Brazil Farm Equipment Market (2026-2032) | Size, Revenue, Analysis, Outlook, Value, Companies, Growth, Share, Industry, Forecast & Trends

Market Forecast By Power Output (<30 HP, 31-70 HP, 71-130 HP, 131-250 HP, >250 HP), By Drive Type (Two-wheel, Four-wheel), By Function (Plowing & Cultivating, Sowing & Planting, Plant Protection & Fertilizing, Harvesting & Threshing, Others), By Equipment Type (Tractors, Combines, Sprayers, Balers, Others) And Competitive Landscape

| Product Code: ETC324542 | Publication Date: Aug 2022 | Updated Date: Dec 2025 | Product Type: Market Research Report | |

| Publisher: 6Wresearch | Author: Ravi Bhandari | No. of Pages: 70 | No. of Figures: 35 | No. of Tables: 5 |

Brazil Farm Equipment Market | Country-Wise Share and Competition Analysis

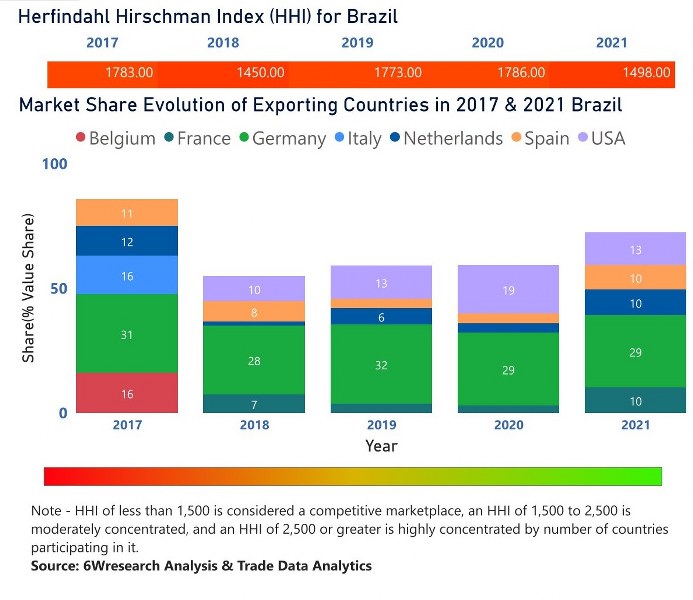

In the year 2021, Germany was the largest exporter in terms of value, followed by the USA. It has registered a decline of -13.99% over the previous year. While the USA registered a decline of -40.86% as compared to the previous year. In the year 2017, Germany was the largest exporter followed by Belgium. In terms of the Herfindahl Index, which measures the competitiveness of countries exporting, Brazil has a Herfindahl index of 1783 in 2017 which signifies moderately concentrated also in 2021 it registered a Herfindahl index of 1498 which signifies high competitiveness in the market.

![Brazil Farm Equipment Market | Country-Wise Share and Competition Analysis]() Brazil Farm Equipment Market - Export Market Opportunities

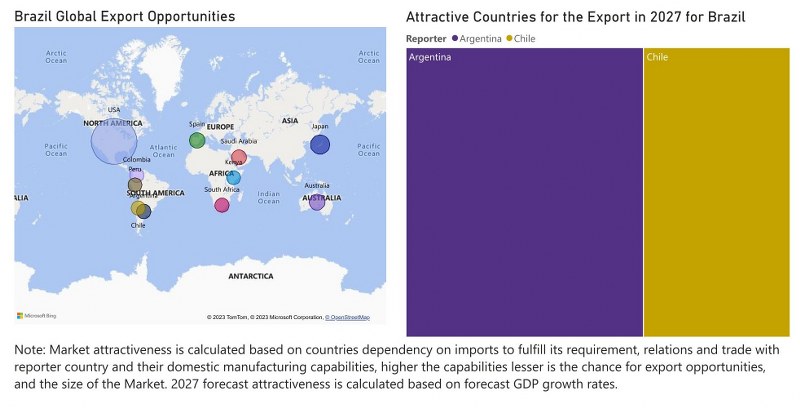

Brazil Farm Equipment Market - Export Market Opportunities

Brazil Farm Equipment Market Highlights

| Report Name | Brazil Farm Equipment Market |

| Forecast period | 2026-2032 |

| CAGR | 6.5% |

| Growing Sector | Tractors |

Topics Covered in Brazil Farm Equipment Market Report

Brazil Farm Equipment Market report thoroughly covers the market by power output, by drive type. By function and equipment type. The outlook report provides an unbiased and detailed analysis of the ongoing Market trends, opportunities/high growth areas, and market drivers which would help the stakeholders to devise and align their market strategies according to the current and future market dynamics.

Brazil Farm Equipment Market Synopsis

Brazil Farm Equipment Market is likely to grow in the forecast year. The collaboration between foreign companies and local producers is the major driver for the expansion of the market. The significant increase in demand for the good locally and globally has fuelled the growth of the market.

According to 6Wresearch, Brazil Farm Equipment Market size is projected to grow at a compound annual growth rate (CAGR) of 6.5% during the forecast period (2026–2032). The market has witnessed exponential growth over the years due to an increase in awareness about healthy eating habits and the population is demanding more fresh vegetables and fruit. This increased demand has led farmers to maximize their production of crops by using better equipment. The advancement in technology has also played a major role in the expansion of the market. The government of Brazil has also played a major role in driving growth within this market by providing loans and subsidies to the farmers. The farmers are constantly upgrading their equipment to increase their operations in farming. Certain challenges exist in the Farm Equipment Market In Brazil. The major challenge is the lack of infrastructure in the rural area of the country. The lack of adequate roads and transportation systems for the efficient movement of the equipment hampers the growth of the market. The high cost of the equipment is also a major challenge in the market as it creates an unfavorable situation for small-scale farmers. The lack of access to credit is also restraining the growth of the market. It limits the ability of farmers to upgrade their equipment and compete against large-scale farmers.

Brazil Farm Equipment Market: Key Players

These are the notable players in the market who have contributed significantly to Brazil Farm Equipment Market Growth.

- AGCO Corporation

- CNH Industrial (Case IH and New Holland)

- John Deere

- Stara S.A.

- Jacto

- Agrale S.A.

- Baldan Implementos Agrícolas

Market By Drive Type

On the basis of drive type, the market is segmented into Two-Wheel and Four-Wheel. Both segments are expected to dominate the market due to their effectiveness in various activities like plowing and seeding and it will lead to a major increase in Brazil Farm Equipment Market Share.

Market By Function Type

Based on function type, the market is segmented into Plowing & Cultivating, Sowing & Planting, Plant Protection & Fertilizing, Harvesting & Threshing, and Others. All the segments are expected to dominate the market due to their use in the performance of specific functions.

Market by Equipment Type

On the basis of Equipment Type, the market is segmented into tractors, Combines, Sprayers, Balers, and Others. The tractors segment is projected to dominate the market due to its suitability for various farming needs.

Key Attractiveness of the Report

- 10 Years of Market Numbers.

- Historical Data Starting from 2022 to 2025.

- Base Year: 2025

- Forecast Data until 2032.

- Key Performance Indicators Impacting the market.

- Major Upcoming Developments and Projects.

Key Highlights of the Report:

- Brazil Farm Equipment Market Outlook

- Market Size of Brazil Farm Equipment Market, 2025

- Forecast of Brazil Farm Equipment Market, 2032

- Historical Data and Forecast of Brazil Farm Equipment Revenues & Volume for the Period 2022-2032

- Brazil Farm Equipment Market Trend Evolution

- Brazil Farm Equipment Market Drivers and Challenges

- Brazil Farm Equipment Price Trends

- Brazil Farm Equipment Porter's Five Forces

- Brazil Farm Equipment Industry Life Cycle

- Historical Data and Forecast of Brazil Farm Equipment Market Revenues & Volume By Power Output for the Period 2022-2032

- Historical Data and Forecast of Brazil Farm Equipment Market Revenues & Volume By <30 HP for the Period 2022-2032

- Historical Data and Forecast of Brazil Farm Equipment Market Revenues & Volume By 31-70 HP for the Period 2022-2032

- Historical Data and Forecast of Brazil Farm Equipment Market Revenues & Volume By 71-130 HP for the Period 2022-2032

- Historical Data and Forecast of Brazil Farm Equipment Market Revenues & Volume By 131-250 HP for the Period 2022-2032

- Historical Data and Forecast of Brazil Farm Equipment Market Revenues & Volume By >250 HP for the Period 2022-2032

- Historical Data and Forecast of Brazil Farm Equipment Market Revenues & Volume By Drive Type for the Period 2022-2032

- Historical Data and Forecast of Brazil Farm Equipment Market Revenues & Volume By Two-wheel for the Period 2022-2032

- Historical Data and Forecast of Brazil Farm Equipment Market Revenues & Volume By Four-wheel for the Period 2022-2032

- Historical Data and Forecast of Brazil Farm Equipment Market Revenues & Volume By Function for the Period 2022-2032

- Historical Data and Forecast of Brazil Farm Equipment Market Revenues & Volume By Plowing & Cultivating for the Period 2022-2032

- Historical Data and Forecast of Brazil Farm Equipment Market Revenues & Volume By Sowing & Planting for the Period 2022-2032

- Historical Data and Forecast of Brazil Farm Equipment Market Revenues & Volume By Plant Protection & Fertilizing for the Period 2022-2032

- Historical Data and Forecast of Brazil Farm Equipment Market Revenues & Volume By Harvesting & Threshing for the Period 2022-2032

- Historical Data and Forecast of Brazil Farm Equipment Market Revenues & Volume By Others for the Period 2022-2032

- Historical Data and Forecast of Brazil Farm Equipment Market Revenues & Volume By Equipment Type for the Period 2022-2032

- Historical Data and Forecast of Brazil Farm Equipment Market Revenues & Volume By Tractors for the Period 2022-2032

- Historical Data and Forecast of Brazil Farm Equipment Market Revenues & Volume By Combines for the Period 2022-2032

- Historical Data and Forecast of Brazil Farm Equipment Market Revenues & Volume By Sprayers for the Period 2022-2032

- Historical Data and Forecast of Brazil Farm Equipment Market Revenues & Volume By Balers for the Period 2022-2032

- Historical Data and Forecast of Brazil Farm Equipment Market Revenues & Volume By Others for the Period 2022-2032

- Brazil Farm Equipment Import Export Trade Statistics

- Market Opportunity Assessment By Power Output

- Market Opportunity Assessment By Drive Type

- Market Opportunity Assessment By Function

- Market Opportunity Assessment By Equipment Type

- Brazil Farm Equipment Top Companies Market Share

- Brazil Farm Equipment Competitive Benchmarking By Technical and Operational Parameters

- Brazil Farm Equipment Company Profiles

- Brazil Farm Equipment Key Strategic Recommendations

Market Covered

The report offers a comprehensive study of the subsequent market segments

By Power Output

- >30 HP

- 31-70 HP

- 71-130 HP

- 131-250 HP

- >250 HP

By Drive Type

- Two-Wheel

- Four-Wheel

By function Type

- Plowing & Cultivating

- Sowing & Planting

- Plant Protection & Fertilizing

- Harvesting & Threshing

- Others

By Equipment type

- Tractors

- Combines

- Sprayers

- Balers

- Others

Brazil Farm Equipment Market (2026-2032): FAQs

| 1 Executive Summary |

| 2 Introduction |

| 2.1 Key Highlights of the Report |

| 2.2 Report Description |

| 2.3 Market Scope & Segmentation |

| 2.4 Research Methodology |

| 2.5 Assumptions |

| 3 Brazil Farm Equipment Market Overview |

| 3.1 Brazil Farm Equipment Market Revenues & Volume, 2022-2032F |

| 3.2 Brazil Farm Equipment Market - Industry Life Cycle |

| 3.3 Brazil Farm Equipment Market - Porter's Five Forces |

| 3.4 Brazil Farm Equipment Market Revenues & Volume Share, By Power Output, 2022 & 2032F |

| 3.5 Brazil Farm Equipment Market Revenues & Volume Share, By Drive Type, 2022 & 2032F |

| 3.6 Brazil Farm Equipment Market Revenues & Volume Share, By Function, 2022 & 2032F |

| 3.7 Brazil Farm Equipment Market Revenues & Volume Share, By Equipment Type, 2022 & 2032F |

| 4 Brazil Farm Equipment Market Dynamics |

| 4.1 Impact Analysis |

| 4.2 Market Drivers |

| 4.2.1 Increasing adoption of mechanized farming practices in Brazil |

| 4.2.2 Government initiatives and subsidies to promote agricultural mechanization |

| 4.2.3 Growing demand for advanced farm equipment to improve productivity and efficiency |

| 4.3 Market Restraints |

| 4.3.1 High initial investment and maintenance costs associated with farm equipment |

| 4.3.2 Fluctuating prices of raw materials impacting the manufacturing costs |

| 4.3.3 Limited access to credit facilities for small and medium-sized farmers |

| 5 Brazil Farm Equipment Market Trends |

| 6 Brazil Farm Equipment Market Segmentation |

| 6.1 Brazil Farm Equipment Market, By Power Output |

| 6.1.1 Overview and Analysis |

| 6.1.2 Brazil Farm Equipment Market Revenues & Volume, By Power Output, 2022-2032F |

| 6.1.3 Brazil Farm Equipment Market Revenues & Volume, By <30 HP, 2022-2032F |

| 6.1.4 Brazil Farm Equipment Market Revenues & Volume, By 31-70 HP, 2022-2032F |

| 6.1.5 Brazil Farm Equipment Market Revenues & Volume, By 71-130 HP, 2022-2032F |

| 6.1.6 Brazil Farm Equipment Market Revenues & Volume, By 131-250 HP, 2022-2032F |

| 6.1.7 Brazil Farm Equipment Market Revenues & Volume, By >250 HP, 2022-2032F |

| 6.2 Brazil Farm Equipment Market, By Drive Type |

| 6.2.1 Overview and Analysis |

| 6.2.2 Brazil Farm Equipment Market Revenues & Volume, By Two-wheel, 2022-2032F |

| 6.2.3 Brazil Farm Equipment Market Revenues & Volume, By Four-wheel, 2022-2032F |

| 6.3 Brazil Farm Equipment Market, By Function |

| 6.3.1 Overview and Analysis |

| 6.3.2 Brazil Farm Equipment Market Revenues & Volume, By Plowing & Cultivating, 2022-2032F |

| 6.3.3 Brazil Farm Equipment Market Revenues & Volume, By Sowing & Planting, 2022-2032F |

| 6.3.4 Brazil Farm Equipment Market Revenues & Volume, By Plant Protection & Fertilizing, 2022-2032F |

| 6.3.5 Brazil Farm Equipment Market Revenues & Volume, By Harvesting & Threshing, 2022-2032F |

| 6.3.6 Brazil Farm Equipment Market Revenues & Volume, By Others, 2022-2032F |

| 6.4 Brazil Farm Equipment Market, By Equipment Type |

| 6.4.1 Overview and Analysis |

| 6.4.2 Brazil Farm Equipment Market Revenues & Volume, By Tractors, 2022-2032F |

| 6.4.3 Brazil Farm Equipment Market Revenues & Volume, By Combines, 2022-2032F |

| 6.4.4 Brazil Farm Equipment Market Revenues & Volume, By Sprayers, 2022-2032F |

| 6.4.5 Brazil Farm Equipment Market Revenues & Volume, By Balers, 2022-2032F |

| 6.4.6 Brazil Farm Equipment Market Revenues & Volume, By Others, 2022-2032F |

| 7 Brazil Farm Equipment Market Import-Export Trade Statistics |

| 7.1 Brazil Farm Equipment Market Export to Major Countries |

| 7.2 Brazil Farm Equipment Market Imports from Major Countries |

| 8 Brazil Farm Equipment Market Key Performance Indicators |

| 8.1 Average age of farm equipment in use |

| 8.2 Adoption rate of precision agriculture technologies |

| 8.3 Percentage of agricultural land using mechanized farming practices |

| 8.4 Average annual growth rate of agricultural productivity |

| 8.5 Percentage of farmers utilizing farm equipment rental services |

| 9 Brazil Farm Equipment Market - Opportunity Assessment |

| 9.1 Brazil Farm Equipment Market Opportunity Assessment, By Power Output, 2022 & 2032F |

| 9.2 Brazil Farm Equipment Market Opportunity Assessment, By Drive Type, 2022 & 2032F |

| 9.3 Brazil Farm Equipment Market Opportunity Assessment, By Function, 2022 & 2032F |

| 9.4 Brazil Farm Equipment Market Opportunity Assessment, By Equipment Type, 2022 & 2032F |

| 10 Brazil Farm Equipment Market - Competitive Landscape |

| 10.1 Brazil Farm Equipment Market Revenue Share, By Companies, 2025 |

| 10.2 Brazil Farm Equipment Market Competitive Benchmarking, By Operating and Technical Parameters |

| 11 Company Profiles |

| 12 Recommendations |

| 13 Disclaimer |

- Single User License$ 1,995

- Department License$ 2,400

- Site License$ 3,120

- Global License$ 3,795

Search

Thought Leadership and Analyst Meet

Our Clients

Related Reports

- Afghanistan Apparel Market (2026-2032) | Growth, Outlook, Industry, Segmentation, Forecast, Size, Companies, Trends, Value, Share, Analysis & Revenue

- Canada Oil and Gas Market (2026-2032) | Share, Segmentation, Value, Industry, Trends, Forecast, Analysis, Size & Revenue, Growth, Competitive Landscape, Outlook, Companies

- Germany Breakfast Food Market (2026-2032) | Industry, Share, Growth, Size, Companies, Value, Analysis, Revenue, Trends, Forecast & Outlook

- Australia Briquette Market (2025-2031) | Growth, Size, Revenue, Forecast, Analysis, Trends, Value, Share, Industry & Companies

- Vietnam System Integrator Market (2025-2031) | Size, Companies, Analysis, Industry, Value, Forecast, Growth, Trends, Revenue & Share

- ASEAN and Thailand Brain Health Supplements Market (2025-2031) | Strategy, Consumer Insights, Analysis, Investment Trends, Opportunities, Growth, Size, Share, Industry, Revenue, Segments, Value, Segmentation, Supply, Forecast, Restraints, Outlook, Competition, Drivers, Trends, Demand, Pricing Analysis, Competitive, Strategic Insights, Companies, Challenges

- ASEAN Bearings Market (2025-2031) | Strategy, Consumer Insights, Analysis, Investment Trends, Opportunities, Growth, Size, Share, Industry, Revenue, Segments, Value, Segmentation, Supply, Forecast, Restraints, Outlook, Competition, Drivers, Trends, Demand, Pricing Analysis, Competitive, Strategic Insights, Companies, Challenges

- Europe Flooring Market (2025-2031) | Outlook, Share, Industry, Trends, Forecast, Companies, Revenue, Size, Analysis, Growth & Value

- Saudi Arabia Manlift Market (2025-2031) | Outlook, Size, Growth, Trends, Companies, Industry, Revenue, Value, Share, Forecast & Analysis

- Uganda Excavator, Crane, and Wheel Loaders Market (2025-2031) | Strategy, Consumer Insights, Analysis, Investment Trends, Opportunities, Growth, Size, Share, Industry, Revenue, Segments, Value, Segmentation, Supply, Forecast, Restraints, Outlook, Competition, Drivers, Trends, Demand, Pricing Analysis, Competitive, Strategic Insights, Companies, Challenges

Industry Events and Analyst Meet

Whitepaper

- Middle East & Africa Commercial Security Market Click here to view more.

- Middle East & Africa Fire Safety Systems & Equipment Market Click here to view more.

- GCC Drone Market Click here to view more.

- Middle East Lighting Fixture Market Click here to view more.

- GCC Physical & Perimeter Security Market Click here to view more.

6WResearch In News

- Doha a strategic location for EV manufacturing hub: IPA Qatar

- Demand for luxury TVs surging in the GCC, says Samsung

- Empowering Growth: The Thriving Journey of Bangladesh’s Cable Industry

- Demand for luxury TVs surging in the GCC, says Samsung

- Video call with a traditional healer? Once unthinkable, it’s now common in South Africa

- Intelligent Buildings To Smooth GCC’s Path To Net Zero