China Sulphuric Acid Market (2025-2031) | Analysis, Industry, Share, Growth, Value, Trends, Companies, Revenue, Forecast & Size

Market Forecast By Raw Material (Elemental sulfur, Base metal smelters, Pyrite ore, Others), By Applications (Fertilizers, Chemical manufacturing, Metal processing, Petroleum refining, Textile industry, Automotive, Paper & pulp, Others) And Competitive Landscape

| Product Code: ETC074560 | Publication Date: Jun 2021 | Updated Date: Oct 2025 | Product Type: Report | |

| Publisher: 6Wresearch | Author: Ravi Bhandari | No. of Pages: 70 | No. of Figures: 35 | No. of Tables: 5 |

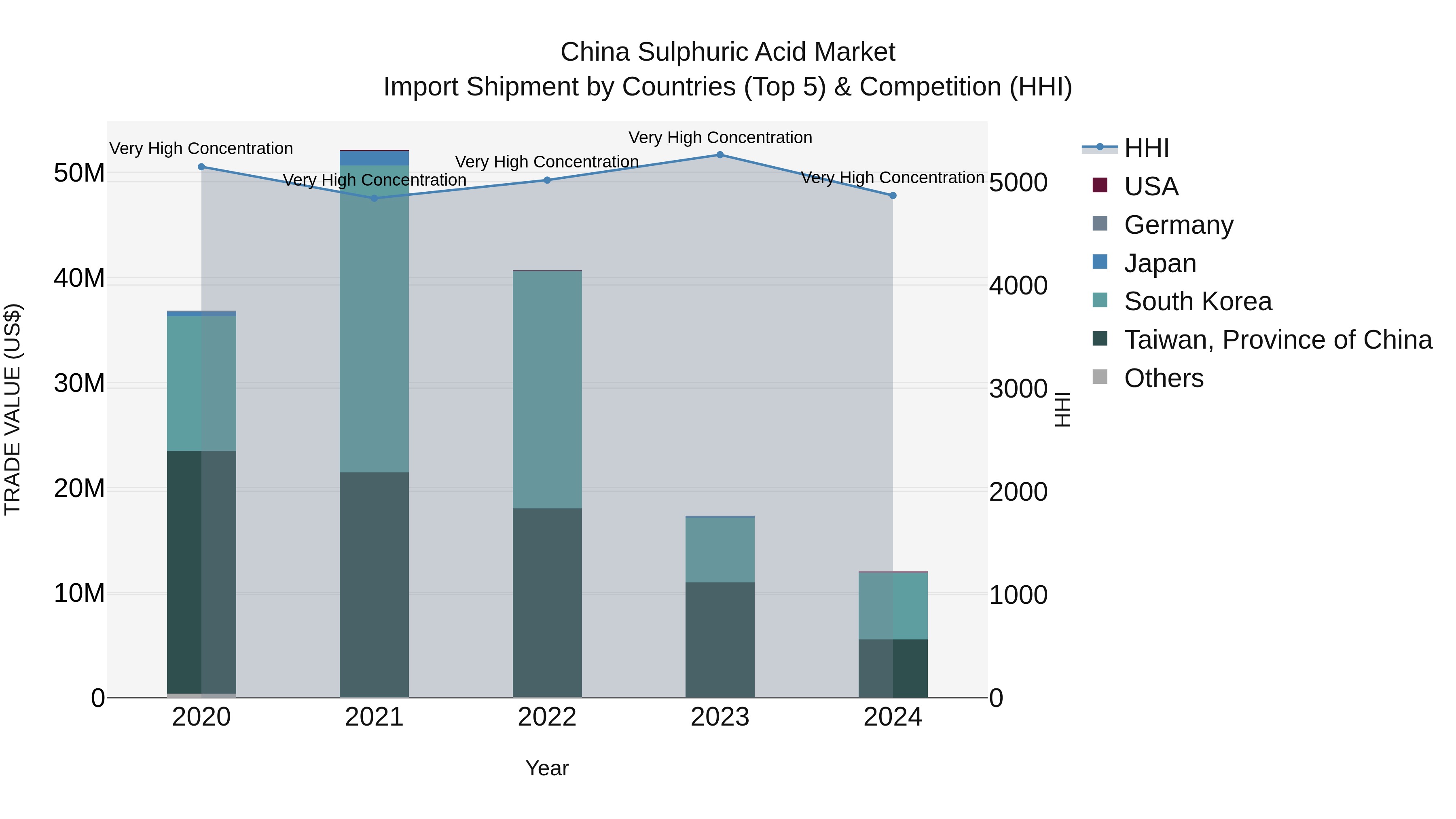

China Sulphuric Acid Market Top 5 Importing Countries and Market Competition (HHI) Analysis

Despite a decline in growth rate for China sulphuric acid imports in 2024, the market remained highly concentrated with top exporters being South Korea, Taiwan, USA, Germany, and Spain. The HHI index reflects this high concentration, indicating limited diversification in import sources. The negative CAGR from 2020 to 2024 suggests a downward trend in import volumes, with a significant decline in the growth rate from 2023 to 2024. This data indicates a challenging market environment for sulphuric acid importers in China, potentially impacted by various economic and trade factors.

China Sulphuric Acid Market Highlights

| Report Name | India Rockwool Market |

| Forecast period | 2025-2031 |

| CAGR | 3% |

| Growing Sector | Phosphate fertilizers |

Topics Covered in the China Sulphuric Acid Market Report

The China Sulphuric Acid Market report thoroughly covers the market by Raw Material, Applications, and Distribution Channel. The market report provides an unbiased and detailed analysis of the ongoing market trends, opportunities/high growth areas, and market drivers which would help the stakeholders to devise and align their market strategies according to the current and future market dynamics.

China Sulphuric Acid Market Synopsis

In the rapidly evolving Chinese economy, the Sulphuric Acid industry is experiencing growth, driven by emerging domestic and international markets, and the continuous demand for a variety of applications. The China Sulphuric Acid Market is witnessing substantial growth, fueled by increasing demands across various industries such as Fertilizers, Chemical manufacturing, Metal processing, Petroleum refining, Textile industry, Automotive, Paper & pulp, among others.

According to 6Wresearch, the China Sulphuric Acid Market revenue is projected to grow at a significant CAGR of 3% during the forecast period 2025-2031. The Urbanization and increasing demand for fertilizers and chemical products are driving the growth of China’s sulphuric acid market. Advances in manufacturing technologies and stringent environmental regulations are shaping the industry, ensuring sustainable and efficient production. As industries seek reliable and high-quality sulphuric acid solutions, the market’s growth trajectory emphasizes the importance of innovation and adherence to environmental standards further boosting China's Sulphuric Acid Market growth. Despite growth, the market faces challenges such as maintaining consistently high-quality standards, managing production costs, and addressing environmental concerns related to emissions and waste. Furthermore, fluctuations in raw material prices and the need for sustainable practices may potentially impact market growth.

China Sulphuric Acid Market Trends

The sulphuric acid market in China is experiencing notable growth, driven by factors such as industrialization, increased demand for agricultural inputs, and evolving environmental regulations. The fertilizer segment, in particular, is witnessing a surge in demand due to the rising need for agricultural productivity. Similarly, chemical manufacturing and metal processing sectors are key contributors to market growth, reflecting the growing emphasis on industrial development and technological advancements. Additionally, there is an increasing focus on sustainable production processes, which align with China’s environmental policies and long-term industrial goals.

Investment Opportunities in the China Sulphuric Acid Market

-

Eco-Friendly Production Technologies: Investing in environmentally sustainable production technologies and emission control systems offers significant growth potential, as industries align with China’s environmental regulations.

-

Strategic Raw Material Sourcing: Leveraging abundant raw materials such as elemental sulfur and pyrite ore ensures a stable supply chain, reducing dependency on imports and minimizing costs.

-

Value-Added Products: Developing specialized sulphuric acid formulations tailored to specific industrial needs, such as high-purity acid for electronics or pharmaceutical applications, can open new revenue streams.

Leading Players of the China Sulphuric Acid Market

In the China sulphuric acid market, leading players include both domestic and international companies that cater to diverse industry requirements. Prominent players such as China National Chemical Corporation (ChemChina), Hubei Yihua Chemical Industry, and Sinochem International dominate the market by offering reliable and efficient sulphuric acid solutions. Additionally, international brands like BASF and DuPont maintain a strong presence by providing high-quality products and leveraging advanced technologies to meet market demands.

Government Regulations Introduced in the China Sulphuric Acid Market

The Chinese government has implemented stringent regulations to oversee the production, storage, and distribution of sulphuric acid, given its widespread industrial use and potential environmental hazards. These regulations are primarily aimed at reducing the environmental and health impacts associated with sulphuric acid emissions. Environmental policies, such as the "Made in China 2025" initiative, emphasize cleaner production methods and stricter monitoring of chemical manufacturing facilities. Companies operating in this sector are required to adhere to national standards for pollutant discharge and adopt advanced technologies to minimize their environmental footprint. Additionally, regulatory updates often include guidelines for safety in handling and transportation to prevent industrial accidents, ensuring both public safety and sustainable industrial growth.

Future Insights of the China Sulphuric Acid Market

The future of China’s sulphuric acid industry looks promising, with continued growth driven by the expansion of key end-user industries, urbanization, and the adoption of sustainable practices. The rising demand for fertilizers to boost agricultural productivity and the growing emphasis on industrial innovation will create significant opportunities for market players. Additionally, advancements in eco-friendly production technologies and increasing investments in research and development are expected to shape the market’s growth trajectory. E-commerce and digital platforms will further facilitate market expansion by improving supply chain efficiency and accessibility.

Market Segmentation Analysis

The report offers a comprehensive study of the subsequent market segments and their leading categories

Elemental Sulfur to Dominate the Market - By Raw Material

According to Research Head, 6Wresearch, Elemental sulfur is expected to dominate due to its integral role in the production of Sulphuric Acid. The abundance of elemental sulfur in China makes it an economical and widely used raw material for Sulphuric Acid production.

Fertilizers to Dominate the Market - By Applications

In the China Sulphuric Acid Market, the Fertilizers segment is expected to dominate due to high demand for Sulphuric Acid in the production of various fertilizers. The segment is also expected to witness significant growth due to the increasing need for sustainable agriculture practices and growing food demands in China.

Key Attractiveness of the Report

- 10 Years of Market Numbers.

- Historical Data Starting from 2021 to 2024

- Base Year: 2024

- Forecast Data until 2031.

- Key Performance Indicators Impacting the market.

- Major Upcoming Developments and Projects.

Key Highlights of the Report:

- China Sulphuric Acid Market Outlook

- Market Size of China Sulphuric Acid Market, 2024

- Forecast of China Sulphuric Acid Market, 2031

- Historical Data and Forecast of China Sulphuric Acid Revenues & Volume for the Period 2021-2031

- China Sulphuric Acid Market Trend Evolution

- China Sulphuric Acid Market Drivers and Challenges

- China Sulphuric Acid Price Trends

- China Sulphuric Acid Porter's Five Forces

- China Sulphuric Acid Industry Life Cycle

- Historical Data and Forecast of China Sulphuric Acid Market Revenues & Volume By Raw Material for the Period 2021-2031

- Historical Data and Forecast of China Sulphuric Acid Market Revenues & Volume By Elemental sulfur for the Period 2021-2031

- Historical Data and Forecast of China Sulphuric Acid Market Revenues & Volume By Base metal smelters for the Period 2021-2031

- Historical Data and Forecast of China Sulphuric Acid Market Revenues & Volume By Pyrite ore for the Period 2021-2031

- Historical Data and Forecast of China Sulphuric Acid Market Revenues & Volume By Others for the Period 2021-2031

- Historical Data and Forecast of China Sulphuric Acid Market Revenues & Volume By Applications for the Period 2021-2031

- Historical Data and Forecast of China Sulphuric Acid Market Revenues & Volume By Fertilizers for the Period 2021-2031

- Historical Data and Forecast of China Sulphuric Acid Market Revenues & Volume By Chemical manufacturing for the Period 2021-2031

- Historical Data and Forecast of China Sulphuric Acid Market Revenues & Volume By Metal processing for the Period 2021-2031

- Historical Data and Forecast of China Sulphuric Acid Market Revenues & Volume By Petroleum refining for the Period 2021-2031

- Historical Data and Forecast of China Sulphuric Acid Market Revenues & Volume By Textile industry for the Period 2021-2031

- Historical Data and Forecast of China Sulphuric Acid Market Revenues & Volume By Automotive for the Period 2021-2031

- Historical Data and Forecast of China Sulphuric Acid Market Revenues & Volume By Paper & pulp for the Period 2021-2031

- Historical Data and Forecast of China Sulphuric Acid Market Revenues & Volume By Others for the Period 2021-2031

- China Sulphuric Acid Import Export Trade Statistics

- Market Opportunity Assessment By Raw Material

- Market Opportunity Assessment By Applications

- China Sulphuric Acid Top Companies Market Share

- China Sulphuric Acid Competitive Benchmarking By Technical and Operational Parameters

- China Sulphuric Acid Company Profiles

- China Sulphuric Acid Key Strategic Recommendations

Markets Covered

The market report has been segmented and sub segmented into the following categories:

By Raw Material

- Elemental sulfur

- Base metal smelters

- Pyrite ore

- Others

By Applications

- Fertilizers

- Chemical manufacturing

- Metal processing

- Petroleum refining

- Textile industry

- Automotive

- Paper & pulp

- Others

China Sulphuric Acid Market (2025-2031): FAQs

| 1 Executive Summary |

| 2 Introduction |

| 2.1 Key Highlights of the Report |

| 2.2 Report Description |

| 2.3 Market Scope & Segmentation |

| 2.4 Research Methodology |

| 2.5 Assumptions |

| 3 China Sulphuric Acid Market Overview |

| 3.1 China Sulphuric Acid Market Revenues & Volume, 2021 - 2031F |

| 3.2 China Sulphuric Acid Market - Industry Life Cycle |

| 3.3 China Sulphuric Acid Market - Porter's Five Forces |

| 3.4 China Sulphuric Acid Market Revenues & Volume Share, By Raw Material, 2021 & 2031F |

| 3.5 China Sulphuric Acid Market Revenues & Volume Share, By Applications, 2021 & 2031F |

| 4 China Sulphuric Acid Market Dynamics |

| 4.1 Impact Analysis |

| 4.2 Market Drivers |

| 4.2.1 Growing demand from industries such as agriculture, chemicals, and metal processing |

| 4.2.2 Increasing use of sulphuric acid in the production of fertilizers |

| 4.2.3 Government initiatives promoting industrial growth and infrastructure development in China |

| 4.3 Market Restraints |

| 4.3.1 Volatility in raw material prices, such as sulfur and energy costs |

| 4.3.2 Stringent environmental regulations impacting production processes |

| 4.3.3 Competition from substitute products like hydrochloric acid and nitric acid |

| 5 China Sulphuric Acid Market Trends |

| 6 China Sulphuric Acid Market Segmentation |

| 6.1 China Sulphuric Acid Market, By Raw Material |

| 6.1.1 Overview and Analysis |

| 6.1.2 China Sulphuric Acid Market Revenues & Volume, By Raw Material, 2021 - 2031F |

| 6.1.3 China Sulphuric Acid Market Revenues & Volume, By Elemental sulfur, 2021 - 2031F |

| 6.1.4 China Sulphuric Acid Market Revenues & Volume, By Base metal smelters, 2021 - 2031F |

| 6.1.5 China Sulphuric Acid Market Revenues & Volume, By Pyrite ore, 2021 - 2031F |

| 6.1.6 China Sulphuric Acid Market Revenues & Volume, By Others, 2021 - 2031F |

| 6.2 China Sulphuric Acid Market, By Applications |

| 6.2.1 Overview and Analysis |

| 6.2.2 China Sulphuric Acid Market Revenues & Volume, By Fertilizers, 2021 - 2031F |

| 6.2.3 China Sulphuric Acid Market Revenues & Volume, By Chemical manufacturing, 2021 - 2031F |

| 6.2.4 China Sulphuric Acid Market Revenues & Volume, By Metal processing, 2021 - 2031F |

| 6.2.5 China Sulphuric Acid Market Revenues & Volume, By Petroleum refining, 2021 - 2031F |

| 6.2.6 China Sulphuric Acid Market Revenues & Volume, By Textile industry, 2021 - 2031F |

| 6.2.7 China Sulphuric Acid Market Revenues & Volume, By Automotive, 2021 - 2031F |

| 6.2.8 China Sulphuric Acid Market Revenues & Volume, By Others, 2021 - 2031F |

| 6.2.9 China Sulphuric Acid Market Revenues & Volume, By Others, 2021 - 2031F |

| 7 China Sulphuric Acid Market Import-Export Trade Statistics |

| 7.1 China Sulphuric Acid Market Export to Major Countries |

| 7.2 China Sulphuric Acid Market Imports from Major Countries |

| 8 China Sulphuric Acid Market Key Performance Indicators |

| 8.1 Capacity utilization rate of sulphuric acid plants in China |

| 8.2 Average selling price of sulphuric acid in the market |

| 8.3 Percentage of sulphuric acid demand met by domestic production in China |

| 9 China Sulphuric Acid Market - Opportunity Assessment |

| 9.1 China Sulphuric Acid Market Opportunity Assessment, By Raw Material, 2021 & 2031F |

| 9.2 China Sulphuric Acid Market Opportunity Assessment, By Applications, 2021 & 2031F |

| 10 China Sulphuric Acid Market - Competitive Landscape |

| 10.1 China Sulphuric Acid Market Revenue Share, By Companies, 2024 |

| 10.2 China Sulphuric Acid Market Competitive Benchmarking, By Operating and Technical Parameters |

| 11 Company Profiles |

| 12 Recommendations |

| 13 Disclaimer |

- Single User License$ 1,995

- Department License$ 2,400

- Site License$ 3,120

- Global License$ 3,795

Search

Thought Leadership and Analyst Meet

Our Clients

Related Reports

- Afghanistan Apparel Market (2026-2032) | Growth, Outlook, Industry, Segmentation, Forecast, Size, Companies, Trends, Value, Share, Analysis & Revenue

- Canada Oil and Gas Market (2026-2032) | Share, Segmentation, Value, Industry, Trends, Forecast, Analysis, Size & Revenue, Growth, Competitive Landscape, Outlook, Companies

- Germany Breakfast Food Market (2026-2032) | Industry, Share, Growth, Size, Companies, Value, Analysis, Revenue, Trends, Forecast & Outlook

- Australia Briquette Market (2025-2031) | Growth, Size, Revenue, Forecast, Analysis, Trends, Value, Share, Industry & Companies

- Vietnam System Integrator Market (2025-2031) | Size, Companies, Analysis, Industry, Value, Forecast, Growth, Trends, Revenue & Share

- ASEAN and Thailand Brain Health Supplements Market (2025-2031) | Strategy, Consumer Insights, Analysis, Investment Trends, Opportunities, Growth, Size, Share, Industry, Revenue, Segments, Value, Segmentation, Supply, Forecast, Restraints, Outlook, Competition, Drivers, Trends, Demand, Pricing Analysis, Competitive, Strategic Insights, Companies, Challenges

- ASEAN Bearings Market (2025-2031) | Strategy, Consumer Insights, Analysis, Investment Trends, Opportunities, Growth, Size, Share, Industry, Revenue, Segments, Value, Segmentation, Supply, Forecast, Restraints, Outlook, Competition, Drivers, Trends, Demand, Pricing Analysis, Competitive, Strategic Insights, Companies, Challenges

- Europe Flooring Market (2025-2031) | Outlook, Share, Industry, Trends, Forecast, Companies, Revenue, Size, Analysis, Growth & Value

- Saudi Arabia Manlift Market (2025-2031) | Outlook, Size, Growth, Trends, Companies, Industry, Revenue, Value, Share, Forecast & Analysis

- Uganda Excavator, Crane, and Wheel Loaders Market (2025-2031) | Strategy, Consumer Insights, Analysis, Investment Trends, Opportunities, Growth, Size, Share, Industry, Revenue, Segments, Value, Segmentation, Supply, Forecast, Restraints, Outlook, Competition, Drivers, Trends, Demand, Pricing Analysis, Competitive, Strategic Insights, Companies, Challenges

Industry Events and Analyst Meet

Whitepaper

- Middle East & Africa Commercial Security Market Click here to view more.

- Middle East & Africa Fire Safety Systems & Equipment Market Click here to view more.

- GCC Drone Market Click here to view more.

- Middle East Lighting Fixture Market Click here to view more.

- GCC Physical & Perimeter Security Market Click here to view more.

6WResearch In News

- Doha a strategic location for EV manufacturing hub: IPA Qatar

- Demand for luxury TVs surging in the GCC, says Samsung

- Empowering Growth: The Thriving Journey of Bangladesh’s Cable Industry

- Demand for luxury TVs surging in the GCC, says Samsung

- Video call with a traditional healer? Once unthinkable, it’s now common in South Africa

- Intelligent Buildings To Smooth GCC’s Path To Net Zero