India Metalworking Fluids Market (2025-2031) Outlook | Trends, Analysis, Revenue, Size, Companies, Industry, Share, Growth, Forecast & Value

| Product Code: ETC297984 | Publication Date: Aug 2023 | Updated Date: Nov 2025 | Product Type: Market Research Report | |

| Publisher: 6Wresearch | Author: Ravi Bhandari | No. of Pages: 75 | No. of Figures: 35 | No. of Tables: 20 |

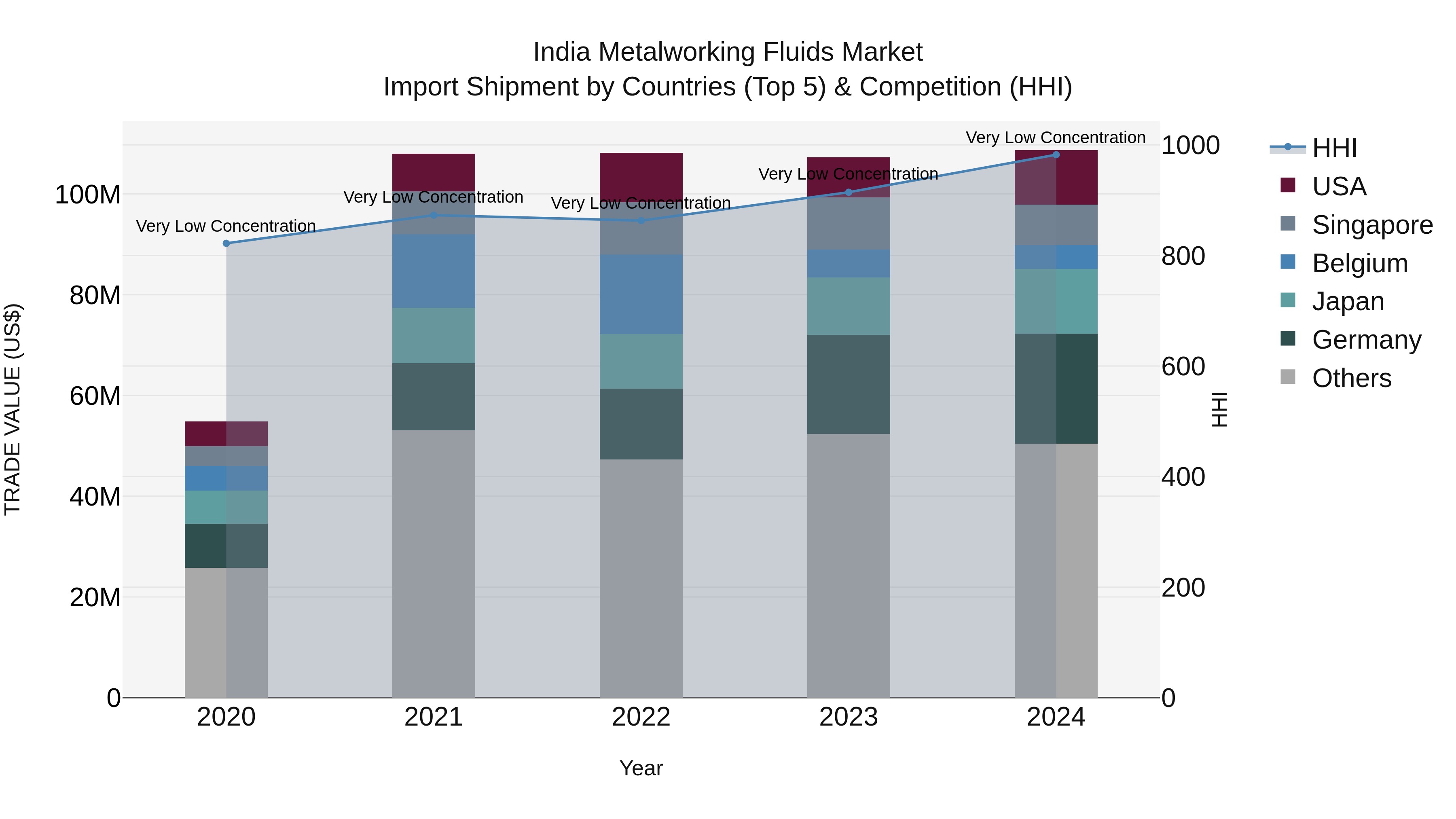

India Metalworking Fluids Market Top 5 Importing Countries and Market Competition (HHI) Analysis

India`s metalworking fluids import shipments saw significant growth in 2024, with top exporting countries being Germany, Japan, USA, UK, and Switzerland. The market remains highly competitive with a low Herfindahl-Hirschman Index (HHI) concentration. The compound annual growth rate (CAGR) for the period 2020-2024 was impressive at 18.63%, indicating a strong upward trend in demand. Additionally, the growth rate from 2023 to 2024 stood at 1.3%, highlighting continued expansion and opportunities in the metalworking fluids market in India.

India Metalworking Fluids Market Synopsis

The India metalworking fluids market is poised for significant growth in the coming years. Metalworking fluids, such as cutting oils, coolants, and lubricants, play a crucial role in the manufacturing industry by providing lubrication and cooling during metal machining processes. The market`s growth is primarily driven by the expanding manufacturing sector in the country, driven by various industries such as automotive, aerospace, and machinery manufacturing. The increasing demand for high-precision components and the need for efficient metalworking processes are propelling the adoption of advanced metalworking fluids. Additionally, the focus on reducing operational costs, improving tool life, and enhancing machining performance is driving the demand for specialized metalworking fluid formulations. However, challenges related to environmental regulations and the need for sustainable and eco-friendly metalworking fluid solutions may impact market growth.

Drivers of the market

The India metalworking fluids market is expected to witness substantial growth, driven by several key drivers. One of the primary drivers is the flourishing manufacturing and automotive sectors in the country. The metalworking fluids are extensively used in machining and metal forming processes, catering to the increasing demand for high-precision components and parts in these industries. Moreover, the growing focus on improving manufacturing efficiency and reducing operational costs is driving the adoption of metalworking fluids. These fluids offer benefits such as enhanced tool life, improved surface finish, and reduced friction, leading to increased productivity and cost savings. Additionally, stringent environmental regulations and the need for sustainable practices are propelling the demand for eco-friendly metalworking fluids. Manufacturers are investing in bio-based and biodegradable fluids to comply with environmental norms and ensure a safer working environment for employees.

Challenges of the Market

The India metalworking fluids market is witnessing growth as industries such as automotive, aerospace, and manufacturing prioritize efficient machining processes. This market`s outlook is driven by factors such as the expansion of metalworking industries, the increasing demand for high-performance cutting and grinding fluids, and the adoption of advanced metalworking fluid formulations for improved tool life and surface finish. Additionally, the rising focus on eco-friendly and sustainable metalworking fluids, such as water-based and vegetable oil-based fluids, and the development of specialized fluids for specific machining applications are further contributing to market growth.

Covid-19 Impact on the Market

The India metalworking fluids market is witnessing steady growth as the manufacturing sector continues to expand and adopt advanced machining processes. This market`s outlook is driven by factors such as the increasing demand for metalworking fluids in automotive, aerospace, and machinery industries, the rise of precision manufacturing and engineering applications, and the need for improved tool life and surface finish. Additionally, the growing focus on eco-friendly and bio-based metalworking fluids and the development of specialized formulations for high-speed machining and difficult-to-machine materials are further contributing to market growth. The COVID-19 pandemic had a significant impact on the manufacturing sector, leading to disruptions in production and supply chain activities. However, the market is expected to recover as industrial activities resume and the demand for metalworking fluids rebounds.

Key Players of the Market

In the India metalworking fluids market, several key players dominate the landscape. International companies such as ExxonMobil Corporation, FUCHS Group, and Castrol India Limited are among the leading suppliers of metalworking fluids, offering a wide range of products catering to various metal processing industries. These companies have a strong global presence and are known for their high-quality and technologically advanced metalworking fluids. Moreover, domestic manufacturers like HP Lubricants and India Oil Corporation Limited also play a significant role in the market, providing localized solutions and catering to the specific requirements of India industries. These players often offer cost-effective metalworking fluids without compromising on performance and quality.

Key Highlights of the Report:

- India Metalworking Fluids Market Outlook

- Market Size of India Metalworking Fluids Market, 2024

- Forecast of India Metalworking Fluids Market, 2031

- Historical Data and Forecast of India Metalworking Fluids Revenues & Volume for the Period 2021-2031

- India Metalworking Fluids Market Trend Evolution

- India Metalworking Fluids Market Drivers and Challenges

- India Metalworking Fluids Price Trends

- India Metalworking Fluids Porter's Five Forces

- India Metalworking Fluids Industry Life Cycle

- Historical Data and Forecast of India Metalworking Fluids Market Revenues & Volume By Product for the Period 2021-2031

- Historical Data and Forecast of India Metalworking Fluids Market Revenues & Volume By Mineral for the Period 2021-2031

- Historical Data and Forecast of India Metalworking Fluids Market Revenues & Volume By Synthetic for the Period 2021-2031

- Historical Data and Forecast of India Metalworking Fluids Market Revenues & Volume By Bio-based for the Period 2021-2031

- Historical Data and Forecast of India Metalworking Fluids Market Revenues & Volume By Application for the Period 2021-2031

- Historical Data and Forecast of India Metalworking Fluids Market Revenues & Volume By Neat Cutting Oils for the Period 2021-2031

- Historical Data and Forecast of India Metalworking Fluids Market Revenues & Volume By Water Cutting Oils for the Period 2021-2031

- Historical Data and Forecast of India Metalworking Fluids Market Revenues & Volume By Corrosion Preventive Oils for the Period 2021-2031

- Historical Data and Forecast of India Metalworking Fluids Market Revenues & Volume By Others for the Period 2021-2031

- Historical Data and Forecast of India Metalworking Fluids Market Revenues & Volume By End-use for the Period 2021-2031

- Historical Data and Forecast of India Metalworking Fluids Market Revenues & Volume By Metal Fabrication for the Period 2021-2031

- Historical Data and Forecast of India Metalworking Fluids Market Revenues & Volume By Transportation Equipment for the Period 2021-2031

- Historical Data and Forecast of India Metalworking Fluids Market Revenues & Volume By Machinery for the Period 2021-2031

- Historical Data and Forecast of India Metalworking Fluids Market Revenues & Volume By Others for the Period 2021-2031

- India Metalworking Fluids Import Export Trade Statistics

- Market Opportunity Assessment By Product

- Market Opportunity Assessment By Application

- Market Opportunity Assessment By End-use

- India Metalworking Fluids Top Companies Market Share

- India Metalworking Fluids Competitive Benchmarking By Technical and Operational Parameters

- India Metalworking Fluids Company Profiles

- India Metalworking Fluids Key Strategic Recommendations

Frequently Asked Questions About the Market Study (FAQs):

1 Executive Summary |

2 Introduction |

2.1 Key Highlights of the Report |

2.2 Report Description |

2.3 Market Scope & Segmentation |

2.4 Research Methodology |

2.5 Assumptions |

3 India Metalworking Fluids Market Overview |

3.1 India Country Macro Economic Indicators |

3.2 India Metalworking Fluids Market Revenues & Volume, 2021 & 2031F |

3.3 India Metalworking Fluids Market - Industry Life Cycle |

3.4 India Metalworking Fluids Market - Porter's Five Forces |

3.5 India Metalworking Fluids Market Revenues & Volume Share, By Product, 2021 & 2031F |

3.6 India Metalworking Fluids Market Revenues & Volume Share, By Application, 2021 & 2031F |

3.7 India Metalworking Fluids Market Revenues & Volume Share, By End-use, 2021 & 2031F |

4 India Metalworking Fluids Market Dynamics |

4.1 Impact Analysis |

4.2 Market Drivers |

4.2.1 Growing automotive and manufacturing sectors in India leading to increased demand for metalworking fluids. |

4.2.2 Technological advancements and innovations in metalworking fluids improving their performance and efficiency. |

4.2.3 Increasing focus on sustainability and environmental regulations driving the adoption of eco-friendly metalworking fluids. |

4.3 Market Restraints |

4.3.1 Fluctuating raw material prices impacting the cost of metalworking fluids production. |

4.3.2 Lack of skilled labor and expertise in handling advanced metalworking fluid technologies. |

4.3.3 Competition from substitute products such as dry machining processes affecting the demand for metalworking fluids. |

5 India Metalworking Fluids Market Trends |

6 India Metalworking Fluids Market, By Types |

6.1 India Metalworking Fluids Market, By Product |

6.1.1 Overview and Analysis |

6.1.2 India Metalworking Fluids Market Revenues & Volume, By Product, 2021-2031F |

6.1.3 India Metalworking Fluids Market Revenues & Volume, By Mineral, 2021-2031F |

6.1.4 India Metalworking Fluids Market Revenues & Volume, By Synthetic, 2021-2031F |

6.1.5 India Metalworking Fluids Market Revenues & Volume, By Bio-based, 2021-2031F |

6.2 India Metalworking Fluids Market, By Application |

6.2.1 Overview and Analysis |

6.2.2 India Metalworking Fluids Market Revenues & Volume, By Neat Cutting Oils, 2021-2031F |

6.2.3 India Metalworking Fluids Market Revenues & Volume, By Water Cutting Oils, 2021-2031F |

6.2.4 India Metalworking Fluids Market Revenues & Volume, By Corrosion Preventive Oils, 2021-2031F |

6.2.5 India Metalworking Fluids Market Revenues & Volume, By Others, 2021-2031F |

6.3 India Metalworking Fluids Market, By End-use |

6.3.1 Overview and Analysis |

6.3.2 India Metalworking Fluids Market Revenues & Volume, By Metal Fabrication, 2021-2031F |

6.3.3 India Metalworking Fluids Market Revenues & Volume, By Transportation Equipment, 2021-2031F |

6.3.4 India Metalworking Fluids Market Revenues & Volume, By Machinery, 2021-2031F |

6.3.5 India Metalworking Fluids Market Revenues & Volume, By Others, 2021-2031F |

7 India Metalworking Fluids Market Import-Export Trade Statistics |

7.1 India Metalworking Fluids Market Export to Major Countries |

7.2 India Metalworking Fluids Market Imports from Major Countries |

8 India Metalworking Fluids Market Key Performance Indicators |

8.1 Energy efficiency improvements in metalworking processes. |

8.2 Reduction in waste generation and environmental impact. |

8.3 Adoption rate of advanced metalworking fluid technologies. |

8.4 Customer satisfaction and loyalty towards metalworking fluid suppliers. |

8.5 Compliance with environmental regulations and certifications. |

9 India Metalworking Fluids Market - Opportunity Assessment |

9.1 India Metalworking Fluids Market Opportunity Assessment, By Product, 2021 & 2031F |

9.2 India Metalworking Fluids Market Opportunity Assessment, By Application, 2021 & 2031F |

9.3 India Metalworking Fluids Market Opportunity Assessment, By End-use, 2021 & 2031F |

10 India Metalworking Fluids Market - Competitive Landscape |

10.1 India Metalworking Fluids Market Revenue Share, By Companies, 2024 |

10.2 India Metalworking Fluids Market Competitive Benchmarking, By Operating and Technical Parameters |

11 Company Profiles |

12 Recommendations |

13 Disclaimer |

- Single User License$ 1,995

- Department License$ 2,400

- Site License$ 3,120

- Global License$ 3,795

Search

Thought Leadership and Analyst Meet

Our Clients

Related Reports

- Canada Oil and Gas Market (2026-2032) | Share, Segmentation, Value, Industry, Trends, Forecast, Analysis, Size & Revenue, Growth, Competitive Landscape, Outlook, Companies

- Germany Breakfast Food Market (2026-2032) | Industry, Share, Growth, Size, Companies, Value, Analysis, Revenue, Trends, Forecast & Outlook

- Australia Briquette Market (2025-2031) | Growth, Size, Revenue, Forecast, Analysis, Trends, Value, Share, Industry & Companies

- Vietnam System Integrator Market (2025-2031) | Size, Companies, Analysis, Industry, Value, Forecast, Growth, Trends, Revenue & Share

- ASEAN and Thailand Brain Health Supplements Market (2025-2031) | Strategy, Consumer Insights, Analysis, Investment Trends, Opportunities, Growth, Size, Share, Industry, Revenue, Segments, Value, Segmentation, Supply, Forecast, Restraints, Outlook, Competition, Drivers, Trends, Demand, Pricing Analysis, Competitive, Strategic Insights, Companies, Challenges

- ASEAN Bearings Market (2025-2031) | Strategy, Consumer Insights, Analysis, Investment Trends, Opportunities, Growth, Size, Share, Industry, Revenue, Segments, Value, Segmentation, Supply, Forecast, Restraints, Outlook, Competition, Drivers, Trends, Demand, Pricing Analysis, Competitive, Strategic Insights, Companies, Challenges

- Europe Flooring Market (2025-2031) | Outlook, Share, Industry, Trends, Forecast, Companies, Revenue, Size, Analysis, Growth & Value

- Saudi Arabia Manlift Market (2025-2031) | Outlook, Size, Growth, Trends, Companies, Industry, Revenue, Value, Share, Forecast & Analysis

- Uganda Excavator, Crane, and Wheel Loaders Market (2025-2031) | Strategy, Consumer Insights, Analysis, Investment Trends, Opportunities, Growth, Size, Share, Industry, Revenue, Segments, Value, Segmentation, Supply, Forecast, Restraints, Outlook, Competition, Drivers, Trends, Demand, Pricing Analysis, Competitive, Strategic Insights, Companies, Challenges

- Rwanda Excavator, Crane, and Wheel Loaders Market (2025-2031) | Strategy, Consumer Insights, Analysis, Investment Trends, Opportunities, Growth, Size, Share, Industry, Revenue, Segments, Value, Segmentation, Supply, Forecast, Restraints, Outlook, Competition, Drivers, Trends, Demand, Pricing Analysis, Competitive, Strategic Insights, Companies, Challenges

Industry Events and Analyst Meet

Whitepaper

- Middle East & Africa Commercial Security Market Click here to view more.

- Middle East & Africa Fire Safety Systems & Equipment Market Click here to view more.

- GCC Drone Market Click here to view more.

- Middle East Lighting Fixture Market Click here to view more.

- GCC Physical & Perimeter Security Market Click here to view more.

6WResearch In News

- Doha a strategic location for EV manufacturing hub: IPA Qatar

- Demand for luxury TVs surging in the GCC, says Samsung

- Empowering Growth: The Thriving Journey of Bangladesh’s Cable Industry

- Demand for luxury TVs surging in the GCC, says Samsung

- Video call with a traditional healer? Once unthinkable, it’s now common in South Africa

- Intelligent Buildings To Smooth GCC’s Path To Net Zero