China Candy Market (2025-2029) | Growth, Share, Revenue, Analysis, Forecast, Value, Outlook, Size, Trends, Industry & Companies

Market Forecast By Product Type (Chocolate Candy, Non-Chocolate Candy), By Distribution (Supermarkets and Hypermarkets, Convenience Stores, Specalist Retailers, Online Retail, Others) And Competitive Landscape

| Product Code: ETC040142 | Publication Date: Jan 2021 | Updated Date: Oct 2025 | Product Type: Report | |

| Publisher: 6Wresearch | Author: Ravi Bhandari | No. of Pages: 70 | No. of Figures: 35 | No. of Tables: 5 |

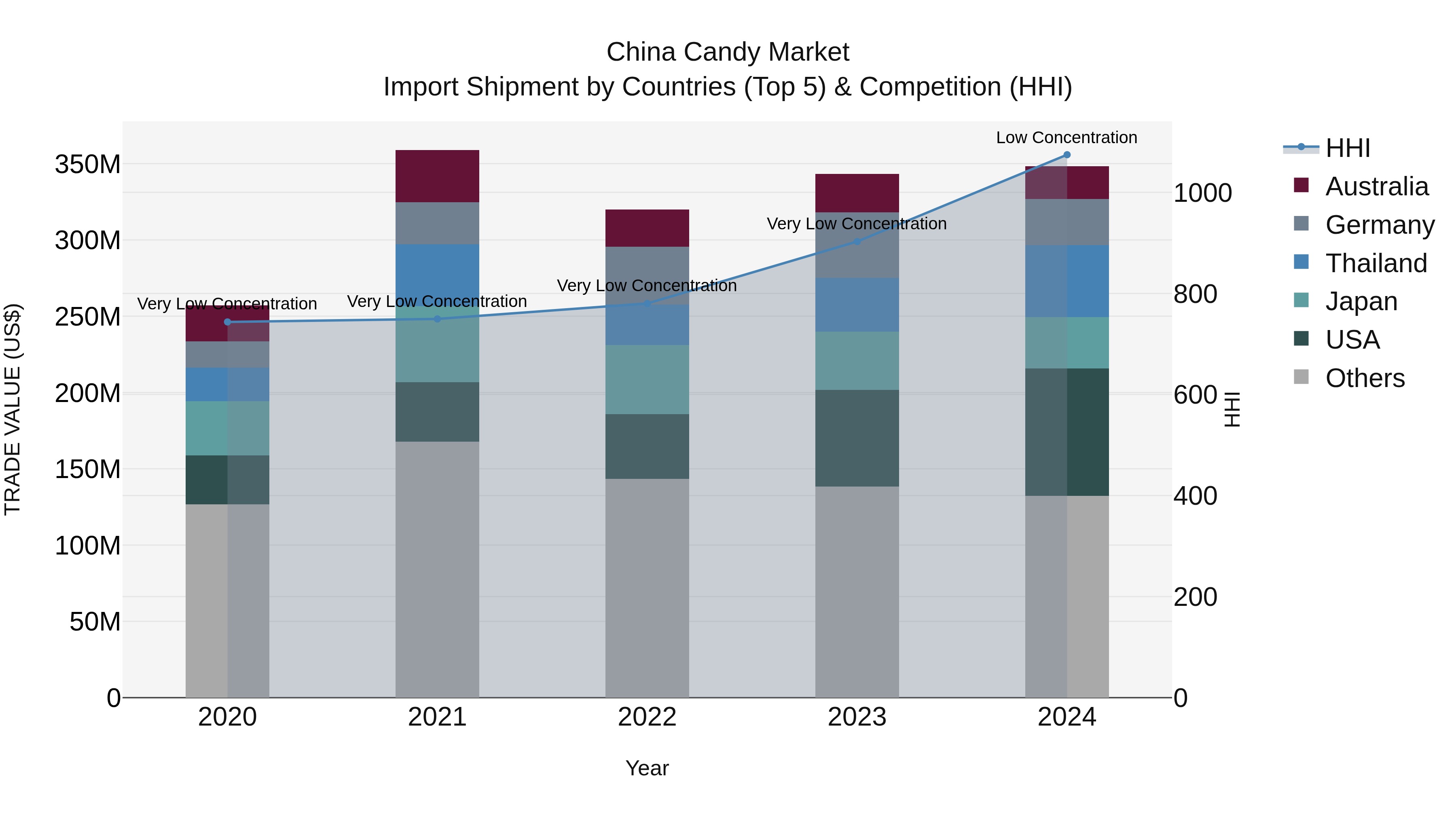

China Candy Market Top 5 Importing Countries and Market Competition (HHI) Analysis

China candy import market continues to show steady growth, with the USA, Thailand, Japan, Germany, and Australia emerging as the top exporting countries in 2024. The market has seen a shift towards lower concentration levels, indicating increased competition and diversity among suppliers. With a healthy Compound Annual Growth Rate (CAGR) of 7.89% from 2020 to 2024 and a respectable growth rate of 1.47% in 2024 alone, the candy import industry in China is poised for further expansion and opportunities for both domestic and international players.

China Candy Market Highlights

| Report Name | China Candy Market |

| Forecast period | 2025-2029 |

| CAGR | 6.50% |

| Growing Sector | Chocolate & Confectionery |

Topics Covered in the China Candy Market Report

The China Candy Market report thoroughly covers the market by product type, distribution channel, and regions. It presents a balanced and in-depth evaluation of market trends, drivers, high-growth areas, and strategic opportunities to help stakeholders understand changing consumer behavior and capitalize on emerging revenue potential within China's expansive retail and FMCG ecosystem.

China Candy Market Synopsis

The candy market in China is growing significantly, supported by greater disposable income, a culture of gift-giving, and a taste for high-end confections. City dwellers desire more indulgent, imaginative candy, especially during celebrations. Brands are innovating with new tastes, healthier variants, and vitamin-rich offerings. At the same time, global candy imports and e-commerce platforms are enhancing distribution and increasing profit margins throughout China’s diverse consumer segments.

China Candy Market is projected to grow rapidly, growing at a growth rate of (CAGR) of 6.50% during the forecast period 2025–2029. Shifting taste trends, greater western influence in eating habits, and strong appeal among younger consumers are major growth drivers for the candy market. Sales spike during Chinese New Year and Mid-Autumn Festival due to seasonal consumption. Broader product offerings from both domestic and international companies are increasing variety and competition. Influencer-driven digital campaigns and livestream e-commerce are further amplifying brand exposure and encouraging spontaneous buying decisions.

China Candy Market Challenges

While maintaining solid growth, the China Candy Industry contends with persistent challenges like mounting health worries about sugar, rising demand for clean-label products, and tough rivalry from better-for-you snacks. Small-scale manufacturers face strict food safety regulations and packaging requirements. Unpredictable pricing of essential ingredients such as cocoa and dairy adds pressure on production budgets. Growing distrust of synthetic additives is compelling companies to focus on openness, gain certifications, and adopt sustainable sourcing methods to build consumer trust and long-term brand allegiance across competitive segments.

China Candy Market Trends

Major industry trends include rising interest in sugar-free and vegan confectionery, rollout of limited-edition flavors inspired by classic Chinese ingredients, and premium touches like stylish packaging and added health benefits. The demand is also increasing for customizable and personalized candy gifts. E-commerce platforms continue to support the growth of niche, imported, and artisanal offerings. Meanwhile, QR-code-driven storytelling and augmented reality packaging are gaining popularity among Gen Z, offering interactive experiences that increase product engagement and appeal.

Investment Opportunities in the China Candy Industry

The China candy market Growth offers various investment prospects in functional sweets, organic components, and novel retail approaches. Fast-growing segments include low-GI treats and nutritionally enhanced gummies. Investors focused on automation are drawn to tech-driven manufacturing and logistics. Retail innovators promoting curated candy boxes and subscription formats are attracting consumer attention. Government support for food-tech progress and cleaner labeling is encouraging R&D in areas such as natural flavor profiles, compostable packaging, and allergy-friendly candy product lines.

Leading Players of the China Candy Market

The China Candy Market Share is led by a mix of international and local players that are expanding their presence through digital platforms, diversified product lines, and cultural relevance. Major companies include Mars China, Mondelez International, Ferrero, Hsu Fu Chi (Nestlé), and Orion Corp. Domestic brands are increasingly launching regional flavors to appeal to local tastes. Companies are also adopting localized marketing campaigns and brand collaborations with celebrities and animated franchises to build emotional connections and brand recall.

Government Regulations Introduced in the China Candy Market

According to the Chinese government data, there are some strict regulations under the Food Safety Law of the People's Republic of China, focusing on sugar content labeling, use of artificial sweeteners, and hygiene compliance. Initiatives like "Healthy China 2030" advocate for manufacturers to lower sugar content and increases ingredient quality. The National Health Commission requires explicit ingredient transparency and allergen notifications. Regulatory initiatives encompass the reduction of packaging waste via the Circular Economy Promotion Law, advocating for sustainable material utilization across the fast-moving consumer goods sectors.

Future Insights of the China Candy Market

Ongoing growth in China candy sector will stem from rising consumer experimentation and increasing digital involvement. Future trends include AI-based personalization for flavor selection and algorithm-designed wellness candies. Export of uniquely Chinese confectionery to overseas markets will enhance global presence. Technological updates like interactive vending, smart labels, and creative packaging will change retail norms. Health-forward movements will push candy makers to fuse enjoyment and functionality, offering hybrid products across general retail and specialized wellness niches.

Market Segmentation Analysis

The report offers a comprehensive study of the subsequent market segments and their leading categories.

Chocolate Candy to Dominate the Market – By Product Type

According to Guneet Kaur, Senior Research Analyst, 6Wresearch, Chocolate candy leads the product type segment due to its wide appeal, emotional connect, and premium gifting potential. Popular among all age groups, chocolate consumption spikes during seasonal events and holidays. The segment includes dark, milk, filled, and health-focused chocolates. Domestic and international brands invest heavily in product innovation and luxury presentation.

Supermarkets and Hypermarkets to Dominate the Market – By Distribution Channel

Supermarkets and hypermarkets dominate the distribution segment owing to their extensive reach, variety, and attractive in-store promotions. These retail outlets offer consumers the ability to explore multiple candy brands, take advantage of bundled deals, and make impulse purchases. Modern retail expansion in Tier 1 and Tier 2 cities has boosted visibility for both local and imported candies.

Key Attractiveness of the Report

- 10 Years of Market Numbers.

- Historical Data Starting from 2021 to 2024.

- Base Year: 2024.

- Forecast Data until 2029

- Key Performance Indicators Impacting the Market.

- Major Upcoming Developments and Projects.

Key Highlights of the Report:

- China Candy Market Outlook

- Market Size of China Candy Market, 2024

- Forecast of China Candy Market, 2029

- Historical Data and Forecast of China Candy Revenues & Volume for the Period 2019-2029

- China Candy Market Trend Evolution

- China Candy Market Drivers and Challenges

- China Candy Price Trends

- China Candy Porter's Five Forces

- China Candy Industry Life Cycle

- Historical Data and Forecast of China Candy Market Revenues & Volume By Product Type for the Period 2019-2029

- Historical Data and Forecast of China Candy Market Revenues & Volume By Chocolate Candy for the Period 2019-2029

- Historical Data and Forecast of China Candy Market Revenues & Volume By Non-Chocolate Candy for the Period 2019-2029

- Historical Data and Forecast of China Candy Market Revenues & Volume By Distribution for the Period 2019-2029

- Historical Data and Forecast of China Candy Market Revenues & Volume By Supermarkets and Hypermarkets for the Period 2019-2029

- Historical Data and Forecast of China Candy Market Revenues & Volume By Convenience Stores for the Period 2019-2029

- Historical Data and Forecast of China Candy Market Revenues & Volume By Specalist Retailers for the Period 2019-2029

- Historical Data and Forecast of China Candy Market Revenues & Volume By Online Retail for the Period 2019-2029

- Historical Data and Forecast of China Candy Market Revenues & Volume By Others for the Period 2019-2029

- China Candy Import Export Trade Statistics

- Market Opportunity Assessment By Product Type

- Market Opportunity Assessment By Distribution

- China Candy Top Companies Market Share

- China Candy Competitive Benchmarking By Technical and Operational Parameters

- China Candy Company Profiles

- China Candy Key Strategic Recommendations

Market Covered

The market report provides a detailed analysis of the following market segments:

By Product Type

- Chocolate Candy

- Non-Chocolate Candy

By Distribution Channel

- Supermarkets and Hypermarkets

- Convenience Stores

- Specialist Retailers

- Online Retail

- Others

China Candy Market (2025-2029) : FAQ's

| 1 Executive Summary |

| 2 Introduction |

| 2.1 Key Highlights of the Report |

| 2.2 Report Description |

| 2.3 Market Scope & Segmentation |

| 2.4 Research Methodology |

| 2.5 Assumptions |

| 3 China Candy Market Overview |

| 3.1 China Country Macro Economic Indicators |

| 3.2 China Candy Market Revenues & Volume, 2019 & 2029F |

| 3.3 China Candy Market - Industry Life Cycle |

| 3.4 China Candy Market - Porter's Five Forces |

| 3.5 China Candy Market Revenues & Volume Share, By Product Type, 2019 & 2029F |

| 3.6 China Candy Market Revenues & Volume Share, By Distribution, 2019 & 2029F |

| 4 China Candy Market Dynamics |

| 4.1 Impact Analysis |

| 4.2 Market Drivers |

| 4.2.1 Increasing disposable income of Chinese consumers leading to higher spending on confectionery products |

| 4.2.2 Growing popularity of Western-style candies and confectionery in China |

| 4.2.3 Rising demand for premium and innovative candy products in the market |

| 4.3 Market Restraints |

| 4.3.1 Stringent regulations and standards for food safety and labeling in China |

| 4.3.2 Health concerns related to high sugar content in candies leading to consumer shift towards healthier snack options |

| 5 China Candy Market Trends |

| 6 China Candy Market, By Types |

| 6.1 China Candy Market, By Product Type |

| 6.1.1 Overview and Analysis |

| 6.1.2 China Candy Market Revenues & Volume, By Product Type, 2019-2029F |

| 6.1.3 China Candy Market Revenues & Volume, By Chocolate Candy, 2019-2029F |

| 6.1.4 China Candy Market Revenues & Volume, By Non-Chocolate Candy, 2019-2029F |

| 6.2 China Candy Market, By Distribution |

| 6.2.1 Overview and Analysis |

| 6.2.2 China Candy Market Revenues & Volume, By Supermarkets and Hypermarkets, 2019-2029F |

| 6.2.3 China Candy Market Revenues & Volume, By Convenience Stores, 2019-2029F |

| 6.2.4 China Candy Market Revenues & Volume, By Specalist Retailers, 2019-2029F |

| 6.2.5 China Candy Market Revenues & Volume, By Online Retail, 2019-2029F |

| 6.2.6 China Candy Market Revenues & Volume, By Others, 2019-2029F |

| 7 China Candy Market Import-Export Trade Statistics |

| 7.1 China Candy Market Export to Major Countries |

| 7.2 China Candy Market Imports from Major Countries |

| 8 China Candy Market Key Performance Indicators |

| 8.1 Consumer engagement on social media platforms for candy brands |

| 8.2 Number of new product launches and innovations in the candy market |

| 8.3 Growth in online sales and e-commerce penetration for candy products in China |

| 9 China Candy Market - Opportunity Assessment |

| 9.1 China Candy Market Opportunity Assessment, By Product Type, 2019 & 2029F |

| 9.2 China Candy Market Opportunity Assessment, By Distribution, 2019 & 2029F |

| 10 China Candy Market - Competitive Landscape |

| 10.1 China Candy Market Revenue Share, By Companies, 2024 |

| 10.2 China Candy Market Competitive Benchmarking, By Operating and Technical Parameters |

| 11 Company Profiles |

| 12 Recommendations |

| 13 Disclaimer |

Export potential assessment - trade Analytics for 2030

Export potential enables firms to identify high-growth global markets with greater confidence by combining advanced trade intelligence with a structured quantitative methodology. The framework analyzes emerging demand trends and country-level import patterns while integrating macroeconomic and trade datasets such as GDP and population forecasts, bilateral import–export flows, tariff structures, elasticity differentials between developed and developing economies, geographic distance, and import demand projections. Using weighted trade values from 2020–2024 as the base period to project country-to-country export potential for 2030, these inputs are operationalized through calculated drivers such as gravity model parameters, tariff impact factors, and projected GDP per-capita growth. Through an analysis of hidden potentials, demand hotspots, and market conditions that are most favorable to success, this method enables firms to focus on target countries, maximize returns, and global expansion with data, backed by accuracy.

By factoring in the projected importer demand gap that is currently unmet and could be potential opportunity, it identifies the potential for the Exporter (Country) among 190 countries, against the general trade analysis, which identifies the biggest importer or exporter.

To discover high-growth global markets and optimize your business strategy:

Click Here- Single User License$ 1,995

- Department License$ 2,400

- Site License$ 3,120

- Global License$ 3,795

Search

Thought Leadership and Analyst Meet

Our Clients

Related Reports

- Iraq Insulation and Waterproofing Market (2026-2032) | Outlook, Drivers, Growth, Size, Share, Industry, Revenue, Trends, Demand, Competitive, Strategic Insights, Opportunities, Segments, Companies, Challenges, Strategy, Consumer Insights, Analysis, Investment Trends, Value, Segmentation, Forecast, Restraints

- India Switchgear Market Outlook (2026 - 2032) | Size, Share, Trends, Growth, Revenue, Forecast, Analysis, Value, Outlook

- Pakistan Contraceptive Implants Market (2025-2031) | Demand, Growth, Size, Share, Industry, Pricing Analysis, Competitive, Strategic Insights, Strategy, Consumer Insights, Analysis, Investment Trends, Opportunities, Revenue, Segments, Value, Segmentation, Supply, Forecast, Restraints, Outlook, Competition, Drivers, Trends, Companies, Challenges

- Sri Lanka Packaging Market (2026-2032) | Outlook, Competition, Drivers, Trends, Demand, Pricing Analysis, Competitive, Strategic Insights, Companies, Challenges, Strategy, Consumer Insights, Analysis, Investment Trends, Opportunities, Growth, Size, Share, Industry, Revenue, Segments, Value, Segmentation, Supply, Forecast, Restraints

- India Kids Watches Market (2026-2032) | Strategy, Consumer Insights, Analysis, Investment Trends, Opportunities, Growth, Size, Share, Industry, Revenue, Segments, Value, Segmentation, Supply, Forecast, Restraints, Outlook, Competition, Drivers, Trends, Demand, Pricing Analysis, Competitive, Strategic Insights, Companies, Challenges

- Saudi Arabia Core Assurance Service Market (2025-2031) | Strategy, Consumer Insights, Analysis, Investment Trends, Opportunities, Growth, Size, Share, Industry, Revenue, Segments, Value, Segmentation, Supply, Forecast, Restraints, Outlook, Competition, Drivers, Trends, Demand, Pricing Analysis, Competitive, Strategic Insights, Companies, Challenges

- Romania Uninterruptible Power Supply (UPS) Market (2026-2032) | Industry, Analysis, Revenue, Size, Forecast, Outlook, Value, Trends, Share, Growth & Companies

- Saudi Arabia Car Window Tinting Film, Paint Protection Film (PPF), and Ceramic Coating Market (2025-2031) | Strategy, Consumer Insights, Analysis, Investment Trends, Opportunities, Growth, Size, Share, Industry, Revenue, Segments, Value, Segmentation, Supply, Forecast, Restraints, Outlook, Competition, Drivers, Trends, Demand, Pricing Analysis, Competitive, Strategic Insights, Companies, Challenges

- South Africa Stationery Market (2025-2031) | Share, Size, Industry, Value, Growth, Revenue, Analysis, Trends, Segmentation & Outlook

- Afghanistan Rocking Chairs And Adirondack Chairs Market (2026-2032) | Size & Revenue, Competitive Landscape, Share, Segmentation, Industry, Value, Outlook, Analysis, Trends, Growth, Forecast, Companies

Industry Events and Analyst Meet

Whitepaper

- Middle East & Africa Commercial Security Market Click here to view more.

- Middle East & Africa Fire Safety Systems & Equipment Market Click here to view more.

- GCC Drone Market Click here to view more.

- Middle East Lighting Fixture Market Click here to view more.

- GCC Physical & Perimeter Security Market Click here to view more.

6WResearch In News

- Doha a strategic location for EV manufacturing hub: IPA Qatar

- Demand for luxury TVs surging in the GCC, says Samsung

- Empowering Growth: The Thriving Journey of Bangladesh’s Cable Industry

- Demand for luxury TVs surging in the GCC, says Samsung

- Video call with a traditional healer? Once unthinkable, it’s now common in South Africa

- Intelligent Buildings To Smooth GCC’s Path To Net Zero