India Adipic Acid Market (2019-2024) | Value, Growth, Industry, Share, Trends, Size, Analysis, Forecast, Revenue, Outlook & Companies

Market Forecast By Applications (Nylon 66, Plasticizers, Polyurethanes, Automotive and Polyester Staple Fiber), By Regions (Eastern, Western, Northern and Southern), and Competitive landscape

| Product Code: ETC000570 | Publication Date: Feb 2022 | Updated Date: Nov 2025 | Product Type: Report | |

| Publisher: 6Wresearch | Author: Ravi Bhandari | No. of Pages: 120 | No. of Figures: 63 | No. of Tables: 6 |

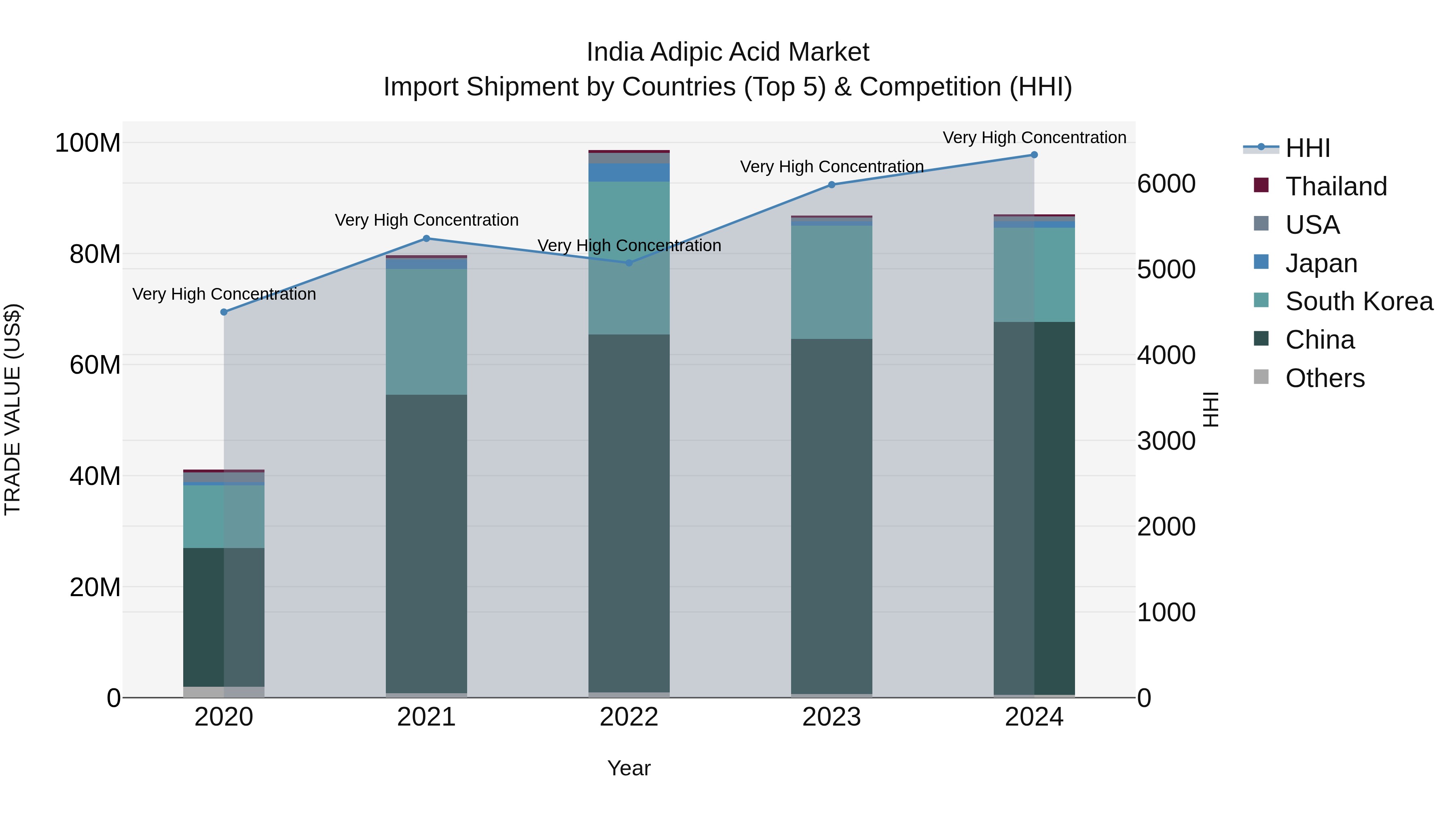

India Adipic Acid Market Top 5 Importing Countries and Market Competition (HHI) Analysis

India`s adipic acid import market in 2024 continued to be dominated by top exporting countries such as China, South Korea, Japan, USA, and Thailand. The high concentration of the Herfindahl-Hirschman Index (HHI) indicates a consolidated market with limited competition. The impressive compound annual growth rate (CAGR) of 20.68% from 2020 to 2024 highlights the increasing demand for this chemical compound in India. Although the growth rate slightly decreased to 0.28% from 2023 to 2024, the overall market trend remains positive, showcasing a steady interest in importing adipic acid.

India Adipic Acid Market is expected to register modest growth during the upcoming years on account of the strengthening of the chemical sector. Increasing demand for nylon and polyurethane across several industrial domains would aid the India Adipic Acid Market Growth. Flourishing end-user industries such as plasticizer, automotive, construction, and polyester staple fiber are likely to boost the demand for adipic acid derivatives in the country further expected to increase the India Adipic Acid Market Share. The chemical industry in particular is one of the key contributors in India and offers immense opportunities for the growth of adipic acid market in the future.

According to 6Wresearch India Adipic Acid Market Size is projected to grow at a CAGR of 6.6% during 2019-24. India adipic acid market is primarily import-based as the country lacks the presence of official large-scale adipic acid manufacturing plants. However, government initiatives to attract foreign investments in the chemical sector and strong support for research & development are expected to drive the demand for the adipic acid application. Further, initiatives, such as 'Make in India', would strengthen the domestic manufacturing sector in the country, including the chemical industry, and create more avenues for the use of adipic acid during the forecast period.

Nylon 66 and polyurethane applications were the key revenue-generating segments in the overall India adipic acid market Revenue due to their usage in construction equipment and packing products.

The India adipic acid market report thoroughly covers the market by applications and regions. India Adipic acid market outlook report provides an unbiased and detailed analysis of the ongoing India adipic acid market trends, opportunities/high growth areas, and market drivers which would help the stakeholders to devise and align their market strategies according to the current and future market dynamics.

Key Highlights of the Report:

• Historical Data of Global Adipic Acid Market Revenues and Volume, By Applications for the Period 2014-2018.

• Market Size & Forecast of Global Adipic Acid Market Revenues and Volume until 2024

• India Adipic Acid Market Overview

• India Adipic Acid Market Outlook

• India Adipic Acid Market Size and India Adipic Acid Market Forecast until 2024

• Historical Data of India Adipic Acid Market Revenues and Volume, By Applications, 2014-2018

• Market Size & Forecast of India Adipic Acid Market Revenues and Volume, By Applications until 2024

• Historical Data of India Adipic Acid Market Revenues and Volume, By Regions, 2014-2017

• Market Size & Forecast of India Adipic Acid Market Revenues and Volume, By Regions until 2024

• India Adipic Acid Market Trends and Developments.

• Market Drivers and Restraints

• Porter's Five Force Analysis and India Adipic Acid Market Overview on Opportunity Assessment

• India Adipic Acid Market Share, By Players

• Competitive Landscape

• Company Profiles

• Strategic Recommendations.

Markets Covered

India Adipic Acid market report provides a detailed analysis of the following market segments:

By Applications

- Nylon 66

- Plasticizers

- Polyurethanes

- Automotive

- Polyester Staple Fiber

By Regions

- Eastern

- Western

- Northern

- Southern

Frequently Asked Questions About the Market Study (FAQs):

1. Executive Summary

2. Introduction

2.1. Introduction

2.2. Key Highlights Of The Report

2.3. Market Scope and Segmentation

2.4. Research Methodology

2.5. Assumptions

3. Global Adipic Acid Market Overview

3.1. Global Adipic Acid Market Revenue, 2014-2024F

3.2. Global Adipic Acid Market Revenues Share, By Regions, (2018)

4. India Adipic Acid Market Overview

4.1. India Country Indicators

4.2. India Adipic Acid Market Revenues and Volume, 2014-2024F

4.3. India Adipic Acid Market Revenue Share, By Applications, 2018 & 2024F

4.4. India Adipic Acid Market Volume Share, By Applications, 2018 & 2024F

4.5. India Adipic Acid Market Revenue Share, By Regions, 2018 & 2024F

4.6. India Adipic Acid Market Volume Share, By Regions, 2018 & 2024F

4.7. India Adipic Acid Market Industry Life Cycle, 2018

4.8. India Adipic Acid Market Porter's Five Forces

5. India Adipic Acid Market Dynamics

5.1. Impact Analysis

5.2. Market Drivers

5.3. Market Restraints

6. India Adipic Acid Market Trends

6.1. Market Trends

7. India Adipic Acid Market Overview, By Applications

7.1. India Adipic Acid Market Revenues And Volume, By Nylon 66 Application, 2014-2024F

7.2. India Adipic Acid Market Revenues And Volume, By Polyurethane Application, 2014-2024F

7.3. India Adipic Acid Market Revenues And Volume, By Plasticizer Application, 2014-2024F

7.4 India Adipic Acid Market Revenues And Volume, By Automotive Application, 2014-2024F

7.5. India Adipic Acid Market Revenues And Volume, By Polyester Staple Fibre Application, 2014-2024F

7.6. India Adipic Acid Market Revenues And Volume, By Other Application, 2014-2024F

8. India Adipic Acid Market Overview, By Regions

8.1. Northern India Adipic Acid Market Revenues And Volume, 2014-2024F

8.2. Western India Adipic Acid Market Revenues And Volume, 2014-2024F

8.3. Southern India Adipic Acid Market Revenues And Volume, 2014-2024F

8.4. Eastern India Adipic Acid Market Revenues And Volume, 2014-2024F

9. India Adipic Acid Market Related Upcoming Projects

10. India Adipic Acid Market Key Performance Indicators

10.1. India Government Spending Outlook

10.2. India Construction Sector Outlook

10.3. India Pharma Industry Outlook

10.4. India Manufacturing Industry Outlook

10.5. India Industrial Sector Outlook

10.6. India Chemical Sector Outlook

10.7. India Petrochemicals Sector Outlook

11. India Adipic Acid Market Opportunity Assessment

11.1. India Adipic Acid Market Opportunity Assessment, By Applications (2024F)

11.2. India Adipic Acid Market Opportunity Assessment, By Regions (2024F)

12. India Adipic Acid Market Competitive Landscape

12.1. India Adipic Acid Market Revenue Share, By Companies (2018)

13. Company Profiles

13.1. Asahi Kasei India Pvt. Ltd.

13.2. Ascend Performance Materials

13.3. BASF India Ltd.

13.4. E.I. DuPont India Private Limited

13.5. LANXESS India

13.6. Radici Plastics India Pvt. Ltd.

13.7. Shandong Haili Chemical Industry Co. Ltd.

13.8. Solvay Specialties India Private Limited

14. Strategic Recommendations

15. Disclaimer

List of Figures

Figure1. Global Adipic Acid Market Revenues, 2014-2024F ($ Billion)

Figure2. Global Adipic Acid Market Revenues Share, By Regions, 2018

Figure3. India Adipic Acid Market Revenues and Volume, 2014-2024F (INR Crore & Thousand Tons)

Figure4. India Adipic Acid Market Revenue Share, By Applications, 2018 & 2024F

Figure5. India Adipic Acid Market Volume Share, By Applications, 2018 & 2024F

Figure6. India Adipic Acid Market Revenue Share, By Regions, 2018 & 2024F

Figure7. India Adipic Acid Market Volume Share, By Regions, 2018 & 2024F

Figure8. India Adipic Acid Market Industry Life Cycle, 2018

Figure9. India Nylon 66 Market Volume, 2014-2024F (Tons)

Figure10. India Polyurethane Market Volume, 2014-2024F (Thousand Tons)

Figure11. India Polyester Staple Fiber Market Volume, 2014-2024F (Thousand Tons)

Figure12. Country-wise Exports of Polyester Staple Fiber from India in Value Terms, 2017 ($ million)

Figure13. Country-wise Imports of Polyester Staple Fiber from India in Value Terms, 2017 ($ million)

Figure14. India Automotive Market Volume, 2014-2024F (Lac Units)

Figure15. Adipic Acid Market Revenues And Volume, By Nylon 66, 2014-2024F (INR Crore & Thousand Tons)

Figure16. Adipic Acid Market Revenues And Volume, By Polyurethane, 2014-2024F (INR Crore & Thousand Tons)

Figure17. Adipic Acid Market Revenues And Volume, By Plasticizer, 2014-2024F (INR Crore & Thousand Tons)

Figure18. Adipic Acid Market Revenues And Volume, By Automotive, 2014-2024F (INR Crore & Thousand Tons)

Figure19. Adipic Acid Market Revenues And Volume, By Polyester Staple Fiber, 2014-2024F (INR Crore & Thousand Tons)

Figure20. Adipic Acid Market Revenues And Volume, By Other Products, 2014-2024F (INR Crore & Thousand Tons)

Figure21. Northern India Adipic Acid Market Revenues And Volume, 2014-2024F (INR Crore & Thousand Tons)

Figure22. Western India Adipic Acid Market Revenues And Volume, 2014-2024F (INR Crore & Thousand Tons)

Figure23. Southern India Adipic Acid Market Revenues And Volume, 2014-2024F (INR Crore & Thousand Tons)

Figure24. Eastern India Adipic Acid Market Revenues And Volume, 2014-2024F (INR Crore & Thousand Tons)

Figure25. India Actual Government Spending Vs Actual Government Revenues, 2014-2024F (INR Trillion)

Figure26. India Expected Government Budget Outlook, 2018-2019

Figure27. India Construction Industry Value, 2019-2021 (INR Lakh Crore)

Figure28. India Infrastructure Investment Forecast, 2017-2040 (INR Lakh Crore)

Figure29. India Infrastructure Investment Forecast, By Sector, 2017-2040 (INR Lakh Crore)

Figure30. India Pharmaceutical Industry Revenues, 2005-2025F ($ Billion)

Figure31. Expected Contribution of Manufacturing Sector to GDP, 2012-2022

Figure32. India Proposed Industrial Investment, By Sub-Sectors, 2016-March 2018 (INR Thousand Crore)

Figure33. India Oil Demand, 2016-2022F (Million B/D)

Figure34. India Existing and Upcoming SEZ Supply, 2017-2020F (Million Sq. Ft.)

Figure35. Total Installed Production Capacity Share, By Chemical Types, 2018

Figure36. Total Actual Production Capacity Share, By Chemical Types, 2018

Figure37. Total Import Quantity Share, By Chemical Types, 2018

Figure38. Total Import Value Share, By Chemical Types, 2018

Figure39. Total Export Quantity Share, By Chemical Types, 2018

Figure40. Total Export Value Share, By Chemical Types, 2018

Figure41. India Major Petrochemicals Installed Capacity and Production, 2018 (Kilo Thousand Tons)

Figure42. Total Production Installed Capacity Share, By Petrochemical Types, 2017

Figure43. Total Actual Production Capacity Share, By Petrochemical Types, 2017

Figure44. Total Petrochemical Volume Import Share, By Types, 2018

Figure45. Total Petrochemical Revenue Import Share, By Types, 2018

Figure46. Total Petrochemical Volume Export Share, By Types, 2018

Figure47. Total Petrochemical Revenue Export Share, By Types, 2018

Figure48. India Synthetic Fibres/Yarn Installed Capacity and Production, 2014-17 (Thousand Tons)

Figure49. India Fabric Production, 2018 (Million Sq. M)

Figure50. India Total Yarn Production Share, By Segments (2018)

Figure51. India Total Yarn Production Share, By Sub-Segments (2018)

Figure52. India Textile and Apparel Market Size, 2015-2025F ($ Billion)

Figure53. India Fibre Intermediates Installed Capacity and Production, 2014-17 (Thousand Tons)

Figure54. India Total Fiber Production Share, By Segments (2018)

Figure55. India Total Fiber Production Share, By Sub-Segments (2018)

Figure56. India Fiber Exports Revenue Share, By Types, 2017

Figure57. India Fiber Imports Revenue Share, By Types, 2017

Figure58. India Polymers Installed Capacity and Production, 2014-17 (Thousand Tons)

Figure59.India Performance Plastic Installed Capacity and Production, 2014-17 (Thousand Tons)

Figure60. India Synthetic Detergent Installed Capacity and Production, 2014-17 (Thousand Tons)

Figure61. India Adipic Acid Market Opportunity Assessment, By Applications, 2024F

Figure62. India Adipic Acid Market Opportunity Assessment, By Regions, 2024F

Figure63. India Adipic Acid Market Revenue Share, By Companies, 2018

List of Tables

Table1. Upcoming Automotive Projects In India

Table2. Upcoming Infrastructure Projects In India

Table3. Upcoming Food & Beverage Projects In India

Table4. Upcoming Oil & Gas and Petroleum Projects In India

Table5. Upcoming Plastic Sector Projects In India

Table6. India Under Construction LNG Import Terminals

- Single User License$ 1,995

- Department License$ 2,400

- Site License$ 3,120

- Global License$ 3,795

Search

Thought Leadership and Analyst Meet

Our Clients

Related Reports

- Afghanistan Apparel Market (2026-2032) | Growth, Outlook, Industry, Segmentation, Forecast, Size, Companies, Trends, Value, Share, Analysis & Revenue

- Canada Oil and Gas Market (2026-2032) | Share, Segmentation, Value, Industry, Trends, Forecast, Analysis, Size & Revenue, Growth, Competitive Landscape, Outlook, Companies

- Germany Breakfast Food Market (2026-2032) | Industry, Share, Growth, Size, Companies, Value, Analysis, Revenue, Trends, Forecast & Outlook

- Australia Briquette Market (2025-2031) | Growth, Size, Revenue, Forecast, Analysis, Trends, Value, Share, Industry & Companies

- Vietnam System Integrator Market (2025-2031) | Size, Companies, Analysis, Industry, Value, Forecast, Growth, Trends, Revenue & Share

- ASEAN and Thailand Brain Health Supplements Market (2025-2031) | Strategy, Consumer Insights, Analysis, Investment Trends, Opportunities, Growth, Size, Share, Industry, Revenue, Segments, Value, Segmentation, Supply, Forecast, Restraints, Outlook, Competition, Drivers, Trends, Demand, Pricing Analysis, Competitive, Strategic Insights, Companies, Challenges

- ASEAN Bearings Market (2025-2031) | Strategy, Consumer Insights, Analysis, Investment Trends, Opportunities, Growth, Size, Share, Industry, Revenue, Segments, Value, Segmentation, Supply, Forecast, Restraints, Outlook, Competition, Drivers, Trends, Demand, Pricing Analysis, Competitive, Strategic Insights, Companies, Challenges

- Europe Flooring Market (2025-2031) | Outlook, Share, Industry, Trends, Forecast, Companies, Revenue, Size, Analysis, Growth & Value

- Saudi Arabia Manlift Market (2025-2031) | Outlook, Size, Growth, Trends, Companies, Industry, Revenue, Value, Share, Forecast & Analysis

- Uganda Excavator, Crane, and Wheel Loaders Market (2025-2031) | Strategy, Consumer Insights, Analysis, Investment Trends, Opportunities, Growth, Size, Share, Industry, Revenue, Segments, Value, Segmentation, Supply, Forecast, Restraints, Outlook, Competition, Drivers, Trends, Demand, Pricing Analysis, Competitive, Strategic Insights, Companies, Challenges

Industry Events and Analyst Meet

Whitepaper

- Middle East & Africa Commercial Security Market Click here to view more.

- Middle East & Africa Fire Safety Systems & Equipment Market Click here to view more.

- GCC Drone Market Click here to view more.

- Middle East Lighting Fixture Market Click here to view more.

- GCC Physical & Perimeter Security Market Click here to view more.

6WResearch In News

- Doha a strategic location for EV manufacturing hub: IPA Qatar

- Demand for luxury TVs surging in the GCC, says Samsung

- Empowering Growth: The Thriving Journey of Bangladesh’s Cable Industry

- Demand for luxury TVs surging in the GCC, says Samsung

- Video call with a traditional healer? Once unthinkable, it’s now common in South Africa

- Intelligent Buildings To Smooth GCC’s Path To Net Zero