Oman Cards Market Outlook | Companies, Industry, COVID-19 IMPACT, Value, Trends, Share, Analysis, Growth, Forecast, Size & Revenue

| Product Code: ETC259183 | Publication Date: Aug 2022 | Updated Date: Aug 2025 | Product Type: Market Research Report | |

| Publisher: 6Wresearch | Author: Sumit Sagar | No. of Pages: 75 | No. of Figures: 35 | No. of Tables: 20 |

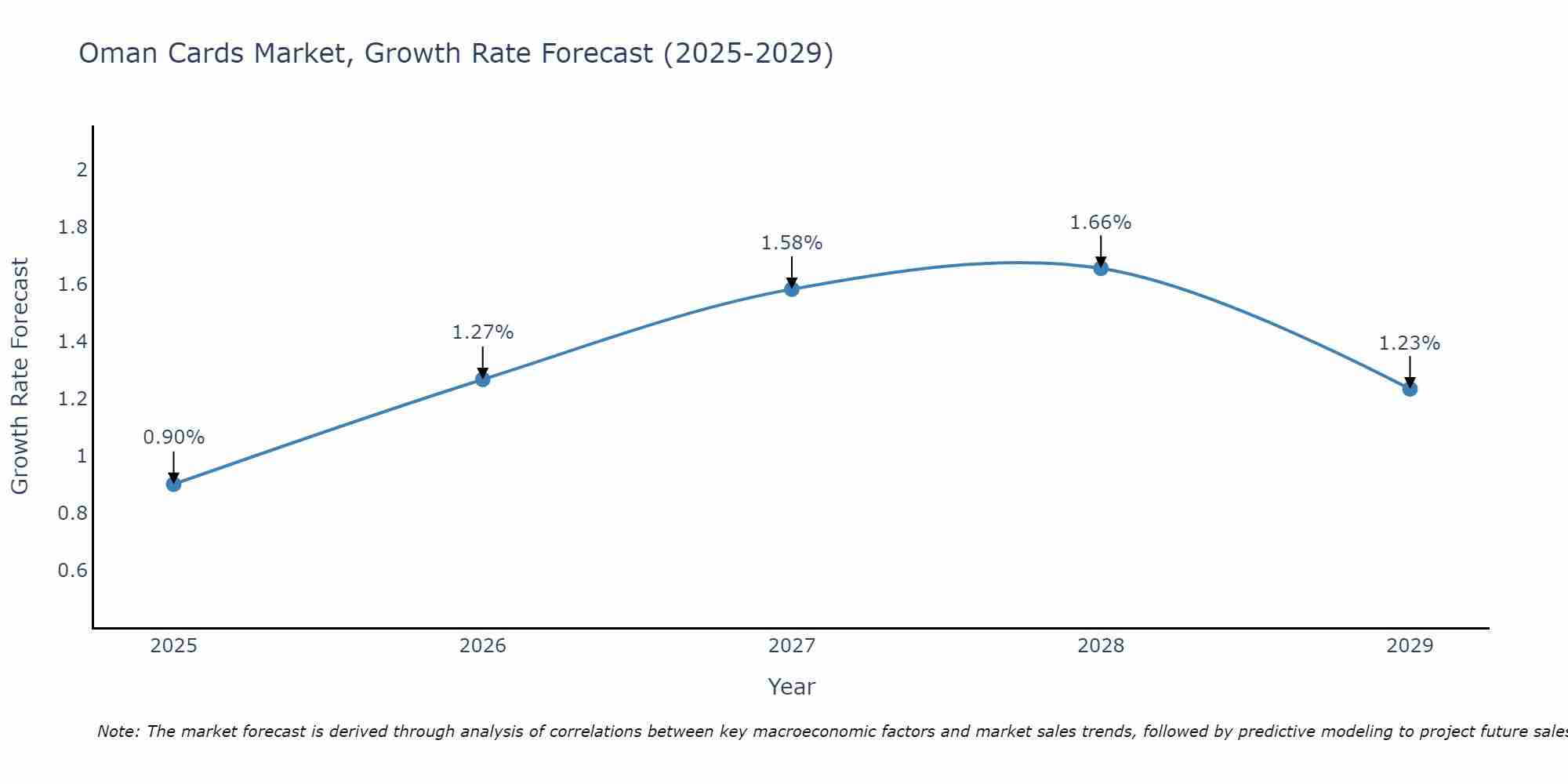

Oman Cards Market Size Growth Rate

The Oman Cards Market is projected to witness mixed growth rate patterns during 2025 to 2029. Starting at 0.90% in 2025, the market peaks at 1.66% in 2028, and settles at 1.23% by 2029.

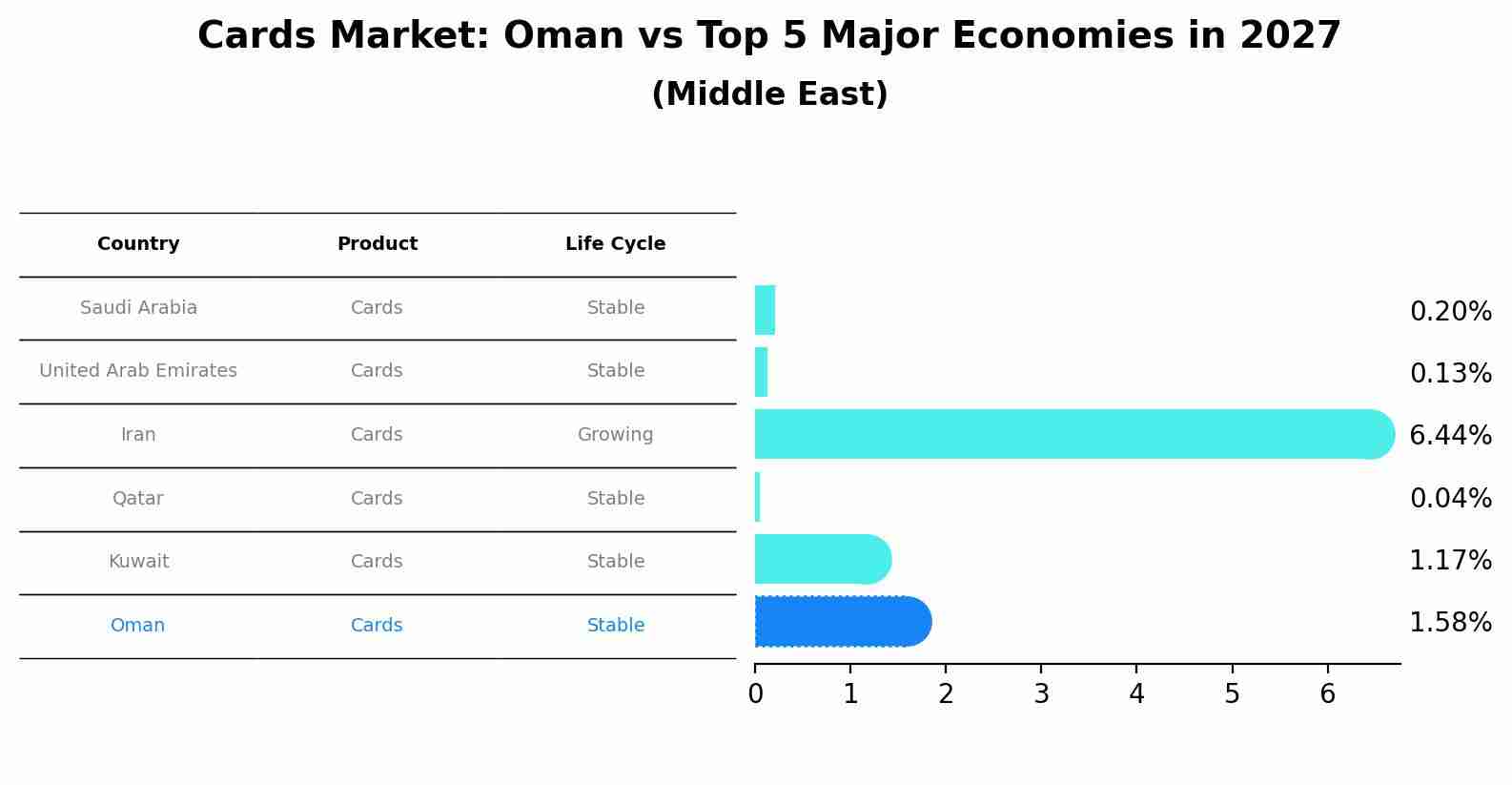

Cards Market: Oman vs Top 5 Major Economies in 2027 (Middle East)

The Cards market in Oman is projected to grow at a stable growth rate of 1.58% by 2027, within the Middle East region led by Saudi Arabia, along with other countries like United Arab Emirates, Iran, Qatar and Kuwait, collectively shaping a dynamic and evolving market environment driven by innovation and increasing adoption of emerging technologies.

Oman Cards Market Overview

The Oman Cards Market is experiencing steady growth driven by factors such as increasing adoption of digital payment methods, rising e-commerce activities, and government initiatives promoting cashless transactions. Debit cards dominate the market, followed by credit cards, with a growing preference for contactless and prepaid cards. The market is highly competitive with key players including local banks and international financial institutions offering a wide range of card products and services. Technological advancements such as mobile payments and biometric authentication are reshaping the market landscape, enhancing convenience and security for cardholders. Regulatory frameworks and collaborations between banks and fintech companies are further driving innovation in the Oman Cards Market, making it a dynamic and evolving sector poised for continued expansion.

Oman Cards Market Trends

The Oman Cards Market is witnessing several key trends. Firstly, there is a growing shift towards digital payments and contactless transactions, driven by the increasing adoption of smartphones and online shopping. Secondly, there is a rise in demand for prepaid cards, particularly among the youth and expatriate population, for budgeting and convenience. Thirdly, banks and financial institutions are focusing on enhancing card security features to combat fraud and ensure customer trust. Additionally, there is a trend towards personalized and customizable card options to cater to the diverse preferences of consumers. Overall, the Oman Cards Market is evolving towards more convenient, secure, and personalized payment solutions to meet the changing needs of consumers in the digital age.

Oman Cards Market Challenges

In the Oman Cards Market, some challenges faced include regulatory constraints and compliance requirements, limited acceptance of electronic payments in certain sectors, such as small merchants and government services, and the prevalence of cash transactions in day-to-day transactions, leading to a slow adoption of card payments. Additionally, the market faces competition from alternative payment methods, such as mobile wallets and digital payment platforms, which offer convenience and innovative features. Moreover, the lack of awareness among consumers about the benefits and security features of card payments poses a challenge in increasing card usage. Overall, overcoming these challenges would require strategic partnerships, investments in technology infrastructure, and educational campaigns to promote card usage and drive growth in the Oman Cards Market.

Oman Cards Market Investment Opportunities

The Oman Cards Market offers promising investment opportunities across various segments, including credit cards, debit cards, and prepaid cards. With increasing digitalization and a growing preference for cashless transactions among consumers, there is a rising demand for innovative payment solutions and value-added services in the market. Investors can explore opportunities in partnering with financial institutions to launch co-branded cards, introducing loyalty programs, or developing secure mobile payment solutions. Additionally, the government`s initiatives to promote financial inclusion and enhance the country`s payment infrastructure further contribute to the market`s growth potential. Investing in the Oman Cards Market presents a chance to capitalize on the evolving payment landscape and cater to the changing consumer preferences towards convenience, security, and efficiency in transactions.

Oman Cards Market Government Policy

In Oman, the government has implemented various policies to regulate the Cards Market. The Central Bank of Oman oversees the issuance and management of payment cards, ensuring compliance with regulatory standards and consumer protection. The government has introduced initiatives to promote the adoption of electronic payments, such as the National Payment System and the Oman Vision 2040 strategy, which includes digital transformation objectives. Additionally, there are regulations in place to combat fraud and enhance cybersecurity in the cards market. Overall, the government is focused on modernizing the payment ecosystem in Oman through regulatory frameworks and strategic initiatives to drive growth and financial inclusion in the Cards Market.

Oman Cards Market Future Outlook

The Oman Cards Market is poised for significant growth in the coming years, driven by increasing consumer preference for digital payments, rising adoption of contactless payment technology, and the government`s initiatives to promote a cashless economy. With a growing young population and expanding retail sector, the demand for debit, credit, and prepaid cards is expected to rise steadily. Furthermore, the introduction of innovative payment solutions such as mobile wallets and wearable technology is likely to further boost market growth. As financial inclusion efforts continue to gain momentum and the country`s infrastructure improves, the Oman Cards Market is projected to witness a surge in transaction volumes and value, presenting lucrative opportunities for card issuers, payment processors, and other stakeholders in the ecosystem.

Key Highlights of the Report:

- Oman Cards Market Outlook

- Market Size of Oman Cards Market, 2021

- Forecast of Oman Cards Market, 2031

- Historical Data and Forecast of Oman Cards Revenues & Volume for the Period 2018 - 2031

- Oman Cards Market Trend Evolution

- Oman Cards Market Drivers and Challenges

- Oman Cards Price Trends

- Oman Cards Porter's Five Forces

- Oman Cards Industry Life Cycle

- Historical Data and Forecast of Oman Cards Market Revenues & Volume By Type for the Period 2018 - 2031

- Historical Data and Forecast of Oman Cards Market Revenues & Volume By General Purpose for the Period 2018 - 2031

- Historical Data and Forecast of Oman Cards Market Revenues & Volume By Private Label for the Period 2018 - 2031

- Historical Data and Forecast of Oman Cards Market Revenues & Volume By Usage for the Period 2018 - 2031

- Historical Data and Forecast of Oman Cards Market Revenues & Volume By General Purpose Re-Loadable Card for the Period 2018 - 2031

- Historical Data and Forecast of Oman Cards Market Revenues & Volume By Government Benefit/Disbursement Card for the Period 2018 - 2031

- Historical Data and Forecast of Oman Cards Market Revenues & Volume By Payroll Card for the Period 2018 - 2031

- Historical Data and Forecast of Oman Cards Market Revenues & Volume By Others for the Period 2018 - 2031

- Historical Data and Forecast of Oman Cards Market Revenues & Volume By End-User for the Period 2018 - 2031

- Historical Data and Forecast of Oman Cards Market Revenues & Volume By Retail Establishments for the Period 2018 - 2031

- Historical Data and Forecast of Oman Cards Market Revenues & Volume By Corporate Institutions for the Period 2018 - 2031

- Historical Data and Forecast of Oman Cards Market Revenues & Volume By Government for the Period 2018 - 2031

- Historical Data and Forecast of Oman Cards Market Revenues & Volume By Financial Institutions for the Period 2018 - 2031

- Historical Data and Forecast of Oman Cards Market Revenues & Volume By Others for the Period 2018 - 2031

- Oman Cards Import Export Trade Statistics

- Market Opportunity Assessment By Type

- Market Opportunity Assessment By Usage

- Market Opportunity Assessment By End-User

- Oman Cards Top Companies Market Share

- Oman Cards Competitive Benchmarking By Technical and Operational Parameters

- Oman Cards Company Profiles

- Oman Cards Key Strategic Recommendations

Frequently Asked Questions About the Market Study (FAQs):

1 Executive Summary |

2 Introduction |

2.1 Key Highlights of the Report |

2.2 Report Description |

2.3 Market Scope & Segmentation |

2.4 Research Methodology |

2.5 Assumptions |

3 Oman Cards Market Overview |

3.1 Oman Country Macro Economic Indicators |

3.2 Oman Cards Market Revenues & Volume, 2021 & 2031F |

3.3 Oman Cards Market - Industry Life Cycle |

3.4 Oman Cards Market - Porter's Five Forces |

3.5 Oman Cards Market Revenues & Volume Share, By Type, 2021 & 2031F |

3.6 Oman Cards Market Revenues & Volume Share, By Usage, 2021 & 2031F |

3.7 Oman Cards Market Revenues & Volume Share, By End-User, 2021 & 2031F |

4 Oman Cards Market Dynamics |

4.1 Impact Analysis |

4.2 Market Drivers |

4.2.1 Increasing adoption of digital payment methods in Oman |

4.2.2 Government initiatives to promote cashless transactions |

4.2.3 Growing e-commerce industry in Oman |

4.3 Market Restraints |

4.3.1 Limited merchant acceptance of card payments |

4.3.2 Low levels of financial literacy among the population |

4.3.3 Concerns about cybersecurity and data privacy |

5 Oman Cards Market Trends |

6 Oman Cards Market, By Types |

6.1 Oman Cards Market, By Type |

6.1.1 Overview and Analysis |

6.1.2 Oman Cards Market Revenues & Volume, By Type, 2021-2031F |

6.1.3 Oman Cards Market Revenues & Volume, By General Purpose, 2021-2031F |

6.1.4 Oman Cards Market Revenues & Volume, By Private Label, 2021-2031F |

6.2 Oman Cards Market, By Usage |

6.2.1 Overview and Analysis |

6.2.2 Oman Cards Market Revenues & Volume, By General Purpose Re-Loadable Card, 2021-2031F |

6.2.3 Oman Cards Market Revenues & Volume, By Government Benefit/Disbursement Card, 2021-2031F |

6.2.4 Oman Cards Market Revenues & Volume, By Payroll Card, 2021-2031F |

6.2.5 Oman Cards Market Revenues & Volume, By Others, 2021-2031F |

6.3 Oman Cards Market, By End-User |

6.3.1 Overview and Analysis |

6.3.2 Oman Cards Market Revenues & Volume, By Retail Establishments, 2021-2031F |

6.3.3 Oman Cards Market Revenues & Volume, By Corporate Institutions, 2021-2031F |

6.3.4 Oman Cards Market Revenues & Volume, By Government, 2021-2031F |

6.3.5 Oman Cards Market Revenues & Volume, By Financial Institutions, 2021-2031F |

6.3.6 Oman Cards Market Revenues & Volume, By Others, 2021-2031F |

7 Oman Cards Market Import-Export Trade Statistics |

7.1 Oman Cards Market Export to Major Countries |

7.2 Oman Cards Market Imports from Major Countries |

8 Oman Cards Market Key Performance Indicators |

8.1 Average transaction value per card |

8.2 Number of active users of digital wallets in Oman |

8.3 Percentage of transactions made through cards compared to cash payments |

8.4 Number of new merchants accepting card payments |

8.5 Customer satisfaction rating for card payment services |

9 Oman Cards Market - Opportunity Assessment |

9.1 Oman Cards Market Opportunity Assessment, By Type, 2021 & 2031F |

9.2 Oman Cards Market Opportunity Assessment, By Usage, 2021 & 2031F |

9.3 Oman Cards Market Opportunity Assessment, By End-User, 2021 & 2031F |

10 Oman Cards Market - Competitive Landscape |

10.1 Oman Cards Market Revenue Share, By Companies, 2021 |

10.2 Oman Cards Market Competitive Benchmarking, By Operating and Technical Parameters |

11 Company Profiles |

12 Recommendations |

13 Disclaimer |

- Single User License$ 1,995

- Department License$ 2,400

- Site License$ 3,120

- Global License$ 3,795

Search

Thought Leadership and Analyst Meet

Our Clients

Related Reports

- Afghanistan Apparel Market (2026-2032) | Growth, Outlook, Industry, Segmentation, Forecast, Size, Companies, Trends, Value, Share, Analysis & Revenue

- Canada Oil and Gas Market (2026-2032) | Share, Segmentation, Value, Industry, Trends, Forecast, Analysis, Size & Revenue, Growth, Competitive Landscape, Outlook, Companies

- Germany Breakfast Food Market (2026-2032) | Industry, Share, Growth, Size, Companies, Value, Analysis, Revenue, Trends, Forecast & Outlook

- Australia Briquette Market (2025-2031) | Growth, Size, Revenue, Forecast, Analysis, Trends, Value, Share, Industry & Companies

- Vietnam System Integrator Market (2025-2031) | Size, Companies, Analysis, Industry, Value, Forecast, Growth, Trends, Revenue & Share

- ASEAN and Thailand Brain Health Supplements Market (2025-2031) | Strategy, Consumer Insights, Analysis, Investment Trends, Opportunities, Growth, Size, Share, Industry, Revenue, Segments, Value, Segmentation, Supply, Forecast, Restraints, Outlook, Competition, Drivers, Trends, Demand, Pricing Analysis, Competitive, Strategic Insights, Companies, Challenges

- ASEAN Bearings Market (2025-2031) | Strategy, Consumer Insights, Analysis, Investment Trends, Opportunities, Growth, Size, Share, Industry, Revenue, Segments, Value, Segmentation, Supply, Forecast, Restraints, Outlook, Competition, Drivers, Trends, Demand, Pricing Analysis, Competitive, Strategic Insights, Companies, Challenges

- Europe Flooring Market (2025-2031) | Outlook, Share, Industry, Trends, Forecast, Companies, Revenue, Size, Analysis, Growth & Value

- Saudi Arabia Manlift Market (2025-2031) | Outlook, Size, Growth, Trends, Companies, Industry, Revenue, Value, Share, Forecast & Analysis

- Uganda Excavator, Crane, and Wheel Loaders Market (2025-2031) | Strategy, Consumer Insights, Analysis, Investment Trends, Opportunities, Growth, Size, Share, Industry, Revenue, Segments, Value, Segmentation, Supply, Forecast, Restraints, Outlook, Competition, Drivers, Trends, Demand, Pricing Analysis, Competitive, Strategic Insights, Companies, Challenges

Industry Events and Analyst Meet

Whitepaper

- Middle East & Africa Commercial Security Market Click here to view more.

- Middle East & Africa Fire Safety Systems & Equipment Market Click here to view more.

- GCC Drone Market Click here to view more.

- Middle East Lighting Fixture Market Click here to view more.

- GCC Physical & Perimeter Security Market Click here to view more.

6WResearch In News

- Doha a strategic location for EV manufacturing hub: IPA Qatar

- Demand for luxury TVs surging in the GCC, says Samsung

- Empowering Growth: The Thriving Journey of Bangladesh’s Cable Industry

- Demand for luxury TVs surging in the GCC, says Samsung

- Video call with a traditional healer? Once unthinkable, it’s now common in South Africa

- Intelligent Buildings To Smooth GCC’s Path To Net Zero