Philippines Ferromolybdenum Market (2025-2031) Outlook | Industry, Forecast, Companies, Share, Analysis, Value, Revenue, Size, Trends & Growth

| Product Code: ETC358109 | Publication Date: Aug 2022 | Updated Date: Nov 2025 | Product Type: Market Research Report | |

| Publisher: 6Wresearch | Author: Ravi Bhandari | No. of Pages: 75 | No. of Figures: 35 | No. of Tables: 20 |

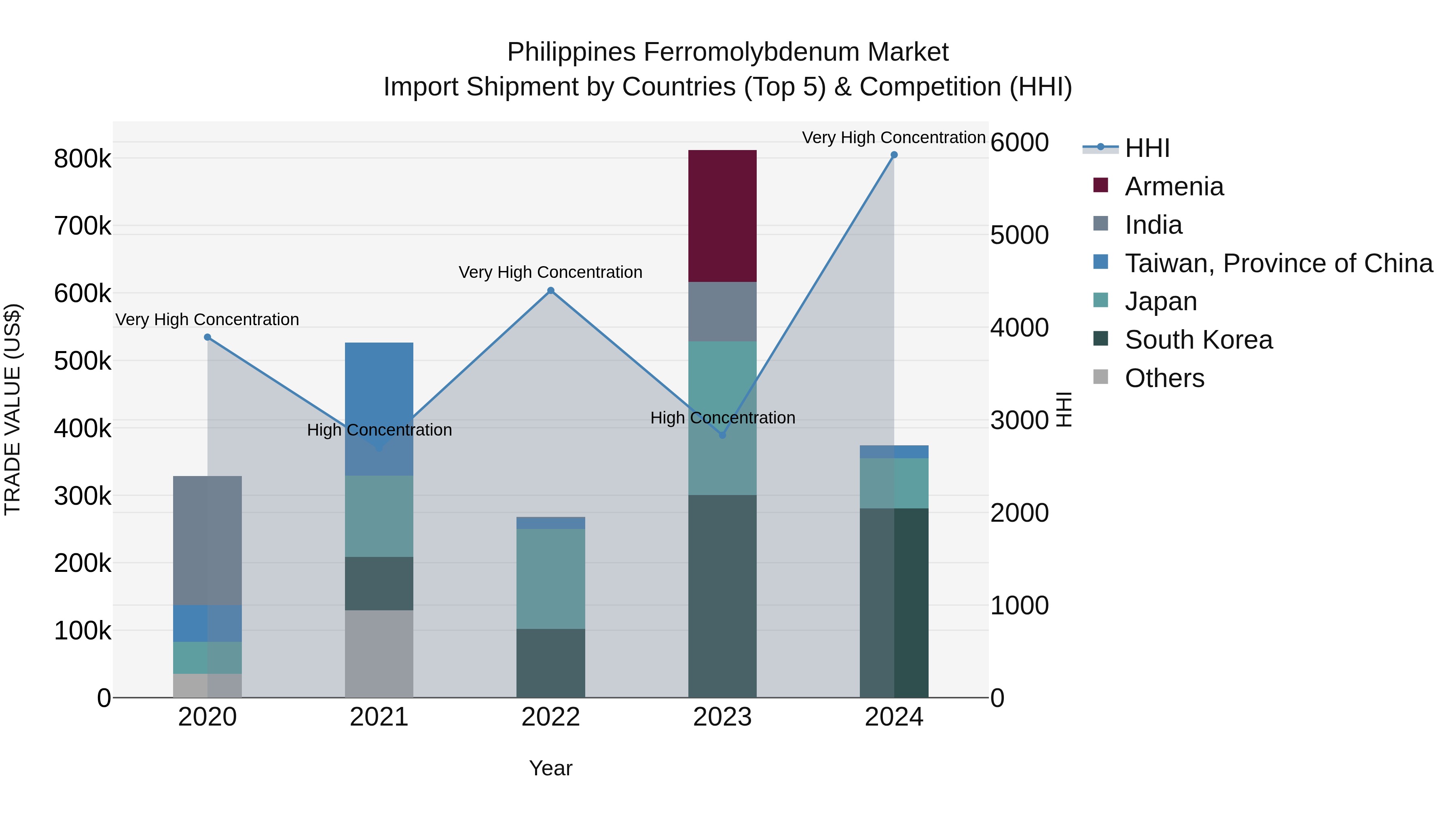

Philippines Ferromolybdenum Market Top 5 Importing Countries and Market Competition (HHI) Analysis

The Philippines saw a notable increase in ferromolybdenum import shipments in 2024, with top exporters including South Korea, Japan, and Taiwan. The market exhibited a very high concentration level, indicating a strong dominance of key players. Despite a negative growth rate in 2024, the compound annual growth rate for the period 2020-2024 remained positive at 3.28%. This suggests a stable demand for ferromolybdenum in the Philippines, with potential for further growth and market development in the coming years.

philippines ferromolybdenum market Synopsis

The ferromolybdenum market in the Philippines is estimated to be worth around USD 2 million in 2025. The country`s largest producer of ferromolybdenum is Philippine Associated Smelting and Refining Corporation (PASAR). It currently produces over 1,000 metric tons of ferromolybdenum annually. In 2025, imports from the US accounted for 54% of total sales while Japan contributed 34%. China was another major supplier with a 9% share.

Drivers of the Market

Ferromolybdenum is utilized similarly to ferrovanadium, as an alloying element in steel production. Its properties contribute to enhanced strength and corrosion resistance. The growth of construction, manufacturing, and infrastructure projects in the Philippines will impact the demand for ferromolybdenum, reflecting the need for high-performance materials.

Challenges of the Market

The ferromolybdenum market is facing some challenges like other metal markets, competition from alternative materials or technological solutions remains a concern. Economic factors such as currency fluctuations and global demand variations can influence these markets, adding complexity to their growth prospects.

COVID-19 Impact on the Market

The ferromolybdenum market faced challenges due to disruptions in steel production and manufacturing. The pandemic-induced slowdown in construction and infrastructure projects led to decreased demand for steel products containing ferromolybdenum. As economies reopened and industrial activities resumed, the market for ferromolybdenum started to stabilize and improve.

Key Players in the Market

Ferromolybdenum is another alloying element used in steel production, especially for enhancing corrosion resistance and strength. The market outlook depends on steel industry trends. Key players might include companies like Freeport-McMoRan, Rio Tinto, and suppliers specializing in ferroalloys.

Key Highlights of the Report:

- Philippines Ferromolybdenum Market Outlook

- Market Size of Philippines Ferromolybdenum Market, 2024

- Forecast of Philippines Ferromolybdenum Market, 2031

- Historical Data and Forecast of Philippines Ferromolybdenum Revenues & Volume for the Period 2021-2031

- Philippines Ferromolybdenum Market Trend Evolution

- Philippines Ferromolybdenum Market Drivers and Challenges

- Philippines Ferromolybdenum Price Trends

- Philippines Ferromolybdenum Porter's Five Forces

- Philippines Ferromolybdenum Industry Life Cycle

- Historical Data and Forecast of Philippines Ferromolybdenum Market Revenues & Volume By Type for the Period 2021-2031

- Historical Data and Forecast of Philippines Ferromolybdenum Market Revenues & Volume By 0.55 for the Period 2021-2031

- Historical Data and Forecast of Philippines Ferromolybdenum Market Revenues & Volume By 0.6 for the Period 2021-2031

- Historical Data and Forecast of Philippines Ferromolybdenum Market Revenues & Volume By 0.65 for the Period 2021-2031

- Historical Data and Forecast of Philippines Ferromolybdenum Market Revenues & Volume By 0.7 for the Period 2021-2031

- Historical Data and Forecast of Philippines Ferromolybdenum Market Revenues & Volume By Application for the Period 2021-2031

- Historical Data and Forecast of Philippines Ferromolybdenum Market Revenues & Volume By Steel Alloy Industry for the Period 2021-2031

- Historical Data and Forecast of Philippines Ferromolybdenum Market Revenues & Volume By Other for the Period 2021-2031

- Philippines Ferromolybdenum Import Export Trade Statistics

- Market Opportunity Assessment By Type

- Market Opportunity Assessment By Application

- Philippines Ferromolybdenum Top Companies Market Share

- Philippines Ferromolybdenum Competitive Benchmarking By Technical and Operational Parameters

- Philippines Ferromolybdenum Company Profiles

- Philippines Ferromolybdenum Key Strategic Recommendations

Frequently Asked Questions About the Market Study (FAQs):

- Single User License$ 1,995

- Department License$ 2,400

- Site License$ 3,120

- Global License$ 3,795

Search

Thought Leadership and Analyst Meet

Our Clients

Related Reports

- Afghanistan Rocking Chairs And Adirondack Chairs Market (2026-2032) | Size & Revenue, Competitive Landscape, Share, Segmentation, Industry, Value, Outlook, Analysis, Trends, Growth, Forecast, Companies

- Afghanistan Apparel Market (2026-2032) | Growth, Outlook, Industry, Segmentation, Forecast, Size, Companies, Trends, Value, Share, Analysis & Revenue

- Canada Oil and Gas Market (2026-2032) | Share, Segmentation, Value, Industry, Trends, Forecast, Analysis, Size & Revenue, Growth, Competitive Landscape, Outlook, Companies

- Germany Breakfast Food Market (2026-2032) | Industry, Share, Growth, Size, Companies, Value, Analysis, Revenue, Trends, Forecast & Outlook

- Australia Briquette Market (2025-2031) | Growth, Size, Revenue, Forecast, Analysis, Trends, Value, Share, Industry & Companies

- Vietnam System Integrator Market (2025-2031) | Size, Companies, Analysis, Industry, Value, Forecast, Growth, Trends, Revenue & Share

- ASEAN and Thailand Brain Health Supplements Market (2025-2031) | Strategy, Consumer Insights, Analysis, Investment Trends, Opportunities, Growth, Size, Share, Industry, Revenue, Segments, Value, Segmentation, Supply, Forecast, Restraints, Outlook, Competition, Drivers, Trends, Demand, Pricing Analysis, Competitive, Strategic Insights, Companies, Challenges

- ASEAN Bearings Market (2025-2031) | Strategy, Consumer Insights, Analysis, Investment Trends, Opportunities, Growth, Size, Share, Industry, Revenue, Segments, Value, Segmentation, Supply, Forecast, Restraints, Outlook, Competition, Drivers, Trends, Demand, Pricing Analysis, Competitive, Strategic Insights, Companies, Challenges

- Europe Flooring Market (2025-2031) | Outlook, Share, Industry, Trends, Forecast, Companies, Revenue, Size, Analysis, Growth & Value

- Saudi Arabia Manlift Market (2025-2031) | Outlook, Size, Growth, Trends, Companies, Industry, Revenue, Value, Share, Forecast & Analysis

Industry Events and Analyst Meet

Whitepaper

- Middle East & Africa Commercial Security Market Click here to view more.

- Middle East & Africa Fire Safety Systems & Equipment Market Click here to view more.

- GCC Drone Market Click here to view more.

- Middle East Lighting Fixture Market Click here to view more.

- GCC Physical & Perimeter Security Market Click here to view more.

6WResearch In News

- Doha a strategic location for EV manufacturing hub: IPA Qatar

- Demand for luxury TVs surging in the GCC, says Samsung

- Empowering Growth: The Thriving Journey of Bangladesh’s Cable Industry

- Demand for luxury TVs surging in the GCC, says Samsung

- Video call with a traditional healer? Once unthinkable, it’s now common in South Africa

- Intelligent Buildings To Smooth GCC’s Path To Net Zero