Sri Lanka Precious Metals Market (2025-2031) Outlook | Forecast, Value, Share, Industry, Size, Trends, Revenue, Companies, Analysis & Growth

| Product Code: ETC205123 | Publication Date: May 2022 | Updated Date: Sep 2025 | Product Type: Market Research Report | |

| Publisher: 6Wresearch | Author: Sachin Kumar Rai | No. of Pages: 60 | No. of Figures: 40 | No. of Tables: 7 |

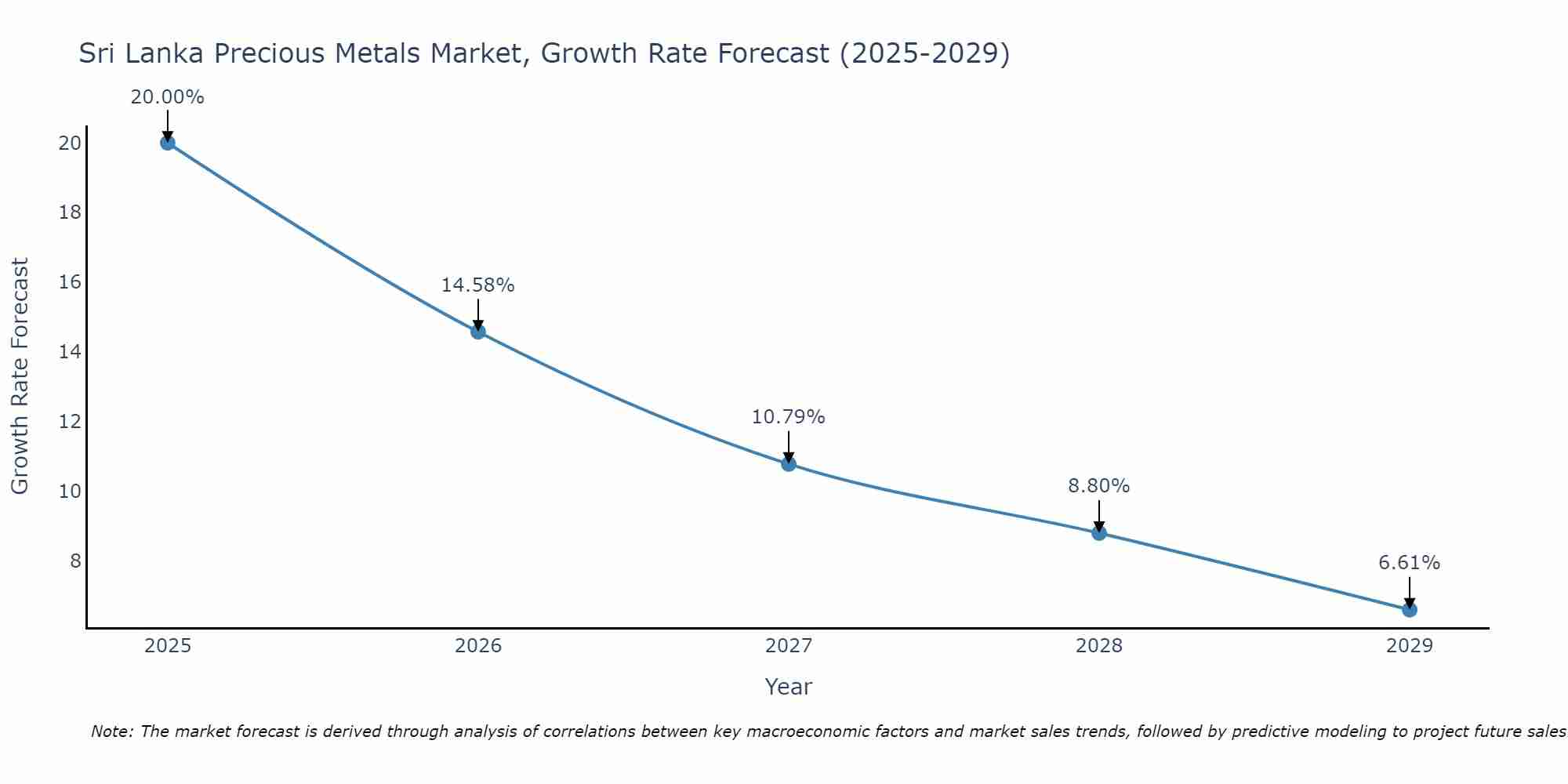

Sri Lanka Precious Metals Market Size Growth Rate

The Sri Lanka Precious Metals Market could see a tapering of growth rates over 2025 to 2029. Beginning strongly at 20.00% in 2025, growth softens to 6.61% in 2029.

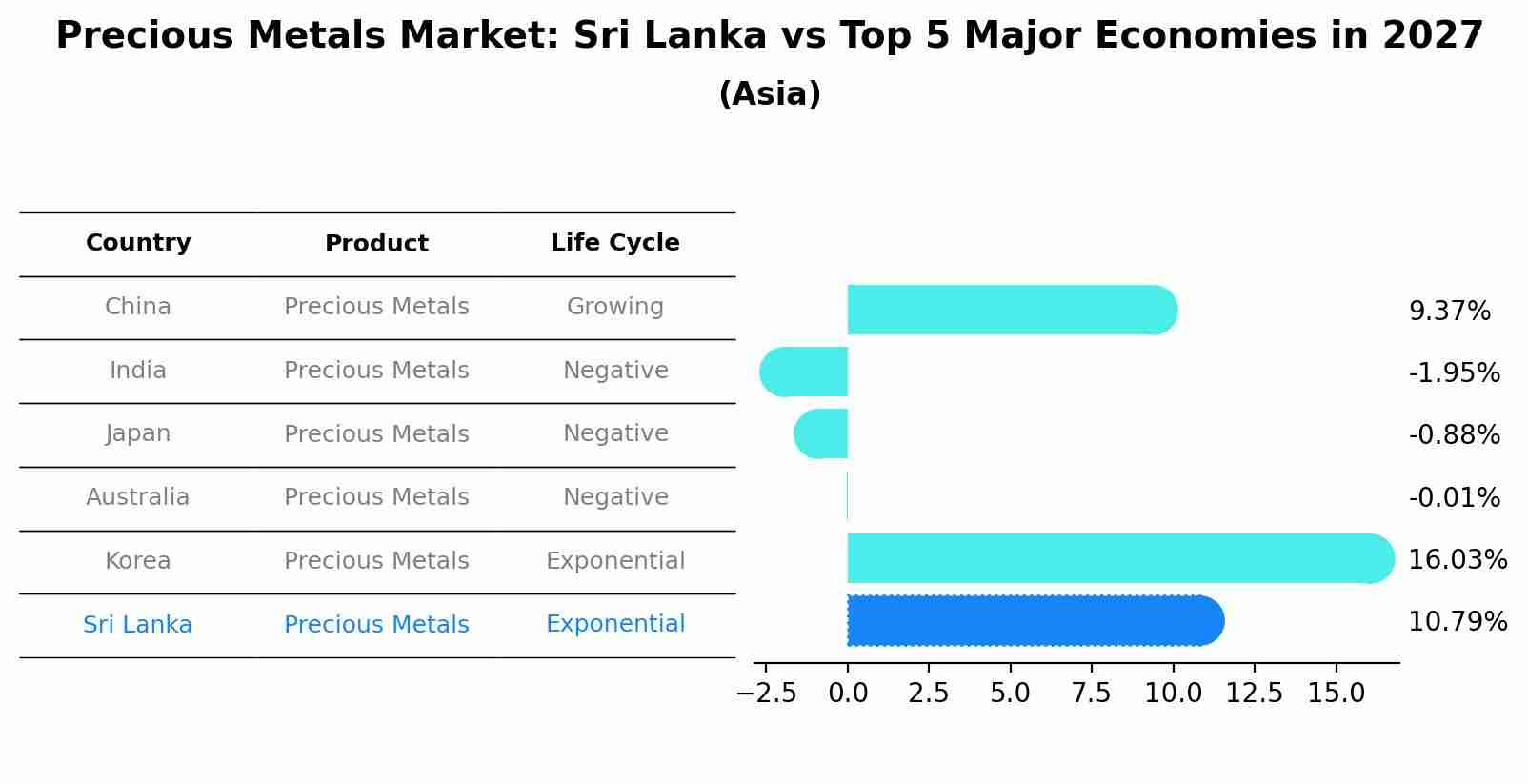

Precious Metals Market: Sri Lanka vs Top 5 Major Economies in 2027 (Asia)

The Precious Metals market in Sri Lanka is projected to grow at a high growth rate of 10.79% by 2027, within the Asia region led by China, along with other countries like India, Japan, Australia and South Korea, collectively shaping a dynamic and evolving market environment driven by innovation and increasing adoption of emerging technologies.

Sri Lanka Precious Metals Market Overview

The Sri Lankan Precious Metals Market is characterized by a growing demand for gold, silver, and other precious metals as investment options and for ornamental purposes. Gold holds a special cultural significance in Sri Lanka and is often purchased during festive seasons and weddings. The market is primarily driven by consumer preferences, global market trends, and economic factors. Local jewellers and retailers play a crucial role in the distribution and sale of precious metals, with Colombo being a key hub for trading. The government`s policies and regulations regarding imports and exports also influence market dynamics. Despite facing some challenges such as fluctuating prices and competition from alternative investment options, the Sri Lankan Precious Metals Market continues to attract investors and consumers seeking to diversify their portfolios and preserve wealth.

Sri Lanka Precious Metals Market Trends

In the Sri Lankan precious metals market, a notable trend is the increasing demand for gold as a safe haven investment amid global economic uncertainties. Gold prices have been on the rise, driven by factors such as inflation concerns, geopolitical tensions, and the weakening of the US dollar. Additionally, there is a growing interest in investing in silver and platinum as alternative precious metals due to their industrial applications and relatively lower prices compared to gold. The market also sees a shift towards sustainable and ethically sourced precious metals, with consumers and investors showing a preference for responsibly mined and environmentally friendly products. Overall, the Sri Lankan precious metals market is witnessing a combination of traditional investment preferences and evolving consumer preferences towards sustainability and diversity in their investment portfolios.

Sri Lanka Precious Metals Market Challenges

In the Sri Lanka precious metals market, some challenges include fluctuating global market prices, limited domestic production leading to dependency on imports, regulatory issues, and the impact of currency exchange rates. The market is also vulnerable to geopolitical events and economic uncertainties, which can affect investor sentiment and demand for precious metals. Additionally, there are issues related to counterfeiting and fraud in the industry, leading to concerns about the authenticity of precious metal products. Overall, navigating these challenges requires market participants to stay informed about global trends, manage risks effectively, and adapt to changing market conditions to succeed in the Sri Lanka precious metals market.

Sri Lanka Precious Metals Market Investment Opportunities

In the Sri Lanka precious metals market, there are opportunities for investment in gold and gemstones. Gold is traditionally seen as a safe haven asset and a hedge against inflation, making it a popular choice for investors looking to diversify their portfolios. Sri Lanka is also renowned for its high-quality gemstones, particularly sapphires, rubies, and topaz, which presents an opportunity for investors interested in the luxury jewelry market. Additionally, with the growth of the tourism industry in Sri Lanka, there is a potential increase in demand for gemstone jewelry, further boosting the market. Investors can consider purchasing physical gold or gemstones, investing in mining companies, or trading precious metals through financial instruments to capitalize on the opportunities in the Sri Lanka precious metals market.

Sri Lanka Precious Metals Market Government Policy

The Sri Lankan government has implemented several policies related to the precious metals market to regulate and monitor the industry. The Central Bank of Sri Lanka oversees the importation and exportation of precious metals such as gold and silver, imposing restrictions on quantities and documentation requirements to combat illegal activities. Additionally, the government has enforced taxation measures on the sale and purchase of precious metals to generate revenue and deter tax evasion. The Central Bank also sets guidelines for licensed dealers and jewelers to ensure compliance with standards and prevent money laundering. Overall, these policies aim to promote transparency, fair trade practices, and the stability of the precious metals market in Sri Lanka.

Sri Lanka Precious Metals Market Future Outlook

The future outlook for the Sri Lanka Precious Metals Market appears positive, driven by the increasing demand for safe-haven assets and growing interest in alternative investments among investors. Gold and other precious metals are expected to remain attractive due to their historical value preservation qualities and as a hedge against economic uncertainties. Additionally, the expansion of the jewelry industry and the rise of online trading platforms are likely to further boost the market. However, factors such as fluctuations in global metal prices, currency exchange rates, and geopolitical tensions could pose challenges. Overall, with the ongoing economic development in Sri Lanka and the region, coupled with the enduring appeal of precious metals, the market is poised for steady growth in the foreseeable future.

Key Highlights of the Report:

- Sri Lanka Precious Metals Market Outlook

- Market Size of Sri Lanka Precious Metals Market, 2024

- Forecast of Sri Lanka Precious Metals Market, 2031

- Historical Data and Forecast of Sri Lanka Precious Metals Revenues & Volume for the Period 2021 - 2031

- Sri Lanka Precious Metals Market Trend Evolution

- Sri Lanka Precious Metals Market Drivers and Challenges

- Sri Lanka Precious Metals Price Trends

- Sri Lanka Precious Metals Porter's Five Forces

- Sri Lanka Precious Metals Industry Life Cycle

- Historical Data and Forecast of Sri Lanka Precious Metals Market Revenues & Volume By Product for the Period 2021 - 2031

- Historical Data and Forecast of Sri Lanka Precious Metals Market Revenues & Volume By Gold for the Period 2021 - 2031

- Historical Data and Forecast of Sri Lanka Precious Metals Market Revenues & Volume By Silver for the Period 2021 - 2031

- Historical Data and Forecast of Sri Lanka Precious Metals Market Revenues & Volume By Platinum Group Metals (PGM) for the Period 2021 - 2031

- Historical Data and Forecast of Sri Lanka Precious Metals Market Revenues & Volume By Application for the Period 2021 - 2031

- Historical Data and Forecast of Sri Lanka Precious Metals Market Revenues & Volume By Jewelry for the Period 2021 - 2031

- Historical Data and Forecast of Sri Lanka Precious Metals Market Revenues & Volume By Industrial for the Period 2021 - 2031

- Historical Data and Forecast of Sri Lanka Precious Metals Market Revenues & Volume By Investment for the Period 2021 - 2031

- Sri Lanka Precious Metals Import Export Trade Statistics

- Market Opportunity Assessment By Product

- Market Opportunity Assessment By Application

- Sri Lanka Precious Metals Top Companies Market Share

- Sri Lanka Precious Metals Competitive Benchmarking By Technical and Operational Parameters

- Sri Lanka Precious Metals Company Profiles

- Sri Lanka Precious Metals Key Strategic Recommendations

Frequently Asked Questions About the Market Study (FAQs):

1 Executive Summary |

2 Introduction |

2.1 Key Highlights of the Report |

2.2 Report Description |

2.3 Market Scope & Segmentation |

2.4 Research Methodology |

2.5 Assumptions |

3 Sri Lanka Precious Metals Market Overview |

3.1 Sri Lanka Country Macro Economic Indicators |

3.2 Sri Lanka Precious Metals Market Revenues & Volume, 2021 & 2031F |

3.3 Sri Lanka Precious Metals Market - Industry Life Cycle |

3.4 Sri Lanka Precious Metals Market - Porter's Five Forces |

3.5 Sri Lanka Precious Metals Market Revenues & Volume Share, By Product, 2021 & 2031F |

3.6 Sri Lanka Precious Metals Market Revenues & Volume Share, By Application, 2021 & 2031F |

4 Sri Lanka Precious Metals Market Dynamics |

4.1 Impact Analysis |

4.2 Market Drivers |

4.2.1 Increasing demand for precious metals as safe-haven assets during economic uncertainties |

4.2.2 Growth in jewelry industry driving the consumption of precious metals |

4.2.3 Rising disposable income leading to higher investments in precious metals |

4.3 Market Restraints |

4.3.1 Volatility in global prices of precious metals impacting local market prices |

4.3.2 Government regulations and policies affecting imports and exports of precious metals |

4.3.3 Competition from alternative investment options such as cryptocurrencies |

5 Sri Lanka Precious Metals Market Trends |

6 Sri Lanka Precious Metals Market, By Types |

6.1 Sri Lanka Precious Metals Market, By Product |

6.1.1 Overview and Analysis |

6.1.2 Sri Lanka Precious Metals Market Revenues & Volume, By Product, 2021 - 2031F |

6.1.3 Sri Lanka Precious Metals Market Revenues & Volume, By Gold, 2021 - 2031F |

6.1.4 Sri Lanka Precious Metals Market Revenues & Volume, By Silver, 2021 - 2031F |

6.1.5 Sri Lanka Precious Metals Market Revenues & Volume, By Platinum Group Metals (PGM), 2021 - 2031F |

6.2 Sri Lanka Precious Metals Market, By Application |

6.2.1 Overview and Analysis |

6.2.2 Sri Lanka Precious Metals Market Revenues & Volume, By Jewelry, 2021 - 2031F |

6.2.3 Sri Lanka Precious Metals Market Revenues & Volume, By Industrial, 2021 - 2031F |

6.2.4 Sri Lanka Precious Metals Market Revenues & Volume, By Investment, 2021 - 2031F |

7 Sri Lanka Precious Metals Market Import-Export Trade Statistics |

7.1 Sri Lanka Precious Metals Market Export to Major Countries |

7.2 Sri Lanka Precious Metals Market Imports from Major Countries |

8 Sri Lanka Precious Metals Market Key Performance Indicators |

8.1 Average daily trading volume of precious metals in Sri Lanka |

8.2 Percentage change in local demand for precious metals year-on-year |

8.3 Number of new entrants in the precious metals market in Sri Lanka |

9 Sri Lanka Precious Metals Market - Opportunity Assessment |

9.1 Sri Lanka Precious Metals Market Opportunity Assessment, By Product, 2021 & 2031F |

9.2 Sri Lanka Precious Metals Market Opportunity Assessment, By Application, 2021 & 2031F |

10 Sri Lanka Precious Metals Market - Competitive Landscape |

10.1 Sri Lanka Precious Metals Market Revenue Share, By Companies, 2024 |

10.2 Sri Lanka Precious Metals Market Competitive Benchmarking, By Operating and Technical Parameters |

11 Company Profiles |

12 Recommendations |

13 Disclaimer |

- Single User License$ 1,995

- Department License$ 2,400

- Site License$ 3,120

- Global License$ 3,795

Search

Thought Leadership and Analyst Meet

Our Clients

Related Reports

- Afghanistan Rocking Chairs And Adirondack Chairs Market (2026-2032) | Size & Revenue, Competitive Landscape, Share, Segmentation, Industry, Value, Outlook, Analysis, Trends, Growth, Forecast, Companies

- Afghanistan Apparel Market (2026-2032) | Growth, Outlook, Industry, Segmentation, Forecast, Size, Companies, Trends, Value, Share, Analysis & Revenue

- Canada Oil and Gas Market (2026-2032) | Share, Segmentation, Value, Industry, Trends, Forecast, Analysis, Size & Revenue, Growth, Competitive Landscape, Outlook, Companies

- Germany Breakfast Food Market (2026-2032) | Industry, Share, Growth, Size, Companies, Value, Analysis, Revenue, Trends, Forecast & Outlook

- Australia Briquette Market (2025-2031) | Growth, Size, Revenue, Forecast, Analysis, Trends, Value, Share, Industry & Companies

- Vietnam System Integrator Market (2025-2031) | Size, Companies, Analysis, Industry, Value, Forecast, Growth, Trends, Revenue & Share

- ASEAN and Thailand Brain Health Supplements Market (2025-2031) | Strategy, Consumer Insights, Analysis, Investment Trends, Opportunities, Growth, Size, Share, Industry, Revenue, Segments, Value, Segmentation, Supply, Forecast, Restraints, Outlook, Competition, Drivers, Trends, Demand, Pricing Analysis, Competitive, Strategic Insights, Companies, Challenges

- ASEAN Bearings Market (2025-2031) | Strategy, Consumer Insights, Analysis, Investment Trends, Opportunities, Growth, Size, Share, Industry, Revenue, Segments, Value, Segmentation, Supply, Forecast, Restraints, Outlook, Competition, Drivers, Trends, Demand, Pricing Analysis, Competitive, Strategic Insights, Companies, Challenges

- Europe Flooring Market (2025-2031) | Outlook, Share, Industry, Trends, Forecast, Companies, Revenue, Size, Analysis, Growth & Value

- Saudi Arabia Manlift Market (2025-2031) | Outlook, Size, Growth, Trends, Companies, Industry, Revenue, Value, Share, Forecast & Analysis

Industry Events and Analyst Meet

Whitepaper

- Middle East & Africa Commercial Security Market Click here to view more.

- Middle East & Africa Fire Safety Systems & Equipment Market Click here to view more.

- GCC Drone Market Click here to view more.

- Middle East Lighting Fixture Market Click here to view more.

- GCC Physical & Perimeter Security Market Click here to view more.

6WResearch In News

- Doha a strategic location for EV manufacturing hub: IPA Qatar

- Demand for luxury TVs surging in the GCC, says Samsung

- Empowering Growth: The Thriving Journey of Bangladesh’s Cable Industry

- Demand for luxury TVs surging in the GCC, says Samsung

- Video call with a traditional healer? Once unthinkable, it’s now common in South Africa

- Intelligent Buildings To Smooth GCC’s Path To Net Zero