Morocco Cards Market Outlook | Companies, Size, Share, Value, COVID-19 IMPACT, Growth, Trends, Analysis, Revenue, Industry & Forecast

| Product Code: ETC259193 | Publication Date: Aug 2022 | Updated Date: Aug 2025 | Product Type: Market Research Report | |

| Publisher: 6Wresearch | Author: Dhaval Chaurasia | No. of Pages: 75 | No. of Figures: 35 | No. of Tables: 20 |

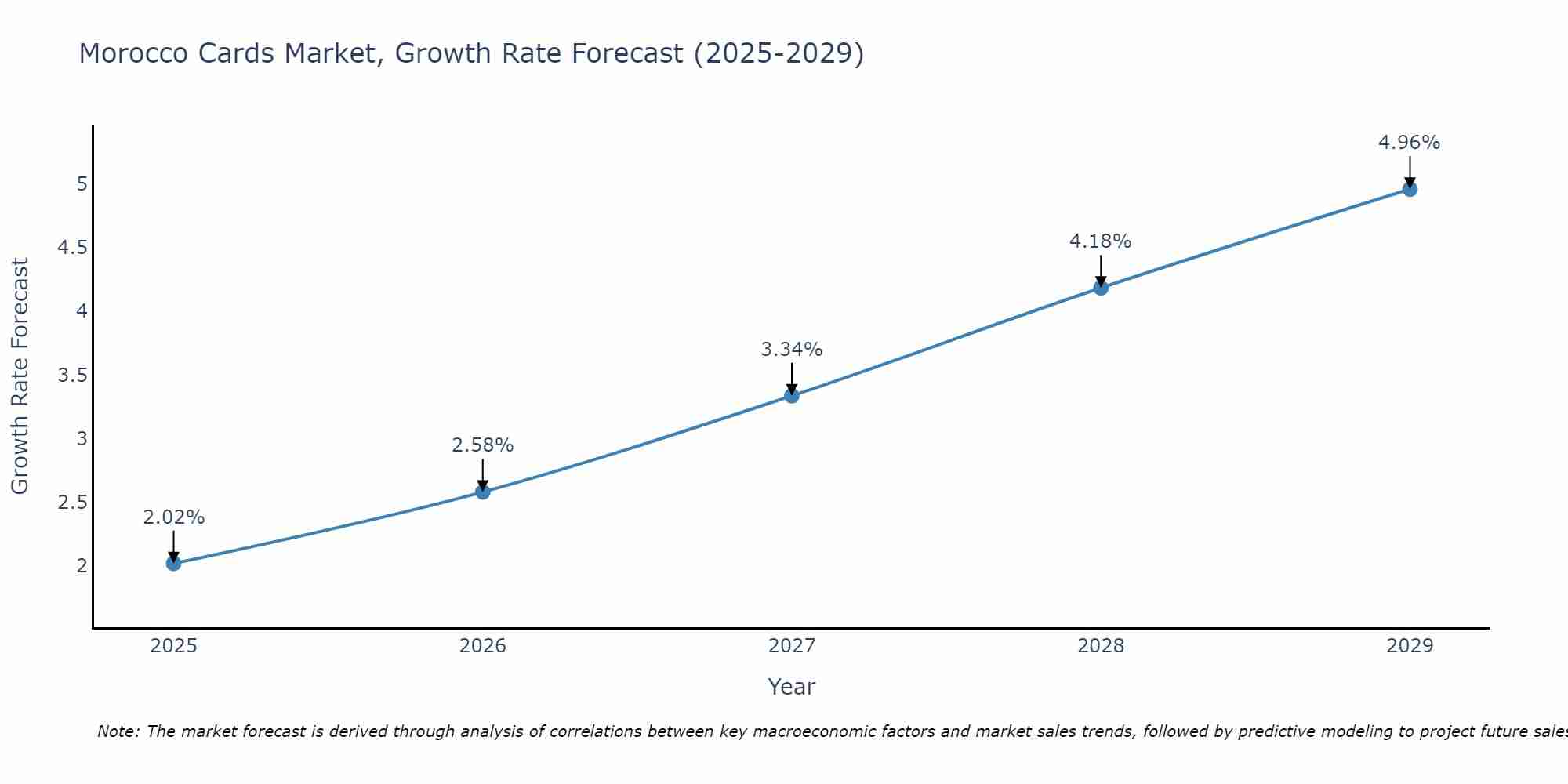

Morocco Cards Market Size Growth Rate

The Morocco Cards Market is likely to experience consistent growth rate gains over the period 2025 to 2029. From 2.02% in 2025, the growth rate steadily ascends to 4.96% in 2029.

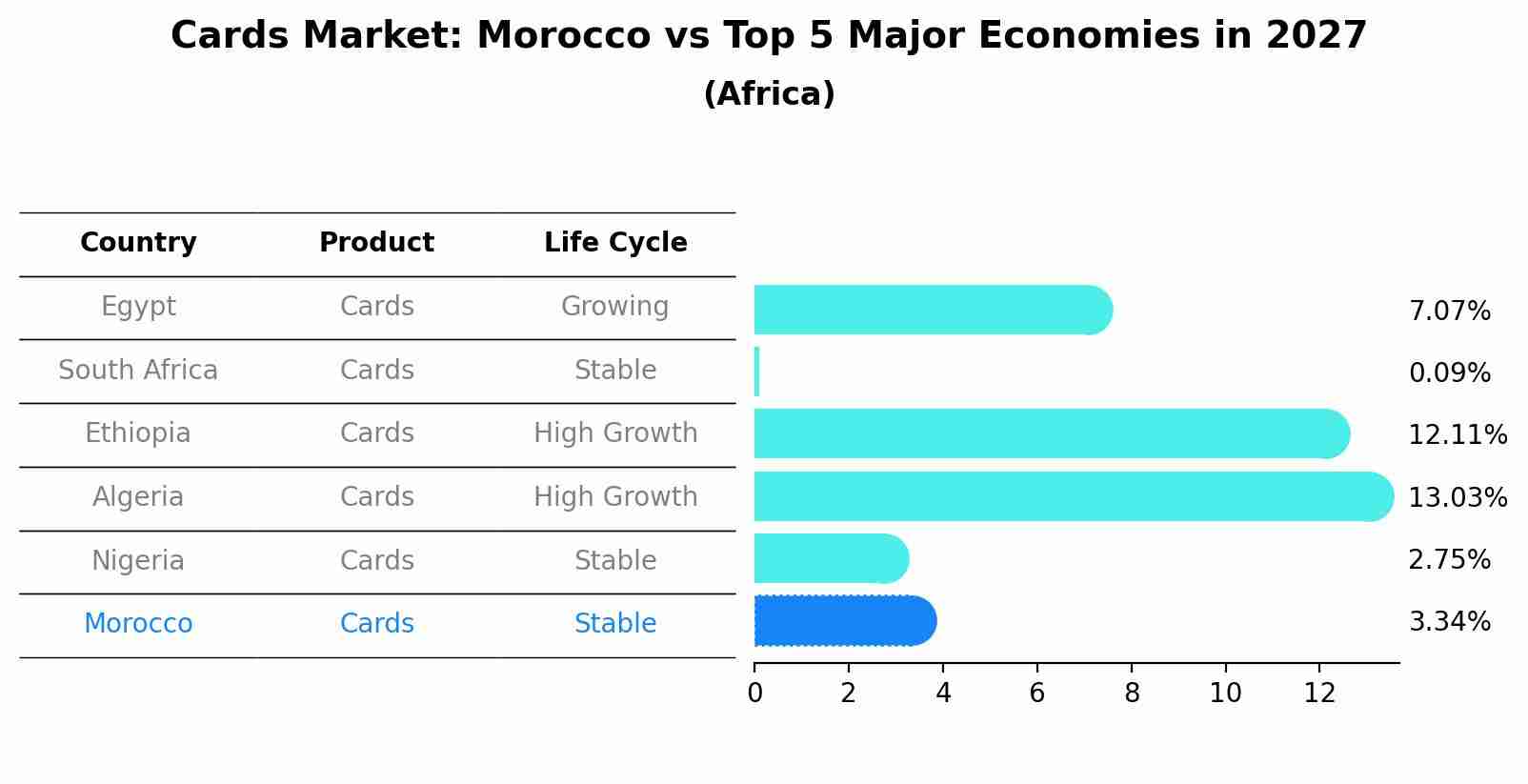

Cards Market: Morocco vs Top 5 Major Economies in 2027 (Africa)

Morocco's Cards market is anticipated to experience a stable growth rate of 3.34% by 2027, reflecting trends observed in the largest economy Egypt, followed by South Africa, Ethiopia, Algeria and Nigeria.

Morocco Cards Market Overview

The Morocco Cards Market has been experiencing steady growth driven by factors such as increasing adoption of digital payments, rising internet penetration, and government initiatives promoting electronic transactions. Debit and credit cards are the most popular types of cards in the market, with a shift towards contactless payments and mobile wallets. The market is also witnessing a rise in prepaid cards for gifting and travel purposes. Key players in the market include major banks, financial institutions, and international card networks. As the economy continues to modernize and consumers seek convenient and secure payment options, the Morocco Cards Market is expected to further expand, with opportunities for innovation in payment technologies and services.

Morocco Cards Market Trends

The Morocco Cards Market is experiencing several key trends. Contactless payment technology is gaining popularity, with more consumers and merchants adopting contactless cards for convenience and speed of transactions. Additionally, there is a growing demand for prepaid cards among consumers looking for budgeting tools and secure payment options. Digital wallets are also on the rise, with mobile payment solutions becoming increasingly popular among tech-savvy Moroccans. Furthermore, there is a shift towards eco-friendly card options, with biodegradable and recyclable materials being preferred by environmentally-conscious consumers. Overall, the Morocco Cards Market is evolving to meet the changing needs and preferences of consumers, with a focus on convenience, security, and sustainability.

Morocco Cards Market Challenges

The Morocco Cards Market faces challenges such as high levels of cash usage, low banking penetration in rural areas, and a lack of consumer awareness about the benefits of card usage. Additionally, there are concerns about security and fraud, as well as the need for improved infrastructure to support electronic payment systems. Regulatory hurdles and limited acceptance of cards at smaller merchants also hinder the growth of the market. To overcome these challenges, stakeholders in the Morocco Cards Market need to focus on increasing financial literacy, enhancing security measures, expanding the acceptance network, and promoting the advantages of card payments over cash to drive adoption and usage in the country.

Morocco Cards Market Investment Opportunities

The Morocco Cards Market presents promising investment opportunities across various segments. With a growing economy and increasing consumer spending, there is a rising demand for credit cards, debit cards, and prepaid cards in the country. The digital transformation and the government`s efforts to promote financial inclusion are also driving the growth of the cards market. Investing in payment technologies, fintech solutions, and digital payment platforms can be lucrative in this market. Additionally, there is potential for partnerships between financial institutions and technology companies to innovate and offer more convenient and secure card payment solutions to meet the evolving needs of Moroccan consumers. Overall, the Morocco Cards Market offers a dynamic landscape for investors seeking to capitalize on the expanding financial services sector in the country.

Morocco Cards Market Government Policy

The government policies related to the Morocco Cards Market primarily focus on promoting financial inclusion, enhancing consumer protection, and regulating the industry to ensure transparency and security. The Central Bank of Morocco, Bank Al-Maghrib, plays a key role in overseeing the cards market through regulations that govern payment systems, electronic money, and consumer rights. The government has also implemented initiatives to encourage the adoption of digital payments and reduce cash transactions, aiming to modernize the financial sector and boost economic growth. Additionally, efforts are being made to combat fraud and money laundering through stringent regulations and monitoring mechanisms. Overall, the government`s policies aim to create a competitive and sustainable cards market that benefits both consumers and businesses while ensuring compliance with international standards and best practices.

Morocco Cards Market Future Outlook

The future outlook for the Morocco Cards Market appears promising, driven by factors such as increasing adoption of digital payments, growing e-commerce activities, and government initiatives to promote financial inclusion. With the rising trend of contactless payments and mobile wallets, the demand for debit, credit, and prepaid cards is expected to grow significantly. Additionally, the shift towards a cashless society, coupled with advancements in technology and infrastructure, is likely to fuel the expansion of the cards market in Morocco. As more consumers embrace the convenience and security offered by card payments, financial institutions and card issuers are poised for opportunities to innovate and cater to the evolving needs of the market, positioning the sector for sustained growth in the coming years.

Key Highlights of the Report:

- Morocco Cards Market Outlook

- Market Size of Morocco Cards Market, 2021

- Forecast of Morocco Cards Market, 2031

- Historical Data and Forecast of Morocco Cards Revenues & Volume for the Period 2018 - 2031

- Morocco Cards Market Trend Evolution

- Morocco Cards Market Drivers and Challenges

- Morocco Cards Price Trends

- Morocco Cards Porter's Five Forces

- Morocco Cards Industry Life Cycle

- Historical Data and Forecast of Morocco Cards Market Revenues & Volume By Type for the Period 2018 - 2031

- Historical Data and Forecast of Morocco Cards Market Revenues & Volume By General Purpose for the Period 2018 - 2031

- Historical Data and Forecast of Morocco Cards Market Revenues & Volume By Private Label for the Period 2018 - 2031

- Historical Data and Forecast of Morocco Cards Market Revenues & Volume By Usage for the Period 2018 - 2031

- Historical Data and Forecast of Morocco Cards Market Revenues & Volume By General Purpose Re-Loadable Card for the Period 2018 - 2031

- Historical Data and Forecast of Morocco Cards Market Revenues & Volume By Government Benefit/Disbursement Card for the Period 2018 - 2031

- Historical Data and Forecast of Morocco Cards Market Revenues & Volume By Payroll Card for the Period 2018 - 2031

- Historical Data and Forecast of Morocco Cards Market Revenues & Volume By Others for the Period 2018 - 2031

- Historical Data and Forecast of Morocco Cards Market Revenues & Volume By End-User for the Period 2018 - 2031

- Historical Data and Forecast of Morocco Cards Market Revenues & Volume By Retail Establishments for the Period 2018 - 2031

- Historical Data and Forecast of Morocco Cards Market Revenues & Volume By Corporate Institutions for the Period 2018 - 2031

- Historical Data and Forecast of Morocco Cards Market Revenues & Volume By Government for the Period 2018 - 2031

- Historical Data and Forecast of Morocco Cards Market Revenues & Volume By Financial Institutions for the Period 2018 - 2031

- Historical Data and Forecast of Morocco Cards Market Revenues & Volume By Others for the Period 2018 - 2031

- Morocco Cards Import Export Trade Statistics

- Market Opportunity Assessment By Type

- Market Opportunity Assessment By Usage

- Market Opportunity Assessment By End-User

- Morocco Cards Top Companies Market Share

- Morocco Cards Competitive Benchmarking By Technical and Operational Parameters

- Morocco Cards Company Profiles

- Morocco Cards Key Strategic Recommendations

Frequently Asked Questions About the Market Study (FAQs):

1 Executive Summary |

2 Introduction |

2.1 Key Highlights of the Report |

2.2 Report Description |

2.3 Market Scope & Segmentation |

2.4 Research Methodology |

2.5 Assumptions |

3 Morocco Cards Market Overview |

3.1 Morocco Country Macro Economic Indicators |

3.2 Morocco Cards Market Revenues & Volume, 2021 & 2031F |

3.3 Morocco Cards Market - Industry Life Cycle |

3.4 Morocco Cards Market - Porter's Five Forces |

3.5 Morocco Cards Market Revenues & Volume Share, By Type, 2021 & 2031F |

3.6 Morocco Cards Market Revenues & Volume Share, By Usage, 2021 & 2031F |

3.7 Morocco Cards Market Revenues & Volume Share, By End-User, 2021 & 2031F |

4 Morocco Cards Market Dynamics |

4.1 Impact Analysis |

4.2 Market Drivers |

4.2.1 Increasing adoption of digital payment methods in Morocco |

4.2.2 Growth in e-commerce and online transactions |

4.2.3 Government initiatives to promote cashless transactions |

4.3 Market Restraints |

4.3.1 Limited internet penetration and access to banking services in rural areas |

4.3.2 Concerns regarding cybersecurity and data privacy |

4.3.3 Cultural preference for cash transactions over card payments |

5 Morocco Cards Market Trends |

6 Morocco Cards Market, By Types |

6.1 Morocco Cards Market, By Type |

6.1.1 Overview and Analysis |

6.1.2 Morocco Cards Market Revenues & Volume, By Type, 2021-2031F |

6.1.3 Morocco Cards Market Revenues & Volume, By General Purpose, 2021-2031F |

6.1.4 Morocco Cards Market Revenues & Volume, By Private Label, 2021-2031F |

6.2 Morocco Cards Market, By Usage |

6.2.1 Overview and Analysis |

6.2.2 Morocco Cards Market Revenues & Volume, By General Purpose Re-Loadable Card, 2021-2031F |

6.2.3 Morocco Cards Market Revenues & Volume, By Government Benefit/Disbursement Card, 2021-2031F |

6.2.4 Morocco Cards Market Revenues & Volume, By Payroll Card, 2021-2031F |

6.2.5 Morocco Cards Market Revenues & Volume, By Others, 2021-2031F |

6.3 Morocco Cards Market, By End-User |

6.3.1 Overview and Analysis |

6.3.2 Morocco Cards Market Revenues & Volume, By Retail Establishments, 2021-2031F |

6.3.3 Morocco Cards Market Revenues & Volume, By Corporate Institutions, 2021-2031F |

6.3.4 Morocco Cards Market Revenues & Volume, By Government, 2021-2031F |

6.3.5 Morocco Cards Market Revenues & Volume, By Financial Institutions, 2021-2031F |

6.3.6 Morocco Cards Market Revenues & Volume, By Others, 2021-2031F |

7 Morocco Cards Market Import-Export Trade Statistics |

7.1 Morocco Cards Market Export to Major Countries |

7.2 Morocco Cards Market Imports from Major Countries |

8 Morocco Cards Market Key Performance Indicators |

8.1 Number of new digital payment users in Morocco |

8.2 Percentage increase in online transactions in the country |

8.3 Adoption rate of mobile payment solutions in Morocco |

8.4 Percentage growth in the usage of contactless cards |

8.5 Average transaction value through card payments |

9 Morocco Cards Market - Opportunity Assessment |

9.1 Morocco Cards Market Opportunity Assessment, By Type, 2021 & 2031F |

9.2 Morocco Cards Market Opportunity Assessment, By Usage, 2021 & 2031F |

9.3 Morocco Cards Market Opportunity Assessment, By End-User, 2021 & 2031F |

10 Morocco Cards Market - Competitive Landscape |

10.1 Morocco Cards Market Revenue Share, By Companies, 2021 |

10.2 Morocco Cards Market Competitive Benchmarking, By Operating and Technical Parameters |

11 Company Profiles |

12 Recommendations |

13 Disclaimer |

Export potential assessment - trade Analytics for 2030

Export potential enables firms to identify high-growth global markets with greater confidence by combining advanced trade intelligence with a structured quantitative methodology. The framework analyzes emerging demand trends and country-level import patterns while integrating macroeconomic and trade datasets such as GDP and population forecasts, bilateral import–export flows, tariff structures, elasticity differentials between developed and developing economies, geographic distance, and import demand projections. Using weighted trade values from 2020–2024 as the base period to project country-to-country export potential for 2030, these inputs are operationalized through calculated drivers such as gravity model parameters, tariff impact factors, and projected GDP per-capita growth. Through an analysis of hidden potentials, demand hotspots, and market conditions that are most favorable to success, this method enables firms to focus on target countries, maximize returns, and global expansion with data, backed by accuracy.

By factoring in the projected importer demand gap that is currently unmet and could be potential opportunity, it identifies the potential for the Exporter (Country) among 190 countries, against the general trade analysis, which identifies the biggest importer or exporter.

To discover high-growth global markets and optimize your business strategy:

Click Here- Single User License$ 1,995

- Department License$ 2,400

- Site License$ 3,120

- Global License$ 3,795

Search

Thought Leadership and Analyst Meet

Our Clients

Related Reports

- India Switchgear Market Outlook (2026 - 2032) | Size, Share, Trends, Growth, Revenue, Forecast, Analysis, Value, Outlook

- Pakistan Contraceptive Implants Market (2025-2031) | Demand, Growth, Size, Share, Industry, Pricing Analysis, Competitive, Strategic Insights, Strategy, Consumer Insights, Analysis, Investment Trends, Opportunities, Revenue, Segments, Value, Segmentation, Supply, Forecast, Restraints, Outlook, Competition, Drivers, Trends, Companies, Challenges

- Sri Lanka Packaging Market (2026-2032) | Outlook, Competition, Drivers, Trends, Demand, Pricing Analysis, Competitive, Strategic Insights, Companies, Challenges, Strategy, Consumer Insights, Analysis, Investment Trends, Opportunities, Growth, Size, Share, Industry, Revenue, Segments, Value, Segmentation, Supply, Forecast, Restraints

- India Kids Watches Market (2026-2032) | Strategy, Consumer Insights, Analysis, Investment Trends, Opportunities, Growth, Size, Share, Industry, Revenue, Segments, Value, Segmentation, Supply, Forecast, Restraints, Outlook, Competition, Drivers, Trends, Demand, Pricing Analysis, Competitive, Strategic Insights, Companies, Challenges

- Saudi Arabia Core Assurance Service Market (2025-2031) | Strategy, Consumer Insights, Analysis, Investment Trends, Opportunities, Growth, Size, Share, Industry, Revenue, Segments, Value, Segmentation, Supply, Forecast, Restraints, Outlook, Competition, Drivers, Trends, Demand, Pricing Analysis, Competitive, Strategic Insights, Companies, Challenges

- Romania Uninterruptible Power Supply (UPS) Market (2026-2032) | Industry, Analysis, Revenue, Size, Forecast, Outlook, Value, Trends, Share, Growth & Companies

- Saudi Arabia Car Window Tinting Film, Paint Protection Film (PPF), and Ceramic Coating Market (2025-2031) | Strategy, Consumer Insights, Analysis, Investment Trends, Opportunities, Growth, Size, Share, Industry, Revenue, Segments, Value, Segmentation, Supply, Forecast, Restraints, Outlook, Competition, Drivers, Trends, Demand, Pricing Analysis, Competitive, Strategic Insights, Companies, Challenges

- South Africa Stationery Market (2025-2031) | Share, Size, Industry, Value, Growth, Revenue, Analysis, Trends, Segmentation & Outlook

- Afghanistan Rocking Chairs And Adirondack Chairs Market (2026-2032) | Size & Revenue, Competitive Landscape, Share, Segmentation, Industry, Value, Outlook, Analysis, Trends, Growth, Forecast, Companies

- Afghanistan Apparel Market (2026-2032) | Growth, Outlook, Industry, Segmentation, Forecast, Size, Companies, Trends, Value, Share, Analysis & Revenue

Industry Events and Analyst Meet

Whitepaper

- Middle East & Africa Commercial Security Market Click here to view more.

- Middle East & Africa Fire Safety Systems & Equipment Market Click here to view more.

- GCC Drone Market Click here to view more.

- Middle East Lighting Fixture Market Click here to view more.

- GCC Physical & Perimeter Security Market Click here to view more.

6WResearch In News

- Doha a strategic location for EV manufacturing hub: IPA Qatar

- Demand for luxury TVs surging in the GCC, says Samsung

- Empowering Growth: The Thriving Journey of Bangladesh’s Cable Industry

- Demand for luxury TVs surging in the GCC, says Samsung

- Video call with a traditional healer? Once unthinkable, it’s now common in South Africa

- Intelligent Buildings To Smooth GCC’s Path To Net Zero