Malaysia Poultry Market (2025-2029) | Value, Revenue, Growth, Size, Companies, Outlook, Analysis, Trends, Industry, Forecast & Share

Market Forecast By Segments (Broiler, Eggs), By End Uses (Food Service, Household), By Distribution Channels (Traditional Retail Stores, Business To Business, Modern Retail Stores) And Competitive Landscape

| Product Code: ETC384206 | Publication Date: Aug 2022 | Updated Date: Aug 2025 | Product Type: Market Research Report | |

| Publisher: 6Wresearch | Author: Ravi Bhandari | No. of Pages: 75 | No. of Figures: 35 | No. of Tables: 20 |

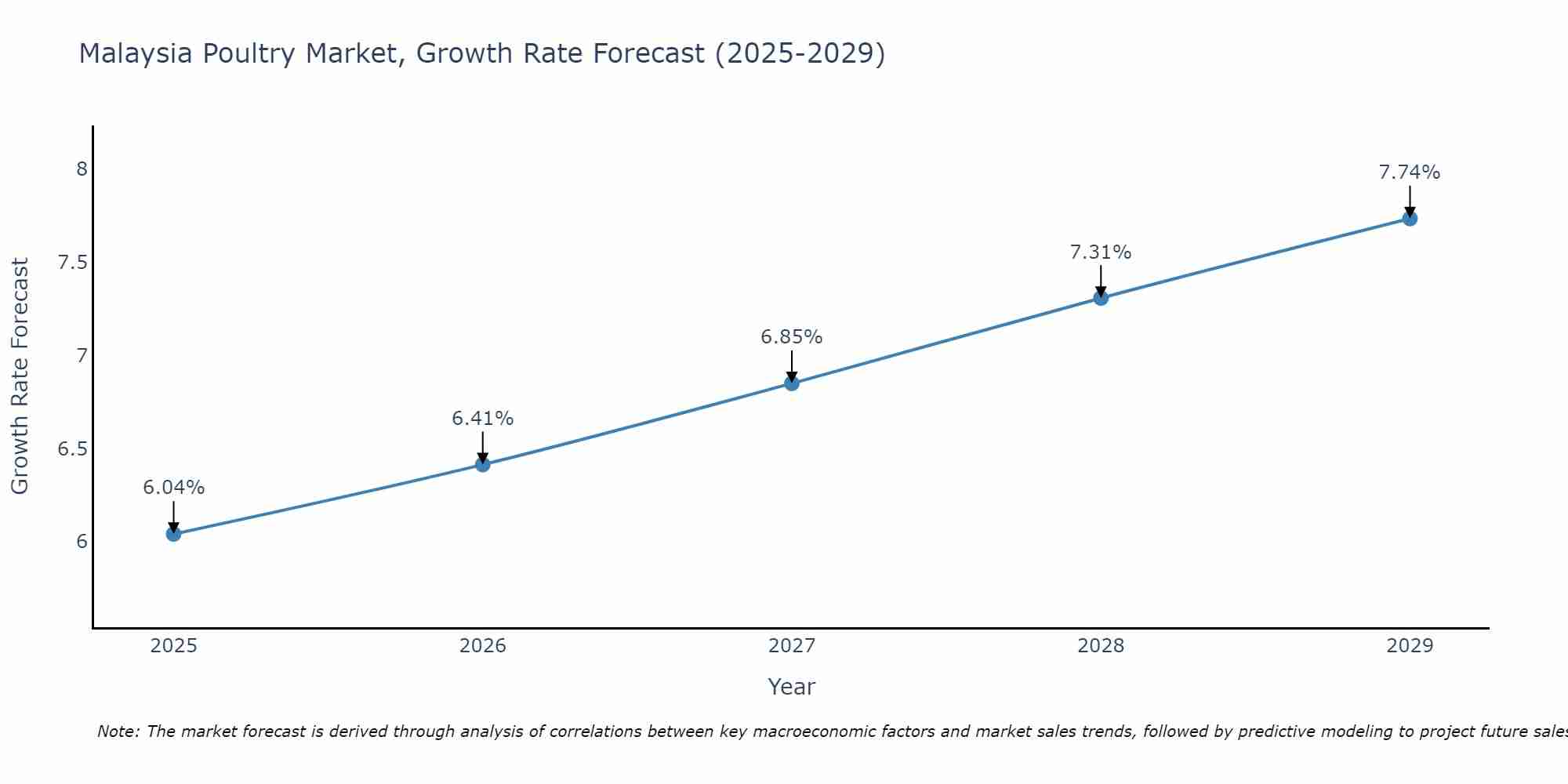

Malaysia Poultry Market Size Growth Rate

The Malaysia Poultry Market is poised for steady growth rate improvements from 2025 to 2029. From 6.04% in 2025, the growth rate steadily ascends to 7.74% in 2029.

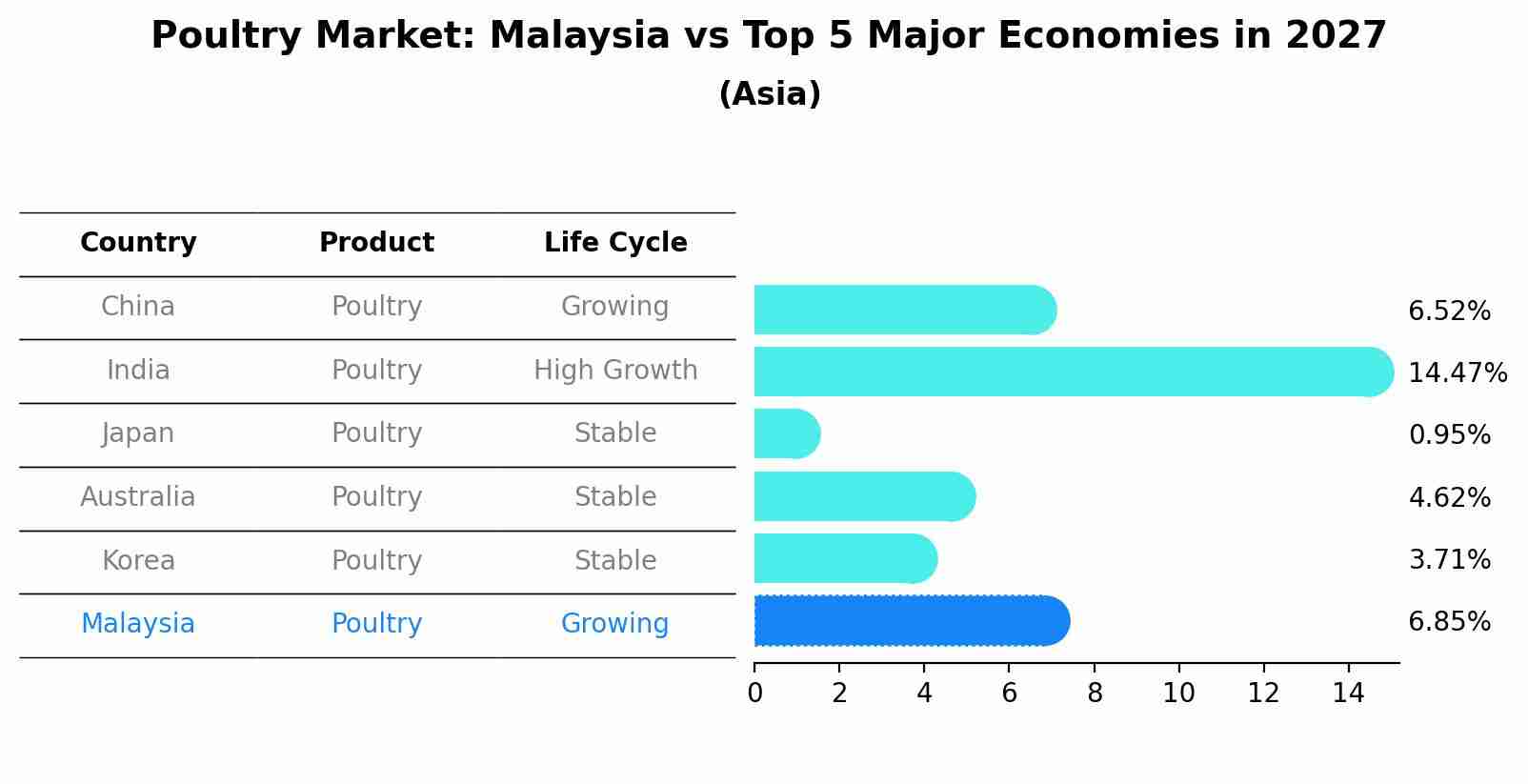

Poultry Market: Malaysia vs Top 5 Major Economies in 2027 (Asia)

By 2027, Malaysia's Poultry market is forecasted to achieve a growing growth rate of 6.85%, with China leading the Asia region, followed by India, Japan, Australia and South Korea.

Malaysia Poultry Market Highlights

| Report Name | Malaysia Poultry Market |

| Forecast period | 2025-2029 |

| CAGR | 7.74% |

| Growing Sector | Livestock & Animal Protein |

Topics Covered in the Malaysia Poultry Market Report

The Malaysia poultry market report thoroughly covers the market by Segments, End Uses and Distribution Channel. The report provides an unbiased and detailed analysis of the ongoing market trends, opportunities/high-growth areas, and market drivers to help stakeholders align their strategies with current and future market dynamics.

Malaysia Poultry Market Synopsis

The Malaysia poultry market growth has been steady due to increasing demand for affordable urbanisation and animal protein across the country. Shifting consumer eating patterns towards rising reliance on quick-service restaurants and increased awareness of high-protein diets further support the growth of the market. Additionally, the rising middle class, along with population growth, is propelling the demand for poultry products consumption across various sectors such as foodservice and retail. Overall, both fresh and frozen segments are significantly contributing to the robust growth of the market.

The Malaysia Poultry Market is anticipated to grow at a CAGR of 7.74% during the forecast period 2025–2029. Several key drivers are driving the steady growth of the Malaysia poultry market. Key drivers such as increasing penetration of modern retail formats, amplified demand for processed and value-added poultry products are propelling the demand for poultry products. Furthermore, technological advancements in disease prevention and breeding are another key driver supporting the growth of the market. Moreover, the role of vertical integration by large producers and increased automation in poultry operations is crucial, shaping the competitive landscape and boosting market expansion across the country.

Malaysia Poultry Market Challenges

The Malaysia poultry market faces numerous operational challenges even with the steady growth across the country. Disease outbreaks, such as avian influenza, pose a major challenge as they pose a risk to farm productivity and poultry health. Furthermore, fluctuations in the prices of feed ingredients such as soybean and corn also pose major hurdles as they rely on imports, impacting the profit margins for poultry producers. Additionally, issues such as regulatory compliance on antibiotic usage and environmental concerns related to poultry waste management are hampering the steady growth of the market.

Malaysia Poultry Market Trends

Several key trends are evolving the Malaysia poultry market, driven by both industry innovation and rising consumer demand. Key trend is the rising popularity of antibiotic-free, organic, and free-range poultry products among health-conscious consumers, further boosting the market growth. Additionally, the fast-paced urban lifestyles and increase in dual-income households are propelling the demand for ready-to-cook and frozen poultry across the country. Furthermore, ongoing investments in AI-based monitoring systems, precision farming, and sustainable poultry rearing practices are also contributing to the expansion of the market.

Investment Opportunities in the Malaysia Poultry Market

The Malaysia poultry industry presents various strong and promising investment opportunities for investors seeking long-term growth. Factors such as temperature-controlled broiler houses, farm infrastructure, including automated feeding systems, and waste-to-energy facilities offer strong opportunities. Furthermore, investors can explore companies that focus on the innovation of value-added products such as seasoned cuts, marinated chicken, and ready-to-cook frozen meals presents. Moreover, partnerships with QSR chains, foodservice operators, and institutional buyers also create ample opportunities, further supporting the robust growth of the market.

Leading Players of the Malaysia Poultry Market

Major players in the Malaysia poultry market sustain a competitive edge across the region through brand recognition, large-scale operations, distribution networks, and vertical integration. Key companies include Berhad CAB Cakaran Corporation, Leong Hup International Berhad, QL Resources, Berhad Dindings Poultry (Malayan Flour Mills Group), and Huat Lai Resources Berhad.

Government Regulations Introduced in the Malaysia Poultry Market

According to Malaysia government data, the government has been launching various strict regulations in the Malaysia poultry market. The market is regulated by the Department of Veterinary Services (DVS) under the Ministry of Agriculture and Food Security. Additionally, these regulations focus on the mandatory vaccination schedules, disease control measures, hygiene protocols, and environmental compliance in poultry farms, supporting the responsible growth of the market. Moreover, various government programs encourage modern poultry practices and provide training to improve smallholder boosting the market growth.

Future Insights of the Malaysia Poultry Market

The Malaysia poultry market is expected to witness robust growth in the future, driven by the expansion of retail and export channels and growing protein demand. Rising consumer emphasis on sustainability, food safety, and nutrition will likely encourage producers to innovate in production and product formats in the upcoming years. Additionally, ongoing Investments in automation, cold storage, disease control, and alternative feed sources will shape the future competitiveness of the market. Moreover, factors such as urbanisation, digital commerce, and foodservice partnerships will boost the market growth in the coming years.

Market Segmentation Analysis

The report offers a comprehensive study of the following market segments and their leading categories:

Fresh/chilled poultry to dominate the Market – By Product

According to Mansi Kaushik, Senior Research Analyst at 6Wresearch, Fresh/chilled poultry dominates the Malaysia poultry market, due to strong consumer preference for freshness, taste, and perceived quality. It is widely available through traditional wet markets and butcher shops.

Household Consumption to Dominate the Market – By Application

Household Consumption holds the largest Malaysia poultry market share, driven by the widespread use of chicken in daily home-cooked meals across Malaysian households. Poultry is a staple protein source due to its affordability, availability, and alignment with halal dietary practices.

Key Attractiveness of the Report

- 10 Years of Market Numbers.

- Historical Data Starting from 2021 to 2024.

- Base Year: 2024

- Forecast Data until 2029.

- Key Performance Indicators Impacting the Market.

- Major Upcoming Developments and Projects.

Key Highlights of the Report:

- Malaysia Poultry Market Outlook

- Market Size of Malaysia Poultry Market, 2024

- Forecast of Malaysia Poultry Market, 2029

- Historical Data and Forecast of Malaysia Poultry Revenues & Volume for the Period 2019-2029

- Malaysia Poultry Market Trend Evolution

- Malaysia Poultry Market Drivers and Challenges

- Malaysia Poultry Price Trends

- Malaysia Poultry Porter's Five Forces

- Malaysia Poultry Industry Life Cycle

- Historical Data and Forecast of Malaysia Poultry Market Revenues & Volume By Segments for the Period 2019-2029

- Historical Data and Forecast of Malaysia Poultry Market Revenues & Volume By Broiler for the Period 2019-2029

- Historical Data and Forecast of Malaysia Poultry Market Revenues & Volume By Eggs for the Period 2019-2029

- Historical Data and Forecast of Malaysia Poultry Market Revenues & Volume By End Uses for the Period 2019-2029

- Historical Data and Forecast of Malaysia Poultry Market Revenues & Volume By Food Service for the Period 2019-2029

- Historical Data and Forecast of Malaysia Poultry Market Revenues & Volume By Household for the Period 2019-2029

- Historical Data and Forecast of Malaysia Poultry Market Revenues & Volume By Distribution Channels for the Period 2019-2029

- Historical Data and Forecast of Malaysia Poultry Market Revenues & Volume By Traditional Retail Stores for the Period 2019-2029

- Historical Data and Forecast of Malaysia Poultry Market Revenues & Volume By Business To Business for the Period 2019-2029

- Historical Data and Forecast of Malaysia Poultry Market Revenues & Volume By Modern Retail Stores for the Period 2019-2029

- Malaysia Poultry Import Export Trade Statistics

- Market Opportunity Assessment By Segments

- Market Opportunity Assessment By End Uses

- Market Opportunity Assessment By Distribution Channels

- Malaysia Poultry Top Companies Market Share

- Malaysia Poultry Competitive Benchmarking By Technical and Operational Parameters

- Malaysia Poultry Company Profiles

- Malaysia Poultry Key Strategic Recommendations

Market Segmentation

The Market report covers a detailed analysis of the following market segments:

By Segments

- Broiler

- Eggs

By End Uses

- Food Service

- Household

By Distribution Channels

- Traditional Retail Stores

- Business To Business

- Modern Retail Stores

Malaysia Poultry Market (2025-2029): FAQs

| 1 Executive Summary |

| 2 Introduction |

| 2.1 Key Highlights of the Report |

| 2.2 Report Description |

| 2.3 Market Scope & Segmentation |

| 2.4 Research Methodology |

| 2.5 Assumptions |

| 3 Malaysia Poultry Market Overview |

| 3.1 Malaysia Country Macro Economic Indicators |

| 3.2 Malaysia Poultry Market Revenues & Volume, 2019 & 2029F |

| 3.3 Malaysia Poultry Market - Industry Life Cycle |

| 3.4 Malaysia Poultry Market - Porter's Five Forces |

| 3.5 Malaysia Poultry Market Revenues & Volume Share, By Segments, 2019 & 2029F |

| 3.6 Malaysia Poultry Market Revenues & Volume Share, By End Uses, 2019 & 2029F |

| 3.7 Malaysia Poultry Market Revenues & Volume Share, By Distribution Channels, 2019 & 2029F |

| 4 Malaysia Poultry Market Dynamics |

| 4.1 Impact Analysis |

| 4.2 Market Drivers |

| 4.2.1 Increasing population and urbanization leading to higher demand for poultry products. |

| 4.2.2 Growing awareness about the health benefits of consuming poultry as a source of protein. |

| 4.2.3 Government initiatives to support the development of the poultry industry through subsidies and infrastructure improvements. |

| 4.3 Market Restraints |

| 4.3.1 Fluctuating feed prices affecting the cost of production for poultry farmers. |

| 4.3.2 Disease outbreaks impacting poultry production and supply. |

| 4.3.3 Competition from alternative protein sources such as plant-based meat substitutes. |

| 5 Malaysia Poultry Market Trends |

| 6 Malaysia Poultry Market Segmentations |

| 6.1 Malaysia Poultry Market, By Segments |

| 6.1.1 Overview and Analysis |

| 6.1.2 Malaysia Poultry Market Revenues & Volume, By Broiler, 2019 - 2029F |

| 6.1.3 Malaysia Poultry Market Revenues & Volume, By Eggs, 2019 - 2029F |

| 6.2 Malaysia Poultry Market, By End Uses |

| 6.2.1 Overview and Analysis |

| 6.2.2 Malaysia Poultry Market Revenues & Volume, By Food Service, 2019 - 2029F |

| 6.2.3 Malaysia Poultry Market Revenues & Volume, By Household, 2019 - 2029F |

| 6.3 Malaysia Poultry Market, By Distribution Channels |

| 6.3.1 Overview and Analysis |

| 6.3.2 Malaysia Poultry Market Revenues & Volume, By Traditional Retail Stores, 2019 - 2029F |

| 6.3.3 Malaysia Poultry Market Revenues & Volume, By Business To Business, 2019 - 2029F |

| 6.3.4 Malaysia Poultry Market Revenues & Volume, By Modern Retail Stores, 2019 - 2029F |

| 7 Malaysia Poultry Market Import-Export Trade Statistics |

| 7.1 Malaysia Poultry Market Export to Major Countries |

| 7.2 Malaysia Poultry Market Imports from Major Countries |

| 8 Malaysia Poultry Market Key Performance Indicators |

| 8.1 Feed conversion ratio (FCR) to measure the efficiency of feed utilization in poultry production. |

| 8.2 Average selling price of poultry products to assess market demand and pricing trends. |

| 8.3 Number of poultry farms implementing biosecurity measures to prevent disease outbreaks. |

| 9 Malaysia Poultry Market - Opportunity Assessment |

| 9.1 Malaysia Poultry Market Opportunity Assessment, By Segments, 2019 & 2029F |

| 9.2 Malaysia Poultry Market Opportunity Assessment, By End Uses, 2019 & 2029F |

| 9.3 Malaysia Poultry Market Opportunity Assessment, By Distribution Channels, 2019 & 2029F |

| 10 Malaysia Poultry Market - Competitive Landscape |

| 10.1 Malaysia Poultry Market Revenue Share, By Companies, 2024 |

| 10.2 Malaysia Poultry Market Competitive Benchmarking, By Operating and Technical Parameters |

| 11 Company Profiles |

| 12 Recommendations |

| 13 Disclaimer |

- Single User License$ 1,995

- Department License$ 2,400

- Site License$ 3,120

- Global License$ 3,795

Search

Thought Leadership and Analyst Meet

Our Clients

Related Reports

- Germany Breakfast Food Market (2026-2032) | Industry, Share, Growth, Size, Companies, Value, Analysis, Revenue, Trends, Forecast & Outlook

- Australia Briquette Market (2025-2031) | Growth, Size, Revenue, Forecast, Analysis, Trends, Value, Share, Industry & Companies

- Vietnam System Integrator Market (2025-2031) | Size, Companies, Analysis, Industry, Value, Forecast, Growth, Trends, Revenue & Share

- ASEAN and Thailand Brain Health Supplements Market (2025-2031) | Strategy, Consumer Insights, Analysis, Investment Trends, Opportunities, Growth, Size, Share, Industry, Revenue, Segments, Value, Segmentation, Supply, Forecast, Restraints, Outlook, Competition, Drivers, Trends, Demand, Pricing Analysis, Competitive, Strategic Insights, Companies, Challenges

- ASEAN Bearings Market (2025-2031) | Strategy, Consumer Insights, Analysis, Investment Trends, Opportunities, Growth, Size, Share, Industry, Revenue, Segments, Value, Segmentation, Supply, Forecast, Restraints, Outlook, Competition, Drivers, Trends, Demand, Pricing Analysis, Competitive, Strategic Insights, Companies, Challenges

- Europe Flooring Market (2025-2031) | Outlook, Share, Industry, Trends, Forecast, Companies, Revenue, Size, Analysis, Growth & Value

- Saudi Arabia Manlift Market (2025-2031) | Outlook, Size, Growth, Trends, Companies, Industry, Revenue, Value, Share, Forecast & Analysis

- Uganda Excavator, Crane, and Wheel Loaders Market (2025-2031) | Strategy, Consumer Insights, Analysis, Investment Trends, Opportunities, Growth, Size, Share, Industry, Revenue, Segments, Value, Segmentation, Supply, Forecast, Restraints, Outlook, Competition, Drivers, Trends, Demand, Pricing Analysis, Competitive, Strategic Insights, Companies, Challenges

- Rwanda Excavator, Crane, and Wheel Loaders Market (2025-2031) | Strategy, Consumer Insights, Analysis, Investment Trends, Opportunities, Growth, Size, Share, Industry, Revenue, Segments, Value, Segmentation, Supply, Forecast, Restraints, Outlook, Competition, Drivers, Trends, Demand, Pricing Analysis, Competitive, Strategic Insights, Companies, Challenges

- Kenya Excavator, Crane, and Wheel Loaders Market (2025-2031) | Strategy, Consumer Insights, Analysis, Investment Trends, Opportunities, Growth, Size, Share, Industry, Revenue, Segments, Value, Segmentation, Supply, Forecast, Restraints, Outlook, Competition, Drivers, Trends, Demand, Pricing Analysis, Competitive, Strategic Insights, Companies, Challenges

Industry Events and Analyst Meet

Whitepaper

- Middle East & Africa Commercial Security Market Click here to view more.

- Middle East & Africa Fire Safety Systems & Equipment Market Click here to view more.

- GCC Drone Market Click here to view more.

- Middle East Lighting Fixture Market Click here to view more.

- GCC Physical & Perimeter Security Market Click here to view more.

6WResearch In News

- Doha a strategic location for EV manufacturing hub: IPA Qatar

- Demand for luxury TVs surging in the GCC, says Samsung

- Empowering Growth: The Thriving Journey of Bangladesh’s Cable Industry

- Demand for luxury TVs surging in the GCC, says Samsung

- Video call with a traditional healer? Once unthinkable, it’s now common in South Africa

- Intelligent Buildings To Smooth GCC’s Path To Net Zero