Kuwait Unit Linked Insurance Market (2025-2031) | Outlook, Strategy, Demand, Trends, Revenue, Supply, Drivers, Challenges, Segmentation, Competitive, Companies, Segments, Investment Trends, Consumer Insights, Growth, Value, Competition, Forecast, Size, Opportunities, Restraints, Strategic Insights, Analysis, Pricing Analysis, Industry, Share

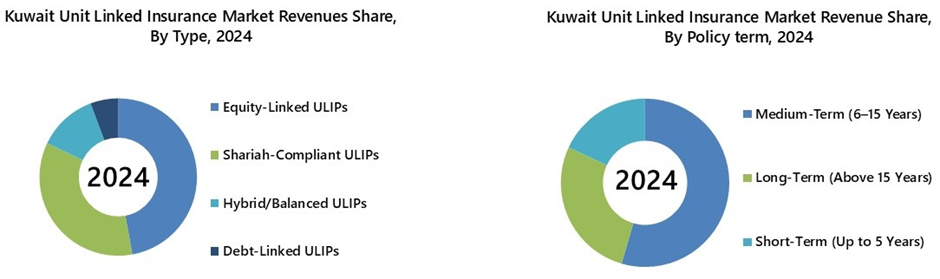

Market Forecast By Type (Equity-Linked ULIPs, Shariah-Compliant ULIPs, Hybrid/Balanced ULIPs, Debt-Linked ULIPs), By Policy Term (Medium-Term (6–15 Years), Long-Term (Above 15 Years), Short-Term (Up to 5 Years)), By End-User (Individuals (Salaried, HNIs, Self-employed), Corporate/Group Insurance Buyers)), And Competitive Landscape

| Product Code: ETC11245334 | Publication Date: Apr 2025 | Updated Date: Sep 2025 | Product Type: Market Research Report | |

| Publisher: 6Wresearch | Author: Ravi Bhandari | No. of Pages: 60 | No. of Figures: 17 | No. of Tables: 3 |

Topics Covered in Kuwait Unit Linked Insurance Market Report

Kuwait Unit Linked Insurance Market Report thoroughly covers the market by type, policy term and end-user. Kuwait Unit Linked Insurance Market Outlook report provides an unbiased and detailed analysis of the ongoing Kuwait Unit Linked Insurance Market trends, opportunities/high growth areas, and market drivers. This would help stakeholders devise and align their market strategies according to the current and future market dynamics.

Kuwait Unit Linked

Insurance Market Synopsis

Kuwait Unit-Linked Insurance Plan (ULIP) market is positioned for expansion, underpinned by the strong performance and digital transformation of the country’s banking sector. The retail banking segment is projected to exceed market volume, with bank account penetration expected to rise by next year broadening the pool of financially included individuals.

Simultaneously, the formalization and expansion of Kuwait’s insurance sector are expected to play a critical role, with the market surpassing in 2022 and projected to grow at a CAGR of over 5% between 2023 and 2027. Regulatory measures such as mandatory health insurance for visitors, and proposed coverage for business travellers are driving insurance adoption and expanding the insured population, a key enabler for the penetration of life and investment-linked products. Moreover, with the population forecasted to grow at a CAGR of 1.7% through 2026, the addressable market for ULIPs is set to expand significantly.

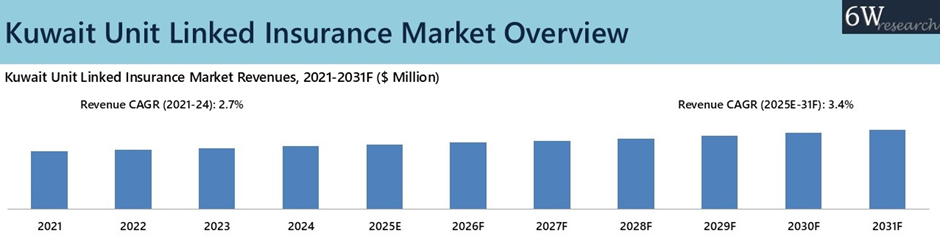

According to 6Wresearch, Kuwait Unit Linked Insurance Market size is projected to grow at a CAGR of 3.4% during 2025E-2031F. The Unit-Linked Insurance Plan (ULIP) market in Kuwait is positioned for sustained growth, driven by the rapid advancement of digital commerce, robust banking infrastructure, and favourable macroeconomic conditions. The country’s accelerating digital transformation fueled by rising internet penetration and widespread adoption of digital banking is creating a solid foundation for integrated financial products such as ULIPs. Kuwait’s retail banking sector is expected to surpass, with bank account penetration projected to increase by next year, indicating broader financial inclusion. This momentum is reinforced by improving economic indicators. According to the IMF, Kuwait’s real GDP is expected to grow by in 2024, reflecting enhanced consumer confidence and financial activity.

Concurrently, the country is witnessing a surge in consumer spending and a decisive shift toward digital payments. In 2024, total consumer expenditure marked a year-on-year increase, largely driven by greater card usage and e-commerce activity. Point-of-sale (POS) transactions rose, while ATM withdrawals declined, underscoring a reduced reliance on cash. Online and mobile payments also grew, matching POS volumes reflecting the impact of high mobile penetration and a digitally engaged, youthful population. Additionally, the ULIP market stands to benefit from Kuwait’s growing investment income. The sharp increase in portfolio investment outflows to signals robust global yield-seeking behavior and a preference for fixed-income and equity-linked instruments further supporting demand for ULIP products that offer a combination of protection and market-linked returns.

Market Segmentation By Type

By 2031, Shariah-Compliant ULIPs are expected to experience the highest growth in Kuwait’s unit linked insurance market, driven by the increasing demand for ethical and Shariah-compliant investment products. As more Kuwaiti investors seek financial solutions that align with their religious beliefs, the popularity of these products would continue to rise. This growth would be further supported by the expanding awareness of Shariah-compliant financial instruments and the increasing preference for investment products that offer both ethical assurance and attractive returns.

Market Segmentation By Policy Term

By 2031, Long-Term (Above 15 Years) policies are expected to experience the highest growth in Kuwait’s unit linked insurance market, driven by the increasing preference for long-term wealth accumulation and retirement planning. As more individuals prioritize financial security and long-term investment strategies, the demand for extended policy terms will rise, leveraging the compounding benefits of long-term investments.

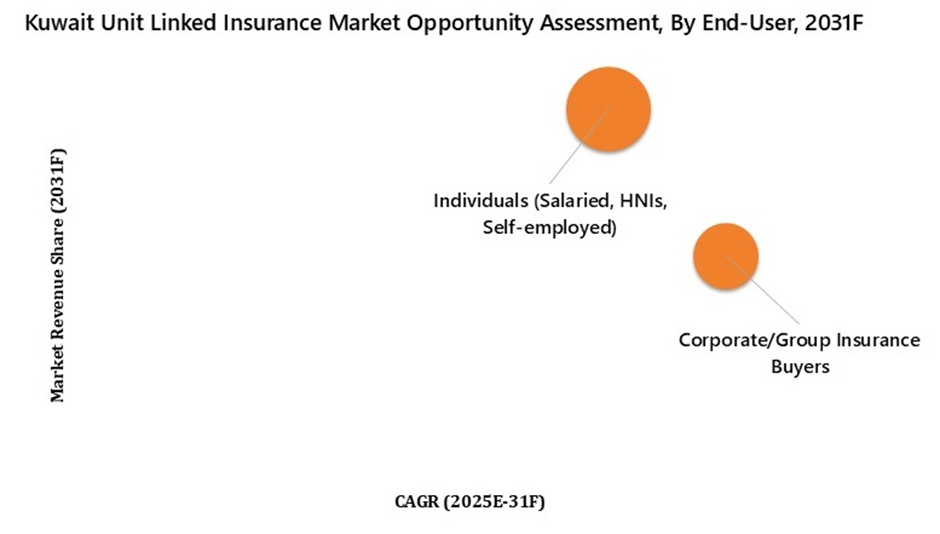

Market Segmentation By End-User

By 2031, Corporate/Group Insurance Buyers are expected to experience the highest growth in Kuwait’s unit linked insurance market, driven by the increasing adoption of employee benefit programs and corporate wellness initiatives. As more organizations recognize the value of offering comprehensive insurance products to attract and retain talent, the demand for group-based investment-linked insurance policies would rise.

Key Attractiveness of the Report

- 10 Years Market Numbers.

- Historical Data: Starting from 2021 to 2024

- Base Year: 2024

- Forecast Data until 2031

- Key Performance Indicators Impacting the Market.

- Major Upcoming Developments and Projects.

Key Highlights of the Report:

- Kuwait Unit Linked Insurance Market Overview

- Kuwait Unit Linked Insurance Market Outlook

- Kuwait Unit Linked Insurance Market Forecast

- Historical Data and Forecast of Kuwait Unit Linked Insurance Market Revenues for the Period 2021-2031F

- Historical Data and Forecast of Kuwait Unit Linked Insurance Market Revenues, By Type, for the Period 2021-2031F

- Historical Data and Forecast of Kuwait Unit Linked Insurance Market Revenues, By Policy Term, for the Period 2021-2031F

- Historical Data and Forecast of Kuwait Unit Linked Insurance Market Revenues, By End-User, for the Period 2021-2031F

- Industry Life Cycle

- Market Drivers

- Market Trends

- Key Performance Indicators

- Key Strategic Recommendation

- Kuwait Unit Linked Insurance Market Top Companies Revenue Ranking

Market Scope and Segmentation

The report provides a detailed analysis of the following market segments:

By Type

- Equity-Linked ULIPs

- Shariah-Compliant ULIPs

- Hybrid/Balanced ULIPs

- Debt-Linked ULIPs

By Policy Term

- Medium-Term (6–15 Years)

- Long-Term (Above 15 Years)

- Short-Term (Up to 5 Years)

By End-User

- Individuals (Salaried, HNIs, Self-employed)

- Corporate/Group Insurance Buyers

Kuwait Unit Linked Insurance Market (2025-2031): FAQs

| 1. Executive Summary |

| 2. Introduction |

| 2.1 Report Description |

| 2.2 Key Highlights of the Report |

| 2.3 Market Scope & Segmentation |

| 2.4 Methodology |

| 2.5 Assumptions |

| 3. Kuwait Unit Linked Insurance Market Overview |

| 3.1. Kuwait Unit Linked Insurance Market Revenues (2021-2031F) |

| 3.2. Kuwait Unit Linked Insurance Market Industry Life Cycle |

| 3.3. Kuwait Unit Linked Insurance Market Porter’s Five Forces Model |

| 4. Kuwait Unit Linked Insurance Market Dynamics |

| 4.1. Impact Analysis |

| 4.2. Market Drivers |

| 4.2.1 Growth in disposable income of the population in Kuwait |

| 4.2.2 Increasing awareness about the need for long-term financial planning and investment |

| 4.2.3 Favorable regulatory environment supporting the insurance industry in Kuwait |

| 4.3. Market Restraints |

| 4.3.1 Economic instability and fluctuations in Kuwait's financial markets |

| 4.3.2 Competition from traditional insurance products and other investment options |

| 4.3.3 Changing consumer preferences and risk aversion |

| 5. Kuwait Unit Linked Insurance Market Evolution & Trends |

| 6. Kuwait Unit Linked Insurance Market Overview, By Type |

| 6.1. Kuwait Unit Linked Insurance Market Revenue Share, By Type (2024 & 2031F) |

| 6.1.1. Kuwait Unit Linked Insurance Market Revenues, By Equity-Linked ULIPs (2021-2031F) |

| 6.1.2. Kuwait Unit Linked Insurance Market Revenues, By Shariah-Compliant ULIPs (2021-2031F) |

| 6.1.3. Kuwait Unit Linked Insurance Market Revenues, By Hybrid/Balanced ULIPs (2021-2031F) |

| 6.1.4. Kuwait Unit Linked Insurance Market Revenues, By Debt-Linked ULIPs (2021-2031F) |

| 7. Kuwait Unit Linked Insurance Market Overview, By Policy Term |

| 7.1. Kuwait Unit Linked Insurance Market Revenue, By Policy Term (2024 & 2031F) |

| 7.1.1. Kuwait Unit Linked Insurance Market Revenues, By Medium-Term (6–15 Years) (2021-2031F) |

| 7.1.2. Kuwait Unit Linked Insurance Market Revenues, By Long-Term (Above 15 Years) (2021-2031F) |

| 7.1.3. Kuwait Unit Linked Insurance Market Revenues, By Short-Term (Up to 5 Years) (2021-2031F) |

| 8. Kuwait Unit Linked Insurance Market Overview, By End-User |

| 8.1. Kuwait Unit Linked Insurance Market Revenue, By End-User (2024 & 2031F) |

| 8.1.1. Kuwait Unit Linked Insurance Market Revenues, By Individuals (Salaried, HNIs, Self-employed) (2021-2031F) |

| 8.1.2. Kuwait Unit Linked Insurance Market Revenues, By Corporate/Group Insurance Buyers (2021-2031F) |

| 9. Kuwait Unit Linked Insurance Market- Key Performance Indicators |

| 9.1 Average policy duration indicating the retention of policyholders |

| 9.2 Asset under management (AUM) growth reflecting the attractiveness of unit linked insurance products |

| 9.3 Customer satisfaction scores measuring the quality of service and product offerings |

| 9.4 Investment performance metrics showing the returns generated by the unit linked insurance products |

| 9.5 Market penetration rate of unit linked insurance products compared to traditional insurance products |

| 10. Kuwait Unit Linked Insurance Market Opportunity Assessment |

| 10.1 Kuwait Unit Linked Insurance Market Opportunity Assessment, By Type (2031F) |

| 10.2 Kuwait Unit Linked Insurance Market Opportunity Assessment, By Policy Term (2031F) |

| 10.3 Kuwait Unit Linked Insurance Market Opportunity Assessment, By End-User (2031F) |

| 11. Kuwait Unit Linked Insurance Market- Competitive Landscape |

| 11.1 Kuwait Unit Linked Insurance Market Revenue Ranking, By Top 3 Companies, 2024 |

| 11.2 Kuwait Unit Linked Insurance Market Competitive Benchmarking, By Operating Parameters |

| 12. Company Profiles |

| 12.1 Kuwait Insurance Company |

| 12.2 Gulf Insurance Group-Kuwait |

| 12.3 MetLife |

| 12.4 Bajaj Allianz Life Insurance Co. Ltd. |

| 12.5 ICICI Prudential Life Insurance Company Limited |

| 12.6 HDFC Life Insurance Company Limited |

| 13. Key Strategic Recommendation |

| 14. Disclaimer |

| List of figures |

| 1. Kuwait Unit Linked Insurance Market Revenues, 2021-2031F, ($ Million) |

| 2. Kuwait Growth in Consumer Spending, 2023 – 2024, (USD Billion) |

| 3. Kuwait Transaction Value of Different Payment Modes, 2024, (USD Billion) |

| 4. Kuwait Investment Income and its Share in GDP, 2022-2024 (in US $ billion, %) |

| 5. Kuwait Bank deposit interest rate, 2024-2025 (in %) |

| 6. Kuwait Unit Linked Insurance Market Revenue Share, By Type, 2024 & 2031F |

| 7.Kuwait Unit Linked Insurance Market Revenue Share, By Policy Term, 2024 & 2031F |

| 8. Kuwait Unit Linked Insurance Market Revenue Share, By End-User, 2024 & 2031F |

| 9. Kuwait Return on Assets Across Banks, 2024 |

| 10. Kuwait NPL Ratio Across Banks, 2024 |

| 11. Kuwait Revenues of Top 3 Insurance Companies, 2024, (USD Millions) |

| 12. Kuwait Revenue Share of Insurance Companies, 2025 (In %) |

| 13. Kuwait Unit Linked Insurance Market Opportunity Assessment, By Type, 2031F |

| 14. Kuwait Unit Linked Insurance Market Opportunity Assessment, By Policy Term, 2031F |

| 15. Kuwait Unit Linked Insurance Market Opportunity Assessment, By End-User, 2031F |

| 16. Kuwait Unit Linked Insurance Market Revenue Ranking, By Companies, 2024 |

| 17. Kuwait Growing Number of Mobile Connections, 2020-2025, (In Millions) |

| List of Tables |

| 1. Kuwait Unit Linked Insurance Market Revenues, By Type, 2021 - 2031F ($ Million) |

| 2. Kuwait Unit Linked Insurance Market Revenues, By Policy Term, 2021 - 2031F ($ Million) |

| 3. Kuwait Unit Linked Insurance Market Revenues, By End-User, 2021 - 2031F ($ Million) |

Export potential assessment - trade Analytics for 2030

Export potential enables firms to identify high-growth global markets with greater confidence by combining advanced trade intelligence with a structured quantitative methodology. The framework analyzes emerging demand trends and country-level import patterns while integrating macroeconomic and trade datasets such as GDP and population forecasts, bilateral import–export flows, tariff structures, elasticity differentials between developed and developing economies, geographic distance, and import demand projections. Using weighted trade values from 2020–2024 as the base period to project country-to-country export potential for 2030, these inputs are operationalized through calculated drivers such as gravity model parameters, tariff impact factors, and projected GDP per-capita growth. Through an analysis of hidden potentials, demand hotspots, and market conditions that are most favorable to success, this method enables firms to focus on target countries, maximize returns, and global expansion with data, backed by accuracy.

By factoring in the projected importer demand gap that is currently unmet and could be potential opportunity, it identifies the potential for the Exporter (Country) among 190 countries, against the general trade analysis, which identifies the biggest importer or exporter.

To discover high-growth global markets and optimize your business strategy:

Click Here- Single User License$ 1,995

- Department License$ 2,400

- Site License$ 3,120

- Global License$ 3,795

Search

Thought Leadership and Analyst Meet

Our Clients

Related Reports

- India Switchgear Market Outlook (2026 - 2032) | Size, Share, Trends, Growth, Revenue, Forecast, Analysis, Value, Outlook

- Pakistan Contraceptive Implants Market (2025-2031) | Demand, Growth, Size, Share, Industry, Pricing Analysis, Competitive, Strategic Insights, Strategy, Consumer Insights, Analysis, Investment Trends, Opportunities, Revenue, Segments, Value, Segmentation, Supply, Forecast, Restraints, Outlook, Competition, Drivers, Trends, Companies, Challenges

- Sri Lanka Packaging Market (2026-2032) | Outlook, Competition, Drivers, Trends, Demand, Pricing Analysis, Competitive, Strategic Insights, Companies, Challenges, Strategy, Consumer Insights, Analysis, Investment Trends, Opportunities, Growth, Size, Share, Industry, Revenue, Segments, Value, Segmentation, Supply, Forecast, Restraints

- India Kids Watches Market (2026-2032) | Strategy, Consumer Insights, Analysis, Investment Trends, Opportunities, Growth, Size, Share, Industry, Revenue, Segments, Value, Segmentation, Supply, Forecast, Restraints, Outlook, Competition, Drivers, Trends, Demand, Pricing Analysis, Competitive, Strategic Insights, Companies, Challenges

- Saudi Arabia Core Assurance Service Market (2025-2031) | Strategy, Consumer Insights, Analysis, Investment Trends, Opportunities, Growth, Size, Share, Industry, Revenue, Segments, Value, Segmentation, Supply, Forecast, Restraints, Outlook, Competition, Drivers, Trends, Demand, Pricing Analysis, Competitive, Strategic Insights, Companies, Challenges

- Romania Uninterruptible Power Supply (UPS) Market (2026-2032) | Industry, Analysis, Revenue, Size, Forecast, Outlook, Value, Trends, Share, Growth & Companies

- Saudi Arabia Car Window Tinting Film, Paint Protection Film (PPF), and Ceramic Coating Market (2025-2031) | Strategy, Consumer Insights, Analysis, Investment Trends, Opportunities, Growth, Size, Share, Industry, Revenue, Segments, Value, Segmentation, Supply, Forecast, Restraints, Outlook, Competition, Drivers, Trends, Demand, Pricing Analysis, Competitive, Strategic Insights, Companies, Challenges

- South Africa Stationery Market (2025-2031) | Share, Size, Industry, Value, Growth, Revenue, Analysis, Trends, Segmentation & Outlook

- Afghanistan Rocking Chairs And Adirondack Chairs Market (2026-2032) | Size & Revenue, Competitive Landscape, Share, Segmentation, Industry, Value, Outlook, Analysis, Trends, Growth, Forecast, Companies

- Afghanistan Apparel Market (2026-2032) | Growth, Outlook, Industry, Segmentation, Forecast, Size, Companies, Trends, Value, Share, Analysis & Revenue

Industry Events and Analyst Meet

Whitepaper

- Middle East & Africa Commercial Security Market Click here to view more.

- Middle East & Africa Fire Safety Systems & Equipment Market Click here to view more.

- GCC Drone Market Click here to view more.

- Middle East Lighting Fixture Market Click here to view more.

- GCC Physical & Perimeter Security Market Click here to view more.

6WResearch In News

- Doha a strategic location for EV manufacturing hub: IPA Qatar

- Demand for luxury TVs surging in the GCC, says Samsung

- Empowering Growth: The Thriving Journey of Bangladesh’s Cable Industry

- Demand for luxury TVs surging in the GCC, says Samsung

- Video call with a traditional healer? Once unthinkable, it’s now common in South Africa

- Intelligent Buildings To Smooth GCC’s Path To Net Zero