China Bauxite Market Outlook | COVID-19 IMPACT, Forecast, Growth, Share, Trends, Size, Analysis, Revenue, Value, Industry & Companies

| Product Code: ETC108100 | Publication Date: Jun 2021 | Updated Date: Oct 2025 | Product Type: Report | |

| Publisher: 6Wresearch | Author: Sumit Sagar | No. of Pages: 70 | No. of Figures: 35 | No. of Tables: 5 |

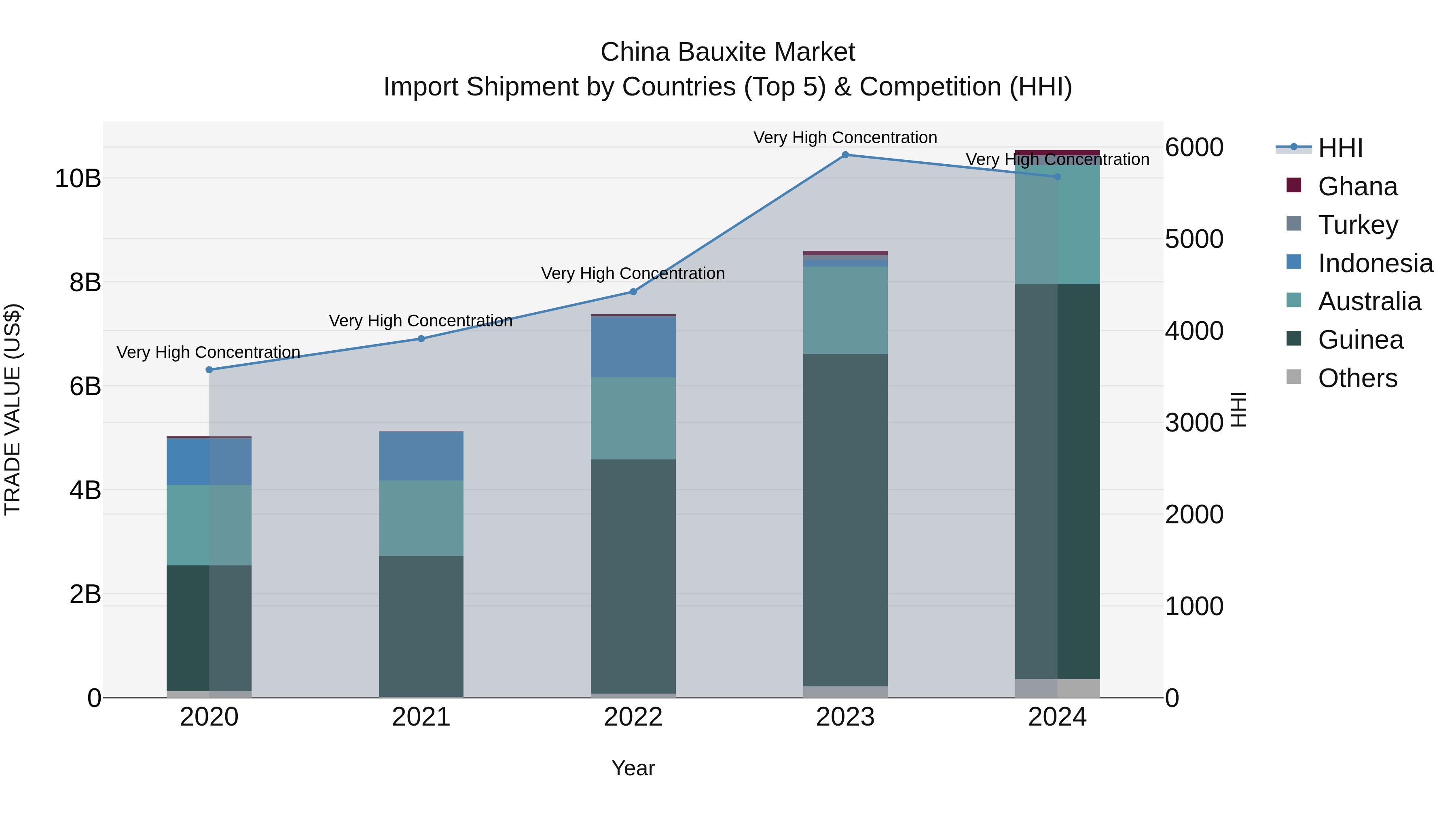

China Bauxite Market Top 5 Importing Countries and Market Competition (HHI) Analysis

In 2024, China bauxite import market continued to be dominated by countries such as Guinea, Australia, Turkey, Lao People`s Dem. Rep., and Ghana. The high Herfindahl-Hirschman Index (HHI) indicates a concentrated market structure. The impressive compound annual growth rate (CAGR) of 20.33% from 2020 to 2024 underscores the strong demand for bauxite in China. Moreover, the growth rate of 22.53% from 2023 to 2024 suggests a further acceleration in import shipments, highlighting the importance of these key exporting countries in meeting China bauxite needs.

China Export Potential Assessment For Bauxite Market (Values in USD Thousand)

China Bauxite Market Overview

The China Bauxite Market is experiencing steady growth driven by the country`s strong demand for aluminum production. China is the world`s largest producer and consumer of bauxite, a key raw material used in the production of aluminum. The market is influenced by factors such as government policies, industrial development, and global economic conditions. Environmental regulations and sustainability concerns are increasingly shaping the industry, leading to efforts to improve mining practices and reduce environmental impact. China`s bauxite market is competitive, with both domestic production and imports playing significant roles in meeting the growing demand. The market is expected to continue to expand as China`s industrial sector evolves and the country remains a key player in the global aluminum supply chain.

China Bauxite Market Trends

The China Bauxite market is experiencing several key trends currently. One significant trend is the increasing demand for bauxite imports due to the country`s limited domestic supply and the closure of illegal mining operations. Environmental regulations and a push for sustainable mining practices are also shaping the market, leading to stricter enforcement and higher compliance costs for bauxite producers. Additionally, China`s focus on reducing reliance on foreign bauxite sources is driving investments in domestic mining projects and exploration activities. As the country continues to ramp up its aluminum production capacity, the China Bauxite market is likely to see continued growth in demand, with a strong emphasis on sustainable sourcing and supply chain transparency.

China Bauxite Market Challenges

In the China bauxite market, one of the key challenges faced is overcapacity. The industry has experienced rapid expansion in recent years, leading to an oversupply of bauxite ore. This has resulted in intense price competition among suppliers, leading to lower profit margins and financial strains for many companies. Additionally, environmental concerns surrounding bauxite mining and processing have led to increased regulatory scrutiny and compliance costs. The need to adhere to stricter environmental standards has added to operational challenges for companies in the bauxite industry. Overall, managing overcapacity, navigating pricing pressures, and meeting stringent environmental regulations are significant challenges faced by players in the China bauxite market.

China Bauxite Market Investment Opportunities

Investment opportunities in the China Bauxite Market can be lucrative due to the growing demand for bauxite, a key ingredient in aluminum production. China is the world`s largest producer and consumer of aluminum, driving the demand for bauxite as a raw material. Investing in bauxite mining companies or companies involved in bauxite exploration and extraction in China could offer promising returns. Additionally, investing in companies that provide transportation and logistics services for bauxite shipments could also be a viable opportunity. With China`s continued industrialization and infrastructure development, the demand for bauxite is expected to remain strong, making the China Bauxite Market an attractive investment option for those looking to capitalize on the country`s growing aluminum industry.

China Bauxite Market Government Policy

The Chinese government has implemented various policies related to the bauxite market to ensure sustainable development and environmental protection. These policies include regulations on mining practices to prevent overexploitation and environmental degradation, as well as restrictions on bauxite imports to support domestic production. Additionally, the government has implemented measures to promote the recycling of bauxite waste and the development of new technologies to improve resource efficiency in the bauxite industry. Overall, the government aims to balance the demand for bauxite with environmental concerns and domestic production capabilities to maintain a stable and sustainable bauxite market in China.

China Bauxite Market Future Outlook

The future outlook for the China Bauxite Market appears to be positive, driven by factors such as the country`s strong demand for aluminum, which is a key end-use of bauxite, and ongoing industrialization and urbanization initiatives. China is the world`s largest producer and consumer of aluminum, and bauxite is the primary raw material used in its production. Additionally, the Chinese government`s focus on infrastructure development and sustainable growth is expected to further boost the demand for bauxite in the coming years. However, challenges such as environmental regulations and supply chain disruptions could impact the market. Overall, with the increasing demand for aluminum and the government`s support for the industry, the China Bauxite Market is likely to witness steady growth in the foreseeable future.

Key Highlights of the Report:

- China Bauxite Market Outlook

- Market Size of China Bauxite Market, 2021

- Forecast of China Bauxite Market, 2027

- Historical Data and Forecast of China Bauxite Revenues & Volume for the Period 2018 - 2027

- China Bauxite Market Trend Evolution

- China Bauxite Market Drivers and Challenges

- China Bauxite Price Trends

- China Bauxite Porter's Five Forces

- China Bauxite Industry Life Cycle

- Historical Data and Forecast of China Bauxite Market Revenues & Volume By Product for the Period 2018 - 2027

- Historical Data and Forecast of China Bauxite Market Revenues & Volume By Metallurgical Grade for the Period 2018 - 2027

- Historical Data and Forecast of China Bauxite Market Revenues & Volume By Refractory Grade for the Period 2018 - 2027

- Historical Data and Forecast of China Bauxite Market Revenues & Volume By Application for the Period 2018 - 2027

- Historical Data and Forecast of China Bauxite Market Revenues & Volume By Alumina Production for the Period 2018 - 2027

- Historical Data and Forecast of China Bauxite Market Revenues & Volume By Refractory for the Period 2018 - 2027

- Historical Data and Forecast of China Bauxite Market Revenues & Volume By Cement for the Period 2018 - 2027

- Historical Data and Forecast of China Bauxite Market Revenues & Volume By Others for the Period 2018 - 2027

- China Bauxite Import Export Trade Statistics

- Market Opportunity Assessment By Product

- Market Opportunity Assessment By Application

- China Bauxite Top Companies Market Share

- China Bauxite Competitive Benchmarking By Technical and Operational Parameters

- China Bauxite Company Profiles

- China Bauxite Key Strategic Recommendations

Frequently Asked Questions About the Market Study (FAQs):

1 Executive Summary |

2 Introduction |

2.1 Key Highlights of the Report |

2.2 Report Description |

2.3 Market Scope & Segmentation |

2.4 Research Methodology |

2.5 Assumptions |

3 China Bauxite Market Overview |

3.1 China Country Macro Economic Indicators |

3.2 China Bauxite Market Revenues & Volume, 2021 & 2027F |

3.3 China Bauxite Market - Industry Life Cycle |

3.4 China Bauxite Market - Porter's Five Forces |

3.5 China Bauxite Market Revenues & Volume Share, By Product, 2021 & 2027F |

3.6 China Bauxite Market Revenues & Volume Share, By Application, 2021 & 2027F |

4 China Bauxite Market Dynamics |

4.1 Impact Analysis |

4.2 Market Drivers |

4.2.1 Increasing demand for aluminum in various industries such as automotive, construction, and packaging. |

4.2.2 Growing infrastructure development projects in China driving the demand for bauxite. |

4.2.3 Government initiatives to support domestic bauxite production and reduce reliance on imports. |

4.3 Market Restraints |

4.3.1 Environmental concerns and regulations impacting bauxite mining and processing. |

4.3.2 Fluctuating prices of bauxite in the global market affecting profitability. |

5 China Bauxite Market Trends |

6 China Bauxite Market, By Types |

6.1 China Bauxite Market, By Product |

6.1.1 Overview and Analysis |

6.1.2 China Bauxite Market Revenues & Volume, By Product, 2018 - 2027F |

6.1.3 China Bauxite Market Revenues & Volume, By Metallurgical Grade, 2018 - 2027F |

6.1.4 China Bauxite Market Revenues & Volume, By Refractory Grade, 2018 - 2027F |

6.2 China Bauxite Market, By Application |

6.2.1 Overview and Analysis |

6.2.2 China Bauxite Market Revenues & Volume, By Alumina Production, 2018 - 2027F |

6.2.3 China Bauxite Market Revenues & Volume, By Refractory, 2018 - 2027F |

6.2.4 China Bauxite Market Revenues & Volume, By Cement, 2018 - 2027F |

6.2.5 China Bauxite Market Revenues & Volume, By Others, 2018 - 2027F |

7 China Bauxite Market Import-Export Trade Statistics |

7.1 China Bauxite Market Export to Major Countries |

7.2 China Bauxite Market Imports from Major Countries |

8 China Bauxite Market Key Performance Indicators |

8.1 Energy efficiency of bauxite mining and processing operations. |

8.2 Percentage of bauxite demand met through domestic production. |

8.3 Investment in research and development for sustainable bauxite mining practices. |

9 China Bauxite Market - Opportunity Assessment |

9.1 China Bauxite Market Opportunity Assessment, By Product, 2021 & 2027F |

9.2 China Bauxite Market Opportunity Assessment, By Application, 2021 & 2027F |

10 China Bauxite Market - Competitive Landscape |

10.1 China Bauxite Market Revenue Share, By Companies, 2021 |

10.2 China Bauxite Market Competitive Benchmarking, By Operating and Technical Parameters |

11 Company Profiles |

12 Recommendations |

13 Disclaimer |

- Single User License$ 1,995

- Department License$ 2,400

- Site License$ 3,120

- Global License$ 3,795

Search

Thought Leadership and Analyst Meet

Our Clients

Related Reports

- Canada Oil and Gas Market (2026-2032) | Share, Segmentation, Value, Industry, Trends, Forecast, Analysis, Size & Revenue, Growth, Competitive Landscape, Outlook, Companies

- Germany Breakfast Food Market (2026-2032) | Industry, Share, Growth, Size, Companies, Value, Analysis, Revenue, Trends, Forecast & Outlook

- Australia Briquette Market (2025-2031) | Growth, Size, Revenue, Forecast, Analysis, Trends, Value, Share, Industry & Companies

- Vietnam System Integrator Market (2025-2031) | Size, Companies, Analysis, Industry, Value, Forecast, Growth, Trends, Revenue & Share

- ASEAN and Thailand Brain Health Supplements Market (2025-2031) | Strategy, Consumer Insights, Analysis, Investment Trends, Opportunities, Growth, Size, Share, Industry, Revenue, Segments, Value, Segmentation, Supply, Forecast, Restraints, Outlook, Competition, Drivers, Trends, Demand, Pricing Analysis, Competitive, Strategic Insights, Companies, Challenges

- ASEAN Bearings Market (2025-2031) | Strategy, Consumer Insights, Analysis, Investment Trends, Opportunities, Growth, Size, Share, Industry, Revenue, Segments, Value, Segmentation, Supply, Forecast, Restraints, Outlook, Competition, Drivers, Trends, Demand, Pricing Analysis, Competitive, Strategic Insights, Companies, Challenges

- Europe Flooring Market (2025-2031) | Outlook, Share, Industry, Trends, Forecast, Companies, Revenue, Size, Analysis, Growth & Value

- Saudi Arabia Manlift Market (2025-2031) | Outlook, Size, Growth, Trends, Companies, Industry, Revenue, Value, Share, Forecast & Analysis

- Uganda Excavator, Crane, and Wheel Loaders Market (2025-2031) | Strategy, Consumer Insights, Analysis, Investment Trends, Opportunities, Growth, Size, Share, Industry, Revenue, Segments, Value, Segmentation, Supply, Forecast, Restraints, Outlook, Competition, Drivers, Trends, Demand, Pricing Analysis, Competitive, Strategic Insights, Companies, Challenges

- Rwanda Excavator, Crane, and Wheel Loaders Market (2025-2031) | Strategy, Consumer Insights, Analysis, Investment Trends, Opportunities, Growth, Size, Share, Industry, Revenue, Segments, Value, Segmentation, Supply, Forecast, Restraints, Outlook, Competition, Drivers, Trends, Demand, Pricing Analysis, Competitive, Strategic Insights, Companies, Challenges

Industry Events and Analyst Meet

Whitepaper

- Middle East & Africa Commercial Security Market Click here to view more.

- Middle East & Africa Fire Safety Systems & Equipment Market Click here to view more.

- GCC Drone Market Click here to view more.

- Middle East Lighting Fixture Market Click here to view more.

- GCC Physical & Perimeter Security Market Click here to view more.

6WResearch In News

- Doha a strategic location for EV manufacturing hub: IPA Qatar

- Demand for luxury TVs surging in the GCC, says Samsung

- Empowering Growth: The Thriving Journey of Bangladesh’s Cable Industry

- Demand for luxury TVs surging in the GCC, says Samsung

- Video call with a traditional healer? Once unthinkable, it’s now common in South Africa

- Intelligent Buildings To Smooth GCC’s Path To Net Zero