Taiwan High Purity Alumina Market (2025-2031) | Segmentation, Trends, Analysis, Revenue, Share, Forecast, Size, Companies, Outlook, Value, Growth & Industry

Market Forecast By Purity Level (4N, 5N, 6N), By Application (Light Emitting Diode, Semiconductor, Phosphor, Sapphire, Lithium-ion Batteries, Others), By Product Manufacturers (LED Manufacturers (LED Chips, Sapphire Substrates/Wafers, Backlight Units (BLUs), etc.), Semiconductor Equipment & Component Manufacturers (RF chips, Wafers, Insulators, etc.), Lithium-ion Battery Separator Manufacturers (Ceramic-coated Battery Separators, HPA Slurry for Separator Coating, etc.), Optical & Electronic Component Manufacturers (Watch Glasses, Smartphone Screens, IR Windows, etc.), Ceramic Component Manufacturers (Ceramic Suction Cups, Electrical Insulators, etc.), Thermal-Management Materials (Ceramic Heat Spreaders/Heat Sinks, Insulating Ceramic Layers, etc.), Medical & Dental Bioceramics Manufacturers (Orthopedic Implants, Dental Prosthetics, Surgical Tools, etc.), Other Manufacturers (Water Treatment & Environmental Filtration, Aerospace & Defense, etc.)), And Competitive Landscape

| Product Code: ETC5689300 | Publication Date: Nov 2023 | Updated Date: Sep 2025 | Product Type: Market Research Report | |

| Publisher: 6Wresearch | Author: Ravi Bhandari | No. of Pages: 60 | No. of Figures: 30 | No. of Tables: 5 |

Topics Covered in Taiwan High Purity Alumina Market Report

The Taiwan High Purity Alumina Market Report thoroughly covers the market purity level, application and product manufacturers. Taiwan High Purity Alumina Market Outlook report provides an unbiased and detailed analysis of the ongoing Taiwan High Purity Alumina Market trends, opportunities/high growth areas, and market drivers. This would help stakeholders devise and align their market strategies according to the current and future market dynamics.

Taiwan High Purity Alumina Market Synopsis

Taiwan high purity alumina (HPA) market has expanded during 2021-2024, driven by growth in the country’s high-tech sector, rising EV adoption, and expanding energy storage infrastructure. Strong performance in the electronics industry, supported by increasing semiconductor capacity and expanding high-tech production facilities, has heightened demand for HPA, which is critical for manufacturing synthetic sapphire substrates used in LEDs, displays, and other advanced components. Taiwan’s electronics output, for instance, grew from 2023 to 2024. Meanwhile, TSMC, producing world’s most advanced semiconductors in 2024, significantly boosted HPA consumption for defect-free wafers and high-performance chips. Additionally, Taiwan’s e-mobility and energy storage ecosystem is accelerating, driven by government incentives, rising EV and HEV adoption, and ambitious battery storage targets. EV sales surged in 2022, representing total vehicle registrations, further driving HPA demand.

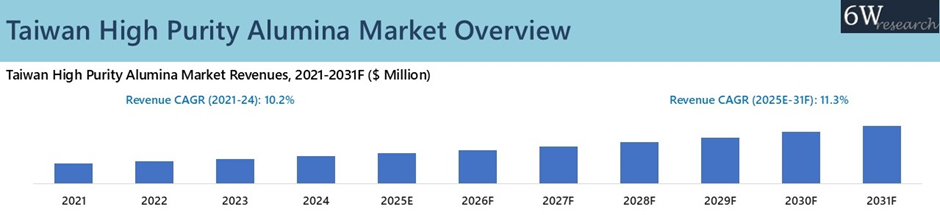

According to 6Wresearch, Taiwan High Purity Alumina Market is projected to grow at a CAGR of 11.3% in revenues during 2025-31F, driven by increasing demand from high-tech component makers and advanced battery producers, supported by innovation, electrification trends, and expanding production capabilities. As per the Industrial Technology Research Institute (ITRI), Taiwan’s semiconductor industry output is anticipated to reach more in 2025, reflecting a year-on-year increase, with Q2 2025 output expected to rise, largely due to early customer orders aimed at mitigating tariff risks.

Furthermore, Taiwan’s energy storage deployment targets, rising from 2025 to 2030, are set to boost demand for advanced battery materials, further supporting HPA market growth. Notable operational energy storage projects, including the Longtan Battery Energy Storage System and Billion Watts Technologies Energy Storage System, are expected to reinforce this demand. Additionally, semiconductors remain the top priority under the government’s “Five Trusted Industry Sectors” initiative, while the “Taiwan Chip-based Industrial Innovation Program,” a cornerstone of the “Taiwan Semiconductor Strategic Policy 2025” running from 2024 to 2033, is allocated to enhance technological sovereignty. This would assist in driving HPA demand across Taiwan in the coming years.

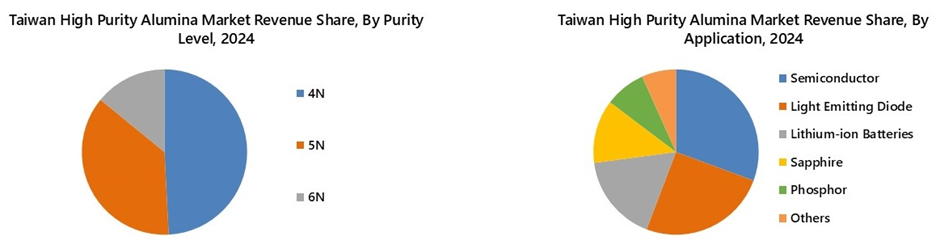

Market Segmentation By Purity Level

In 2031, 4N segment would have the largest revenue size due to its entrenched use in high-volume applications such as LEDs, sapphire substrates, and ceramics, where ultra-high purity is not mandatory. However, 6N segment would register the fastest growth during 2025-2031, as Taiwan’s advanced semiconductor ecosystem increasingly requires ultra-pure alumina for wafer polishing and insulating layers. Growing R&D in quantum, AI, and advanced packaging accelerates the shift to ultra-pure grades, with 6N benefitting from its role in next-generation CMP slurries and defect-free substrates.

Market Segmentation By Application

In 2031, the semiconductor segment would have the largest revenue size in Taiwan’s HPA market as demand for advanced nodes, RF chips, and power devices sustains high HPA consumption. However, lithium-ion batteries would register the fastest growth during 2025-2031, as EV adoption and localization of battery material supply chains drive HPA demand for ceramic-coated separators, with policy incentives further boosting uptake.

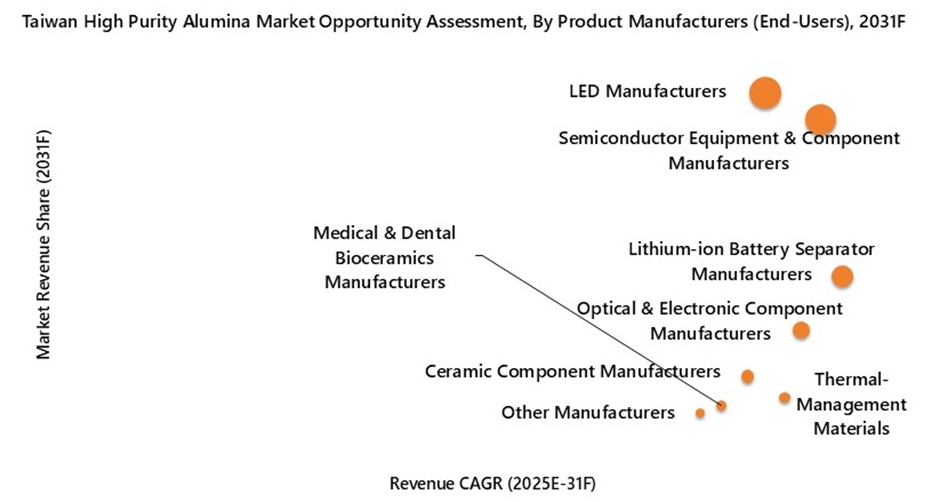

Market Segmentation By Product Manufacturers

In 2031, LED manufacturers segment would have the largest revenue size supported by sustained demand for advanced LEDs in display, automotive, and lighting applications, though growth would be more moderate as the sector matures. However, lithium-ion battery separator manufacturers would register the fastest growth during 2025-2031, fueled by Taiwan’s rising role in the EV and energy storage value chain, with HPA enabling safer, heat-resistant separators and aligning with government-backed green energy transition policies.

Key Attractiveness of the Report

- 10 Years Market Numbers.

- Historical Data: Starting from 2021 to 2024.

- Base Year: 2024

- Forecast Data until 2031

- Key Performance Indicators Impacting the Market.

- Major Upcoming Developments and Projects.

Key Highlights of the Report:

- Taiwan High Purity Alumina Market Overview

- Taiwan High Purity Alumina Market Outlook

- Taiwan High Purity Alumina Market Forecast

- Historical Data and Forecast of Taiwan High Purity Alumina Market Revenues for the Period 2021-2031F

- Historical Data and Forecast of Taiwan High Purity Alumina Market Revenues, By Purity Level, for the Period 2021-2031F

- Historical Data and Forecast of Taiwan High Purity Alumina Market Revenues, By Application, for the Period 2021-2031F

- Historical Data and Forecast of Taiwan High Purity Alumina Market Revenues, By Product Manufacturers (End-Users), for the Period 2021-2031F

- Taiwan High Purity Alumina Market Drivers and Restraints

- Industry Life Cycle

- Porter’s Five Force Analysis

- Taiwan High Purity Alumina Market Trends & Evolution

- Market Opportunity Assessment

- Taiwan High Purity Alumina Market Revenue Ranking, By Top 3 Companies

- Competitive Benchmarking

- Company Profiles

- Key Strategic Recommendations

Market Scope and Segmentation

The report provides a detailed analysis of the following market segments:

By Purity Level

- 4N

- 5N

- 6N

By Application

- Light Emitting Diode

- Semiconductor

- Phosphor

- Sapphire

- Lithium-ion Batteries

- Others

By Product Manufacturers

- LED Manufacturers (LED Chips, Sapphire Substrates/Wafers, Backlight Units (BLUs) etc.)

- Semiconductor Equipment & Component Manufacturers (RF chips, Wafers, Insulators etc.)

- Lithium-ion Battery Separator Manufacturers (Ceramic-coated Battery Separators, HPA Slurry for Separator Coating etc.)

- Optical & Electronic Component Manufacturers (Watch Glasses, Smartphone Screens, IR Windows etc.)

- Ceramic Component Manufacturers (Ceramic Suction Cups, Electrical Insulators etc.)

- Thermal-Management Materials (Ceramic Heat Spreaders/Heat Sinks, Insulating Ceramic Layers etc.)

- Medical & Dental Bioceramics Manufacturers (Orthopedic Implants, Dental Prosthetics, Surgical Tools etc.)

- Other Manufacturers (Water Treatment & Environmental Filtration, Aerospace & Defense etc.)

Taiwan High Purity Alumina Market (2025-2031): FAQs

| 1. Executive Summary |

| 2. Introduction |

| 2.1. Report Description |

| 2.2. Key Highlights of the Report |

| 2.3. Market Scope & Segmentation |

| 2.4. Research Methodology |

| 2.5. Assumptions |

| 3. Taiwan High Purity Alumina Market Overview |

| 3.1. Taiwan High Purity Alumina Market Revenues, 2021-2031F |

| 3.2. Taiwan High Purity Alumina Market – Industry Life Cycle |

| 3.3. Taiwan High Purity Alumina Market – Porter’s Five Forces |

| 4. Taiwan High Purity Alumina Market Dynamics |

| 4.1. Impact Analysis |

| 4.2. Market Drivers |

| 4.3. Market Restraints |

| 5. Taiwan High Purity Alumina Market Trends |

| 6. Taiwan High Purity Alumina Market Overview, By Purity Level |

| 6.1. Taiwan High Purity Alumina Market Revenue Share, By Purity Level, 2024 & 2031F |

| 6.1.1 Taiwan High Purity Alumina Market Revenues, By 4N, 2021- 2031F |

| 6.1.2 Taiwan High Purity Alumina Market Revenues, By 5N, 2021- 2031F |

| 6.1.3 Taiwan High Purity Alumina Market Revenues, By 6N, 2021- 2031F |

| 7. Taiwan High Purity Alumina Market Overview, By Application |

| 7.1 Taiwan High Purity Alumina Market Revenue Share, By Application, 2024 & 2031F |

| 7.1.1 Taiwan High Purity Alumina Market Revenues, By Light Emitting Diode, 2021- 2031F |

| 7.1.2 Taiwan High Purity Alumina Market Revenues, By Semiconductor, 2021- 2031F |

| 7.1.3 Taiwan High Purity Alumina Market Revenues, By Phosphor, 2021- 2031F |

| 7.1.4 Taiwan High Purity Alumina Market Revenues, By Sapphire, 2021- 2031F |

| 7.1.5 Taiwan High Purity Alumina Market Revenues, By Lithium-ion Batteries, 2021- 2031F |

| 7.1.6 Taiwan High Purity Alumina Market Revenues, By Others, 2021- 2031F |

| 8. Taiwan High Purity Alumina Market Overview, By Product Manufacturers (End-Users) |

| 8.1 Taiwan High Purity Alumina Market Revenue Share, By Product Manufacturers (End-Users), 2024 & 2031F |

| 8.1.1 Taiwan High Purity Alumina Market Revenues, By LED Manufacturers, 2021- 2031F |

| 8.1.2 Taiwan High Purity Alumina Market Revenues, By Semiconductor Equipment & Component Manufacturers, 2021- 2031F |

| 8.1.3 Taiwan High Purity Alumina Market Revenues, By Lithium-ion Battery Separator Manufacturers, 2021- 2031F |

| 8.1.4 Taiwan High Purity Alumina Market Revenues, By Optical & Electronic Component Manufacturers, 2021- 2031F |

| 8.1.5 Taiwan High Purity Alumina Market Revenues, By Ceramic Component Manufacturers, 2021- 2031F |

| 8.1.6 Taiwan High Purity Alumina Market Revenues, By Thermal-Management Materials Manufacturers, 2021- 2031F |

| 8.1.7 Taiwan High Purity Alumina Market Revenues, By Medical & Dental Bioceramics Manufacturers, 2021- 2031F |

| 8.1.8 Taiwan High Purity Alumina Market Revenues, By Other Manufacturers, 2021- 2031F |

| 9. Taiwan High Purity Alumina Market Key End Users |

| 9.1. Manufacturer Name |

| 9.2. Product Offerings |

| 9.3 Key Executives |

| 9.4 Contact No. (Board line No.) |

| 9.5 Email Id |

| 9.6 Address |

| 10. Taiwan High Purity Alumina Market Key Performance Indicators |

| 11. Taiwan High Purity Alumina Market Opportunity Assessment |

| 11.1. Taiwan High Purity Alumina Market Opportunity Assessment, By Purity Level, 2031F |

| 11.2. Taiwan High Purity Alumina Market Opportunity Assessment, By Application, 2031F |

| 11.3. Taiwan High Purity Alumina Market Opportunity Assessment, By Product Manufacturers (End-Users), 2031F |

| 12. Taiwan High Purity Alumina Market Competitive Landscape |

| 12.1 Taiwan High Purity Alumina Market Revenue Ranking, By Top 3 Companies, CY2024 |

| 12.2 Taiwan High Purity Alumina Market Competitive Benchmarking, By Operating Parameters |

| 12.3 Taiwan High Purity Alumina Market Competitive Benchmarking, By Technical Parameters |

| 13. Company Profiles |

| 13.1 Baikowski SA |

| 13.2 Zipro Technology Corporation |

| 13.3 Hydro Group |

| 13.4 Sumitomo Chemical Co. Ltd. |

| 13.5 Zibo Honghao Crystal Materials Co., LTD. |

| 13.6 Shanghai Yiming Materials Science and Technology Co, Ltd. |

| 13.7 Hebei Pengda Advanced Materials Technology Co. Ltd. |

| 13.8 Sasol Limited |

| 14. Key Strategic Recommendations |

| 15. Disclaimer |

| List of Figures |

| 1. Taiwan High Purity Alumina Market Revenues, 2021-2031F ($ Million) |

| 2. Taiwan’s Energy Storage Targets, (MW), 2025E & 2030F |

| 3. Taiwan HEV Registrations, 2023 & 2024 (Units) |

| 4. Taiwan Electronic Components Output Growth, 2023 & 2024 ($ Billion) |

| 5. Taiwan High Purity Alumina Market Revenue Share, By Purity Level, 2024 & 2031F |

| 6. Taiwan High Purity Alumina Market Revenue Share, By Application, 2024 & 2031F |

| 7. Taiwan High Purity Alumina Market Revenue Share, By Product Manufacturers (End-Users), 2024 & 2031F |

| 8. Taiwan Semiconductor Output Value, 2023-2025E ($ billion) |

| 9. Taiwan High Purity Alumina Market Opportunity Assessment, By Purity Level, 2031F |

| 10. Taiwan High Purity Alumina Market Opportunity Assessment, By Application, 2031F |

| 11. Taiwan High Purity Alumina Market Opportunity Assessment, By Product Manufacturers (End-Users), 2031F |

| 12. Taiwan High Purity Alumina Market Revenue Ranking, By Companies, CY2024 |

| List of table |

| 1. Taiwan Energy Storage Projects, As of 2024 |

| 2. Taiwan Strategic Investment in Technology and Semiconductor Initiatives ($ Million) |

| 3. Taiwan High Purity Alumina Market Revenues, By Purity Level, 2021-2031F ($ Million) |

| 4. Taiwan High Purity Alumina Market Revenues, By Application, 2021-2031F ($ Million) |

| 5. Taiwan High Purity Alumina Market Revenues, By Product Manufacturers (End-Users), 2021-2031F ($ Million) |

- Single User License$ 1,995

- Department License$ 2,400

- Site License$ 3,120

- Global License$ 3,795

Search

Thought Leadership and Analyst Meet

Our Clients

Related Reports

- Afghanistan Apparel Market (2026-2032) | Growth, Outlook, Industry, Segmentation, Forecast, Size, Companies, Trends, Value, Share, Analysis & Revenue

- Canada Oil and Gas Market (2026-2032) | Share, Segmentation, Value, Industry, Trends, Forecast, Analysis, Size & Revenue, Growth, Competitive Landscape, Outlook, Companies

- Germany Breakfast Food Market (2026-2032) | Industry, Share, Growth, Size, Companies, Value, Analysis, Revenue, Trends, Forecast & Outlook

- Australia Briquette Market (2025-2031) | Growth, Size, Revenue, Forecast, Analysis, Trends, Value, Share, Industry & Companies

- Vietnam System Integrator Market (2025-2031) | Size, Companies, Analysis, Industry, Value, Forecast, Growth, Trends, Revenue & Share

- ASEAN and Thailand Brain Health Supplements Market (2025-2031) | Strategy, Consumer Insights, Analysis, Investment Trends, Opportunities, Growth, Size, Share, Industry, Revenue, Segments, Value, Segmentation, Supply, Forecast, Restraints, Outlook, Competition, Drivers, Trends, Demand, Pricing Analysis, Competitive, Strategic Insights, Companies, Challenges

- ASEAN Bearings Market (2025-2031) | Strategy, Consumer Insights, Analysis, Investment Trends, Opportunities, Growth, Size, Share, Industry, Revenue, Segments, Value, Segmentation, Supply, Forecast, Restraints, Outlook, Competition, Drivers, Trends, Demand, Pricing Analysis, Competitive, Strategic Insights, Companies, Challenges

- Europe Flooring Market (2025-2031) | Outlook, Share, Industry, Trends, Forecast, Companies, Revenue, Size, Analysis, Growth & Value

- Saudi Arabia Manlift Market (2025-2031) | Outlook, Size, Growth, Trends, Companies, Industry, Revenue, Value, Share, Forecast & Analysis

- Uganda Excavator, Crane, and Wheel Loaders Market (2025-2031) | Strategy, Consumer Insights, Analysis, Investment Trends, Opportunities, Growth, Size, Share, Industry, Revenue, Segments, Value, Segmentation, Supply, Forecast, Restraints, Outlook, Competition, Drivers, Trends, Demand, Pricing Analysis, Competitive, Strategic Insights, Companies, Challenges

Industry Events and Analyst Meet

Whitepaper

- Middle East & Africa Commercial Security Market Click here to view more.

- Middle East & Africa Fire Safety Systems & Equipment Market Click here to view more.

- GCC Drone Market Click here to view more.

- Middle East Lighting Fixture Market Click here to view more.

- GCC Physical & Perimeter Security Market Click here to view more.

6WResearch In News

- Doha a strategic location for EV manufacturing hub: IPA Qatar

- Demand for luxury TVs surging in the GCC, says Samsung

- Empowering Growth: The Thriving Journey of Bangladesh’s Cable Industry

- Demand for luxury TVs surging in the GCC, says Samsung

- Video call with a traditional healer? Once unthinkable, it’s now common in South Africa

- Intelligent Buildings To Smooth GCC’s Path To Net Zero