Saudi Arabia Overhead Cable Management Solutions Market (2018-2024) | Analysis, Size, Share, Revenue, Trends, Growth, Forecast, industry, Outlook & Segmentation

Market Forecast By Overhead Types (Cable Trays (Ladder, Perforated, Solid Bottom, Wiremesh, Single Rail and Channel), Cable Trunking and Accessories)), By Finishing Types (Hot Dip Galvanized, Pre-Galvanized, Electro Galvanized, Stainless Steel, Epoxy Coating, GRP/FRP and Others including Powder and Painted), By Thickness (Below 1.5 mm, 1.5 mm - 2.5 mm and Above 2.5 mm), By Applications (Commercial, Transportation, Industrial, Power Utilities, Mining, Oil & Gas and Others including Residential and Telecom), By Regions (Eastern, Western, Central and Southern) and Competitive Landscape

| Product Code: ETC000552 | Publication Date: Sep 2021 | Updated Date: Aug 2025 | Product Type: Report | |

| Publisher: 6Wresearch | Author: Ravi Bhandari | No. of Pages: 125 | No. of Figures: 61 | No. of Tables: 11 |

Latest 2023 Developments of the Saudi Arabia Overhead Cable Management Solutions Market

Saudi Arabia Overhead Cable Management Solutions Market is witnessing development with the Saudi Vision 2030 initiative, which focuses on reducing oil dependency and increasing investments in renewable energy for power supply. This creates an opportunity to deploy new infrastructure, which is further energizing the growth of the Saudi Arabia overhead cable management solutions market. Swiftwire, Legrand's latest wire-based suspension technology, was introduced in 2019, and it can suspend lighting busbar and overhead cable management portfolios. When compared to traditional threaded rod suspension systems, it is easier to install. It allows the system to readily and quickly adapt for precise installation.

Mergers and Acquisition:

- On March 17, 2021, Eaton completed the acquisition of Tripp Lite.

Saudi Arabia Overhead Cable Management Solutions Market Synopsis

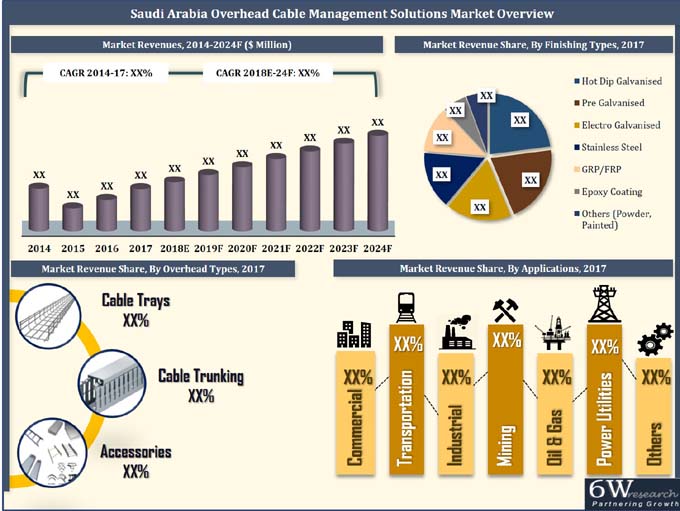

Growing social infrastructure, expanding power transmission and distribution networks along with ambitious transportation projects would act as the key drivers for the growth of the overhead cable management solutions market in Saudi Arabia. Government initiatives such as Saudi Vision 2030 and the National Transformation Programme 2020 would strengthen several public and private sector segments and are, therefore, expected to increase the demand for overhead cable management solutions during 2018-24.

According to 6Wresearch, Saudi Arabia overhead cable management solutions market size is projected to grow at a CAGR of 11.7% during 2018-24. Under the Saudi Vision 2030 initiative, the government plans on reducing the country's dependence on oil-sector revenues and focusing on developing and strengthening its non-oil economy. The power utilities, oil & gas, renewable energy and industrial sectors of the country are poised for growth over the coming years. With hot-dip galvanization being the prominent type of finishing used for overhead cable management solutions in outdoor and harsh industrial environments, the segment is predicted to show the highest growth during the forecast period.

The transportation segment is expected to capture significant Saudi Arabia overhead cable management solutions market share owing to a large number of upcoming transportation infrastructure projects in the country.

The Saudi Arabia overhead cable management solutions market report comprehensively covers the Saudi Arabia overhead cable management solutions market by type, finishing, thickness, applications, and regions. The Saudi Arabia overhead cable management solutions market outlook report provides an unbiased and detailed analysis of the Saudi Arabia overhead cable management solutions market trends, opportunities/high growth areas, and market drivers which would help the stakeholders to devise and align their market strategies according to the current and future market dynamics.

Key Highlights of the Report:

• Saudi Arabia Overhead Cable Management Solutions Market Overview

• Saudi Arabia Overhead Cable Management Solutions Market Outlook

• Saudi Arabia Overhead Cable Management Solutions Market Forecast

• Historical Data of Saudi Arabia Overhead Cable Management Solutions Market Revenues for the Period, 2014-2017

• Saudi Arabia Overhead Cable Management Solutions Market Size and Saudi Arabia Overhead Cable Management Solutions Market Forecast of Revenues, until 2024

• Historical Data of Saudi Arabia Overhead Cable Management Solutions Market Revenues, by Overhead Types, for the Period, 2014-2017

• Market Size & Forecast of Saudi Arabia Overhead Cable Management Solutions Market Revenues,by Overhead Types, until 2024

• Historical Data of Saudi Arabia Overhead Cable Management Solutions Market Revenues, by Cable Tray Types for the Period, 2014-2017

• Market Size & Forecast of Saudi Arabia Overhead Cable Management Solutions Market Revenues, by Cable Tray Types, until 2024

• Historical Data of Saudi Arabia Overhead Cable Management Solutions Market Revenues, by Thickness, for the Period, 2014-2017

• Market Size & Forecast of Saudi Arabia Overhead Cable Management Solutions Market Revenues,by Thickness, until 2024

• Historical Data of Saudi Arabia Overhead Cable Management Solutions Market Revenues, by Finishing Types, for the Period, 2014-2017

• Market Size & Forecast of Saudi Arabia Overhead Cable Management Solutions Market Revenues, by Finishing Types, until 2024

• Historical Data of Saudi Arabia Overhead Cable Management Solutions Market Revenues, by Applications, for the Period, 2014-2017

• Market Size & Forecast of Saudi Arabia Overhead Cable Management Solutions Market Revenues, by Applications, until 2024

• Historical Data of Saudi Arabia Overhead Cable Management Solutions Market Revenues,by Regions, for the Period, 2014-2017

• Market Size & Forecast of Saudi Arabia Overhead Cable Management Solutions Market Revenues, by Regions, until 2024

• Market Drivers and Restraints

• Saudi Arabia Overhead Cable Management Solutions Market Trends and Opportunities

• Porter's Five Force Analysis

• Market Opportunity Assessment

• Saudi Arabia Overhead Cable Management Solutions Market Share, By Players

• Saudi Arabia Overhead Cable Management Solutions Market Overview on Competitive Landscape

• Company Profiles

• Key Strategic Recommendations

Markets Covered

The Saudi Arabia overhead cable management solutions market report provides detailed analysis of the following market segments:

• By Overhead Types

o Cable Trays

?Ladder

?Perforated

?Solid Bottom

?Wiremesh

?Single Rail

?Channel

o Cable Trunking

o Accessories

By Finishing Types

- Hot Dip Galvanized

- Pre-Galvanized

- Electro-Galvanized

- Stainless Steel

- Epoxy Coating

- GRP/FRP

- Others (Powder, Painted, etc.)

By Thickness

- Below 1.5 mm

- 1.5 mm - 2.5 mm

- Above 2.5 mm

By Applications

- Commercial

- Transportation

- Industrial

- Power Utilities

- Mining

- Oil & Gas

- Others (Residential, Telecom, etc.)

By Regions

- Eastern

- Western

- Central

- Southern

Frequently Asked Questions About the Market Study (FAQs):

| 1. Executive Summary |

| 2. Introduction |

| 2.1 Report Description |

| 2.2 Key Highlights of The Report |

| 2.3 Market Scope & Segmentation |

| 2.4 Research Methodology |

| 2.5 Assumptions |

| 3. Saudi Arabia Overhead Cable Management Solutions Market Overview |

| 3.1 Saudi Arabia Country Indicators |

| 3.2 Saudi Arabia Overhead Cable Management Solutions Market Revenues |

| 3.3 Saudi Arabia Overhead Cable Management Solutions Market Revenue Share, By Overhead Types |

| 3.4 Saudi Arabia Overhead Cable Management Solutions Market Revenue Share, By Cable Tray Types |

| 3.5 Saudi Arabia Overhead Cable Management Solutions Market Revenue Share, By Finishing Types |

| 3.6 Saudi Arabia Overhead Cable Management Solutions Market Revenue Share, By Thickness |

| 3.7 Saudi Arabia Overhead Cable Management Solutions Market Revenue Share, By Applications |

| 3.8 Saudi Arabia Overhead Cable Management Solutions Market Revenue Share, By Regions |

| 3.9 Saudi Arabia Overhead Cable Management Solutions Market - Industry Life Cycle, 2017 |

| 3.10 Saudi Arabia Overhead Cable Management Solutions Market - Ecosystem and Value Chain Analysis |

| 3.11 Saudi Arabia Overhead Cable Management Solutions Market - Porter's Five Forces |

| 4. Saudi Arabia Overhead Cable Management Solutions Market Dynamics |

| 4.1 Impact Analysis |

| 4.2 Market Drivers |

| 4.2.1 Rapid urbanization and industrialization leading to increased demand for infrastructure development. |

| 4.2.2 Government initiatives to modernize and expand the energy sector. |

| 4.2.3 Growing adoption of smart technologies and IoT, requiring efficient cable management solutions. |

| 4.3 Market Restraints |

| 4.3.1 High initial investment required for implementing overhead cable management solutions. |

| 4.3.2 Lack of skilled labor for installation and maintenance. |

| 4.3.3 Regulatory challenges and compliance issues in the construction sector. |

| 5. Saudi Arabia Overhead Cable Management Solutions Market Trends |

| 6. Saudi Arabia Overhead Cable Management Solutions Market Overview, By Overhead Types |

| 6.1 Saudi Arabia Overhead Cable Management Solutions Market Revenues, By Overhead Types |

| 6.1.1 Saudi Arabia Ladder Cable Tray Market Revenues, 2014-2024F |

| 6.1.2 Saudi Arabia Channel Cable Tray Market Revenues, 2014-2024F |

| 6.1.3 Saudi Arabia Solid Bottom Cable Tray Market Revenues, 2014-2024F |

| 6.1.4 Saudi Arabia Wiremesh Cable Tray Market Revenues, 2014-2024F |

| 6.1.5 Saudi Arabia Perforated Cable Tray Market Revenues, 2014-2024F |

| 6.1.6 Saudi Arabia Single Rail Cable Tray Market Revenues, 2014-2024F |

| 7. Saudi Arabia Overhead Cable Management Solutions Market Overview, By Finishing Types |

| 7.1 Saudi Arabia Hot Dip Galvanised Overhead Cable Management Solutions Market Revenues, 2014-2024F |

| 7.2 Saudi Arabia Pre Galvanised Overhead Cable Management Solutions Market Revenues, 2014-2024F |

| 7.3 Saudi Arabia Electro Galvanised Overhead Cable Management Solutions Market Revenues, 2014-2024F |

| 7.4 Saudi Arabia Stainless Steel Overhead Cable Management Solutions Market Revenues, 2014-2024F |

| 7.5 Saudi Arabia GRP/FRP Overhead Cable Management Solutions Market Revenues, 2014-2024F |

| 7.6 Saudi Arabia Epoxy Coating Overhead Cable Management Solutions Market Revenues, 2014-2024F |

| 7.7 Saudi Arabia Other Finishing Overhead Cable Management Solutions Market Revenues, 2014-2024F |

| 8. Saudi Arabia Overhead Cable Management Solutions Market Overview, By Thickness |

| 8.1 Saudi Arabia Below 1.5mm Thickness Cable Trays and Trunking Market Revenues, 2014-2024F |

| 8.2 Saudi Arabia 1.5mm-2.5mm Thickness Cable Trays and Trunking Market Revenues, 2014-2024F |

| 8.3 Saudi Arabia Above 2.5mm Thickness Cable Trays and Trunking Market Revenues, 2014-2024F |

| 9. Saudi Arabia Overhead Cable Management Solutions Market Overview, By Applications |

| 9.1 Saudi Arabia Overhead Cable Management Solutions Market Revenues, By Commercial Application |

| 9.1.1 Saudi Arabia Commercial Sector Outlook |

| 9.2 Saudi Arabia Overhead Cable Management Solutions Market Revenues, By Transportation Application |

| 9.2.1 Saudi Arabia Transportation Sector Outlook |

| 9.3 Saudi Arabia Overhead Cable Management Solutions Market Revenues, By Industrial Application |

| 9.3.1 Saudi Arabia Industrial Sector Outlook |

| 9.4 Saudi Arabia Overhead Cable Management Solutions Market Revenues, By Mining Application |

| 9.5 Saudi Arabia Overhead Cable Management Solutions Market Revenues, By Oil & Gas Application |

| 9.5.1 Saudi Arabia Oil & Gas Sector Outlook |

| 9.6 Saudi Arabia Overhead Cable Management Solutions Market Revenues, By Power Utilities Application |

| 9.6.1 Saudi Arabia Power Sector Outlook |

| 9.7 Saudi Arabia Overhead Cable Management Solutions Market Revenues, By Other Applications |

| 9.7.1 Saudi Arabia Residential Outlook |

| 9.7.2 Saudi Arabia IT and Telecommunication Sector Outlook |

| 10. Saudi Arabia Overhead Cable Management Solutions Market Overview, By Regions |

| 10.1 Central Saudi Arabia Overhead Cable Management Solutions Market Revenues, 2014-2024F |

| 10.2 Western Saudi Arabia Overhead Cable Management Solutions Market Revenues, 2014-2024F |

| 10.3 Eastern Saudi Arabia Overhead Cable Management Solutions Market Revenues, 2014-2024F |

| 10.4 Southern Saudi Arabia Overhead Cable Management Solutions Market Revenues, 2014-2024F |

| 11. Saudi Arabia Overhead Cable Management Solutions Market Key Performance Indicators |

| 11.1 Saudi Arabia Government Spending Outlook |

| 11.2 Major Infrastructure Projects in Saudi Arabia |

| 12. Saudi Arabia Overhead Cable Management Solutions Market Opportunity Assessment |

| 12.1 Saudi Arabia Overhead Cable Management Solutions Market Opportunity Assessment, By Applications, 2024F |

| 12.2 Saudi Arabia Overhead Cable Management Solutions Market Opportunity Assessment, By Cable Tray Types, 2024F |

| 13. Saudi Arabia Overhead Cable Management Solutions Market Competitive Landscape |

| 13.1 Competitive Benchmarking, By-Products |

| 13.2 Saudi Arabia Overhead Cable Tray Market Revenue Share, By Company |

| 14. Company Profiles |

| 14.1 Wahah Electric Supply Company of Saudi Arabia Ltd. |

| 14.2 Power Solution Industries LLC |

| 14.3 Mideast Cable Support Solutions |

| 14.4 Abahsain - Cope Saudi Arabia Ltd. |

| 14.5 Khereiji Showrooms Co. Ltd. |

| 14.6 Legrand Saudi Electric Industries Co. Ltd. |

| 14.7 Fas Al Jazeera United Factory Co. |

| 14.8 Adhwa Al-Rawafid Electric Industries |

| 14.9 Cooper Industries Middle East LLC |

| 14.10 Thomas & Betts Corporation |

| 15. Key Strategic Recommendations |

| 16. Disclaimer |

| List of Figures |

| 1. Saudi Arabia Overhead Cable Management Solutions Market Revenues, 2014-2024F ($ Million) |

| 2. Saudi Arabia Overhead Cable Management Solutions Market Revenue Share, By Overhead Types, 2017 & 2024F |

| 3. Saudi Arabia Overhead Cable Management Solutions Market Revenue Share, By Cable Tray Types, 2017 & 2024F |

| 4. Saudi Arabia Overhead Cable Management Solutions Market Revenue Share, By Finishing Types, 2017 & 2024F |

| 5. Saudi Arabia Overhead Cable Management Solutions Market Revenue Share, By Thickness, 2017 & 2024F |

| 6. Saudi Arabia Overhead Cable Management Solutions Market Revenue Share, By Applications, 2017 & 2024F |

| 7. Saudi Arabia Overhead Cable Management Solutions Market Revenue Share, By Regions, 2017 & 2024F |

| 8. Saudi Arabia Overhead Cable Management Solutions Market - Industry Life Cycle, 2017 |

| 9. Saudi Vision 2030 Goals for Non-Oil Sector |

| 10. Saudi Arabia Non-Oil Revenues, 2012-2018E ($ Billion) |

| 11. Saudi Arabia Renewable Energy Contribution to Total Installed Power Capacity, 2015-2023F (GW) |

| 12. Average Brent Spot Crude Oil Price, 2012-2019F ($ per Barrel) |

| 13. Saudi Arabia Building Sector Construction Contracts Awards, 2013-2018E ($ Million) |

| 14. Saudi Arabia Pace of Project Cancellations, 2013-2017 ($ Billion) |

| 15. Saudi Arabia Cable Trays Market Revenues, 2014-2024F ($ Million) |

| 16. Saudi Arabia Cable Trunking Market Revenues, 2014-2024F ($ Million) |

| 17. Saudi Arabia Overhead Cable Management Accessories Market Revenues, 2014-2024F ($ Million) |

| 18. Saudi Arabia Ladder Cable Tray Market Revenues, 2014-2024F ($ Million) |

| 19. Saudi Arabia Channel Cable Tray Market Revenues, 2014-2024F ($ Million) |

| 20. Saudi Arabia Solid Bottom Cable Tray Market Revenues, 2014-2024F ($ Million) |

| 21. Saudi Arabia Wiremesh Cable Tray Market Revenues, 2014-2024F ($ Million) |

| 22. Saudi Arabia Perforated Cable Tray Market Revenues, 2014-2024F ($ Million) |

| 23. Saudi Arabia Single Rail Cable Tray Market Revenues, 2014-2024F ($ Million) |

| 24. Saudi Arabia Hot Dip Galvanised Overhead Cable Management Solutions, 2014-2024F ($ Million) |

| 25. Saudi Arabia Pre Galvanised Overhead Cable Management Solutions, 2014-2024F ($ Million) |

| 26. Saudi Arabia Electro Galvanised Overhead Cable Management Solutions, 2014-2024F ($ Million) |

| 27. Saudi Arabia Stainless Steel Overhead Cable Management Solutions, 2014-2024F ($ Million) |

| 28. Saudi Arabia GRP/FRP Overhead Cable Management Solutions, 2014-2024F ($ Million) |

| 29. Saudi Arabia Epoxy Coating Overhead Cable Management Solutions, 2014-2024F ($ Million) |

| 30. Saudi Arabia Other Finishing Overhead Cable Management Solutions, 2014-2024F ($ Million) |

| 31. Saudi Arabia Below 1.5mm Thickness Cable Trays and Trunking Market Revenues, 2014-2024F ($ Million) |

| 32. Saudi Arabia 1.5mm-2.5mm Thickness Cable Trays and Trunking Market Revenues, 2014-2024F ($ Million) |

| 33. Saudi Arabia Above 2.5mm Thickness Cable Trays and Trunking Market Revenues, 2014-2024F ($ Million) |

| 34. Saudi Arabia Commercial Application Overhead Cable Management Solutions Market Revenues, 2014-2024F ($ Million) |

| 35. Upcoming Economic Cities in Saudi Arabia |

| 36. Riyadh Office Supply, 2014-2019F ('000 Sq. m.) |

| 37. Jeddah Office Supply, 2014-2019F ('000 Sq. m.) |

| 38. Riyadh Retail Supply, 2014-2019F ('000 Sq. m.) |

| 39. Jeddah Retail Supply, 2014-2019F ('000 Sq. m.) |

| 40. Riyadh Hotel Supply, 2014-2019F (No. of Rooms) |

| 41. Jeddah Hotel Supply, 2014-2019F (No. of Rooms) |

| 42. Major Upcoming Healthcare Projects in Saudi Arabia |

| 43. Upcoming Healthcare Projects in Saudi Arabia |

| 44. Saudi Arabia Transportation Application Overhead Cable Management Solutions Market Revenues,2014-2024F ($ Million) |

| 45. Saudi Arabia Industrial Application Overhead Cable Management Solutions Market Revenues,2014-2024F ($ Million) |

| 46. Production of Refined Products in Saudi Arabia, 2016-2017 (Million Barrels) |

| 47. Saudi Arabia Mining Application Overhead Cable Management Solutions Market Revenues, 2014-2024F ($ Million) |

| 48. Saudi Arabia Oil & Gas Application Overhead Cable Management Solutions Market Revenues, 2014-2024F ($ Million) |

| 49. Saudi Arabia Power Utilities Application Overhead Cable Management Solutions Market Revenues, 2014-2024F ($ Million) |

| 50. Upcoming Power Plant Projects in Saudi Arabia |

| 51. Saudi Arabia Other Applications Overhead Cable Management Solutions Market Revenues, 2014-2024F ($ Million) |

| 52. Central Saudi Arabia Overhead Cable Management Solutions Market Revenues, 2014-2024F ($ Million) |

| 53. Western Saudi Arabia Overhead Cable Management Solutions Market Revenues, 2014-2024F ($ Million) |

| 54. Eastern Saudi Arabia Overhead Cable Management Solutions Market Revenues, 2014-2024F ($ Million) |

| 55. Southern Saudi Arabia Overhead Cable Management Solutions Market Revenues, 2014-2024F ($ Million) |

| 56. Saudi Arabia Actual Government Spending Vs Actual Government Revenues, 2014-2023F (SR Billion) |

| 57. Saudi Arabia Government Budget Spending Outlook, 2018E ($ Billion) |

| 58. Saudi Arabia Overhead Cable Management Solutions Market Opportunity Assessment, By Applications, 2024F |

| 59. Saudi Arabia Overhead Cable Management Solutions Market Opportunity Assessment, By Cable Tray Types, 2024F |

| 60. Saudi Arabia Overhead Cable Tray Market Revenue Share, By Company, 2017 |

| 61. Saudi Arabia International Visitor Arrivals, 2014-2021F (Million) |

| List of Tables |

| 1. Saudi Arabia Upcoming Renewable Energy Sector Projects |

| 2. Upcoming Hotel Projects in Saudi Arabia |

| 3. Saudi Arabia Upcoming Transportation Projects |

| 4. Under Construction Manufacturing Units in Saudi Arabia, Q4 2017 & Q1 2018 |

| 5. Saudi Arabia Upcoming Petrochemical Projects |

| 6. Saudi Arabia Upcoming Oil & Gas Projects |

| 7. Upcoming Residential Projects in Saudi Arabia |

| 8. Upcoming Residential Projects in Saudi Arabia |

| 9. Saudi Arabia Ministry of Communications & Information Technology Strategic Objectives Under National Transformation Program |

| 10. Saudi Arabia Budget Expenses By Sectors, 2017 & 2018 ($ Billion) |

| 11. List of Major Infrastructure Projects in Saudi Arabia |

- Single User License$ 1,995

- Department License$ 2,400

- Site License$ 3,120

- Global License$ 3,795

Search

Thought Leadership and Analyst Meet

Our Clients

Related Reports

- South Africa Stationery Market (2025-2031) | Share, Size, Industry, Value, Growth, Revenue, Analysis, Trends, Segmentation & Outlook

- Afghanistan Rocking Chairs And Adirondack Chairs Market (2026-2032) | Size & Revenue, Competitive Landscape, Share, Segmentation, Industry, Value, Outlook, Analysis, Trends, Growth, Forecast, Companies

- Afghanistan Apparel Market (2026-2032) | Growth, Outlook, Industry, Segmentation, Forecast, Size, Companies, Trends, Value, Share, Analysis & Revenue

- Canada Oil and Gas Market (2026-2032) | Share, Segmentation, Value, Industry, Trends, Forecast, Analysis, Size & Revenue, Growth, Competitive Landscape, Outlook, Companies

- Germany Breakfast Food Market (2026-2032) | Industry, Share, Growth, Size, Companies, Value, Analysis, Revenue, Trends, Forecast & Outlook

- Australia Briquette Market (2025-2031) | Growth, Size, Revenue, Forecast, Analysis, Trends, Value, Share, Industry & Companies

- Vietnam System Integrator Market (2025-2031) | Size, Companies, Analysis, Industry, Value, Forecast, Growth, Trends, Revenue & Share

- ASEAN and Thailand Brain Health Supplements Market (2025-2031) | Strategy, Consumer Insights, Analysis, Investment Trends, Opportunities, Growth, Size, Share, Industry, Revenue, Segments, Value, Segmentation, Supply, Forecast, Restraints, Outlook, Competition, Drivers, Trends, Demand, Pricing Analysis, Competitive, Strategic Insights, Companies, Challenges

- ASEAN Bearings Market (2025-2031) | Strategy, Consumer Insights, Analysis, Investment Trends, Opportunities, Growth, Size, Share, Industry, Revenue, Segments, Value, Segmentation, Supply, Forecast, Restraints, Outlook, Competition, Drivers, Trends, Demand, Pricing Analysis, Competitive, Strategic Insights, Companies, Challenges

- Europe Flooring Market (2025-2031) | Outlook, Share, Industry, Trends, Forecast, Companies, Revenue, Size, Analysis, Growth & Value

Industry Events and Analyst Meet

Whitepaper

- Middle East & Africa Commercial Security Market Click here to view more.

- Middle East & Africa Fire Safety Systems & Equipment Market Click here to view more.

- GCC Drone Market Click here to view more.

- Middle East Lighting Fixture Market Click here to view more.

- GCC Physical & Perimeter Security Market Click here to view more.

6WResearch In News

- Doha a strategic location for EV manufacturing hub: IPA Qatar

- Demand for luxury TVs surging in the GCC, says Samsung

- Empowering Growth: The Thriving Journey of Bangladesh’s Cable Industry

- Demand for luxury TVs surging in the GCC, says Samsung

- Video call with a traditional healer? Once unthinkable, it’s now common in South Africa

- Intelligent Buildings To Smooth GCC’s Path To Net Zero