Poland Agricultural Tractors Market (2025-2031) | Analysis, Size, Forecast, Outlook, Growth, Share, Revenue, Value, Trends, Segmentation

Market Forecast By Drive Type (Two-wheel drive, Four-wheel drive), By System Type (Without loaders, Front loaders, Backhoe loaders), By Design Type (Tractor without CAB, Tractor with CAB), By Power Output (<30 hp, 31-100 hp, 101-200 hp, 201-300 hp, >300 hp), By Applications (Row Crop Tractors, Orchard Tractors, Other Applications) And Competitive Landscape

| Product Code: ETC025535 | Publication Date: Oct 2020 | Updated Date: Jan 2025 | Product Type: Report | |

| Publisher: 6Wresearch | Author: Ravi Bhandari | No. of Pages: 70 | No. of Figures: 35 | No. of Tables: 5 |

Poland Agricultural Tractors Market | Country-Wise Share and Competition Analysis

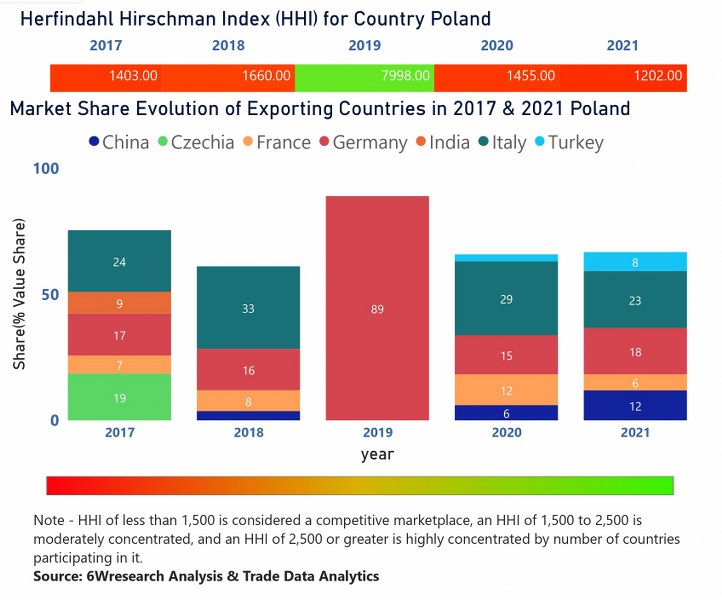

In the year 2021, Italy was the largest exporter in terms of value, followed by Germany. It has registered a growth of 10.55% over the previous year. While Germany registered a growth of 70.61% over the previous year. While in 2017 Italy was the largest exporter followed by Czechia. In terms of the Herfindahl Index, which measures the competitiveness of countries exporting, Poland has a Herfindahl index of 1403 in 2017 which signifies high competitiveness while in 2021 it registered a Herfindahl index of 1202 which signifies high competitiveness in the market

![Poland Agricultural Tractors Market Country-Wise Share and Competition Analysis]() Poland Agricultural Tractors Market - Export Market Opportunities

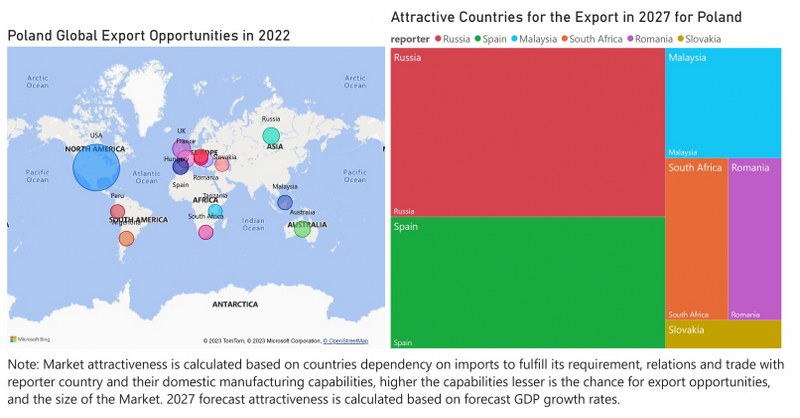

Poland Agricultural Tractors Market - Export Market Opportunities![Poland Agricultural Tractors Market - Export Market Opportunities]()

Latest 2023 Developments of the Poland Agricultural Tractors Market

The Poland Agricultural Tractors Market is witnessing growth owing to a number of developments. The rise in demand for advanced tractors in the country is amongst the major developments of the market. Advanced tractors are the ones that are prepared with smart technologies such as precision farming as well as GPS. Such technologies have made it easy for farmers to manage their fields effectively by providing real-time data on crop yields, weather conditions, and soil moisture levels. The advent of electric tractors is another major development of the market. There is a push towards sustainable agriculture practices with a focus on climate change and air pollution growing worldwide. Electric tractors are eco-friendly options to conventional gasoline-powered ones and they also offer a number of benefits like decreased noise pollution and lower operating costs, which highly supports stimulating the Poland Agricultural Tractors Market Share.

Poland Agricultural Tractors Market Highlights

| Report Name | Poland Agricultural Tractors Market |

| Forecast period | 2025-2031 |

| CAGR | 5.5% |

| Growing Sector | Agriculture |

Topics Covered in the Poland Agricultural Tractors Market Report

Poland Agricultural Tractors Market report thoroughly covers the drive type, system type, design type, power output and application. The market report provides an unbiased and detailed analysis of the ongoing market trends, opportunities/high growth areas, and market drivers which would help the stakeholders to devise and align their market strategies according to the current and future market dynamics.

Poland Agricultural Tractors Market Synopsis

The growing use of cutting-edge agricultural techniques and technology is one of the main reasons propelling the Poland agricultural Tractors market's expansion. In order to increase their production and efficiency, Polish farmers are investing in tractors as they become more aware of the necessity for mechanization. Furthermore, it is anticipated that government programs to encourage modernized agriculture will help fuel market expansion.

According to 6Wresearch, the Poland Agricultural Tractors Market revenue is expected to reach at a significant CAGR of 5.5% during the forecast period 2025-2031. In Poland, the agricultural Tractors market is driven by several key factors. The country's commitment to agricultural modernization and sustainability plays a pivotal role, with both government and EU subsidies supporting farmers in acquiring modern equipment. The rise in demand for efficient and versatile tractors is further propelled by the growing emphasis on operational efficiency and productivity in farming practices. Additionally, the increasing adoption of precision agriculture technologies enhances the demand for advanced machinery that can support such systems, leading to the Poland Agricultural Tractors Market growth.

Despite the drivers, the market faces a number of challenges. Economic volatility, including fluctuating agricultural commodity prices, can affect farmers' purchasing power and investment capabilities. Furthermore, stringent environmental regulations require manufacturers to innovate continually, which may lead to increased costs. Another challenge is the ageing farmer population, which can slow the adoption of new technologies as some older farmers may be resistant to changing traditional practices. However, efforts to educate and support farmers in the transition to modern equipment aim to mitigate these challenges over time.

Poland Agricultural Tractors Market Trends

In recent years, several notable trends have emerged within the Poland agricultural Tractors market. One of the key trends is the integration of smart technology and automation, allowing tractors to operate more efficiently with less human intervention. This movement towards technology-driven solutions aligns with broader agricultural trends such as precision farming, which relies on data and analytics to optimize crop yield and reduce resource consumption. Additionally, there is a growing focus on sustainability, with a shift towards tractors that offer reduced emissions and enhanced fuel efficiency.

Investment Opportunities in the Poland Agricultural Tractors Market

The Poland agricultural Tractors market also presents opportunities through partnerships and collaborations with local agricultural institutions and research bodies. By engaging with these entities, investors can tap into innovative research and development projects that are tailored to Poland's agronomic conditions. Furthermore, with an increasing demand for custom solutions to address diverse farming needs in the country, businesses that provide complementary services, such as maintenance, training, and spare parts distribution, can find lucrative prospects. The integration of IoT and AI in agricultural equipment also opens avenues for tech-driven startups to enter the market, providing software solutions that enhance Tractors functionality and farm management.

Leading Players of the Poland Agricultural Tractors Market

In the Poland agricultural Tractors market, several key players have established a strong presence due to their innovative products and strategic approaches. Major international brands such as John Deere, New Holland, and Massey Ferguson lead the market with their advanced Tractors models and extensive distribution networks. These companies benefit from their global expertise while tailoring their products to meet the specific needs of Polish farmers.

Government Regulations Introduced in the Poland Agricultural Tractors Market

Government regulations in the Poland agricultural Tractors market are designed to align the industry with both European Union standards and national policies aimed at sustainable farming practices. These regulations mandate compliance with stringent emission norms and safety requirements, ensuring that tractors contribute to environmental preservation while maintaining high operational safety standards. Subsidies and financial incentives are also provided to encourage the adoption of modern and eco-friendly machinery.

Future Insights of the Poland Agricultural Tractors Market

The Poland agricultural Tractors industry is poised for significant growth, driven by technological advancements and a growing focus on sustainable farming practices. The increasing adoption of precision agriculture is expected to revolutionize traditional farming methods, making operations more efficient and environmentally friendly. The integration of autonomous and semi-autonomous tractors will further enhance productivity, enabling farms to manage labour shortages effectively. Furthermore, continuous investments in research and development, coupled with supportive government policies, are likely to accelerate the pace of innovation in the sector.

Market Segmentation Analysis

The report offers a comprehensive study of the subsequent market segments and their leading categories.

Four-Wheel Drive to Dominate the Market - By Drive Type

According to Ravi Bhandari, Research Head, 6wresearch, Four-wheel drive tractors are increasingly favoured by Polish farmers due to their superior traction and stability, particularly in uneven terrains and challenging weather conditions. With a growing emphasis on efficiency and productivity, 4WD tractors enable farmers to perform a wide range of tasks, from ploughing and sowing to transporting goods.

Front Loaders to dominate the market - By System Type

Front loaders are also witnessing notable growth. These attachments enhance the functionality of tractors, allowing operators to easily handle various materials, including feed, soil, and equipment. The growing focus on efficiency in agricultural operations drives the demand for tractors equipped with front loaders.

Tractors with CAB to dominate the market - By Design Type

Tractors with CAB are gaining popularity among Polish farmers. As the agricultural sector places more emphasis on safety and ergonomics, the demand for tractors with modern cabin designs is increasing. Features such as improved visibility, climate control, and reduced noise contribute to a more productive working environment, encouraging more farmers to invest in this type of Tractors.

Key Attractiveness of the Report

- 10 Years of Market Numbers.

- Historical Data Starting from 2021 to 2024.

- Base Year: 2024

- Forecast Data until 2031.

- Key Performance Indicators Impacting the Market.

- Major Upcoming Developments and Projects.

Key Highlights of the Report:

- Poland Agricultural Tractors Market Outlook

- Market Size of Poland Agricultural Tractors Market, 2024

- Forecast of Poland Agricultural Tractors Market, 2031

- Historical Data and Forecast of Poland Agricultural Tractors Revenues & Volume for the Period 2021-2031

- Poland Agricultural Tractors Market Trend Evolution

- Poland Agricultural Tractors Market Drivers and Challenges

- Poland Agricultural Tractors Price Trends

- Poland Agricultural Tractors Porter's Five Forces

- Poland Agricultural Tractors Porter's Life Cycle

- Historical Data and Forecast of Poland Agricultural Tractors Market Revenues & Volume By Drive Type for the Period 2021-2031

- Historical Data and Forecast of Poland Agricultural Tractors Market Revenues & Volume By Two-wheel Drive for the Period 2021-2031

- Historical Data and Forecast of Poland Agricultural Tractors Market Revenues & Volume By Four-wheel Drive for the Period 2021-2031

- Historical Data and Forecast of Poland Agricultural Tractors Market Revenues & Volume By System Type for the Period 2021-2031

- Historical Data and Forecast of Poland Agricultural Tractors Market Revenues & Volume By Without loaders for the Period 2021-2031

- Historical Data and Forecast of Poland Agricultural Tractors Market Revenues & Volume By Front loaders for the Period 2021-2031

- Historical Data and Forecast of Poland Agricultural Tractors Market Revenues & Volume By Backhoe loaders for the Period 2021-2031

- Historical Data and Forecast of Poland Agricultural Tractors Market Revenues & Volume By Design Type for the Period 2021-2031

- Historical Data and Forecast of Poland Agricultural Tractors Market Revenues & Volume By Tractors without CAB for the Period 2021-2031

- Historical Data and Forecast of Poland Agricultural Tractors Market Revenues & Volume By Tractors with CAB for the Period 2021-2031

- Historical Data and Forecast of Poland Agricultural Tractors Market Revenues & Volume By Power Output for the Period 2021-2031

- Historical Data and Forecast of Poland Agricultural Tractors Market Revenues & Volume By <30 hp for the Period 2021-2031

- Historical Data and Forecast of Poland Agricultural Tractors Market Revenues & Volume By 31-100 hp for the Period 2021-2031

- Historical Data and Forecast of Poland Agricultural Tractors Market Revenues & Volume By 101-200 hp for the Period 2021-2031

- Historical Data and Forecast of Poland Agricultural Tractors Market Revenues & Volume By 201-300 hp for the Period 2021-2031

- Historical Data and Forecast of Poland Agricultural Tractors Market Revenues & Volume By >300 hp for the Period 2021-2031

- Historical Data and Forecast of Poland Agricultural Tractors Market Revenues & Volume By Applications for the Period 2021-2031

- Historical Data and Forecast of Poland Agricultural Tractors Market Revenues & Volume By Row Crop Tractors for the Period 2021-2031

- Historical Data and Forecast of Poland Agricultural Tractors Market Revenues & Volume By Orchard Tractors for the Period 2021-2031

- Historical Data and Forecast of Poland Agricultural Tractors Market Revenues & Volume By Other Applications for the Period 2021-2031

- Poland Agricultural Tractors Import Export Trade Statistics

- Market Opportunity Assessment By Drive Type

- Market Opportunity Assessment By System Type

- Market Opportunity Assessment By Design Type

- Market Opportunity Assessment By Power Output

- Market Opportunity Assessment By Applications

- Poland Agricultural Tractors Top Companies Market Share

- Poland Agricultural Tractors Competitive Benchmarking By Technical and Operational Parameters

- Poland Agricultural Tractors Company Profiles

- Poland Agricultural Tractors Key Strategic Recommendations

Market Covered

The market report covers the following market segments:

By Drive Type

- Two-wheel drive

- Four-wheel drive

By System Type

- Without loaders

- Front loaders

- Backhoe loaders

By Design Type

- Tractors without CAB

- Tractors with CAB

By Power Output

- <30 hp

- 31-100 hp

- 101-200 hp

- 201-300 hp

- >300 hp

By Applications

- Row Crop Tractors

- Orchard Tractors

- Other Applications

Poland Agricultural Tractors Market 2025- 2031: FAQS

| 1 Executive Summary |

| 2 Introduction |

| 2.1 Key Highlights of the Report |

| 2.2 Report Description |

| 2.3 Market Scope & Segmentation |

| 2.4 Research Methodology |

| 2.5 Assumptions |

| 3 Poland Agricultural Tractors Market Overview |

| 3.1 Poland Agricultural Tractors Market Revenues & Volume, 2021 - 2031F |

| 3.2 Poland Agricultural Tractors Market - Industry Life Cycle |

| 3.3 Poland Agricultural Tractors Market - Porter's Five Forces |

| 3.4 Poland Agricultural Tractors Market Revenues & Volume Share, By Drive Type, 2021 & 2031F |

| 3.5 Poland Agricultural Tractors Market Revenues & Volume Share, By System Type, 2021 & 2031F |

| 3.6 Poland Agricultural Tractors Market Revenues & Volume Share, By Design Type, 2021 & 2031F |

| 3.7 Poland Agricultural Tractors Market Revenues & Volume Share, By Power Output, 2021 & 2031F |

| 3.8 Poland Agricultural Tractors Market Revenues & Volume Share, By Applications, 2021 & 2031F |

| 4 Poland Agricultural Tractors Market Dynamics |

| 4.1 Impact Analysis |

| 4.2 Market Drivers |

| 4.3 Market Restraints |

| 5 Poland Agricultural Tractors Market Trends |

| 6 Poland Agricultural Tractors Market Segmentation |

| 6.1 Poland Agricultural Tractors Market, By Drive Type |

| 6.1.1 Overview and Analysis |

| 6.1.2 Poland Agricultural Tractors Market Revenues & Volume, By Drive Type, 2021 - 2031F |

| 6.1.3 Poland Agricultural Tractors Market Revenues & Volume, By Two-wheel drive, 2021 - 2031F |

| 6.1.4 Poland Agricultural Tractors Market Revenues & Volume, By Four-wheel drive, 2021 - 2031F |

| 6.2 Poland Agricultural Tractors Market, By System Type |

| 6.2.1 Overview and Analysis |

| 6.2.2 Poland Agricultural Tractors Market Revenues & Volume, By Without loaders, 2021 - 2031F |

| 6.2.3 Poland Agricultural Tractors Market Revenues & Volume, By Front loaders, 2021 - 2031F |

| 6.2.4 Poland Agricultural Tractors Market Revenues & Volume, By Backhoe loaders, 2021 - 2031F |

| 6.3 Poland Agricultural Tractors Market, By Design Type |

| 6.3.1 Overview and Analysis |

| 6.3.2 Poland Agricultural Tractors Market Revenues & Volume, By Tractor without CAB, 2021 - 2031F |

| 6.3.3 Poland Agricultural Tractors Market Revenues & Volume, By Tractor with CAB, 2021 - 2031F |

| 6.4 Poland Agricultural Tractors Market, By Power Output |

| 6.4.1 Overview and Analysis |

| 6.4.2 Poland Agricultural Tractors Market Revenues & Volume, By <30 hp, 2021 - 2031F |

| 6.4.3 Poland Agricultural Tractors Market Revenues & Volume, By 31-100 hp, 2021 - 2031F |

| 6.4.4 Poland Agricultural Tractors Market Revenues & Volume, By 101-200 hp, 2021 - 2031F |

| 6.4.5 Poland Agricultural Tractors Market Revenues & Volume, By 201-300 hp, 2021 - 2031F |

| 6.4.6 Poland Agricultural Tractors Market Revenues & Volume, By >300 hp, 2021 - 2031F |

| 6.5 Poland Agricultural Tractors Market, By Applications |

| 6.5.1 Overview and Analysis |

| 6.5.2 Poland Agricultural Tractors Market Revenues & Volume, By Row Crop Tractors, 2021 - 2031F |

| 6.5.3 Poland Agricultural Tractors Market Revenues & Volume, By Orchard Tractors, 2021 - 2031F |

| 6.5.4 Poland Agricultural Tractors Market Revenues & Volume, By Other Applications, 2021 - 2031F |

| 7 Poland Agricultural Tractors Market Import-Export Trade Statistics |

| 7.1 Poland Agricultural Tractors Market Export to Major Countries |

| 7.2 Poland Agricultural Tractors Market Imports from Major Countries |

| 8 Poland Agricultural Tractors Market Key Performance Indicators |

| 9 Poland Agricultural Tractors Market - Opportunity Assessment |

| 9.1 Poland Agricultural Tractors Market Opportunity Assessment, By Drive Type, 2021 & 2031F |

| 9.2 Poland Agricultural Tractors Market Opportunity Assessment, By System Type, 2021 & 2031F |

| 9.3 Poland Agricultural Tractors Market Opportunity Assessment, By Design Type, 2021 & 2031F |

| 9.4 Poland Agricultural Tractors Market Opportunity Assessment, By Power Output, 2021 & 2031F |

| 9.5 Poland Agricultural Tractors Market Opportunity Assessment, By Applications, 2021 & 2031F |

| 10 Poland Agricultural Tractors Market - Competitive Landscape |

| 10.1 Poland Agricultural Tractors Market Revenue Share, By Companies, 2024 |

| 10.2 Poland Agricultural Tractors Market Competitive Benchmarking, By Operating and Technical Parameters |

| 11 Company Profiles |

| 12 Recommendations |

| 13 Disclaimer |

- Single User License$ 1,995

- Department License$ 2,400

- Site License$ 3,120

- Global License$ 3,795

Search

Thought Leadership and Analyst Meet

Our Clients

Related Reports

- Afghanistan Apparel Market (2026-2032) | Growth, Outlook, Industry, Segmentation, Forecast, Size, Companies, Trends, Value, Share, Analysis & Revenue

- Canada Oil and Gas Market (2026-2032) | Share, Segmentation, Value, Industry, Trends, Forecast, Analysis, Size & Revenue, Growth, Competitive Landscape, Outlook, Companies

- Germany Breakfast Food Market (2026-2032) | Industry, Share, Growth, Size, Companies, Value, Analysis, Revenue, Trends, Forecast & Outlook

- Australia Briquette Market (2025-2031) | Growth, Size, Revenue, Forecast, Analysis, Trends, Value, Share, Industry & Companies

- Vietnam System Integrator Market (2025-2031) | Size, Companies, Analysis, Industry, Value, Forecast, Growth, Trends, Revenue & Share

- ASEAN and Thailand Brain Health Supplements Market (2025-2031) | Strategy, Consumer Insights, Analysis, Investment Trends, Opportunities, Growth, Size, Share, Industry, Revenue, Segments, Value, Segmentation, Supply, Forecast, Restraints, Outlook, Competition, Drivers, Trends, Demand, Pricing Analysis, Competitive, Strategic Insights, Companies, Challenges

- ASEAN Bearings Market (2025-2031) | Strategy, Consumer Insights, Analysis, Investment Trends, Opportunities, Growth, Size, Share, Industry, Revenue, Segments, Value, Segmentation, Supply, Forecast, Restraints, Outlook, Competition, Drivers, Trends, Demand, Pricing Analysis, Competitive, Strategic Insights, Companies, Challenges

- Europe Flooring Market (2025-2031) | Outlook, Share, Industry, Trends, Forecast, Companies, Revenue, Size, Analysis, Growth & Value

- Saudi Arabia Manlift Market (2025-2031) | Outlook, Size, Growth, Trends, Companies, Industry, Revenue, Value, Share, Forecast & Analysis

- Uganda Excavator, Crane, and Wheel Loaders Market (2025-2031) | Strategy, Consumer Insights, Analysis, Investment Trends, Opportunities, Growth, Size, Share, Industry, Revenue, Segments, Value, Segmentation, Supply, Forecast, Restraints, Outlook, Competition, Drivers, Trends, Demand, Pricing Analysis, Competitive, Strategic Insights, Companies, Challenges

Industry Events and Analyst Meet

Whitepaper

- Middle East & Africa Commercial Security Market Click here to view more.

- Middle East & Africa Fire Safety Systems & Equipment Market Click here to view more.

- GCC Drone Market Click here to view more.

- Middle East Lighting Fixture Market Click here to view more.

- GCC Physical & Perimeter Security Market Click here to view more.

6WResearch In News

- Doha a strategic location for EV manufacturing hub: IPA Qatar

- Demand for luxury TVs surging in the GCC, says Samsung

- Empowering Growth: The Thriving Journey of Bangladesh’s Cable Industry

- Demand for luxury TVs surging in the GCC, says Samsung

- Video call with a traditional healer? Once unthinkable, it’s now common in South Africa

- Intelligent Buildings To Smooth GCC’s Path To Net Zero