Thailand Acrylic ester Market (2025-2031) Outlook | Share, Analysis, Growth, Companies, Size, Industry, Forecast, Revenue, Value & Trends

| Product Code: ETC103664 | Publication Date: Jun 2021 | Updated Date: Nov 2025 | Product Type: Report | |

| Publisher: 6Wresearch | Author: Ravi Bhandari | No. of Pages: 70 | No. of Figures: 35 | No. of Tables: 5 |

Thailand Acrylic Ester Market: Import Trend Analysis

Thailand import trend for the acrylic ester market exhibited a notable growth rate of 11.4% from 2023 to 2024, with a compound annual growth rate (CAGR) of 9.67% from 2020 to 2024. This import momentum can be attributed to increasing industrial demand for acrylic esters, indicating a stable market with sustained demand growth during the period analyzed.

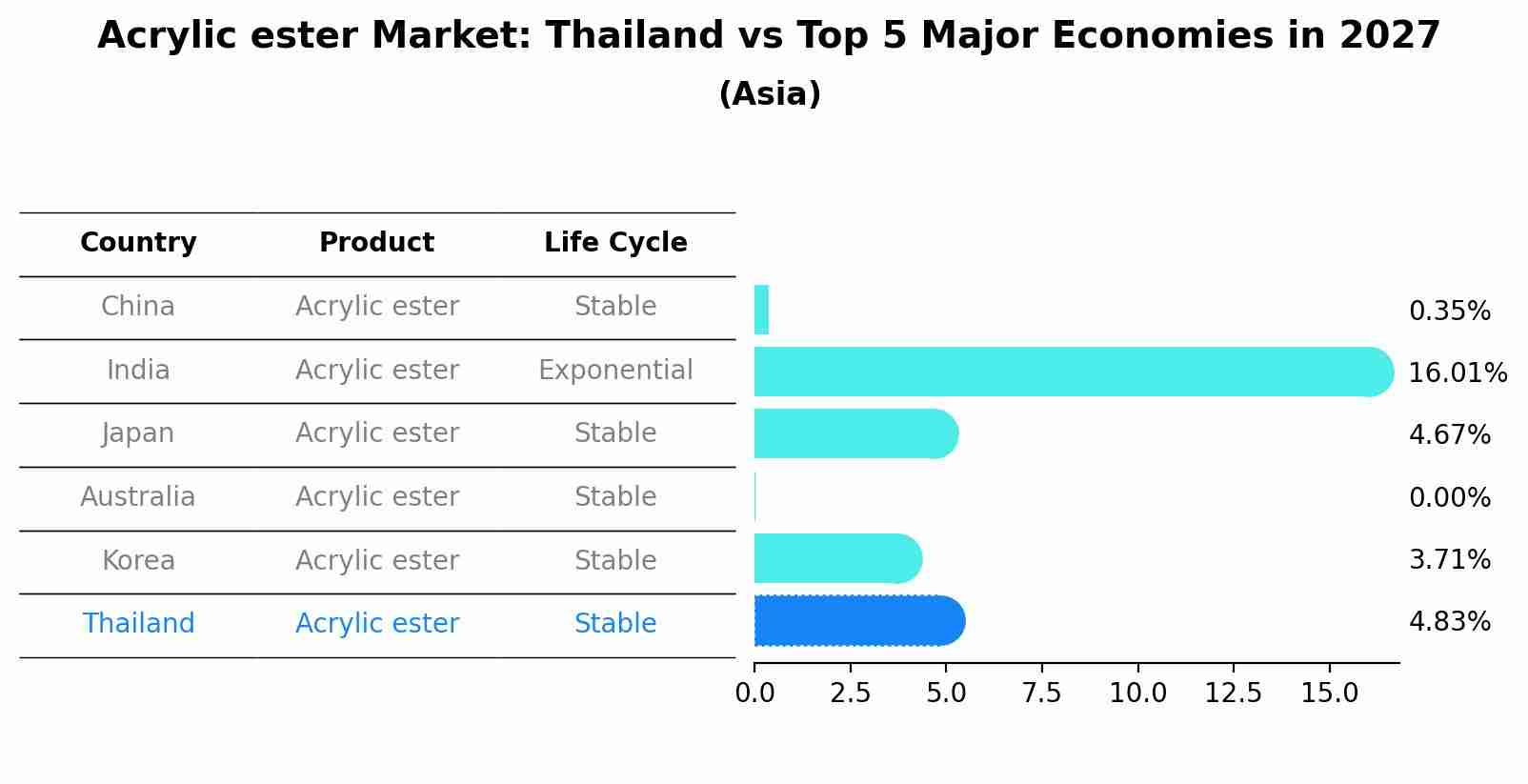

Acrylic ester Market: Thailand vs Top 5 Major Economies in 2027 (Asia)

The Acrylic ester market in Thailand is projected to grow at a stable growth rate of 4.83% by 2027, highlighting the country's increasing focus on advanced technologies within the Asia region, where China holds the dominant position, followed closely by India, Japan, Australia and South Korea, shaping overall regional demand.

Thailand Acrylic Ester Market Synopsis

The acrylic ester market size in Thailand was estimated at USD 18 million in 2017 and is projected to expand rapidly owing primarily to its wide range uses which include coatings adhesives sealants plastics rubber printing ink paper processing etcetera. Major end users are construction automotive paints & coatings furniture woodworking industrial chemical manufacturing industries among others where prices range from THB 38 - 50 per kg depending upon purity requirement specifications along with numerous other factors like supplier location availability transport costs etc.

Drivers of the Market

Key drivers in the Thailand acrylic ester market include the demand for acrylic esters in industries such as coatings, adhesives, and textiles. Acrylic esters are valued for their versatility, adhesion properties, and UV resistance. The expansion of construction, automotive, and consumer goods sectors fuels the demand for acrylic ester-based products, driving the market`s growth.

Challenges of the Market

Challenges in the Thailand acrylic ester market include raw material availability and market competition. Acrylic esters are derived from petrochemical feedstocks, and fluctuations in feedstock prices can impact production costs. Additionally, the presence of global competitors can influence market dynamics. Ensuring a stable supply chain, optimizing production processes, and focusing on product differentiation are strategies to navigate these challenges.

COVID-19 Impact on the Market

The Thailand acrylic ester market experienced shifts due to the COVID-19 pandemic. Acrylic esters find applications in coatings, adhesives, and textiles. Market demand was impacted by disruptions in manufacturing and decreased consumer spending on non-essential items. As economic activities regain momentum, the demand for acrylic esters is expected to gradually rebound.

Key Players in the Market

In the Thailand acrylic ester market, leading players include AcrylicEsterTech Solutions, ThaiAcrylic Esters Ltd., and ChemicalInnovations. These companies specialize in producing acrylic esters used in coatings, adhesives, and polymer manufacturing. Their commitment to chemical synthesis and material versatility establishes them as key contributors to the market.

Key Highlights of the Report:

- Thailand Acrylic ester Market Outlook

- Market Size of Thailand Acrylic ester Market, 2024

- Forecast of Thailand Acrylic ester Market, 2031

- Historical Data and Forecast of Thailand Acrylic ester Revenues & Volume for the Period 2021-2031

- Thailand Acrylic ester Market Trend Evolution

- Thailand Acrylic ester Market Drivers and Challenges

- Thailand Acrylic ester Price Trends

- Thailand Acrylic ester Porter's Five Forces

- Thailand Acrylic ester Industry Life Cycle

- Historical Data and Forecast of Thailand Acrylic ester Market Revenues & Volume By Type for the Period 2021-2031

- Historical Data and Forecast of Thailand Acrylic ester Market Revenues & Volume By Methyl Acrylate for the Period 2021-2031

- Historical Data and Forecast of Thailand Acrylic ester Market Revenues & Volume By Ethyl Acrylate for the Period 2021-2031

- Historical Data and Forecast of Thailand Acrylic ester Market Revenues & Volume By Butyl Acrylate for the Period 2021-2031

- Historical Data and Forecast of Thailand Acrylic ester Market Revenues & Volume By 2-EH Acrylate for the Period 2021-2031

- Historical Data and Forecast of Thailand Acrylic ester Market Revenues & Volume By Others for the Period 2021-2031

- Historical Data and Forecast of Thailand Acrylic ester Market Revenues & Volume By Application for the Period 2021-2031

- Historical Data and Forecast of Thailand Acrylic ester Market Revenues & Volume By Surface Coatings for the Period 2021-2031

- Historical Data and Forecast of Thailand Acrylic ester Market Revenues & Volume By Adhesives and Sealants for the Period 2021-2031

- Historical Data and Forecast of Thailand Acrylic ester Market Revenues & Volume By Plastic additives for the Period 2021-2031

- Historical Data and Forecast of Thailand Acrylic ester Market Revenues & Volume By Detergents for the Period 2021-2031

- Historical Data and Forecast of Thailand Acrylic ester Market Revenues & Volume By Textiles for the Period 2021-2031

- Thailand Acrylic ester Import Export Trade Statistics

- Market Opportunity Assessment By Type

- Market Opportunity Assessment By Application

- Thailand Acrylic ester Top Companies Market Share

- Thailand Acrylic ester Competitive Benchmarking By Technical and Operational Parameters

- Thailand Acrylic ester Company Profiles

- Thailand Acrylic ester Key Strategic Recommendations

Frequently Asked Questions About the Market Study (FAQs):

1 Executive Summary |

2 Introduction |

2.1 Key Highlights of the Report |

2.2 Report Description |

2.3 Market Scope & Segmentation |

2.4 Research Methodology |

2.5 Assumptions |

3 Thailand Acrylic ester Market Overview |

3.1 Thailand Country Macro Economic Indicators |

3.2 Thailand Acrylic ester Market Revenues & Volume, 2021 & 2031F |

3.3 Thailand Acrylic ester Market - Industry Life Cycle |

3.4 Thailand Acrylic ester Market - Porter's Five Forces |

3.5 Thailand Acrylic ester Market Revenues & Volume Share, By Type, 2021 & 2031F |

3.6 Thailand Acrylic ester Market Revenues & Volume Share, By Application, 2021 & 2031F |

4 Thailand Acrylic ester Market Dynamics |

4.1 Impact Analysis |

4.2 Market Drivers |

4.3 Market Restraints |

5 Thailand Acrylic ester Market Trends |

6 Thailand Acrylic ester Market, By Types |

6.1 Thailand Acrylic ester Market, By Type |

6.1.1 Overview and Analysis |

6.1.2 Thailand Acrylic ester Market Revenues & Volume, By Type, 2021-2031F |

6.1.3 Thailand Acrylic ester Market Revenues & Volume, By Methyl Acrylate, 2021-2031F |

6.1.4 Thailand Acrylic ester Market Revenues & Volume, By Ethyl Acrylate, 2021-2031F |

6.1.5 Thailand Acrylic ester Market Revenues & Volume, By Butyl Acrylate, 2021-2031F |

6.1.6 Thailand Acrylic ester Market Revenues & Volume, By 2-EH Acrylate, 2021-2031F |

6.1.7 Thailand Acrylic ester Market Revenues & Volume, By Others, 2021-2031F |

6.2 Thailand Acrylic ester Market, By Application |

6.2.1 Overview and Analysis |

6.2.2 Thailand Acrylic ester Market Revenues & Volume, By Surface Coatings, 2021-2031F |

6.2.3 Thailand Acrylic ester Market Revenues & Volume, By Adhesives and Sealants, 2021-2031F |

6.2.4 Thailand Acrylic ester Market Revenues & Volume, By Plastic additives, 2021-2031F |

6.2.5 Thailand Acrylic ester Market Revenues & Volume, By Detergents, 2021-2031F |

6.2.6 Thailand Acrylic ester Market Revenues & Volume, By Textiles, 2021-2031F |

7 Thailand Acrylic ester Market Import-Export Trade Statistics |

7.1 Thailand Acrylic ester Market Export to Major Countries |

7.2 Thailand Acrylic ester Market Imports from Major Countries |

8 Thailand Acrylic ester Market Key Performance Indicators |

9 Thailand Acrylic ester Market - Opportunity Assessment |

9.1 Thailand Acrylic ester Market Opportunity Assessment, By Type, 2021 & 2031F |

9.2 Thailand Acrylic ester Market Opportunity Assessment, By Application, 2021 & 2031F |

10 Thailand Acrylic ester Market - Competitive Landscape |

10.1 Thailand Acrylic ester Market Revenue Share, By Companies, 2024 |

10.2 Thailand Acrylic ester Market Competitive Benchmarking, By Operating and Technical Parameters |

11 Company Profiles |

12 Recommendations |

13 Disclaimer |

- Single User License$ 1,995

- Department License$ 2,400

- Site License$ 3,120

- Global License$ 3,795

Search

Thought Leadership and Analyst Meet

Our Clients

Related Reports

- Germany Breakfast Food Market (2026-2032) | Industry, Share, Growth, Size, Companies, Value, Analysis, Revenue, Trends, Forecast & Outlook

- Australia Briquette Market (2025-2031) | Growth, Size, Revenue, Forecast, Analysis, Trends, Value, Share, Industry & Companies

- Vietnam System Integrator Market (2025-2031) | Size, Companies, Analysis, Industry, Value, Forecast, Growth, Trends, Revenue & Share

- ASEAN and Thailand Brain Health Supplements Market (2025-2031) | Strategy, Consumer Insights, Analysis, Investment Trends, Opportunities, Growth, Size, Share, Industry, Revenue, Segments, Value, Segmentation, Supply, Forecast, Restraints, Outlook, Competition, Drivers, Trends, Demand, Pricing Analysis, Competitive, Strategic Insights, Companies, Challenges

- ASEAN Bearings Market (2025-2031) | Strategy, Consumer Insights, Analysis, Investment Trends, Opportunities, Growth, Size, Share, Industry, Revenue, Segments, Value, Segmentation, Supply, Forecast, Restraints, Outlook, Competition, Drivers, Trends, Demand, Pricing Analysis, Competitive, Strategic Insights, Companies, Challenges

- Europe Flooring Market (2025-2031) | Outlook, Share, Industry, Trends, Forecast, Companies, Revenue, Size, Analysis, Growth & Value

- Saudi Arabia Manlift Market (2025-2031) | Outlook, Size, Growth, Trends, Companies, Industry, Revenue, Value, Share, Forecast & Analysis

- Uganda Excavator, Crane, and Wheel Loaders Market (2025-2031) | Strategy, Consumer Insights, Analysis, Investment Trends, Opportunities, Growth, Size, Share, Industry, Revenue, Segments, Value, Segmentation, Supply, Forecast, Restraints, Outlook, Competition, Drivers, Trends, Demand, Pricing Analysis, Competitive, Strategic Insights, Companies, Challenges

- Rwanda Excavator, Crane, and Wheel Loaders Market (2025-2031) | Strategy, Consumer Insights, Analysis, Investment Trends, Opportunities, Growth, Size, Share, Industry, Revenue, Segments, Value, Segmentation, Supply, Forecast, Restraints, Outlook, Competition, Drivers, Trends, Demand, Pricing Analysis, Competitive, Strategic Insights, Companies, Challenges

- Kenya Excavator, Crane, and Wheel Loaders Market (2025-2031) | Strategy, Consumer Insights, Analysis, Investment Trends, Opportunities, Growth, Size, Share, Industry, Revenue, Segments, Value, Segmentation, Supply, Forecast, Restraints, Outlook, Competition, Drivers, Trends, Demand, Pricing Analysis, Competitive, Strategic Insights, Companies, Challenges

Industry Events and Analyst Meet

Whitepaper

- Middle East & Africa Commercial Security Market Click here to view more.

- Middle East & Africa Fire Safety Systems & Equipment Market Click here to view more.

- GCC Drone Market Click here to view more.

- Middle East Lighting Fixture Market Click here to view more.

- GCC Physical & Perimeter Security Market Click here to view more.

6WResearch In News

- Doha a strategic location for EV manufacturing hub: IPA Qatar

- Demand for luxury TVs surging in the GCC, says Samsung

- Empowering Growth: The Thriving Journey of Bangladesh’s Cable Industry

- Demand for luxury TVs surging in the GCC, says Samsung

- Video call with a traditional healer? Once unthinkable, it’s now common in South Africa

- Intelligent Buildings To Smooth GCC’s Path To Net Zero