Philippines Wall Covering Market (2025-2031) | Forecast, Industry, Size & Revenue, Competitive Landscape, Companies, Analysis, Share, Outlook, Trends, Growth, Segmentation, Value

Market Forecast By Type (Wallpaper, Wood Wall Covering, Ceramic Wall Covering, Wall Panels, Others), By Application (Residential, Commercial) And Competitive Landscape

| Product Code: ETC8854488 | Publication Date: Sep 2024 | Updated Date: Oct 2025 | Product Type: Market Research Report | |

| Publisher: 6Wresearch | Author: Ravi Bhandari | No. of Pages: 65 | No. of Figures: 15 | No. of Tables: 5 |

Topics Covered in Philippines Wall Covering Market Report

Philippines Wall Covering Market Report thoroughly covers the market by type and end-user. Philippines Wall Covering Market Outlook report provides an unbiased and detailed analysis of the ongoing Philippines Wall Covering Market trends, opportunities/high growth areas, and market drivers. This would help stakeholders devise and align their market strategies according to the current and future market dynamics.

Philippines Wall Covering Market Synopsis

The Philippines wall covering market has been experiencing growth in recent years due to rapid urbanization, expansion of the real estate sector, and increasing demand for aesthetic home and office interiors. Additionally, the residential and commercial construction projects which are completing in 2025 such as Masters Tower Cebu, Shang One Horizon and Pavilions has been expected to drive demand for wall coverings in the Philippines, as new residential and commercial spaces require interior finishes.

Further government programs, such as the “Build, Build, Build” infrastructure initiative and green building certifications such as the BERDE (Philippine Green Building Council) and LEED standards has further influenced the demand for eco-friendly wall coverings. Moreover, the growing preference for low-maintenance and high-performance materials in infrastructure projects such as the Mactan-Cebu International Airport expansion and MRT-reflects the demand for durable and visually appealing wall finishes. And boosting demand for wall coverings materials, including paints, wallpapers, and cladding. This period also saw increased foreign direct investments (FDI) from countries such as China and Japan, which stimulated the development of malls, hotels, and office spaces, all contributing to the higher consumption of wall coverings.

According to 6Wresearch, Philippines wall covering market size is projected to grow at a CAGR of 4.8% and 3.5% in terms of revenues and volume respectively during 2025-2031, supported by long-term urbanization trends and sustainability efforts. Also, the government’s AmBisyon Natin 2040 vision, which focuses on inclusive and sustainable development, would encourage the adoption of green building materials, including eco-friendly wall coverings. Additionally, the growing industrial sector would be assisting in the growth of the wall covering market in coming years. For instance, the delivery of almost 400 hectares of new industrial space in the CALABARZON area from 2025 to 2027, coupled with developments in Central Luzon, particularly in Pampanga, Tarlac, and Bataan would provide additional opportunities for wall covering manufacturers.

Furthermore, the growth in retail space has been expected to continue with an additional 160,000 sqm of space projected in 2025, creating a sustained demand for high-end wall coverings in both new and renovated stores. Also, the rise of smart homes and advanced technologies would influence the wall covering market, especially in luxury housing segments. With more than 4 million households in the Philippines expected to own smart home devices by 2026, demand for wall coverings that offer features such as soundproofing, energy efficiency, and integration with modern technology would increase. This trend would be pushing the development of innovative, tech-integrated wall finishes.

Market Segmentation By Type

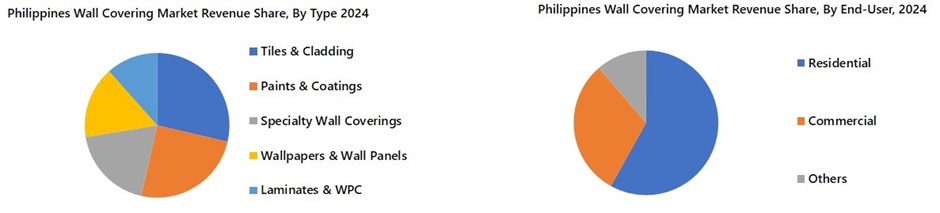

Tiles & cladding segment is expected to retain the largest revenue size in 2031, driven by ongoing infrastructure development, urbanization, and a growing preference for aesthetically appealing and durable building materials, and paints & coatings segment is expected to retain the largest volume size in 2031 due to their widespread use in new builds, renovations, and protective applications. However, specialty wall coverings segment is projected to be the fastest-growing segment in both revenue and volume terms during 2025-2031 due to rising demand for premium aesthetics, acoustic solutions, and eco-friendly materials in residential and commercial interiors. Increasing adoption in luxury projects and hotels is also boosting growth. Decorative concrete, as part of specialty wall coverings segment, is gaining traction for its modern appeal, durability, and customizability in design-centric applications.

Market Segmentation By End-User

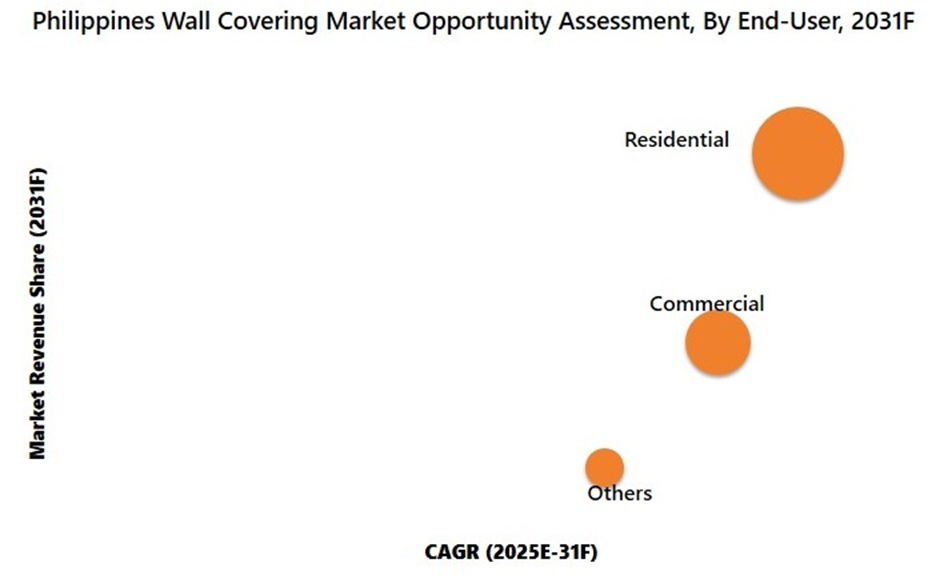

Residential segment would continue to dominate the Philippines wall covering market in revenue share in 2031 and would have fastest growth during 2025-2031 due to rapid urbanization and a rising number of housing developments driven by population growth. Government initiatives promoting affordable housing and vertical living projects “National Housing Authority’s BALAI Program” which ensures stable and high-value demand across urban and semi-urban regions, further support demand. Increasing disposable income and evolving lifestyle preferences are encouraging homeowners to invest in aesthetic and functional interior solutions. The trend of home renovation and DIY improvements is also fueling the segment. Additionally, the shift toward sustainable and stylish wall coverings aligns well with modern residential preferences, driving growth.

Key Attractiveness of the Report

- 10 Years Market Numbers.

- Historical Data Starting from 2021 to 2024

- Base Year: 2024

- Forecast Data until 2031

- Key Performance Indicators Impacting the Market.

- Major Upcoming Developments and Projects.

Key Highlights of the Report:

- Philippines Wall Covering Market Overview

- Philippines Wall Covering Market Outlook

- Philippines Wall Covering Market Forecast

- Historical Data and Forecast of Philippines Wall Covering Market Revenues and Volume for the Period 2021-2031F

- Historical Data and Forecast of Market Revenues and Volume, By Type, for the Period 2021-2031F

- Historical Data and Forecast of Market Revenues, By End-User, for the Period 2021-2031F

- Philippines Wall Covering Market Drivers and Restraints

- Industry Life Cycle

- Porter’s Five Force Analysis

- Philippines Wall Covering Market Trends & Evolution

- Market Opportunity Assessment

- Philippines Wall Covering Market Revenue Ranking, By Top 3 Companies

- Competitive Benchmarking

- Company Profiles

- Key Strategic Recommendations

Market Scope and Segmentation

Thereportprovides a detailed analysis of the following market segments:

By Type

- Wallpaper

- Wood Wall Covering

- Ceramic Wall Covering

- Wall Panels

- Others

By Application

- Residential

- Commercial

Philippines Wall Covering Market (2025-2031): FAQs

| 1. Executive Summary |

| 2. Introduction |

| 2.1. Report Description |

| 2.2. Key Highlights of the Report |

| 2.3. Market Scope & Segmentation |

| 2.4. Research Methodology |

| 2.5. Assumptions |

| 3. Philippines Wall Covering Market Overview |

| 3.1. Philippines Wall Covering Market Revenues and Volume, 2021-2031F |

| 3.2. Philippines Wall Covering Market – Industry Life Cycle |

| 3.3. Philippines Wall Covering Market – Porter’s Five Forces |

| 4. Philippines Wall Covering Market Dynamics |

| 4.1. Impact Analysis |

| 4.2. Market Drivers |

| 4.2.1 Growing demand for aesthetically pleasing interiors in residential and commercial spaces |

| 4.2.2 Increasing urbanization and infrastructure development projects in the Philippines |

| 4.2.3 Rising disposable income leading to higher spending on home decor and renovation |

| 4.3. Market Restraints |

| 4.3.1 Volatile raw material prices impacting production costs |

| 4.3.2 Intense competition from alternative wall covering solutions like paint and wallpaper |

| 4.3.3 Economic uncertainties affecting consumer spending on non-essential items |

| 5. Philippines Wall Covering Market Trends |

| 6. Philippines Wall Covering Market Overview, By Type |

| 6.1. Philippines Wall Covering Market Revenue Share and Volume Share, By Type, 2024 & 2031F |

| 6.2. Philippines Wall Covering Market Revenues and Volume, By Type, 2021- 2031F |

| 6.2.1 Philippines Wall Covering Market Revenues and Volume, By Paints & Coatings, 2021- 2031F |

| 6.2.2 Philippines Wall Covering Market Revenues and Volume, By Wallpapers & Wall Panels, 2021- 2031F |

| 6.2.3 Philippines Wall Covering Market Revenues and Volume, By Tiles & Cladding, 2021- 2031F |

| 6.2.4 Philippines Wall Covering Market Revenues and Volume, By Laminates & WPC (Wood-Plastic Composites), 2021- 2031F |

| 6.2.5 Philippines Wall Covering Market Revenues and Volume, By Specialty Wall Coverings, 2021- 2031F |

| 7. Philippines Wall Covering Market Overview, By End-User |

| 7.1 Philippines Wall Covering Market Revenue Share, By End-User, 2024 & 2031F |

| 7.1.1 Philippines Wall Covering Market Revenues, By Residential, 2021- 2031F |

| 7.1.2 Philippines Wall Covering Market Revenues, By Commercial, 2021- 2031F |

| 7.1.3 Philippines Wall Covering Market Revenues, By Others, 2021- 2031F |

| 8. Philippines Wall Covering Market Key Performance Indicators |

| 8.1 Number of new construction projects in the Philippines |

| 8.2 Average spending on home renovation per household |

| 8.3 Adoption rate of eco-friendly and sustainable wall covering materials |

| 9. Philippines Wall Covering Market Opportunity Assessment |

| 9.1 Philippines Wall Covering Market Opportunity Assessment, By Type, 2031F |

| 9.2 Philippines Wall Covering Market Opportunity Assessment, By End-User, 2031F |

| 10. Philippines Wall Covering Market Competitive Landscape |

| 10.1 Philippines Wall Covering Market Revenue Ranking, By Top 3 Companies, CY2024 |

| 10.2 Philippines Wall Covering Market Key Companies Competitive Benchmarking, By Operating Parameters |

| 10.3 Philippines Wall Covering Market Key Companies Competitive Benchmarking, By Technical Parameters |

| 11. Company Profiles |

| 11.1 Mariwasa Siam Ceramics Inc. |

| 11.2 Saint-Gobain Philippines |

| 11.3 Asian Coatings Phils., Inc. |

| 11.4 Guangzhou Hengde Green Material Co., Ltd. (MATECO) |

| 11.5 Len-Tex Corporation |

| 11.6 Arte International |

| 11.7 Benjamin Moore Philippines |

| 11.8 Grandeco Wallfashion Group Belgium NV |

| 11.9 J. Josephson, Inc. |

| 11.10 Marazzi Group S.r.l. |

| 11.11 Wallquest Inc. |

| 11.12 Machuca Tile, Inc. |

| 12. Key Strategic Recommendations |

| 13. Disclaimer |

| List of Figures |

| 1. Philippines Wall Covering Market Revenues and Volume, 2021-2031F ($ Million, Million SQM) |

| 2. Total Metro Manila Offices Supply Per Submarket in Philippines, 2024 & 2028F (in 1000 Units) |

| 3. Philippines Office Spaces Under Green-certified Buildings, 2024-2029F |

| 4. Philippines Number of Infrastructure Flagship Projects, By Sectors, As of Jan 2025 |

| 5. Philippines Public Spending on Infrastructure, 2024-2028F (in Billion) |

| 6. Philippines Wall Covering Market Revenue Share, By Type, 2024 & 2031F |

| 7. Philippines Wall Covering Market Volume Share, By Type, 2024 & 2031F |

| 8. Philippines Wall Covering Market Revenue Share, By End-User, 2024 & 2031F |

| 9. Philippines Metro Manila Condominium Residential Stock, 2022- 2026F (in 1000) |

| 10. Philippines Residential Approved Building Permits, October Oct 2023 & Oct 24 |

| 11. Philippines Metro Manila’s Total Number of Condominium Units, 2022-2025E (in 1000) |

| 12. Philippines Wall Covering Market Opportunity Assessment, By Type-Revenue Outlook, 2031F |

| 13. Philippines Wall Covering Market Opportunity Assessment, By Type-Volume Outlook, 2031F |

| 14. Philippines Wall Covering Market Opportunity Assessment, By End-User, 2031F |

| 15. Philippines Wall Covering Market Revenue Ranking, By Companies, CY2024 |

| List of Table |

| 1. Philippines Upcoming Branded Hotel Projects |

| 2. Philippines Major Ongoing Commercial Infrastructure Projects, 2025E-2026F |

| 3. Philippines Wall Covering Market Revenues, By Type, 2021-2031F ($ Million) |

| 4. Philippines Wall Covering Market Volume, By Type, 2021-2031F (Units) |

| 5. Philippines Wall Covering Market Revenues, By End-User, 2021-2031F ($ Million) |

Export potential assessment - trade Analytics for 2030

Export potential enables firms to identify high-growth global markets with greater confidence by combining advanced trade intelligence with a structured quantitative methodology. The framework analyzes emerging demand trends and country-level import patterns while integrating macroeconomic and trade datasets such as GDP and population forecasts, bilateral import–export flows, tariff structures, elasticity differentials between developed and developing economies, geographic distance, and import demand projections. Using weighted trade values from 2020–2024 as the base period to project country-to-country export potential for 2030, these inputs are operationalized through calculated drivers such as gravity model parameters, tariff impact factors, and projected GDP per-capita growth. Through an analysis of hidden potentials, demand hotspots, and market conditions that are most favorable to success, this method enables firms to focus on target countries, maximize returns, and global expansion with data, backed by accuracy.

By factoring in the projected importer demand gap that is currently unmet and could be potential opportunity, it identifies the potential for the Exporter (Country) among 190 countries, against the general trade analysis, which identifies the biggest importer or exporter.

To discover high-growth global markets and optimize your business strategy:

Click Here- Single User License$ 1,995

- Department License$ 2,400

- Site License$ 3,120

- Global License$ 3,795

Search

Thought Leadership and Analyst Meet

Our Clients

Related Reports

- India Switchgear Market Outlook (2026 - 2032) | Size, Share, Trends, Growth, Revenue, Forecast, Analysis, Value, Outlook

- Pakistan Contraceptive Implants Market (2025-2031) | Demand, Growth, Size, Share, Industry, Pricing Analysis, Competitive, Strategic Insights, Strategy, Consumer Insights, Analysis, Investment Trends, Opportunities, Revenue, Segments, Value, Segmentation, Supply, Forecast, Restraints, Outlook, Competition, Drivers, Trends, Companies, Challenges

- Sri Lanka Packaging Market (2026-2032) | Outlook, Competition, Drivers, Trends, Demand, Pricing Analysis, Competitive, Strategic Insights, Companies, Challenges, Strategy, Consumer Insights, Analysis, Investment Trends, Opportunities, Growth, Size, Share, Industry, Revenue, Segments, Value, Segmentation, Supply, Forecast, Restraints

- India Kids Watches Market (2026-2032) | Strategy, Consumer Insights, Analysis, Investment Trends, Opportunities, Growth, Size, Share, Industry, Revenue, Segments, Value, Segmentation, Supply, Forecast, Restraints, Outlook, Competition, Drivers, Trends, Demand, Pricing Analysis, Competitive, Strategic Insights, Companies, Challenges

- Saudi Arabia Core Assurance Service Market (2025-2031) | Strategy, Consumer Insights, Analysis, Investment Trends, Opportunities, Growth, Size, Share, Industry, Revenue, Segments, Value, Segmentation, Supply, Forecast, Restraints, Outlook, Competition, Drivers, Trends, Demand, Pricing Analysis, Competitive, Strategic Insights, Companies, Challenges

- Romania Uninterruptible Power Supply (UPS) Market (2026-2032) | Industry, Analysis, Revenue, Size, Forecast, Outlook, Value, Trends, Share, Growth & Companies

- Saudi Arabia Car Window Tinting Film, Paint Protection Film (PPF), and Ceramic Coating Market (2025-2031) | Strategy, Consumer Insights, Analysis, Investment Trends, Opportunities, Growth, Size, Share, Industry, Revenue, Segments, Value, Segmentation, Supply, Forecast, Restraints, Outlook, Competition, Drivers, Trends, Demand, Pricing Analysis, Competitive, Strategic Insights, Companies, Challenges

- South Africa Stationery Market (2025-2031) | Share, Size, Industry, Value, Growth, Revenue, Analysis, Trends, Segmentation & Outlook

- Afghanistan Rocking Chairs And Adirondack Chairs Market (2026-2032) | Size & Revenue, Competitive Landscape, Share, Segmentation, Industry, Value, Outlook, Analysis, Trends, Growth, Forecast, Companies

- Afghanistan Apparel Market (2026-2032) | Growth, Outlook, Industry, Segmentation, Forecast, Size, Companies, Trends, Value, Share, Analysis & Revenue

Industry Events and Analyst Meet

Whitepaper

- Middle East & Africa Commercial Security Market Click here to view more.

- Middle East & Africa Fire Safety Systems & Equipment Market Click here to view more.

- GCC Drone Market Click here to view more.

- Middle East Lighting Fixture Market Click here to view more.

- GCC Physical & Perimeter Security Market Click here to view more.

6WResearch In News

- Doha a strategic location for EV manufacturing hub: IPA Qatar

- Demand for luxury TVs surging in the GCC, says Samsung

- Empowering Growth: The Thriving Journey of Bangladesh’s Cable Industry

- Demand for luxury TVs surging in the GCC, says Samsung

- Video call with a traditional healer? Once unthinkable, it’s now common in South Africa

- Intelligent Buildings To Smooth GCC’s Path To Net Zero