Brazil Nuts Market (2025-2031) | Outlook, Growth, Trends, Value, Industry, Share, Analysis, Revenue, Companies, Size & Forecast

Market Forecast By Product (Almonds, Peanuts, Cashew, Walnuts, Hazelnuts, Pistachios, Others), By Distribution Channel (Offline, Online) And Competitive Landscape

| Product Code: ETC383342 | Publication Date: Aug 2022 | Updated Date: Oct 2025 | Product Type: Market Research Report | |

| Publisher: 6Wresearch | Author: Shubham Padhi | No. of Pages: 75 | No. of Figures: 35 | No. of Tables: 20 |

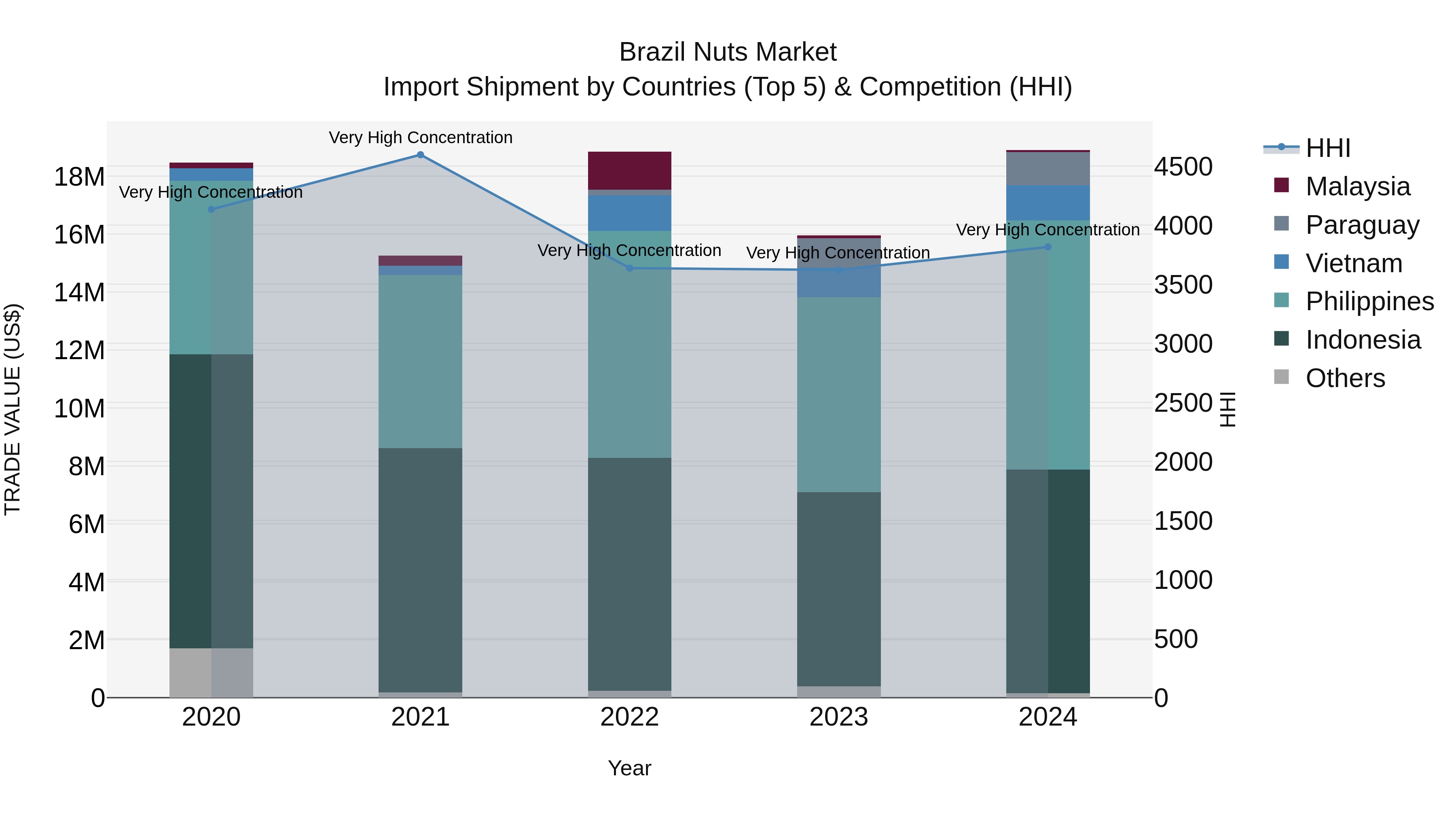

Brazil Nuts Market Top 5 Importing Countries and Market Competition (HHI) Analysis

Brazil nut import shipments in 2024 saw significant contributions from the Philippines, Indonesia, Vietnam, Paraguay, and Singapore. Despite a modest compound annual growth rate of 0.58% from 2020 to 2024, the sector experienced a notable growth spurt of 18.42% from 2023 to 2024. The high Herfindahl-Hirschman Index (HHI) indicates a concentrated market, highlighting the dominance of key exporting countries. This data suggests a dynamic landscape for Brazil nut imports, with potential opportunities for market players to explore in the coming years.

Brazil Nuts Market Growth Rate

According to 6Wresearch internal database and industry insights, the Brazil Nuts Market is estimated to grow at a significant compound annual growth rate (CAGR) of 4.8% during the forecast period 2025-2031, driven by plant-based diets, product innovation, sustainability and health nutrition trends.

Brazil Nuts Market Highlights

| Report Name | Brazil Nuts Market |

| Forecast Period | 2025-2031 |

| CAGR | 4.8% |

| Growing Sector | Consumables |

Topics Covered in the Brazil Nuts Market Report

The Brazil Nuts Market report thoroughly covers the market by Product channel and by Distribution channel. The market report provides an unbiased and detailed analysis of the ongoing market trends, opportunities/high growth areas, and market drivers which would help the stakeholders to devise and align their market strategies according to the current and future market dynamics.

Brazil Nuts Market Synopsis

Brazil Nuts Market is expanding nationwide over the few years as the consumers are increasingly preferring the nutritional and health beneficial foods. This market includes cashews, peanuts, walnuts, and Brazil nuts and offers both online & offline services.

Brazil Nuts Market is predicted to expand at a substantial CAGR of 4.8% during the forecast period 2025-2031. The growth of market is driven by rising global demand for healthy and natural foods, as consumers increasingly seek nutrient-rich snacks. High selenium, protein, and antioxidant content makes Brazil nuts attractive for health-conscious and vegan populations. The sales of nuts fuels with the major demand from Europe, North America, and Asia is boosting trade opportunities. Further, sustainability and fair-trade certifications are encouraging the ethical sourcing and widening the market’s appeal.

Despite growth potential, there are various challenges who distress the Brazil Nuts Market Growth such as fluctuating supply due to climate change and dependence on wild harvesting. Deforestation and unsustainable practices are two major obstacles which threaten long-term availability of Brazil nuts. Apar from this, the stringent food safety and quality regulations also increase cost of compliance for exporters. Further, volatility in the price of nuts and limited processing infrastructure in producing regions can restrict market expansion.

Brazil Nuts Market Trends

Brazil Nuts Market is moving forward with steadily rate due to emerging trends which include the rising global demand for healthy snacks and plant-based proteins. One major trend is the increasing awareness of their nutritional benefits, especially selenium content, is boosting consumption. Export markets in Europe, North America, and Asia are driving higher production volumes. Further, sustainability initiatives and traceability practices are shaping long-term market dynamics.

Investment Opportunities in the Brazil Nuts Market

In Brazil Nuts Market, health-conscious consumer segments are expanding which presents strong opportunities for investors. Growth is noticed in organic, vegan, and functional food categories is further fuelling new product innovations. Excluding these, partnerships in processing, packaging, and value-added products such as nut oils and powders offer attractive returns. Investments are increased by companies in the sustainable sourcing and fair-trade certification further enhance market prospects.

Leading Players of the Brazil Nuts Market

Key players are playing pivotal role in the Brazil Nuts Industry which include Olam International, Royal Nuts Company, Bolivia Nut Company. Olam International is a global leader in agricultural supply chains who is known for its sustainable sourcing of nuts. Royal Nuts Company has a strong presence in premium quality nut distribution worldwide, while Bolivia Nut Company is one who are specialised in the organic Brazil nuts and caters to North American and European markets. Regional cooperatives in Brazil and Bolivia also play an important role in the global supply chain.

Government Regulations Introduced in the Brazil Nuts Market

According to Brazilian Government Data, Brazil nuts market is regulated under policies such as Brazil’s Forest Code (Codigo Florestal) which ensures sustainable harvesting. The National Policy on Agroecology and Organic Production (PNAPO) supports the organic certification and eco-friendly practices. Further, ANVISA’s food safety regulations investigate the processing and quality standards for domestic and export markets. International certifications like Fair Trade and Rainforest Alliance further reinforce compliance.

Future Insights of the Brazil Nuts Market

Brazil nuts market looks promising in the next five years with rising demand for clean-label and organic products. This market is being advanced with processing technologies that will improve quality and reduce waste. Nutraceuticals and functional food industries are expanding, will also create new revenue streams. Overall, sustainability, traceability, and premiumization will define the next growth phase.

Market Segmentation Analysis

The report offers a comprehensive study of the subsequent market segments and their leading categories.

Almonds to Dominate the Market – By Product

According to Anjali, Senior Research Analyst, 6Wresearch, almonds are expected to dominate the Brazil Nuts Market due to their high nutritional value and increasing consumer preference for plant-based protein sources. Peanuts also contribute significantly due to their affordability and versatility in snacks and processed food products. Cashews, walnuts, hazelnuts, and pistachios are also seeing rising demand.

Offline to Dominate the Market – By Distribution Channel

Among distribution channels, offline retail is likely to capture the largest Brazil Nuts Market Share as consumers continue to prefer purchasing fresh products from supermarkets, local stores, and health food retailers. Online sales are also growing rapidly owing to convenience of doorstep delivery and the increasing popularity of e-commerce platforms for purchasing bulk and specialty nuts.

Key Attractiveness of the Report

- 10 Years of Market Numbers.

- Historical Data Starting from 2021 to 2024.

- Base Year: 2024

- Forecast Data until 2031.

- Key Performance Indicators Impacting the Market.

- Major Upcoming Developments and Projects.

Key Highlights of the Report:

- Brazil Nuts Market Outlook

- Market Size of Brazil Nuts Market, 2024

- Forecast of Brazil Nuts Market, 2031

- Historical Data and Forecast of Brazil Nuts Revenues & Volume for the Period 2021-2031

- Brazil Nuts Market Trend Evolution

- Brazil Nuts Market Drivers and Challenges

- Brazil Nuts Price Trends

- Brazil Nuts Porter's Five Forces

- Brazil Nuts Industry Life Cycle

- Historical Data and Forecast of Brazil Nuts Market Revenues & Volume By Product for the Period 2021-2031

- Historical Data and Forecast of Brazil Nuts Market Revenues & Volume By Almonds for the Period 2021-2031

- Historical Data and Forecast of Brazil Nuts Market Revenues & Volume By Peanuts for the Period 2021-2031

- Historical Data and Forecast of Brazil Nuts Market Revenues & Volume By Cashew for the Period 2021-2031

- Historical Data and Forecast of Brazil Nuts Market Revenues & Volume By Walnuts for the Period 2021-2031

- Historical Data and Forecast of Brazil Nuts Market Revenues & Volume By Hazelnuts for the Period 2021-2031

- Historical Data and Forecast of Brazil Nuts Market Revenues & Volume By Pistachios for the Period 2021-2031

- Historical Data and Forecast of Brazil Nuts Market Revenues & Volume By Others for the Period 2021-2031

- Historical Data and Forecast of Brazil Nuts Market Revenues & Volume By Distribution Channel for the Period 2021-2031

- Historical Data and Forecast of Brazil Nuts Market Revenues & Volume By Offline for the Period 2021-2031

- Historical Data and Forecast of Brazil Nuts Market Revenues & Volume By Online for the Period 2021-2031

- Brazil Nuts Import Export Trade Statistics

- Market Opportunity Assessment By Product

- Market Opportunity Assessment By Distribution Channel

- Brazil Nuts Top Companies Market Share

- Brazil Nuts Competitive Benchmarking By Technical and Operational Parameters

- Brazil Nuts Company Profiles

- Brazil Nuts Key Strategic Recommendations

Market Covered

The report has been segmented and sub-segmented into the following categories:

By Product

- Almonds

- Peanuts

- Cashew

- Walnuts

- Hazelnuts

- Pistachios

- Others

By Distribution Channel

- Offline

- Online

Brazil Nuts Market (2025-2031): FAQs

| 1. Executive Summary |

| 1.1 Key Findings & Takeaways |

| 1.2 Market Size Snapshot (Value, Volume) & 2025–2031 CAGR |

| 1.3 Growth Drivers, Challenges, Opportunities |

| 1.4 High-Impact Trends (sustainability, traceability, clean-label protein, premium snacking) |

| 1.5 Analyst Outlook & Strategic Recommendations |

| 2. Research Methodology |

| 2.1 Scope & Definitions (raw/roasted, oil/butter/flour/meals, organic vs. conventional, grades) |

| 2.2 Forecasting Framework & Assumptions |

| 2.3 Data Sources (Primary/Secondary) |

| 2.4 Market Modeling (Top-down/Bottom-up; Triangulation) |

| 2.5 Limitations & Notes |

| 3. Market Overview & Context |

| 3.1 Brazil Nuts at a Glance: Nutrition, Functional Properties, Applications |

| 3.2 Global & Regional Context; Role of Amazon Basin (Bolivia, Brazil, Peru) |

| 3.3 Supply Chain Map (wild harvesting → collectors/co-ops → shelling → processing → distribution → end users) |

| 3.4 Logistics & Infrastructure (collection routes, processing hubs, export gateways) |

| 3.5 Price Formation & Benchmarks (in-shell vs. shelled, grade spreads) |

| 4. Regulatory & Policy Landscape |

| 4.1 Food Safety & Quality (maximum residue levels, mycotoxins/aflatoxin, allergens) |

| 4.2 Organic, Fairtrade, Rainforest Alliance & Other Certifications |

| 4.3 Trade & Tariff Regimes (HS codes, duties, NTBs, sanitary/phyto) |

| 4.4 Sustainability & ESG (deforestation-free, indigenous rights, labor standards) |

| 4.5 Importing Market Regulations (EU, US, Asia) & Labeling Rules |

| 5. Market Dynamics |

| 5.1 Demand Drivers (healthy snacking, plant-based proteins, selenium-rich positioning) |

| 5.2 Restraints (supply variability, climate & forest policy risks, quality consistency) |

| 5.3 Opportunities (value-added processing, nut blends, personal care oils, nutraceuticals) |

| 5.4 Risk Analysis (weather/El Niño, logistics, FX, compliance) |

| 5.5 Porter’s Five Forces |

| 6. Market Size & Forecast (2019–2031) |

| 6.1 Historical Performance (2019–2024): Value, Volume, Average Prices |

| 6.2 Base-Year Structure (2024/2025): By Nature, Product/Form, End-use, Grade, Channel |

| 6.3 Forecast (2025–2031): Value, Volume, CAGR |

| 6.4 Scenario Analysis (Base / Optimistic / Conservative) |

| 6.5 Sensitivity to Key Variables (yield, certification premiums, retail pricing, FX) |

| 7. Segmentation by Nature |

| 7.1 Organic |

| 7.1.1 Market Size & Forecast |

| 7.1.2 Certification & Compliance Landscape |

| 7.1.3 Pricing & Margin Analysis |

| 7.1.4 Key Buyers & Case Examples |

| 7.2 Conventional |

| 7.2.1 Market Size & Forecast |

| 7.2.2 Industrial & Retail Demand Anchors |

| 7.2.3 Cost Competitiveness vs. Other Tree Nuts |

| 7.2.4 Procurement Best Practices |

| 8. Segmentation by Product / Form |

| 8.1 Raw (Shelled; Whole, Halves, Pieces) |

| 8.1.1 Market Size & Forecast |

| 8.1.2 Grade Specs & Yield Considerations |

| 8.1.3 Quality/Defect Standards & Testing |

| 8.2 Roasted & Salted / Seasoned |

| 8.2.1 Market Size & Forecast |

| 8.2.2 Flavor & Coating Innovations |

| 8.2.3 Private Label vs. Branded Penetration |

| 8.3 Processed Ingredients |

| 8.3.1 Brazil Nut Oil (cosmetics, culinary) |

| 8.3.2 Brazil Nut Butter & Pastes |

| 8.3.3 Brazil Nut Flour/Meal (bakery, gluten-free) |

| 8.3.4 Market Size & Forecast by Sub-form |

| 9. Segmentation by End-use |

| 9.1 Food & Beverage |

| 9.1.1 Snacks, Trail Mixes, Nut Blends |

| 9.1.2 Bakery & Confectionery (inclusions, coatings, pralines) |

| 9.1.3 Dairy Alternatives & Spreads |

| 9.1.4 HORECA & Foodservice Trends |

| 9.1.5 Market Size & Forecast |

| 9.2 Personal Care & Cosmetics |

| 9.2.1 Oil-based Emollients, Hair/Skincare |

| 9.2.2 Natural/Organic Positioning & Claims |

| 9.2.3 Market Size & Forecast |

| 9.3 Nutraceuticals / Pharmaceuticals |

| 9.3.1 Selenium Positioning, Supplements, Fortification |

| 9.3.2 Regulatory & Quality Requirements (GMP) |

| 9.3.3 Market Size & Forecast |

| 9.4 Others (Pet Food/Animal Nutrition, Specialty Uses) |

| 9.4.1 Use-Cases & Growth Niches |

| 9.4.2 Pricing & Substitution Dynamics |

| 9.4.3 Market Size & Forecast |

| 10. Segmentation by Grade |

| 10.1 Whole, Halves, Pieces (industrial specs, yield loss) |

| 10.2 In-shell vs. Shelled Trade Dynamics |

| 10.3 Grade-wise Price Spreads & Applications |

| 10.4 Forecast by Grade Mix (Value/Volume) |

| 11. Route-to-Market & Distribution |

| 11.1 B2B (ingredient suppliers, processors, contract manufacturers) |

| 11.2 B2C Retail (hyper/supermarkets, convenience, specialty, online) |

| 11.3 Private Label vs. Brands; Channel Margins |

| 11.4 E-commerce Acceleration & D2C Models |

| 11.5 Cold Chain/Storage, Shelf-life & Handling |

| 12. Geography & Trade |

| 12.1 Origin Analysis: Bolivia/Brazil/Peru Production & Export Capacities |

| 12.2 Importing Markets & Demand Hotspots (US, EU-5, UK, China, Middle East) |

| 12.3 Trade Flows, Seasonality & Inventory Cycles |

| 12.4 Landed Cost Build-Up (FOB/CIF, freight, duties, taxes) |

| 12.5 Domestic vs. International Price Correlations |

| 13. Technology, Processing & Quality |

| 13.1 Collection & Post-Harvest Practices (drying, storage) |

| 13.2 Shelling & Sorting Tech; Defect Reduction |

| 13.3 Oil Extraction & Refining (cosmetic vs. culinary grades) |

| 13.4 Food Safety Management (HACCP, allergen controls, aflatoxin testing) |

| 13.5 Traceability Systems & Digital Tools |

| 14. Consumer & Category Trends |

| 14.1 Health & Nutrition Perceptions (selenium halo, clean-label) |

| 14.2 Premiumization & Gifting; Flavor Innovation |

| 14.3 Sustainability Storytelling & Provenance |

| 14.4 Competitive Substitutes (macadamia, almonds, cashews) & Price Elasticity |

| 15. Competitive Landscape |

| 15.1 Market Structure (collectives/co-ops, exporters, processors, importers, brands) |

| 15.2 Market Share Analysis (Value/Volume; by Form where available) |

| 15.3 Strategic Moves (partnerships, certifications, capacity upgrades, M&A) |

| 15.4 Competitive Benchmarking (sourcing, certifications, footprint, key clients) |

| 15.5 Company Profiles (Indicative) |

| Origin Collectives/Exporters (Bolivia, Brazil, Peru) |

| International Importers/Processors & Ingredient Specialists |

| Leading Retail Brands & Private Labels |

| (Each profile: overview, product mix, capacity, certifications, financials where available, customers, recent developments, SWOT) |

| 16. Procurement & Strategy Playbook |

| 16.1 Sourcing Strategies (origins mix, long-term vs. spot, quality specs) |

| 16.2 Supplier Qualification & Audit Checklists |

| 16.3 Cost Optimization (grade/spec optimization, blends, logistics) |

| 16.4 ESG & Compliance Roadmap (KPIs, traceability, audits, claims) |

| 17. Forecast Deep Dives & Scenarios |

| 17.1 Nature Split Outlook (Organic vs. Conventional) |

| 17.2 Form/Product Outlook (Raw, Roasted, Oil, Butter, Flour/Meal) |

| 17.3 End-use Outlook (F&B, Personal Care & Cosmetics, Nutraceuticals, Others) |

| 17.4 Macro/Policy Shocks (trade policy, certification adoption, climate) |

| 17.5 Post-2031 Qualitative Outlook |

| 18. Appendices |

| 18.1 Glossary of Terms & Abbreviations |

| 18.2 Conversion Factors & Technical Specs |

| 18.3 Tables, Figures & Charts List |

| 18.4 Interview Guides & Survey Instruments (if applicable) |

| 18.5 Company/Organization Directory |

| 18.6 Notes on Compliance, Ethics & Data Privacy |

Export potential assessment - trade Analytics for 2030

Export potential enables firms to identify high-growth global markets with greater confidence by combining advanced trade intelligence with a structured quantitative methodology. The framework analyzes emerging demand trends and country-level import patterns while integrating macroeconomic and trade datasets such as GDP and population forecasts, bilateral import–export flows, tariff structures, elasticity differentials between developed and developing economies, geographic distance, and import demand projections. Using weighted trade values from 2020–2024 as the base period to project country-to-country export potential for 2030, these inputs are operationalized through calculated drivers such as gravity model parameters, tariff impact factors, and projected GDP per-capita growth. Through an analysis of hidden potentials, demand hotspots, and market conditions that are most favorable to success, this method enables firms to focus on target countries, maximize returns, and global expansion with data, backed by accuracy.

By factoring in the projected importer demand gap that is currently unmet and could be potential opportunity, it identifies the potential for the Exporter (Country) among 190 countries, against the general trade analysis, which identifies the biggest importer or exporter.

To discover high-growth global markets and optimize your business strategy:

Click Here- Single User License$ 1,995

- Department License$ 2,400

- Site License$ 3,120

- Global License$ 3,795

Search

Thought Leadership and Analyst Meet

Our Clients

Related Reports

- India Switchgear Market Outlook (2026 - 2032) | Size, Share, Trends, Growth, Revenue, Forecast, Analysis, Value, Outlook

- Pakistan Contraceptive Implants Market (2025-2031) | Demand, Growth, Size, Share, Industry, Pricing Analysis, Competitive, Strategic Insights, Strategy, Consumer Insights, Analysis, Investment Trends, Opportunities, Revenue, Segments, Value, Segmentation, Supply, Forecast, Restraints, Outlook, Competition, Drivers, Trends, Companies, Challenges

- Sri Lanka Packaging Market (2026-2032) | Outlook, Competition, Drivers, Trends, Demand, Pricing Analysis, Competitive, Strategic Insights, Companies, Challenges, Strategy, Consumer Insights, Analysis, Investment Trends, Opportunities, Growth, Size, Share, Industry, Revenue, Segments, Value, Segmentation, Supply, Forecast, Restraints

- India Kids Watches Market (2026-2032) | Strategy, Consumer Insights, Analysis, Investment Trends, Opportunities, Growth, Size, Share, Industry, Revenue, Segments, Value, Segmentation, Supply, Forecast, Restraints, Outlook, Competition, Drivers, Trends, Demand, Pricing Analysis, Competitive, Strategic Insights, Companies, Challenges

- Saudi Arabia Core Assurance Service Market (2025-2031) | Strategy, Consumer Insights, Analysis, Investment Trends, Opportunities, Growth, Size, Share, Industry, Revenue, Segments, Value, Segmentation, Supply, Forecast, Restraints, Outlook, Competition, Drivers, Trends, Demand, Pricing Analysis, Competitive, Strategic Insights, Companies, Challenges

- Romania Uninterruptible Power Supply (UPS) Market (2026-2032) | Industry, Analysis, Revenue, Size, Forecast, Outlook, Value, Trends, Share, Growth & Companies

- Saudi Arabia Car Window Tinting Film, Paint Protection Film (PPF), and Ceramic Coating Market (2025-2031) | Strategy, Consumer Insights, Analysis, Investment Trends, Opportunities, Growth, Size, Share, Industry, Revenue, Segments, Value, Segmentation, Supply, Forecast, Restraints, Outlook, Competition, Drivers, Trends, Demand, Pricing Analysis, Competitive, Strategic Insights, Companies, Challenges

- South Africa Stationery Market (2025-2031) | Share, Size, Industry, Value, Growth, Revenue, Analysis, Trends, Segmentation & Outlook

- Afghanistan Rocking Chairs And Adirondack Chairs Market (2026-2032) | Size & Revenue, Competitive Landscape, Share, Segmentation, Industry, Value, Outlook, Analysis, Trends, Growth, Forecast, Companies

- Afghanistan Apparel Market (2026-2032) | Growth, Outlook, Industry, Segmentation, Forecast, Size, Companies, Trends, Value, Share, Analysis & Revenue

Industry Events and Analyst Meet

Whitepaper

- Middle East & Africa Commercial Security Market Click here to view more.

- Middle East & Africa Fire Safety Systems & Equipment Market Click here to view more.

- GCC Drone Market Click here to view more.

- Middle East Lighting Fixture Market Click here to view more.

- GCC Physical & Perimeter Security Market Click here to view more.

6WResearch In News

- Doha a strategic location for EV manufacturing hub: IPA Qatar

- Demand for luxury TVs surging in the GCC, says Samsung

- Empowering Growth: The Thriving Journey of Bangladesh’s Cable Industry

- Demand for luxury TVs surging in the GCC, says Samsung

- Video call with a traditional healer? Once unthinkable, it’s now common in South Africa

- Intelligent Buildings To Smooth GCC’s Path To Net Zero