Vietnam UPS Systems Market (2024-2030) | Value, Trends, Size, Revenue, Forecast, Outlook, Growth, Industry, Share, Analysis & Companies

Market Forecast By KVA Ratings (Up to 1.1 kVA, 1.1 kVA - 5 kVA, 5.1 kVA - 20 kVA, 20.1 kVA - 50 kVA, 50.1 kVA - 200 kVA and Above 200 kVA),By Phases (1 Phase, 3 Phase), By Applications (Commercial, Industrial and Residential) and Competitive Landscape

| Product Code: ETC000533 | Publication Date: Jun 2024 | Updated Date: Aug 2025 | Product Type: Report | |

| Publisher: 6Wresearch | Author: Ravi Bhandari | No. of Pages: 72 | No. of Figures: 20 | No. of Tables: 6 |

Vietnam UPS System Market Synopsis

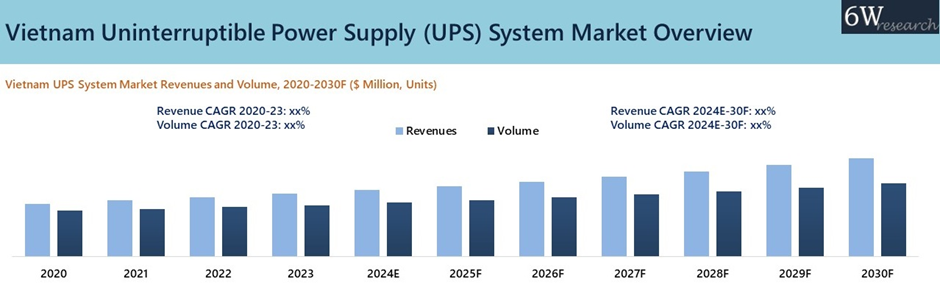

Vietnam UPS system market witnessed remarkable growth from 2020 to 2023, driven by the nation's digital transformation and economic development initiatives. The country's push towards establishing a $45 billion digital economy by 2025 fueled IT adoption and investments in high-tech hubs like Ho Chi Minh City. This surge in digitalization amplified the demand for reliable UPS solutions across industries to ensure uninterrupted power supply. The data center market emerged as a significant growth engine during this period. The sector's operational capacity more than doubled, growing from 60 MW in 2018 to around 130 MW in 2023. This expansion was driven by several key factors, including data localization laws, the National Data Center Project (Resolution 175/NQ-CP), and substantial investments from major players like Equinix, FPT Telecom, and NTT, collectively committing over $900 million.

According to 6Wresearch, the Vietnam UPS System market size is projected to grow at a CAGR of 6.7% during 2024-2030. Vietnam's UPS system market is poised for further growth, supported by several upcoming projects and growth drivers. Firstly, the data center market is expected to continue its upward trajectory, with a projected capacity of 250 MW by 2025. This expansion would be fueled by ongoing investments from industry giants, such as Equinix's $64 million commitment for its third data center in Ho Chi Minh City, FPT Telecom's $350 million investment in a new Hanoi campus, and NTT's $500 million allocation for a Ho Chi Minh City facility. Moreover, Vietnam's rapid urbanization, projected to reach 50% by 2040, necessitates the adoption of smart city infrastructure. This development would create a significant demand for UPS systems to maintain uninterrupted operations in these smart cities.

Major urban development projects, including the construction of smart cities, would drive the need for reliable power backup solutions. Further, the government's thrust on industrial development through projects like the Leyte Ecological Industrial Zone has prompted foreign manufacturers to establish facilities in Vietnam. As industrial processes expand, the demand for UPS solutions to prevent production disruptions will continue to rise, further fueling the market's growth.

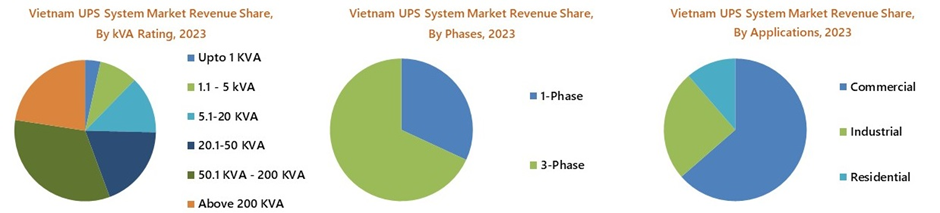

Market Segmentation by kVA Rating

50.1 - 200 kVA had the highest revenue share in the kVA rating segment in Vietnam's UPS system industry in 2023 owing to strong demand from commercial buildings and mid-sized data centers. Moreover, rating of 50.1 - 200 kVA balances power requirements with cost-effectiveness compared to higher-end options above 200 kVA. Additionally, these systems benefit from lower manufacturing costs compared to units above 200 kVA, driving supplier focus and fueling a 27% revenue share for the segment.

Market Segmentation by Phases

3- UPS systems captured 68.1% revenue share driven by robust demand from commercial/industrial facilities and data centers requiring higher load capacities. Greater energy efficiency and reliability of 3-phase topology justifies the premium pricing over 1-phase counterparts for mission-critical applications.

Market Segmentation by Applications

Commercial projects acquired the highest revenue share in Vietnam's UPS system market in 2023 owing to the rapid expansion of office complexes, retail centers, and hospitality developments across major cities. These commercial endeavors necessitated reliable UPS solutions to safeguard critical operations against power disruptions. Notable projects driving demand included Ho Chi Minh City's iconic Landmark 81 skyscraper, the massive Vincom Mega Mall Royal City retail complex, and the new JW Marriott Hanoi luxury hotel fueling the demand for UPS in the country.

Key Attractiveness of the Report

- 10 Years Market Numbers.

- Historical Data Starting from 2020 to 2023.

- Base Year: 2023

- Forecast Data until 2030.

- Key Performance Indicators Impacting the Market.

- Major Upcoming Developments and Projects.

Key Highlights of the Report:

- Vietnam Uninterruptible Power Supply (UPS) System Market Overview

- Vietnam Uninterruptible Power Supply (UPS) System Market Outlook

- Vietnam Uninterruptible Power Supply (UPS) System Market Forecast

- Historical Data and Forecast of Vietnam Uninterruptible Power Supply (UPS) System Market Revenues and Volume, for the Period 2020-2030F

- Historical Data and Forecast of Vietnam Uninterruptible Power Supply (UPS) System Market Revenues and Volume, By kVA Rating, for the Period 2020-2030F

- Historical Data and Forecast of Vietnam Uninterruptible Power Supply (UPS) System Market Revenues, By Phases, for the Period 2020-2030F

- Historical Data and Forecast of Vietnam Uninterruptible Power Supply (UPS) System Market Revenues, By Applications, for the Period 2020-2030F

- Market Drivers and Restraints

- Vietnam Uninterruptible Power Supply (UPS) System Market Trends

- Porter’s Five Forces Analysis

- Market Opportunity Assessment

- Vietnam Uninterruptible Power Supply (UPS) System Market Revenue Ranking, By Companies, 2023

- Competitive Benchmarking

- Company Profiles

- Key Strategic Recommendations

Market Scope and Segmentation

Thereportprovides a detailed analysis of the following market segments:

By kVA Rating

- Up to 1kVA

- 1.1- 5kVA

- 5.1- 20kVA

- 20.1- 50kVA

- 50.1- 200kVA

- Above 200kVA

By Phases

- 1 Phase

- 3 Phase

By Applications

- Residential

- Industrial

- Commercial

Frequently Asked Questions About the Market Study: FAQ

| 1. Executive Summary |

| 2. Introduction |

| 2.1 Report Description |

| 2.2 Key Highlights of the Report |

| 2.3 Market Scope & Segmentation |

| 2.4 Methodology |

| 2.5 Assumptions |

| 3. Vietnam Uninterruptible Power Supply (UPS) System Market Overview |

| 3.1 Vietnam Uninterruptible Power Supply (UPS) System Market Revenues & Volume, 2020-2030F |

| 3.2 Vietnam Uninterruptible Power Supply (UPS) System Market Industry Life Cycle |

| 3.4 Vietnam Uninterruptible Power Supply (UPS) System Market Porter’s Five Forces |

| 4. Vietnam Uninterruptible Power Supply (UPS) System Market Dynamics |

| 4.1 Impact Analysis |

| 4.2 Market Drivers |

| 4.2.1 Increasing demand for uninterrupted power supply in various industries such as IT, healthcare, and telecommunications. |

| 4.2.2 Growing awareness about the importance of power protection and backup solutions. |

| 4.2.3 Government initiatives to improve the reliability and efficiency of the power infrastructure in Vietnam. |

| 4.3 Market Restraints |

| 4.3.1 High initial investment costs associated with UPS systems. |

| 4.3.2 Limited awareness and understanding of UPS systems among small and medium-sized enterprises. |

| 4.3.3 Challenges related to the disposal and recycling of UPS batteries and electronic components. |

| 5. Vietnam Uninterruptible Power Supply (UPS) System Market Evolution & Trends |

| 6. Vietnam Uninterruptible Power Supply (UPS) System Market Overview, By kVA Ratings |

| 6.1 Vietnam Uninterruptible Power Supply (UPS) System Market Revenue Share and Revenues, By kVA Ratings, 2023 & 2030F |

| 6.1.1 Vietnam Uninterruptible Power Supply (UPS) System Market Revenues, By Up to 1kVA, 2020-2030F |

| 6.1.2 Vietnam Uninterruptible Power Supply (UPS) System Market Revenues, By 1.1- 5kVA, 2020-2030F |

| 6.1.3 Vietnam Uninterruptible Power Supply (UPS) System Market Revenues, By 5.1-20kVA, 2020-2030F |

| 6.1.4 Vietnam Uninterruptible Power Supply (UPS) System Market Revenues, By 20.1-50kVA, 2020-2030F |

| 6.1.5 Vietnam Uninterruptible Power Supply (UPS) System Market Revenues, By 50.1-200kVA, 2020-2030F |

| 6.1.6 Vietnam Uninterruptible Power Supply (UPS) System Market Revenues, By Above 200kVA, 2020-2030F |

| 6.2 Vietnam Uninterruptible Power Supply (UPS) System Market Volume Share and Volume, By kVA Ratings, 2023 & 2030F |

| 6.2.1 Vietnam Uninterruptible Power Supply (UPS) System Market Volume, By Up to 1kVA, 2020-2030F |

| 6.2.2 Vietnam Uninterruptible Power Supply (UPS) System Market Volume, By 1.1- 5kVA, 2020-2030F |

| 6.2.3 Vietnam Uninterruptible Power Supply (UPS) System Market Volume, By 5.1-20kVA, 2020-2030F |

| 6.2.4 Vietnam Uninterruptible Power Supply (UPS) System Market Volume, By 20.1-50kVA, 2020-2030F |

| 6.2.5 Vietnam Uninterruptible Power Supply (UPS) System Market Volume, By 50.1-200kVA, 2020-2030F |

| 6.2.6 Vietnam Uninterruptible Power Supply (UPS) System Market Volume, By Above 200kVA, 2020-2030F |

| 7. Vietnam Uninterruptible Power Supply (UPS) System Market Overview, By Phase |

| 7.1 Vietnam Uninterruptible Power Supply (UPS) System Market Revenue Share & Revenues, By Phase, 2023 & 2030F |

| 7.1.1 Vietnam Uninterruptible Power Supply (UPS) System Market Revenues, By Phase 1, 2020-2030F |

| 7.1.2 Vietnam Uninterruptible Power Supply (UPS) System Market Revenues, By Phase 3, 2020-2030F |

| 8. Vietnam Uninterruptible Power Supply (UPS) System Market Overview, By Applications |

| 8.1 Vietnam Uninterruptible Power Supply (UPS) System Market Revenue Share & Revenues, By Applications, 2023 & 2030F |

| 8.1.1 Vietnam Uninterruptible Power Supply (UPS) System Market Revenues, By Residential, 2020-2030F |

| 8.1.2 Vietnam Uninterruptible Power Supply (UPS) System Market Revenues, By Industrial, 2020-2030F |

| 8.1.3 Vietnam Uninterruptible Power Supply (UPS) System Market Revenues, By Commercial, 2020-2030F |

| 8.1.3.1 Vietnam Uninterruptible Power Supply (UPS) System Market Revenues, By Data Centers, 2020-2030F |

| 8.1.3.2 Vietnam Uninterruptible Power Supply (UPS) System Market Revenues, By BFSI, 2020-2030F |

| 8.1.3.3 Vietnam Uninterruptible Power Supply (UPS) System Market Revenues, By Government Building and Offices, 2020-2030F |

| 8.1.3.4 Vietnam Uninterruptible Power Supply (UPS) System Market Revenues, By Healthcare, 2020-2030F |

| 8.1.3.5 Vietnam Uninterruptible Power Supply (UPS) System Market Revenues, By Hospitality, 2020-2030F |

| 8.1.3.6 Vietnam Uninterruptible Power Supply (UPS) System Market Revenues, By Others, 2020-2030F |

| 9. Vietnam Uninterruptible Power Supply (UPS) System Market Key Performance Indicators |

| 9.1 Average uptime percentage of UPS systems in use. |

| 9.2 Number of new installations and upgrades of UPS systems. |

| 9.3 Energy efficiency improvements achieved through UPS system deployments. |

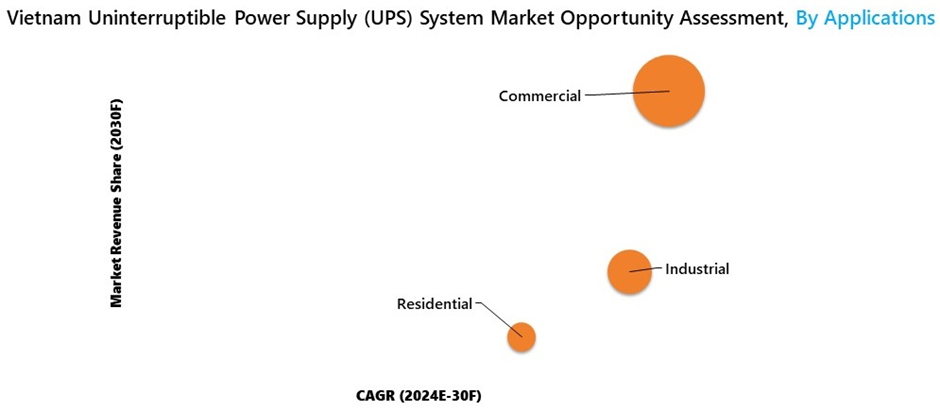

| 10. Vietnam Uninterruptible Power Supply (UPS) System Market Opportunity Assessment |

| 10.1 Vietnam Uninterruptible Power Supply (UPS) System Market Opportunity Assessment, By kVA Rating, 2030F |

| 10.2 Vietnam Uninterruptible Power Supply (UPS) System Market Opportunity Assessment, By Phases, 2030F |

| 10.3 Vietnam Uninterruptible Power Supply (UPS) System Market Opportunity Assessment, By Applications, 2030F |

| 11. Vietnam Uninterruptible Power Supply (UPS) System Market Competitive Landscape |

| 11.1 Vietnam Uninterruptible Power Supply (UPS) System Market Revenue Ranking, By Company, 2023 |

| 11.2 Vietnam Uninterruptible Power Supply (UPS) System Market Competitive Benchmarking, By Technical Parameters |

| 11.3 Vietnam Uninterruptible Power Supply (UPS) System Market Competitive Benchmarking, By Operating Parameters |

| 12. Company Profiles |

| 12.1 Eaton Corporation Plc |

| 12.2 Schneider Electric SE |

| 12.3 Vertiv Co |

| 12.4 General Electric Company. |

| 12.5 ABB Ltd. |

| 12.6 Delta Electronics, Inc. |

| 12.7 RPS S.p.A. |

| 12.8 Socomec |

| 12.9 PT Fuji Electric Vietnam Co. Ltd. |

| 12.10 Emerson Electric Co |

| 13. Key Strategic Recommendations |

| 14. Disclaimer |

| List of Figures |

| 1. Vietnam Uninterruptible Power Supply (UPS) System Market Revenues and Volume, 2020-2030F ($ Million and Units) |

| 2. Data Centers Market in Vietnam (million $) (2020-2026F) |

| 3. Region wise percentage of Data Centers in Vietnam (2022) |

| 4. Share of Firms adopting Industry 4.0 Technologies (2022) |

| 5. Vietnam Digital Technologies Market Revenue ($ million) (2022-2027F) |

| 6. Vietnam Uninterruptible Power Supply (UPS) System Market Revenue Share, By kVA Rating, 2023 & 2030F |

| 7. Vietnam Uninterruptible Power Supply (UPS) System Market Volume Share, By kVA Rating, 2023 & 2030F |

| 8. Vietnam Uninterruptible Power Supply (UPS) System Market Revenue Share, By Phases, 2023 & 2030F |

| 9. Vietnam Uninterruptible Power Supply (UPS) System Market Revenue Share, By Application, 2023 & 2030F |

| 10. Vietnam UPS System Market Revenue Share, By Commercial Application, 2023 & 2030F |

| 11. Share of Digital Payments in Vietnam, 2018-2023 ($ Billion) |

| 12. Vietnam GDP Value added by Industrial Sector (2020-2022) in $ Billion |

| 13. Vietnam ICT Sector Market, 2021 & 2031F ($ Billion) |

| 14. Vietnam ICT Budget, 2023 & 2024F ($ Million) |

| 15. Vietnam Number of Data Centers, By Regions, 2023 |

| 16. Vietnam Uninterruptible Power Supply (UPS) System Market Opportunity Assessment, By kVA Rating (2029F) |

| 17. Vietnam Uninterruptible Power Supply (UPS) System Market Opportunity Assessment, By Phases (2029F) |

| 18. Vietnam Uninterruptible Power Supply (UPS) System Market Opportunity Assessment, By Applications (2029F) |

| 19. Vietnam Uninterruptible Power Supply (UPS) System Market Revenue Ranking, By Company, 2022 |

| 20. Upcoming Supply for Office Spaces in Ho Chi Minh City, By Cities, Q2 2022-2025F (in %) |

| List of Tables |

| 1. Vietnam Uninterruptible Power Supply (UPS) System Market Revenues, By kVA Rating, 2020-2030F ($ Million) |

| 2. Vietnam Uninterruptible Power Supply (UPS) System Market Volume, By kVA Rating, 2020-2030F (Units) |

| 3. Vietnam Uninterruptible Power Supply (UPS) System Market Revenues, By Phases, 2020-2030F ($ Million) |

| 4. Vietnam Uninterruptible Power Supply (UPS) System Market Revenues, By Applications, 2020-2030F ($ Million) |

| 5. Vietnam Uninterruptible Power Supply (UPS) System Market Revenues, By Commercial Applications, 2020-2030F ($ Million)Vietnam Uninterruptible Power Supply (UPS) System Market Revenues, By Commercial Applications, 2020-2030F ($ Million) |

| 6. Under Construction Data Center Projects In Ho Chi Minh City |

Market Forecast By KVA Ratings (Up to 1.1 kVA, 1.1 kVA - 5 kVA, 5.1 kVA - 20 kVA, 20.1 kVA - 50 kVA, 50.1 kVA - 200 kVA and Above 200 kVA), By Applications (Commercial (Offices, Healthcare, Hospitality, BFSI, Data Centers and Others including Retail, Government Buildings, and Transportation Infrastructure), Industrial and Residential)), By Regions (Northern, Central, and Southern) and Competitive Landscape

| Product Code: ETC000533 | Publication Date: Dec 2021 | Product Type: Report | |

| Publisher: 6Wresearch | No. of Pages: 126 | No. of Figures: 50 | No. of Tables: 22 |

Topics Covered in Vietnam UPS Systems Market Report

The Vietnam UPS Market report thoroughly covers the Vietnam Uninterruptible Power Supply UPS Systems market by KVA ratings, applications, and regions. The Vietnam UPS market outlook report provides an unbiased and detailed analysis of the Vietnam UPS market trends, opportunities/high growth areas, and market drivers which would help the stakeholders to devise and align their market strategies according to the current and future market dynamics.

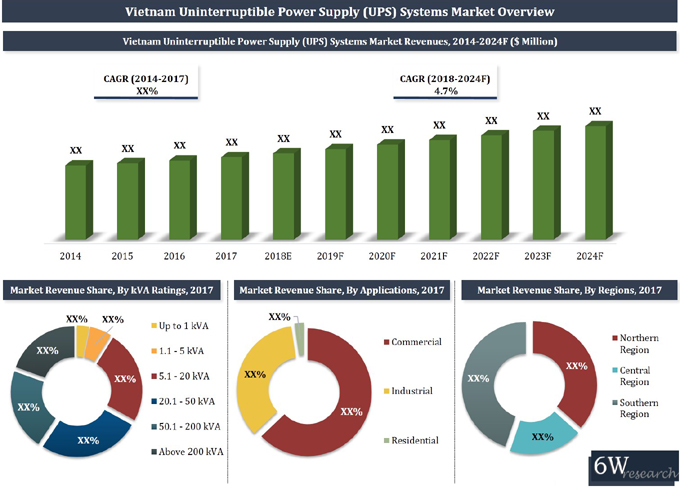

Vietnam UPS Systems Market Synopsis

Vietnam UPS Market is anticipated to project substantial growth during the forthcoming period on account of the growing infrastructure sector to keep up with the increasing population of the country coupled with rising in commercial and manufacturing sectors. This market has been accomplishing prominent growth and it is ready to rise more in the future.

According to 6Wresearch, Vietnam UPS market size is projected to grow at a CAGR of 4.7% during 2018-2024. Vietnam's digital economy growth has fueled a rise in data centres, cloud computing, and other IT-intensive sectors. These sectors require a stable power supply to avoid data loss and server downtime. The UPS systems market has grown to fill this need for backup power. E-commerce sales in Vietnam have boomed in recent years, with a predicted annual growth rate of 30%. E-commerce requires a secure, consistent power supply to keep operations running smoothly. Therefore, UPS systems demand is surging to prevent product delivery delays or losses due to power outages. Government-led infrastructure projects such as industrial zones, high-tech parks, and smart cities require backup power solutions. UPS systems provide these solutions and drive the Vietnam UPS Market Growth.

The price competition in the UPS systems market has increased significantly in recent years. As new players enter the market, the competition is likely to become more intense, resulting in lower profit margins. As the demand for UPS systems increases, companies need to find engineers with expertise in installation, maintenance, and repair. The technical expertise shortage can hinder market growth if not addressed. Despite the increasing use of UPS systems, technical failures can still occur. Companies need to invest in quality and reliable equipment to avoid downtime and costly damage.

UPS Market in Vietnam: Key Players

Some of the key players in the Vietnam UPS market include:

- Eaton

- Schneider Electric

- General Electric

- ABB

- Socomec

- Tripp Lite

Vietnam UPS Industry: Government Initiatives

Government plans such as the National Transport Master Plan (2011-20) and the $121 billion Ho Chi Minh City Master Transport Plan are likely to create huge opportunities for UPS companies as these would lead to infrastructural development across the country. According to the Government of Vietnam (GVN), the manufacturing and processing sectors are expected to flourish and contribute significantly to the industrial segment of Vietnam on account of growing foreign investment in the country. Also, the inflow of FDI in industrial and manufacturing segments is further expected to improve the market for UPS. Further, increasing IT infrastructure, the need to provide power back up, and the rising number of data centers would spur the market for UPS in Vietnam.

Market Segmentation by Application

Amongst all the applications, the commercial sector captured the highest Vietnam Uninterrupted Power Supply Systems market share in 2017. In the commercial sector, data centers, BFSI, and hospitality segments were the major revenue shareholders and are expected to maintain their dominance over the coming years on account of the government's emphasis on developing the social infrastructure of the country.

Market Segmentation by Region

According to Dhaval, Research Manager, 6Wresearch, the Southern region is projected to witness the highest growth rate over the next six years due to various upcoming infrastructure projects in the region. Additionally, the Northern region also provides positive prospects for the deployment of UPS systems in the region. Further, the development of Special Economic Zones (SEZ) in provinces such as Quang Ninh is expected to create additional opportunities for the UPS companies in the Northern region.

Key Attractiveness of the Report

- 10 Years of Market Numbers.

- Historical Data Starting from 2015 to 2017.

- Base Year: 2017

- Forecast Data until 2024.

- Key Performance Indicators Impacting the Market.

- Major Upcoming Developments and Projects.

Key Highlights of the Report:

- Vietnam UPS Market Overview

- Vietnam UPS Market Outlook

- Vietnam UPS Market Forecast

- Historical Data of Global Uninterruptible Power Supply (UPS) Systems Market For The Period 2014-2017

- Vietnam UPS Market Size and Vietnam UPS Market Forecast Until 2024

- Historic Data of Vietnam UPS Market Revenues and Volume 2014-2017

- Market Size & Forecast of Vietnam UPS Market Revenues & Volume Market Until 2024

- Historic Data of Vietnam Up to 1 kVA UPS Systems Market Revenues & Volume 2014-2017

- Market Size & Forecast of Vietnam Up to 1 kVA UPS Systems Market Revenues & Volume Market Until 2024

- Historic Data for 1.1 kVA - 5 kVA, of Vietnam UPS Market Revenues & Volume during 2014-2017

- Market Size & Forecast for 1.1 kVA - 5 kVA, of Vietnam UPS Market Revenues & Volume Market Until 2024

- Historic Data of Vietnam 5.1 kVA - 20 kVA UPS Systems Market Revenues & Volume 2014-2017

- Market Size & Forecast of Vietnam 5.1 kVA - 20 kVA UPS Systems Market Revenues & Volume Market Until 2024

- Historic Data of Vietnam 20.1 kVA - 50 kVA UPS Systems Market Revenues & Volume 2014-2017

- Market Size & Forecast of Vietnam 20.1 kVA - 50 kVA UPS Systems Market Revenues & Volume Market Until 2024

- Historic Data of Vietnam 50.1 kVA - 200 kVA UPS Systems Market Revenues & Volume 2014-2017

- Market Size & Forecast of Vietnam 50.1 kVA - 200 kVA UPS Systems Market Revenues & Volume Market Until 2024

- Historic Data of Vietnam Above 200 kVA UPS Systems Market Revenues & Volume 2014-2017

- Market Size & Forecast of Vietnam 200 kVA & Above UPS Systems Market Revenues & Volume Market until 2024

- Historical data and Forecast of Vietnam Uninterruptible Power Supply (UPS) Systems Market, By Applications

- Historical data and Forecast of Vietnam Uninterruptible Power Supply (UPS) Systems Market, By Regions

- Vietnam UPS Market Trends and Opportunities

- Market Drivers and Restraints

- Vietnam UPS Market Overview on Competitive Landscape

- Vietnam UPS Market Share, By Players

- Company Profiles

- Strategic Recommendations

Market Scope and Segmentation

The report provides a detailed analysis of the following market segments:

The Vietnam UPS market report provides a detailed analysis of the following market segments:

By KVA Ratings

- Up to 1.1 kVA

- 1.1 kVA - 5 kVA

- 5.1 kVA - 20 kVA

- 20.1 kVA - 50 kVA

- 50.1 kVA - 200 kVA

- Above 200 kVA

By Applications

- Commercial

- Industrial

- Residential

By Regions

- Northern

- Central

- Southern

- Single User License$ 1,995

- Department License$ 2,400

- Site License$ 3,120

- Global License$ 3,795

Search

Thought Leadership and Analyst Meet

Our Clients

Related Reports

- Afghanistan Rocking Chairs And Adirondack Chairs Market (2026-2032) | Size & Revenue, Competitive Landscape, Share, Segmentation, Industry, Value, Outlook, Analysis, Trends, Growth, Forecast, Companies

- Afghanistan Apparel Market (2026-2032) | Growth, Outlook, Industry, Segmentation, Forecast, Size, Companies, Trends, Value, Share, Analysis & Revenue

- Canada Oil and Gas Market (2026-2032) | Share, Segmentation, Value, Industry, Trends, Forecast, Analysis, Size & Revenue, Growth, Competitive Landscape, Outlook, Companies

- Germany Breakfast Food Market (2026-2032) | Industry, Share, Growth, Size, Companies, Value, Analysis, Revenue, Trends, Forecast & Outlook

- Australia Briquette Market (2025-2031) | Growth, Size, Revenue, Forecast, Analysis, Trends, Value, Share, Industry & Companies

- Vietnam System Integrator Market (2025-2031) | Size, Companies, Analysis, Industry, Value, Forecast, Growth, Trends, Revenue & Share

- ASEAN and Thailand Brain Health Supplements Market (2025-2031) | Strategy, Consumer Insights, Analysis, Investment Trends, Opportunities, Growth, Size, Share, Industry, Revenue, Segments, Value, Segmentation, Supply, Forecast, Restraints, Outlook, Competition, Drivers, Trends, Demand, Pricing Analysis, Competitive, Strategic Insights, Companies, Challenges

- ASEAN Bearings Market (2025-2031) | Strategy, Consumer Insights, Analysis, Investment Trends, Opportunities, Growth, Size, Share, Industry, Revenue, Segments, Value, Segmentation, Supply, Forecast, Restraints, Outlook, Competition, Drivers, Trends, Demand, Pricing Analysis, Competitive, Strategic Insights, Companies, Challenges

- Europe Flooring Market (2025-2031) | Outlook, Share, Industry, Trends, Forecast, Companies, Revenue, Size, Analysis, Growth & Value

- Saudi Arabia Manlift Market (2025-2031) | Outlook, Size, Growth, Trends, Companies, Industry, Revenue, Value, Share, Forecast & Analysis

Industry Events and Analyst Meet

Whitepaper

- Middle East & Africa Commercial Security Market Click here to view more.

- Middle East & Africa Fire Safety Systems & Equipment Market Click here to view more.

- GCC Drone Market Click here to view more.

- Middle East Lighting Fixture Market Click here to view more.

- GCC Physical & Perimeter Security Market Click here to view more.

6WResearch In News

- Doha a strategic location for EV manufacturing hub: IPA Qatar

- Demand for luxury TVs surging in the GCC, says Samsung

- Empowering Growth: The Thriving Journey of Bangladesh’s Cable Industry

- Demand for luxury TVs surging in the GCC, says Samsung

- Video call with a traditional healer? Once unthinkable, it’s now common in South Africa

- Intelligent Buildings To Smooth GCC’s Path To Net Zero