Singapore Home Fragrance Market (2025-2031) Outlook | Revenue, Trends, Companies, Industry, Value, Size, Forecast, Analysis, Growth & Share

| Product Code: ETC328167 | Publication Date: Aug 2022 | Updated Date: Nov 2025 | Product Type: Market Research Report | |

| Publisher: 6Wresearch | Author: Ravi Bhandari | No. of Pages: 75 | No. of Figures: 35 | No. of Tables: 20 |

Singapore Home Fragrance Market: Import Trend Analysis

In the Singapore home fragrance market, the import trend showed a significant upsurge from 2023 to 2024 with a growth rate of 107.69%. The compound annual growth rate (CAGR) for imports between 2020 and 2024 stood at 45.65%. This remarkable growth in imports can be attributed to shifting consumer preferences towards premium home fragrance products, indicating a strong demand shift within the market.

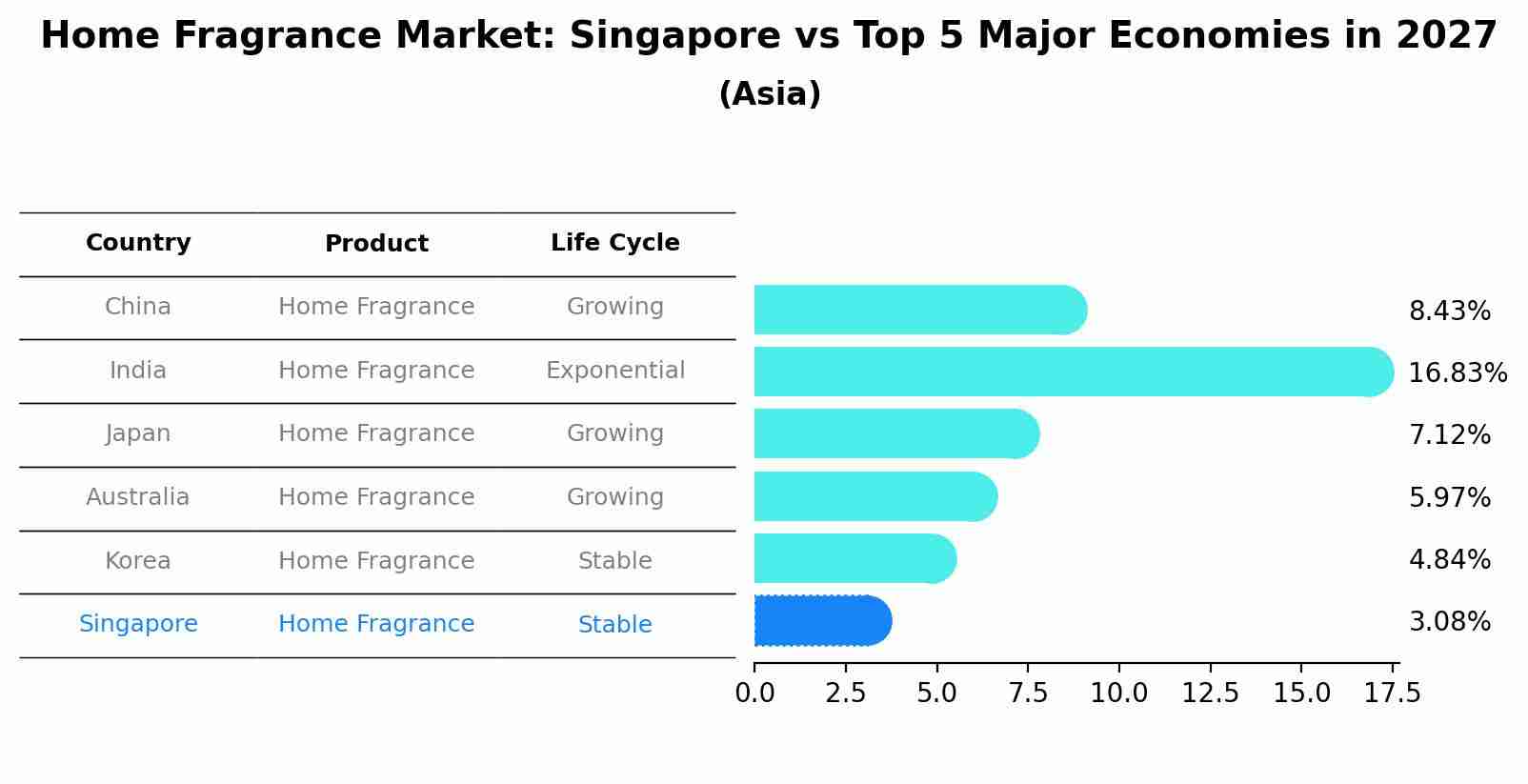

Home Fragrance Market: Singapore vs Top 5 Major Economies in 2027 (Asia)

By 2027, Singapore's Home Fragrance market is forecasted to achieve a stable growth rate of 3.08%, with China leading the Asia region, followed by India, Japan, Australia and South Korea.

Singapore Home Fragrance Market Synopsis

The home fragrance market in Singapore has experienced significant growth as consumers increasingly seek to create pleasant and inviting environments in their homes. This market includes products such as scented candles, diffusers, and incense, with a variety of scents to choose from. Lifestyle changes, a focus on mental well-being, and the desire to personalize living spaces have all contributed to the expansion of this market.

Drivers of the Market

The home fragrance market in Singapore is on the rise due to the increasing importance placed on creating pleasant and comfortable living environments. Consumers are looking for ways to enhance their homes with fragrances that promote relaxation and well-being. The trend of using scented candles, diffusers, and air fresheners to create ambiance and mask odors is driving market growth. Additionally, the growing interest in aromatherapy and wellness contributes to the demand for home fragrances, making it a dynamic market.

Challenges of the Market

The home fragrance market in Singapore faces challenges related to changing consumer preferences and environmental concerns. Consumers are becoming more conscious of the environmental impact of home fragrance products, leading to a demand for sustainable and eco-friendly options. Additionally, competition is high, with numerous players offering a wide range of products, making it challenging for new entrants to differentiate themselves. Ensuring consistent and long-lasting fragrance delivery without the use of harmful chemicals can also be a technical hurdle for manufacturers.

COVID-19 Impact on the Market

The home fragrance market experienced shifts in consumer preferences during the pandemic. With people spending more time at home, there was an initial uptick in demand for home fragrances like candles and diffusers. However, supply chain disruptions affected the production and distribution of these products. As the pandemic continued, consumer priorities evolved, with some individuals prioritizing essential items over luxury fragrances. The market adjusted to these changes, emphasizing product quality and versatility.

Key Players in the Market

In the home fragrance industry, brands such as Yankee Candle, Jo Malone, and Bath & Body Works have a strong presence in the Singapore market. These companies offer a wide range of scented candles, diffusers, and other home fragrance products. Their dedication to creating captivating fragrances and stylish packaging has made them popular choices among consumers looking to enhance their living spaces with delightful scents.

Key Highlights of the Report:

- Singapore Home Fragrance Market Outlook

- Market Size of Singapore Home Fragrance Market, 2024

- Forecast of Singapore Home Fragrance Market, 2031

- Historical Data and Forecast of Singapore Home Fragrance Revenues & Volume for the Period 2021-2031

- Singapore Home Fragrance Market Trend Evolution

- Singapore Home Fragrance Market Drivers and Challenges

- Singapore Home Fragrance Price Trends

- Singapore Home Fragrance Porter's Five Forces

- Singapore Home Fragrance Industry Life Cycle

- Historical Data and Forecast of Singapore Home Fragrance Market Revenues & Volume By Product Type for the Period 2021-2031

- Historical Data and Forecast of Singapore Home Fragrance Market Revenues & Volume By Candles for the Period 2021-2031

- Historical Data and Forecast of Singapore Home Fragrance Market Revenues & Volume By Room Sprays for the Period 2021-2031

- Historical Data and Forecast of Singapore Home Fragrance Market Revenues & Volume By Reed Diffuser for the Period 2021-2031

- Historical Data and Forecast of Singapore Home Fragrance Market Revenues & Volume By Essential Oils for the Period 2021-2031

- Historical Data and Forecast of Singapore Home Fragrance Market Revenues & Volume By Incense Sticks for the Period 2021-2031

- Historical Data and Forecast of Singapore Home Fragrance Market Revenues & Volume By Distribution Channel for the Period 2021-2031

- Historical Data and Forecast of Singapore Home Fragrance Market Revenues & Volume By Offline Channels for the Period 2021-2031

- Historical Data and Forecast of Singapore Home Fragrance Market Revenues & Volume By Online Channel for the Period 2021-2031

- Singapore Home Fragrance Import Export Trade Statistics

- Market Opportunity Assessment By Product Type

- Market Opportunity Assessment By Distribution Channel

- Singapore Home Fragrance Top Companies Market Share

- Singapore Home Fragrance Competitive Benchmarking By Technical and Operational Parameters

- Singapore Home Fragrance Company Profiles

- Singapore Home Fragrance Key Strategic Recommendations

Frequently Asked Questions About the Market Study (FAQs):

1 Executive Summary |

2 Introduction |

2.1 Key Highlights of the Report |

2.2 Report Description |

2.3 Market Scope & Segmentation |

2.4 Research Methodology |

2.5 Assumptions |

3 Singapore Home Fragrance Market Overview |

3.1 Singapore Country Macro Economic Indicators |

3.2 Singapore Home Fragrance Market Revenues & Volume, 2021 & 2031F |

3.3 Singapore Home Fragrance Market - Industry Life Cycle |

3.4 Singapore Home Fragrance Market - Porter's Five Forces |

3.5 Singapore Home Fragrance Market Revenues & Volume Share, By Product Type, 2021 & 2031F |

3.6 Singapore Home Fragrance Market Revenues & Volume Share, By Distribution Channel, 2021 & 2031F |

4 Singapore Home Fragrance Market Dynamics |

4.1 Impact Analysis |

4.2 Market Drivers |

4.2.1 Increasing focus on home aesthetics and ambiance |

4.2.2 Growing awareness about the benefits of aromatherapy |

4.2.3 Rising disposable income levels in Singapore |

4.3 Market Restraints |

4.3.1 High competition from established and new players |

4.3.2 Fluctuating raw material prices |

4.3.3 Regulatory restrictions on certain fragrance ingredients |

5 Singapore Home Fragrance Market Trends |

6 Singapore Home Fragrance Market, By Types |

6.1 Singapore Home Fragrance Market, By Product Type |

6.1.1 Overview and Analysis |

6.1.2 Singapore Home Fragrance Market Revenues & Volume, By Product Type, 2021-2031F |

6.1.3 Singapore Home Fragrance Market Revenues & Volume, By Candles, 2021-2031F |

6.1.4 Singapore Home Fragrance Market Revenues & Volume, By Room Sprays, 2021-2031F |

6.1.5 Singapore Home Fragrance Market Revenues & Volume, By Reed Diffuser, 2021-2031F |

6.1.6 Singapore Home Fragrance Market Revenues & Volume, By Essential Oils, 2021-2031F |

6.1.7 Singapore Home Fragrance Market Revenues & Volume, By Incense Sticks, 2021-2031F |

6.2 Singapore Home Fragrance Market, By Distribution Channel |

6.2.1 Overview and Analysis |

6.2.2 Singapore Home Fragrance Market Revenues & Volume, By Offline Channels, 2021-2031F |

6.2.3 Singapore Home Fragrance Market Revenues & Volume, By Online Channel, 2021-2031F |

7 Singapore Home Fragrance Market Import-Export Trade Statistics |

7.1 Singapore Home Fragrance Market Export to Major Countries |

7.2 Singapore Home Fragrance Market Imports from Major Countries |

8 Singapore Home Fragrance Market Key Performance Indicators |

8.1 Consumer engagement on social media platforms |

8.2 Number of new product launches in the home fragrance segment |

8.3 Rate of adoption of smart home fragrance devices |

9 Singapore Home Fragrance Market - Opportunity Assessment |

9.1 Singapore Home Fragrance Market Opportunity Assessment, By Product Type, 2021 & 2031F |

9.2 Singapore Home Fragrance Market Opportunity Assessment, By Distribution Channel, 2021 & 2031F |

10 Singapore Home Fragrance Market - Competitive Landscape |

10.1 Singapore Home Fragrance Market Revenue Share, By Companies, 2024 |

10.2 Singapore Home Fragrance Market Competitive Benchmarking, By Operating and Technical Parameters |

11 Company Profiles |

12 Recommendations |

13 Disclaimer |

- Single User License$ 1,995

- Department License$ 2,400

- Site License$ 3,120

- Global License$ 3,795

Search

Thought Leadership and Analyst Meet

Our Clients

Related Reports

- Canada Oil and Gas Market (2026-2032) | Share, Segmentation, Value, Industry, Trends, Forecast, Analysis, Size & Revenue, Growth, Competitive Landscape, Outlook, Companies

- Germany Breakfast Food Market (2026-2032) | Industry, Share, Growth, Size, Companies, Value, Analysis, Revenue, Trends, Forecast & Outlook

- Australia Briquette Market (2025-2031) | Growth, Size, Revenue, Forecast, Analysis, Trends, Value, Share, Industry & Companies

- Vietnam System Integrator Market (2025-2031) | Size, Companies, Analysis, Industry, Value, Forecast, Growth, Trends, Revenue & Share

- ASEAN and Thailand Brain Health Supplements Market (2025-2031) | Strategy, Consumer Insights, Analysis, Investment Trends, Opportunities, Growth, Size, Share, Industry, Revenue, Segments, Value, Segmentation, Supply, Forecast, Restraints, Outlook, Competition, Drivers, Trends, Demand, Pricing Analysis, Competitive, Strategic Insights, Companies, Challenges

- ASEAN Bearings Market (2025-2031) | Strategy, Consumer Insights, Analysis, Investment Trends, Opportunities, Growth, Size, Share, Industry, Revenue, Segments, Value, Segmentation, Supply, Forecast, Restraints, Outlook, Competition, Drivers, Trends, Demand, Pricing Analysis, Competitive, Strategic Insights, Companies, Challenges

- Europe Flooring Market (2025-2031) | Outlook, Share, Industry, Trends, Forecast, Companies, Revenue, Size, Analysis, Growth & Value

- Saudi Arabia Manlift Market (2025-2031) | Outlook, Size, Growth, Trends, Companies, Industry, Revenue, Value, Share, Forecast & Analysis

- Uganda Excavator, Crane, and Wheel Loaders Market (2025-2031) | Strategy, Consumer Insights, Analysis, Investment Trends, Opportunities, Growth, Size, Share, Industry, Revenue, Segments, Value, Segmentation, Supply, Forecast, Restraints, Outlook, Competition, Drivers, Trends, Demand, Pricing Analysis, Competitive, Strategic Insights, Companies, Challenges

- Rwanda Excavator, Crane, and Wheel Loaders Market (2025-2031) | Strategy, Consumer Insights, Analysis, Investment Trends, Opportunities, Growth, Size, Share, Industry, Revenue, Segments, Value, Segmentation, Supply, Forecast, Restraints, Outlook, Competition, Drivers, Trends, Demand, Pricing Analysis, Competitive, Strategic Insights, Companies, Challenges

Industry Events and Analyst Meet

Whitepaper

- Middle East & Africa Commercial Security Market Click here to view more.

- Middle East & Africa Fire Safety Systems & Equipment Market Click here to view more.

- GCC Drone Market Click here to view more.

- Middle East Lighting Fixture Market Click here to view more.

- GCC Physical & Perimeter Security Market Click here to view more.

6WResearch In News

- Doha a strategic location for EV manufacturing hub: IPA Qatar

- Demand for luxury TVs surging in the GCC, says Samsung

- Empowering Growth: The Thriving Journey of Bangladesh’s Cable Industry

- Demand for luxury TVs surging in the GCC, says Samsung

- Video call with a traditional healer? Once unthinkable, it’s now common in South Africa

- Intelligent Buildings To Smooth GCC’s Path To Net Zero