Norway Gelling Agents Market (2025-2031) | Size & Revenue, Industry, Competitive Landscape, Share, Value, Trends, Analysis, Outlook, Forecast, Companies, Growth, Segmentation

| Product Code: ETC8669027 | Publication Date: Sep 2024 | Updated Date: Nov 2025 | Product Type: Market Research Report | |

| Publisher: 6Wresearch | Author: Dhaval Chaurasia | No. of Pages: 75 | No. of Figures: 35 | No. of Tables: 20 |

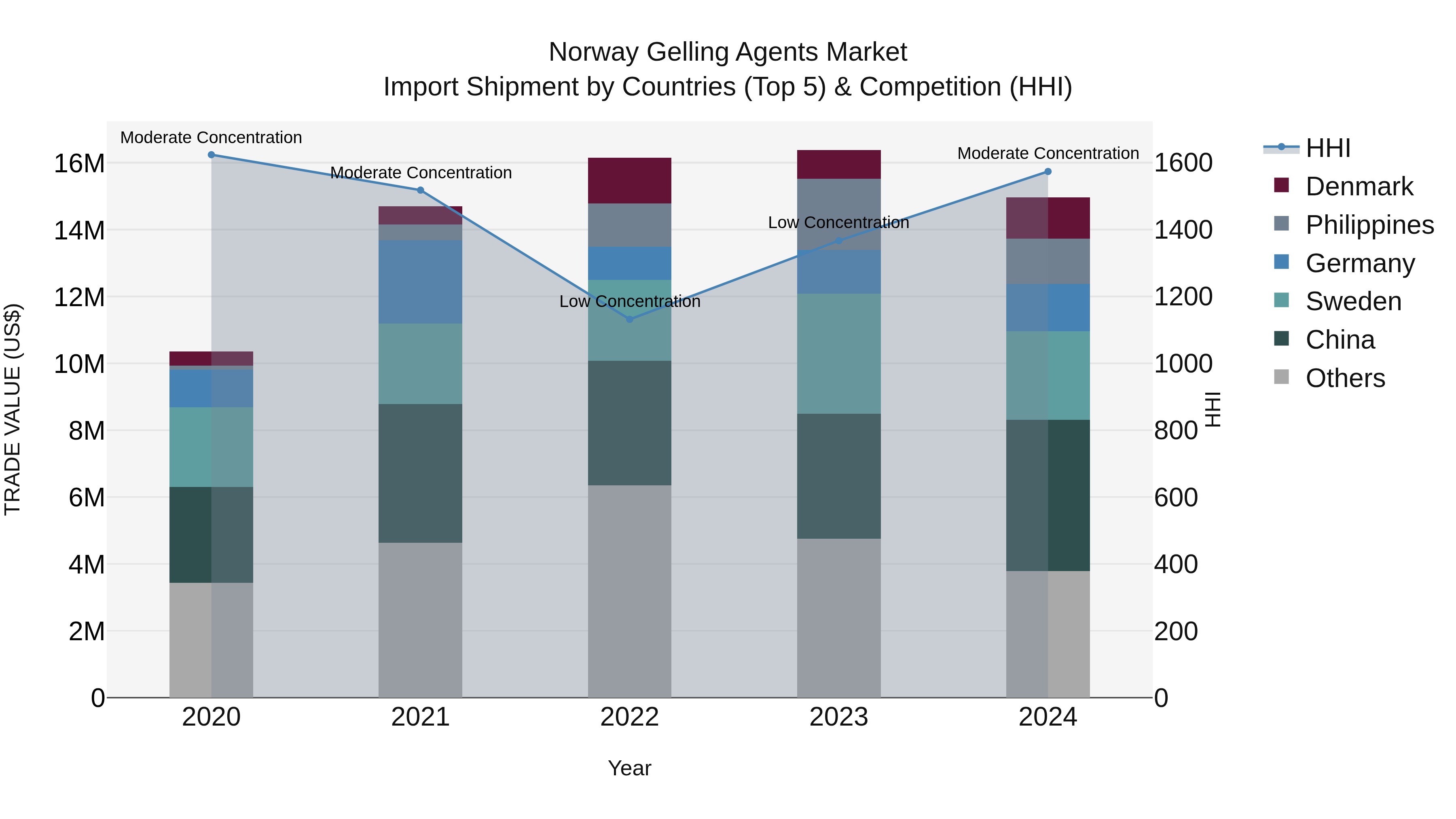

Norway Gelling Agents Market Top 5 Importing Countries and Market Competition (HHI) Analysis

Norway`s import of gelling agents in 2024 saw a shift in concentration from low to moderate, reflecting changes in the market dynamics. The leading exporters to Norway in 2024 were China, Sweden, Germany, Philippines, and Denmark, indicating a diverse source of gelling agents. Despite a slight decline in growth rate from 2023 to 2024, the compound annual growth rate (CAGR) over the past five years remains strong at 9.65%. This data suggests a stable demand for gelling agents in Norway, with opportunities for further growth and market expansion in the coming years.

Norway Gelling Agents Market Synopsis

The Norway gelling agents market is experiencing steady growth driven by the increasing demand for food and beverage products that require thickening and gelling agents. The market is dominated by both domestic and international manufacturers offering a wide range of gelling agents such as agar-agar, pectin, carrageenan, and gelatin. The food industry accounts for a significant share of the market, with gelling agents being used in various applications including confectionery, dairy products, and processed meat. The growing trend towards clean label and natural ingredients is also influencing product development in the gelling agents market, with manufacturers focusing on providing clean-label solutions to meet consumer preferences. Additionally, the pharmaceutical and personal care industries are emerging as key sectors driving the demand for gelling agents in Norway.

Norway Gelling Agents Market Trends

The Norway gelling agents market is witnessing a growing demand for natural and plant-based gelling agents due to increasing consumer preference for clean label and sustainable products. The trend towards healthier food options has fueled the demand for gelling agents derived from seaweed, agar-agar, and pectin. Manufacturers are also exploring innovative applications of gelling agents in the food and beverage industry, such as vegan gummies, dairy alternatives, and gluten-free products. Opportunities exist for companies to capitalize on the rising demand for clean label ingredients by offering customized gelling solutions to meet specific customer needs. Additionally, the pharmaceutical and personal care sectors present untapped potential for gelling agents, creating avenues for market expansion and diversification within the Norway gelling agents industry.

Norway Gelling Agents Market Challenges

In the Norway Gelling Agents Market, challenges include competition from alternative thickeners like starches and emulsifiers, regulatory restrictions on certain gelling agents due to health or environmental concerns, fluctuating raw material prices affecting production costs, and the need for continuous innovation to meet changing consumer preferences for clean label and natural ingredients. Additionally, the market may face challenges related to sustainability and sourcing of raw materials, as well as the impact of climate change on crop yields and availability of key ingredients. Adapting to these challenges will require companies in the Norway Gelling Agents Market to invest in research and development, maintain strong supply chain relationships, and stay informed about evolving regulations and consumer trends to remain competitive in the market.

Norway Gelling Agents Market Investment Opportunities

The Norway Gelling Agents Market is primarily driven by the growing demand for convenience food products, as gelling agents are widely used in the food industry for texture enhancement and preservation. In addition, the increasing awareness among consumers regarding clean label ingredients and natural food additives is fueling the demand for gelling agents derived from plant-based sources. The trend towards healthier eating habits and the rise in vegan and vegetarian populations are also contributing to the market growth, as plant-based gelling agents are preferred over animal-derived options. Furthermore, the expanding food processing industry in Norway and the focus on product innovation and development by manufacturers are further propelling the demand for gelling agents in various food applications.

Norway Gelling Agents Market Government Polices

The Norwegian government has implemented policies aimed at regulating the Gelling Agents Market to ensure consumer safety and environmental sustainability. These policies focus on strict quality control measures, labeling requirements, and adherence to international standards for gelling agents used in food and pharmaceutical products. Additionally, the government promotes research and development in the field of gelling agents to encourage innovation and improve product efficiency. Environmental regulations also play a significant role, with an emphasis on sustainable sourcing and production practices to reduce the industry`s carbon footprint. Overall, the government policies in Norway aim to create a transparent and competitive market for gelling agents while prioritizing health, safety, and environmental concerns.

Norway Gelling Agents Market Future Outlook

The Norway gelling agents market is expected to show steady growth in the coming years, driven by increasing demand for convenience foods, functional ingredients, and clean label products. Consumer preferences for natural and plant-based ingredients, along with the growing awareness of health benefits associated with gelling agents, will further fuel market expansion. With the food and beverage industry emphasizing texture, stability, and mouthfeel in products, gelling agents will continue to play a crucial role in product development. Manufacturers are likely to focus on innovation, introducing new gelling agents derived from sustainable sources to meet the evolving consumer demands for clean-label and environmentally friendly solutions. Overall, the Norway gelling agents market is poised for growth, supported by changing consumer preferences and expanding applications across various industries.

Key Highlights of the Report:

- Norway Gelling Agents Market Outlook

- Market Size of Norway Gelling Agents Market, 2024

- Forecast of Norway Gelling Agents Market, 2031

- Historical Data and Forecast of Norway Gelling Agents Revenues & Volume for the Period 2021- 2031

- Norway Gelling Agents Market Trend Evolution

- Norway Gelling Agents Market Drivers and Challenges

- Norway Gelling Agents Price Trends

- Norway Gelling Agents Porter's Five Forces

- Norway Gelling Agents Industry Life Cycle

- Historical Data and Forecast of Norway Gelling Agents Market Revenues & Volume By Nature for the Period 2021- 2031

- Historical Data and Forecast of Norway Gelling Agents Market Revenues & Volume By Conventional for the Period 2021- 2031

- Historical Data and Forecast of Norway Gelling Agents Market Revenues & Volume By Organic for the Period 2021- 2031

- Historical Data and Forecast of Norway Gelling Agents Market Revenues & Volume By Type for the Period 2021- 2031

- Historical Data and Forecast of Norway Gelling Agents Market Revenues & Volume By Natural Gelling Agents for the Period 2021- 2031

- Historical Data and Forecast of Norway Gelling Agents Market Revenues & Volume By Artificial Gelling Agents for the Period 2021- 2031

- Historical Data and Forecast of Norway Gelling Agents Market Revenues & Volume By Function for the Period 2021- 2031

- Historical Data and Forecast of Norway Gelling Agents Market Revenues & Volume By Stabilizer for the Period 2021- 2031

- Historical Data and Forecast of Norway Gelling Agents Market Revenues & Volume By Thickener for the Period 2021- 2031

- Historical Data and Forecast of Norway Gelling Agents Market Revenues & Volume By Texturizer for the Period 2021- 2031

- Historical Data and Forecast of Norway Gelling Agents Market Revenues & Volume By Emulsifier for the Period 2021- 2031

- Historical Data and Forecast of Norway Gelling Agents Market Revenues & Volume By Form for the Period 2021- 2031

- Historical Data and Forecast of Norway Gelling Agents Market Revenues & Volume By Whole for the Period 2021- 2031

- Historical Data and Forecast of Norway Gelling Agents Market Revenues & Volume By Diced/Cut for the Period 2021- 2031

- Historical Data and Forecast of Norway Gelling Agents Market Revenues & Volume By Roasted for the Period 2021- 2031

- Historical Data and Forecast of Norway Gelling Agents Market Revenues & Volume By Granular for the Period 2021- 2031

- Historical Data and Forecast of Norway Gelling Agents Market Revenues & Volume By Application for the Period 2021- 2031

- Historical Data and Forecast of Norway Gelling Agents Market Revenues & Volume By Food and Beverage for the Period 2021- 2031

- Historical Data and Forecast of Norway Gelling Agents Market Revenues & Volume By Cosmetics and Personal Care for the Period 2021- 2031

- Historical Data and Forecast of Norway Gelling Agents Market Revenues & Volume By Pharmaceuticals for the Period 2021- 2031

- Historical Data and Forecast of Norway Gelling Agents Market Revenues & Volume By Other Applications for the Period 2021- 2031

- Historical Data and Forecast of Norway Gelling Agents Market Revenues & Volume By Product type for the Period 2021- 2031

- Historical Data and Forecast of Norway Gelling Agents Market Revenues & Volume By Agar-Agar for the Period 2021- 2031

- Historical Data and Forecast of Norway Gelling Agents Market Revenues & Volume By Gellan Gum for the Period 2021- 2031

- Historical Data and Forecast of Norway Gelling Agents Market Revenues & Volume By Curdlan for the Period 2021- 2031

- Historical Data and Forecast of Norway Gelling Agents Market Revenues & Volume By Xanthan Gum for the Period 2021- 2031

- Historical Data and Forecast of Norway Gelling Agents Market Revenues & Volume By Karaya Gum for the Period 2021- 2031

- Historical Data and Forecast of Norway Gelling Agents Market Revenues & Volume By Gelatin for the Period 2021- 2031

- Historical Data and Forecast of Norway Gelling Agents Market Revenues & Volume By Pectin for the Period 2021- 2031

- Norway Gelling Agents Import Export Trade Statistics

- Market Opportunity Assessment By Nature

- Market Opportunity Assessment By Type

- Market Opportunity Assessment By Function

- Market Opportunity Assessment By Form

- Market Opportunity Assessment By Application

- Market Opportunity Assessment By Product type

- Norway Gelling Agents Top Companies Market Share

- Norway Gelling Agents Competitive Benchmarking By Technical and Operational Parameters

- Norway Gelling Agents Company Profiles

- Norway Gelling Agents Key Strategic Recommendations

Frequently Asked Questions About the Market Study (FAQs):

1 Executive Summary |

2 Introduction |

2.1 Key Highlights of the Report |

2.2 Report Description |

2.3 Market Scope & Segmentation |

2.4 Research Methodology |

2.5 Assumptions |

3 Norway Gelling Agents Market Overview |

3.1 Norway Country Macro Economic Indicators |

3.2 Norway Gelling Agents Market Revenues & Volume, 2021 & 2031F |

3.3 Norway Gelling Agents Market - Industry Life Cycle |

3.4 Norway Gelling Agents Market - Porter's Five Forces |

3.5 Norway Gelling Agents Market Revenues & Volume Share, By Nature, 2021 & 2031F |

3.6 Norway Gelling Agents Market Revenues & Volume Share, By Type, 2021 & 2031F |

3.7 Norway Gelling Agents Market Revenues & Volume Share, By Function, 2021 & 2031F |

3.8 Norway Gelling Agents Market Revenues & Volume Share, By Form, 2021 & 2031F |

3.9 Norway Gelling Agents Market Revenues & Volume Share, By Application, 2021 & 2031F |

3.10 Norway Gelling Agents Market Revenues & Volume Share, By Product type, 2021 & 2031F |

4 Norway Gelling Agents Market Dynamics |

4.1 Impact Analysis |

4.2 Market Drivers |

4.2.1 Growing demand for natural and organic gelling agents in the food industry |

4.2.2 Increasing consumer awareness about health benefits of gelling agents in pharmaceuticals and personal care products |

4.2.3 Technological advancements leading to the development of innovative gelling agent formulations |

4.3 Market Restraints |

4.3.1 Fluctuating prices of raw materials used in gelling agent production |

4.3.2 Stringent regulations and standards governing the use of gelling agents in various industries |

4.3.3 Competition from substitute products impacting market penetration |

5 Norway Gelling Agents Market Trends |

6 Norway Gelling Agents Market, By Types |

6.1 Norway Gelling Agents Market, By Nature |

6.1.1 Overview and Analysis |

6.1.2 Norway Gelling Agents Market Revenues & Volume, By Nature, 2021- 2031F |

6.1.3 Norway Gelling Agents Market Revenues & Volume, By Conventional, 2021- 2031F |

6.1.4 Norway Gelling Agents Market Revenues & Volume, By Organic, 2021- 2031F |

6.2 Norway Gelling Agents Market, By Type |

6.2.1 Overview and Analysis |

6.2.2 Norway Gelling Agents Market Revenues & Volume, By Natural Gelling Agents, 2021- 2031F |

6.2.3 Norway Gelling Agents Market Revenues & Volume, By Artificial Gelling Agents, 2021- 2031F |

6.3 Norway Gelling Agents Market, By Function |

6.3.1 Overview and Analysis |

6.3.2 Norway Gelling Agents Market Revenues & Volume, By Stabilizer, 2021- 2031F |

6.3.3 Norway Gelling Agents Market Revenues & Volume, By Thickener, 2021- 2031F |

6.3.4 Norway Gelling Agents Market Revenues & Volume, By Texturizer, 2021- 2031F |

6.3.5 Norway Gelling Agents Market Revenues & Volume, By Emulsifier, 2021- 2031F |

6.4 Norway Gelling Agents Market, By Form |

6.4.1 Overview and Analysis |

6.4.2 Norway Gelling Agents Market Revenues & Volume, By Whole, 2021- 2031F |

6.4.3 Norway Gelling Agents Market Revenues & Volume, By Diced/Cut, 2021- 2031F |

6.4.4 Norway Gelling Agents Market Revenues & Volume, By Roasted, 2021- 2031F |

6.4.5 Norway Gelling Agents Market Revenues & Volume, By Granular, 2021- 2031F |

6.5 Norway Gelling Agents Market, By Application |

6.5.1 Overview and Analysis |

6.5.2 Norway Gelling Agents Market Revenues & Volume, By Food and Beverage, 2021- 2031F |

6.5.3 Norway Gelling Agents Market Revenues & Volume, By Cosmetics and Personal Care, 2021- 2031F |

6.5.4 Norway Gelling Agents Market Revenues & Volume, By Pharmaceuticals, 2021- 2031F |

6.5.5 Norway Gelling Agents Market Revenues & Volume, By Other Applications, 2021- 2031F |

6.6 Norway Gelling Agents Market, By Product type |

6.6.1 Overview and Analysis |

6.6.2 Norway Gelling Agents Market Revenues & Volume, By Agar-Agar, 2021- 2031F |

6.6.3 Norway Gelling Agents Market Revenues & Volume, By Gellan Gum, 2021- 2031F |

6.6.4 Norway Gelling Agents Market Revenues & Volume, By Curdlan, 2021- 2031F |

6.6.5 Norway Gelling Agents Market Revenues & Volume, By Xanthan Gum, 2021- 2031F |

6.6.6 Norway Gelling Agents Market Revenues & Volume, By Karaya Gum, 2021- 2031F |

6.6.7 Norway Gelling Agents Market Revenues & Volume, By Gelatin, 2021- 2031F |

7 Norway Gelling Agents Market Import-Export Trade Statistics |

7.1 Norway Gelling Agents Market Export to Major Countries |

7.2 Norway Gelling Agents Market Imports from Major Countries |

8 Norway Gelling Agents Market Key Performance Indicators |

8.1 Research and development investment in new gelling agent formulations |

8.2 Adoption rate of natural and organic gelling agents in the market |

8.3 Number of patents filed for gelling agent technologies |

8.4 Consumer perception and acceptance of gelling agents in different product categories |

8.5 Rate of adoption of innovative gelling agent applications in various industries |

9 Norway Gelling Agents Market - Opportunity Assessment |

9.1 Norway Gelling Agents Market Opportunity Assessment, By Nature, 2021 & 2031F |

9.2 Norway Gelling Agents Market Opportunity Assessment, By Type, 2021 & 2031F |

9.3 Norway Gelling Agents Market Opportunity Assessment, By Function, 2021 & 2031F |

9.4 Norway Gelling Agents Market Opportunity Assessment, By Form, 2021 & 2031F |

9.5 Norway Gelling Agents Market Opportunity Assessment, By Application, 2021 & 2031F |

9.6 Norway Gelling Agents Market Opportunity Assessment, By Product type, 2021 & 2031F |

10 Norway Gelling Agents Market - Competitive Landscape |

10.1 Norway Gelling Agents Market Revenue Share, By Companies, 2024 |

10.2 Norway Gelling Agents Market Competitive Benchmarking, By Operating and Technical Parameters |

11 Company Profiles |

12 Recommendations |

13 Disclaimer |

Export potential assessment - trade Analytics for 2030

Export potential enables firms to identify high-growth global markets with greater confidence by combining advanced trade intelligence with a structured quantitative methodology. The framework analyzes emerging demand trends and country-level import patterns while integrating macroeconomic and trade datasets such as GDP and population forecasts, bilateral import–export flows, tariff structures, elasticity differentials between developed and developing economies, geographic distance, and import demand projections. Using weighted trade values from 2020–2024 as the base period to project country-to-country export potential for 2030, these inputs are operationalized through calculated drivers such as gravity model parameters, tariff impact factors, and projected GDP per-capita growth. Through an analysis of hidden potentials, demand hotspots, and market conditions that are most favorable to success, this method enables firms to focus on target countries, maximize returns, and global expansion with data, backed by accuracy.

By factoring in the projected importer demand gap that is currently unmet and could be potential opportunity, it identifies the potential for the Exporter (Country) among 190 countries, against the general trade analysis, which identifies the biggest importer or exporter.

To discover high-growth global markets and optimize your business strategy:

Click Here- Single User License$ 1,995

- Department License$ 2,400

- Site License$ 3,120

- Global License$ 3,795

Search

Thought Leadership and Analyst Meet

Our Clients

Related Reports

- India Switchgear Market Outlook (2026 - 2032) | Size, Share, Trends, Growth, Revenue, Forecast, Analysis, Value, Outlook

- Pakistan Contraceptive Implants Market (2025-2031) | Demand, Growth, Size, Share, Industry, Pricing Analysis, Competitive, Strategic Insights, Strategy, Consumer Insights, Analysis, Investment Trends, Opportunities, Revenue, Segments, Value, Segmentation, Supply, Forecast, Restraints, Outlook, Competition, Drivers, Trends, Companies, Challenges

- Sri Lanka Packaging Market (2026-2032) | Outlook, Competition, Drivers, Trends, Demand, Pricing Analysis, Competitive, Strategic Insights, Companies, Challenges, Strategy, Consumer Insights, Analysis, Investment Trends, Opportunities, Growth, Size, Share, Industry, Revenue, Segments, Value, Segmentation, Supply, Forecast, Restraints

- India Kids Watches Market (2026-2032) | Strategy, Consumer Insights, Analysis, Investment Trends, Opportunities, Growth, Size, Share, Industry, Revenue, Segments, Value, Segmentation, Supply, Forecast, Restraints, Outlook, Competition, Drivers, Trends, Demand, Pricing Analysis, Competitive, Strategic Insights, Companies, Challenges

- Saudi Arabia Core Assurance Service Market (2025-2031) | Strategy, Consumer Insights, Analysis, Investment Trends, Opportunities, Growth, Size, Share, Industry, Revenue, Segments, Value, Segmentation, Supply, Forecast, Restraints, Outlook, Competition, Drivers, Trends, Demand, Pricing Analysis, Competitive, Strategic Insights, Companies, Challenges

- Romania Uninterruptible Power Supply (UPS) Market (2026-2032) | Industry, Analysis, Revenue, Size, Forecast, Outlook, Value, Trends, Share, Growth & Companies

- Saudi Arabia Car Window Tinting Film, Paint Protection Film (PPF), and Ceramic Coating Market (2025-2031) | Strategy, Consumer Insights, Analysis, Investment Trends, Opportunities, Growth, Size, Share, Industry, Revenue, Segments, Value, Segmentation, Supply, Forecast, Restraints, Outlook, Competition, Drivers, Trends, Demand, Pricing Analysis, Competitive, Strategic Insights, Companies, Challenges

- South Africa Stationery Market (2025-2031) | Share, Size, Industry, Value, Growth, Revenue, Analysis, Trends, Segmentation & Outlook

- Afghanistan Rocking Chairs And Adirondack Chairs Market (2026-2032) | Size & Revenue, Competitive Landscape, Share, Segmentation, Industry, Value, Outlook, Analysis, Trends, Growth, Forecast, Companies

- Afghanistan Apparel Market (2026-2032) | Growth, Outlook, Industry, Segmentation, Forecast, Size, Companies, Trends, Value, Share, Analysis & Revenue

Industry Events and Analyst Meet

Whitepaper

- Middle East & Africa Commercial Security Market Click here to view more.

- Middle East & Africa Fire Safety Systems & Equipment Market Click here to view more.

- GCC Drone Market Click here to view more.

- Middle East Lighting Fixture Market Click here to view more.

- GCC Physical & Perimeter Security Market Click here to view more.

6WResearch In News

- Doha a strategic location for EV manufacturing hub: IPA Qatar

- Demand for luxury TVs surging in the GCC, says Samsung

- Empowering Growth: The Thriving Journey of Bangladesh’s Cable Industry

- Demand for luxury TVs surging in the GCC, says Samsung

- Video call with a traditional healer? Once unthinkable, it’s now common in South Africa

- Intelligent Buildings To Smooth GCC’s Path To Net Zero