India Medical Tubing Market (2025-2031) Outlook | Forecast, Industry, Share, Size, Companies, Trends, Analysis, Revenue, Value & Growth

| Product Code: ETC377244 | Publication Date: Aug 2022 | Updated Date: Nov 2025 | Product Type: Market Research Report | |

| Publisher: 6Wresearch | Author: Ravi Bhandari | No. of Pages: 75 | No. of Figures: 35 | No. of Tables: 20 |

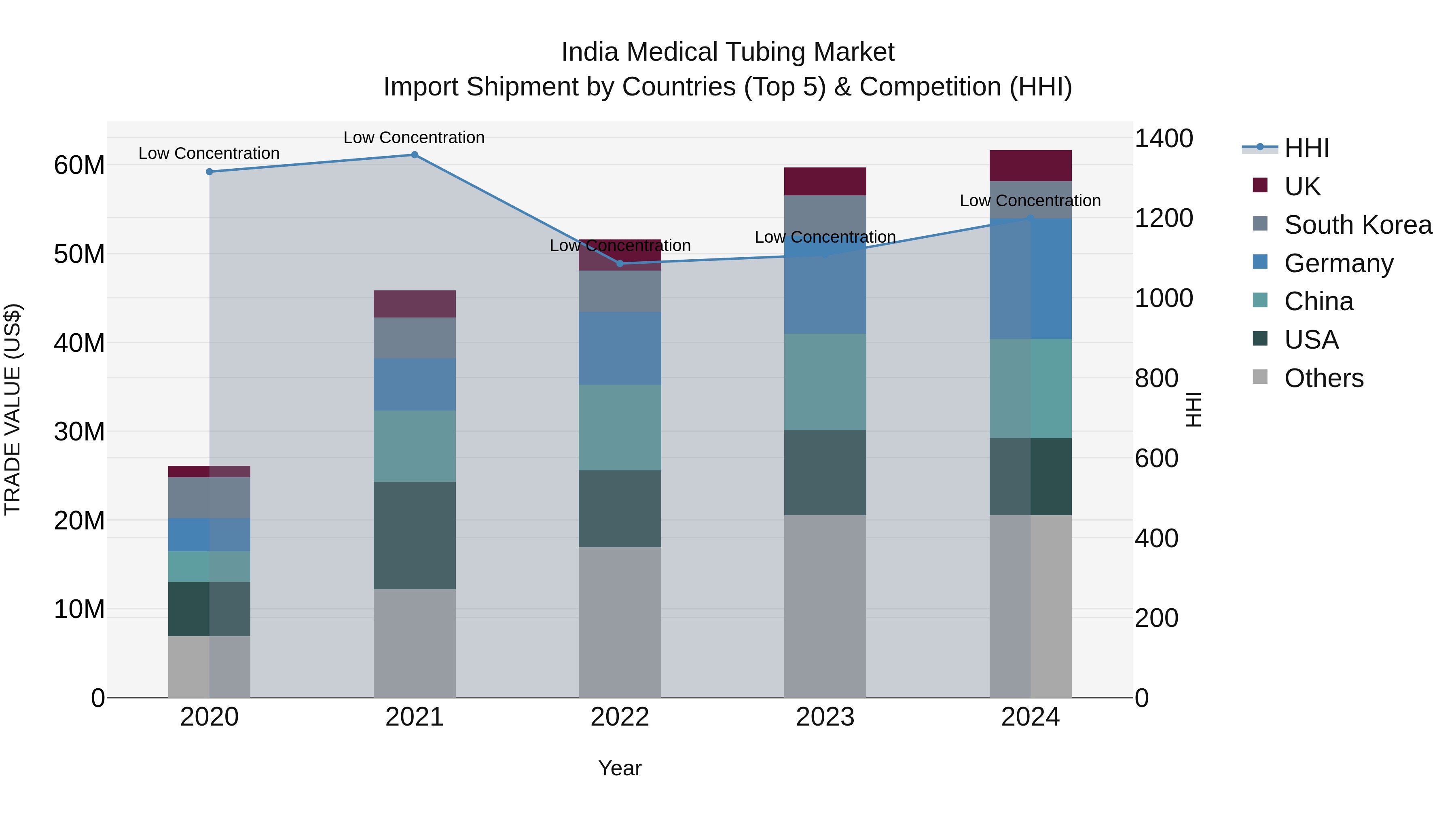

India Medical Tubing Market Top 5 Importing Countries and Market Competition (HHI) Analysis

India`s medical tubing import market saw strong growth in 2024, with top exporters being Germany, China, USA, Malaysia, and South Korea. Despite the high CAGR of 23.99% from 2020 to 2024, the market remained relatively unconcentrated with a low Herfindahl-Hirschman Index (HHI). The modest growth rate of 3.26% from 2023 to 2024 suggests a stable expansion trajectory for the industry, indicating sustained demand for medical tubing imports in India.

India Medical Tubing Market Synopsis

The India medical tubing market size stood at around 432 Million US$ and is projected to witness a compound annual growth rate (CAGR) of 9% on account of its surging application scope across different end use segments such as pharmaceuticals & biotechnology, diagnostics & research laboratories etc. Rapidly evolving healthcare infrastructure along with high adoption rate regarding minimally invasive surgical procedures will create lucrative business opportunities throughout 2022-2031 timeline thereby augmenting overall revenue generation pertaining to sale of these components into local region based upon their specific properties like gas permeability or flexibility grade etc.

Market Drivers of the market

In the medical tubing market, the key drivers include technological advancements in medical devices and the growing demand for minimally invasive procedures. Medical tubing is essential for various applications, including catheters, intravenous lines, and respiratory devices, making it a critical component in modern healthcare.

Challenges of the Market

The medical tubing market in India faces various challenges that affect its growth and competitiveness. One of the primary challenges is the strict regulatory requirements imposed on medical devices, including tubing. Complying with these regulations and obtaining necessary certifications can be a complex and expensive process for manufacturers.The market also contends with the presence of low-quality and non-compliant medical tubing products, which can compromise patient safety and tarnish the reputation of genuine suppliers.Furthermore, the market`s dependence on raw material imports can expose it to supply chain disruptions and price fluctuations, impacting overall production costs. Developing local sourcing options and resilient supply chains is essential for sustainability.

Covid-19 Impact on the Market

The medical tubing market in India experienced fluctuations during the COVID-19 pandemic. The increased demand for medical equipment, including tubing, strained the supply chain. Additionally, logistical challenges and raw material shortages affected production and distribution, impacting market dynamics.

Key Players of the Market

In the India Medical Tubing Market, major players include Poly Medicure Limited, RAUMEDIC AG, Optinova Group, Ami Polymer Pvt. Ltd., and Zeus Industrial Products India Pvt. Ltd.

Key Highlights of the Report:

- India Medical Tubing Market Outlook

- Market Size of India Medical Tubing Market, 2024

- Forecast of India Medical Tubing Market, 2031

- Historical Data and Forecast of India Medical Tubing Revenues & Volume for the Period 2021-2031

- India Medical Tubing Market Trend Evolution

- India Medical Tubing Market Drivers and Challenges

- India Medical Tubing Price Trends

- India Medical Tubing Porter's Five Forces

- India Medical Tubing Industry Life Cycle

- Historical Data and Forecast of India Medical Tubing Market Revenues & Volume By Material for the Period 2021-2031

- Historical Data and Forecast of India Medical Tubing Market Revenues & Volume By Plastics for the Period 2021-2031

- Historical Data and Forecast of India Medical Tubing Market Revenues & Volume By Rubbers for the Period 2021-2031

- Historical Data and Forecast of India Medical Tubing Market Revenues & Volume By Specialty Polymers for the Period 2021-2031

- Historical Data and Forecast of India Medical Tubing Market Revenues & Volume By Structure for the Period 2021-2031

- Historical Data and Forecast of India Medical Tubing Market Revenues & Volume By Single-lumen for the Period 2021-2031

- Historical Data and Forecast of India Medical Tubing Market Revenues & Volume By Co-extruded for the Period 2021-2031

- Historical Data and Forecast of India Medical Tubing Market Revenues & Volume By Multi-lumen for the Period 2021-2031

- Historical Data and Forecast of India Medical Tubing Market Revenues & Volume By Tapered Or Bump Tubing for the Period 2021-2031

- Historical Data and Forecast of India Medical Tubing Market Revenues & Volume By Braided Tubing for the Period 2021-2031

- Historical Data and Forecast of India Medical Tubing Market Revenues & Volume By Application for the Period 2021-2031

- Historical Data and Forecast of India Medical Tubing Market Revenues & Volume By Bulk Disposable Tubing for the Period 2021-2031

- Historical Data and Forecast of India Medical Tubing Market Revenues & Volume By Catheters & Cannulas for the Period 2021-2031

- Historical Data and Forecast of India Medical Tubing Market Revenues & Volume By Drug Delivery System for the Period 2021-2031

- Historical Data and Forecast of India Medical Tubing Market Revenues & Volume By Special Applications for the Period 2021-2031

- India Medical Tubing Import Export Trade Statistics

- Market Opportunity Assessment By Material

- Market Opportunity Assessment By Structure

- Market Opportunity Assessment By Application

- India Medical Tubing Top Companies Market Share

- India Medical Tubing Competitive Benchmarking By Technical and Operational Parameters

- India Medical Tubing Company Profiles

- India Medical Tubing Key Strategic Recommendations

Frequently Asked Questions About the Market Study (FAQs):

- Single User License$ 1,995

- Department License$ 2,400

- Site License$ 3,120

- Global License$ 3,795

Search

Thought Leadership and Analyst Meet

Our Clients

Related Reports

- Afghanistan Apparel Market (2026-2032) | Growth, Outlook, Industry, Segmentation, Forecast, Size, Companies, Trends, Value, Share, Analysis & Revenue

- Canada Oil and Gas Market (2026-2032) | Share, Segmentation, Value, Industry, Trends, Forecast, Analysis, Size & Revenue, Growth, Competitive Landscape, Outlook, Companies

- Germany Breakfast Food Market (2026-2032) | Industry, Share, Growth, Size, Companies, Value, Analysis, Revenue, Trends, Forecast & Outlook

- Australia Briquette Market (2025-2031) | Growth, Size, Revenue, Forecast, Analysis, Trends, Value, Share, Industry & Companies

- Vietnam System Integrator Market (2025-2031) | Size, Companies, Analysis, Industry, Value, Forecast, Growth, Trends, Revenue & Share

- ASEAN and Thailand Brain Health Supplements Market (2025-2031) | Strategy, Consumer Insights, Analysis, Investment Trends, Opportunities, Growth, Size, Share, Industry, Revenue, Segments, Value, Segmentation, Supply, Forecast, Restraints, Outlook, Competition, Drivers, Trends, Demand, Pricing Analysis, Competitive, Strategic Insights, Companies, Challenges

- ASEAN Bearings Market (2025-2031) | Strategy, Consumer Insights, Analysis, Investment Trends, Opportunities, Growth, Size, Share, Industry, Revenue, Segments, Value, Segmentation, Supply, Forecast, Restraints, Outlook, Competition, Drivers, Trends, Demand, Pricing Analysis, Competitive, Strategic Insights, Companies, Challenges

- Europe Flooring Market (2025-2031) | Outlook, Share, Industry, Trends, Forecast, Companies, Revenue, Size, Analysis, Growth & Value

- Saudi Arabia Manlift Market (2025-2031) | Outlook, Size, Growth, Trends, Companies, Industry, Revenue, Value, Share, Forecast & Analysis

- Uganda Excavator, Crane, and Wheel Loaders Market (2025-2031) | Strategy, Consumer Insights, Analysis, Investment Trends, Opportunities, Growth, Size, Share, Industry, Revenue, Segments, Value, Segmentation, Supply, Forecast, Restraints, Outlook, Competition, Drivers, Trends, Demand, Pricing Analysis, Competitive, Strategic Insights, Companies, Challenges

Industry Events and Analyst Meet

Whitepaper

- Middle East & Africa Commercial Security Market Click here to view more.

- Middle East & Africa Fire Safety Systems & Equipment Market Click here to view more.

- GCC Drone Market Click here to view more.

- Middle East Lighting Fixture Market Click here to view more.

- GCC Physical & Perimeter Security Market Click here to view more.

6WResearch In News

- Doha a strategic location for EV manufacturing hub: IPA Qatar

- Demand for luxury TVs surging in the GCC, says Samsung

- Empowering Growth: The Thriving Journey of Bangladesh’s Cable Industry

- Demand for luxury TVs surging in the GCC, says Samsung

- Video call with a traditional healer? Once unthinkable, it’s now common in South Africa

- Intelligent Buildings To Smooth GCC’s Path To Net Zero