China Lime Market (2025-2029) | Revenue, Analysis, Share, Trends, Forecast, Industry, Outlook, Companies, Growth, Size & Value

Market Forecast By Product Type (Quick Lime, Hydrated Lime), By Applications (Agriculture, Building Material, Mining and Metallurgy, Water Treatment, Others) And Competitive Landscape

| Product Code: ETC008321 | Publication Date: Oct 2020 | Updated Date: Oct 2025 | Product Type: Report | |

| Publisher: 6Wresearch | Author: Ravi Bhandari | No. of Pages: 70 | No. of Figures: 35 | No. of Tables: 5 |

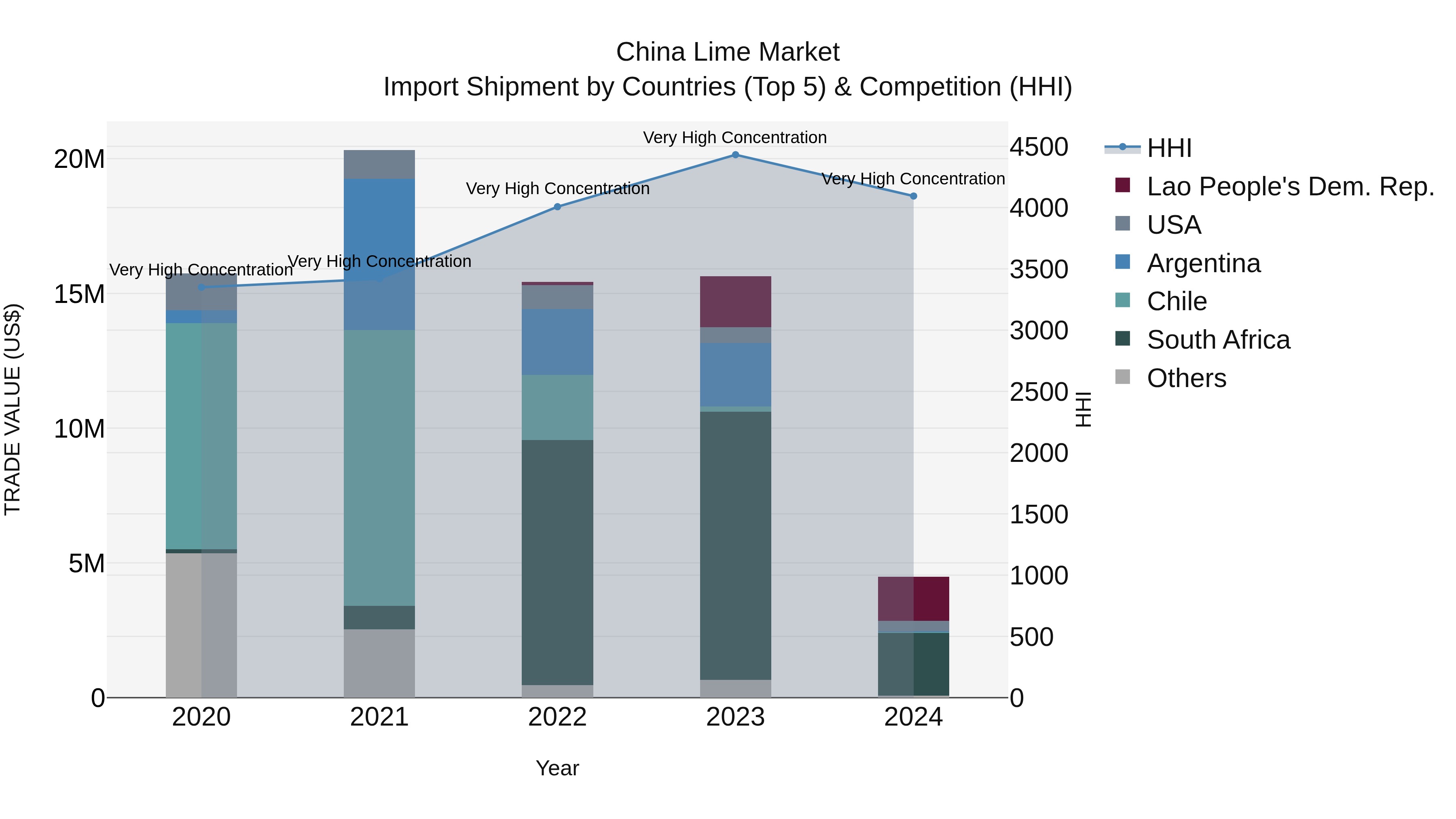

China Lime Market Top 5 Importing Countries and Market Competition (HHI) Analysis

China lime import shipments in 2024 continued to show a high level of concentration, with top exporting countries including South Africa, Lao People`s Dem. Rep., USA, Vietnam, and Chile. The market experienced a significant decline in CAGR from 2020 to 2024 at -26.94%, with a sharp drop in growth rate from 2023 to 2024 at -71.32%. Despite challenges, these statistics indicate a dynamic landscape for lime imports in China, suggesting potential shifts in market dynamics and opportunities for stakeholders to adapt to changing trends.

China Lime Market Highlights

| Report Name | China Lime Market |

| Forecast Period | 2025-2029 |

| CAGR | 5.64% |

| Growing Sector | Construction & Building Materials |

Topics Covered in the China Lime Market Report

The China Lime Market report thoroughly covers the market by product type, and applications. The market report provides an unbiased and detailed analysis of ongoing market trends, opportunities/high growth areas, and market drivers, which would help stakeholders to devise and align their market strategies according to the current and future market dynamics.

China Lime Market Synopsis

China Lime Market is expected to attain strong growth due to the rising demand from construction, metallurgy, agriculture, and water treatment industries. Lime is produced mainly in quick lime and hydrated lime forms, a versatile material widely used in building materials, steel manufacturing, soil stabilization, and environmental management. The country rapid infrastructure expansion, combined with industrial activities in metallurgy and mining, is boosting lime consumption. Subsequently, government initiatives to improve water quality and agricultural productivity are further strengthening lime demand across the country.

Evaluation of Growth Drivers in the China Lime Market

Below mentioned are some prominent drivers and their influence to the market dynamics:

| Driver | Primary Segments Affected | Why it matters (evidence) |

| Infrastructure & Urbanization | Quick Lime; Building Materials | Large-scale construction projects and urbanization efforts in China require lime for cement, concrete, and soil stabilization. |

| Steel & Metallurgy Expansion | Quick Lime; Mining & Metallurgy | Lime is essential in steel manufacturing for purifying iron ore and controlling emissions, making it critical for China’s industrial output. |

| Water Treatment Needs | Hydrated Lime; Water Treatment | Growing water pollution concerns are driving the use of hydrated lime in municipal and industrial water treatment plants. |

| Agricultural Productivity | Hydrated Lime; Agriculture | Lime is increasingly used to neutralize soil acidity and improve crop yield, aligning with China focus on food security. |

| Government Environmental Initiatives | Both product types; Multiple sectors | Programs targeting emission reduction and clean water supply create long-term demand for lime-based solutions. |

The China Lime Market size is projected to grow at the CAGR of 5.64% during the forecast period of 2025-2029. There are several key trends which are supporting the China Lime Market Growth, including rapid urbanization and infrastructure development that are driving demand for lime in cement and construction materials, as well as the expansion of the steel and metallurgy industries where quick lime plays a critical role. Additionally, the increased needs for water treatment to meet pollution control programs are increasing the consumption of hydrated lime, where agricultural applications for soil improvement and food security, along with government led programs promoting green infrastructure and stricter environmental management.

Evaluation of Restraints in the China Lime Market

Below mentioned are some major restraints and their influence to the market dynamics:

| Restraint | Primary Segments Affected | What this means (evidence) |

| Strict Environmental Regulations | All production; quick & hydrated | Stringent emission rules for lime kilns raise compliance costs for manufacturers. |

| High Energy Costs | Quick Lime production | Lime production is energy-intensive, with increasing coal and electricity prices impacting margins. |

| Substitutes in Applications | Construction & Water Treatment | Alternative materials like gypsum and chemical treatments may reduce lime demand in certain applications. |

| Logistics & Storage Issues | Rural demand & agriculture | Lime reactive nature requires specialized storage and handling, limiting easy transport to remote areas. |

| Market Volatility in Steel | Quick Lime; Metallurgy | Dependence on steel industry demand creates cyclical risks for lime producers. |

China Lime Market Challenges

Despite robust demand, the China Lime Industry faces several challenges, including the high energy requirements of production and stricter emission regulations for lime kilns. Rising operational costs are reducing the affordability of lime in large-scale applications. In addition, the growing availability of substitutes such as gypsum and advanced chemical treatments in construction and water management may lessen dependence on lime. Supply chain and transportation constraints, particularly for hydrated lime, also hinder distribution to rural and less-developed regions.

China Lime Market Trends

Several prominent trends reshaping the market growth include:

- Implementation of Sustainable Kiln Technologies - Increasing transition to sustainable and eco-friendly production practices that will help to mitigate carbon emissions associated with lime.

- Complementing Environmental Initiatives - More lime consumption in air emissions control, flue gas desulfurization, and wastewater treatment.

- Automation in Lime Production - Employing Internet of Things (IoT) enabled inspections and automated kiln management to improve efficiencies and consistency.

- Rural Agricultural Use - Increased hydrated lime use for soil amendment and conditioning and productivity in rural agricultural settings.

- Emphasis on Value-Added Lime Products - Creating bespoke lime products from blended lime products for individual industries (e.g., paper and sugar refining, chemical processing).

Investment Opportunities in the China Lime Industry

Some prominent investment opportunities in the market include:

- Green Lime Manufacturing Facilities - Investments in low-carbon, energy-saving lime kilns that respond to governmental environment goals.

- Water Treatment - Supplying hydrated lime for municipal and industrial water treatment projects.

- Quick Lime for Construction - Exporting high purity quick lime for cement and major constructions.

- Agricultural Lime - Expanding lime products for soil conditioner applications and sustainable farming.

- A Lime Export Business - Taking advantage of the manufacturing capabilities of China to export lime to the Asia Pacific and Middle East.

Top 5 Leading Players in the China Lime Market

Some leading players operating in the China Lime Market Share include:

1. China National Building Material Group Co., Ltd. (CNBM)

| Company Name | China National Building Material Group Co., Ltd. (CNBM) |

| Establishment Year | 1984 |

| Headquarter | Beijing, China |

| Official Website | Click here |

CNBM is a state-owned enterprise and one of China’s largest building material producers, manufacturing quick lime and other construction materials.

2. Anhui Conch Group Co., Ltd.

| Company Name | Anhui Conch Group Co., Ltd. |

| Establishment Year | 1996 |

| Headquarter | Wuhu, Anhui, China |

| Official Website | Click here |

Anhui Conch specializes in cement and lime production, supplying quick lime extensively for construction and industrial applications.

3. Shougang Group

| Company Name | Shougang Group |

| Establishment Year | 1919 |

| Headquarter | Beijing, China |

| Official Website | Click here |

Shougang is a major steel manufacturer that also operates lime production facilities to support its metallurgy operations.

4. Tangshan Jidong Cement Co., Ltd.

| Company Name | Tangshan Jidong Cement Co., Ltd. |

| Establishment Year | 1994 |

| Headquarter | Tangshan, Hebei, China |

| Official Website | Click here |

Jidong Cement is a prominent player in cement and lime manufacturing, producing high-quality quick lime for construction and mining sectors.

5. Lhoist China (subsidiary of Lhoist Group)

| Company Name | Lhoist China (subsidiary of Lhoist Group) |

| Establishment Year | 1889 (Group), China operations 2007 |

| Headquarter | Nanjing, China |

| Official Website | Click here |

Lhoist China is part of the global Lhoist Group and focuses on producing hydrated lime and specialty lime products for industrial and environmental applications.

Government Regulations Introduced in the China Lime Market

According to Chinese Government data, the government of China has enacted numerous polices to regulate and facilitate the lime industry. Under the Made in China 2025 initiative, manufacturers receive economic incentives to invest in energy efficient machines. The Ministry of Ecology and Environment (MEE) has enacted regulations limiting emissions in lime kilns to reduce pollution. Rural soil remediation initiatives, and water treatment initiatives have increased demand in hydrated lime. Furthermore, the government rising focus on green infrastructure projects ensures steady consumption of lime in construction and industrial applications.

Future Insights of the China Lime Market

The China Lime Market is projected to grow in the coming years. Growth will be driven by urbanization, rising demand from the steel and metallurgy sectors, and increasing requirements for water treatment services, all of which will continue to support lime consumption. Agricultural lime is also expected to gain traction, as soil enhancements remain vital for food security. Technological advancement such as energy- efficient kilns and automation will improve production efficiency, while stricter environmental regulations will reshape production practices.

Market Segmentation Analysis

The report offers a comprehensive study of the subsequent market segments and their leading categories.

Quick Lime to Dominate the Market – By Product Type

According to Ritika Kalra, Senior Research Analyst at 6Wresearch, the Quick Lime category holds the largest market share in the China Lime Market. Quick lime is extensively used in steel production, cement, and construction materials, all of which form the backbone of China’s industrial and urban growth. Its ability to act as a flux in steelmaking and as a vital ingredient in cement manufacturing ensures its dominance across multiple industrial applications.

Building Material to Dominate the Market – By Applications

Among applications, the Building Material segment dominates the China Lime Market. Massive infrastructure projects, urban development, and construction of residential and commercial spaces have created a sustained demand for lime in cement, plaster, and concrete production. Additionally, government-driven initiatives for green cities and smart infrastructure continue to strengthen lime usage in the construction sector.

Key Attractiveness of the Report

- 10 Years of Market Numbers.

- Historical Data Starting from 2021 to 2024.

- Base Year: 2024.

- Forecast Data until 2029.

- Key Performance Indicators Impacting the Market.

- Major Upcoming Developments and Projects.

Key Highlights of the Report:

- China Lime Market Outlook

- Market Size of China Lime Market, 2024

- Forecast of China Lime Market, 2029

- Historical Data and Forecast of China Lime Revenues & Volume for the Period 2019 - 2029

- China Lime Market Trend Evolution

- China Lime Market Drivers and Challenges

- China Lime Price Trends

- China Lime Porter's Five Forces

- China Lime Industry Life Cycle

- Historical Data and Forecast of China Lime Market Revenues & Volume By Product Type for the Period 2019 - 2029

- Historical Data and Forecast of China Lime Market Revenues & Volume By Quick Lime for the Period 2019 - 2029

- Historical Data and Forecast of China Lime Market Revenues & Volume By Hydrated Lime for the Period 2019 - 2029

- Historical Data and Forecast of China Lime Market Revenues & Volume By Applications for the Period 2019 - 2029

- Historical Data and Forecast of China Lime Market Revenues & Volume By Agriculture for the Period 2019 - 2029

- Historical Data and Forecast of China Lime Market Revenues & Volume By Building Material for the Period 2019 - 2029

- Historical Data and Forecast of China Lime Market Revenues & Volume By Mining and Metallurgy for the Period 2019 - 2029

- Historical Data and Forecast of China Lime Market Revenues & Volume By Water Treatment for the Period 2019 - 2029

- Historical Data and Forecast of China Lime Market Revenues & Volume By Others for the Period 2019 - 2029

- China Lime Import Export Trade Statistics

- Market Opportunity Assessment By Product Type

- Market Opportunity Assessment By Applications

- China Lime Top Companies Market Share

- China Lime Competitive Benchmarking By Technical and Operational Parameters

- China Lime Company Profiles

- China Lime Key Strategic Recommendations

Market Covered

The report offers a comprehensive study of the subsequent market segments:

By Product Type

- Quick Lime

- Hydrated Lime

By Applications

- Agriculture

- Building Material

- Mining and Metallurgy

- Water Treatment

- Others

China Lime Market (2025-2029): FAQs

| 1 Executive Summary |

| 2 Introduction |

| 2.1 Key Highlights of the Report |

| 2.2 Report Description |

| 2.3 Market Scope & Segmentation |

| 2.4 Research Methodology |

| 2.5 Assumptions |

| 3 China Lime Market Overview |

| 3.1 China Country Macro Economic Indicators |

| 3.2 China Lime Market Revenues & Volume, 2019 & 2029F |

| 3.3 China Lime Market - Industry Life Cycle |

| 3.4 China Lime Market - Porter's Five Forces |

| 3.5 China Lime Market Revenues & Volume Share, By Product Type, 2019 & 2029F |

| 3.6 China Lime Market Revenues & Volume Share, By Applications, 2019 & 2029F |

| 4 China Lime Market Dynamics |

| 4.1 Impact Analysis |

| 4.2 Market Drivers |

| 4.2.1 Increasing demand for lime in various industries such as construction, agriculture, and chemical manufacturing |

| 4.2.2 Growth in infrastructure development projects in China leading to higher consumption of lime |

| 4.2.3 Rising awareness about the benefits of lime in waste water treatment and soil stabilization applications |

| 4.3 Market Restraints |

| 4.3.1 Fluctuating prices of raw materials used in lime production affecting overall cost and profitability |

| 4.3.2 Environmental concerns related to lime production processes and emissions |

| 4.3.3 Intense competition in the market leading to pricing pressures and margin constraints |

| 5 China Lime Market Trends |

| 6 China Lime Market, By Types |

| 6.1 China Lime Market, By Product Type |

| 6.1.1 Overview and Analysis |

| 6.1.2 China Lime Market Revenues & Volume, By Product Type, 2019 - 2029F |

| 6.1.3 China Lime Market Revenues & Volume, By Quick Lime, 2019 - 2029F |

| 6.1.4 China Lime Market Revenues & Volume, By Hydrated Lime, 2019 - 2029F |

| 6.2 China Lime Market, By Applications |

| 6.2.1 Overview and Analysis |

| 6.2.2 China Lime Market Revenues & Volume, By Agriculture, 2019 - 2029F |

| 6.2.3 China Lime Market Revenues & Volume, By Building Material, 2019 - 2029F |

| 6.2.4 China Lime Market Revenues & Volume, By Mining and Metallurgy, 2019 - 2029F |

| 6.2.5 China Lime Market Revenues & Volume, By Water Treatment, 2019 - 2029F |

| 6.2.6 China Lime Market Revenues & Volume, By Others, 2019 - 2029F |

| 7 China Lime Market Import-Export Trade Statistics |

| 7.1 China Lime Market Export to Major Countries |

| 7.2 China Lime Market Imports from Major Countries |

| 8 China Lime Market Key Performance Indicators |

| 8.1 Average selling price of lime products |

| 8.2 Number of new infrastructure projects using lime as a key material |

| 8.3 Adoption rate of lime in emerging applications like soil stabilization and waste water treatment |

| 9 China Lime Market - Opportunity Assessment |

| 9.1 China Lime Market Opportunity Assessment, By Product Type, 2019 & 2029F |

| 9.2 China Lime Market Opportunity Assessment, By Applications, 2019 & 2029F |

| 10 China Lime Market - Competitive Landscape |

| 10.1 China Lime Market Revenue Share, By Companies, 2024 |

| 10.2 China Lime Market Competitive Benchmarking, By Operating and Technical Parameters |

| 11 Company Profiles |

| 12 Recommendations |

| 13 Disclaimer |

- Single User License$ 1,995

- Department License$ 2,400

- Site License$ 3,120

- Global License$ 3,795

Search

Thought Leadership and Analyst Meet

Our Clients

Related Reports

- Canada Oil and Gas Market (2026-2032) | Share, Segmentation, Value, Industry, Trends, Forecast, Analysis, Size & Revenue, Growth, Competitive Landscape, Outlook, Companies

- Germany Breakfast Food Market (2026-2032) | Industry, Share, Growth, Size, Companies, Value, Analysis, Revenue, Trends, Forecast & Outlook

- Australia Briquette Market (2025-2031) | Growth, Size, Revenue, Forecast, Analysis, Trends, Value, Share, Industry & Companies

- Vietnam System Integrator Market (2025-2031) | Size, Companies, Analysis, Industry, Value, Forecast, Growth, Trends, Revenue & Share

- ASEAN and Thailand Brain Health Supplements Market (2025-2031) | Strategy, Consumer Insights, Analysis, Investment Trends, Opportunities, Growth, Size, Share, Industry, Revenue, Segments, Value, Segmentation, Supply, Forecast, Restraints, Outlook, Competition, Drivers, Trends, Demand, Pricing Analysis, Competitive, Strategic Insights, Companies, Challenges

- ASEAN Bearings Market (2025-2031) | Strategy, Consumer Insights, Analysis, Investment Trends, Opportunities, Growth, Size, Share, Industry, Revenue, Segments, Value, Segmentation, Supply, Forecast, Restraints, Outlook, Competition, Drivers, Trends, Demand, Pricing Analysis, Competitive, Strategic Insights, Companies, Challenges

- Europe Flooring Market (2025-2031) | Outlook, Share, Industry, Trends, Forecast, Companies, Revenue, Size, Analysis, Growth & Value

- Saudi Arabia Manlift Market (2025-2031) | Outlook, Size, Growth, Trends, Companies, Industry, Revenue, Value, Share, Forecast & Analysis

- Uganda Excavator, Crane, and Wheel Loaders Market (2025-2031) | Strategy, Consumer Insights, Analysis, Investment Trends, Opportunities, Growth, Size, Share, Industry, Revenue, Segments, Value, Segmentation, Supply, Forecast, Restraints, Outlook, Competition, Drivers, Trends, Demand, Pricing Analysis, Competitive, Strategic Insights, Companies, Challenges

- Rwanda Excavator, Crane, and Wheel Loaders Market (2025-2031) | Strategy, Consumer Insights, Analysis, Investment Trends, Opportunities, Growth, Size, Share, Industry, Revenue, Segments, Value, Segmentation, Supply, Forecast, Restraints, Outlook, Competition, Drivers, Trends, Demand, Pricing Analysis, Competitive, Strategic Insights, Companies, Challenges

Industry Events and Analyst Meet

Whitepaper

- Middle East & Africa Commercial Security Market Click here to view more.

- Middle East & Africa Fire Safety Systems & Equipment Market Click here to view more.

- GCC Drone Market Click here to view more.

- Middle East Lighting Fixture Market Click here to view more.

- GCC Physical & Perimeter Security Market Click here to view more.

6WResearch In News

- Doha a strategic location for EV manufacturing hub: IPA Qatar

- Demand for luxury TVs surging in the GCC, says Samsung

- Empowering Growth: The Thriving Journey of Bangladesh’s Cable Industry

- Demand for luxury TVs surging in the GCC, says Samsung

- Video call with a traditional healer? Once unthinkable, it’s now common in South Africa

- Intelligent Buildings To Smooth GCC’s Path To Net Zero