India Flour Market (2025-2031) | Outlook, Revenue, Size, Share, Growth, Trends, Industry, Companies, Value, Analysis & Forecast

Market Forecast By Raw Material (Wheat, Rice, Maize, Others), By Applications (Bread & Bakery Products, Noodles & Pasta, Animal Feed, Wafers, Crackers, & Biscuits, Non-Food Application, Others), By Technology (Dry Technology, Wet Technology) And Competitive Landscape

| Product Code: ETC039965 | Publication Date: Aug 2023 | Updated Date: Nov 2025 | Product Type: Report | |

| Publisher: 6Wresearch | Author: Ravi Bhandari | No. of Pages: 70 | No. of Figures: 35 | No. of Tables: 5 |

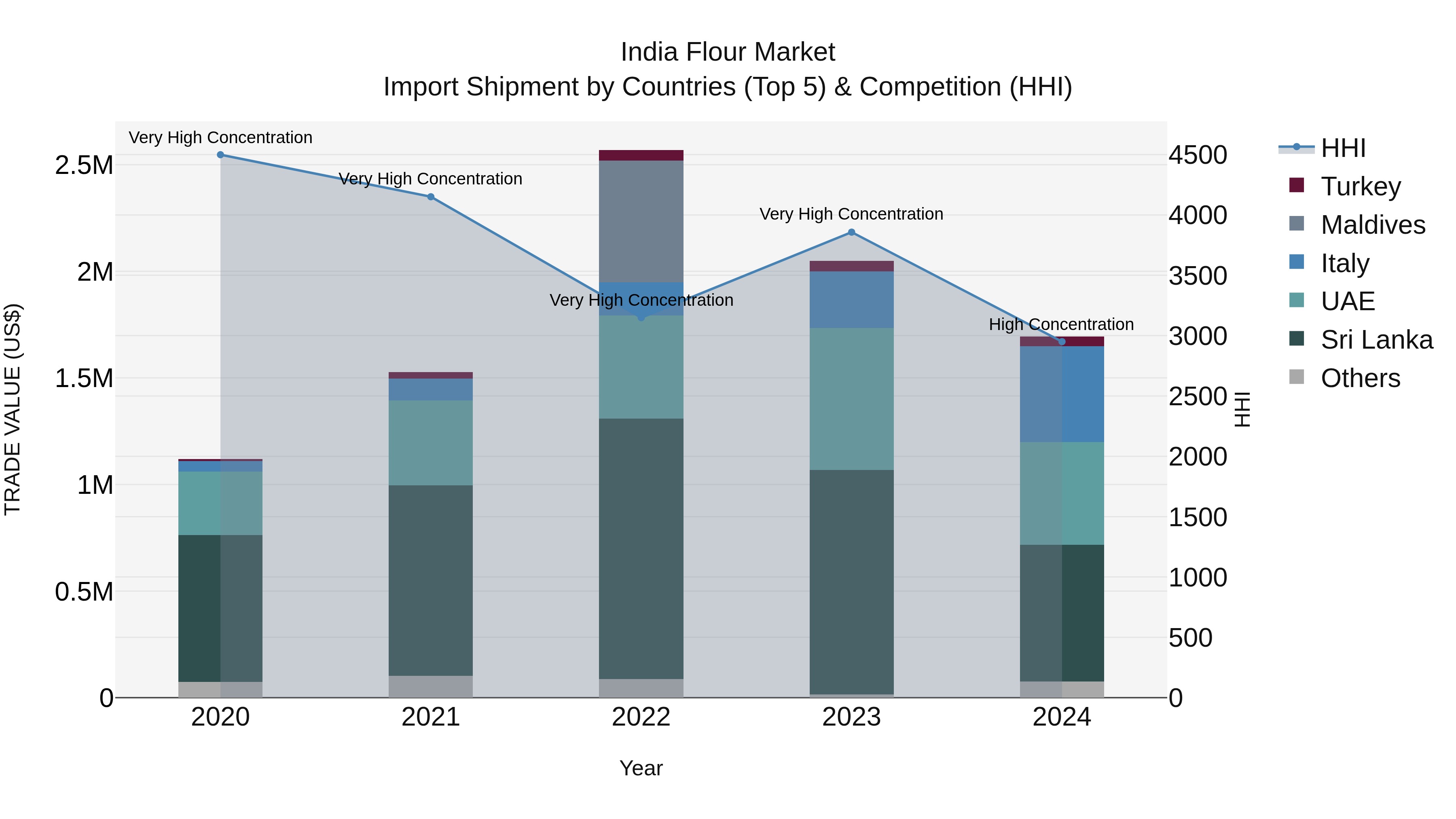

India Flour Market Top 5 Importing Countries and Market Competition (HHI) Analysis

India`s flour import market saw a notable shift in 2024, with top exporting countries being Sri Lanka, UAE, Italy, Bangladesh, and Turkey. Despite a decrease in growth rate from 2023 to 2024, the compound annual growth rate (CAGR) over the period 2020-2024 remained strong at 10.94%. The market concentration, as measured by the Herfindahl-Hirschman Index (HHI), was very high in 2023 and continued to be at a high level in 2024. This indicates a competitive market landscape with a few major players dominating the flour import sector in India.

India Flour Market Size & Growth Rate

As per 6Wresearch, India Flour Market Size is projected to exhibit a steady growth rate, with forecasts indicating a Compound Annual Growth Rate (CAGR) of around 8% between 2025 and 2031.

India Flour Market Highlights

| Report Name | India Flour Market |

| Forecast period | 2025-2031 |

| CAGR | 8% |

| Growing Sector | Food |

Topics Covered in the India Flour Market Report

The India Flour Market report thoroughly covers the market by Raw Material, Applications, and Technology. The report provides an unbiased and detailed analysis of the ongoing market trends, opportunities/high-growth areas, and market drivers to help stakeholders align their strategies with current and future market dynamics.

India Flour Market Synopsis

The India flour market is considered a major part of the India's food processing sector, underppinned by status of flour as a staple in Indian food. The market comprises of wide array of products ranging from wheat flour (atta), refined flour (maida) to other speciality flours. Population growth, urbanisation, and altered dietary patterns have greatly increased the demand for convenient and packaged flour products. In addition, the rising health-aware consumer base has boosted whole wheat and multigrain flour demand.

The India Flour Market is anticipated to grow at a CAGR of 8% during the forecast period 2025-2031. The India flour market growth is estimated to surge tremendosuly due to various factors. The urbanization process and upward-rising disposable incomes have motivated customers to move towards branded and packaged, flour products because of their higher quality and convenience. Moreover, the increasing consciousness about health and well-being among customers has resulted in increased demand for nutritionally rich flours like multigrain, organic, and fortified flours. The thriving food processing sector, especially in the bakery and snack categories, has also played a role in increasing demand for various kinds of flour. In addition, government efforts to promote agricultural production and food security have supported the supply chain and infrastructure, driving the India Flour Market growth. Despite the promising growth prospects, the India flour market faces several challenges. One of the significant hurdles is the fluctuating prices of raw materials due to unpredictable weather conditions and supply chain disruptions. This volatility affects both producers and consumers, leading to market uncertainties.

India Flour Market Trends

The India flour market is witnessing evolving trends driven by shifting consumer preferences and technological advancements. The rising demand for healthier and organic flour options is reshaping the market, with consumers increasingly opting for whole wheat, multigrain, and gluten-free variants. The convenience of ready-to-cook and packaged flour products is also gaining traction, particularly in urban areas with fast-paced lifestyles. Additionally, the integration of technology in flour milling and packaging is enhancing product quality and shelf life, further supporting market growth.

Investment Opportunities in the India Flour Market

The India flour market presents significant investment opportunities for both domestic and international players. Key areas of potential include the development of premium and niche flour products catering to health-conscious consumers. Investments in modern milling facilities and robust supply chain infrastructure can help streamline operations and reduce costs. There is also a growing opportunity in e-commerce channels, with online platforms serving as an efficient means to reach a broader customer base.

Leading Players in the India Flour Market

The India flour market is highly competitive and includes several prominent players who have established a strong foothold. Companies such as ITC Limited, General Mills India, and Shakti Bhog Foods dominate the organized segment with their diverse product offerings and extensive distribution networks. These major players continuously innovate by introducing fortified and premium-grade flours catering to changing consumer demands.

Government Regulations in the India Flour Market

The flour industry in India operates under several government regulations aimed at ensuring food safety, quality standards, and fair pricing practices. The Food Safety and Standards Authority of India (FSSAI) enforces strict guidelines on product labeling, nutritional content, and production processes. Additionally, the government promotes the use of fortified flour to combat malnutrition under initiatives like the Food Fortification Resource Centre (FFRC). Policies supporting agricultural productivity and wheat procurement also indirectly influence the industry's operations.

Future Insights of the India Flour Market

The future of the India flour market looks promising, driven by evolving consumer preferences, technological advancements, and policy support. Rising health awareness is set to boost the demand for fortified, whole-grain, and gluten-free flours. Expansion in urbanization and disposable incomes will further propel the demand for convenience-oriented and premium products. Innovations in milling techniques and automation are expected to improve production efficiency, while growth in e-commerce platforms predicts a wider reach to both urban and rural customers.

Role of E-Commerce in Boosting Flour Accessibility

The rise of e-commerce has revolutionized the way consumers access and purchase flour products, breaking down geographical barriers and offering unparalleled convenience. Online platforms have enabled both manufacturers and retailers to tap into broader markets, reaching customers in urban, suburban, and even rural areas. With the growing preference for doorstep delivery, many consumers now rely on e-commerce for a wide variety of flour products, from basic staples to specialty and premium options.

Innovations in Milling Technologies and Their Impact

Advancements in milling technologies have dramatically transformed the flour industry, enhancing both the quality and efficiency of production processes. Modern milling techniques, such as roller milling and high-performance stone milling, have made it possible to produce flour with precise textures and consistent quality while minimizing waste. Additionally, innovations in energy-efficient machinery have reduced the environmental footprint of flour production, supporting sustainability practices. The use of advanced sorting and cleaning technologies ensures higher food safety standards by eliminating impurities and contaminants.

Market Segmentation Analysis

The report offers a comprehensive study of the following market segments and their leading categories:

Wheat to Dominate the Market– By Raw Material

According to Ashutosh, Senior Research Analyst at 6Wresearch, wheat dominates the India flour market, accounting for the largest share. Wheat-based flour is a staple in Indian households and is extensively used in preparing traditional cuisines such as chapati, paratha, and puri. Its versatility and nutritional profile further solidify its position as the leading raw material in the market.

Bread and bakery products to Lead the Market – By Application

Bread and bakery products lead the application segment in the India flour market. The rising consumption of baked goods like bread, cakes, and pastries, coupled with changing consumer lifestyles and preferences for ready-to-eat food items, contributes to the dominance of this category.

Key Attractiveness of the Report

- 10 Years of Market Numbers.

- Historical Data Starting from 2021 to 2024.

- Base Year: 2024

- Forecast Data until 2031.

- Key Performance Indicators Impacting the Market.

- Major Upcoming Developments and Projects.

Key Highlights of the Report:

- India Flour Market Outlook

- Market Size of India Flour Market, 2024

- Forecast of India Flour Market, 2031

- Historical Data and Forecast of India Flour Revenues & Volume for the Period 2021-2031

- India Flour Market Trend Evolution

- India Flour Market Drivers and Challenges

- India Flour Price Trends

- India Flour Porter's Five Forces

- India Flour Industry Life Cycle

- Historical Data and Forecast of India Flour Market Revenues & Volume By Raw Material for the Period 2021-2031

- Historical Data and Forecast of India Flour Market Revenues & Volume By Wheat for the Period 2021-2031

- Historical Data and Forecast of India Flour Market Revenues & Volume By Rice for the Period 2021-2031

- Historical Data and Forecast of India Flour Market Revenues & Volume By Maize for the Period 2021-2031

- Historical Data and Forecast of India Flour Market Revenues & Volume By Others for the Period 2021-2031

- Historical Data and Forecast of India Flour Market Revenues & Volume By Applications for the Period 2021-2031

- Historical Data and Forecast of India Flour Market Revenues & Volume By Bread & Bakery Products for the Period 2021-2031

- Historical Data and Forecast of India Flour Market Revenues & Volume By Noodles & Pasta for the Period 2021-2031

- Historical Data and Forecast of India Flour Market Revenues & Volume By Animal Feed for the Period 2021-2031

- Historical Data and Forecast of India Flour Market Revenues & Volume By Wafers, Crackers, & Biscuits for the Period 2021-2031

- Historical Data and Forecast of India Flour Market Revenues & Volume By Non-Food Application for the Period 2021-2031

- Historical Data and Forecast of India Flour Market Revenues & Volume By Others for the Period 2021-2031

- Historical Data and Forecast of India Flour Market Revenues & Volume By Technology for the Period 2021-2031

- Historical Data and Forecast of India Flour Market Revenues & Volume By Dry Technology for the Period 2021-2031

- Historical Data and Forecast of India Flour Market Revenues & Volume By Wet Technology for the Period 2021-2031

- India Flour Import Export Trade Statistics

- Market Opportunity Assessment By Raw Material

- Market Opportunity Assessment By Applications

- Market Opportunity Assessment By Technology

- India Flour Top Companies Market Share

- India Flour Competitive Benchmarking By Technical and Operational Parameters

- India Flour Company Profiles

- India Flour Key Strategic Recommendations

Market Segmentation

The Market report covers a detailed analysis of the following market segments:

By Raw Material

- Wheat

- Rice

- Maize

- Others

By Applications

- Bread & Bakery Products

- Noodles & Pasta

- Animal Feed

- Wafers

- Crackers, & Biscuits

- Non-Food Application

- Others

By Technology

- Dry Technology

- Wet Technology

India Flour Market (2025-2031): FAQs

| 1 Executive Summary |

| 2 Introduction |

| 2.1 Key Highlights of the Report |

| 2.2 Report Description |

| 2.3 Market Scope & Segmentation |

| 2.4 Research Methodology |

| 2.5 Assumptions |

| 3 India Flour Market Overview |

| 3.1 India Country Macro Economic Indicators |

| 3.2 India Flour Market Revenues & Volume, 2021 & 2031F |

| 3.3 India Flour Market - Industry Life Cycle |

| 3.4 India Flour Market - Porter's Five Forces |

| 3.5 India Flour Market Revenues & Volume Share, By Raw Material, 2021 & 2031F |

| 3.6 India Flour Market Revenues & Volume Share, By Applications, 2021 & 2031F |

| 3.7 India Flour Market Revenues & Volume Share, By Technology, 2021 & 2031F |

| 4 India Flour Market Dynamics |

| 4.1 Impact Analysis |

| 4.2 Market Drivers |

| 4.2.1 Increasing consumption of bakery and processed food products in India |

| 4.2.2 Growing health consciousness leading to higher demand for whole wheat flour |

| 4.2.3 Rising disposable income levels driving the demand for premium flour products |

| 4.3 Market Restraints |

| 4.3.1 Fluctuating prices of raw materials such as wheat impacting production costs |

| 4.3.2 Competition from alternative flours like rice flour, millet flour, and others in the market |

| 4.3.3 Challenges in distribution and logistics leading to inefficiencies in reaching all regions effectively |

| 5 India Flour Market Trends |

| 6 India Flour Market, By Types |

| 6.1 India Flour Market, By Raw Material |

| 6.1.1 Overview and Analysis |

| 6.1.2 India Flour Market Revenues & Volume, By Raw Material, 2021-2031F |

| 6.1.3 India Flour Market Revenues & Volume, By Wheat, 2021-2031F |

| 6.1.4 India Flour Market Revenues & Volume, By Rice, 2021-2031F |

| 6.1.5 India Flour Market Revenues & Volume, By Maize, 2021-2031F |

| 6.1.6 India Flour Market Revenues & Volume, By Others, 2021-2031F |

| 6.2 India Flour Market, By Applications |

| 6.2.1 Overview and Analysis |

| 6.2.2 India Flour Market Revenues & Volume, By Bread & Bakery Products, 2021-2031F |

| 6.2.3 India Flour Market Revenues & Volume, By Noodles & Pasta, 2021-2031F |

| 6.2.4 India Flour Market Revenues & Volume, By Animal Feed, 2021-2031F |

| 6.2.5 India Flour Market Revenues & Volume, By Wafers, Crackers, & Biscuits, 2021-2031F |

| 6.2.6 India Flour Market Revenues & Volume, By Non-Food Application, 2021-2031F |

| 6.2.7 India Flour Market Revenues & Volume, By Others, 2021-2031F |

| 6.3 India Flour Market, By Technology |

| 6.3.1 Overview and Analysis |

| 6.3.2 India Flour Market Revenues & Volume, By Dry Technology, 2021-2031F |

| 6.3.3 India Flour Market Revenues & Volume, By Wet Technology, 2021-2031F |

| 7 India Flour Market Import-Export Trade Statistics |

| 7.1 India Flour Market Export to Major Countries |

| 7.2 India Flour Market Imports from Major Countries |

| 8 India Flour Market Key Performance Indicators |

8.1 Consumer awareness and preference for whole wheat flour products |

8.2 Adoption rate of innovative and premium flour products in the market |

8.3 Investment in RD for new flour product development |

8.4 Efficiency in supply chain management for timely distribution to all regions |

8.5 Consumer feedback and satisfaction levels with flour products |

| 9 India Flour Market - Opportunity Assessment |

| 9.1 India Flour Market Opportunity Assessment, By Raw Material, 2021 & 2031F |

| 9.2 India Flour Market Opportunity Assessment, By Applications, 2021 & 2031F |

| 9.3 India Flour Market Opportunity Assessment, By Technology, 2021 & 2031F |

| 10 India Flour Market - Competitive Landscape |

| 10.1 India Flour Market Revenue Share, By Companies, 2024 |

| 10.2 India Flour Market Competitive Benchmarking, By Operating and Technical Parameters |

| 11 Company Profiles |

| 12 Recommendations |

| 13 Disclaimer |

- Single User License$ 1,995

- Department License$ 2,400

- Site License$ 3,120

- Global License$ 3,795

Search

Thought Leadership and Analyst Meet

Our Clients

Related Reports

- South Africa Stationery Market (2025-2031) | Share, Size, Industry, Value, Growth, Revenue, Analysis, Trends, Segmentation & Outlook

- Afghanistan Rocking Chairs And Adirondack Chairs Market (2026-2032) | Size & Revenue, Competitive Landscape, Share, Segmentation, Industry, Value, Outlook, Analysis, Trends, Growth, Forecast, Companies

- Afghanistan Apparel Market (2026-2032) | Growth, Outlook, Industry, Segmentation, Forecast, Size, Companies, Trends, Value, Share, Analysis & Revenue

- Canada Oil and Gas Market (2026-2032) | Share, Segmentation, Value, Industry, Trends, Forecast, Analysis, Size & Revenue, Growth, Competitive Landscape, Outlook, Companies

- Germany Breakfast Food Market (2026-2032) | Industry, Share, Growth, Size, Companies, Value, Analysis, Revenue, Trends, Forecast & Outlook

- Australia Briquette Market (2025-2031) | Growth, Size, Revenue, Forecast, Analysis, Trends, Value, Share, Industry & Companies

- Vietnam System Integrator Market (2025-2031) | Size, Companies, Analysis, Industry, Value, Forecast, Growth, Trends, Revenue & Share

- ASEAN and Thailand Brain Health Supplements Market (2025-2031) | Strategy, Consumer Insights, Analysis, Investment Trends, Opportunities, Growth, Size, Share, Industry, Revenue, Segments, Value, Segmentation, Supply, Forecast, Restraints, Outlook, Competition, Drivers, Trends, Demand, Pricing Analysis, Competitive, Strategic Insights, Companies, Challenges

- ASEAN Bearings Market (2025-2031) | Strategy, Consumer Insights, Analysis, Investment Trends, Opportunities, Growth, Size, Share, Industry, Revenue, Segments, Value, Segmentation, Supply, Forecast, Restraints, Outlook, Competition, Drivers, Trends, Demand, Pricing Analysis, Competitive, Strategic Insights, Companies, Challenges

- Europe Flooring Market (2025-2031) | Outlook, Share, Industry, Trends, Forecast, Companies, Revenue, Size, Analysis, Growth & Value

Industry Events and Analyst Meet

Whitepaper

- Middle East & Africa Commercial Security Market Click here to view more.

- Middle East & Africa Fire Safety Systems & Equipment Market Click here to view more.

- GCC Drone Market Click here to view more.

- Middle East Lighting Fixture Market Click here to view more.

- GCC Physical & Perimeter Security Market Click here to view more.

6WResearch In News

- Doha a strategic location for EV manufacturing hub: IPA Qatar

- Demand for luxury TVs surging in the GCC, says Samsung

- Empowering Growth: The Thriving Journey of Bangladesh’s Cable Industry

- Demand for luxury TVs surging in the GCC, says Samsung

- Video call with a traditional healer? Once unthinkable, it’s now common in South Africa

- Intelligent Buildings To Smooth GCC’s Path To Net Zero