Vietnam System Integrator Market (2026-2032) | Size, Companies, Analysis, Industry, Value, Forecast, Growth, Trends, Revenue & Share

Market Forecast By Technology (Manufacturing, BFSI, IT & Telecom, Transportation, Defence & Security, Healthcare, Retail, Oil & Gas, Others (Energy, Construction etc.), By End Users (SCADA (Supervisory Control and Data Acquisition), MES/MOM (Manufacturing Execution System/Manufacturing Operations Management), ERP (Enterprise Resource Planning), PLC/PAC (Programmable Logic Controller/Programmable Automation Controller), Industrial Robots, Cloud Migration / Cloud Services, DCS (Distributed Control System), HMI (Human-Machine Interface), IIoT (Industrial IoT), Industrial PC, Others (Machine Vision, Plant Asset Management (PAM), Functional Safety, Remote Terminal Unit (RTU), Cybersecurity Solutions, Customer Relationship Management, etc.)), And Competitive Landscape

| Product Code: ETC4581751 | Publication Date: Nov 2025 | Updated Date: Nov 2025 | Product Type: Report | |

| Publisher: 6Wresearch | Author: Ravi Bhandari | No. of Pages: 72 | No. of Figures: 15 | No. of Tables: 2 |

Vietnam System Integrator Market Growth Rate

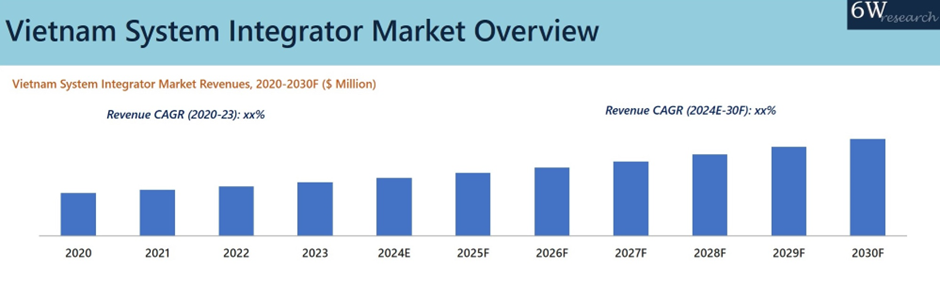

According to 6Wresearch internal database and industry insights, the Vietnam System Integrator Market is expected to grow at a compound annual growth rate (CAGR) of 8.5% during the forecast period (2026-2032).

Five-Years Growth Trajectory of the Vietnam System Integrator Market with Key Drivers

Below mentioned is the evaluation of year-wise growth rate along with key drivers:

|

Years |

Est. Annual Growth in % |

Growth Drivers |

|

2021 |

7% |

An increase in the investments in digital transformation and automation across industries. |

|

2022 |

7.3% |

A rise in the expansion of IT and telecom sectors, which drive the demand for integrated solutions. |

|

2023 |

7.7% |

A rise in the demand for cloud services and IIoT adoption in manufacturing sector. |

|

2024 |

8% |

Increasing government focus on smart cities and industrial automation. |

|

2025 |

8.3% |

A rise in the demand for advanced cybersecurity solutions and digital infrastructure. |

Topics Covered in the Vietnam System Integrator Market Report

The Vietnam System Integrator Market report thoroughly covers the market by technology, and by end-users. The report provides an unbiased and detailed analysis of ongoing market trends, opportunities, and growth areas, which would help stakeholders align their market strategies according to the current and future dynamics.

Vietnam System Integrator Market Highlights

| Report Name | Vietnam System Integrator Market |

| Forecast Period | 2026–2032 |

| CAGR | 8.5% |

| Growing Sector | IT & Automation |

Vietnam System Integrator Market Synopsis

The Vietnam System Integrator Market has been experiencing a massive surge over the past few years as it has been influenced by increasing digital transformation efforts in some major industries, such as manufacturing, IT & telecom, and healthcare. System integrators are becoming popular in organizations that are looking to adopt smart technologies and automate processes, especially as businesses embrace cloud services, Industrial IoT, and advanced cybersecurity solutions.

Evaluation of Growth Drivers in the Vietnam System Integrator Market

Below mentioned are some growth drivers and their impact on market dynamics:

| Drivers | Primary Segments Affected | Why It Matters |

| Increasing Digital Transformation | Manufacturing, IT & Telecom, Retail | Companies are adopting new technologies such as IIoT, cloud, and automation to stay competitive. |

| Government Support for Smart Cities | Transportation, Healthcare, Retail | Increased government investments in smart city projects create new opportunities for system integrators. |

| Rising Industrial Automation Demand | Manufacturing, Oil & Gas, Energy | There is a growing need for automation in manufacturing and oil & gas, which increases the demand for system integration. |

| Cybersecurity Threats | BFSI, IT & Telecom, Healthcare | As cyber threats rise, the need for integrated cybersecurity solutions is increasing demand for system integration services. |

| Cloud Adoption and Migration | IT & Telecom, BFSI, Healthcare | There is a shift to cloud computing requires system integrators to help businesses migrate. |

The Vietnam System Integrator Market is projected to grow steadily, with a CAGR of 8.5% during the forecast period of 2026-2032. Here are some major reasons for this growth include the increasing need for digital transformation across industries, the rising expansion of smart city projects that are supported by the government, a rise in the demand for industrial automation, and the growing dependency on cloud migration services and cybersecurity solutions. There is a growing importance of cybersecurity due to rising cyber threats, which also drives the market, as companies require integrated security solutions. Along with this, a rise in the adoption of cloud services and Industrial IoT (IIoT) technologies in manufacturing and other industries contributes to the growing need for system integration services, creating significant Vietnam System Integrator Market growth.

Evaluation of Restraints in the Vietnam System Integrator Market

Below are some major restraints and their influence on market dynamics:

| Restraints | Primary Segments Affected | What This Means |

| High Integration Costs | Manufacturing, Healthcare | The high upfront costs of system integration can limit adoption, particularly in cost-sensitive sectors. |

| Complexity of Integration | All Segments | The complex nature of system integration projects can create hurdles, especially for smaller organizations. |

| A Lack of Skilled Labor | IT & Telecom, Manufacturing | There is a lack of skilled professionals for advanced system integration tasks, which can delay project timelines. |

| Regulatory Challenges | Healthcare, BFSI | Stringent regulatory requirements in some sectors, such as healthcare and BFSI, can delay system integration projects. |

Vietnam System Integrator Market Challenges

The Vietnam System Integrator Market has numerous threats, like high costs that are associated with system integration projects, which may affect small and medium-sized businesses from adopting advanced technologies. Besides this, the difficulty of integration and the lack of skilled labor can slow down the pace of implementation. Regulatory challenges in highly regulated sectors, such as healthcare and banking, also present obstacles for system integrators trying to meet compliance standards.

Vietnam System Integrator Market Trends

Below mentioned are some major trends that are contributing to the Vietnam System Integrator Market growth include:

- Increasing Demand for Cloud Solutions: The demand for system integrators that can migrate, optimize, and manage cloud infrastructures is increasing with the rising shift to cloud-based systems.

- Rise of IIoT and Industry 4.0: In some sectors, especially manufacturing and energy have a high use of system integrators, as the adoption of industrial IoT solutions in these sectors is increasing.

- Smart Cities and Infrastructure Projects: A rise in the expansion of smart cities supported by the Vietnamese government is increasing the demand for system integration in urban infrastructure.

Investment Opportunities in the Vietnam System Integrator Market

Here are some major investment opportunities for long term market growth:

- Cloud Services and Migration: There is an opportunity for new investors to focus on system integrators offering cloud services and migration solutions, as more businesses are shifting towards cloud.

- Industrial IoT Solutions: Making an investment in IIoT solutions for manufacturing, logistics, and other industrial sectors offers high-growth potential due to Industry 4.0 adoption.

- Cybersecurity Solutions: There is an increasing number of cyberattacks makes cybersecurity a critical investment area, with opportunities in integrated solutions for various industries.

Top 5 Leading Players in the Vietnam System Integrator Market

Here are some top companies contributing to the Vietnam System Integrator Market share:

1. FPT Software

| Company Name | FPT Software |

|---|---|

| Established Year | 1999 |

| Headquarters | Hanoi, Vietnam |

| Official Website | Click Here |

FPT Software is one of the leading system integrators in Vietnam, specializing in cloud services, industrial automation, and IT systems integration.

2. Viettel Group

| Company Name | Viettel Group |

|---|---|

| Established Year | 2004 |

| Headquarters | Hanoi, Vietnam |

| Official Website | Click Here |

Viettel Group is a major player in the telecom sector, offering comprehensive system integration solutions across various industries, including defense, security, and healthcare.

3. TMA Solutions

| Company Name | TMA Solutions |

|---|---|

| Established Year | 1997 |

| Headquarters | Ho Chi Minh City, Vietnam |

| Official Website | Click Here |

TMA Solutions provides IT consulting and system integration services, specializing in sectors such as healthcare, education, and logistics.

4. CMC Corporation

| Company Name | CMC Corporation |

|---|---|

| Established Year | 1997 |

| Headquarters | Hanoi, Vietnam |

| Official Website | Click Here |

CMC Corporation is a key player in Vietnam's IT services market, offering a range of solutions, including system integration for manufacturing, banking, and government sectors.

5. SangBanDo

| Company Name | SangBanDo |

|---|---|

| Established Year | 2010 |

| Headquarters | Ho Chi Minh City, Vietnam |

| Official Website | - |

SangBanDo specializes in automation, cybersecurity, and IIoT solutions, providing system integration services to various industrial sectors in Vietnam.

Government Regulations Introduced in the Vietnam System Integrator Market

According to Vietnamese government data, some regulatory actions that are taken, especially in sectors like healthcare and BFSI. There is a high demand for system integrators to adhere to rules when implementing solutions, the government applies some strict guidelines, to protect data and cybersecurity. Aside from that, the government also supports the development of smart cities and digital infrastructure projects, which provide funding and set guidelines for system integrators involved in these initiatives.

Future Insights of the Vietnam System Integrator Market

The Vietnam System Integrator Market share is estimated to increase in the coming years, as the country continues to digitize its infrastructure and embrace Industry 4.0 technologies. Also, there is a government's focus on smart city projects and industrial automation, along with the rising demand for cloud solutions and cybersecurity, which will drive significant demand for system integration services. Investments in industrial IoT and the healthcare sector will also provide additional growth opportunities for system integrators adoption in the market.

Market Segmentation Analysis

The report offers a comprehensive study of the following market segments and their leading categories:

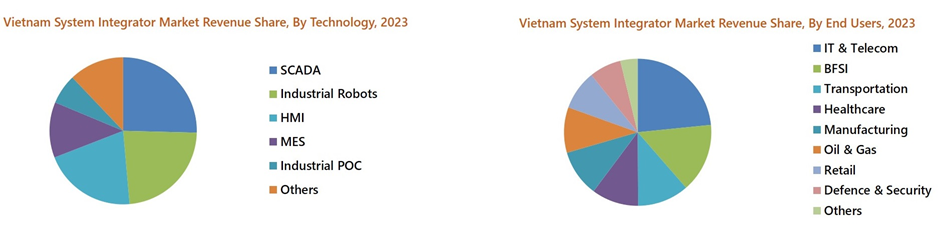

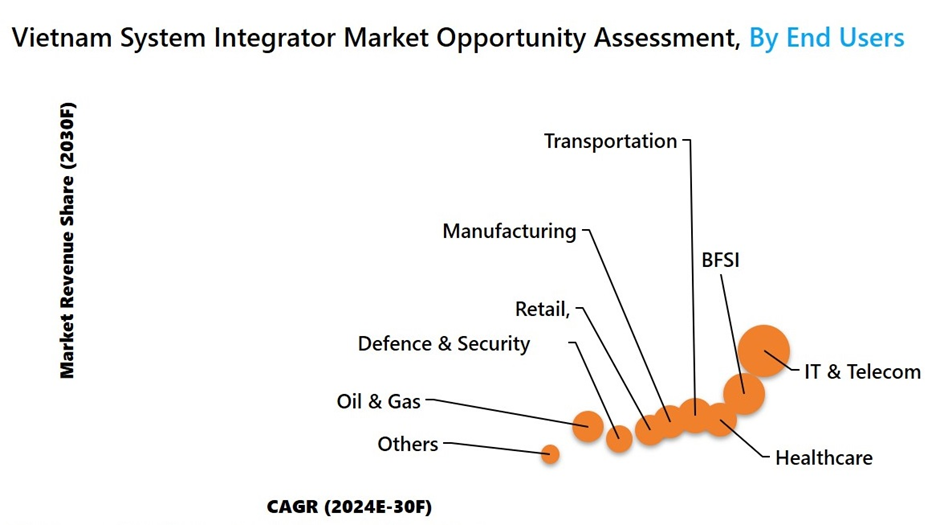

IT & Telecom to Dominate the Market - By Technology

According to Srishti Aneja, Senior Research Analyst, 6Wresearch, the IT & Telecom sector remains the largest contributor to the market, driven by the growing need for integrated communication and cloud solutions across businesses.

SCADA to Dominate the Market - By End-User

SCADA (Supervisory Control and Data Acquisition) systems dominate the market due to their extensive use in industrial automation and real-time monitoring of processes across various industries.

Key Attractiveness of the Report:

- 10 Years Market Numbers

- Historical Data Starting from 2022 to 2025

- Base Year: 2025

- Forecast Data until 2032

- Key Performance Indicators Impacting the Market

Key Highlights of the Report:

- Vietnam System Integrator Market Overview

- Vietnam System Integrator Market Outlook

- Vietnam System Integrator Market Forecast

- Historical Data and Forecast of Vietnam System Integrator Market Revenues, for the Period 2022-2032F

- Historical Data and Forecast of Vietnam System Integrator Market Revenues, By Technology, for the Period 2022-2032F

- Historical Data and Forecast of Vietnam System Integrator Market Revenues, By End Users, for the Period 2022-2032F

- Vietnam System Integrator Market Porter’s Five forces Analysis

- Vietnam System Integrator Market Industry Life Cycle Analysis

- Market Drivers and Restraints

- Key Performance Indicators

- Market Opportunity Assessment

- Competitive Benchmarking

- Company Profiles

- Market Revenue Ranking by Top 3 Players

- Key Strategic Recommendations

Market Scope and Segmentation

The report provides a detailed analysis of the following market segments:

By Technology

- Manufacturing

- BFSI

- IT & Telecom

- Transportation

- Defence & Security

- Healthcare

- Retail

- Oil & Gas

- Others (Energy, Construction etc.)

By End Users

- SCADA (Supervisory Control and Data Acquisition)

- MES/MOM (Manufacturing Execution System/Manufacturing Operations Management)

- ERP (Enterprise Resource Planning)

- PLC/PAC (Programmable Logic Controller/Programmable Automation Controller)

- Industrial Robots

- Cloud Migration / Cloud Services

- DCS (Distributed Control System)

- HMI (Human-Machine Interface)

- IIoT (Industrial IoT)

- Industrial PC

- Others (Machine Vision, Plant Asset Management (PAM), Functional Safety, Remote Terminal Unit (RTU), Cybersecurity Solutions, Customer Relationship Management, etc.)

Vietnam System Integrator Market (2026-2032) : FAQs

| 1. Executive Summary |

| 2. Introduction |

| 2.1 Report Description |

| 2.2 Key Highlights of the Report |

| 2.3 Market Scope & Segmentation |

| 2.4 Research Methodology |

| 2.5 Assumptions |

| 3. Vietnam System Integrator Market Overview |

| 3.1 Vietnam System Integrator Market Revenues, 2022-2032F |

| 3.2 Vietnam System Integrator Market Industry Life Cycle |

| 3.3 Vietnam System Integrator Market Porter's Five Forces |

| 4. Vietnam System Integrator Market Dynamics |

| 4.1 Impact Analysis |

| 4.2 Market Drivers |

| 4.3 Market Restraints |

| 5. Vietnam System Integrator Market Trends |

| 6. Vietnam System Integrator Market Overview, By Technology |

| 6.1 Vietnam System Integrator Market Revenue Share, By Technology, 2024 & 2032F |

| 6.1.1 Vietnam System Integrator Market Revenues, By SCADA, 2022-2032F |

| 6.1.2 Vietnam System Integrator Market Revenues, By MES/MOM, 2022-2032F |

| 6.1.3 Vietnam System Integrator Market Revenues, By ERP, 2022-2032F |

| 6.1.4 Vietnam System Integrator Market Revenues, By PLC/PAC, 2022-2032F |

| 6.1.5 Vietnam System Integrator Market Revenues, By Industrial Robots, 2022-2032F |

| 6.1.6 Vietnam System Integrator Market Revenues, By Cloud Migration / Cloud Services , 2022-2032F |

| 6.1.7 Vietnam System Integrator Market Revenues, By DCS, 2022-2032F |

| 6.1.8 Vietnam System Integrator Market Revenues, By HMI, 2022-2032F |

| 6.1.9 Vietnam System Integrator Market Revenues, By IIoT, 2022-2032F |

| 6.1.10 Vietnam System Integrator Market Revenues, By Industrial PC, 2022-2032F |

| 6.1.11 Vietnam System Integrator Market Revenues, By Others, 2022-2032F |

| 7. Vietnam System Integrator Market Overview, By End Users |

| 7.1 Vietnam System Integrator Market Revenue Share, By End Users, 2024 & 2032F |

| 7.1.1 Vietnam System Integrator Market Revenues, By Manufacturing, 2022-2032F |

| 7.1.2 Vietnam System Integrator Market Revenues, By BFSI, 2022-2032F |

| 7.1.3 Vietnam System Integrator Market Revenues, By IT & Telecom, 2022-2032F |

| 7.1.4 Vietnam System Integrator Market Revenues, By Transportation, 2022-2032F |

| 7.1.5 Vietnam System Integrator Market Revenues, By Defence & Security, 2022-2032F |

| 7.1.6 Vietnam System Integrator Market Revenues, By Healthcare, 2022-2032F |

| 7.1.7 Vietnam System Integrator Market Revenues, By Retail, 2022-2032F |

| 7.1.8 Vietnam System Integrator Market Revenues, By Oil & Gas, 2022-2032F |

| 7.1.9 Vietnam System Integrator Market Revenues, By Others, 2022-2032F |

| 8. Vietnam System Integrator Market Key Performance Indicators |

| 9. Vietnam System Integrator Market Opportunity Assessment |

| 9.1 Vietnam System Integrator Market Opportunity Assessment, By Technology, 2032F |

| 9.2 Vietnam System Integrator Market Opportunity Assessment, By End Users, 2032F |

| 10. Vietnam System Integrator Market Competitive Landscape |

| 10.1 Vietnam System Integrator Market Revenue Ranking, By Companies, 2024 |

| 10.2 Vietnam System Integrator Market Competitive Benchmarking, By Operating Parameters |

| 10.3 Vietnam System Integrator Market Competitive Benchmarking, By Technical Parameters |

| 11. Company Profiles |

| 11.1 FPT Corporation |

| 11.2 TMA Solutions |

| 11.3 Viettel Solutions |

| 11.4 VNPT Technology |

| 11.5 CMC Corporation |

| 11.6 SystemEXE Co., Ltd. |

| 11.7 MISA Joint Stock Company |

| 11.8 Advanced Information Technology & Building Automation Co., Ltd. |

| 11.9 SaoBacDau Technologies Group |

| 11.10 ELCOM Telecommunications Technology Joint Stock Company |

| 11.11 KDDI Corporation |

| 11.12 AHT Tech |

| 11.13 Hitachi Digital Services |

| 11.14 Siemens Vietnam |

| 12. Key Strategic Recommendations |

| 13. Disclaimer |

| List of figures |

| 1. Vietnam System Integrator Market Revenues, 2022-2032F ($ Million) |

| 2. Vietnam Digital Technology Enterprises, 2032 and 2024 |

| 3. Share of Firms adopting I4.0 Technologies in Vietnam, 2022 |

| 4. Vietnam Digital Industry Size, 2032-2025F (In $ Billion) |

| 5. Vietnam Digital Sector Contribution towards GDP, 2025F-2030F (In %) |

| 6. Vietnam ICT Market Value, 2022-2027F (In $ Billion) |

| 7. Vietnam Mobile Subscribers, 2022 & 2032F (In Millions) |

| 8. Number of Cyberattacks in Vietnam, 2022 & 2022 |

| 9. Vietnam System Integrator Market Revenue Share, By Technology, 2024 & 2032F |

| 10. Vietnam System Integrator Market Revenue Share, By End Users, 2024 & 2032F |

| 11. Vietnam Manufacturing Sector Contribution towards GDP, 2022-2024 |

| 12. Vietnam Investments in Transportation, 2022-2032F ($ Million) |

| 13. Vietnam System Integrator Market Opportunity Assessment, By Technology, 2032F |

| 14. Vietnam System Integrator Market Opportunity Assessment, By End Users, 2032F |

| 15. Vietnam System Integrator Market Revenue Ranking, By Companies, 2025 |

| List of Tables |

| 1. Vietnam System Integrator Market Revenues, By Technology, 2022-2032F ($ Million) |

| 2. Vietnam System Integrator Market Revenues, By End Users, 2022-2032F ($ Million) |

Market ForecastBy Technology (Human-Machine Interface (HMI), Supervisory Control And Data Acquisition (SCADA), Manufacturing Execution System (MES), Machine Vision, Industrial Robotics, Industrial PC, Industrial Internet Of Things (IIoT), Others), By Industry (IT & Telecom, Manufacturing (Automotive, Electric And Electronic, Etc.), BFSI, Oil & Gas, Transportation And Logistics, Healthcare, Defence & Security, Retail, Others) And Competitive Landscape

| Product Code: ETC4581751 | Publication Date: Jul 2023 | Product Type: Report | |

| Publisher: 6wresearch | No. of Pages: 66 | No. of Figures: 14 | No. of Tables: 2 |

Vietnam System Integrator Market Synopsis

Vietnam System Integrator Market witnessed substantial growth owing to the automotive sector, which relies on system integrators for process automation. In 2019, Vietnam’s automotive production was 306,073 units, making significant contributions to Vietnam’s automobile sector. The automotive market in Vietnam comprises approximately 639 companies, ranging from major players to numerous automotive part producers. With an estimated 4.5 million vehicles in circulation as of 2021, the country is dedicated to bolstering its competitiveness in the next-generation automobile sector through incentives and infrastructure development presenting opportunities for the system integrator market.

According to 6Wresearch, Vietnam System Integrator Market is projected to grow at a CAGR of 8.9% during 2024-2030. The System Integrator market in Vietnam is set to experience significant growth, fueled by the approval of smart city development projects in 48 out of the country's 63 centrally managed cities and provinces. With Vietnam boasting 819 cities as of 2019 and an estimated 50% of its population projected to reside in urban areas by 2040, the momentum is strong. Urban economic growth has surged, averaging a remarkable 12% annually, surpassing the national rate by 1.5 times. This accelerated urbanization, coupled with economic expansion, is propelling city administrations across Vietnam to implement smart technological solutions.

The objective is to efficiently and sustainably manage urban infrastructures while enhancing digital government services for residents and businesses. Major cities namely Hanoi, Ho Chi Minh City, and Da Nang are all set to embark on ambitious Smart Cities initiatives.

Market Segmentation by Technology

By technology, Industrial Robots is expected to grow at a higher rate in the future on account of Vietnam’s ambitious 20-year strategy (Vietnam 4.0) aimed at driving digital transformation and innovation in various industries. Aided by government support, industries in Vietnam, particularly manufacturing, are increasingly embracing Industry 4.0 principles to enhance competitiveness and productivity.

Market Segmentation by End Users

IT and Telecom segment is expected to witness significant growth in Vietnam System Integrator Industry due to factors such as digital transformation initiatives across industries, rapid technological advancements, expanding internet penetration, the rise of e-commerce and digital services, government support, and the need for industry-specific solutions.

Key Attractiveness of the Report

- 10 Years of Market Numbers.

- Historical Data Starting from 2020 to 2023.

- Base Year: 2023

- Forecast Data until 2030.

- Key Performance Indicators Impacting the Market.

- Major Upcoming Developments and Projects.

Key Highlights of the Report:

- Vietnam System Integrator Market Overview

- Vietnam System Integrator Market Outlook

- Vietnam System Integrator Market Forecast

- Vietnam System Integrator Market Porter’s Five forces Analysis

- Vietnam System Integrator Market Industry Life Cycle Analysis

- Historical Data and Forecast of Vietnam System Integrator Market Revenues, for the Period 2020-2030F

- Market Drivers and Restraints

- Historical Data and Forecast of Vietnam System Integrator Market Revenues, By Technology, for the Period 2020-2030F

- Historical Data and Forecast of Vietnam System Integrator Market Revenues, By End Users, for the Period 2020-2030F

- Key Performance Indicators

- Market Opportunity Assessment

- Competitive Benchmarking

- Company Profiles

- Key Strategic Recommendations

Market Scope and Segmentation

Thereportprovides a detailed analysis of the following market segments:

By Technology

- Human-Machine Interface (HMI)

- Supervisory Control and Data Acquisition (SCADA)

- Manufacturing Execution System (MES)

- Industrial Robots

- Industrial POC

- Others (DCS, PLC, Machine Vision etc.)

By End Users

- IT & Telecom

- Defense & Security

- BFSI

- Oil & Gas

- Healthcare

- Transportation

- Retail

- Others

Export potential assessment - trade Analytics for 2030

Export potential enables firms to identify high-growth global markets with greater confidence by combining advanced trade intelligence with a structured quantitative methodology. The framework analyzes emerging demand trends and country-level import patterns while integrating macroeconomic and trade datasets such as GDP and population forecasts, bilateral import–export flows, tariff structures, elasticity differentials between developed and developing economies, geographic distance, and import demand projections. Using weighted trade values from 2020–2024 as the base period to project country-to-country export potential for 2030, these inputs are operationalized through calculated drivers such as gravity model parameters, tariff impact factors, and projected GDP per-capita growth. Through an analysis of hidden potentials, demand hotspots, and market conditions that are most favorable to success, this method enables firms to focus on target countries, maximize returns, and global expansion with data, backed by accuracy.

By factoring in the projected importer demand gap that is currently unmet and could be potential opportunity, it identifies the potential for the Exporter (Country) among 190 countries, against the general trade analysis, which identifies the biggest importer or exporter.

To discover high-growth global markets and optimize your business strategy:

Click Here- Single User License$ 1,995

- Department License$ 2,400

- Site License$ 3,120

- Global License$ 3,795

Search

Thought Leadership and Analyst Meet

Our Clients

Related Reports

- Pakistan Contraceptive Implants Market (2025-2031) | Demand, Growth, Size, Share, Industry, Pricing Analysis, Competitive, Strategic Insights, Strategy, Consumer Insights, Analysis, Investment Trends, Opportunities, Revenue, Segments, Value, Segmentation, Supply, Forecast, Restraints, Outlook, Competition, Drivers, Trends, Companies, Challenges

- Sri Lanka Packaging Market (2026-2032) | Outlook, Competition, Drivers, Trends, Demand, Pricing Analysis, Competitive, Strategic Insights, Companies, Challenges, Strategy, Consumer Insights, Analysis, Investment Trends, Opportunities, Growth, Size, Share, Industry, Revenue, Segments, Value, Segmentation, Supply, Forecast, Restraints

- India Kids Watches Market (2026-2032) | Strategy, Consumer Insights, Analysis, Investment Trends, Opportunities, Growth, Size, Share, Industry, Revenue, Segments, Value, Segmentation, Supply, Forecast, Restraints, Outlook, Competition, Drivers, Trends, Demand, Pricing Analysis, Competitive, Strategic Insights, Companies, Challenges

- Saudi Arabia Core Assurance Service Market (2025-2031) | Strategy, Consumer Insights, Analysis, Investment Trends, Opportunities, Growth, Size, Share, Industry, Revenue, Segments, Value, Segmentation, Supply, Forecast, Restraints, Outlook, Competition, Drivers, Trends, Demand, Pricing Analysis, Competitive, Strategic Insights, Companies, Challenges

- Romania Uninterruptible Power Supply (UPS) Market (2026-2032) | Industry, Analysis, Revenue, Size, Forecast, Outlook, Value, Trends, Share, Growth & Companies

- Saudi Arabia Car Window Tinting Film, Paint Protection Film (PPF), and Ceramic Coating Market (2025-2031) | Strategy, Consumer Insights, Analysis, Investment Trends, Opportunities, Growth, Size, Share, Industry, Revenue, Segments, Value, Segmentation, Supply, Forecast, Restraints, Outlook, Competition, Drivers, Trends, Demand, Pricing Analysis, Competitive, Strategic Insights, Companies, Challenges

- South Africa Stationery Market (2025-2031) | Share, Size, Industry, Value, Growth, Revenue, Analysis, Trends, Segmentation & Outlook

- Afghanistan Rocking Chairs And Adirondack Chairs Market (2026-2032) | Size & Revenue, Competitive Landscape, Share, Segmentation, Industry, Value, Outlook, Analysis, Trends, Growth, Forecast, Companies

- Afghanistan Apparel Market (2026-2032) | Growth, Outlook, Industry, Segmentation, Forecast, Size, Companies, Trends, Value, Share, Analysis & Revenue

- Canada Oil and Gas Market (2026-2032) | Share, Segmentation, Value, Industry, Trends, Forecast, Analysis, Size & Revenue, Growth, Competitive Landscape, Outlook, Companies

Industry Events and Analyst Meet

Whitepaper

- Middle East & Africa Commercial Security Market Click here to view more.

- Middle East & Africa Fire Safety Systems & Equipment Market Click here to view more.

- GCC Drone Market Click here to view more.

- Middle East Lighting Fixture Market Click here to view more.

- GCC Physical & Perimeter Security Market Click here to view more.

6WResearch In News

- Doha a strategic location for EV manufacturing hub: IPA Qatar

- Demand for luxury TVs surging in the GCC, says Samsung

- Empowering Growth: The Thriving Journey of Bangladesh’s Cable Industry

- Demand for luxury TVs surging in the GCC, says Samsung

- Video call with a traditional healer? Once unthinkable, it’s now common in South Africa

- Intelligent Buildings To Smooth GCC’s Path To Net Zero