China Iron Ore Market (2025-2029) | Companies, Industry, Analysis, Size, Share, Value, Growth, Revenue, Outlook, Trends, Forecast

Market Forecast By Type (Hematite, Magnetite, Others), By Form (Pellets, Lumps, Fines), By Application (Steel Production, Medicine, Others) And Competitive Landscape

| Product Code: ETC050941 | Publication Date: Jan 2021 | Updated Date: Oct 2025 | Product Type: Report | |

| Publisher: 6Wresearch | Author: Ravi Bhandari | No. of Pages: 70 | No. of Figures: 35 | No. of Tables: 5 |

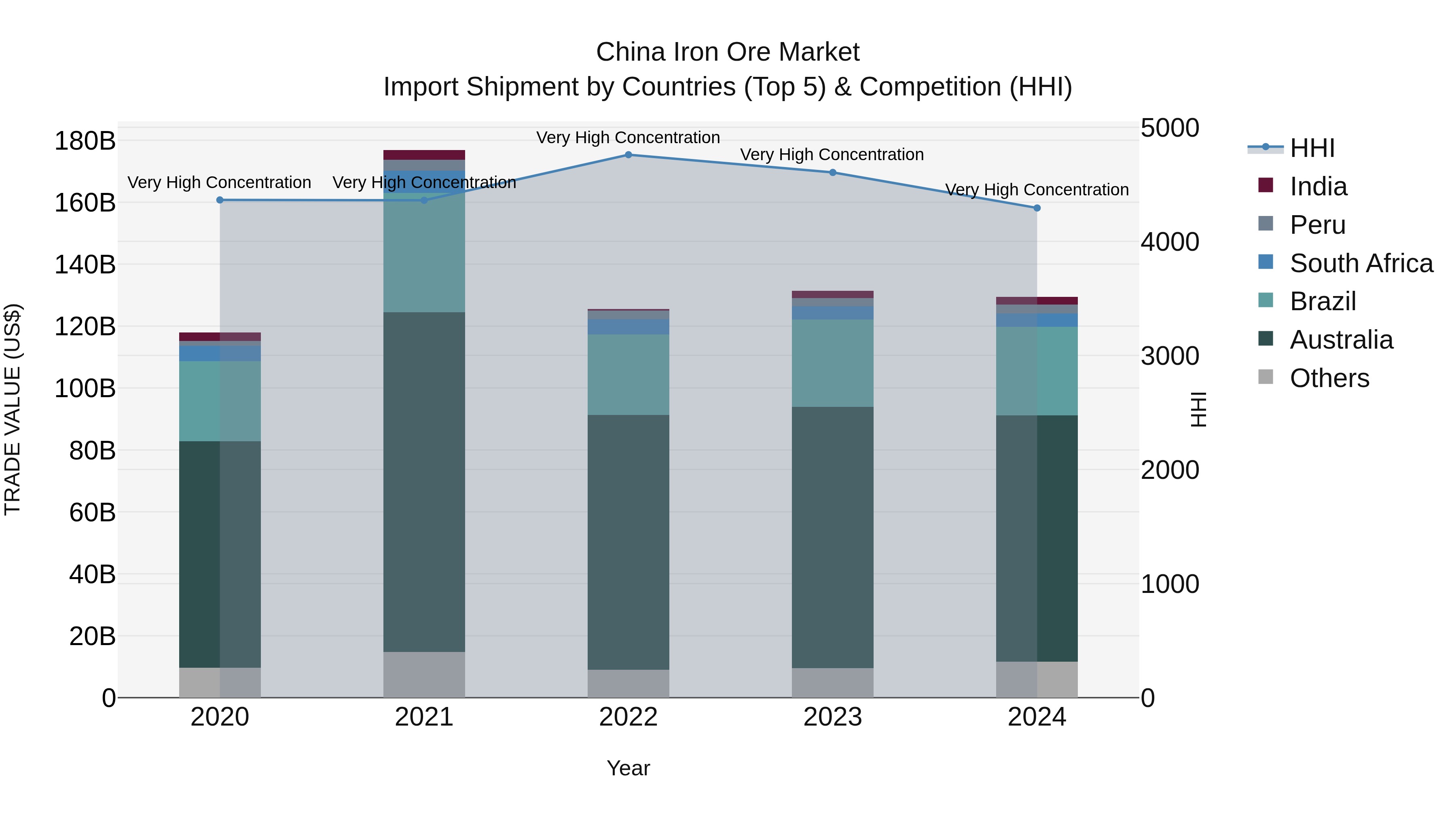

China Iron Ore Market Top 5 Importing Countries and Market Competition (HHI) Analysis

China iron ore import market in 2024 continued to be dominated by top exporters including Australia, Brazil, South Africa, Peru, and India. Despite a slight decline in growth rate from 2023 to 2024, the industry maintained a high level of concentration, as indicated by the Herfindahl-Hirschman Index (HHI). With a compound annual growth rate (CAGR) of 2.34% from 2020 to 2024, the market demonstrated steady expansion over the past few years, pointing to continued reliance on these key exporting countries for China iron ore supply.

China Iron Ore Market Highlights

| Report Name | China Iron Ore Market |

| Forecast period | 2025-2029 |

| CAGR | 6.79% |

| Growing Sector | Steel Production Sector |

Topics Covered in the China Iron Ore Market Report

The China Iron Ore Market report thoroughly covers the market by type, form, and application. The report provides an unbiased and detailed analysis of the ongoing market trends, opportunities, growth areas, and market drivers to help stakeholders align their strategies with current and future market dynamics.

China Iron Ore Market Synopsis

Growing usage of steel in various sectors like construction, automotive, and shipbuilding has been driving the robust growth in the China iron ore market. Another key factor driving the market is strong foreign partnerships. Market ecosystem is being influenced by government support for self-sufficiency in raw materials. China’s efforts to protect overseas iron ore mines, particularly in Guinea and Africa, display tactics for a long run to decrease dependence on Australian and Brazilian suppliers while ensuring steady revenue growth.

China Iron Ore Market is expected to grow at a CAGR of 6.79% during the forecast period 2025–2029. The China iron ore market is primarily driven by rising steel production, fueled by demand from construction, automotive, shipbuilding, and renewable energy industries. Government-backed infrastructure projects, including smart cities, high-speed railways, and the Belt and Road Initiative, further stimulate consumption. Additionally, strict environmental regulations are pushing demand for high-grade ores like hematite and pellets. Policies promoting domestic mining and self-sufficiency under the “Iron Ore Security Strategy” are also strengthening long-term industry growth.

China Iron Ore Market Challenges

The China iron ore market encounters several obstacles that hinder its growth. Major challenges include environmental limitations on low-grade ore consumptions. Uncertain global prices are also a key hurdle that interferes with market growth. Market revenue is impacted by rising logistics costs. Heavy reliance on imports is causing complexities by making the market vulnerable to geopolitical problems. Extraction costs and regulatory monitoring are adding hurdles to large-scale market growth across the country. Limited access to advanced beneficiation technology is a major obstacle faced by local mining firms. These challenges hamper steady supply and raise the pressure on China’s steel manufacturers to seek sustainable sourcing.

China Iron Ore Market Trends

The China iron ore market is experiencing significant trends. Increasing adoption of beneficiation technologies for higher efficiency is one of the major trends in the market. Another key trend influencing the market is the growing preference for pelletized ore in green steel initiatives. Market growth is being shaped by digital mining solutions for operational improvements. There’s a rise in demand for magnetite reserves owing to government investments in high-grade exploration. Partnerships with Belt and Road countries for long-term supply contracts are becoming essential for ensuring steady China iron ore market share.

Investment Opportunities in the China Iron Ore Market

The China iron ore market offers compelling opportunities for growth. Promising investment prospects can be found in pellet plants and exploration of domestic magnetite mines. Market growth is expanded by investment in sustainable steel production processes. Developing eco-friendly iron ore processing methods can offer prospects for growth. Further, opportunities lie in tapping into AI-driven mining technologies. Ventures supported by government like the Simandou mine in Guinea offer possibilities for global investments. Increased demand in renewable energy infrastructure can be profitable for investors, where lightweight steel materials are progressively applied.

Leading Players in the China Iron Ore Market

Both local and international companies lead the market. Prominent domestic companies that dominate the China iron ore market include Ansteel Group, HBIS Group, China Baowu Steel Group, and Shougang Group. Leading global players are Rio Tinto, Vale, and BHP Group. These players lead in the industry by emphasizing established distribution networks and technological capabilities. They control most of the production, imports, and processing through large-scale operations.

Government Regulations in the China Iron Ore Market

The Chinese government has implemented policies like the “Iron Ore Security Strategy” to boost domestic mining and reduce reliance on foreign sources. Investments in magnetite exploration, strict environmental regulations on steel plants, and promotion of high-grade pellet usage are key initiatives. Projects such as Guinea’s Simandou mine highlight China’s commitment to diversifying imports. Regulations are also focusing on emissions control, ensuring environmentally sustainable industry growth.

Future Insights of the China Iron Ore Market

The future of the China iron ore market seems attractive. The industry is expected to grow with steady demand from steel-intensive industries. Growth in renewable energy ventures is also anticipated to be a key driver in market growth. Development will also be influenced by urban infrastructure, and electric vehicles. In the future, digital mining technologies and green steel processes are likely to shape expansion. Tactical partnerships for overseas resources will also play a key role in redefining the industry. Government policies ensuring sustainability and diversification will further support revenue growth.

Market Segmentation Analysis

The report offers a comprehensive study of the subsequent market segments and their leading categories.

Hematite to Dominate the Market- By Type

Hematite dominates the China iron ore market due to its high iron content and suitability for large-scale steelmaking processes. Its widespread availability and strong demand from blast furnace operators secure its leading position.

Pellets to Dominate the Market- By Form

According to Guneet Kaur, Senior Research Analyst, 6Wresearch, pellets dominate the market as they provide uniform size, higher efficiency, and reduced emissions during steel production. Growing demand for high-grade pellets in environmentally compliant steel plants drives this segment.

Steel Production to Dominate the Market- By Application

Steel production dominates the China iron ore market as the majority of ore is consumed in blast furnaces and electric arc furnaces. Expanding construction, automotive, and infrastructure projects ensure steel production remains the largest application segment.

Key Attractiveness of the Report

- 10 Years of Market Numbers.

- Historical Data Starting from 2021 to 2024.

- Base Year: 2024

- Forecast Data until 2029.

- Key Performance Indicators Impacting the Market.

- Major Upcoming Developments and Projects.

Key Highlights of the Report:

- China Iron Ore Market Outlook

- Market Size of China Iron Ore Market, 2024

- Forecast of China Iron Ore Market, 2029

- Historical Data and Forecast of China Iron Ore Revenues & Volume for the Period 2019 - 2029

- China Iron Ore Market Trend Evolution

- China Iron Ore Market Drivers and Challenges

- China Iron Ore Price Trends

- China Iron Ore Porter's Five Forces

- China Iron Ore Industry Life Cycle

- Historical Data and Forecast of China Iron Ore Market Revenues & Volume By Type for the Period 2019 - 2029

- Historical Data and Forecast of China Iron Ore Market Revenues & Volume By Hematite for the Period 2019 - 2029

- Historical Data and Forecast of China Iron Ore Market Revenues & Volume By Magnetite for the Period 2019 - 2029

- Historical Data and Forecast of China Iron Ore Market Revenues & Volume By Others for the Period 2019 - 2029

- Historical Data and Forecast of China Iron Ore Market Revenues & Volume By Form for the Period 2019 - 2029

- Historical Data and Forecast of China Iron Ore Market Revenues & Volume By Pellets for the Period 2019 - 2029

- Historical Data and Forecast of China Iron Ore Market Revenues & Volume By Lumps for the Period 2019 - 2029

- Historical Data and Forecast of China Iron Ore Market Revenues & Volume By Fines for the Period 2019 - 2029

- Historical Data and Forecast of China Iron Ore Market Revenues & Volume By Application for the Period 2019 - 2029

- Historical Data and Forecast of China Iron Ore Market Revenues & Volume By Steel Production for the Period 2019 - 2029

- Historical Data and Forecast of China Iron Ore Market Revenues & Volume By Medicine for the Period 2019 - 2029

- Historical Data and Forecast of China Iron Ore Market Revenues & Volume By Others for the Period 2019 - 2029

- China Iron Ore Import Export Trade Statistics

- Market Opportunity Assessment By Type

- Market Opportunity Assessment By Form

- Market Opportunity Assessment By Application

- China Iron Ore Top Companies Market Share

- China Iron Ore Competitive Benchmarking By Technical and Operational Parameters

- China Iron Ore Company Profiles

- China Iron Ore Key Strategic Recommendations

Markets Covered

The market report provides a detailed analysis of the following market segments:

By Type:

- Hematite

- Magnetite

- Others

By Form:

- Pellets

- Lumps

- Fines

By Application:

- Steel Production

- Medicine

- Others

China Iron Ore Market (2025-2029) : FAQ's

| 1 Executive Summary |

| 2 Introduction |

| 2.1 Key Highlights of the Report |

| 2.2 Report Description |

| 2.3 Market Scope & Segmentation |

| 2.4 Research Methodology |

| 2.5 Assumptions |

| 3 China Iron Ore Market Overview |

| 3.1 China Country Macro Economic Indicators |

| 3.2 China Iron Ore Market Revenues & Volume, 2019 & 2029F |

| 3.3 China Iron Ore Market - Industry Life Cycle |

| 3.4 China Iron Ore Market - Porter's Five Forces |

| 3.5 China Iron Ore Market Revenues & Volume Share, By Type, 2019 & 2029F |

| 3.6 China Iron Ore Market Revenues & Volume Share, By Form, 2019 & 2029F |

| 3.7 China Iron Ore Market Revenues & Volume Share, By Application, 2019 & 2029F |

| 4 China Iron Ore Market Dynamics |

| 4.1 Impact Analysis |

| 4.2 Market Drivers |

| 4.2.1 Increasing demand for steel production in China |

| 4.2.2 Government initiatives to boost infrastructure development |

| 4.2.3 Growing urbanization and industrialization in China |

| 4.3 Market Restraints |

| 4.3.1 Fluctuating iron ore prices in the global market |

| 4.3.2 Environmental regulations impacting mining operations in China |

| 5 China Iron Ore Market Trends |

| 6 China Iron Ore Market, By Types |

| 6.1 China Iron Ore Market, By Type |

| 6.1.1 Overview and Analysis |

| 6.1.2 China Iron Ore Market Revenues & Volume, By Type, 2019 - 2029F |

| 6.1.3 China Iron Ore Market Revenues & Volume, By Hematite, 2019 - 2029F |

| 6.1.4 China Iron Ore Market Revenues & Volume, By Magnetite, 2019 - 2029F |

| 6.1.5 China Iron Ore Market Revenues & Volume, By Others, 2019 - 2029F |

| 6.2 China Iron Ore Market, By Form |

| 6.2.1 Overview and Analysis |

| 6.2.2 China Iron Ore Market Revenues & Volume, By Pellets, 2019 - 2029F |

| 6.2.3 China Iron Ore Market Revenues & Volume, By Lumps, 2019 - 2029F |

| 6.2.4 China Iron Ore Market Revenues & Volume, By Fines, 2019 - 2029F |

| 6.3 China Iron Ore Market, By Application |

| 6.3.1 Overview and Analysis |

| 6.3.2 China Iron Ore Market Revenues & Volume, By Steel Production, 2019 - 2029F |

| 6.3.3 China Iron Ore Market Revenues & Volume, By Medicine, 2019 - 2029F |

| 6.3.4 China Iron Ore Market Revenues & Volume, By Others, 2019 - 2029F |

| 7 China Iron Ore Market Import-Export Trade Statistics |

| 7.1 China Iron Ore Market Export to Major Countries |

| 7.2 China Iron Ore Market Imports from Major Countries |

| 8 China Iron Ore Market Key Performance Indicators |

| 8.1 Average selling price of iron ore in China |

| 8.2 Capacity utilization rate of iron ore mines in China |

| 8.3 Percentage of iron ore imports vs domestic production in China |

| 9 China Iron Ore Market - Opportunity Assessment |

| 9.1 China Iron Ore Market Opportunity Assessment, By Type, 2019 & 2029F |

| 9.2 China Iron Ore Market Opportunity Assessment, By Form, 2019 & 2029F |

| 9.3 China Iron Ore Market Opportunity Assessment, By Application, 2019 & 2029F |

| 10 China Iron Ore Market - Competitive Landscape |

| 10.1 China Iron Ore Market Revenue Share, By Companies, 2024 |

| 10.2 China Iron Ore Market Competitive Benchmarking, By Operating and Technical Parameters |

| 11 Company Profiles |

| 12 Recommendations |

| 13 Disclaimer |

- Single User License$ 1,995

- Department License$ 2,400

- Site License$ 3,120

- Global License$ 3,795

Search

Thought Leadership and Analyst Meet

Our Clients

Related Reports

- Germany Breakfast Food Market (2026-2032) | Industry, Share, Growth, Size, Companies, Value, Analysis, Revenue, Trends, Forecast & Outlook

- Australia Briquette Market (2025-2031) | Growth, Size, Revenue, Forecast, Analysis, Trends, Value, Share, Industry & Companies

- Vietnam System Integrator Market (2025-2031) | Size, Companies, Analysis, Industry, Value, Forecast, Growth, Trends, Revenue & Share

- ASEAN and Thailand Brain Health Supplements Market (2025-2031) | Strategy, Consumer Insights, Analysis, Investment Trends, Opportunities, Growth, Size, Share, Industry, Revenue, Segments, Value, Segmentation, Supply, Forecast, Restraints, Outlook, Competition, Drivers, Trends, Demand, Pricing Analysis, Competitive, Strategic Insights, Companies, Challenges

- ASEAN Bearings Market (2025-2031) | Strategy, Consumer Insights, Analysis, Investment Trends, Opportunities, Growth, Size, Share, Industry, Revenue, Segments, Value, Segmentation, Supply, Forecast, Restraints, Outlook, Competition, Drivers, Trends, Demand, Pricing Analysis, Competitive, Strategic Insights, Companies, Challenges

- Europe Flooring Market (2025-2031) | Outlook, Share, Industry, Trends, Forecast, Companies, Revenue, Size, Analysis, Growth & Value

- Saudi Arabia Manlift Market (2025-2031) | Outlook, Size, Growth, Trends, Companies, Industry, Revenue, Value, Share, Forecast & Analysis

- Uganda Excavator, Crane, and Wheel Loaders Market (2025-2031) | Strategy, Consumer Insights, Analysis, Investment Trends, Opportunities, Growth, Size, Share, Industry, Revenue, Segments, Value, Segmentation, Supply, Forecast, Restraints, Outlook, Competition, Drivers, Trends, Demand, Pricing Analysis, Competitive, Strategic Insights, Companies, Challenges

- Rwanda Excavator, Crane, and Wheel Loaders Market (2025-2031) | Strategy, Consumer Insights, Analysis, Investment Trends, Opportunities, Growth, Size, Share, Industry, Revenue, Segments, Value, Segmentation, Supply, Forecast, Restraints, Outlook, Competition, Drivers, Trends, Demand, Pricing Analysis, Competitive, Strategic Insights, Companies, Challenges

- Kenya Excavator, Crane, and Wheel Loaders Market (2025-2031) | Strategy, Consumer Insights, Analysis, Investment Trends, Opportunities, Growth, Size, Share, Industry, Revenue, Segments, Value, Segmentation, Supply, Forecast, Restraints, Outlook, Competition, Drivers, Trends, Demand, Pricing Analysis, Competitive, Strategic Insights, Companies, Challenges

Industry Events and Analyst Meet

Whitepaper

- Middle East & Africa Commercial Security Market Click here to view more.

- Middle East & Africa Fire Safety Systems & Equipment Market Click here to view more.

- GCC Drone Market Click here to view more.

- Middle East Lighting Fixture Market Click here to view more.

- GCC Physical & Perimeter Security Market Click here to view more.

6WResearch In News

- Doha a strategic location for EV manufacturing hub: IPA Qatar

- Demand for luxury TVs surging in the GCC, says Samsung

- Empowering Growth: The Thriving Journey of Bangladesh’s Cable Industry

- Demand for luxury TVs surging in the GCC, says Samsung

- Video call with a traditional healer? Once unthinkable, it’s now common in South Africa

- Intelligent Buildings To Smooth GCC’s Path To Net Zero