Bulgaria Ultrasound Device Market (2023-2029) | Industry, Size, Trends, Revenue, COVID-19 IMPACT, Companies, Forecast, Outlook, Analysis, Growth, Share & Value

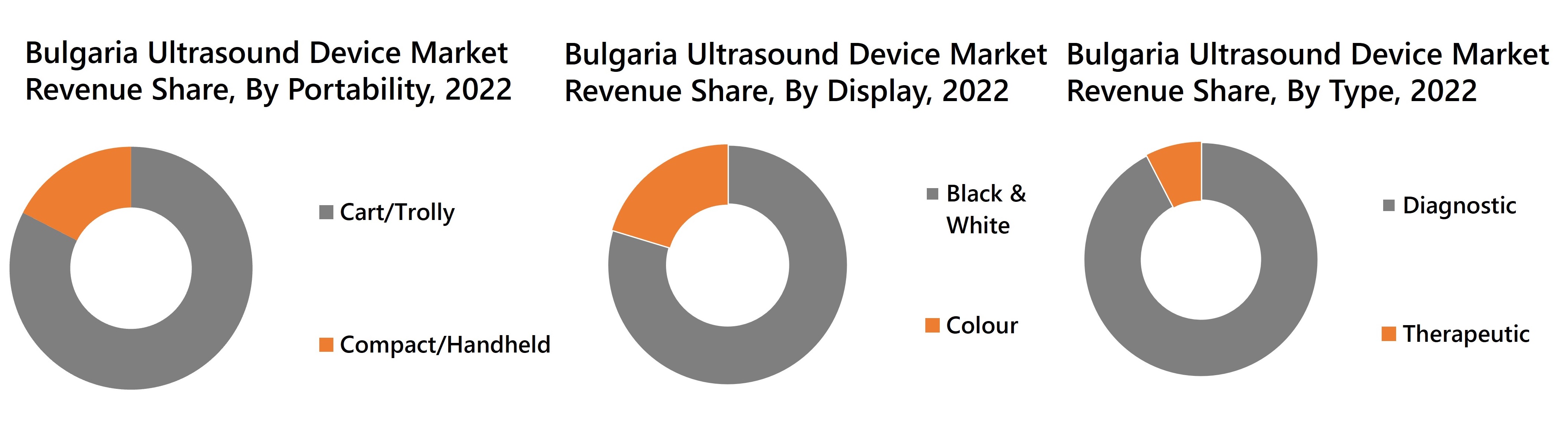

Market Forecast By Portability (Cart/Trolly, Compact/Handled),By Display (Black & White, Color),By Type (Diagnostic, Therapeutic),By Application (Radiology/General Imaging, Obstetrics/Gynecology, Cardiology, Urology, Vascular, Others (Oncology, Ophthalmology and Orthopedics))And Competitive Landscape

| Product Code: ETC4378019 | Publication Date: Sep 2023 | Updated Date: Oct 2025 | Product Type: Report | |

| Publisher: 6Wresearch | Author: Ravi Bhandari | No. of Pages: 74 | No. of Figures: 20 | No. of Tables: 6 |

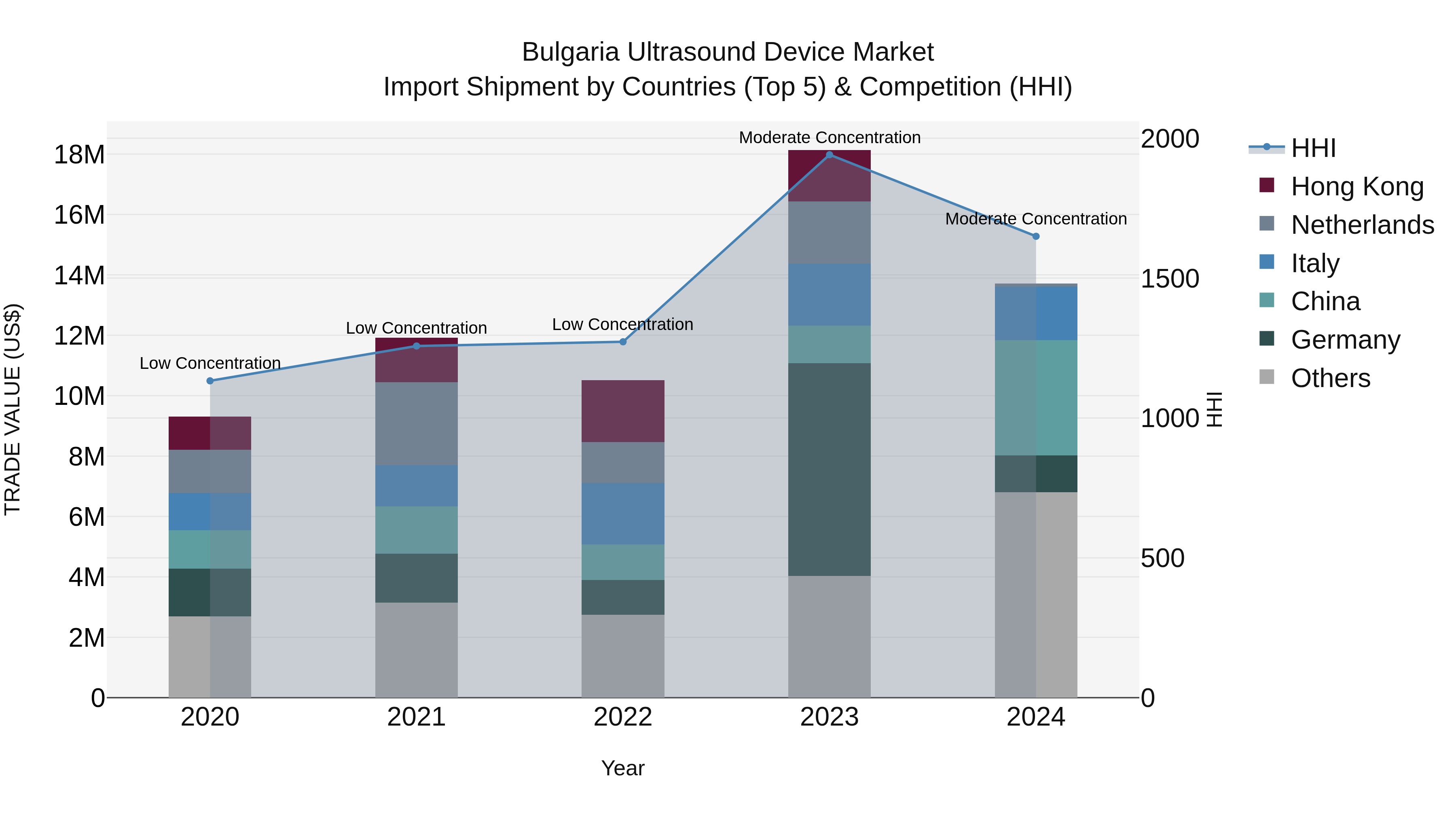

Bulgaria Ultrasound Device Market Top 5 Importing Countries and Market Competition (HHI) Analysis

Bulgaria`s ultrasound device import shipments in 2024 continued to show strong growth, with top exporting countries being China, USA, Italy, Germany, and Norway. The Herfindahl-Hirschman Index (HHI) indicated moderate concentration in the Market Top 5 Importing Countries and Market Competition (HHI) Analysis . Despite a slight decline in growth rate from 2023 to 2024, the compound annual growth rate (CAGR) for the period 2020-2024 was impressive at 10.16%. This suggests a steady demand for ultrasound devices in Bulgaria, with diverse sourcing from leading global suppliers.

Bulgaria Ultrasound Device Market Synopsis

The Bulgaria Ultrasound Device Market is projected to rise significantly in the future. In 2019, the Bulgarian healthcare system was facing significant challenges due to corruption and insufficient funding. However, during the pandemic in 2020, Bulgaria realized the necessity for medical imaging technology, and trade barriers were loosened, which resulted in a 21% rise in imports. Moreover, the development of a new advanced medical device manufacturing facility in Plovdiv with an investment of $12.1 million by BTL Industries coupled with measures taken by the Bulgarian government to privatize the healthcare sector would further contribute to the growth of the Ultrasound Devices Market in Bulgaria.

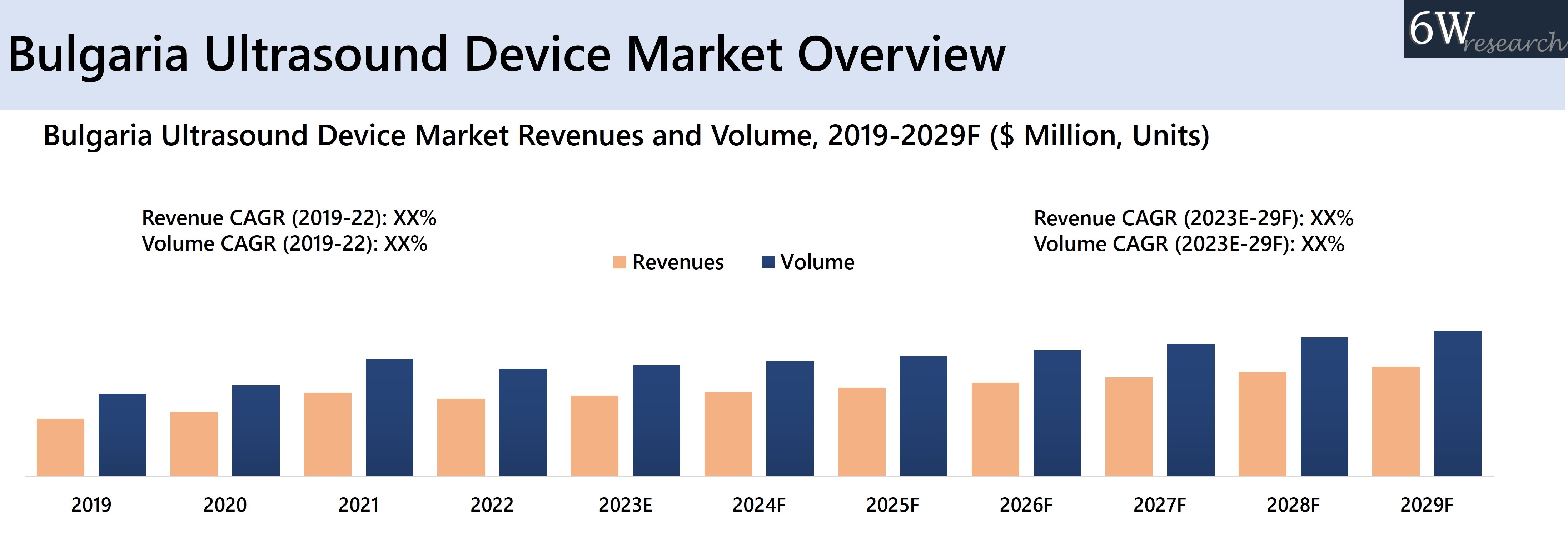

According to 6Wresearch, Bulgaria ultrasound device market revenue is projected to grow at a CAGR of 5.2% during 2023-29. The demand for ultrasound devices would increase on account of the high rate of adoption of hospitals and clinics as well as different projects in the healthcare sphere receiving funding worth $350 million from the European Resilience and Recovery fund in forthcoming years. Older population share in the country is projected to increase from 21.3% in 2018 to 32.7% of the country’s population by 2060 and as the majority of the older population suffer from cardiovascular disease, cancer, and musculoskeletal disorders they are more likely to undergo ultrasound guidance which would result in fuelling the demand for ultrasound devices in the coming years, which will stimulate the Bulgaria Ultrasound Device Market Share.

According to 6Wresearch, Bulgaria ultrasound device market revenue is projected to grow at a CAGR of 5.2% during 2023-29. The demand for ultrasound devices would increase on account of the high rate of adoption of hospitals and clinics as well as different projects in the healthcare sphere receiving funding worth $350 million from the European Resilience and Recovery fund in forthcoming years. Older population share in the country is projected to increase from 21.3% in 2018 to 32.7% of the country’s population by 2060 and as the majority of the older population suffer from cardiovascular disease, cancer, and musculoskeletal disorders they are more likely to undergo ultrasound guidance which would result in fuelling the demand for ultrasound devices in the coming years, which will stimulate the Bulgaria Ultrasound Device Market Share.

![Bulgaria Ultrasound Device Market Revenue Share]() Market by Portability

Market by Portability

On the basis of portability, cart/trolly ultrasound devices accounted for both the highest revenue and volume share in 2022 owing to more advanced software and versatility as they can be used in a wide range of medical specialties. However, the compact/handheld ultrasound devices segment is expected to grow at a higher rate in future years on account of advancing technology increased adoption of point-of-care applications, and the preference for home treatment by Bulgarian citizens

Market by Display

Based on the display, the black & white segment dominated the market share in the year 2022 owing to its inexpensiveness, and ability to emit no radiation making it safer for pregnant women. Further, the market for color ultrasound devices is anticipated to witness significant growth in the coming years due to the advantages of color Doppler imaging as it allows guidance of needles to precise locations within the body, which can reduce the risk of complications and increase the success rate of the procedures.

Market by Type

Based on type, the diagnostic ultrasound systems segment dominated the market in 2022 and is anticipated to maintain its dominance during the forecast period due to their application in many medical specialties including gynecology, cardiology, and radiology. It also provides versatile, non-invasive imaging modalities that can produce high-quality images of internal body structures. However, the therapeutic segment of the ultrasound device market is expected to experience rapid growth during the forecast period, primarily due to its ability to promote fast and effective healing and its use in conjunction with other treatments such as physical therapy.

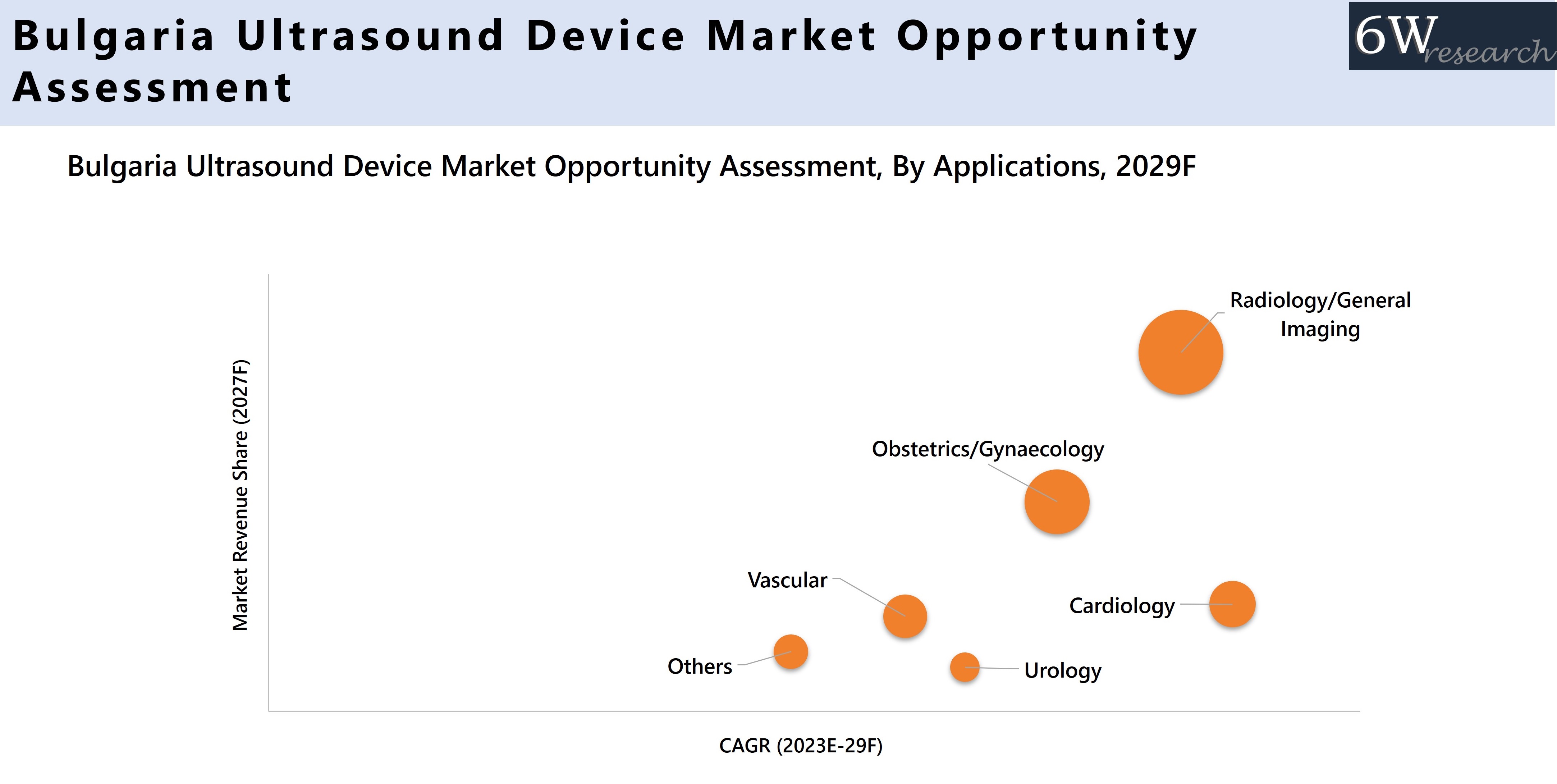

Market by Application

On the basis of application, the radiology/general imaging segment contributed the highest revenue share in 2022 owing to images being produced in real-time, allowing radiologists to see the movement of organs and blood flow as well as advanced imaging techniques allowing for more accurate and detailed imaging of the body.

![Bulgaria Ultrasound Device Market Opportunity Assessment]() Key Attractiveness of the Report

Key Attractiveness of the Report

- COVID-19 Impact on the Market.

- 11 Years Market Numbers.

- Historical Data Starting from 2019 to 2022.

- Base Year: 2022

- Forecast Data until 2029.

- Key Performance Indicators Impacting the Market.

- Major Upcoming Developments and Projects.

Key Highlights of the Report:

- Historical data & Forecast of Bulgaria Ultrasound Device Market Revenues and Volume for the Period 2019-2029F

- Historical data & Forecast of Bulgaria Ultrasound Device Market Revenues and Volume, By Portability, for the Period 2019-2029F

- Historical data & Forecast of Bulgaria Ultrasound Device Market Revenues and Volume, By Display, for the Period 2019-2029F

- Historical data & Forecast of Bulgaria Ultrasound Device Market Revenues , By Type, for the Period 2019-2029F

- Historical data & Forecast of Bulgaria Ultrasound Device Market Revenues, By Applications, for the Period 2019-2029F

- Bulgaria Ultrasound Device Market Outlook on Drivers and Restraints

- Bulgaria Ultrasound Device Market Trends

- Porter’s Five Force Analysis

- Bulgaria Ultrasound Device Market Opportunity Assessment

- Bulgaria Ultrasound Device Market Ranking, By Company

- Bulgaria Ultrasound Device Market Overview on Competitive Benchmarking

- Company Profiles

- Key Strategic Recommendations

Market Scope and Segmentation

Thereportprovides a detailed analysis of the following market segments:

By Portability

- Cart/Trolly

- Compact/Handled

By Display

- Black & White

- Color

By Type

- Diagnostic

- Therapeutic

By Application

- Radiology/General Imaging

- Obstetrics/Gynaecology

- Cardiology

- Urology

- Vascular

- Others (Oncology, Ophthalmology and Orthopedics)

What is the overall structure and scope of the Bulgaria ultrasound device market?

| 1. Executive Summary |

| 2. Introduction |

| 2.1 Report Description |

| 2.2 Key Highlights of the Report |

| 2.3 Market Scope & Segmentation |

| 2.4 Research Methodology |

| 2.5 Assumptions |

| 3. Bulgaria Ultrasound Device Market Overview |

| 3.1 Bulgaria Ultrasound Device Market Revenues & Volume, 2019- 2029F |

| 3.2 Bulgaria Ultrasound Device Market - Industry Life Cycle |

| 3.3 Bulgaria Ultrasound Device Market - Porter's Five Forces |

| 3.4 Bulgaria Ultrasound Device Market Revenue & Volume Share, By Portability, 2020 & 2029F |

| 3.5 Bulgaria Ultrasound Device Market Revenue & Volume Share, By Display, 2020 & 2029F |

| 3.6 Bulgaria Ultrasound Device Market Revenue Share, By Type, 2020 & 2029F |

| 3.7 Bulgaria Ultrasound Device Market Revenue Share, By Applications, 2020 & 2029F |

| 4. Bulgaria Ultrasound Device Market Dynamics |

| 4.1 Impact Analysis |

| 4.2 Market Drivers |

| 4.2.1 Increasing prevalence of chronic diseases leading to higher demand for diagnostic imaging services |

| 4.2.2 Technological advancements in ultrasound devices improving accuracy and efficiency of diagnoses |

| 4.2.3 Growing healthcare infrastructure and investments in Bulgaria enhancing accessibility to healthcare services |

| 4.3 Market Restraints |

| 4.3.1 High cost associated with ultrasound devices limiting adoption in smaller healthcare facilities |

| 4.3.2 Limited skilled professionals proficient in operating and interpreting ultrasound imaging results |

| 4.3.3 Regulatory challenges and reimbursement limitations impacting the affordability of ultrasound services |

| 5. Impact Analysis of Covid-19 on Bulgaria Ultrasound Device Market |

| 6. Bulgaria Ultrasound Device Market Trends |

| 7. Bulgaria Ultrasound Device Market Overview, By Portability |

| 7.1 Bulgaria Ultrasound Device Market Revenues and Volume, By Portability, 2019- 2029F |

| 7.1.1 Bulgaria Ultrasound Device Market Revenues and Volume, By Trolley/Cart-Based Ultrasound Devices, 2019 - 2029F |

| 7.1.2 Bulgaria Ultrasound Device Market Revenues and Volume, By Compact/Handheld Ultrasound Devices, 2019 - 2029F |

| 8. Bulgaria Ultrasound Device Market Overview, By Display |

| 8.1 Bulgaria Ultrasound Device Market Revenues and Volume, By Display, 2019- 2029F |

| 8.1.1 Bulgaria Ultrasound Device Market Revenues & Volume, By Color Ultrasound Devices, 2019 - 2029F |

| 8.1.2 Bulgaria Ultrasound Device Market Revenues & Volume, By Black & White (B/W) Ultrasound Devices, 2019 - 2029F |

| 9. Bulgaria Ultrasound Device Market Overview, By Type |

| 9.1 Bulgaria Ultrasound Device Market Revenues, By Type, 2019- 2029F |

| 9.1.1 Bulgaria Ultrasound Device Market Revenues, By Diagnostic Ultrasound Systems, 2019 - 2029F |

| 9.1.2 Bulgaria Ultrasound Device Market Revenues, By Therapeutic Ultrasound Systems, 2019 - 2029F |

| 10. Bulgaria Ultrasound Device Market Overview, By Applications |

| 10.1 Bulgaria Ultrasound Device Market Revenues, By Applications, 2019- 2029F |

| 10.1.1 Bulgaria Ultrasound Device Market Revenues, By Radiology/General Imaging, 2019 - 2029F |

| 10.1.2 Bulgaria Ultrasound Device Market Revenues, By Obstetrics/Gynaecology, 2019 - 2029F |

| 10.1.3 Bulgaria Ultrasound Device Market Revenues, By Cardiology, 2019 - 2029F |

| 10.1.4 Bulgaria Ultrasound Device Market Revenues, By Urology, 2019 - 2029F |

| 10.1.5 Bulgaria Ultrasound Device Market Revenues, By Vascular, 2019 - 2029F |

| 10.1.6 Bulgaria Ultrasound Device Market Revenues, By Others, 2019 - 2029F |

| 11. Bulgaria Ultrasound Device Market Price Trend Analysis |

| 12. Bulgaria Ultrasound Device Market Key Performance Indicators |

| 12.1 Average utilization rate of ultrasound devices in healthcare facilities |

| 12.2 Adoption rate of advanced ultrasound technologies in Bulgaria |

| 12.3 Number of healthcare providers offering ultrasound services with improved accessibility and quality |

| 13. Bulgaria Ultrasound Device Market - Opportunity Assessment |

| 13.1 Bulgaria Ultrasound Device Market Opportunity Assessment, By Portability, 2029F |

| 13.2 Bulgaria Ultrasound Device Market Opportunity Assessment, By Display, 2029F |

| 13.3 Bulgaria Ultrasound Device Market Opportunity Assessment, By Type, 2029F |

| 13.4 Bulgaria Ultrasound Device Market Opportunity Assessment, By Applications, 2029F |

| 14. Bulgaria Ultrasound Device Market - Competitive Landscape |

| 14.1 Bulgaria Ultrasound Device Market Ranking, By Company, 2022 |

| 14.2 Bulgaria Ultrasound Device Market Competitive Benchmarking, By Operating Parameters |

| 14.3 Bulgaria Ultrasound Device Market Competitive Benchmarking, By Technical Parameters |

| 15. Company Profiles |

| 15.1 Canon Medical Systems Corporation |

| 15.2 Esaote S.p.A |

| 15.3 FUJIFILM Corporation |

| 15.4 General Electric Healthcare |

| 15.5 Koninklijke Philips N.V. |

| 15.6 Siemens Healthineers AG |

| 15.7 BTL Group of Companies |

| 16. Key Strategic Recommendations |

| 17. Disclaimer |

| List of Figures |

| 1. Bulgaria Ultrasound Device Market Revenues and Volume, 2019-2029F ($ Million, Units) |

| 2. Bulgaria Ultrasound Device Market Revenue Share, By Portability, 2022 & 2029F |

| 3. Bulgaria Ultrasound Device Market Volume Share, By Portability, 2022 & 2029F |

| 4. Bulgaria Ultrasound Device Market Revenue Share, By Display, 2022 & 2029F |

| 5. Bulgaria Ultrasound Device Market Volume Share, By Display, 2022 & 2029F |

| 6. Bulgaria Ultrasound Device Market Revenue Share, By Type, 2022 & 2029F |

| 7. Bulgaria Ultrasound Device Market Revenue Share, By Applications, 2022 & 2029F |

| 8. Percentage Share of Old Age Population in Bulgaria, 2018 -2021 |

| 9. Bulgaria Population, 2020-2050F (Million) |

| 10. Bulagaria Ultrasound Device Market Price Trend Analysis, By Portability ($ Million) |

| 11. New Cancer Cases in Males, 2020 |

| 12. New Cancer Cases in Females, 2020 |

| 13. Total New Cancer Cases, 2020 |

| 14. Healthcare Infrastructure in Bulgaria, 2021 |

| 15. Per Capita Spending For Healthcare Development, 2020-2030F($) |

| 16. Bulgaria Ultrasound Device Market Opportunity Assessment, By Portability, 2029F |

| 17. Bulgaria Ultrasound Device Market Opportunity Assessment, By Display, 2029F |

| 18. Bulgaria Ultrasound Device Market Opportunity Assessment, By Type, 2029F |

| 19. Bulgaria Ultrasound Device Market Opportunity Assessment, By Applications, 2029F |

| 20. Bulgaria Ultrasound Device Market Ranking, By Company, 2022 |

| List of Tables |

| 1. Bulgaria Ultrasound Device Market Revenues, By Portability, 2019-2029F ($ Million) |

| 2. Bulgaria Ultrasound Device Market Volume, By Portability, 2019-2029F (Units) |

| 3. Bulgaria Ultrasound Device Market Revenues, By Display, 2019-2029F ($ Million) |

| 4. Bulgaria Ultrasound Device Market Volume, By Display, 2019-2029F (Units) |

| 5. Bulgaria Ultrasound Device Market Revenues, By Type, 2019-2029F ($ Million) |

| 6. Bulgaria Ultrasound Device Market Revenues, By Applications, 2019-2029F ($ Million) |

- Single User License$ 1,995

- Department License$ 2,400

- Site License$ 3,120

- Global License$ 3,795

Search

Thought Leadership and Analyst Meet

Our Clients

Related Reports

- Germany Breakfast Food Market (2026-2032) | Industry, Share, Growth, Size, Companies, Value, Analysis, Revenue, Trends, Forecast & Outlook

- Australia Briquette Market (2025-2031) | Growth, Size, Revenue, Forecast, Analysis, Trends, Value, Share, Industry & Companies

- Vietnam System Integrator Market (2025-2031) | Size, Companies, Analysis, Industry, Value, Forecast, Growth, Trends, Revenue & Share

- ASEAN and Thailand Brain Health Supplements Market (2025-2031) | Strategy, Consumer Insights, Analysis, Investment Trends, Opportunities, Growth, Size, Share, Industry, Revenue, Segments, Value, Segmentation, Supply, Forecast, Restraints, Outlook, Competition, Drivers, Trends, Demand, Pricing Analysis, Competitive, Strategic Insights, Companies, Challenges

- ASEAN Bearings Market (2025-2031) | Strategy, Consumer Insights, Analysis, Investment Trends, Opportunities, Growth, Size, Share, Industry, Revenue, Segments, Value, Segmentation, Supply, Forecast, Restraints, Outlook, Competition, Drivers, Trends, Demand, Pricing Analysis, Competitive, Strategic Insights, Companies, Challenges

- Europe Flooring Market (2025-2031) | Outlook, Share, Industry, Trends, Forecast, Companies, Revenue, Size, Analysis, Growth & Value

- Saudi Arabia Manlift Market (2025-2031) | Outlook, Size, Growth, Trends, Companies, Industry, Revenue, Value, Share, Forecast & Analysis

- Uganda Excavator, Crane, and Wheel Loaders Market (2025-2031) | Strategy, Consumer Insights, Analysis, Investment Trends, Opportunities, Growth, Size, Share, Industry, Revenue, Segments, Value, Segmentation, Supply, Forecast, Restraints, Outlook, Competition, Drivers, Trends, Demand, Pricing Analysis, Competitive, Strategic Insights, Companies, Challenges

- Rwanda Excavator, Crane, and Wheel Loaders Market (2025-2031) | Strategy, Consumer Insights, Analysis, Investment Trends, Opportunities, Growth, Size, Share, Industry, Revenue, Segments, Value, Segmentation, Supply, Forecast, Restraints, Outlook, Competition, Drivers, Trends, Demand, Pricing Analysis, Competitive, Strategic Insights, Companies, Challenges

- Kenya Excavator, Crane, and Wheel Loaders Market (2025-2031) | Strategy, Consumer Insights, Analysis, Investment Trends, Opportunities, Growth, Size, Share, Industry, Revenue, Segments, Value, Segmentation, Supply, Forecast, Restraints, Outlook, Competition, Drivers, Trends, Demand, Pricing Analysis, Competitive, Strategic Insights, Companies, Challenges

Industry Events and Analyst Meet

Whitepaper

- Middle East & Africa Commercial Security Market Click here to view more.

- Middle East & Africa Fire Safety Systems & Equipment Market Click here to view more.

- GCC Drone Market Click here to view more.

- Middle East Lighting Fixture Market Click here to view more.

- GCC Physical & Perimeter Security Market Click here to view more.

6WResearch In News

- Doha a strategic location for EV manufacturing hub: IPA Qatar

- Demand for luxury TVs surging in the GCC, says Samsung

- Empowering Growth: The Thriving Journey of Bangladesh’s Cable Industry

- Demand for luxury TVs surging in the GCC, says Samsung

- Video call with a traditional healer? Once unthinkable, it’s now common in South Africa

- Intelligent Buildings To Smooth GCC’s Path To Net Zero