Bangladesh Sugar Market (2025-2031) | Revenue, Analysis, Companies, Forecast, Share, Value, Industry, Outlook, Trends, Size & Growth

Market Forecast By Types (White Sugar, Brown Sugar, Liquid Sugar), By Form (Granulated Sugar, Powdered Sugar, Syrup Sugar), By End -Users (Food and Beverages, Pharma and Personal Care, Household), By Sources (Sugarcane, Sugarbeet) And Competitive Landscape

| Product Code: ETC045432 | Publication Date: Jan 2021 | Updated Date: Apr 2025 | Product Type: Report | |

| Publisher: 6Wresearch | Author: Ravi Bhandari | No. of Pages: 70 | No. of Figures: 35 | No. of Tables: 5 |

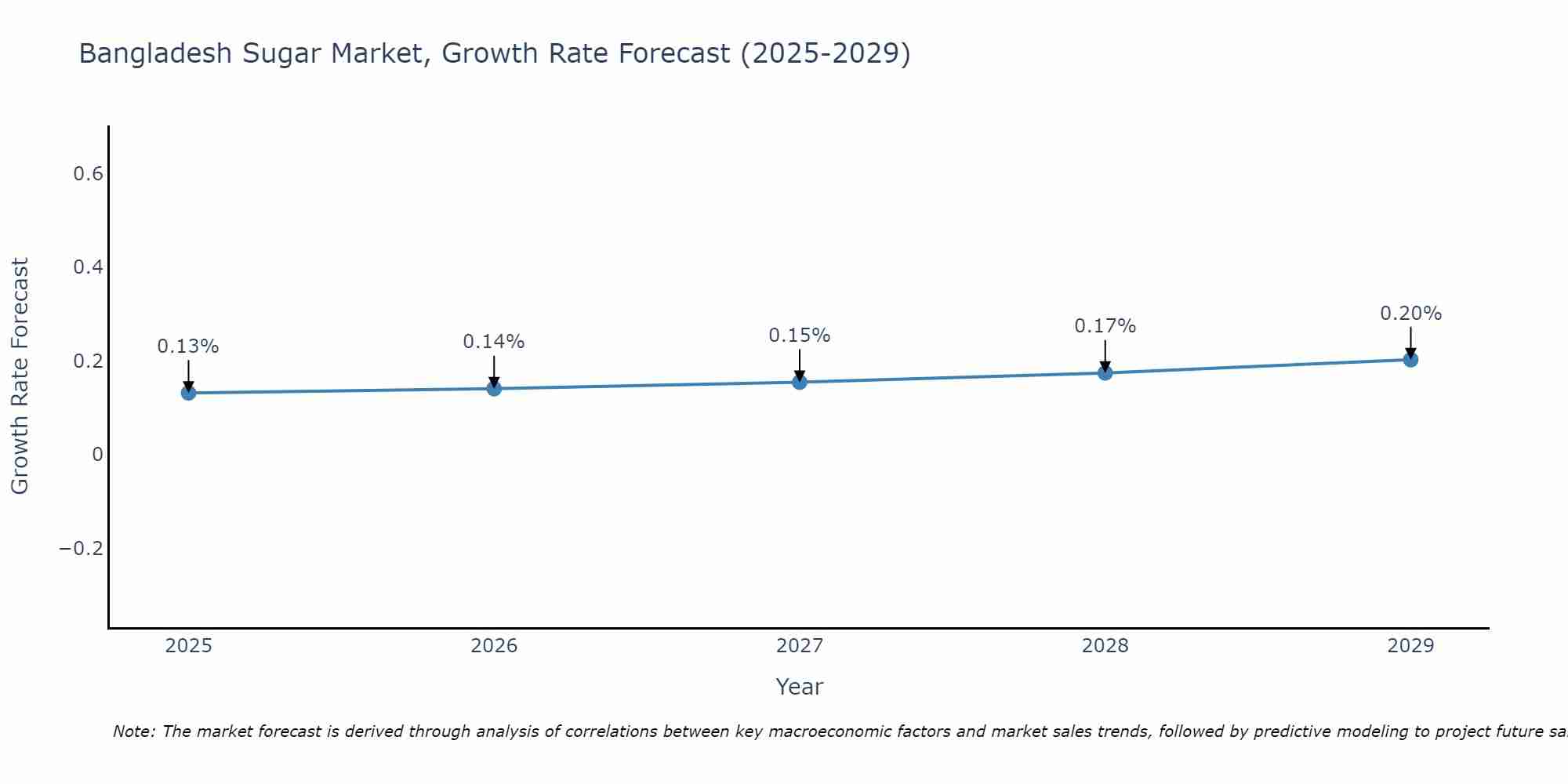

Bangladesh Sugar Market Size Growth Rate

The Bangladesh Sugar Market is poised for steady growth rate improvements from 2025 to 2029. From 0.13% in 2025, the growth rate steadily ascends to 0.20% in 2029.

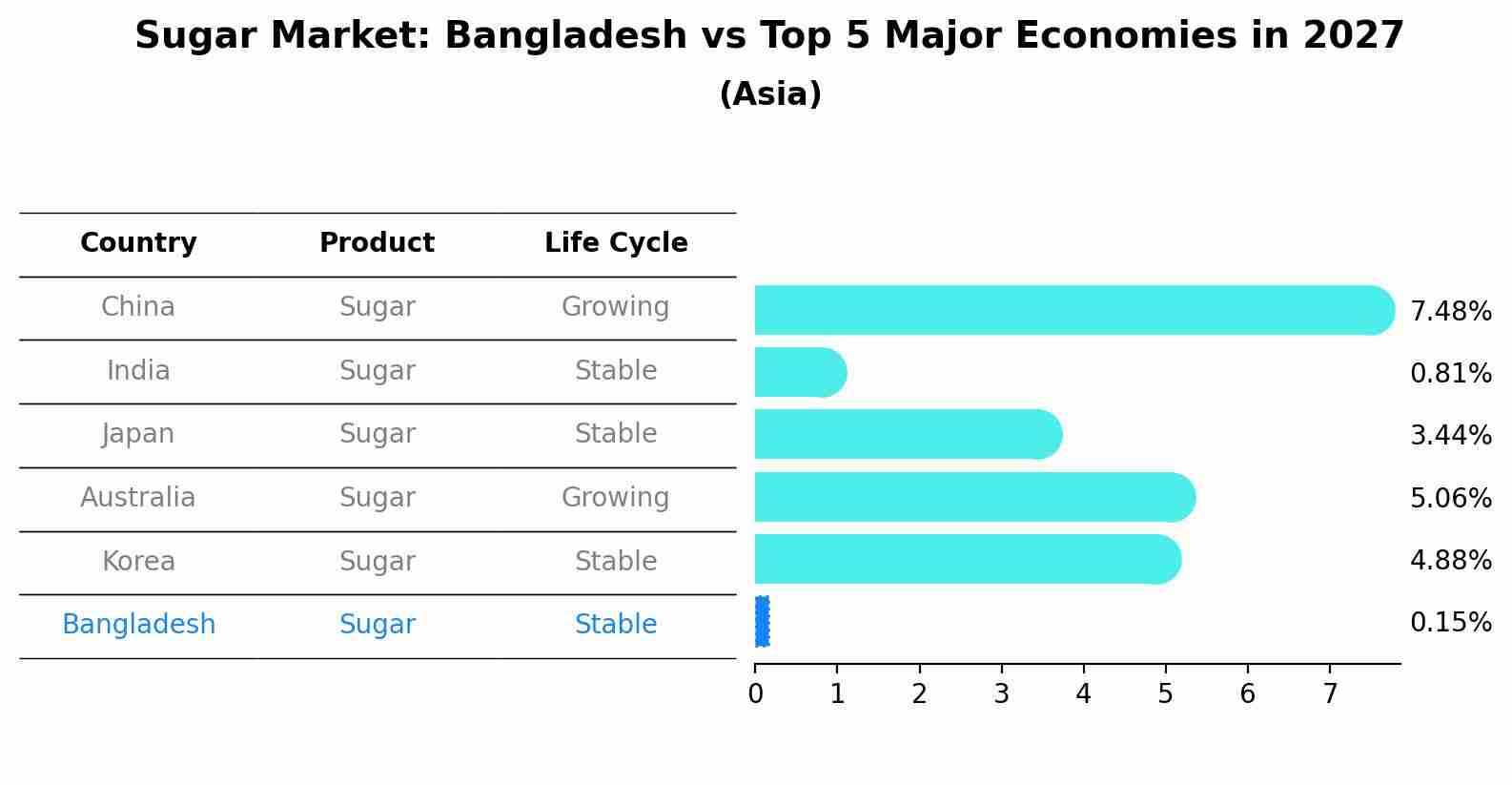

Sugar Market: Bangladesh vs Top 5 Major Economies in 2027 (Asia)

By 2027, the Sugar market in Bangladesh is anticipated to reach a growth rate of 0.15%, as part of an increasingly competitive Asia region, where China remains at the forefront, supported by India, Japan, Australia and South Korea, driving innovations and market adoption across sectors.

Topics Covered in Bangladesh Sugar Market Report

Bangladesh Sugar Market Report thoroughly covers the market By Types, By Form, By End -Users, By Sources. The market report provides an unbiased and detailed analysis of the ongoing market trends, opportunities/high growth areas, and market drivers which would help the stakeholders to devise and align their market strategies according to the current and future market dynamics.

Bangladesh Sugar Market Synopsis

The sugar market in Bangladesh plays a significant role in the country’s economy, catering to both consumer demand and industrial requirements. The market is primarily dependent on imports as domestic production only meets a small portion of the total demand. Sugar consumption in Bangladesh is driven largely by the food and beverage industry, as well as direct household usage. The growing population, coupled with rapid urbanization, has led to an increasing demand for sugar in both household and industrial applications and steady growth of the food processing and beverage sector is a major driver for sugar consumption

According to 6Wresearch, The Bangladesh Sugar Market Size is expected to reach a significant CAGR of 2.5% during the forecast period 2025-2031. Bangladesh Sugar Market is one of the prominent markets as the country produces a portion of its sugar domestically, primarily from sugarcane cultivation. However, the country often relies on imports to meet its domestic demand. The government of Bangladesh implement policies related to import duties and subsidies to regulate the Bangladesh Sugar Market size and ensure fair pricing for consumers. The price of sugar can be influenced by international market trends, weather conditions affecting local production, and government policies.

The Bangladesh sugar market faces several challenges, including fluctuations in global sugar prices, import duties and taxes, and competition from alternative sweeteners. The country's heavy reliance on imports leaves it vulnerable to changes in international market conditions, making it challenging for local manufacturers to maintain consistent pricing. Additionally, the government imposes high import duties and taxes on imported sugar to protect domestic producers, which can further increase the cost of imported sugar products. Moreover, alternative sweeteners such as artificial sweeteners and natural substitutes like jaggery pose a threat to the demand for traditional refined sugar.

Bangladesh Sugar Market Trends

The Bangladesh sugar market growth, driven by rising demand from both industrial and household sectors. Increased urbanization and changing consumer preferences have boosted the consumption of sugar-based products. The Bangladesh sugar market share is heavily influenced by local production and imports, with imports fulfilling a substantial portion of domestic demand due to limited local supply. Additionally, government policies and pricing strategies play a critical role in shaping the market dynamics. As the demand continues to rise, market players are exploring innovative solutions for sustainable production and efficient distribution to strengthen their position in The Sugar Market In Bangladesh .

Investment Opportunities in Bangladesh Sugar Market

Bangladesh’s sugar market presents significant investment opportunities driven by rising demand, a growing population, and evolving consumer preferences. Despite an increase in local demand, the country remains heavily reliant on imported sugar to fulfill supply gaps. This dependence creates room for investments in developing modern sugar refineries, improving agricultural practices for sugarcane cultivation, and fostering resilient supply chain infrastructures.

Additionally, advancements in technology could pave the way for the production of alternative sugars and low-calorie sweeteners, catering to the increasing health-conscious consumer base. Government initiatives supporting agribusiness and favorable policies provide further incentives for investors to tap into this sector. With strategic investments aimed at reducing imports and modernizing production, the Bangladesh sugar market holds promise for sustainable growth and long-term profitability. Entrepreneurs and stakeholders looking to align with the country's economic development can explore this thriving industry for impactful and rewarding opportunities.

Leading Players in the Bangladesh Sugar Market

The Bangladesh sugar market is dominated by both local producers and international imports, with a mix of public and private entities shaping the sector. The state-run Bangladesh Sugar and Food Industries Corporation (BSFIC) remains a central player, overseeing the production and supply of sugar from domestic mills. Additionally, major private enterprises like City Group and Meghna Group of Industries contribute significantly, focusing on refining and importing high volumes of sugar to meet growing demand.

The market also relies heavily on imports from international suppliers, particularly from countries like Brazil and India, to bridge the gap between local production and consumption. With shifting consumer preferences and industrial requirements, these key players continue to shape the dynamics of the sugar industry in Bangladesh.

Government Regulations

The sugar market in Bangladesh is significantly influenced by government regulations aimed at ensuring price stability and sufficient supply. The government often sets import duties and quotas to control the influx of foreign sugar, balancing local production with demand. Subsidies are occasionally provided to domestic sugar mills to support local industries and maintain competitiveness. Price controls are implemented to keep sugar affordable for consumers, preventing market distortions caused by speculation or supply shortages. Additionally, regulatory bodies enforce quality standards for both imported and locally produced sugar to ensure public health is not compromised. These measures collectively aim to provide a stable and fair market environment, though challenges such as smuggling and inefficiencies in production remain major concerns.

Future Insights the Bangladesh Sugar Market

The Bangladesh sugar market is poised for steady growth in the future, driven by rising population numbers and increasing urbanization. Demand for sugar continues to rise due to its significance in household consumption, processed foods, and beverages. However, challenges such as fluctuating global sugar prices and dependency on imports could impact the market’s stability. Investments in modernizing production facilities and diversifying sugarcane byproducts, such as ethanol, are expected to create new opportunities for local sugar industries.

Additionally, a growing focus on healthier sugar alternatives may influence consumer habits and drive innovation within the market. Government policies aimed at supporting local production and reducing reliance on imports will play a critical role in shaping the market dynamics. Overall, the Bangladesh sugar Industry exhibits potential for expansion, provided stakeholders address issues of sustainability, efficiency, and evolving consumer preferences effectively.

Market Segmentation Analysis

The report offers a comprehensive study of the subsequent market segments and their leading categories.

The White Sugar to Dominate the Market- By Type

According to Ravi Bhandari, Research Head, 6Wresearch, the Bangladesh sugar market is projected to witness significant growth, with white sugar expected to dominate by type. White sugar remains the most widely consumed form due to its versatility and extensive usage in household cooking, food processing, and confectionery production. Its longer shelf life and affordability compared to brown sugar and liquid sugar contribute to its dominance in the market. While brown sugar is valued for its distinct flavor and niche applications, and liquid sugar finds preference in industrial uses, white sugar's accessibility and widespread demand ensure its leading position in Bangladesh's sugar market for the foreseeable future.

Powdered Sugar to Dominate the Market- By Form

The powdered sugar segment is expected to dominate the Bangladesh sugar market by form. Its versatility and widespread use in the food and beverage industry, particularly in baking, confectionery, and desserts, contribute significantly to its demand. Powdered sugar dissolves quickly, making it ideal for creating smooth icings, frostings, and other culinary applications. Additionally, its fine consistency makes it highly preferred for decorative purposes, enhancing the appeal of baked goods. The growing urbanization and changing dietary preferences in Bangladesh further drive the popularity of powdered sugar, solidifying its market leadership within the country's sugar industry.

The Food and Beverage to Dominate the Market- By End-Users

The Bangladesh sugar market is projected to see significant demand driven by the food and beverage sector, which is anticipated to dominate the market by end-users. This dominance is attributed to the increasing consumption of sugar in processed foods, beverages, and confectionery products, fueled by rising urbanization and changes in dietary preferences. The pharmaceutical and personal care sectors are also expected to contribute significantly, with sugar being a key ingredient in various medicinal syrups and cosmetic products. However, the household sector's demand remains consistent due to everyday culinary uses. Overall, the food and beverage sector is set to lead this market share expansion.

The Sugarcane to Dominate the Market- By Sources

The Bangladesh sugar market is predominantly dominated by sugarcane as the primary source over sugar beet. Sugarcane accounts for the majority of the sugar production in the country, owing to its favorable growing conditions in Bangladesh’s tropical climate and the established infrastructure for its cultivation and processing. While sugar beet has potential as an alternative source, its contribution remains minimal due to limited adaptation and higher cultivation costs. The reliance on sugarcane continues to shape the market dynamics, making it the leading source for sugar production in Bangladesh and a critical factor in meeting the country’s domestic and industrial sugar demands.

Key Attractiveness of the Report

- 10 Years Market Numbers.

- Historical Data Starting from 2021 to 2024.

- Base Year - 2024.

- Forecast Data until 2031.

- Key Performance Indicators Impacting the Market.

- Major Upcoming Developments and Projects.

Key Highlights of the Report:

- Bangladesh Sugar Market Outlook

- Market Size of Bangladesh Sugar Market, 2024

- Forecast of Bangladesh Sugar Market, 2031

- Historical Data and Forecast of Bangladesh Sugar Revenues & Volume for the Period 2021 - 2031

- Bangladesh Sugar Market Trend Evolution

- Bangladesh Sugar Market Drivers and Challenges

- Bangladesh Sugar Price Trends

- Bangladesh Sugar Porter's Five Forces

- Bangladesh Sugar Industry Life Cycle

- Historical Data and Forecast of Bangladesh Sugar Market Revenues & Volume By Types for the Period 2021 - 2031

- Historical Data and Forecast of Bangladesh Sugar Market Revenues & Volume By White Sugar for the Period 2021 - 2031

- Historical Data and Forecast of Bangladesh Sugar Market Revenues & Volume By Brown Sugar for the Period 2021 - 2031

- Historical Data and Forecast of Bangladesh Sugar Market Revenues & Volume By Liquid Sugar for the Period 2021 - 2031

- Historical Data and Forecast of Bangladesh Sugar Market Revenues & Volume By Form for the Period 2021 - 2031

- Historical Data and Forecast of Bangladesh Sugar Market Revenues & Volume By Granulated Sugar for the Period 2021 - 2031

- Historical Data and Forecast of Bangladesh Sugar Market Revenues & Volume By Powdered Sugar for the Period 2021 - 2031

- Historical Data and Forecast of Bangladesh Sugar Market Revenues & Volume By Syrup Sugar for the Period 2021 - 2031

- Historical Data and Forecast of Bangladesh Sugar Market Revenues & Volume by End-Users for the Period 2021 - 2031

- Historical Data and Forecast of Bangladesh Sugar Market Revenues & Volume By Food and Beverages for the Period 2021 - 2031

- Historical Data and Forecast of Bangladesh Sugar Market Revenues & Volume By Pharma and Personal Care for the Period 2021 - 2031

- Historical Data and Forecast of Bangladesh Sugar Market Revenues & Volume By Household for the Period 2021 - 2031

- Historical Data and Forecast of Bangladesh Sugar Market Revenues & Volume By Sources for the Period 2021 - 2031

- Historical Data and Forecast of Bangladesh Sugar Market Revenues & Volume By Sugarcane for the Period 2021 - 2031

- Historical Data and Forecast of Bangladesh Sugar Market Revenues & Volume By Sugarbeet for the Period 2021 - 2031

- Bangladesh Sugar Import Export Trade Statistics

- Market Opportunity Assessment By Types

- Market Opportunity Assessment By Form

- Market Opportunity Assessment by End-Users

- Market Opportunity Assessment By Sources

- Bangladesh Sugar Top Companies Market Share

- Bangladesh Sugar Competitive Benchmarking By Technical and Operational Parameters

- Bangladesh Sugar Company Profiles

- Bangladesh Sugar Key Strategic Recommendations

Market Covered

The market report has been segmented and sub segmented into the following categories:

By Types

- White Sugar

- Brown Sugar

- Liquid Sugar

By Form

- Granulated Sugar

- Powdered Sugar

- Syrup Sugar

By End -Users

- Food and Beverages

- Pharma and Personal Care

- Household

Bangladesh Sugar Market (2025-2031): FAQs

- Single User License$ 1,995

- Department License$ 2,400

- Site License$ 3,120

- Global License$ 3,795

Search

Thought Leadership and Analyst Meet

Our Clients

Related Reports

- Afghanistan Rocking Chairs And Adirondack Chairs Market (2026-2032) | Size & Revenue, Competitive Landscape, Share, Segmentation, Industry, Value, Outlook, Analysis, Trends, Growth, Forecast, Companies

- Afghanistan Apparel Market (2026-2032) | Growth, Outlook, Industry, Segmentation, Forecast, Size, Companies, Trends, Value, Share, Analysis & Revenue

- Canada Oil and Gas Market (2026-2032) | Share, Segmentation, Value, Industry, Trends, Forecast, Analysis, Size & Revenue, Growth, Competitive Landscape, Outlook, Companies

- Germany Breakfast Food Market (2026-2032) | Industry, Share, Growth, Size, Companies, Value, Analysis, Revenue, Trends, Forecast & Outlook

- Australia Briquette Market (2025-2031) | Growth, Size, Revenue, Forecast, Analysis, Trends, Value, Share, Industry & Companies

- Vietnam System Integrator Market (2025-2031) | Size, Companies, Analysis, Industry, Value, Forecast, Growth, Trends, Revenue & Share

- ASEAN and Thailand Brain Health Supplements Market (2025-2031) | Strategy, Consumer Insights, Analysis, Investment Trends, Opportunities, Growth, Size, Share, Industry, Revenue, Segments, Value, Segmentation, Supply, Forecast, Restraints, Outlook, Competition, Drivers, Trends, Demand, Pricing Analysis, Competitive, Strategic Insights, Companies, Challenges

- ASEAN Bearings Market (2025-2031) | Strategy, Consumer Insights, Analysis, Investment Trends, Opportunities, Growth, Size, Share, Industry, Revenue, Segments, Value, Segmentation, Supply, Forecast, Restraints, Outlook, Competition, Drivers, Trends, Demand, Pricing Analysis, Competitive, Strategic Insights, Companies, Challenges

- Europe Flooring Market (2025-2031) | Outlook, Share, Industry, Trends, Forecast, Companies, Revenue, Size, Analysis, Growth & Value

- Saudi Arabia Manlift Market (2025-2031) | Outlook, Size, Growth, Trends, Companies, Industry, Revenue, Value, Share, Forecast & Analysis

Industry Events and Analyst Meet

Whitepaper

- Middle East & Africa Commercial Security Market Click here to view more.

- Middle East & Africa Fire Safety Systems & Equipment Market Click here to view more.

- GCC Drone Market Click here to view more.

- Middle East Lighting Fixture Market Click here to view more.

- GCC Physical & Perimeter Security Market Click here to view more.

6WResearch In News

- Doha a strategic location for EV manufacturing hub: IPA Qatar

- Demand for luxury TVs surging in the GCC, says Samsung

- Empowering Growth: The Thriving Journey of Bangladesh’s Cable Industry

- Demand for luxury TVs surging in the GCC, says Samsung

- Video call with a traditional healer? Once unthinkable, it’s now common in South Africa

- Intelligent Buildings To Smooth GCC’s Path To Net Zero