India Incinerator Market (2025-2031) Outlook | Industry, Trends, Forecast, Analysis, Size, Growth, Value, Share, Revenue & Companies

| Product Code: ETC130209 | Publication Date: Aug 2023 | Updated Date: Aug 2025 | Product Type: Report | |

| Publisher: 6Wresearch | Author: Ravi Bhandari | No. of Pages: 70 | No. of Figures: 35 | No. of Tables: 5 |

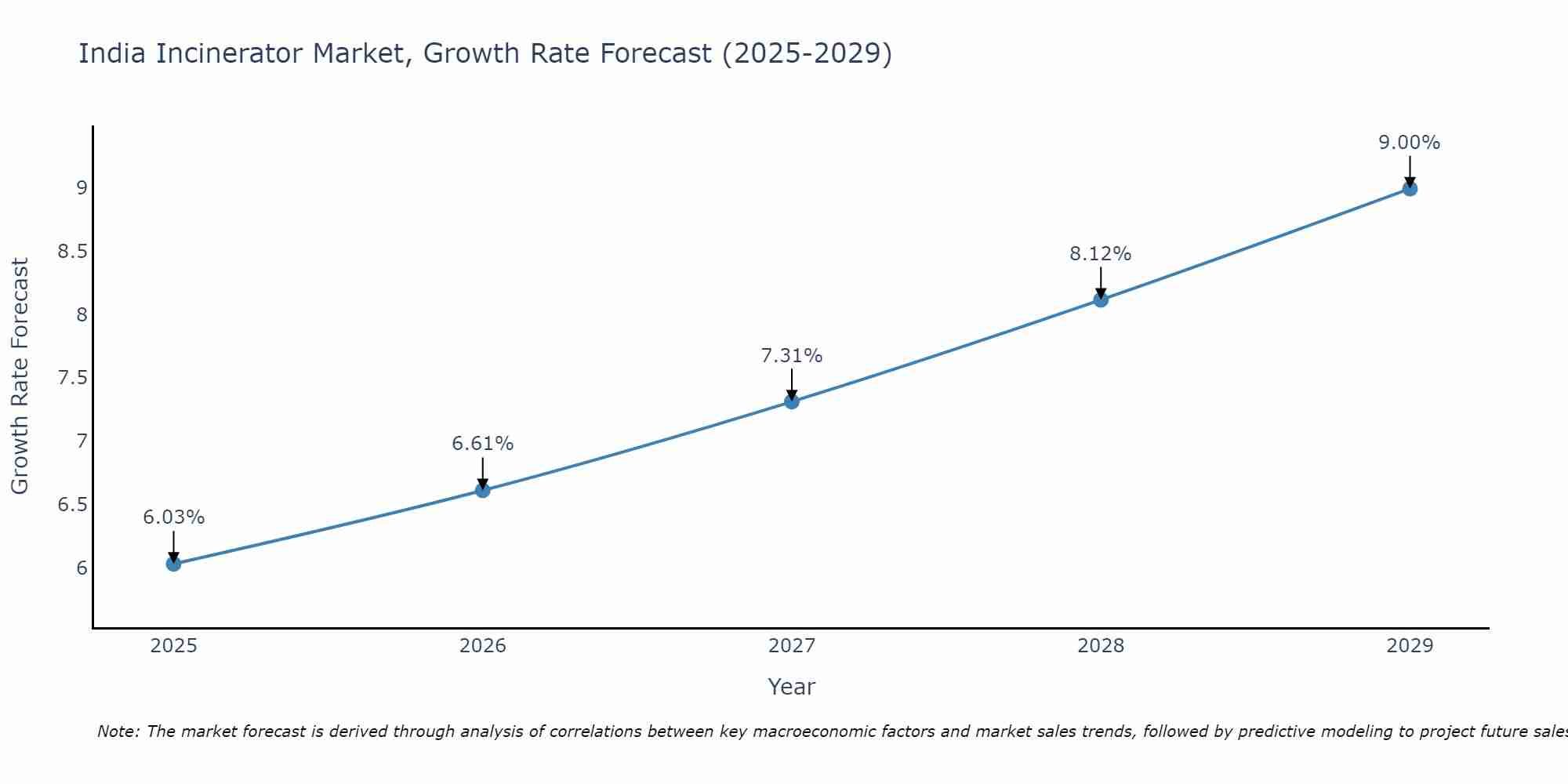

India Incinerator Market Size Growth Rate

The India Incinerator Market is likely to experience consistent growth rate gains over the period 2025 to 2029. Commencing at 6.03% in 2025, growth builds up to 9.00% by 2029.

India Incinerator Market Synopsis

India Incinerator Market is expected to register a CAGR of 3.6% during the forecast period (2025-2031).The increasing demand for waste management services from various industries, coupled with stringent regulations on hazardous waste disposal are driving the growth of the market. The government initiatives such as Swachh Bharat Abhiyan and Make in India Campaign further boost the incineration market in India.

Drivers of the Market:

Growing awareness regarding environmental safety, rapid industrialization coupled with governmental initiatives focusing on reducing greenhouse gas emissions are some of the major factors augmenting the growth of Indian incinerator market. Moreover, increasing urban population and rising disposable income will drive an increase in domestic consumption resulting into more waste generation creating opportunities for industry players operating in this sector. Furthermore, technological advancements have resulted into cost effective solutions which are also fuelling up their demand across multiple industrial applications including medical waste treatment thereby aiding its acceptance among end users

Challenges of the Market:

High capital investments associated with installing these systems pose hindrances to its widespread adoption by end users especially small scale factories and industries who lack adequate financial resources to invest upfront into it . Additionally , high maintenance costs can act as a deterrent for potential buyers seeking long term profitability from these systems thus discouraging them from investing . Lastly , poor infrastructure and inadequate accessibility has hindered its uptake despite numerous benefits offered by these systems.

Trends of the Market:

Increasing use of incinerators due to growing concerns over global warming has led to emergence of new technologies that offer higher efficiency at lower operational costs such as advanced plasma arc technology utilized for destruction of complex pollutants like dioxins & furans released through burning processes . Also , manufacturers have started integrating automation capabilities thereby allowing easy monitoring & control over entire process flow making them attractive proposition for large scale operations.

Key Players of the Market:

Some key players operating in Indian Incinerator Market include Thermax Ltd., Hindustan Dorr-Oliver Ltd., Parle Agro Pvt Ltd., Envirocare Technologies Pvt Ltd., Technopro Solutions Pvt Ltd., Codefire Technologies LLP etc..

The COVID - 19 Impact on the Market:

Covid -19 pandemic has caused disruption throughout economy affecting all sectors including Incinerator market too; however companies engaged in manufacturing essential equipment?s related healthcare sector have benefitted while rest others witnessed moderate decline due to project delays alongwith supply chain disruptions leading towards low order intake . On other hand increased focus on hygiene & sterilisation practices.

Key Highlights of the Report:

- India Incinerator Market Outlook

- Market Size of India Incinerator Market, 2024

- Forecast of India Incinerator Market, 2031

- Historical Data and Forecast of India Incinerator Revenues & Volume for the Period 2021-2031

- India Incinerator Market Trend Evolution

- India Incinerator Market Drivers and Challenges

- India Incinerator Price Trends

- India Incinerator Porter's Five Forces

- India Incinerator Industry Life Cycle

- Historical Data and Forecast of India Incinerator Market Revenues & Volume By Product Type for the Period 2021-2031

- Historical Data and Forecast of India Incinerator Market Revenues & Volume By Moving Grate for the Period 2021-2031

- Historical Data and Forecast of India Incinerator Market Revenues & Volume By Static Hearth, Furnace and Multiple Hearth for the Period 2021-2031

- Historical Data and Forecast of India Incinerator Market Revenues & Volume By Rotary Kiln for the Period 2021-2031

- Historical Data and Forecast of India Incinerator Market Revenues & Volume By Fluidized Bed for the Period 2021-2031

- Historical Data and Forecast of India Incinerator Market Revenues & Volume By End-user for the Period 2021-2031

- Historical Data and Forecast of India Incinerator Market Revenues & Volume By Municipal Sector for the Period 2021-2031

- Historical Data and Forecast of India Incinerator Market Revenues & Volume By Industrial Sector for the Period 2021-2031

- India Incinerator Import Export Trade Statistics

- Market Opportunity Assessment By Product Type

- Market Opportunity Assessment By End-user

- India Incinerator Top Companies Market Share

- India Incinerator Competitive Benchmarking By Technical and Operational Parameters

- India Incinerator Company Profiles

- India Incinerator Key Strategic Recommendations

Frequently Asked Questions About the Market Study (FAQs):

India Incinerator |

1 Executive Summary |

2 Introduction |

2.1 Key Highlights of the Report |

2.2 Report Description |

2.3 Market Scope & Segmentation |

2.4 Research Methodology |

2.5 Assumptions |

3 India Incinerator Market Overview |

3.1 India Country Macro Economic Indicators |

3.2 India Incinerator Market Revenues & Volume, 2021 & 2031F |

3.3 India Incinerator Market - Industry Life Cycle |

3.4 India Incinerator Market - Porter's Five Forces |

3.5 India Incinerator Market Revenues & Volume Share, By Product Type, 2021 & 2031F |

3.6 India Incinerator Market Revenues & Volume Share, By End-user, 2021 & 2031F |

4 India Incinerator Market Dynamics |

4.1 Impact Analysis |

4.2 Market Drivers |

4.2.1 Increasing government initiatives and regulations promoting proper waste management practices in India |

4.2.2 Rising awareness about environmental pollution and the need for sustainable waste disposal methods |

4.2.3 Growing urbanization and industrialization leading to increased waste generation in India |

4.3 Market Restraints |

4.3.1 High initial investment cost for setting up incineration facilities |

4.3.2 Concerns over air pollution and emissions from incinerators, leading to opposition from environmental groups |

4.3.3 Lack of proper infrastructure and technology for efficient operation and maintenance of incineration facilities in India |

5 India Incinerator Market Trends |

6 India Incinerator Market, By Types |

6.1 India Incinerator Market, By Product Type |

6.1.1 Overview and Analysis |

6.1.2 India Incinerator Market Revenues & Volume, By Product Type, 2021-2031F |

6.1.3 India Incinerator Market Revenues & Volume, By Moving Grate, 2021-2031F |

6.1.4 India Incinerator Market Revenues & Volume, By Static Hearth, Furnace and Multiple Hearth, 2021-2031F |

6.1.5 India Incinerator Market Revenues & Volume, By Rotary Kiln, 2021-2031F |

6.1.6 India Incinerator Market Revenues & Volume, By Fluidized Bed, 2021-2031F |

6.2 India Incinerator Market, By End-user |

6.2.1 Overview and Analysis |

6.2.2 India Incinerator Market Revenues & Volume, By Municipal Sector, 2021-2031F |

6.2.3 India Incinerator Market Revenues & Volume, By Industrial Sector, 2021-2031F |

7 India Incinerator Market Import-Export Trade Statistics |

7.1 India Incinerator Market Export to Major Countries |

7.2 India Incinerator Market Imports from Major Countries |

8 India Incinerator Market Key Performance Indicators |

8.1 Waste diversion rate (percentage of waste diverted from landfills to incineration) |

8.2 Energy recovery efficiency (percentage of energy recovered from waste during incineration) |

8.3 Compliance with emission standards (measured by emissions of pollutants such as particulate matter and dioxins) |

9 India Incinerator Market - Opportunity Assessment |

9.1 India Incinerator Market Opportunity Assessment, By Product Type, 2021 & 2031F |

9.2 India Incinerator Market Opportunity Assessment, By End-user, 2021 & 2031F |

10 India Incinerator Market - Competitive Landscape |

10.1 India Incinerator Market Revenue Share, By Companies, 2024 |

10.2 India Incinerator Market Competitive Benchmarking, By Operating and Technical Parameters |

11 Company Profiles |

12 Recommendations |

13 Disclaimer |

- Single User License$ 1,995

- Department License$ 2,400

- Site License$ 3,120

- Global License$ 3,795

Search

Thought Leadership and Analyst Meet

Our Clients

Related Reports

- Afghanistan Apparel Market (2026-2032) | Growth, Outlook, Industry, Segmentation, Forecast, Size, Companies, Trends, Value, Share, Analysis & Revenue

- Canada Oil and Gas Market (2026-2032) | Share, Segmentation, Value, Industry, Trends, Forecast, Analysis, Size & Revenue, Growth, Competitive Landscape, Outlook, Companies

- Germany Breakfast Food Market (2026-2032) | Industry, Share, Growth, Size, Companies, Value, Analysis, Revenue, Trends, Forecast & Outlook

- Australia Briquette Market (2025-2031) | Growth, Size, Revenue, Forecast, Analysis, Trends, Value, Share, Industry & Companies

- Vietnam System Integrator Market (2025-2031) | Size, Companies, Analysis, Industry, Value, Forecast, Growth, Trends, Revenue & Share

- ASEAN and Thailand Brain Health Supplements Market (2025-2031) | Strategy, Consumer Insights, Analysis, Investment Trends, Opportunities, Growth, Size, Share, Industry, Revenue, Segments, Value, Segmentation, Supply, Forecast, Restraints, Outlook, Competition, Drivers, Trends, Demand, Pricing Analysis, Competitive, Strategic Insights, Companies, Challenges

- ASEAN Bearings Market (2025-2031) | Strategy, Consumer Insights, Analysis, Investment Trends, Opportunities, Growth, Size, Share, Industry, Revenue, Segments, Value, Segmentation, Supply, Forecast, Restraints, Outlook, Competition, Drivers, Trends, Demand, Pricing Analysis, Competitive, Strategic Insights, Companies, Challenges

- Europe Flooring Market (2025-2031) | Outlook, Share, Industry, Trends, Forecast, Companies, Revenue, Size, Analysis, Growth & Value

- Saudi Arabia Manlift Market (2025-2031) | Outlook, Size, Growth, Trends, Companies, Industry, Revenue, Value, Share, Forecast & Analysis

- Uganda Excavator, Crane, and Wheel Loaders Market (2025-2031) | Strategy, Consumer Insights, Analysis, Investment Trends, Opportunities, Growth, Size, Share, Industry, Revenue, Segments, Value, Segmentation, Supply, Forecast, Restraints, Outlook, Competition, Drivers, Trends, Demand, Pricing Analysis, Competitive, Strategic Insights, Companies, Challenges

Industry Events and Analyst Meet

Whitepaper

- Middle East & Africa Commercial Security Market Click here to view more.

- Middle East & Africa Fire Safety Systems & Equipment Market Click here to view more.

- GCC Drone Market Click here to view more.

- Middle East Lighting Fixture Market Click here to view more.

- GCC Physical & Perimeter Security Market Click here to view more.

6WResearch In News

- Doha a strategic location for EV manufacturing hub: IPA Qatar

- Demand for luxury TVs surging in the GCC, says Samsung

- Empowering Growth: The Thriving Journey of Bangladesh’s Cable Industry

- Demand for luxury TVs surging in the GCC, says Samsung

- Video call with a traditional healer? Once unthinkable, it’s now common in South Africa

- Intelligent Buildings To Smooth GCC’s Path To Net Zero