive Summary |

2 Introduction |

2.1 Key Highlights of the Report |

2.2 Report Description |

2.3 Market Scope & Segmentation |

2.4 Research Methodology |

2.5 Assumptions |

3 United States (US) Quaternary Ammonium Compounds Market Overview |

3.1 United States (US) Country Macro Economic Indicators |

3.2 United States (US) Quaternary Ammonium Compounds Market Revenues & Volume, 2021 & 2027F |

3.3 United States (US) Quaternary Ammonium Compounds Market - Industry Life Cycle |

3.4 United States (US) Quaternary Ammonium Compounds Market - Porter's Five Forces |

3.5 United States (US) Quaternary Ammonium Compounds Market Revenues & Volume Share, By Product, 2021 & 2027F |

3.6 United States (US) Quaternary Ammonium Compounds Market Revenues & Volume Share, By Applications, 2021 & 2027F |

4 United States (US) Quaternary Ammonium Compounds Market Dynamics |

4.1 Impact Analysis |

4.2 Market Drivers |

4.2.1 Increased demand for disinfectants and sanitizers in various industries |

4.2.2 Rising awareness about the importance of hygiene and cleanliness |

4.2.3 Growth in the healthcare sector leading to higher usage of quaternary ammonium compounds |

4.3 Market Restraints |

4.3.1 Stringent regulations regarding the use of chemicals in various applications |

4.3.2 Potential health and environmental concerns associated with quaternary ammonium compounds |

5 United States (US) Quaternary Ammonium Compounds Market Trends |

6 United States (US) Quaternary Ammonium Compounds Market, By Types |

6.1 United States (US) Quaternary Ammonium Compounds Market, By Product |

6.1.1 Overview and Analysis |

6.1.2 United States (US) Quaternary Ammonium Compounds Market Revenues & Volume, By Product, 2018 - 2027F |

6.1.3 United States (US) Quaternary Ammonium Compounds Market Revenues & Volume, By Industrial Grade, 2018 - 2027F |

6.1.4 United States (US) Quaternary Ammonium Compounds Market Revenues & Volume, By Cosmetic Grade, 2018 - 2027F |

6.1.5 United States (US) Quaternary Ammonium Compounds Market Revenues & Volume, By Pharmaceutical Grade, 2018 - 2027F |

6.2 United States (US) Quaternary Ammonium Compounds Market, By Applications |

6.2.1 Overview and Analysis |

6.2.2 United States (US) Quaternary Ammonium Compounds Market Revenues & Volume, By Disinfectants, 2018 - 2027F |

6.2.3 United States (US) Quaternary Ammonium Compounds Market Revenues & Volume, By Fabric Softeners, 2018 - 2027F |

6.2.4 United States (US) Quaternary Ammonium Compounds Market Revenues & Volume, By Surfactants, 2018 - 2027F |

6.2.5 United States (US) Quaternary Ammonium Compounds Market Revenues & Volume, By Antistatic Agents, 2018 - 2027F |

6.2.6 United States (US) Quaternary Ammonium Compounds Market Revenues & Volume, By Others, 2018 - 2027F |

7 United States (US) Quaternary Ammonium Compounds Market Import-Export Trade Statistics |

7.1 United States (US) Quaternary Ammonium Compounds Market Export to Major Countries |

7.2 United States (US) Quaternary Ammonium Compounds Market Imports from Major Countries |

8 United States (US) Quaternary Ammonium Compounds Market Key Performance Indicators |

8.1 Adoption rate of quaternary ammonium compounds in different industries |

8.2 Number of new applications or industries utilizing quaternary ammonium compounds |

8.3 Regulatory compliance and certifications achieved by quaternary ammonium compound manufacturers |

8.4 Research and development investments in developing safer and more effective quaternary ammonium compounds |

9 United States (US) Quaternary Ammonium Compounds Market - Opportunity Assessment |

9.1 United States (US) Quaternary Ammonium Compounds Market Opportunity Assessment, By Product, 2021 & 2027F |

9.2 United States (US) Quaternary Ammonium Compounds Market Opportunity Assessment, By Applications, 2021 & 2027F |

10 United States (US) Quaternary Ammonium Compounds Market - Competitive Landscape |

10.1 United States (US) Quaternary Ammonium Compounds Market Revenue Share, By Companies, 2021 |

10.2 United States (US) Quaternary Ammonium Compounds Market Competitive Benchmarking, By Operating and Technical Parameters |

11 Company Profiles |

12 Recommendations |

13 Disclaimer |

- Single User License$ 1,995

- Department License$ 2,400

- Site License$ 3,120

- Global License$ 3,795

Search

Related Reports

- ASEAN Bearings Market (2025-2031) | Strategy, Consumer Insights, Analysis, Investment Trends, Opportunities, Growth, Size, Share, Industry, Revenue, Segments, Value, Segmentation, Supply, Forecast, Restraints, Outlook, Competition, Drivers, Trends, Demand, Pricing Analysis, Competitive, Strategic Insights, Companies, Challenges

- Europe Flooring Market (2025-2031) | Outlook, Share, Industry, Trends, Forecast, Companies, Revenue, Size, Analysis, Growth & Value

- Saudi Arabia Manlift Market (2025-2031) | Outlook, Size, Growth, Trends, Companies, Industry, Revenue, Value, Share, Forecast & Analysis

- Uganda Excavator, Crane, and Wheel Loaders Market (2025-2031) | Strategy, Consumer Insights, Analysis, Investment Trends, Opportunities, Growth, Size, Share, Industry, Revenue, Segments, Value, Segmentation, Supply, Forecast, Restraints, Outlook, Competition, Drivers, Trends, Demand, Pricing Analysis, Competitive, Strategic Insights, Companies, Challenges

- Rwanda Excavator, Crane, and Wheel Loaders Market (2025-2031) | Strategy, Consumer Insights, Analysis, Investment Trends, Opportunities, Growth, Size, Share, Industry, Revenue, Segments, Value, Segmentation, Supply, Forecast, Restraints, Outlook, Competition, Drivers, Trends, Demand, Pricing Analysis, Competitive, Strategic Insights, Companies, Challenges

- Kenya Excavator, Crane, and Wheel Loaders Market (2025-2031) | Strategy, Consumer Insights, Analysis, Investment Trends, Opportunities, Growth, Size, Share, Industry, Revenue, Segments, Value, Segmentation, Supply, Forecast, Restraints, Outlook, Competition, Drivers, Trends, Demand, Pricing Analysis, Competitive, Strategic Insights, Companies, Challenges

- Angola Excavator, Crane, and Wheel Loaders Market (2025-2031) | Strategy, Consumer Insights, Analysis, Investment Trends, Opportunities, Growth, Size, Share, Industry, Revenue, Segments, Value, Segmentation, Supply, Forecast, Restraints, Outlook, Competition, Drivers, Trends, Demand, Pricing Analysis, Competitive, Strategic Insights, Companies, Challenges

- Israel Intelligent Transport System Market (2025-2031) | Strategy, Consumer Insights, Analysis, Investment Trends, Opportunities, Growth, Size, Share, Industry, Revenue, Segments, Value, Segmentation, Supply, Forecast, Restraints, Outlook, Competition, Drivers, Trends, Demand, Pricing Analysis, Competitive, Strategic Insights, Companies, Challenges

- Uganda Precast and Aggregate Market (2025-2031) | Strategy, Consumer Insights, Analysis, Investment Trends, Opportunities, Growth, Size, Share, Industry, Revenue, Segments, Value, Segmentation, Supply, Forecast, Restraints, Outlook, Competition, Drivers, Trends, Demand, Pricing Analysis, Competitive, Strategic Insights, Companies, Challenges

- Australia IT Asset Disposal Market (2025-2031) | Strategy, Consumer Insights, Analysis, Investment Trends, Opportunities, Growth, Size, Share, Industry, Revenue, Segments, Value, Segmentation, Supply, Forecast, Restraints, Outlook, Competition, Drivers, Trends, Demand, Pricing Analysis, Competitive, Strategic Insights, Companies, Challenges

Industry Events and Analyst Meet

Our Clients

Whitepaper

- Middle East & Africa Commercial Security Market Click here to view more.

- Middle East & Africa Fire Safety Systems & Equipment Market Click here to view more.

- GCC Drone Market Click here to view more.

- Middle East Lighting Fixture Market Click here to view more.

- GCC Physical & Perimeter Security Market Click here to view more.

6WResearch In News

- Doha a strategic location for EV manufacturing hub: IPA Qatar

- Demand for luxury TVs surging in the GCC, says Samsung

- Empowering Growth: The Thriving Journey of Bangladesh’s Cable Industry

- Demand for luxury TVs surging in the GCC, says Samsung

- Video call with a traditional healer? Once unthinkable, it’s now common in South Africa

- Intelligent Buildings To Smooth GCC’s Path To Net Zero