Africa Chocolate Market (2025-2031) | Size, Share, Trends, Growth, Revenue, Analysis, Forecast, industry & Outlook

Market Forecast By Product Types (Dark Chocolate, Milk Chocolate, White Chocolate), By Chocolate Type (Count Lines & Straight Lines, Molded or Bar Chocolates, Choco-Panned & Sugar Panned and Others including Box Chocolates and Novelties), By Distribution Channels (Supermarket and Hypermarkets, Convenience Stores, Online Channels, Grocery/ Mom n Pop Stores and Others including Specialized Retailers, Pharmacy etc), By Counties (South Africa and Rest of Africa) and Competitive Landscape

| Product Code: ETC001572 | Publication Date: Jun 2025 | Updated Date: Jun 2025 | Product Type: Report | |

| Publisher: 6Wresearch | Author: Ravi Bhandari | No. of Pages: 155 | No. of Figures: 94 | No. of Tables: 31 |

Topics Covered in Africa Chocolate Market Report

Africa Chocolate Market Report thoroughly covers the market market by type, nature, applications, distribution channel and countries. Africa Chocolate Market Outlook report provides an unbiased and detailed analysis of the ongoing Africa Chocolate Market trends, opportunities/high growth areas, and market drivers. This would help stakeholders devise and align their market strategies according to the current and future market dynamics.

Africa Chocolate Market Synopsis

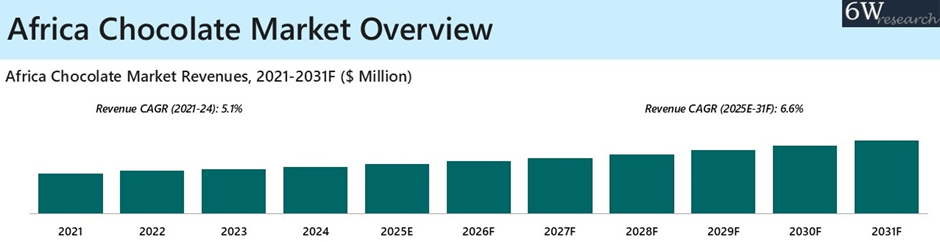

The Africa chocolate market experienced growth between 2021 and 2024, primarily driven by a youthful and rapidly growing population, increasing disposable incomes, urbanization, and shifting dietary habits. With population of Sub-Saharan Africa under the age of 30 the youngest demographic globally, there has been a notable rise in demand for indulgent products such as chocolate. This growing appetite has been reinforced by the strength of the regional food & beverage sector. Further, improved accessibility through expanding retail infrastructure including supermarkets, hypermarkets, and convenience stores combined with the growth of Africa’s e-commerce market, which widened chocolate availability across urban and semi-urban areas. Additionally, Ghana, the world’s second-largest cocoa producer, installed tonnes of domestic cocoa processing capacity to promote local value addition. This significantly contributed to the development of a stronger, more self-sustaining chocolate market across the continent.

According to 6Wresearch, Africa Chocolate Market revenue is projected to grow at a CAGR of 6.6% during 2025-2031, driven by rising health awareness, increasing demand for dark and functional chocolates, and the expansion of the retail along with food & beverage sectors. As health-conscious consumers seek premium and low-sugar options, chocolate manufacturers are innovating to meet evolving tastes. The strong momentum in the F&B sector further supports the growth. Additionally, the plans for retail expansion such as Boxer Superstores' plan to add more outlets in South Africa by 2026 and Casino Group’s strategy to launch convenience stores in Morocco by 2035 would further enhance chocolate availability and accessibility across both urban and emerging consumer markets and position Africa chocolate market in a favourable position.

Market Segmentation By Type

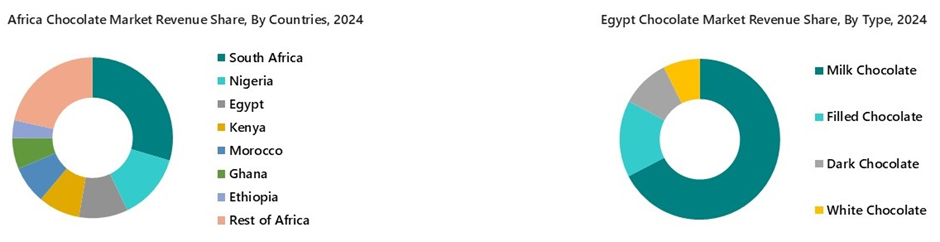

In the coming years, dark chocolate would grow rapidly in Egypt due to rising health awareness among urban consumers, increasing disposable incomes, and the expanding middle class seeking premium products. Additionally, the growing café culture, demand for antioxidant-rich foods, and the influence of global wellness trends combined with improved retail availability would drive its popularity in key cities like Cairo and Alexandria.

Market Segmentation By Nature

In the coming years, organic chocolate would grow rapidly in Egypt due to rising health awareness, increasing lifestyle diseases, and a growing middle class seeking premium, clean-label products. Additionally, government support for organic farming and a rebound in tourism driving demand from luxury hotels and resorts, where international guests prefer organic and sustainable options, would further boost organic chocolate’s market growth in Egypt.

Market Segmentation By Applications

In the coming years, Egypt’s chocolate market in cosmetics and personal care would grow rapidly due to rising beauty consciousness among young consumers, increasing demand for natural and organic products, and the expansion of local wellness centers and spas. Additionally, growing e-commerce penetration and social media influence would boost awareness and accessibility of cocoa-based skincare, aligning with Egypt’s heritage of natural beauty traditions.

Market Segmentation By Countries

By 2031, the online distribution channel is expected to experience the highest growth rate in Nigeria’s chocolate market, driven by increasing internet penetration, widespread smartphone adoption, and the growth of local e-commerce platforms such as Jumia and Konga. Additionally, innovations in digital payment solutions like Flutterwave and Paystack, along with improvements in last-mile delivery services by companies such as Gokada and Max.ng, would further accelerate the growth of online chocolate sales across Nigeria.

Market Segmentation By Distribution Channel

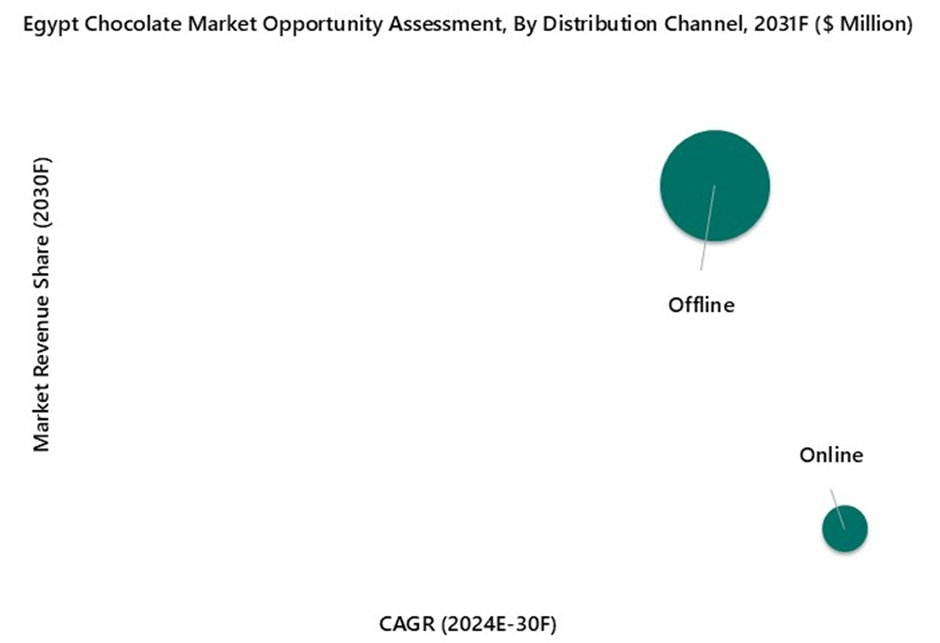

In the coming years, online distribution channel in Egypt's chocolate market would grow rapidly due to rising smartphone penetration, expanding internet access, and increased digital payment adoption. The young, tech-savvy population prefers convenient, home-delivered shopping. Additionally, improving logistics, growing e-commerce platforms, and shifting consumer trust toward online buying, especially post-pandemic, would drive strong growth in Egypt’s online chocolate sales.

Key Attractiveness of the Report

- 10 Years Market Numbers.

- Historical Data Starting from 2021 to 2024

- Base Year: 2024

- Forecast Data until 2031

- Key Performance Indicators Impacting the Market.

- Major Upcoming Developments and Projects.

Key Highlights of the Report:

- Africa Chocolate Market Overview

- Historical Data and Forecast ofAfrica Chocolate MarketRevenues, for the Period 2021-2031F

- Historical Data and Forecast of Egypt, Nigeria, Kenya, Ethiopia, South Africa, Morocco & Ghana Chocolate Market Revenues, By Type, for the Period 2021-2031F

- Historical Data and Forecast of Egypt, Nigeria, Kenya, Ethiopia, South Africa, Morocco & Ghana Chocolate Market Revenues, By Nature, for the Period 2021-2031F

- Historical Data and Forecast of Egypt, Nigeria, Kenya, Ethiopia, South Africa, Morocco & Ghana Chocolate Market Revenues, By Application, for the Period 2021-2031F

- Historical Data and Forecast of Egypt, Nigeria, Kenya, Ethiopia, South Africa, Morocco & Ghana Chocolate Market Revenues, By Distribution Channel, for the Period 2021-2031F

- Historical Data and Forecast of Rest ofAfrica Chocolate MarketRevenues, for the Period 2021-2031F

- Porter’s Five Force Analysis

- Africa Chocolate Market Drivers and Restraints

- Africa Chocolate Market Trends and Evolution

- Market Opportunity Assessmentof Egypt, Nigeria, Kenya, Ethiopia, South Africa, Morocco & Ghana, By Type

- Market Opportunity Assessmentof Egypt, Nigeria, Kenya, Ethiopia, South Africa, Morocco & Ghana, By Nature

- Market Opportunity Assessmentof Egypt, Nigeria, Kenya, Ethiopia, South Africa, Morocco & Ghana, By Application

- Market Opportunity Assessmentof Egypt, Nigeria, Kenya, Ethiopia, South Africa, Morocco & Ghana, By Distribution Channel

- Egypt, Nigeria, Kenya, Ethiopia, South Africa, Morocco & GhanaChocolate Market Revenue Ranking, By Companies

- Africa Chocolate Market Competitive Benchmarking, by Technical and Operating Parameters

- Company Profiles

- Key Strategic Recommendations

Market Scope and Segmentation

Thereportprovides a detailed analysis of the following market segments:

By Type

- Milk Chocolate

- Dark Chocolate

- White Chocolate

- Filled Chocolate

By Nature

- Conventional

- Organic

By Application

- Food and Beverages

- Cosmetics & Personal Care

- Pharmaceuticals

By Distribution Channel

- Offline

- Online

By Countries

- Egypt

- Nigeria

- Kenya

- Ethiopia

- South Africa

- Morocco

- Ghana

Africa Chocolate Market (2025-2031): FAQs

| 1. Executive Summary |

| 2. Introduction |

| 2.1. Key Highlights of the Report |

| 2.2. Report Description |

| 2.3. Market Scope & Segmentation |

| 2.4. Research Methodology |

| 2.5. Assumptions |

| 3. Africa Chocolate Market Overview |

| 3.1. Africa Chocolate Market Revenues, 2021-2031F |

| 3.2. Africa Chocolate Market Revenue Share, By Countries, 2024 & 2031F |

| 3.3. Africa Chocolate Market – Industry Life Cycle |

| 3.4. Africa Chocolate Market – Porter’s Five Forces |

| 4. Africa Chocolate Market Dynamics |

| 4.1. Impact Analysis |

| 4.2. Market Drivers |

| 4.3. Market Restraints |

| 5. Africa Chocolate Market Trends |

| 6. Egypt Chocolate Market Overview |

| 6.1 Egypt Chocolate Market Revenues, 2021-2031F |

| 6.2 Egypt Chocolate Market Revenue Share, By Type, 2024 & 2031F |

| 6.2.1 Egypt Chocolate Market Revenues, By Milk Chocolate, 2021- 2031F |

| 6.2.2 Egypt Chocolate Market Revenues, By Dark Chocolate, 2021- 2031F |

| 6.2.3 Egypt Chocolate Market Revenues, By White Chocolate, 2021- 2031F |

| 6.2.4 Egypt Chocolate Market Revenues, By Filled Chocolate, 2021- 2031F |

| 6.3 Egypt Chocolate Market Revenue Share, By Nature, 2024 & 2031F |

| 6.3.1 Egypt Chocolate Market Revenues, By Conventional, 2021- 2031F |

| 6.3.2 Egypt Chocolate Market Revenues, By Organic, 2021- 2031F |

| 6.4 Egypt Chocolate Market Revenue Share, By Application, 2024 & 2031F |

| 6.4.1 Egypt Chocolate Market Revenues, By Food & Beverages, 2021- 2031F |

| 6.4.2 Egypt Chocolate Market Revenues, By Cosmetics & Personal Care, 2021- 2031F |

| 6.4.3 Egypt Chocolate Market Revenues, By Pharmaceuticals, 2021- 2031F |

| 6.5 Egypt Chocolate Market Revenue Share, By Distribution Channel, 2024 & 2031F |

| 6.5.1 Egypt Chocolate Market Revenues, By Offline, 2021- 2031F |

| 6.5.2 Egypt Chocolate Market Revenues, By Online, 2021- 2031F |

| 6.6 Egypt Chocolate Market Key Performance Indicators |

| 6.7 Egypt Chocolate Market Opportunity Assessment |

| 6.7.1 Egypt Chocolate Market Opportunity Assessment, By Type, 2031F |

| 6.7.2 Egypt Chocolate Market Opportunity Assessment, By Nature, 2031F |

| 6.7.3 Egypt Chocolate Market Opportunity Assessment, By Application, 2031F |

| 6.7.4 Egypt Chocolate Market Opportunity Assessment, By Distribution Channel, 2031F |

| 7. Nigeria Chocolate Market Overview |

| 7.1 Nigeria Chocolate Market Revenues, 2021-2031F |

| 7.2 Nigeria Chocolate Market Revenue Share, By Type, 2024 & 2031F |

| 7.2.1 Nigeria Chocolate Market Revenues, By Milk Chocolate, 2021- 2031F |

| 7.2.2 Nigeria Chocolate Market Revenues, By Dark Chocolate, 2021- 2031F |

| 7.2.3 Nigeria Chocolate Market Revenues, By White Chocolate, 2021- 2031F |

| 7.2.4 Nigeria Chocolate Market Revenues, By Filled Chocolate, 2021- 2031F |

| 7.3 Nigeria Chocolate Market Revenue Share, By Nature, 2024 & 2031F |

| 7.3.1 Nigeria Chocolate Market Revenues, By Conventional, 2021- 2031F |

| 7.3.2 Nigeria Chocolate Market Revenues, By Organic, 2021- 2031F |

| 7.4 Nigeria Chocolate Market Revenue Share, By Application, 2024 & 2031F |

| 7.4.1 Nigeria Chocolate Market Revenues, By Food & Beverages, 2021- 2031F |

| 7.4.2 Nigeria Chocolate Market Revenues, By Cosmetics & Personal Care, 2021- 2031F |

| 7.4.3 Nigeria Chocolate Market Revenues, By Pharmaceuticals, 2021- 2031F |

| 7.5 Nigeria Chocolate Market Revenue Share, By Distribution Channel, 2024 & 2031F |

| 7.5.1 Nigeria Chocolate Market Revenues, By Offline, 2021- 2031F |

| 7.5.2 Nigeria Chocolate Market Revenues, By Online, 2021- 2031F |

| 7.6 Nigeria Chocolate Market Key Performance Indicators |

| 7.7 Nigeria Chocolate Market Opportunity Assessment |

| 7.7.1 Nigeria Chocolate Market Opportunity Assessment, By Type, 2031F |

| 7.7.2 Nigeria Chocolate Market Opportunity Assessment, By Nature, 2031F |

| 7.7.3 Nigeria Chocolate Market Opportunity Assessment, By Application, 2031F |

| 7.7.4 Nigeria Chocolate Market Opportunity Assessment, By Distribution Channel, 2031F |

| 8. Kenya Chocolate Market Overview |

| 8.1 Kenya Chocolate Market Revenues, 2021-2031F |

| 8.2 Kenya Chocolate Market Revenue Share, By Type, 2024 & 2031F |

| 8.2.1 Kenya Chocolate Market Revenues, By Milk Chocolate, 2021- 2031F |

| 8.2.2 Kenya Chocolate Market Revenues, By Dark Chocolate, 2021- 2031F |

| 8.2.3 Kenya Chocolate Market Revenues, By White Chocolate, 2021- 2031F |

| 8.2.4 Kenya Chocolate Market Revenues, By Filled Chocolate, 2021- 2031F |

| 8.3 Kenya Chocolate Market Revenue Share, By Nature, 2024 & 2031F |

| 8.3.1 Kenya Chocolate Market Revenues, By Conventional, 2021- 2031F |

| 8.3.2 Kenya Chocolate Market Revenues, By Organic, 2021- 2031F |

| 8.4 Kenya Chocolate Market Revenue Share, By Application, 2024 & 2031F |

| 8.4.1 Kenya Chocolate Market Revenues, By Food & Beverages, 2021- 2031F |

| 8.4.2 Kenya Chocolate Market Revenues, By Cosmetics & Personal Care, 2021- 2031F |

| 8.4.3 Kenya Chocolate Market Revenues, By Pharmaceuticals, 2021- 2031F |

| 8.5 Kenya Chocolate Market Revenue Share, By Distribution Channel, 2024 & 2031F |

| 8.5.1 Kenya Chocolate Market Revenues, By Offline, 2021- 2031F |

| 8.5.2 Kenya Chocolate Market Revenues, By Online, 2021- 2031F |

| 8.6 Kenya Chocolate Market Key Performance Indicators |

| 8.7 Kenya Chocolate Market Opportunity Assessment |

| 8.7.1 Kenya Chocolate Market Opportunity Assessment, By Type, 2031F |

| 8.7.2 Kenya Chocolate Market Opportunity Assessment, By Nature, 2031F |

| 8.7.3 Kenya Chocolate Market Opportunity Assessment, By Application, 2031F |

| 8.7.4 Kenya Chocolate Market Opportunity Assessment, By Distribution Channel, 2031F |

| 9. Ethiopia Chocolate Market Overview |

| 9.1 Ethiopia Chocolate Market Revenues, 2021-2031F |

| 9.2 Ethiopia Chocolate Market Revenue Share, By Type, 2024 & 2031F |

| 9.2.1 Ethiopia Chocolate Market Revenues, By Milk Chocolate, 2021- 2031F |

| 9.2.2 Ethiopia Chocolate Market Revenues, By Dark Chocolate, 2021- 2031F |

| 9.2.3 Ethiopia Chocolate Market Revenues, By White Chocolate, 2021- 2031F |

| 9.2.4 Ethiopia Chocolate Market Revenues, By Filled Chocolate, 2021- 2031F |

| 9.3 Ethiopia Chocolate Market Revenue Share, By Nature, 2024 & 2031F |

| 9.3.1 Ethiopia Chocolate Market Revenues, By Conventional, 2021- 2031F |

| 9.3.2 Ethiopia Chocolate Market Revenues, By Organic, 2021- 2031F |

| 9.4 Ethiopia Chocolate Market Revenue Share, By Application, 2024 & 2031F |

| 9.4.1 Ethiopia Chocolate Market Revenues, By Food & Beverages, 2021- 2031F |

| 9.4.2 Ethiopia Chocolate Market Revenues, By Cosmetics & Personal Care, 2021- 2031F |

| 9.4.3 Ethiopia Chocolate Market Revenues, By Pharmaceuticals, 2021- 2031F |

| 9.5 Ethiopia Chocolate Market Revenue Share, By Distribution Channel, 2024 & 2031F |

| 9.5.1 Ethiopia Chocolate Market Revenues, By Offline, 2021- 2031F |

| 9.5.2 Ethiopia Chocolate Market Revenues, By Online, 2021- 2031F |

| 9.6 Ethiopia Chocolate Market Key Performance Indicators |

| 9.7 Ethiopia Chocolate Market Opportunity Assessment |

| 9.7.1 Ethiopia Chocolate Market Opportunity Assessment, By Type, 2031F |

| 9.7.2 Ethiopia Chocolate Market Opportunity Assessment, By Nature, 2031F |

| 9.7.3 Ethiopia Chocolate Market Opportunity Assessment, By Application, 2031F |

| 9.7.4 Ethiopia Chocolate Market Opportunity Assessment, By Distribution Channel, 2031F |

| 10. South Africa Chocolate Market Overview |

| 10.1 South Africa Chocolate Market Revenues, 2021-2031F |

| 10.2 South Africa Chocolate Market Revenue Share, By Type, 2024 & 2031F |

| 10.2.1 South Africa Chocolate Market Revenues, By Milk Chocolate, 2021- 2031F |

| 10.2.2 South Africa Chocolate Market Revenues, By Dark Chocolate, 2021- 2031F |

| 10.2.3 South Africa Chocolate Market Revenues, By White Chocolate, 2021- 2031F |

| 10.2.4 South Africa Chocolate Market Revenues, By Filled Chocolate, 2021- 2031F |

| 10.3 South Africa Chocolate Market Revenue Share, By Nature, 2024 & 2031F |

| 10.3.1 South Africa Chocolate Market Revenues, By Conventional, 2021- 2031F |

| 10.3.2 South Africa Chocolate Market Revenues, By Organic, 2021- 2031F |

| 10.4 South Africa Chocolate Market Revenue Share, By Application, 2024 & 2031F |

| 10.4.1 South Africa Chocolate Market Revenues, By Food & Beverages, 2021- 2031F |

| 10.4.2 South Africa Chocolate Market Revenues, By Cosmetics & Personal Care, 2021- 2031F |

| 10.4.3 South Africa Chocolate Market Revenues, By Pharmaceuticals, 2021- 2031F |

| 10.5 South Africa Chocolate Market Revenue Share, By Distribution Channel, 2024 & 2031F |

| 10.5.1 South Africa Chocolate Market Revenues, By Offline, 2021- 2031F |

| 10.5.2 South Africa Chocolate Market Revenues, By Online, 2021- 2031F |

| 10.6 South Africa Chocolate Market Key Performance Indicators |

| 10.7 South Africa Chocolate Market Opportunity Assessment |

| 10.7.1 South Africa Chocolate Market Opportunity Assessment, By Type, 2031F |

| 10.7.2 South Africa Chocolate Market Opportunity Assessment, By Nature, 2031F |

| 10.7.3 South Africa Chocolate Market Opportunity Assessment, By Application, 2031F |

| 10.7.4 South Africa Chocolate Market Opportunity Assessment, By Distribution Channel, 2031F |

| 11. Morocco Chocolate Market Overview |

| 11.1 Morocco Chocolate Market Revenues, 2021-2031F |

| 11.2 Morocco Chocolate Market Revenue Share, By Type, 2024 & 2031F |

| 11.2.1 Morocco Chocolate Market Revenues, By Milk Chocolate, 2021- 2031F |

| 11.2.2 Morocco Chocolate Market Revenues, By Dark Chocolate, 2021- 2031F |

| 11.2.3 Morocco Chocolate Market Revenues, By White Chocolate, 2021- 2031F |

| 11.2.4 Morocco Chocolate Market Revenues, By Filled Chocolate, 2021- 2031F |

| 11.3 Morocco Chocolate Market Revenue Share, By Nature, 2024 & 2031F |

| 11.3.1 Morocco Chocolate Market Revenues, By Conventional, 2021- 2031F |

| 11.3.2 Morocco Chocolate Market Revenues, By Organic, 2021- 2031F |

| 11.4 Morocco Chocolate Market Revenue Share, By Application, 2024 & 2031F |

| 11.4.1 Morocco Chocolate Market Revenues, By Food & Beverages, 2021- 2031F |

| 11.4.2 Morocco Chocolate Market Revenues, By Cosmetics & Personal Care, 2021- 2031F |

| 11.4.3 Morocco Chocolate Market Revenues, By Pharmaceuticals, 2021- 2031F |

| 11.5 Morocco Chocolate Market Revenue Share, By Distribution Channel, 2024 & 2031F |

| 11.5.1 Morocco Chocolate Market Revenues, By Offline, 2021- 2031F |

| 11.5.2 Morocco Chocolate Market Revenues, By Online, 2021- 2031F |

| 11.6 Morocco Chocolate Market Key Performance Indicators |

| 11.7 Morocco Chocolate Market Opportunity Assessment |

| 11.7.1 Morocco Chocolate Market Opportunity Assessment, By Type, 2031F |

| 11.7.2 Morocco Chocolate Market Opportunity Assessment, By Nature, 2031F |

| 11.7.3 Morocco Chocolate Market Opportunity Assessment, By Application, 2031F |

| 11.7.4 Morocco Chocolate Market Opportunity Assessment, By Distribution Channel, 2031F |

| 12. Ghana Chocolate Market Overview |

| 12.1 Ghana Chocolate Market Revenues, 2021-2031F |

| 12.2 Ghana Chocolate Market Revenue Share, By Type, 2024 & 2031F |

| 12.2.1 Ghana Chocolate Market Revenues, By Milk Chocolate, 2021- 2031F |

| 12.2.2 Ghana Chocolate Market Revenues, By Dark Chocolate, 2021- 2031F |

| 12.2.3 Ghana Chocolate Market Revenues, By White Chocolate, 2021- 2031F |

| 12.2.4 Ghana Chocolate Market Revenues, By Filled Chocolate, 2021- 2031F |

| 12.3 Ghana Chocolate Market Revenue Share, By Nature, 2024 & 2031F |

| 12.3.1 Ghana Chocolate Market Revenues, By Conventional, 2021- 2031F |

| 12.3.2 Ghana Chocolate Market Revenues, By Organic, 2021- 2031F |

| 12.4 Ghana Chocolate Market Revenue Share, By Application, 2024 & 2031F |

| 12.4.1 Ghana Chocolate Market Revenues, By Food & Beverages, 2021- 2031F |

| 12.4.2 Ghana Chocolate Market Revenues, By Cosmetics & Personal Care, 2021- 2031F |

| 12.4.3 Ghana Chocolate Market Revenues, By Pharmaceuticals, 2021- 2031F |

| 12.5 Ghana Chocolate Market Revenue Share, By Distribution Channel, 2024 & 2031F |

| 12.5.1 Ghana Chocolate Market Revenues, By Offline, 2021- 2031F |

| 12.5.2 Ghana Chocolate Market Revenues, By Online, 2021- 2031F |

| 12.6 Ghana Chocolate Market Key Performance Indicators |

| 12.7 Ghana Chocolate Market Opportunity Assessment |

| 12.7.1 Ghana Chocolate Market Opportunity Assessment, By Type, 2031F |

| 12.7.2 Ghana Chocolate Market Opportunity Assessment, By Nature, 2031F |

| 12.7.3 Ghana Chocolate Market Opportunity Assessment, By Application, 2031F |

| 12.7.4 Ghana Chocolate Market Opportunity Assessment, By Distribution Channel, 2031F |

| 13. Rest of Africa Chocolate Market Overview |

| 13.1 Rest of Africa Chocolate Market Revenues, 2021-2031F |

| 14. Africa Chocolate Market Competitive Landscape |

| 14.1 Egypt/ Nigeria/ Kenya/ Ethiopia/ South Africa/ Morocco/ Ghana Market Revenue Share, By Top 3/5 Companies, CY2024 |

| 14.2 Africa Chocolate Market Key Companies Competitive Benchmarking, By Technical Parameters |

| 14.3 Africa Chocolate Market Key Companies Competitive Benchmarking, By Operating Parameters |

| 15. Company Profiles |

| 16. Key Strategic Recommendations |

| 17. Disclaimer |

| List of Figures |

| Figure 1: Africa Chocolate Market Revenues, 2021-2031F ($ Million) |

| Figure 2: Africa Chocolate Market Revenue Share, By Countries, 2024 & 2031F |

| Figure 3: Africa Disposable Income Per Capita, in $, (2022-2050) |

| Figure 4: Africa New Store Opening In Modern Trade Segment, (2020-2023) |

| Figure 5: Africa Ecommerce Users In Millions And Ecommerce Penetration Rate In %, (2021-2025) |

| Figure 6: South Africa Chocolate Market Revenues, 2021-2031F ($ Million) |

| Figure 7: Egypt Chocolate Market Revenue Share, By Type, 2024 & 2031F |

| Figure 8: Egypt Chocolate Market Revenue Share, By Nature, 2024 & 2031F |

| Figure 9: Egypt Chocolate Market Revenue Share, By Application, 2024 & 2031F |

| Figure 10: Egypt Chocolate Market Revenue Share, By Distribution Channel, 2024 & 2031F |

| Figure 11: Egypt Food And Beverage Sector Growth, In $ billion (2024-28) |

| Figure 12: Egypt Chocolate Market Opportunity Assessment, By Type, 2031F ($ Million) |

| Figure 13: Egypt Chocolate Market Opportunity Assessment, By Nature, 2031F ($ Million) |

| Figure 14: Egypt Chocolate Market Opportunity Assessment, By Application, 2031F ($ Million) |

| Figure 15: Egypt Chocolate Market Opportunity Assessment, By Distribution Channel, 2031F ($ Million) |

| Figure 16: Nigeria Chocolate Market Revenues, 2021-2031F ($ Million) |

| Figure 17: Nigeria Chocolate Market Revenue Share, By Type, 2024 & 2031F |

| Figure 18: Nigeria Chocolate Market Revenue Share, By Nature, 2024 & 2031F |

| Figure 19: Nigeria Chocolate Market Revenue Share, By Application, 2024 & 2031F |

| Figure 20: Nigeria Chocolate Market Revenue Share, By Distribution Channel, 2024 & 2031F |

| Figure 21: Nigeria Food & Beverages Sector Outlook 2023 |

| Figure 22: Nigeria Spending on Food 2020-2025E ($ Billion) |

| Figure 23: Nigeria Spending on Non-Alcoholic Drink 2020-2025E ($ Billion) |

| Figure 24: Nigeria Packaged Food Retail Sales 2019-2028F ($ Billion) |

| Figure 25: Nigeria Chocolate Market Opportunity Assessment, By Type, 2031F ($ Million) |

| Figure 26: Nigeria Chocolate Market Opportunity Assessment, By Nature, 2031F ($ Million) |

| Figure 27: Nigeria Chocolate Market Opportunity Assessment, By Application, 2031F ($ Million) |

| Figure 28: Nigeria Chocolate Market Opportunity Assessment, By Distribution Channel, 2031F ($ Million) |

| Figure 29: Kenya Chocolate Market Revenues, 2021-2031F ($ Million) |

| Figure 30: Kenya Chocolate Market Revenue Share, By Type, 2024 & 2031F |

| Figure 31: Kenya Chocolate Market Revenue Share, By Nature, 2024 & 2031F |

| Figure 32: Kenya Chocolate Market Revenue Share, By Application, 2024 & 2031F |

| Figure 33: Kenya Chocolate Market Revenue Share, By Distribution Channel, 2024 & 2031F |

| Figure 34: Kenya Food & Beverages Sector Contribution to GDP 2020-2023 (%) |

| Figure 35: Kenya Quantum Indices of Bakery Products 2019-2023 |

| Figure 36: Kenya Quantum Indices of Cocoa, Chocolate and Sugar Confectionery 2019-2023 |

| Figure 37: Kenya Quantum Indices of Beverages Products 2019-2023 |

| Figure 38: Kenya Chocolate Market Opportunity Assessment, By Type, 2031F ($ Million) |

| Figure 39: Kenya Chocolate Market Opportunity Assessment, By Nature, 2031F ($ Million) |

| Figure 40: Kenya Chocolate Market Opportunity Assessment, By Application, 2031F ($ Million) |

| Figure 41: Kenya Chocolate Market Opportunity Assessment, By Distribution Channel, 2031F ($ Million) |

| Figure 42: Ethiopia Chocolate Market Revenues, 2021-2031F ($ Million) |

| Figure 43: Ethiopia Chocolate Market Revenue Share, By Type, 2024 & 2031F |

| Figure 44: Ethiopia Chocolate Market Revenue Share, By Nature, 2024 & 2031F |

| Figure 45: Ethiopia Chocolate Market Revenue Share, By Application, 2024 & 2031F |

| Figure 46: Ethiopia Chocolate Market Revenue Share, By Distribution Channel, 2024 & 2031F |

| Figure 47: Ethiopia Palm Oil Imports, Q1 2023 – Q1 2024, (MT 000’s) |

| Figure 48: Ethiopia's packaged food retail sales, 2023-28F, ($ Billion) |

| Figure 49: Ethiopia Chocolate Market Opportunity Assessment, By Type, 2031F ($ Million) |

| Figure 50: Ethiopia Chocolate Market Opportunity Assessment, By Nature, 2031F ($ Million) |

| Figure 51: Ethiopia Chocolate Market Opportunity Assessment, By Application, 2031F ($ Million) |

| Figure 52: Ethiopia Chocolate Market Opportunity Assessment, By Distribution Channel, 2031F ($ Million) |

| Figure 53: South Africa Chocolate Market Revenues, 2021-2031F ($ Million) |

| Figure 54: South Africa Chocolate Market Revenue Share, By Type, 2024 & 2031F |

| Figure 55: South Africa Chocolate Market Revenue Share, By Nature, 2024 & 2031F |

| Figure 56: South Africa Chocolate Market Revenue Share, By Application, 2024 & 2031F |

| Figure 57: South Africa Chocolate Market Revenue Share, By Distribution Channel, 2024 & 2031F |

| Figure 58: South Africa Food and beverages income at constant prices by type of enterprise, in $ Million, (2023-2025) |

| Figure 59: South Africa Food And Beverages Income At Current Prices, in $ Million, (2021-2024) |

| Figure 60: South Africa Chocolate Market Opportunity Assessment, By Type, 2031F ($ Million) |

| Figure 61: South Africa Chocolate Market Opportunity Assessment, By Nature, 2031F ($ Million) |

| Figure 62: South Africa Chocolate Market Opportunity Assessment, By Application, 2031F ($ Million) |

| Figure 63: South Africa Chocolate Market Opportunity Assessment, By Distribution Channel, 2031F ($ Million) |

| Figure 64: Morocco Chocolate Market Revenues, 2021-2031F ($ Million) |

| Figure 65: Morocco Chocolate Market Revenue Share, By Type, 2024 & 2031F |

| Figure 66: Morocco Chocolate Market Revenue Share, By Nature, 2024 & 2031F |

| Figure 67: Morocco Chocolate Market Revenue Share, By Application, 2024 & 2031F |

| Figure 68: Morocco Chocolate Market Revenue Share, By Distribution Channel, 2024 & 2031F |

| Figure 69: Morocco Packaged Food Retail Sales 2019-2028F ($ Billion) |

| Figure 70: Morocco Baked Goods Retail Sales 2019-2028F ($ Million) |

| Figure 71: Morocco Confectionery Retail Sales 2019-2028F ($ Million) |

| Figure 72: Morocco Chocolate Market Opportunity Assessment, By Type, 2031F ($ Million) |

| Figure 73: Morocco Chocolate Market Opportunity Assessment, By Nature, 2031F ($ Million) |

| Figure 74: Morocco Chocolate Market Opportunity Assessment, By Application, 2031F ($ Million) |

| Figure 75: Morocco Chocolate Market Opportunity Assessment, By Distribution Channel, 2031F ($ Million) |

| Figure 76: Ghana Chocolate Market Revenues, 2021-2031F ($ Million) |

| Figure 77: Ghana Chocolate Market Revenue Share, By Type, 2024 & 2031F |

| Figure 78: Ghana Chocolate Market Revenue Share, By Nature, 2024 & 2031F |

| Figure 79: Ghana Chocolate Market Revenue Share, By Application, 2024 & 2031F |

| Figure 80: Ghana Chocolate Market Revenue Share, By Distribution Channel, 2024 & 2031F |

| Figure 81: Ghana Cocoa Bean Production, FY24-FY25, In Metric Tons |

| Figure 82: Ghana Retail Food & Beverage Market Share, 2023 |

| Figure 83: Ghana Chocolate Market Opportunity Assessment, By Type, 2031F ($ Million) |

| Figure 84: Ghana Chocolate Market Opportunity Assessment, By Nature, 2031F ($ Million) |

| Figure 85: Ghana Chocolate Market Opportunity Assessment, By Application, 2031F ($ Million) |

| Figure 86: Ghana Chocolate Market Opportunity Assessment, By Distribution Channel, 2031F ($ Million) |

| Figure 87: Rest of Africa Chocolate Market Revenues, 2021-2031F ($ Million) |

| Figure 88: Egypt Top 3 Chocolate Company Revenue Share, 2024 |

| Figure 89: Nigeria Top 3 Chocolate Company Revenue Share, 2024 |

| Figure 90: Kenya Top 3 Chocolate Company Revenue Share, 2024 |

| Figure 91: Ethiopia Top 3 Chocolate Company Revenue Share, 2024 |

| Figure 92: South Africa Top 3 Chocolate Company Revenue Share, 2024 |

| Figure 93: Morocco Top 3 Chocolate Company Revenue Share, 2024 |

| Figure 94: Ghana Top 3 Chocolate Company Revenue Share, 2024 |

| List of Tables |

| 1. Africa Chocolate Market Revenues, By Countries, 2021-2031F, ($ Million) |

| 2. Africa’s Population and Urbanization Outlook (2025-2050) |

| 3. Africa Upcoming Retail Stores Expansion Projects |

| 4. Egypt Chocolate Market Revenues, By Type, 2021-2031F, ($ Million) |

| 5. Egypt Chocolate Market Revenues, By Nature, 2021-2031F, ($ Million) |

| 6. Egypt Chocolate Market Revenues, By Application, 2021-2031F, ($ Million) |

| 7. Egypt Chocolate Market Revenues, By Distribution Channel, 2021-2031F, ($ Million) |

| 8. Nigeria Chocolate Market Revenues, By Type, 2021-2031F, ($ Million) |

| 9. Nigeria Chocolate Market Revenues, By Nature, 2021-2031F, ($ Million) |

| 10. Nigeria Chocolate Market Revenues, By Application, 2021-2031F, ($ Million) |

| 11. Nigeria Chocolate Market Revenues, By Distribution Channel, 2021-2031F, ($ Million) |

| 12. Kenya Chocolate Market Revenues, By Type, 2021-2031F, ($ Million) |

| 13. Kenya Chocolate Market Revenues, By Nature, 2021-2031F, ($ Million) |

| 14. Kenya Chocolate Market Revenues, By Application, 2021-2031F, ($ Million) |

| 15. Kenya Chocolate Market Revenues, By Distribution Channel, 2021-2031F, ($ Million) |

| 16. Ethiopia Chocolate Market Revenues, By Type, 2021-2031F, ($ Million) |

| 17. Ethiopia Chocolate Market Revenues, By Nature, 2021-2031F, ($ Million) |

| 18. Ethiopia Chocolate Market Revenues, By Application, 2021-2031F, ($ Million) |

| 19. Ethiopia Chocolate Market Revenues, By Distribution Channel, 2021-2031F, ($ Million) |

| 20. South Africa Chocolate Market Revenues, By Type, 2021-2031F, ($ Million) |

| 21. South Africa Chocolate Market Revenues, By Nature, 2021-2031F, ($ Million) |

| 22. South Africa Chocolate Market Revenues, By Application, 2021-2031F, ($ Million) |

| 23. South Africa Chocolate Market Revenues, By Distribution Channel, 2021-2031F, ($ Million) |

| 24. Morocco Chocolate Market Revenues, By Type, 2021-2031F, ($ Million) |

| 25. Morocco Chocolate Market Revenues, By Nature, 2021-2031F, ($ Million) |

| 26. Morocco Chocolate Market Revenues, By Application, 2021-2031F, ($ Million) |

| 27. Morocco Chocolate Market Revenues, By Distribution Channel, 2021-2031F, ($ Million) |

| 28. Ghana Chocolate Market Revenues, By Type, 2021-2031F, ($ Million) |

| 29. Ghana Chocolate Market Revenues, By Nature, 2021-2031F, ($ Million) |

| 30. Ghana Chocolate Market Revenues, By Application, 2021-2031F, ($ Million) |

| 31. Ghana Chocolate Market Revenues, By Distribution Channel, 2021-2031F, ($ Million) |

Market Forecast By Product Types (Dark Chocolate, Milk Chocolate, White Chocolate), By Chocolate Type (Count Lines & Straight Lines, Molded or Bar Chocolates, Choco-Panned & Sugar Panned and Others including Box Chocolates and Novelties), By Distribution Channels (Supermarket and Hypermarkets, Convenience Stores, Online Channels, Grocery/ Mom n Pop Stores and Others including Specialized Retailers, Pharmacy etc), By Counties (South Africa and Rest of Africa) and Competitive Landscape

| Product Code: ETC001572 | Publication Date: Feb 2023 | Product Type: Report | |

| Publisher: 6Wresearch | No. of Pages: 150 | No. of Figures: 7 | No. of Tables: 3 |

Latest 2023 Development of the Africa Chocolate Market

Africa Chocolate Market is a rapidly growing industry along with many new developments undergone over the years. Some of the latest trends in the chocolate market of Africa are the development of new chocolate products such as dark chocolate with African spices, milk chocolate with African nuts, and white chocolate with African fruits. This expansion of chocolates is helping to differentiate African chocolate from other chocolate products and create a unique identity for the Africa Chocolate Industry.

Many African countries are increasing their chocolate production to meet the growing demand for both domestic and international purposes. This has led to a significant increase in exports and has helped to boost the economies. The focus on sustainable and ethical sourcing by many African chocolate companies includes paying fair prices for the cocoa, sourcing cocoa from farmers who use sustainable agriculture techniques and promoting environment-friendly production methods. African companies are expanding into new markets within Africa and across the globe. This is helping to increase their reach and boost sales for chocolates. The Africa Chocolate Industry is poised for continued growth as new developments and projects are further promoting Africa chocolate products.

Africa Chocolate Market Synopsis

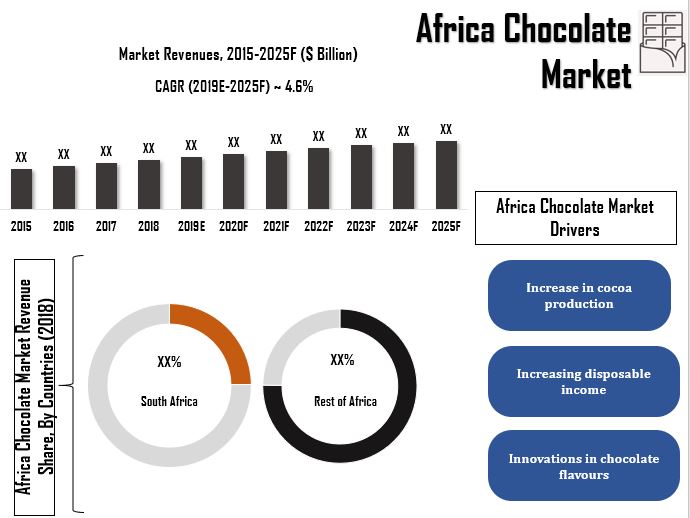

Africa Chocolate market is projected to grow over the coming years due to cocoa production and the rising disposable income of middle-class consumers. Africa holds a dominant share in the world’s cocoa production as it is one of the major suppliers of cocoa beans, However, the region has been estranged from consuming by-products of cocoa such as chocolate for many years but strong growth is expected in Africa’s chocolate consumption patterns. The growth rate of chocolate consumption in African countries is comparable with that of China and India, the two fastest-growing chocolate markets in the world.

According to 6Wresearch, the Africa Chocolate market size is projected to grow at a CAGR of 4.6% during 2019–2025. This is due to remarkable improvements in economic growth, expanding modern retail shops, rapid urbanization, and a possible preference towards Westernized taste. Moreover, increasing investment by companies in attractive packaging would further propel the market growth during the forecast period.

In terms of regions, South Africa dominated the Africa Chocolate market owing to the presence of a large number of companies dealing in the product as compared to other countries as well as increased consumer demand in the region. Additionally, supermarkets and hypermarkets are the dominant distribution channels and are expected to register maximum growth over the coming years as well owing to a variety of chocolates and promotional schemes available in the region.

The Africa Chocolate market report comprehensively covers the market by product type, distribution channels, Chocolate type, and by key countries including South Africa. The Africa Chocolate market outlook report provides an unbiased and detailed analysis of the Africa Chocolate market trends, Africa Chocolate market share, opportunities, high growth areas, and market drivers which would help the stakeholders to device and align their market strategies according to the current and future market dynamics.

The Africa chocolate market is anticipated to grow fast in the upcoming years, on the back of one factor is Cocoa which plays a significant role in raising the sale of chocolate in the Africa market. Africa carries a large production centre in the planting of cocoa which intended an easy availability of highly rich cocoa chocolate registered to a larger scope of growth of Africa chocolate market. Moreover, People carry different preferences which are categorized into several product forms i.e milk chocolate, white chocolate, and dark chocolate. And in Africa, the availability is intended to raise the demand for dark chocolate more which leads to an increase in the growth rate of the chocolate market in Africa in upcoming years.

Key Highlights of the Report:

- Africa Chocolate Market Overview

- Africa Chocolate Market Outlook

- Africa Chocolate Market Forecast

- Historical Data of Africa Chocolate Market Revenues for the Period 2015-2018

- Africa Chocolate Market Size & Africa Chocolate Market Forecast of Revenues, Until 2025

- Historical Data of Africa Chocolate Market Revenues, By Product Type, for the Period 2015-2018

- Market Size & Forecast of Africa Chocolate Market Revenues, By Product Type, Until 2025

- Historical Data of Africa Chocolate Market Revenues, By Distribution Channels, for the Period 2015-2018

- Market Size & Forecast of Africa Chocolate Market Revenues, By Distribution Channels, Until 2025

- Historical Data of Africa Chocolate Market Revenues, By Chocolate Type, for the Period 2015-2018

- Market Size & Forecast of Africa Chocolate Market Revenues, By Chocolate Type, Until 2025

- Historical Data of South Africa Chocolate Market Revenues and Volume, for the Period 2015-2018

- Market Size & Forecast of the South Africa Chocolate Market Revenues, Until 2025

- Market Drivers and Restraints

- Africa Chocolate Market Price Trends

- Africa Chocolate Market Trends and Industry Life Cycle

- Porter’s Five Force Analysis

- Market Opportunity Assessment

- Africa Chocolate Market Share, By Countries

- Africa Chocolate Market Share, By Players

- Africa Chocolate Market Overview on Competitive Benchmarking

- Company Profiles

- Key Strategic Recommendations

Markets Covered

The Africa Chocolate market report provides a detailed analysis of the following market segments:

By Product Type

- Milk Chocolate

- White Chocolate

- Dark Chocolate

By Distribution Channels

- Supermarkets/ Hypermarkets

- Grocery/Mom-n-Pop Stores

- Convenience Stores

- Online Channel

- Others (Specialized Retailers, pharmacies, etc.)

By Chocolate Type

- Count lines & Straight lines

- Molded or Bar Chocolates

- Choco-panned & Sugar panned

- Others (Box chocolates, novelties)

By Countries

- South Africa

- Rest of Africa

- Single User License$ 4,560

- Department License$ 5,055

- Site License$ 5,595

- Global License$ 6,000

Search

Thought Leadership and Analyst Meet

Our Clients

Related Reports

- Afghanistan Apparel Market (2026-2032) | Growth, Outlook, Industry, Segmentation, Forecast, Size, Companies, Trends, Value, Share, Analysis & Revenue

- Canada Oil and Gas Market (2026-2032) | Share, Segmentation, Value, Industry, Trends, Forecast, Analysis, Size & Revenue, Growth, Competitive Landscape, Outlook, Companies

- Germany Breakfast Food Market (2026-2032) | Industry, Share, Growth, Size, Companies, Value, Analysis, Revenue, Trends, Forecast & Outlook

- Australia Briquette Market (2025-2031) | Growth, Size, Revenue, Forecast, Analysis, Trends, Value, Share, Industry & Companies

- Vietnam System Integrator Market (2025-2031) | Size, Companies, Analysis, Industry, Value, Forecast, Growth, Trends, Revenue & Share

- ASEAN and Thailand Brain Health Supplements Market (2025-2031) | Strategy, Consumer Insights, Analysis, Investment Trends, Opportunities, Growth, Size, Share, Industry, Revenue, Segments, Value, Segmentation, Supply, Forecast, Restraints, Outlook, Competition, Drivers, Trends, Demand, Pricing Analysis, Competitive, Strategic Insights, Companies, Challenges

- ASEAN Bearings Market (2025-2031) | Strategy, Consumer Insights, Analysis, Investment Trends, Opportunities, Growth, Size, Share, Industry, Revenue, Segments, Value, Segmentation, Supply, Forecast, Restraints, Outlook, Competition, Drivers, Trends, Demand, Pricing Analysis, Competitive, Strategic Insights, Companies, Challenges

- Europe Flooring Market (2025-2031) | Outlook, Share, Industry, Trends, Forecast, Companies, Revenue, Size, Analysis, Growth & Value

- Saudi Arabia Manlift Market (2025-2031) | Outlook, Size, Growth, Trends, Companies, Industry, Revenue, Value, Share, Forecast & Analysis

- Uganda Excavator, Crane, and Wheel Loaders Market (2025-2031) | Strategy, Consumer Insights, Analysis, Investment Trends, Opportunities, Growth, Size, Share, Industry, Revenue, Segments, Value, Segmentation, Supply, Forecast, Restraints, Outlook, Competition, Drivers, Trends, Demand, Pricing Analysis, Competitive, Strategic Insights, Companies, Challenges

Industry Events and Analyst Meet

Whitepaper

- Middle East & Africa Commercial Security Market Click here to view more.

- Middle East & Africa Fire Safety Systems & Equipment Market Click here to view more.

- GCC Drone Market Click here to view more.

- Middle East Lighting Fixture Market Click here to view more.

- GCC Physical & Perimeter Security Market Click here to view more.

6WResearch In News

- Doha a strategic location for EV manufacturing hub: IPA Qatar

- Demand for luxury TVs surging in the GCC, says Samsung

- Empowering Growth: The Thriving Journey of Bangladesh’s Cable Industry

- Demand for luxury TVs surging in the GCC, says Samsung

- Video call with a traditional healer? Once unthinkable, it’s now common in South Africa

- Intelligent Buildings To Smooth GCC’s Path To Net Zero