Hungary Primary Battery Market Outlook | Companies, Share, Revenue, COVID-19 IMPACT, Analysis, Forecast, Value, Industry, Size, Trends & Growth

| Product Code: ETC269059 | Publication Date: Aug 2022 | Updated Date: Nov 2025 | Product Type: Market Research Report | |

| Publisher: 6Wresearch | Author: Ravi Bhandari | No. of Pages: 75 | No. of Figures: 35 | No. of Tables: 20 |

Hungary Primary Battery Market: Import Trend Analysis

In the Hungary primary battery market, the import trend experienced a decline from 2023 to 2024, with a growth rate of -10.92%. However, the compound annual growth rate (CAGR) for imports from 2020 to 2024 stood at 1.72%. This decline in import momentum in 2024 could be attributed to shifting consumer preferences towards more sustainable energy solutions or changes in trade policies impacting imports.

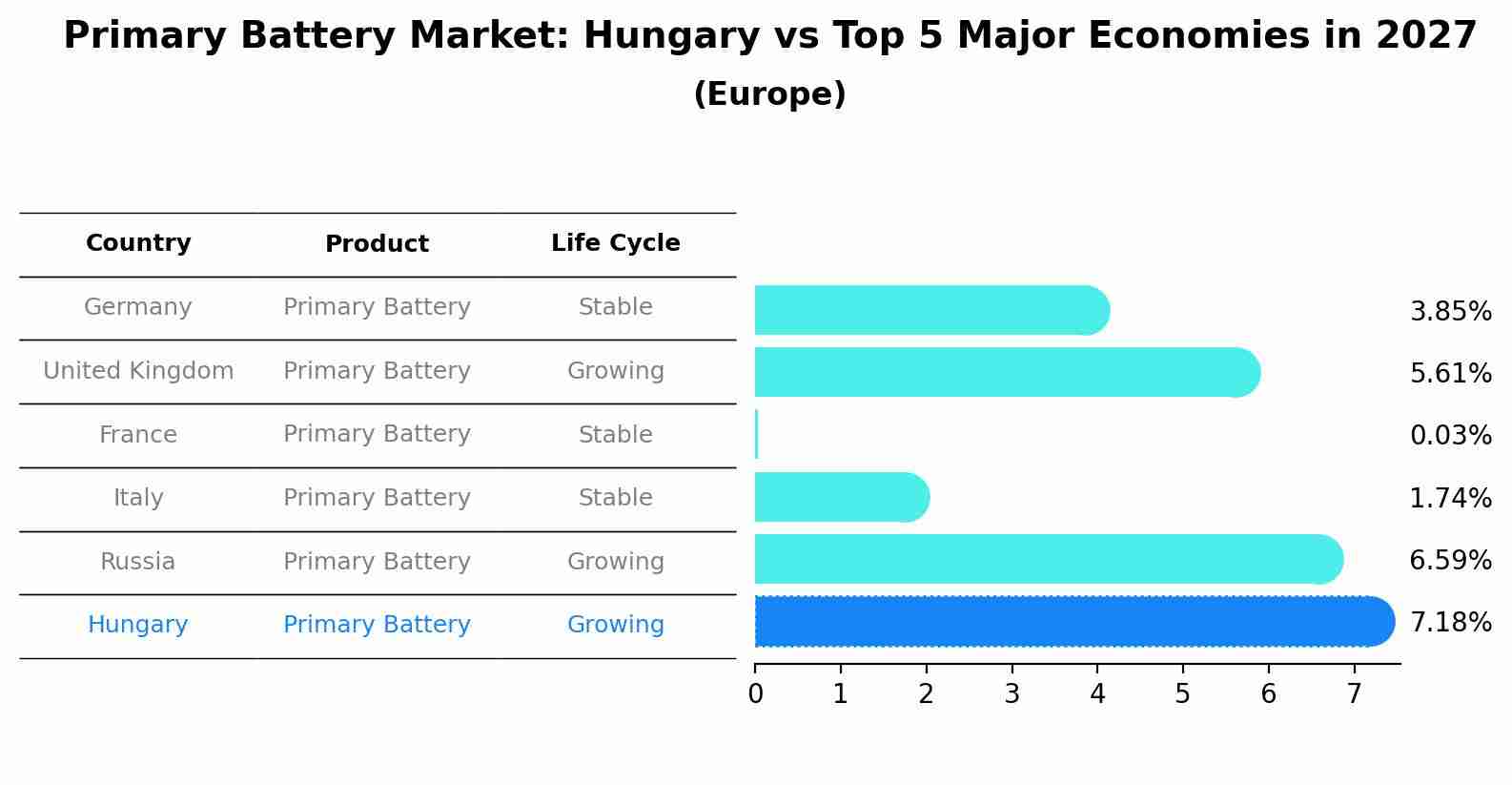

Primary Battery Market: Hungary vs Top 5 Major Economies in 2027 (Europe)

The Primary Battery market in Hungary is projected to grow at a growing growth rate of 7.18% by 2027, highlighting the country's increasing focus on advanced technologies within the Europe region, where Germany holds the dominant position, followed closely by United Kingdom, France, Italy and Russia, shaping overall regional demand.

Hungary Primary Battery Market Overview

The Hungary Primary Battery Market focuses on the production, distribution, and usage of disposable batteries for various applications such as consumer electronics, automotive, healthcare devices, and industrial equipment. Primary batteries, also known as non-rechargeable batteries, provide portable power solutions for devices where long-term energy storage and reliability are essential. In Hungary, the primary battery market is driven by factors such as increasing consumer demand for portable electronic devices, automotive electrification trends, and advancements in battery technology. Key players offer a wide range of primary battery chemistries, including alkaline, lithium, zinc-carbon, and silver oxide, catering to the diverse needs of Hungary consumers and industries.

Drivers of the market

The primary battery market in Hungary is influenced by the demand for portable power sources in consumer electronics, automotive, and industrial applications. Factors such as technological advancements, product miniaturization, and environmental sustainability drive market dynamics. Adoption of high-energy-density chemistries, such as lithium-based batteries, and eco-friendly manufacturing processes contribute to market growth. Collaboration between battery manufacturers, OEMs, and recycling facilities for end-of-life management and sustainability initiatives also fuels market expansion.

Challenges of the market

The Hungary Primary Battery Market faces several challenges that stakeholders need to overcome to drive market growth and innovation. Rising environmental concerns and increasing awareness of sustainability issues are driving demand for eco-friendly battery alternatives, posing a challenge for traditional primary battery manufacturers. Moreover, fluctuations in raw material prices, particularly for metals like lithium and cobalt, impact production costs and profitability. Regulatory compliance, including restrictions on hazardous substances and recycling mandates, adds complexity to battery manufacturing and disposal processes. Market saturation and intense competition from rechargeable battery technologies pose challenges for primary battery suppliers, leading to pricing pressures and margin erosion. Additionally, addressing performance limitations, such as energy density and shelf life, is essential for maintaining competitiveness in the evolving battery market landscape.

Government Policy of the market

The Hungary government has implemented policies to support the primary battery market and promote the development of energy-efficient, environmentally sustainable battery technologies. These policies focus on incentivizing research and innovation in battery chemistry, materials, and manufacturing processes to improve performance, durability, and recyclability. Additionally, the government may offer financial incentives, grants, or tax credits to companies investing in primary battery R&D and production facilities. Moreover, regulatory frameworks are in place to ensure the safety, quality, and environmental compliance of primary batteries, including standards for energy efficiency, hazardous substance restrictions, and recycling requirements to minimize waste and pollution.

Key Highlights of the Report:

- Hungary Primary Battery Market Outlook

- Market Size of Hungary Primary Battery Market, 2021

- Forecast of Hungary Primary Battery Market, 2028

- Historical Data and Forecast of Hungary Primary Battery Revenues & Volume for the Period 2018 - 2028

- Hungary Primary Battery Market Trend Evolution

- Hungary Primary Battery Market Drivers and Challenges

- Hungary Primary Battery Price Trends

- Hungary Primary Battery Porter's Five Forces

- Hungary Primary Battery Industry Life Cycle

- Historical Data and Forecast of Hungary Primary Battery Market Revenues & Volume By Type for the Period 2018 - 2028

- Historical Data and Forecast of Hungary Primary Battery Market Revenues & Volume By Primary Alkaline Battery for the Period 2018 - 2028

- Historical Data and Forecast of Hungary Primary Battery Market Revenues & Volume By Primary Lithium Battery for the Period 2018 - 2028

- Historical Data and Forecast of Hungary Primary Battery Market Revenues & Volume By Other Types for the Period 2018 - 2028

- Hungary Primary Battery Import Export Trade Statistics

- Market Opportunity Assessment By Type

- Hungary Primary Battery Top Companies Market Share

- Hungary Primary Battery Competitive Benchmarking By Technical and Operational Parameters

- Hungary Primary Battery Company Profiles

- Hungary Primary Battery Key Strategic Recommendations

Frequently Asked Questions About the Market Study (FAQs):

1 Executive Summary |

2 Introduction |

2.1 Key Highlights of the Report |

2.2 Report Description |

2.3 Market Scope & Segmentation |

2.4 Research Methodology |

2.5 Assumptions |

3 Hungary Primary Battery Market Overview |

3.1 Hungary Country Macro Economic Indicators |

3.2 Hungary Primary Battery Market Revenues & Volume, 2021 & 2028F |

3.3 Hungary Primary Battery Market - Industry Life Cycle |

3.4 Hungary Primary Battery Market - Porter's Five Forces |

3.5 Hungary Primary Battery Market Revenues & Volume Share, By Type, 2021 & 2028F |

4 Hungary Primary Battery Market Dynamics |

4.1 Impact Analysis |

4.2 Market Drivers |

4.2.1 Increasing demand for portable electronic devices |

4.2.2 Growth in the automotive industry leading to higher demand for batteries |

4.2.3 Rising adoption of renewable energy sources driving the need for energy storage solutions |

4.3 Market Restraints |

4.3.1 Environmental concerns leading to a shift towards sustainable energy solutions |

4.3.2 Competition from rechargeable batteries impacting the primary battery market |

4.3.3 Fluctuating raw material prices affecting production costs |

5 Hungary Primary Battery Market Trends |

6 Hungary Primary Battery Market, By Types |

6.1 Hungary Primary Battery Market, By Type |

6.1.1 Overview and Analysis |

6.1.2 Hungary Primary Battery Market Revenues & Volume, By Type, 2018 - 2028F |

6.1.3 Hungary Primary Battery Market Revenues & Volume, By Primary Alkaline Battery, 2018 - 2028F |

6.1.4 Hungary Primary Battery Market Revenues & Volume, By Primary Lithium Battery, 2018 - 2028F |

6.1.5 Hungary Primary Battery Market Revenues & Volume, By Other Types, 2018 - 2028F |

7 Hungary Primary Battery Market Import-Export Trade Statistics |

7.1 Hungary Primary Battery Market Export to Major Countries |

7.2 Hungary Primary Battery Market Imports from Major Countries |

8 Hungary Primary Battery Market Key Performance Indicators |

8.1 Number of new product launches in the primary battery market |

8.2 Average selling price of primary batteries |

8.3 Adoption rate of primary batteries in emerging applications |

9 Hungary Primary Battery Market - Opportunity Assessment |

9.1 Hungary Primary Battery Market Opportunity Assessment, By Type, 2021 & 2028F |

10 Hungary Primary Battery Market - Competitive Landscape |

10.1 Hungary Primary Battery Market Revenue Share, By Companies, 2021 |

10.2 Hungary Primary Battery Market Competitive Benchmarking, By Operating and Technical Parameters |

11 Company Profiles |

12 Recommendations |

13 Disclaimer |

- Single User License$ 1,995

- Department License$ 2,400

- Site License$ 3,120

- Global License$ 3,795

Search

Thought Leadership and Analyst Meet

Our Clients

Related Reports

- Germany Breakfast Food Market (2026-2032) | Industry, Share, Growth, Size, Companies, Value, Analysis, Revenue, Trends, Forecast & Outlook

- Australia Briquette Market (2025-2031) | Growth, Size, Revenue, Forecast, Analysis, Trends, Value, Share, Industry & Companies

- Vietnam System Integrator Market (2025-2031) | Size, Companies, Analysis, Industry, Value, Forecast, Growth, Trends, Revenue & Share

- ASEAN and Thailand Brain Health Supplements Market (2025-2031) | Strategy, Consumer Insights, Analysis, Investment Trends, Opportunities, Growth, Size, Share, Industry, Revenue, Segments, Value, Segmentation, Supply, Forecast, Restraints, Outlook, Competition, Drivers, Trends, Demand, Pricing Analysis, Competitive, Strategic Insights, Companies, Challenges

- ASEAN Bearings Market (2025-2031) | Strategy, Consumer Insights, Analysis, Investment Trends, Opportunities, Growth, Size, Share, Industry, Revenue, Segments, Value, Segmentation, Supply, Forecast, Restraints, Outlook, Competition, Drivers, Trends, Demand, Pricing Analysis, Competitive, Strategic Insights, Companies, Challenges

- Europe Flooring Market (2025-2031) | Outlook, Share, Industry, Trends, Forecast, Companies, Revenue, Size, Analysis, Growth & Value

- Saudi Arabia Manlift Market (2025-2031) | Outlook, Size, Growth, Trends, Companies, Industry, Revenue, Value, Share, Forecast & Analysis

- Uganda Excavator, Crane, and Wheel Loaders Market (2025-2031) | Strategy, Consumer Insights, Analysis, Investment Trends, Opportunities, Growth, Size, Share, Industry, Revenue, Segments, Value, Segmentation, Supply, Forecast, Restraints, Outlook, Competition, Drivers, Trends, Demand, Pricing Analysis, Competitive, Strategic Insights, Companies, Challenges

- Rwanda Excavator, Crane, and Wheel Loaders Market (2025-2031) | Strategy, Consumer Insights, Analysis, Investment Trends, Opportunities, Growth, Size, Share, Industry, Revenue, Segments, Value, Segmentation, Supply, Forecast, Restraints, Outlook, Competition, Drivers, Trends, Demand, Pricing Analysis, Competitive, Strategic Insights, Companies, Challenges

- Kenya Excavator, Crane, and Wheel Loaders Market (2025-2031) | Strategy, Consumer Insights, Analysis, Investment Trends, Opportunities, Growth, Size, Share, Industry, Revenue, Segments, Value, Segmentation, Supply, Forecast, Restraints, Outlook, Competition, Drivers, Trends, Demand, Pricing Analysis, Competitive, Strategic Insights, Companies, Challenges

Industry Events and Analyst Meet

Whitepaper

- Middle East & Africa Commercial Security Market Click here to view more.

- Middle East & Africa Fire Safety Systems & Equipment Market Click here to view more.

- GCC Drone Market Click here to view more.

- Middle East Lighting Fixture Market Click here to view more.

- GCC Physical & Perimeter Security Market Click here to view more.

6WResearch In News

- Doha a strategic location for EV manufacturing hub: IPA Qatar

- Demand for luxury TVs surging in the GCC, says Samsung

- Empowering Growth: The Thriving Journey of Bangladesh’s Cable Industry

- Demand for luxury TVs surging in the GCC, says Samsung

- Video call with a traditional healer? Once unthinkable, it’s now common in South Africa

- Intelligent Buildings To Smooth GCC’s Path To Net Zero