India Rubber Market (2025-2031) | Revenue, Outlook, Trends, Size, Companies, Industry, Analysis, Share, Growth, Forecast, Value

| Product Code: ETC037805 | Publication Date: Jun 2023 | Updated Date: Nov 2025 | Product Type: Report | |

| Publisher: 6Wresearch | Author: Ravi Bhandari | No. of Pages: 70 | No. of Figures: 35 | No. of Tables: 5 |

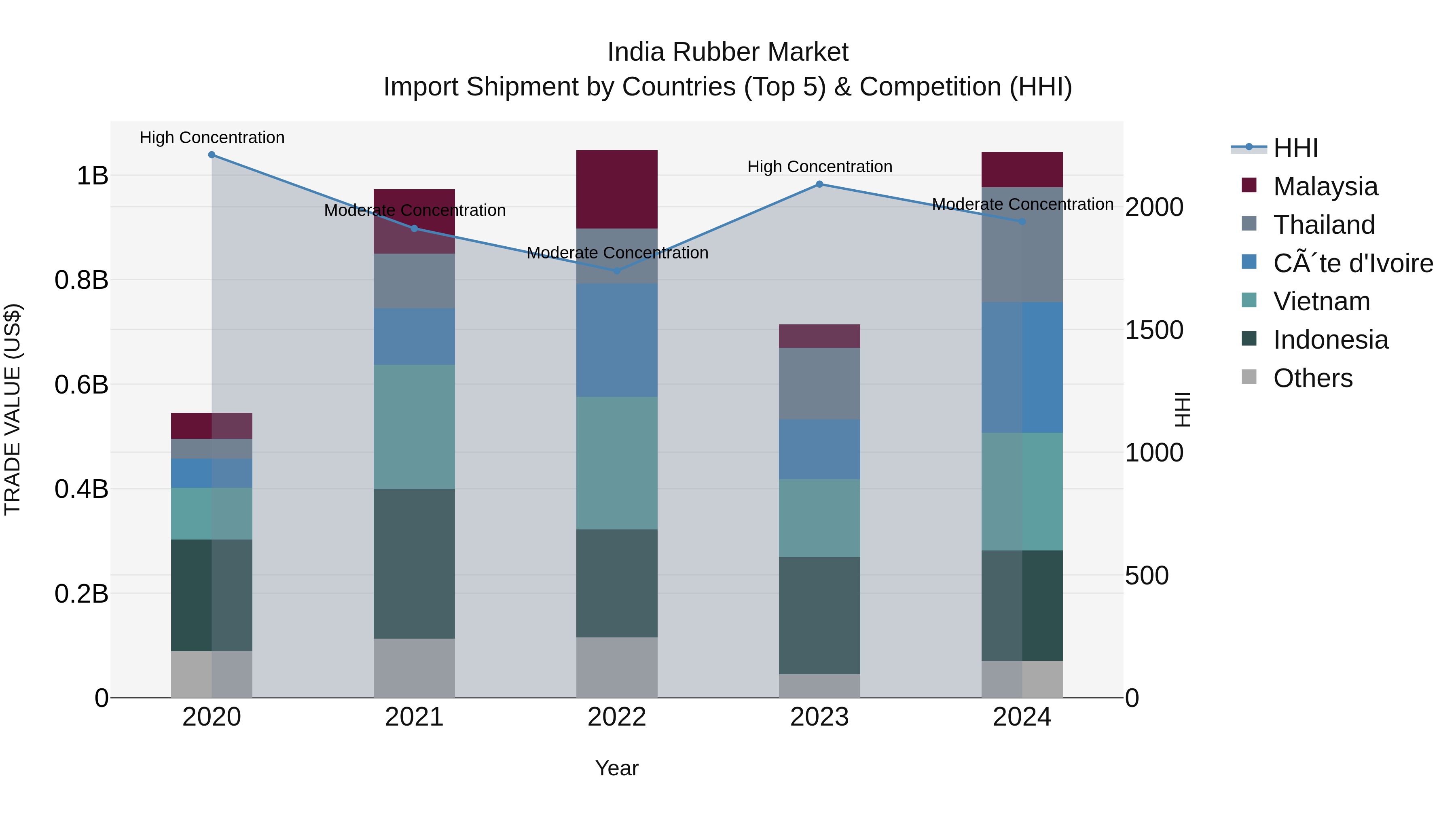

India Rubber Market Top 5 Importing Countries and Market Competition (HHI) Analysis

India`s rubber import market saw significant growth in 2024, with key exporting countries including Côte d`Ivoire, Vietnam, Thailand, Indonesia, and Malaysia. The market concentration, as measured by the HHI, shifted from high to moderate in 2024, indicating a more balanced import landscape. The impressive compound annual growth rate of 17.68% over the period from 2020 to 2024, coupled with a remarkable growth rate of 46.26% in 2024 alone, highlights the increasing demand for rubber imports in India. This robust performance suggests a positive outlook for the industry in the coming years.

India Rubber Market Synopsis

The India rubber market is expected to grow significantly during the forecast period of 2025-2031. India?s rubber industry has been growing steadily over the past few years, due to rising demand from automotive and other industries in the country. The increasing use of rubber products for various industrial purposes has resulted in significant growth of this sector. With a large population, an expanding middle class, and improved infrastructure throughout India, there is likely to be continued growth in the India Rubber Market in coming years.

Drivers of the Market:

1. Growing Automotive Industry: The automotive industry makes up a major share of the India rubber market as it uses synthetic and natural rubber materials extensively for manufacturing vehicles components such as tires, sealant strips, engine mounts etc., which will drive overall demand for rubbers in upcoming years.

2. Rising Demand from Construction Sector: The construction sector is another major contributor towards driving the demand for rubbers due to its extensive usage by contractors across all types of constructions projects worldwide including residential buildings commercial complexes & infrastructural developments like bridges & tunnels etc., thus propelling growth within this segment.

3. Increasing Production Capacity: There have been numerous investments being made by leading manufacturers across India into new production facilities which are helping increase their output capacity while also reducing costs associated with producing these items thereby allowing them to provide competitive prices against foreign players operating within this market space; further boosting demand among end users who require these goods at affordable prices.

Challenges of the Market:

1. High Raw Material Cost ? One of the key challenges faced by companies within this space is increasing raw material cost that are incurred while producing these items; often making it difficult for them to stay profitable amid intense competition from foreign vendors offering lower priced alternatives creating pressure on local manufacturers margins and leaving scope open for illegal imports or counterfeit products entering into Indian markets through back channels.

2 .Poor Infrastructure ? Poor quality roads coupled with inadequate transportation infrastructure often poses problems when attempting delivery orders on time especially if they need urgent supplies during certain seasons when movement becomes restricted affecting businesses operations at times resulting losses or delayed deliveries not meeting customer expectations reducing goodwill among customers.

Trends of the Market:

Emergence Of Biodegradable Rubbers - Manufacturers are increasingly developing biodegradable types of synthetics and natural rubbers that can decompose naturally without releasing any pollutants into environment upon disposal providing eco friendly solutions that many governments worldwide seek out encouraging wider adoption amongst.

Key Highlights of the Report:

- India Rubber Market Outlook

- Market Size of India Rubber Market, 2024

- Forecast of India Rubber Market, 2031

- Historical Data and Forecast of India Rubber Revenues & Volume for the Period 2021-2031

- India Rubber Market Trend Evolution

- India Rubber Market Drivers and Challenges

- India Rubber Price Trends

- India Rubber Porter's Five Forces

- India Rubber Industry Life Cycle

- Historical Data and Forecast of India Rubber Market Revenues & Volume By Product Type for the Period 2021-2031

- Historical Data and Forecast of India Rubber Market Revenues & Volume By Natural Rubber for the Period 2021-2031

- Historical Data and Forecast of India Rubber Market Revenues & Volume By Synthetic Rubber for the Period 2021-2031

- Historical Data and Forecast of India Rubber Market Revenues & Volume By End-users for the Period 2021-2031

- Historical Data and Forecast of India Rubber Market Revenues & Volume By Automotive & Transportation for the Period 2021-2031

- Historical Data and Forecast of India Rubber Market Revenues & Volume By Building & Construction for the Period 2021-2031

- Historical Data and Forecast of India Rubber Market Revenues & Volume By Industrial Machinery & Equipment for the Period 2021-2031

- Historical Data and Forecast of India Rubber Market Revenues & Volume By Others for the Period 2021-2031

- India Rubber Import Export Trade Statistics

- Market Opportunity Assessment By Product Type

- Market Opportunity Assessment By End-users

- India Rubber Top Companies Market Share

- India Rubber Competitive Benchmarking By Technical and Operational Parameters

- India Rubber Company Profiles

- India Rubber Key Strategic Recommendations

Frequently Asked Questions About the Market Study (FAQs):

1 Executive Summary |

2 Introduction |

2.1 Key Highlights of the Report |

2.2 Report Description |

2.3 Market Scope & Segmentation |

2.4 Research Methodology |

2.5 Assumptions |

3 India Rubber Market Overview |

3.1 India Country Macro Economic Indicators |

3.2 India Rubber Market Revenues & Volume, 2021 & 2031F |

3.3 India Rubber Market - Industry Life Cycle |

3.4 India Rubber Market - Porter's Five Forces |

3.5 India Rubber Market Revenues & Volume Share, By Product Type, 2021 & 2031F |

3.6 India Rubber Market Revenues & Volume Share, By End-users, 2021 & 2031F |

4 India Rubber Market Dynamics |

4.1 Impact Analysis |

4.2 Market Drivers |

4.2.1 Growing demand for rubber in industries such as automotive, construction, and healthcare |

4.2.2 Increasing emphasis on sustainability and eco-friendly materials driving the demand for natural rubber |

4.2.3 Government initiatives promoting the use of rubber products in various sectors |

4.3 Market Restraints |

4.3.1 Fluctuating prices of raw materials impacting the production costs of rubber |

4.3.2 Competition from synthetic rubber substitutes affecting market growth |

4.3.3 Environmental concerns related to rubber cultivation and processing impacting consumer perception |

5 India Rubber Market Trends |

6 India Rubber Market, By Types |

6.1 India Rubber Market, By Product Type |

6.1.1 Overview and Analysis |

6.1.2 India Rubber Market Revenues & Volume, By Product Type, 2021-2031F |

6.1.3 India Rubber Market Revenues & Volume, By Natural Rubber, 2021-2031F |

6.1.4 India Rubber Market Revenues & Volume, By Synthetic Rubber, 2021-2031F |

6.2 India Rubber Market, By End-users |

6.2.1 Overview and Analysis |

6.2.2 India Rubber Market Revenues & Volume, By Automotive & Transportation, 2021-2031F |

6.2.3 India Rubber Market Revenues & Volume, By Building & Construction, 2021-2031F |

6.2.4 India Rubber Market Revenues & Volume, By Industrial Machinery & Equipment, 2021-2031F |

6.2.5 India Rubber Market Revenues & Volume, By Others, 2021-2031F |

7 India Rubber Market Import-Export Trade Statistics |

7.1 India Rubber Market Export to Major Countries |

7.2 India Rubber Market Imports from Major Countries |

8 India Rubber Market Key Performance Indicators |

8.1 Rubber consumption in key industries |

8.2 Price trends of natural rubber |

8.3 Adoption rate of sustainable rubber practices |

8.4 Investment in research and development for rubber innovation |

8.5 Regulatory compliance and adherence to environmental standards in rubber production |

9 India Rubber Market - Opportunity Assessment |

9.1 India Rubber Market Opportunity Assessment, By Product Type, 2021 & 2031F |

9.2 India Rubber Market Opportunity Assessment, By End-users, 2021 & 2031F |

10 India Rubber Market - Competitive Landscape |

10.1 India Rubber Market Revenue Share, By Companies, 2024 |

10.2 India Rubber Market Competitive Benchmarking, By Operating and Technical Parameters |

11 Company Profiles |

12 Recommendations |

13 Disclaimer |

- Single User License$ 1,995

- Department License$ 2,400

- Site License$ 3,120

- Global License$ 3,795

Search

Thought Leadership and Analyst Meet

Our Clients

Related Reports

- South Africa Stationery Market (2025-2031) | Share, Size, Industry, Value, Growth, Revenue, Analysis, Trends, Segmentation & Outlook

- Afghanistan Rocking Chairs And Adirondack Chairs Market (2026-2032) | Size & Revenue, Competitive Landscape, Share, Segmentation, Industry, Value, Outlook, Analysis, Trends, Growth, Forecast, Companies

- Afghanistan Apparel Market (2026-2032) | Growth, Outlook, Industry, Segmentation, Forecast, Size, Companies, Trends, Value, Share, Analysis & Revenue

- Canada Oil and Gas Market (2026-2032) | Share, Segmentation, Value, Industry, Trends, Forecast, Analysis, Size & Revenue, Growth, Competitive Landscape, Outlook, Companies

- Germany Breakfast Food Market (2026-2032) | Industry, Share, Growth, Size, Companies, Value, Analysis, Revenue, Trends, Forecast & Outlook

- Australia Briquette Market (2025-2031) | Growth, Size, Revenue, Forecast, Analysis, Trends, Value, Share, Industry & Companies

- Vietnam System Integrator Market (2025-2031) | Size, Companies, Analysis, Industry, Value, Forecast, Growth, Trends, Revenue & Share

- ASEAN and Thailand Brain Health Supplements Market (2025-2031) | Strategy, Consumer Insights, Analysis, Investment Trends, Opportunities, Growth, Size, Share, Industry, Revenue, Segments, Value, Segmentation, Supply, Forecast, Restraints, Outlook, Competition, Drivers, Trends, Demand, Pricing Analysis, Competitive, Strategic Insights, Companies, Challenges

- ASEAN Bearings Market (2025-2031) | Strategy, Consumer Insights, Analysis, Investment Trends, Opportunities, Growth, Size, Share, Industry, Revenue, Segments, Value, Segmentation, Supply, Forecast, Restraints, Outlook, Competition, Drivers, Trends, Demand, Pricing Analysis, Competitive, Strategic Insights, Companies, Challenges

- Europe Flooring Market (2025-2031) | Outlook, Share, Industry, Trends, Forecast, Companies, Revenue, Size, Analysis, Growth & Value

Industry Events and Analyst Meet

Whitepaper

- Middle East & Africa Commercial Security Market Click here to view more.

- Middle East & Africa Fire Safety Systems & Equipment Market Click here to view more.

- GCC Drone Market Click here to view more.

- Middle East Lighting Fixture Market Click here to view more.

- GCC Physical & Perimeter Security Market Click here to view more.

6WResearch In News

- Doha a strategic location for EV manufacturing hub: IPA Qatar

- Demand for luxury TVs surging in the GCC, says Samsung

- Empowering Growth: The Thriving Journey of Bangladesh’s Cable Industry

- Demand for luxury TVs surging in the GCC, says Samsung

- Video call with a traditional healer? Once unthinkable, it’s now common in South Africa

- Intelligent Buildings To Smooth GCC’s Path To Net Zero