India Flat Glass Market (2025-2031) | Industry, Trends, Growth, Forecast, Companies, Value, Size, Outlook, Share, Analysis & Revenue

Market Forecast By Product Type (Basic Float Glass, Toughened Glass, Coated Glass, Laminated Glass, Extra Clear Glass, Others), By Technology (Float, Rolled, Sheet), By End-Use Industry (Construction & Infrastructure, Automotive & Transportation, Solar Energy) And Competitive Landscape

| Product Code: ETC041285 | Publication Date: Aug 2023 | Updated Date: Nov 2025 | Product Type: Report | |

| Publisher: 6Wresearch | Author: Ravi Bhandari | No. of Pages: 70 | No. of Figures: 35 | No. of Tables: 5 |

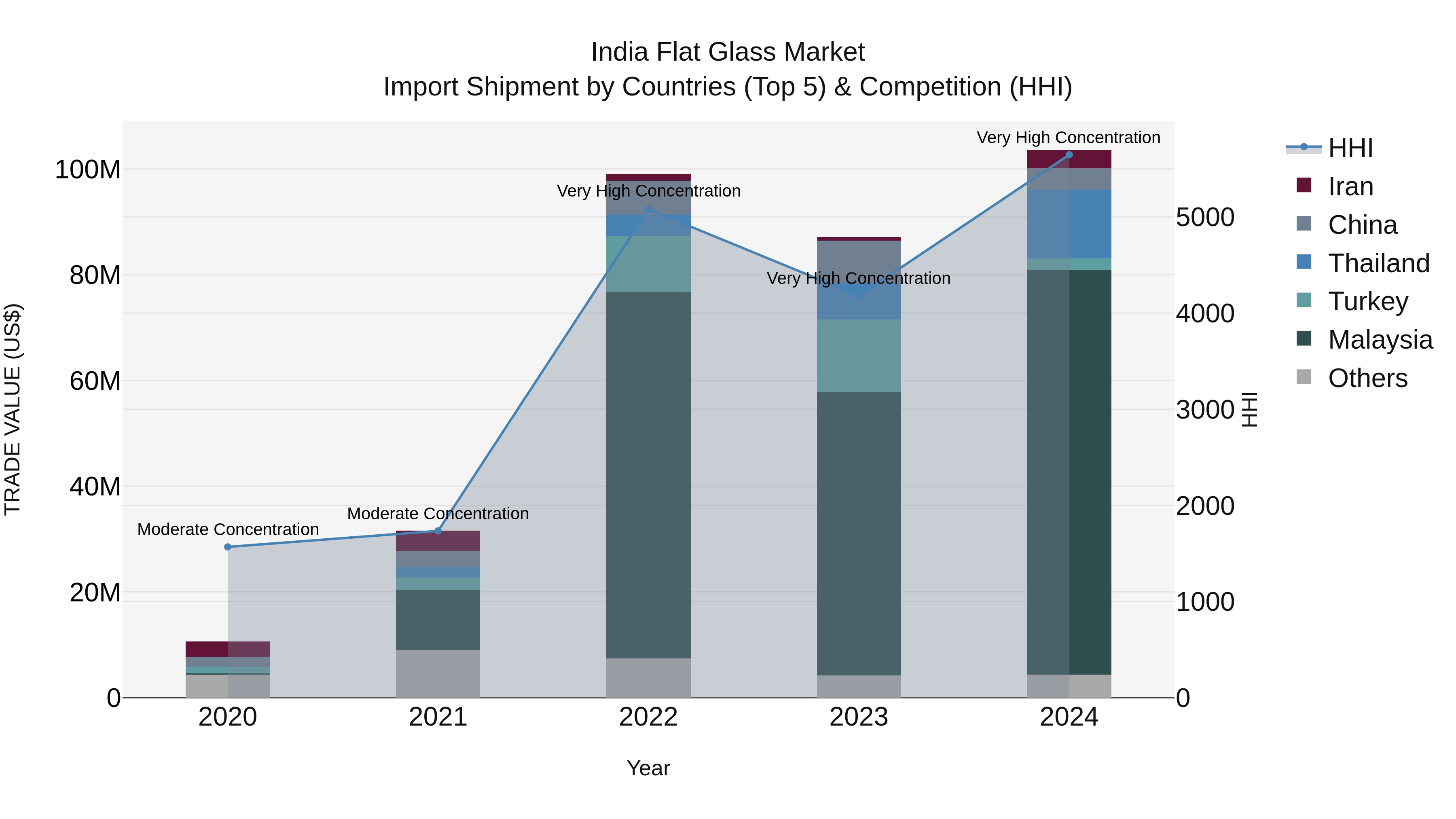

India Flat Glass Market Top 5 Importing Countries and Market Competition (HHI) Analysis

India`s flat glass import market continued to show strong growth in 2024, with top exporting countries being Malaysia, Thailand, China, Iran, and Indonesia. The high Herfindahl-Hirschman Index (HHI) indicates a concentrated market. The compound annual growth rate (CAGR) from 2020 to 2024 was an impressive 76.5%, reflecting the increasing demand for flat glass in India. Additionally, the growth rate from 2023 to 2024 stood at 18.89%, underscoring the continued momentum in the import shipments of flat glass to India.

India Flat Glass Market Growth Rate

According to 6Wresearch internal database and industry insights

India Flat Glass Market Highlights

| Report Name | India Flat Glass Market |

| Forecast period | 2025-2031 |

| CAGR | 8.1% |

| Growing Sector | Construction & Solar Energy |

Topics Covered in the India Flat Glass Market Report

The India Flat Glass Market report thoroughly covers the market by product type, technology, and end-use industry. The market report provides an unbiased and detailed analysis of ongoing market trends, opportunities/high growth areas, and market drivers, which would help stakeholders to devise and align their market strategies according to the current and future market dynamics.

India Flat Glass Market Synopsis

India Flat Glass Market is expected to witness continuous growth, fueled by increasing investments in construction, infrastructure modernization, and solar energy installations. Expanding demand for energy-efficient buildings, smart façades, and automotive glazing materials has fueled adoption of advanced flat glass types such as coated and laminated glass. In addition, strong government support for green buildings, rapid urbanization, and expansion in renewable energy projects are key contributors to market expansion. Furthermore, growing use of high-transparency glass in premium real estate, automobile sunroofs, and photovoltaic applications continues to drive consumption across regions.

Evaluation of Growth Drivers in the India Flat Glass Market

Below mentioned are some prominent drivers and their influence to the market dynamics:

| Drivers | Primary Segments Affected | Why it matters (evidence) |

| Infrastructure & Smart Cities Development | Construction & Infrastructure | National infrastructure programs such as Smart Cities Mission and Housing for All are accelerating the adoption of architectural glass for façades, windows, and energy-efficient glazing systems. |

| Rise in Solar Installations | Solar Energy | Government targets for renewable energy expansion have boosted the demand for high-transmittance and low-iron glass used in solar panels. |

| Growth in Automotive Production | Automotive & Transportation | Growing automotive production and the increasing adoption of advanced glazing solutions such as laminated and UV-resistant glass are propelling market expansion. |

| Sustainability & Energy Efficiency Trends | Construction & Solar Energy | Growing Emphasis on energy-efficient construction materials promotes coated and double-glazed flat glass for thermal insulation and reduced power consumption. |

| Technological Advancements in Glass Manufacturing | All Segments | Integration of automated operations, float glass advancements, and high-performance coatings increases output quality, transparency, and strength, making manufacturers more competitive. |

India Flat Glass Market is anticipated to witness significant expansion, registering a CAGR of 8.1% during the forecast period of 2025–2031. The growth of the market is driven by urban infrastructure development, rising solar capacity, and premium architectural projects, India Flat Glass Market Growth is further strengthened by innovations in float and coating technology. These improvements elevate glass strength, optical quality, and energy efficiency while reducing production inconsistencies. Such advancements support the growing demand for sustainable and high-performance glass solutions in India expanding construction and solar power industries.

Evaluation of Restraints in the India Flat Glass Market

Below mentioned are some major restraints and their influence to the market dynamics:

| Restraints | Primary Segments Affected | What this means (evidence) |

| High Energy & Fuel Costs | All Segments | Glass manufacturing requires continuous melting furnaces, and fluctuations in fuel prices increase operational costs. |

| Import Dependence for Raw Materials | Float & Coated Glass | Reliance on imported soda ash and silica sand can affect supply chain stability and production costs. |

| Stringent Environmental Regulations | All Segments | Tightened environmental regulations on furnace emissions elevate operating expenses and encourage the transition toward eco-efficient glass manufacturing methods. |

| Competition from Substitute Materials | Construction & Automotive | The growing preference for lightweight polymers and composites in architectural glazing and roofing could erode flat glass market share in specific areas. |

| Price Sensitivity in Domestic Market | Construction & Infrastructure | Low-cost competitors and cyclical construction trends may restrict premium glass adoption among smaller builders. |

India Flat Glass Market Challenges

The India Flat Glass Industry is challenged by high investment needs, rapid technological evolution, and dependence on imported inputs. Achieving consistent quality and superior optical clarity requires advanced production technologies and rigorous inspection standards. Furthermore, the increasing use of substitute materials like acrylic and polycarbonate exerts downward pressure on pricing. Certainly, these factors shape cost structures, production strategies, and expansion decisions for domestic manufacturers striving to remain competitive.

India Flat Glass Market Trends

There are several emerging trends shaping the India Flat Glass Market landscape are:

- Eco-Friendly Architecture: The rising push for green construction is driving the use of energy-efficient double-glazed and coated glass to minimize power usage and enhance insulation.

- Renewable Integration: Solar energy projects increasingly depend on precision-engineered glass with higher light transmittance and durability.

- Advanced Mobility Solutions: Preference for luxury features such as panoramic sunroofs and safety windshields enhances flat glass consumption in the automotive sector.

- Industrial Expansion: Indian manufacturers invest in new float lines and coating units to serve domestic demand and promote export-led growth.

Investment Opportunities in the India Flat Glass Industry

There are various potential investment opportunities in the industry which continue to open new avenues:

- Production of Glass for Solar Panels – Fund production lines to produce low-iron, high-clarity glass for solar products such as photovoltaic (PV) modules and solar collectors.

- Glass for Architectural Façade Applications – Investment in manufacturing of laminated, tempered, and coated glass products to meet green building codes and growth in commercial construction.

- Auto Glass Processing – Invest in expensive quality lamination and bending facilities for windshields and roof glazing in electric and luxury vehicle applications.

- Recycling and Sustainable Production – Fund cullet-based manufacturing and waste heat capture and reuse technology in the manufacturing process.

Top 5 Leading Players in the India Flat Glass Market

Some leading players operating in the India Flat Glass Market Share include:

1. Asahi India Glass Limited (AIS)

| CompanyName | Asahi India Glass Limited (AIS) |

|---|---|

| Established Year | 1984 |

| Headquarters | Gurugram, India |

| Official Website | Click Here |

AIS is India leading integrated glass company producing automotive, architectural, and consumer glass. Its strategy focuses on energy-efficient solutions, sustainability, and technological leadership in float and coated glass.

2. Saint-Gobain India Pvt. Ltd.

| CompanyName | Saint-Gobain India Pvt. Ltd. |

|---|---|

| Established Year | 1996 |

| Headquarters | Chennai, India |

| Official Website | Click Here |

Saint-Gobain India is a key player in architectural and automotive glass, emphasizing innovation in coated and sustainable glazing products. The company continues to expand its solar and green building offerings.

3. Gujarat Guardian Limited (Guardian Glass India)

| CompanyName | Gujarat Guardian Limited (Guardian Glass India) |

|---|---|

| Established Year | 1993 |

| Headquarters | Ankleshwar, Gujarat, India |

| Official Website | Click Here |

Gujarat Guardian manufactures float, coated, and mirror glass used in architecture and interior applications. It focuses on product innovation, clarity enhancement, and durable coatings.

4. HNG Float Glass Limited

| CompanyName | HNG Float Glass Limited |

|---|---|

| Established Year | 2006 |

| Headquarters | Kolkata, India |

| Official Website | Click Here |

HNG Float Glass produces high-quality float glass for the building and automotive sectors. Its focus on technology, capacity expansion, and value-added glass positions it as a competitive domestic supplier.

5. Gold Plus Glass Industry Limited

| CompanyName | Gold Plus Glass Industry Limited |

|---|---|

| Established Year | 1985 |

| Headquarters | Roorkee, India |

| Official Website | Click Here |

Gold Plus Glass is a major manufacturer of float and processed glass, emphasizing green building products, solar glass, and architectural applications with a strong distribution network across India.

Government Regulations & Initiatives Introduced in the India Flat Glass Market

According to Indian Government data, Several initiatives drive the flat glass industry. Programs like “Smart Cities Mission” and “Pradhan Mantri Awas Yojana (PMAY)” are accelerating construction demand for energy-efficient and aesthetic façades. The “National Solar Mission” promotes domestic solar glass manufacturing to support 280 GW renewable capacity targets by 2030. Under “Make in India,” fiscal incentives and Production-Linked Incentive (PLI) schemes encourage investments in glass manufacturing. For example, Saint-Gobain’s new float line in Tamil Nadu and AIS’s expansion in Rajasthan align with government efforts to boost domestic production and exports.

Future Insights of the India Flat Glass Market

The India Flat Glass Market is anticipated to grow steadily, driven by rising adoption of sustainable materials, energy-efficient infrastructure, and renewable integration. Producers are upgrading coating and lamination processes to serve evolving requirements in construction and solar applications. Technological progress in low-E and anti-reflective glass enhances efficiency and aesthetics, while the automotive shift to EVs with panoramic roofs stimulates high-value glass usage. Government incentives, green certifications, and export promotion are expected to sustain market momentum.

Market Segmentation Analysis

The report offers a comprehensive study of the subsequent market segments and their leading categories.

Toughened Glass to Dominate the Market- By Product Type

According to Ritika Kalra, Senior Research Analyst, 6Wresearch, Toughened Glass dominates the India Flat Glass Market Share due to its superior strength, thermal resistance, and safety features. It is widely used in façades, doors, and automotive glazing. Rising demand from commercial complexes and residential towers, along with mandatory safety norms, further strengthens its dominance over other categories like basic float and laminated glass.

Float Process to Dominate the Market- By Technology

The Float Process segment dominates the India Flat Glass Market as it ensures high optical clarity, flatness, and uniform thickness suitable for architectural and automotive applications. Continuous innovation in float furnace efficiency and coating compatibility makes it the preferred manufacturing technology across major Indian producers.

Construction & Infrastructure to Dominate the Market- By End-Use Industry

The Construction & Infrastructure segment leads the India Flat Glass Market, driven by increasing investments in smart cities, commercial buildings, airports, and urban housing. The growing adoption of energy-efficient façades and green-certified projects boosts consumption of coated and laminated glass in this segment.

Key attractiveness of the report

- 10 Years of Market Numbers.

- Historical Data Starting from 2021 to 2024.

- Base Year: 2024

- Forecast Data until 2031.

- Key Performance Indicators Impacting the market.

- Major Upcoming Developments and Projects.

Key Highlights of the Report:

- India Flat Glass Market Outlook

- Market Size of India Flat Glass Market, 2024

- Forecast of India Flat Glass Market, 2031

- Historical Data and Forecast of India Flat Glass Revenues & Volume for the Period 2021-2031

- India Flat Glass Market Trend Evolution

- India Flat Glass Market Drivers and Challenges

- India Flat Glass Price Trends

- India Flat Glass Porter's Five Forces

- India Flat Glass Industry Life Cycle

- Historical Data and Forecast of India Flat Glass Market Revenues & Volume By Product Type for the Period 2021-2031

- Historical Data and Forecast of India Flat Glass Market Revenues & Volume By Basic Float Glass for the Period 2021-2031

- Historical Data and Forecast of India Flat Glass Market Revenues & Volume By Toughened Glass for the Period 2021-2031

- Historical Data and Forecast of India Flat Glass Market Revenues & Volume By Coated Glass for the Period 2021-2031

- Historical Data and Forecast of India Flat Glass Market Revenues & Volume By Laminated Glass for the Period 2021-2031

- Historical Data and Forecast of India Flat Glass Market Revenues & Volume By Extra Clear Glass for the Period 2021-2031

- Historical Data and Forecast of India Flat Glass Market Revenues & Volume By Others for the Period 2021-2031

- Historical Data and Forecast of India Flat Glass Market Revenues & Volume By Technology for the Period 2021-2031

- Historical Data and Forecast of India Flat Glass Market Revenues & Volume By Float for the Period 2021-2031

- Historical Data and Forecast of India Flat Glass Market Revenues & Volume By Rolled for the Period 2021-2031

- Historical Data and Forecast of India Flat Glass Market Revenues & Volume By Sheet for the Period 2021-2031

- Historical Data and Forecast of India Flat Glass Market Revenues & Volume By End-Use Industry for the Period 2021-2031

- Historical Data and Forecast of India Flat Glass Market Revenues & Volume By Construction & Infrastructure for the Period 2021-2031

- Historical Data and Forecast of India Flat Glass Market Revenues & Volume By Automotive & Transportation for the Period 2021-2031

- Historical Data and Forecast of India Flat Glass Market Revenues & Volume By Solar Energy for the Period 2021-2031

- India Flat Glass Import Export Trade Statistics

- Market Opportunity Assessment By Product Type

- Market Opportunity Assessment By Technology

- Market Opportunity Assessment By End-Use Industry

- India Flat Glass Top Companies Market Share

- India Flat Glass Competitive Benchmarking By Technical and Operational Parameters

- India Flat Glass Company Profiles

- India Flat Glass Key Strategic Recommendations

Market Covered

The report offers a comprehensive study of the subsequent market segments:

By Product Type

- Basic Float Glass

- Toughened Glass

- Coated Glass

- Laminated Glass

- Extra Clear Glass

- Others

By Technology

- Float

- Rolled

- Sheet

By End-Use Industry

- Construction & Infrastructure

- Automotive & Transportation

- Solar Energy

India Flat Glass Market (2025-2031): FAQs

| 1 Executive Summary |

| 2 Introduction |

| 2.1 Key Highlights of the Report |

| 2.2 Report Description |

| 2.3 Market Scope & Segmentation |

| 2.4 Research Methodology |

| 2.5 Assumptions |

| 3 India Flat Glass Market Overview |

| 3.1 India Country Macro Economic Indicators |

| 3.2 India Flat Glass Market Revenues & Volume, 2021 & 2031F |

| 3.3 India Flat Glass Market - Industry Life Cycle |

| 3.4 India Flat Glass Market - Porter's Five Forces |

| 3.5 India Flat Glass Market Revenues & Volume Share, By Product Type, 2021 & 2031F |

| 3.6 India Flat Glass Market Revenues & Volume Share, By Technology, 2021 & 2031F |

| 3.7 India Flat Glass Market Revenues & Volume Share, By End-Use Industry, 2021 & 2031F |

| 4 India Flat Glass Market Dynamics |

| 4.1 Impact Analysis |

| 4.2 Market Drivers |

| 4.2.1 Increasing demand for energy-efficient and sustainable building materials |

| 4.2.2 Growing construction industry in India |

| 4.2.3 Expansion of the automotive sector driving demand for flat glass in vehicles |

| 4.3 Market Restraints |

| 4.3.1 Fluctuating raw material prices impacting production costs |

| 4.3.2 Intense competition within the flat glass market |

| 4.3.3 Economic instability affecting consumer spending on construction and automotive sectors |

| 5 India Flat Glass Market Trends |

| 6 India Flat Glass Market, By Types |

| 6.1 India Flat Glass Market, By Product Type |

| 6.1.1 Overview and Analysis |

| 6.1.2 India Flat Glass Market Revenues & Volume, By Product Type, 2021-2031F |

| 6.1.3 India Flat Glass Market Revenues & Volume, By Basic Float Glass, 2021-2031F |

| 6.1.4 India Flat Glass Market Revenues & Volume, By Toughened Glass, 2021-2031F |

| 6.1.5 India Flat Glass Market Revenues & Volume, By Coated Glass, 2021-2031F |

| 6.1.6 India Flat Glass Market Revenues & Volume, By Laminated Glass, 2021-2031F |

| 6.1.7 India Flat Glass Market Revenues & Volume, By Extra Clear Glass, 2021-2031F |

| 6.1.8 India Flat Glass Market Revenues & Volume, By Others, 2021-2031F |

| 6.2 India Flat Glass Market, By Technology |

| 6.2.1 Overview and Analysis |

| 6.2.2 India Flat Glass Market Revenues & Volume, By Float, 2021-2031F |

| 6.2.3 India Flat Glass Market Revenues & Volume, By Rolled, 2021-2031F |

| 6.2.4 India Flat Glass Market Revenues & Volume, By Sheet, 2021-2031F |

| 6.3 India Flat Glass Market, By End-Use Industry |

| 6.3.1 Overview and Analysis |

| 6.3.2 India Flat Glass Market Revenues & Volume, By Construction & Infrastructure, 2021-2031F |

| 6.3.3 India Flat Glass Market Revenues & Volume, By Automotive & Transportation, 2021-2031F |

| 6.3.4 India Flat Glass Market Revenues & Volume, By Solar Energy, 2021-2031F |

| 7 India Flat Glass Market Import-Export Trade Statistics |

| 7.1 India Flat Glass Market Export to Major Countries |

| 7.2 India Flat Glass Market Imports from Major Countries |

| 8 India Flat Glass Market Key Performance Indicators |

| 8.1 Adoption rate of energy-efficient flat glass products in the market |

| 8.2 Number of construction permits issued in India |

| 8.3 Growth rate of the automotive sector in India |

| 8.4 Investment in research and development for innovative flat glass products |

| 8.5 Percentage of buildings opting for green building certifications that require sustainable materials like flat glass |

| 9 India Flat Glass Market - Opportunity Assessment |

| 9.1 India Flat Glass Market Opportunity Assessment, By Product Type, 2021 & 2031F |

| 9.2 India Flat Glass Market Opportunity Assessment, By Technology, 2021 & 2031F |

| 9.3 India Flat Glass Market Opportunity Assessment, By End-Use Industry, 2021 & 2031F |

| 10 India Flat Glass Market - Competitive Landscape |

| 10.1 India Flat Glass Market Revenue Share, By Companies, 2024 |

| 10.2 India Flat Glass Market Competitive Benchmarking, By Operating and Technical Parameters |

| 11 Company Profiles |

| 12 Recommendations |

| 13 Disclaimer |

- Single User License$ 1,995

- Department License$ 2,400

- Site License$ 3,120

- Global License$ 3,795

Search

Thought Leadership and Analyst Meet

Our Clients

Related Reports

- South Africa Stationery Market (2025-2031) | Share, Size, Industry, Value, Growth, Revenue, Analysis, Trends, Segmentation & Outlook

- Afghanistan Rocking Chairs And Adirondack Chairs Market (2026-2032) | Size & Revenue, Competitive Landscape, Share, Segmentation, Industry, Value, Outlook, Analysis, Trends, Growth, Forecast, Companies

- Afghanistan Apparel Market (2026-2032) | Growth, Outlook, Industry, Segmentation, Forecast, Size, Companies, Trends, Value, Share, Analysis & Revenue

- Canada Oil and Gas Market (2026-2032) | Share, Segmentation, Value, Industry, Trends, Forecast, Analysis, Size & Revenue, Growth, Competitive Landscape, Outlook, Companies

- Germany Breakfast Food Market (2026-2032) | Industry, Share, Growth, Size, Companies, Value, Analysis, Revenue, Trends, Forecast & Outlook

- Australia Briquette Market (2025-2031) | Growth, Size, Revenue, Forecast, Analysis, Trends, Value, Share, Industry & Companies

- Vietnam System Integrator Market (2025-2031) | Size, Companies, Analysis, Industry, Value, Forecast, Growth, Trends, Revenue & Share

- ASEAN and Thailand Brain Health Supplements Market (2025-2031) | Strategy, Consumer Insights, Analysis, Investment Trends, Opportunities, Growth, Size, Share, Industry, Revenue, Segments, Value, Segmentation, Supply, Forecast, Restraints, Outlook, Competition, Drivers, Trends, Demand, Pricing Analysis, Competitive, Strategic Insights, Companies, Challenges

- ASEAN Bearings Market (2025-2031) | Strategy, Consumer Insights, Analysis, Investment Trends, Opportunities, Growth, Size, Share, Industry, Revenue, Segments, Value, Segmentation, Supply, Forecast, Restraints, Outlook, Competition, Drivers, Trends, Demand, Pricing Analysis, Competitive, Strategic Insights, Companies, Challenges

- Europe Flooring Market (2025-2031) | Outlook, Share, Industry, Trends, Forecast, Companies, Revenue, Size, Analysis, Growth & Value

Industry Events and Analyst Meet

Whitepaper

- Middle East & Africa Commercial Security Market Click here to view more.

- Middle East & Africa Fire Safety Systems & Equipment Market Click here to view more.

- GCC Drone Market Click here to view more.

- Middle East Lighting Fixture Market Click here to view more.

- GCC Physical & Perimeter Security Market Click here to view more.

6WResearch In News

- Doha a strategic location for EV manufacturing hub: IPA Qatar

- Demand for luxury TVs surging in the GCC, says Samsung

- Empowering Growth: The Thriving Journey of Bangladesh’s Cable Industry

- Demand for luxury TVs surging in the GCC, says Samsung

- Video call with a traditional healer? Once unthinkable, it’s now common in South Africa

- Intelligent Buildings To Smooth GCC’s Path To Net Zero