Pakistan Stationery Market (2023-2029) | Size, Trends, Industry, Share, Revenue, Analysis, Growth, Value, Segmentation, Outlook & COVID-19 IMPACT

Market Forecast By Type (Paper Products, Writing Instruments, Office Stationery, Art & Craft Stationery), By Sales Channel (Online, Offline), By Application (Educational, Commercial, Others) and Competitive landscape

| Product Code: ETC4378012 | Publication Date: May 2023 | Updated Date: Aug 2025 | Product Type: Report | |

| Publisher: 6Wresearch | Author: Ravi Bhandari | No. of Pages: 66 | No. of Figures: 12 | No. of Tables: 4 |

Pakistan Stationery Market Synopsis

Pakistan Stationery Market was negatively affected during the COVID-19 pandemic in 2020 due to the temporary closure of educational institutions and commercial places, which led to a decrease in the sale of stationery products. However, as schools reopened, the market started to recover on the back of an upsurge in government investment in the education sector, coupled with a declining rate of student dropouts from schools, which decreased from 21.4% in 2019 to 19% in 2022.

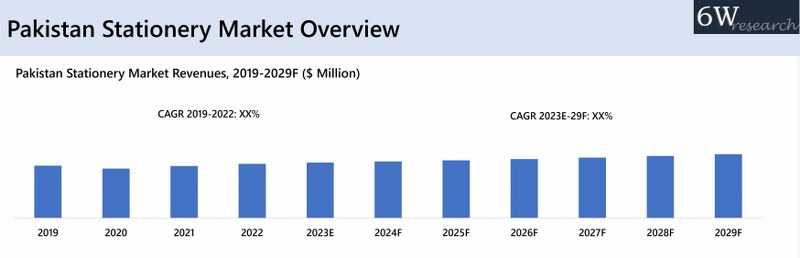

According to 6Wresearch, Pakistan Stationery Market size is projected to grow at a CAGR of 2.3% during 2023–2029. The high inflation crisis in Pakistan, which has reached a 50-year high at 35.4%, with inflation in Stationery products being at 47%, may have negative consequences for Pakistan Stationery Industry. This situation could lead to a decrease in demand for stationery products caused by high prices, which could change the competitive landscape and possibly result in smaller players leaving the market. However, Pakistan has seen a significant rise in enrolment figures for pre-primary education, with a 6.1% increase to reach 13.5 million in the academic year of 2020-21. This is projected to increase further by 6.4% to 14.4 million enrolments in the upcoming academic year of 2022-23. The trend was not limited to pre-primary education but was also observed across primary, middle, secondary/high school, higher secondary, and technical/vocational education with enrolment growth ranging from 3.9% to 8.8%. This increase in student enrolment has led to a corresponding increase in demand for stationery items, thereby contributing to the expansion of the Stationery Market in Pakistan. With a projected increase in literacy rates from 62.3% in 2022 to 70% by 2027, this would further contribute to Pakistan Stationery Market in the upcoming years.

According to 6Wresearch, Pakistan Stationery Market size is projected to grow at a CAGR of 2.3% during 2023–2029. The high inflation crisis in Pakistan, which has reached a 50-year high at 35.4%, with inflation in Stationery products being at 47%, may have negative consequences for Pakistan Stationery Industry. This situation could lead to a decrease in demand for stationery products caused by high prices, which could change the competitive landscape and possibly result in smaller players leaving the market. However, Pakistan has seen a significant rise in enrolment figures for pre-primary education, with a 6.1% increase to reach 13.5 million in the academic year of 2020-21. This is projected to increase further by 6.4% to 14.4 million enrolments in the upcoming academic year of 2022-23. The trend was not limited to pre-primary education but was also observed across primary, middle, secondary/high school, higher secondary, and technical/vocational education with enrolment growth ranging from 3.9% to 8.8%. This increase in student enrolment has led to a corresponding increase in demand for stationery items, thereby contributing to the expansion of the Stationery Market in Pakistan. With a projected increase in literacy rates from 62.3% in 2022 to 70% by 2027, this would further contribute to Pakistan Stationery Market in the upcoming years.

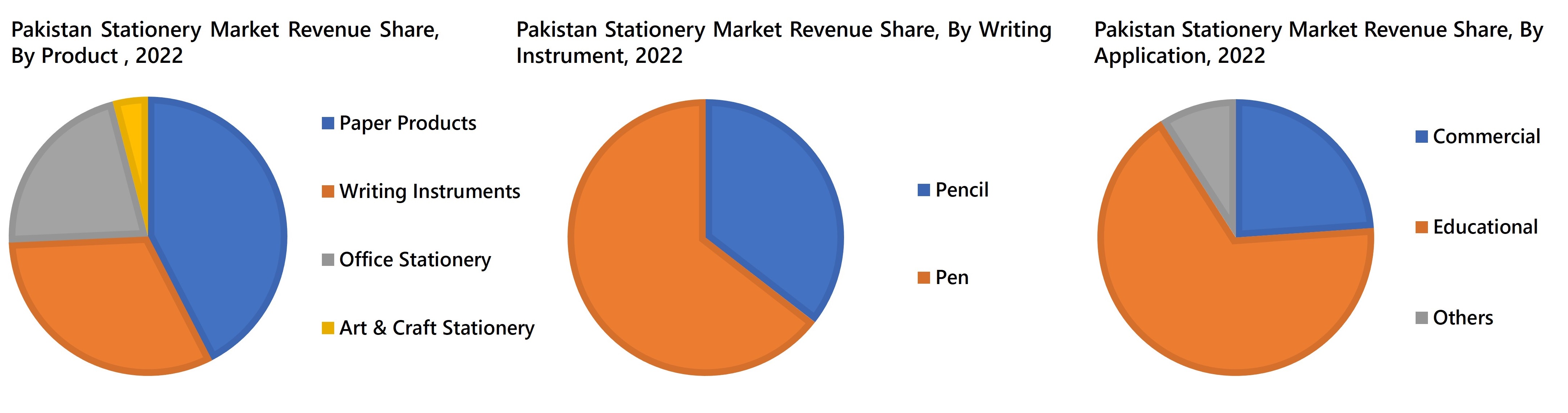

![Pakistan Stationery Market Revenue Share]() Market by Type

Market by Type

Paper products have garnered the major revenue share in the stationery market of Pakistan, owing to their extensive usage in education and office sector. Furthermore, the growing government initiatives to promote the education sector in the country with increase in the investment in tertiary sector is expected increase the number of office spaces simultaneously bolstering Pakistan Stationery Market in upcoming years.

Market by Sales Channel

Offline sales channel garnered majority share in Pakistan Stationery Market and and this trend is expected to continue in the coming years as offline store allows consumers to receive immediate assistance from sales associates who could answer queries, offer product recommendations, and provide guidance on hon the specific stationery items. Moreover, shopping at an offline store allows consumers to avoid the additional costs associated with online shopping, such as shipping fees or minimum order requirements.

Market by Application

The educational sector has acquired the major revenue share in Pakistan Stationery Market due to a rise in the number of institutions, which has grown from 187 in 2019 to 269 in 2021. Moreover, initiatives aimed at bringing back out-of-school children are being supported by organizations such as UNICEF, USAID, and various NGOs through the provision of scholarships to the most vulnerable students and by helping Pakistani universities improve the quality of education. These efforts are expected to further boost the use of stationery items in the education sector.

![Pakistan Stationery Market Opportunity Assessment]() Key Attractiveness of the Report

Key Attractiveness of the Report

- COVID-19 Impact on the Market.

- 11 Years Market Numbers.

- Historical Data Starting from 2019 to 2022.

- Base Year: 2022

- Forecast Data until 2029.

- Key Performance Indicators Impacting the Market.

- Major Upcoming Developments and Projects.

Key Highlights of the Report:

- Pakistan Stationery Market Overview

- Pakistan Stationery Market Outlook

- Pakistan Stationery Market Forecast

- Historical Data and Forecast of Pakistan Stationery Market Revenues, for the Period 2019-2029F

- Historical Data and Forecast of Pakistan Stationery Market Revenues, By Types, for the Period 2019-2029F

- Historical Data and Forecast of Pakistan Stationery Market Revenues, By Sales Channel, for the Period 2019-2029F

- Historical Data and Forecast of Pakistan Stationery Market Revenues, By Application, for the Period 2019-2029F

- Pakistan Stationery Market Revenue Share, By Market Players

- Pakistan Stationery Market Drivers and Restraints

- Pakistan Stationery Market Trends

- Pakistan Stationery Porters Five Forces

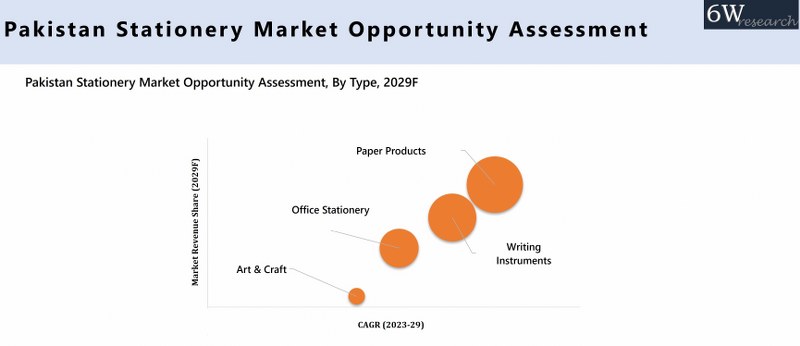

- Pakistan Stationery Opportunity Assessment, By Types, 2029F

- Pakistan Stationery Opportunity Assessment, By Sales Channel, 2029F

- Pakistan Stationery Opportunity Assessment, Application, 2029F

- Market Player’s Revenue Ranking

- Competitive Benchmarking

- Company Profiles

- Key Strategic Recommendations

Market Scope and Segmentation

Thereportprovides a detailed analysis of the following market segments:

By Type

- Paper Products

- Writing Instruments

- Office Stationery

- Art & Craft Stationery

By Sales Channel

- Online

- Offline

By Application

- Educational

- Commercial

- Others

Pakistan Stationery Market: FAQs

| 1. Executive Summary |

| 2. Introduction |

| 2.1. Report Description |

| 2.2. Key Highlights of the Report |

| 2.3. Market Scope & Segmentation |

| 2.4. Research Methodology |

| 2.5. Assumptions |

| 3. Pakistan Stationery Market Overview |

| 3.1. Pakistan Stationery Market Revenues (2019-2029F) |

| 3.2. Pakistan Stationery- Industry Life Cycle |

| 3.3. Pakistan Stationery- Porter’s Five Forces |

| 4. Pakistan Stationery Market Dynamics |

| 4.1. Impact Analysis |

| 4.2. Market Drivers |

| 4.2.1 Increasing literacy rates in Pakistan leading to higher demand for stationery products. |

| 4.2.2 Growth in the education sector, including schools, colleges, and universities, driving the need for stationery supplies. |

| 4.2.3 Rising disposable income levels among the population, allowing for increased spending on stationery items. |

| 4.3. Market Restraints |

| 4.3.1 Price volatility of raw materials used in stationery production impacting overall product costs. |

| 4.3.2 Competition from digital alternatives like tablets and e-books affecting traditional stationery sales. |

| 4.3.3 Economic instability and fluctuating exchange rates impacting consumer purchasing power. |

| 5. Pakistan Stationery Market Trends & Evolution |

| 6. Pakistan Stationery Market Overview, By Types |

| 6.1. Pakistan Stationery Market Revenue Share and Revenues, By Types (2019-2029F) |

| 6.1.1 Pakistan Stationery Market Revenues, By Paper Products (2019-2029F) |

| 6.1.2 Pakistan Stationery Market Revenues, By Office Stationery (2019-2029F) |

| 6.1.3 Pakistan Stationery Market Revenues, By Art & Craft Stationery (2019-2029F) |

| 6.1.4 Pakistan Stationery Market Revenues, By Writing Instruments (2019-2029F) |

| 6.2. Pakistan Stationery Market Revenue Share and Revenues, By Writing Instruments (2019-2029F) |

| 6.2.1 Pakistan Stationery Market Revenues, By Pencil (2019-2029F) |

| 6.2.2 Pakistan Stationery Market Revenues, By Pens (2019-2029F) |

| 6.3. Pakistan Stationery Market Revenue Share and Revenues, By Pens (2019-2029F) |

| 6.3.1 Pakistan Stationery Market Revenues, By Ball Point Pen (2019-2029F) |

| 6.3.2 Pakistan Stationery Market Revenues, By Gel Pen (2019-2029F) |

| 6.3.3 Pakistan Stationery Market Revenues, By Roller Pen (2019-2029F) |

| 6.3.4 Pakistan Stationery Market Revenues, By Fountain Pens (2019-2029F) |

| 6.3.5 Pakistan Stationery Market Revenue Share & Revenues, By Other Pens (2019-2029F) |

| 7. Pakistan Stationery Market Overview, By Sales Channel |

| 7.1. Pakistan Stationery Market Revenue Share and Revenues, By Sales Channel (2019-2029F) |

| 7.1.1 Pakistan Stationery Market Revenues, By Online (2019-2029F) |

| 7.1.2 Pakistan Stationery Market Revenues, By Offline (2019-2029F) |

| 7.2. Pakistan Stationery Market Revenue Share and Revenues, By Offline Sales Channel (2019-2029F) |

| 7.1.1 Pakistan Stationery Market Revenues, By Specialized Stores (2019-2029F) |

| 7.1.2 Pakistan Stationery Market Revenues, By Supermarkets & Hypermarkets (2019-2029F) |

| 7.1.3 Pakistan Stationery Market Revenues, By Convenient Stores (2019-2029F) |

| 7.1.4 Pakistan Stationery Market Revenues, By Others (2019-2029F) |

| 8. Pakistan Stationery Market Overview, By Application |

| 8.1. Pakistan Stationery Market Revenue Share and Revenues, By Application (2022 & 2029F) |

| 8.1.1 Pakistan Stationery Market Revenues, By Educational (2019-2029F) |

| 8.1.2 Pakistan Stationery Market Revenues, By Commercial (2019-2029F) |

| 8.1.3 Pakistan Stationery Market Revenues, By Others (2019-2029F) |

| 9. Pakistan Stationery Market Key Performance Indicators |

| 10. Pakistan Stationery Market Opportunity Assessment |

| 10.1 Pakistan Stationery Market Opportunity Assessment, By Type (2029F) |

| 10.2 Pakistan Stationery Market Opportunity Assessment, By Sales Channel (2029F) |

| 10.3 Pakistan Stationery Market Opportunity Assessment, By Application (2028F) |

| 11. Pakistan Stationery Market Competitive Landscape |

| 11.1 Pakistan Stationery Market Revenue Ranking, By Companies (2022) |

| 11.2 Pakistan Stationery Market Competitive Benchmarking, By Technical Parameter |

| 11.3 Pakistan Stationery Market Competitive Benchmarking, By Operating Parameter |

| 12. Company Profiles |

| 12.1 Indus Pencil Industries |

| 12.2 Hamdam Paper Products Pvt. Ltd. |

| 12.3 PENGUIN Stationery |

| 12.4 Bahadur Group of Industries |

| 12.5 Faber-Castell |

| 12.6 Dollar Stationery |

| 12.7 Sayyed Engineers Ltd. |

| 12.8 ORO Industries Group |

| 12.9 STABILO International GmbH |

| 12.10 MUNGYO |

| 13. Key Strategic Recommendations |

| 14. Disclaimer |

| List of Figures |

| 1. Pakistan Stationery Market Revenues & Volume, 2019-2029F ($ Million) |

| 2. Pakistan Total Number of Enrollment And Total Number of Educational Institution 2019-2021 (In Thousand) |

| 3. Pakistan Inflation Rate April 2022- March 2023 (%) |

| 4. Pakistan Stationery Market Revenue Share, By Types 2022 & 2029F |

| 5. Pakistan Stationery Market Revenue Share, By Types, Writing Instruments 2022 & 2029F |

| 6. Pakistan Stationery Market Revenue Share, By Writing Instruments, Pens 2022 & 2029F |

| 7. Pakistan Stationery Market Revenue Share, By Sales Channel 2022 & 2029F |

| 8. Pakistan Stationery Market Revenue Share, By Sales Channel, Offline 2022 & 2029F |

| 9. Pakistan Stationery Market Revenue Share, By Application 2022 & 2029F |

| 10. Pakistan Province Wise Literacy Rate 2000- 2020 (%) |

| 11. Pakistan Stationery Market Revenue Ranking, By Companies, 2022 |

| 12. Number Of Higher Education Institute City Wise, 2022 |

| List of Tables |

| 1. Pakistan Stationery Market Revenues, By Types 2019-2029F ($ Million) |

| 2. Pakistan Stationery Market Revenues, By Types, Writing Instruments 2019-2029F ($ Million) |

| 3. Pakistan Stationery Market Revenues, By Writing Instruments, Pens 2019-2029F ($ Million) |

| 4. Pakistan Stationery Market Revenues, By Sales Channel 2019-2029F ($ Million) |

| 5. Pakistan Stationery Market Revenues, By Sales Channel, Offline 2019-2029F ($ Million) |

| 6. Pakistan Stationery Market Revenues, By Applications 2019-2029F ($ Million) |

| 7. Pakistan Education Budget Distribution, 2019-2022 (Rs Million) |

Export potential assessment - trade Analytics for 2030

Export potential enables firms to identify high-growth global markets with greater confidence by combining advanced trade intelligence with a structured quantitative methodology. The framework analyzes emerging demand trends and country-level import patterns while integrating macroeconomic and trade datasets such as GDP and population forecasts, bilateral import–export flows, tariff structures, elasticity differentials between developed and developing economies, geographic distance, and import demand projections. Using weighted trade values from 2020–2024 as the base period to project country-to-country export potential for 2030, these inputs are operationalized through calculated drivers such as gravity model parameters, tariff impact factors, and projected GDP per-capita growth. Through an analysis of hidden potentials, demand hotspots, and market conditions that are most favorable to success, this method enables firms to focus on target countries, maximize returns, and global expansion with data, backed by accuracy.

By factoring in the projected importer demand gap that is currently unmet and could be potential opportunity, it identifies the potential for the Exporter (Country) among 190 countries, against the general trade analysis, which identifies the biggest importer or exporter.

To discover high-growth global markets and optimize your business strategy:

Click Here- Single User License$ 1,995

- Department License$ 2,400

- Site License$ 3,120

- Global License$ 3,795

Search

Thought Leadership and Analyst Meet

Our Clients

Related Reports

- Saudi Arabia Core Assurance Service Market (2025-2031) | Strategy, Consumer Insights, Analysis, Investment Trends, Opportunities, Growth, Size, Share, Industry, Revenue, Segments, Value, Segmentation, Supply, Forecast, Restraints, Outlook, Competition, Drivers, Trends, Demand, Pricing Analysis, Competitive, Strategic Insights, Companies, Challenges

- Romania Uninterruptible Power Supply (UPS) Market (2026-2032) | Industry, Analysis, Revenue, Size, Forecast, Outlook, Value, Trends, Share, Growth & Companies

- Saudi Arabia Car Window Tinting Film, Paint Protection Film (PPF), and Ceramic Coating Market (2025-2031) | Strategy, Consumer Insights, Analysis, Investment Trends, Opportunities, Growth, Size, Share, Industry, Revenue, Segments, Value, Segmentation, Supply, Forecast, Restraints, Outlook, Competition, Drivers, Trends, Demand, Pricing Analysis, Competitive, Strategic Insights, Companies, Challenges

- South Africa Stationery Market (2025-2031) | Share, Size, Industry, Value, Growth, Revenue, Analysis, Trends, Segmentation & Outlook

- Afghanistan Rocking Chairs And Adirondack Chairs Market (2026-2032) | Size & Revenue, Competitive Landscape, Share, Segmentation, Industry, Value, Outlook, Analysis, Trends, Growth, Forecast, Companies

- Afghanistan Apparel Market (2026-2032) | Growth, Outlook, Industry, Segmentation, Forecast, Size, Companies, Trends, Value, Share, Analysis & Revenue

- Canada Oil and Gas Market (2026-2032) | Share, Segmentation, Value, Industry, Trends, Forecast, Analysis, Size & Revenue, Growth, Competitive Landscape, Outlook, Companies

- Germany Breakfast Food Market (2026-2032) | Industry, Share, Growth, Size, Companies, Value, Analysis, Revenue, Trends, Forecast & Outlook

- Australia Briquette Market (2025-2031) | Growth, Size, Revenue, Forecast, Analysis, Trends, Value, Share, Industry & Companies

- Vietnam System Integrator Market (2026-2032) | Size, Companies, Analysis, Industry, Value, Forecast, Growth, Trends, Revenue & Share

Industry Events and Analyst Meet

Whitepaper

- Middle East & Africa Commercial Security Market Click here to view more.

- Middle East & Africa Fire Safety Systems & Equipment Market Click here to view more.

- GCC Drone Market Click here to view more.

- Middle East Lighting Fixture Market Click here to view more.

- GCC Physical & Perimeter Security Market Click here to view more.

6WResearch In News

- Doha a strategic location for EV manufacturing hub: IPA Qatar

- Demand for luxury TVs surging in the GCC, says Samsung

- Empowering Growth: The Thriving Journey of Bangladesh’s Cable Industry

- Demand for luxury TVs surging in the GCC, says Samsung

- Video call with a traditional healer? Once unthinkable, it’s now common in South Africa

- Intelligent Buildings To Smooth GCC’s Path To Net Zero