India Stainless Steel Flanges Market (2025-2031) | Analysis, Companies, Trends, Size, Industry, Revenue, Share, Growth, Outlook, Value & Forecast

| Product Code: ETC029984 | Publication Date: Jun 2023 | Updated Date: Nov 2025 | Product Type: Report | |

| Publisher: 6Wresearch | Author: Ravi Bhandari | No. of Pages: 70 | No. of Figures: 35 | No. of Tables: 5 |

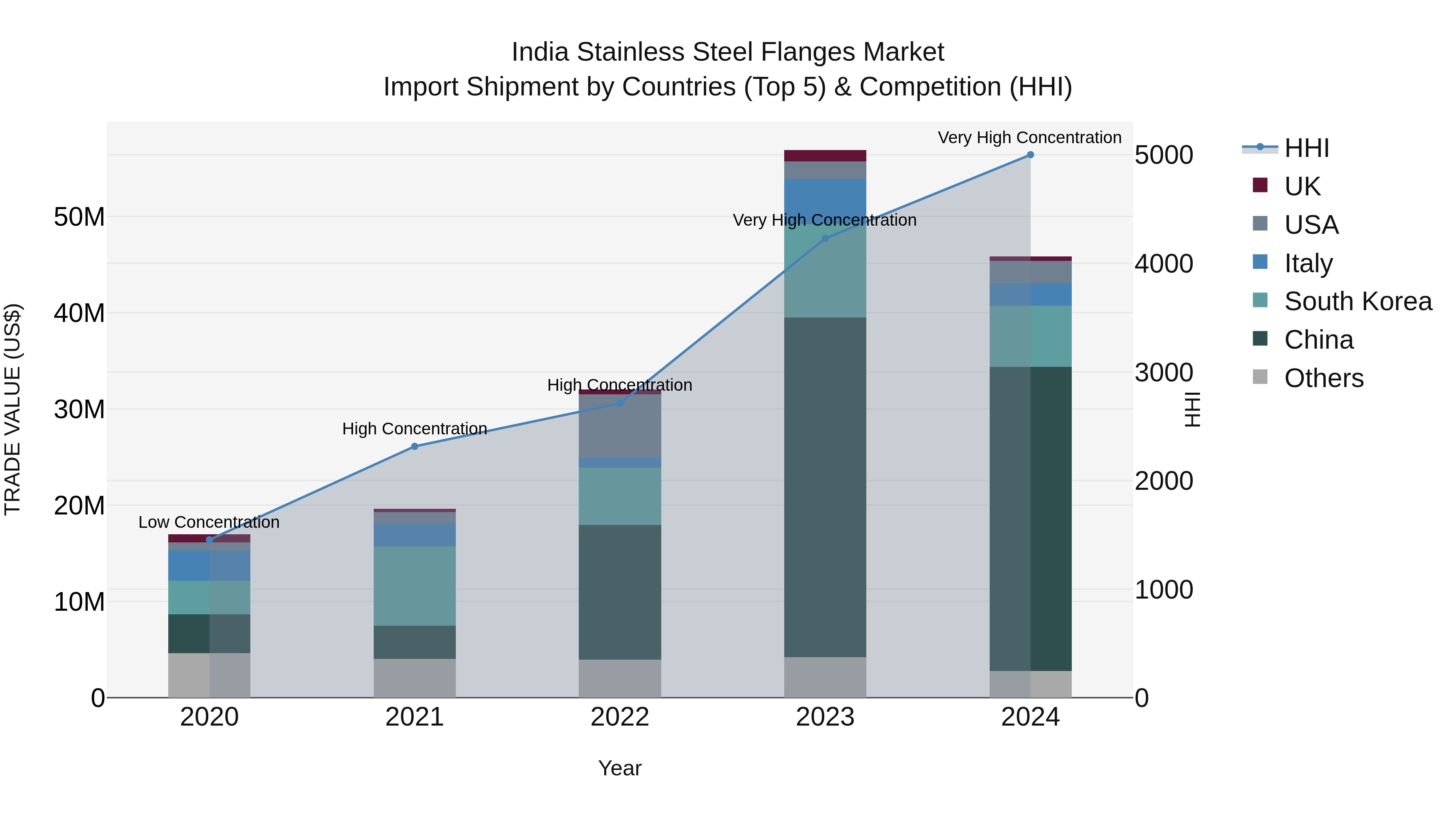

India Stainless Steel Flanges Market Top 5 Importing Countries and Market Competition (HHI) Analysis

India`s stainless steel flanges import market in 2024 saw significant contributions from top exporting countries such as China, South Korea, USA, Italy, and Germany. Despite the high Herfindahl-Hirschman Index (HHI) indicating market concentration, the industry maintained a remarkable Compound Annual Growth Rate (CAGR) of 28.19% from 2020 to 2024. However, there was a slight decline in growth rate from 2023 to 2024 at -19.4%. These statistics suggest a dynamic and competitive landscape for stainless steel flanges imports in India, highlighting the importance of monitoring trends and developments in the global market.

India Stainless Steel Flanges Market Synopsis

The India stainless steel flanges market is expected to witness considerable growth during the forecast period (2025-2031). This can be attributed to increasing demand for stainless steel flanges from various end-use industries such as pharmaceuticals, petrochemicals, construction and food processing. Moreover, rising investments in infrastructure projects including bridges, power plants, water treatment facilities and other government initiatives are anticipated to drive the market growth. Furthermore, improved production capabilities of domestic manufacturing companies has also been a major factor driving the growth of this market in India.

Drivers of the Market:

? Growing demand for stainless steel flanges from end use industries such as automotive and oil & gas is fuelling the growth of the Indian Stainless Steel Flanges Market.

? Increasing investments in infrastructure projects by public & private corporations are likely to act as major drivers for this industry over the forecast period.

? Expansion of industrial activities due to favorable government policies will further boost this market?s growth prospects till 2031.

? The introduction of advanced technologies like automated welding systems is expected to reduce cost and time associated with manual fabrication processes thereby boosting their adoption among manufacturers.

Trends of the Market:

? Manufacturers have started focusing on developing customized products according to clients? requirements that meet international standards which is likely fuel its adoption rate among customers over next few years.

? With growing impetus on energy conservation measures there has been increasing focus on introducing lighter weight materials leading towards increased usage SS flange components used extensively across several applications ranging from pressure vessels tanks etc., thereby augmenting industry expansion trajectory substantially.

? There has been an increase in R&D spending by manufacturers aiming at innovating new product lines capable of providing enhanced performance along with better reliability and operational efficiency while reducing cost related issues thus facilitating their acceptance across different industries globally.

Challenges of the Market:

High installation costs associated with these components may hamper potential buyers who seek lower price alternatives or cheaper substitutes available in local markets leading towards restraining average selling prices (ASPs) within certain limits making it difficult for vendors compete effectively against them.

Key Players of the Market:

Prominent players operating within Indian Stainless Steel Flanges Market include ArcelorMittal SA , Sandvik AB , TATA Steel Ltd., Jindal Stainless Ltd., Ratnamani Metals Tubes Ltd., Metallica Metals India Pvt Ltd., Metal Udyog (India), JFE Holdings Inc., Nippon

Key Highlights of the Report:

- India Stainless Steel Flanges Market Outlook

- Market Size of India Stainless Steel Flanges Market, 2024

- Forecast of India Stainless Steel Flanges Market, 2031

- Historical Data and Forecast of India Stainless Steel Flanges Revenues & Volume for the Period 2021-2031

- India Stainless Steel Flanges Market Trend Evolution

- India Stainless Steel Flanges Market Drivers and Challenges

- India Stainless Steel Flanges Price Trends

- India Stainless Steel Flanges Porter's Five Forces

- India Stainless Steel Flanges Industry Life Cycle

- Historical Data and Forecast of India Stainless Steel Flanges Market Revenues & Volume By Types for the Period 2021-2031

- Historical Data and Forecast of India Stainless Steel Flanges Market Revenues & Volume By Weld Flange for the Period 2021-2031

- Historical Data and Forecast of India Stainless Steel Flanges Market Revenues & Volume By Blind Flange for the Period 2021-2031

- Historical Data and Forecast of India Stainless Steel Flanges Market Revenues & Volume By Slip-On Flange for the Period 2021-2031

- Historical Data and Forecast of India Stainless Steel Flanges Market Revenues & Volume By Others for the Period 2021-2031

- Historical Data and Forecast of India Stainless Steel Flanges Market Revenues & Volume By Applications for the Period 2021-2031

- Historical Data and Forecast of India Stainless Steel Flanges Market Revenues & Volume By Petrochemical Industry for the Period 2021-2031

- Historical Data and Forecast of India Stainless Steel Flanges Market Revenues & Volume By Food and Pharmaceutical Industry for the Period 2021-2031

- Historical Data and Forecast of India Stainless Steel Flanges Market Revenues & Volume By Architectural Decoration Industry for the Period 2021-2031

- India Stainless Steel Flanges Import Export Trade Statistics

- Market Opportunity Assessment By Types

- Market Opportunity Assessment By Applications

- India Stainless Steel Flanges Top Companies Market Share

- India Stainless Steel Flanges Competitive Benchmarking By Technical and Operational Parameters

- India Stainless Steel Flanges Company Profiles

- India Stainless Steel Flanges Key Strategic Recommendations

Frequently Asked Questions About the Market Study (FAQs):

1 Executive Summary |

2 Introduction |

2.1 Key Highlights of the Report |

2.2 Report Description |

2.3 Market Scope & Segmentation |

2.4 Research Methodology |

2.5 Assumptions |

3 India Stainless Steel Flanges Market Overview |

3.1 India Country Macro Economic Indicators |

3.2 India Stainless Steel Flanges Market Revenues & Volume, 2021 & 2031F |

3.3 India Stainless Steel Flanges Market - Industry Life Cycle |

3.4 India Stainless Steel Flanges Market - Porter's Five Forces |

3.5 India Stainless Steel Flanges Market Revenues & Volume Share, By Types, 2021 & 2031F |

3.6 India Stainless Steel Flanges Market Revenues & Volume Share, By Applications, 2021 & 2031F |

4 India Stainless Steel Flanges Market Dynamics |

4.1 Impact Analysis |

4.2 Market Drivers |

4.2.1 Growing demand from industries such as oil gas, chemical, and water treatment |

4.2.2 Increasing infrastructure development projects in India |

4.2.3 Adoption of stainless steel flanges for their corrosion resistance and durability |

4.3 Market Restraints |

4.3.1 Fluctuating raw material prices impacting production costs |

4.3.2 Intense competition from local and international manufacturers |

4.3.3 Lack of standardized quality control measures leading to inconsistent product quality |

5 India Stainless Steel Flanges Market Trends |

6 India Stainless Steel Flanges Market, By Types |

6.1 India Stainless Steel Flanges Market, By Types |

6.1.1 Overview and Analysis |

6.1.2 India Stainless Steel Flanges Market Revenues & Volume, By Types, 2021-2031F |

6.1.3 India Stainless Steel Flanges Market Revenues & Volume, By Weld Flange, 2021-2031F |

6.1.4 India Stainless Steel Flanges Market Revenues & Volume, By Blind Flange, 2021-2031F |

6.1.5 India Stainless Steel Flanges Market Revenues & Volume, By Slip-On Flange, 2021-2031F |

6.1.6 India Stainless Steel Flanges Market Revenues & Volume, By Others, 2021-2031F |

6.2 India Stainless Steel Flanges Market, By Applications |

6.2.1 Overview and Analysis |

6.2.2 India Stainless Steel Flanges Market Revenues & Volume, By Petrochemical Industry, 2021-2031F |

6.2.3 India Stainless Steel Flanges Market Revenues & Volume, By Food and Pharmaceutical Industry, 2021-2031F |

6.2.4 India Stainless Steel Flanges Market Revenues & Volume, By Architectural Decoration Industry, 2021-2031F |

7 India Stainless Steel Flanges Market Import-Export Trade Statistics |

7.1 India Stainless Steel Flanges Market Export to Major Countries |

7.2 India Stainless Steel Flanges Market Imports from Major Countries |

8 India Stainless Steel Flanges Market Key Performance Indicators |

8.1 Percentage of industries adopting stainless steel flanges in their operations |

8.2 Rate of growth in infrastructure projects using stainless steel flanges |

8.3 Number of certifications obtained for product quality assurance |

8.4 Average lead time for delivery of stainless steel flanges |

8.5 Customer satisfaction ratings for stainless steel flange manufacturers |

9 India Stainless Steel Flanges Market - Opportunity Assessment |

9.1 India Stainless Steel Flanges Market Opportunity Assessment, By Types, 2021 & 2031F |

9.2 India Stainless Steel Flanges Market Opportunity Assessment, By Applications, 2021 & 2031F |

10 India Stainless Steel Flanges Market - Competitive Landscape |

10.1 India Stainless Steel Flanges Market Revenue Share, By Companies, 2024 |

10.2 India Stainless Steel Flanges Market Competitive Benchmarking, By Operating and Technical Parameters |

11 Company Profiles |

12 Recommendations |

13 Disclaimer |

- Single User License$ 1,995

- Department License$ 2,400

- Site License$ 3,120

- Global License$ 3,795

Search

Thought Leadership and Analyst Meet

Our Clients

Related Reports

- Afghanistan Apparel Market (2026-2032) | Growth, Outlook, Industry, Segmentation, Forecast, Size, Companies, Trends, Value, Share, Analysis & Revenue

- Canada Oil and Gas Market (2026-2032) | Share, Segmentation, Value, Industry, Trends, Forecast, Analysis, Size & Revenue, Growth, Competitive Landscape, Outlook, Companies

- Germany Breakfast Food Market (2026-2032) | Industry, Share, Growth, Size, Companies, Value, Analysis, Revenue, Trends, Forecast & Outlook

- Australia Briquette Market (2025-2031) | Growth, Size, Revenue, Forecast, Analysis, Trends, Value, Share, Industry & Companies

- Vietnam System Integrator Market (2025-2031) | Size, Companies, Analysis, Industry, Value, Forecast, Growth, Trends, Revenue & Share

- ASEAN and Thailand Brain Health Supplements Market (2025-2031) | Strategy, Consumer Insights, Analysis, Investment Trends, Opportunities, Growth, Size, Share, Industry, Revenue, Segments, Value, Segmentation, Supply, Forecast, Restraints, Outlook, Competition, Drivers, Trends, Demand, Pricing Analysis, Competitive, Strategic Insights, Companies, Challenges

- ASEAN Bearings Market (2025-2031) | Strategy, Consumer Insights, Analysis, Investment Trends, Opportunities, Growth, Size, Share, Industry, Revenue, Segments, Value, Segmentation, Supply, Forecast, Restraints, Outlook, Competition, Drivers, Trends, Demand, Pricing Analysis, Competitive, Strategic Insights, Companies, Challenges

- Europe Flooring Market (2025-2031) | Outlook, Share, Industry, Trends, Forecast, Companies, Revenue, Size, Analysis, Growth & Value

- Saudi Arabia Manlift Market (2025-2031) | Outlook, Size, Growth, Trends, Companies, Industry, Revenue, Value, Share, Forecast & Analysis

- Uganda Excavator, Crane, and Wheel Loaders Market (2025-2031) | Strategy, Consumer Insights, Analysis, Investment Trends, Opportunities, Growth, Size, Share, Industry, Revenue, Segments, Value, Segmentation, Supply, Forecast, Restraints, Outlook, Competition, Drivers, Trends, Demand, Pricing Analysis, Competitive, Strategic Insights, Companies, Challenges

Industry Events and Analyst Meet

Whitepaper

- Middle East & Africa Commercial Security Market Click here to view more.

- Middle East & Africa Fire Safety Systems & Equipment Market Click here to view more.

- GCC Drone Market Click here to view more.

- Middle East Lighting Fixture Market Click here to view more.

- GCC Physical & Perimeter Security Market Click here to view more.

6WResearch In News

- Doha a strategic location for EV manufacturing hub: IPA Qatar

- Demand for luxury TVs surging in the GCC, says Samsung

- Empowering Growth: The Thriving Journey of Bangladesh’s Cable Industry

- Demand for luxury TVs surging in the GCC, says Samsung

- Video call with a traditional healer? Once unthinkable, it’s now common in South Africa

- Intelligent Buildings To Smooth GCC’s Path To Net Zero